Market Overview

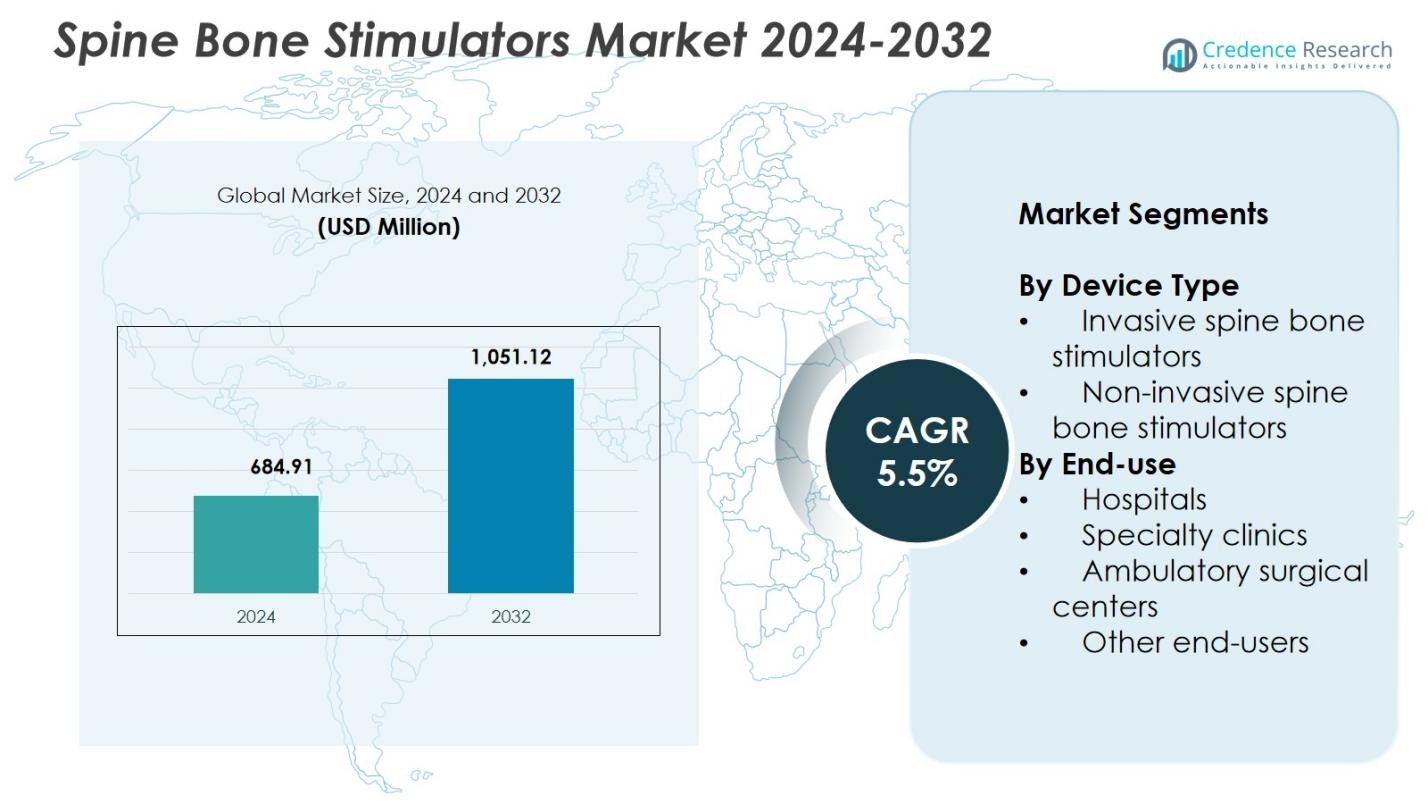

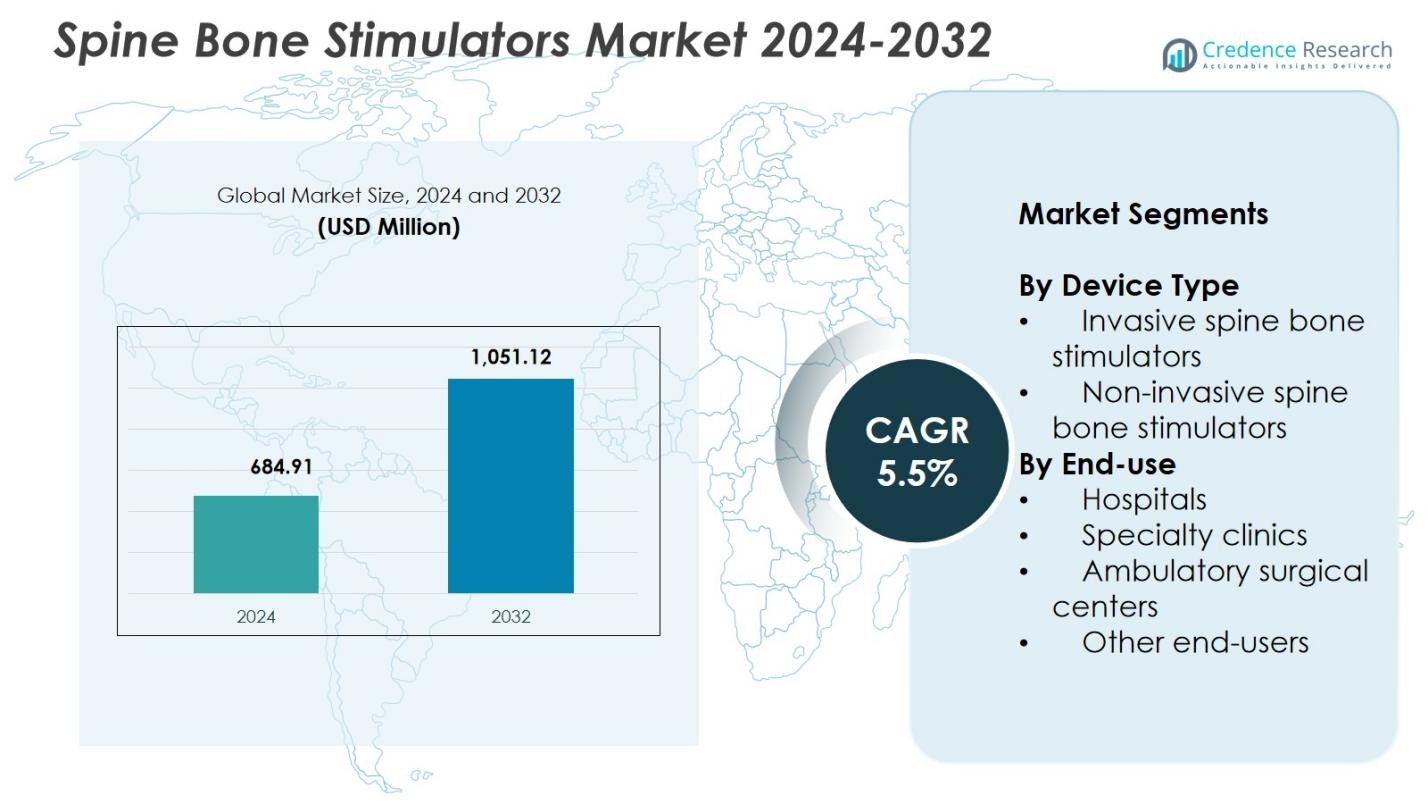

Spine Bone Stimulators Market size was valued at USD 684.91 million in 2024 and is anticipated to reach USD 1,051.12 million by 2032, at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spine Bone Stimulators Market Size 2024 |

USD 684.91 Million |

| Spine Bone Stimulators Market, CAGR |

5.5% |

| Spine Bone Stimulators Market Size 2032 |

USD 1,051.12 Million |

Spine Bone Stimulators Market features leading companies such as Bioventus, ZimVie Inc., Enovis, Medtronic plc, Orthofix Medical Inc., Theragen Inc., Synergy Orthopedics, Ossatec Benelux BV, IGEA S.p.A., and Elizur Corporation that drive innovation across invasive and non-invasive stimulation technologies. These players focus on enhancing device efficacy, expanding non-invasive offerings, and integrating remote monitoring capabilities to support improved spinal fusion outcomes. North America leads the Spine Bone Stimulators Market with a 41.6% share in 2024, supported by strong procedure volumes, advanced healthcare infrastructure, and high adoption of digital-enabled bone healing solutions. Europe and Asia-Pacific follow as significant growth regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Spine Bone Stimulators Market was valued at USD 684.91 million in 2024 and is projected to reach USD 1,051.12 million by 2032, registering a CAGR of 5.5%.

- Rising spinal fusion procedures and increasing prevalence of degenerative spine disorders drive demand, with non-invasive stimulators leading the market at a 63.4% share due to strong clinical adoption and patient convenience.

- Key trends include rapid integration of remote monitoring, growing use of home-based therapy models, and advancements in PEMF and ultrasound-based stimulation technologies that enhance treatment precision and compliance.

- Major players such as Bioventus, ZimVie Inc., Enovis, Medtronic, Orthofix Medical Inc., and Theragen Inc. strengthen market presence through product innovation, partnerships with healthcare providers, and expansion into emerging economies.

- North America leads with a 41.6% share, followed by Europe at 28.4% and Asia-Pacific at 20.7%, reflecting strong regional adoption supported by advanced care infrastructure and growing awareness of bone healing therapies.

Market Segmentation Analysis:

By Device Type:

In the Spine Bone Stimulators Market, non-invasive spine bone stimulators dominate with a market share of 63.4% in 2024, supported by strong adoption due to their ease of use, lower risk profile, and suitability for outpatient settings. These devices gain traction as they eliminate surgical complications and enable routine home-based therapy, improving patient compliance in spinal fusion and fracture healing. Increasing clinical preference for external electrical and ultrasound-based bone stimulation, along with expanding reimbursement support, further accelerates segment growth. Invasive stimulators continue to serve complex cases, but overall demand remains led by non-invasive technologies.

- For instance, Orthofix’s SpinalStim device uses Pulsed Electromagnetic Field (PEMF) technology to generate a low-level electric field, promoting spinal fusion as a non-surgical adjunct treatment.

By End-use:

Hospitals lead the Spine Bone Stimulators Market with a 48.7% share in 2024, driven by high patient inflow for spinal fusion procedures, trauma care, and post-operative rehabilitation. Hospitals benefit from advanced surgical infrastructure, multidisciplinary care teams, and higher utilization of both invasive and non-invasive stimulators, supporting strong segment leadership. Rising adoption of bone stimulation therapy for degenerative spine disorders and growing preference for hospital-based treatment pathways further strengthen dominance. Specialty clinics and ambulatory surgical centers also experience steady growth as minimally invasive procedures increase, but hospitals remain the primary end-use setting.

- For instance, Zimmer Biomet’s SpinalPak Non-invasive Spine Fusion Stimulator System showed 92.7% clinical or radiological healing in posterolateral fusions and 84.7% overall success versus 64.9% placebo in lumbar fusions.

Key Growth Drivers

Rising Prevalence of Spinal Disorders

The Spine Bone Stimulators Market grows significantly as the global burden of spinal degenerative diseases, fractures, and non-union cases increases. Rising incidences of osteoporosis-related complications and trauma injuries drive greater adoption of bone stimulation therapies across clinical settings. Healthcare providers increasingly integrate bone stimulators into post-surgical care for spinal fusion procedures to enhance healing and reduce revision surgery rates. The growing elderly population, which faces a higher risk of delayed bone healing, further strengthens the demand for advanced stimulation technologies.

- For instance, the Orthofix SpinalStim™ device demonstrated a 92% overall success rate in clinical studies for spinal fusion surgery patients, significantly reducing the need for revision surgeries and improving healing outcomes in real-world use.

Advancements in Non-Invasive Bone Stimulation Technologies

Technological innovation strongly accelerates market expansion, particularly in non-invasive bone stimulators that offer improved patient comfort, portability, and therapeutic precision. Advancements in pulsed electromagnetic field (PEMF) therapy, capacitive coupling, and low-intensity ultrasound systems enhance treatment outcomes and appeal to both patients and clinicians. These technologies reduce procedure time, eliminate surgical risks, and support remote or home-based therapy models. Continuous R&D investments by manufacturers strengthen device efficacy, enabling broader adoption across chronic non-union fractures and spinal fusion recovery.

- For instance, BTT Health’s bone4ce device applies low-intensity pulsed ultrasound at 30 mW/cm² and 1.5 MHz to stimulate calcium channel opening in bone tissues at the fracture gap.

Increasing Volume of Spinal Fusion Surgeries

The rising number of spinal fusion surgeries directly fuels demand for bone stimulators that support faster healing and minimize post-operative complications. Hospitals and specialty clinics increasingly use bone stimulation devices for high-risk patients, including smokers, diabetics, and individuals with comorbidities that slow bone regeneration. The expanding use of minimally invasive spine surgeries also contributes to higher stimulator utilization, as faster recovery expectations align with non-invasive stimulation benefits. Growing clinical evidence supporting improved fusion success rates continues to reinforce market adoption.

Key Trends & Opportunities

Growing Adoption of Home-Based and Remote Healing Therapies

A notable trend shaping the market is the shift toward home-based treatment models supported by portable and patient-friendly non-invasive bone stimulators. Healthcare systems increasingly promote remote therapeutic monitoring to reduce hospital visits, cut overall care costs, and improve patient compliance. Digital-enabled devices with data tracking and clinician connectivity provide enhanced oversight of treatment progress. This transition opens strong opportunities for manufacturers to integrate smart health platforms, expand telehealth partnerships, and introduce personalized healing protocols to meet evolving patient needs.

- For instance, DJO’s CMF Spinalogic is a lightweight, battery-powered electromagnetic stimulator designed for home use over casts or braces post-lumbar spinal fusion, featuring one-button operation for easy patient compliance during daily routines.

Expansion in Emerging Markets Through Improved Access and Awareness

Emerging economies present strong growth opportunities as awareness of bone healing technologies increases and healthcare investment rises. Improving access to advanced orthopedic care, expanding insurance coverage, and rising patient willingness to adopt innovative therapies contribute to greater market penetration. Governments and private healthcare providers prioritize modernizing spine surgery infrastructure, creating favorable conditions for device adoption. Manufacturers expanding distribution networks and partnering with regional medical institutions can capitalize on unmet clinical needs and growing demand for non-invasive spinal healing solutions.

- For instance, Orthofix launched the STIM onTrack mobile app compatible with its Bone Growth Therapy devices like SpinalStim and PhysioStim, delivering treatment reminders to boost patient adherence in regions with rising orthopedic procedures.

Key Challenges

High Cost of Advanced Bone Stimulators

The high cost of spine bone stimulators, especially technologically advanced non-invasive devices, remains a major barrier to widespread adoption. Limited reimbursement in several regions and high out-of-pocket expenses deter patients from seeking bone stimulation therapy. Healthcare providers, particularly in resource-constrained markets, may prioritize alternative treatment methods due to budget limitations. These financial constraints slow market expansion and restrict access to effective healing technologies, emphasizing the need for cost-optimized solutions and broader reimbursement support.

Limited Clinical Awareness and Inconsistent Adoption Rates

In many regions, a lack of clinical awareness regarding the benefits, indications, and comparative effectiveness of bone stimulators leads to inconsistent adoption across healthcare settings. Some clinicians remain uncertain about long-term outcomes or prefer conventional healing pathways, reducing device utilization. Variability in training, access to evidence-based guidelines, and patient education gaps further contribute to slow uptake. Strengthening clinical education, generating robust real-world data, and enhancing physician–patient engagement are essential to overcoming hesitancy and driving widespread market adoption.

Regional Analysis

North America

North America leads the Spine Bone Stimulators Market with a 41.6% share in 2024, supported by advanced healthcare infrastructure, strong reimbursement frameworks, and high adoption of non-invasive stimulation technologies. The region benefits from a significant volume of spinal fusion procedures driven by a growing elderly population and high prevalence of degenerative spine conditions. Continuous technological innovation by leading manufacturers and strong clinician acceptance further reinforce regional dominance. Expanding home-based therapy models and increasing integration of digital monitoring solutions also contribute to sustained market growth.

Europe

Europe holds a 28.4% share of the Spine Bone Stimulators Market in 2024, driven by rising demand for minimally invasive treatments and structured care pathways for spinal disorders. The region benefits from strong orthopedic expertise, wide availability of advanced diagnostic systems, and growing emphasis on enhancing post-surgical outcomes. Increasing adoption of non-invasive bone stimulators in Germany, the U.K., France, and Italy fuels market expansion. Supportive reimbursement policies in developed countries and rising awareness of fusion success optimization strengthen Europe’s position as a key market for bone stimulation solutions.

Asia-Pacific

Asia-Pacific accounts for a 20.7% share of the Spine Bone Stimulators Market in 2024 and represents the fastest-growing region due to rising healthcare investments, expanding spine surgery volumes, and growing acceptance of advanced therapeutic devices. Countries such as China, India, Japan, and South Korea increasingly adopt bone stimulators amid rising incidences of spinal injuries and degenerative diseases. Improvements in healthcare access, favorable government initiatives, and increasing patient awareness support strong regional momentum. Manufacturers expanding distribution networks gain significant opportunities across both urban and emerging healthcare settings.

Latin America

Latin America captures a 5.6% share of the Spine Bone Stimulators Market in 2024, driven by gradual improvements in healthcare infrastructure and increasing adoption of advanced orthopedic treatments. Brazil and Mexico lead regional demand due to higher procedure volumes and strengthening availability of non-invasive stimulators. Growing partnerships between medical device manufacturers and regional healthcare providers enhance market penetration. Despite challenges such as limited reimbursement and cost constraints, rising awareness of fusion-enhancing technologies and expanding private healthcare investments support steady regional growth.

Middle East & Africa

The Middle East & Africa region holds a 3.7% share of the Spine Bone Stimulators Market in 2024, supported by ongoing advancements in healthcare modernization and rising demand for effective spinal healing therapies. Gulf countries, particularly the UAE and Saudi Arabia, drive adoption due to expanding specialty orthopedic centers and increasing medical tourism. Growing prevalence of trauma-related spinal injuries and chronic spine disorders further stimulates market interest. Although affordability and access gaps persist in several African nations, improving healthcare expenditure and awareness contribute to gradual market expansion.

Market Segmentations:

By Device Type

- Invasive spine bone stimulators

- Non-invasive spine bone stimulators

By End-use

- Hospitals

- Specialty clinics

- Ambulatory surgical centers

- Other end-users

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Spine Bone Stimulators Market features a diverse and innovation-driven competitive landscape, with key players including Bioventus, ZimVie Inc., Enovis, Medtronic plc, Orthofix Medical Inc., Theragen Inc., Synergy Orthopedics, Ossatec Benelux BV, IGEA S.p.A., and Elizur Corporation leading advancements across both invasive and non-invasive stimulation technologies. Companies focus heavily on expanding non-invasive product portfolios, enhancing PEMF and ultrasound-based devices, and integrating digital health capabilities to strengthen treatment monitoring. Strategic initiatives such as clinical trials, product upgrades, geographic expansion, and physician outreach programs are central to sustaining market leadership. Partnerships with hospitals and specialty clinics support wider adoption, while R&D investments aim to improve efficacy for complex spinal fusion cases and non-union fractures. Competitive differentiation increasingly centers on device portability, patient adherence features, and reimbursement support, enabling leading manufacturers to reinforce their position in a rapidly evolving therapeutic landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Enovis launched the portable, battery-operated LIPUS device Manafuse Bone Growth Stimulator, aimed at accelerating fracture and non-union healing.

- In June 2025, Avista Healthcare Partners acquired EBI from Highridge Medical, establishing EBI as a pure-play company focused on bone growth stimulation solutions for spinal fusion and fracture nonunion healing.

- In May 2023, Zimmer Biomet launched a new external, non-invasive bone growth stimulator named Amplitude targeting non-union and delayed-union fractures.

Report Coverage

The research report offers an in-depth analysis based on Device Type, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as spinal fusion procedures continue to rise globally.

- Non-invasive bone stimulators will gain stronger adoption due to higher patient compliance and clinical preference.

- Digital-enabled devices with remote monitoring features will become increasingly integrated into treatment pathways.

- Expansion in emerging markets will accelerate as healthcare access and awareness improve.

- Manufacturers will invest more in R&D to enhance device efficacy for complex non-union and high-risk cases.

- Home-based therapy models will strengthen, supported by portable and user-friendly stimulation technologies.

- Regulatory approvals will increase as clinical evidence supporting bone stimulator effectiveness grows.

- Collaborations between device companies and healthcare providers will expand to improve adoption and training.

- Reimbursement enhancements in key regions will support broader patient access to bone stimulation therapies.

- Innovation in minimally invasive and hybrid stimulation technologies will shape the next phase of market evolution.