Market Overview

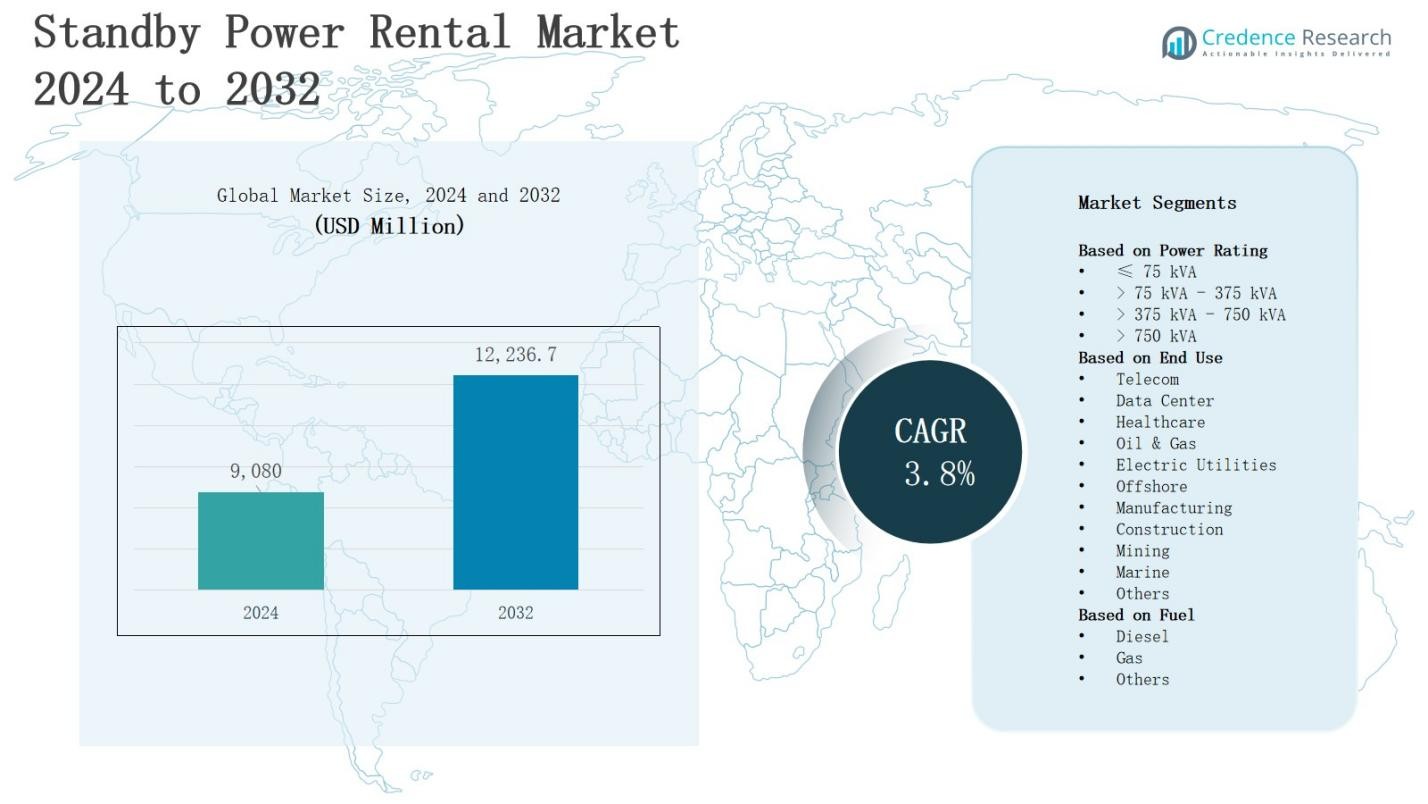

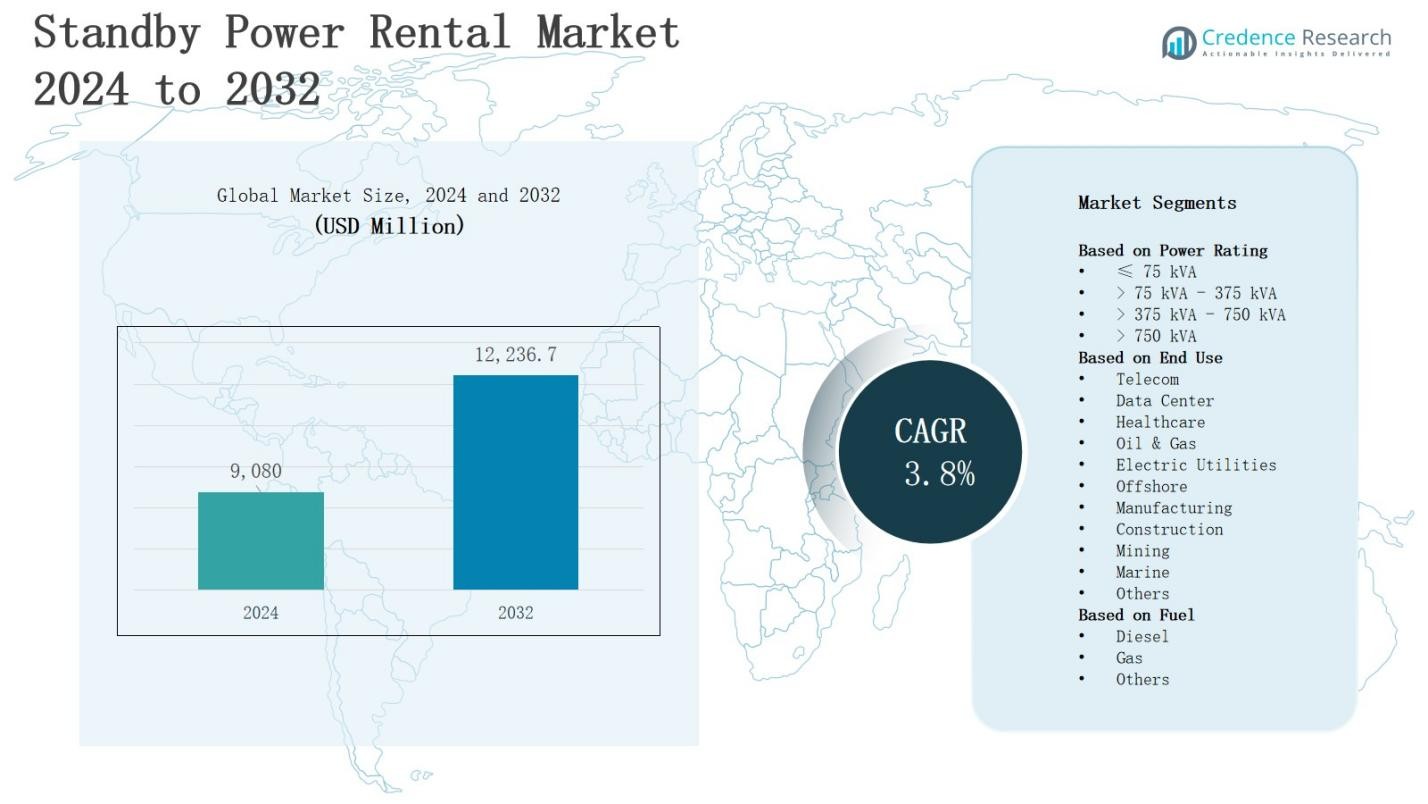

The standby power rental market is projected to grow from USD 9,080 million in 2024 to USD 12,236.7 million by 2032, registering a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Standby Power Rental Market Size 2024 |

USD 9,080 Million |

| Standby Power Rental Market, CAGR |

3.8% |

| Standby Power Rental Market Size 2032 |

USD 12,236.7 Million |

The standby power rental market grows with increasing demand for reliable backup power during grid outages, construction projects, and large-scale events. Stricter regulations on power reliability and rising frequency of natural disasters drive adoption across industries, while businesses seek flexible and cost-effective alternatives to permanent installations. The market benefits from growing industrialization in emerging economies, where infrastructure gaps boost rental demand. Key trends include the integration of hybrid and renewable-powered rental systems, adoption of digital monitoring for real-time efficiency, and a shift toward eco-friendly, fuel-efficient generators that align with sustainability goals and corporate carbon reduction strategies.

The standby power rental market shows diverse geographical presence across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, each contributing to overall growth with distinct demand drivers such as data centers, construction, mining, and oil and gas. North America and Asia Pacific lead with strong adoption, while Europe emphasizes sustainable solutions, and Latin America and the Middle East & Africa witness rising infrastructure demand. Key players include Aggreko, Atlas Copco, Caterpillar, Cummins, HIMOINSA, Finning International, Herc Rentals, Bredenoord, Al Faris, Rehlko, Modern Hiring Service, and BPC Power Rentals.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The standby power rental market is projected to grow from USD 9,080 million in 2024 to USD 12,236.7 million by 2032, registering a CAGR of 3.8%.

- Rising demand for reliable backup power in healthcare, data centers, construction, and large-scale events drives consistent adoption.

- Cost-effectiveness and operational flexibility of rental systems attract businesses seeking short-term or scalable solutions without heavy capital investment.

- Rapid industrialization in Asia Pacific, Latin America, and Africa boosts demand where grid reliability remains limited.

- High operating costs and dependence on fuel prices pose challenges, while stricter emission regulations push providers toward eco-friendly alternatives.

- North America holds 32% share, Europe 24%, Asia Pacific 28%, Latin America 9%, and the Middle East & Africa 7%, each shaped by unique demand drivers.

- Key players include Aggreko, Atlas Copco, Caterpillar, Cummins, HIMOINSA, Finning International, Herc Rentals, Bredenoord, Al Faris, Rehlko, Modern Hiring Service, and BPC Power Rentals.

Market Drivers

Rising Need for Uninterrupted Power Supply in Critical Applications

The standby power rental market expands with growing dependence on reliable electricity in healthcare, data centers, and commercial facilities. Hospitals require immediate backup to maintain life-support systems, while data centers depend on uninterrupted power to safeguard operations. It supports large-scale events, construction sites, and emergency response activities. Increasing power outages from natural disasters and grid instability encourage organizations to rent reliable systems. This demand creates consistent opportunities for rental providers across sectors.

- For instance, Aggreko deployed 292 diesel generators totaling 270 MW across Argentina, rapidly providing emergency power amid unstable grid conditions.

Cost-Effectiveness and Operational Flexibility of Rental Solutions

Organizations adopt rental systems for short-term or seasonal power needs, reducing capital investment in permanent infrastructure. The standby power rental market benefits companies seeking operational flexibility to match varying demand. It provides a scalable solution where users pay only for duration of use, minimizing long-term maintenance costs. Businesses leverage rental services to respond quickly to unexpected outages. This cost advantage drives preference for rentals in both developed and emerging economies.

- For instances, Murari Power Solutions uses IoT monitoring to enhance generator uptime and reduce maintenance costs, speeding issue detection from 24 hours to 1 hour.

Industrialization and Infrastructure Development in Emerging Markets

Rapid industrialization and urbanization in developing regions generate substantial demand for backup power. The standby power rental market supports construction projects, manufacturing plants, and expanding commercial spaces requiring reliable power during infrastructure growth. It serves as a bridge where local grids remain underdeveloped or unstable. Industrial expansion across Asia Pacific, Latin America, and Africa fuels steady growth. The presence of multinational rental companies accelerates adoption by offering standardized, high-capacity systems.

Technological Advancements and Sustainable Power Alternatives

The market benefits from technological integration, including remote monitoring, load optimization, and hybrid systems that combine renewable and conventional energy sources. The standby power rental market aligns with corporate sustainability goals by promoting fuel-efficient, low-emission generators. It supports industries adapting to stricter environmental regulations. Rental providers enhance offerings with digital platforms for predictive maintenance and operational insights. This innovation attracts environmentally conscious clients, positioning rentals as sustainable, modern solutions for future power security.

Market Trends

Growing Integration of Hybrid and Renewable Energy Sources

The standby power rental market evolves with a noticeable shift toward hybrid systems that combine diesel or gas generators with renewable energy solutions. Companies deploy solar and battery-backed systems to reduce fuel dependency and carbon emissions. It reflects global sustainability priorities and supports compliance with stricter emission regulations. Businesses prefer hybrid rentals for efficiency, reliability, and reduced operating costs. This transition reshapes the rental landscape, making clean energy integration a core trend.

- For instance, Tata Power has also expanded its hybrid portfolio by integrating solar and wind power with battery systems, improving both energy reliability and reducing costs.

Expansion of Digital Monitoring and Smart Control Systems

The market witnesses rapid adoption of digital technologies that enable predictive maintenance and real-time performance monitoring. The standby power rental market benefits from IoT-enabled platforms, which improve load management and optimize fuel usage. It enhances reliability by providing operators with instant alerts on potential failures. Remote access to generator data increases operational transparency and client satisfaction. These smart solutions improve efficiency while strengthening trust between rental providers and customers.

Rising Demand from Large-Scale Infrastructure and Event Projects

Infrastructure development, mining operations, and large-scale public events drive rising demand for temporary power solutions. The standby power rental market supports contractors and event organizers by delivering scalable and mobile units capable of meeting fluctuating load requirements. It plays a vital role in mega sporting events, concerts, and exhibitions. Growing government investments in infrastructure projects worldwide further accelerate adoption. The trend highlights the flexibility and resilience of rental systems in dynamic environments.

- For instance, during the construction of a large housing development, POWRBANK MAX battery energy storage systems provided quiet, off-grid power to site operations and homes awaiting grid connection, minimizing emissions and noise.

Shift Toward Eco-Friendly and Low-Emission Equipment

Environmental concerns and regulatory frameworks push the market toward adopting fuel-efficient, low-emission rental equipment. The standby power rental market aligns with corporate green initiatives and global climate commitments. It introduces advanced generators with reduced noise and improved efficiency. Rental providers differentiate themselves by offering sustainable alternatives to conventional models. Clients increasingly prioritize eco-friendly equipment to enhance brand reputation while meeting compliance standards. This shift redefines competitive strategies and long-term growth opportunities.

Market Challenges Analysis

High Operating Costs and Dependency on Fuel Prices

The standby power rental market faces pressure from rising fuel prices and high operating costs, which limit affordability for small and medium-scale users. It depends heavily on diesel and gas generators, making cost fluctuations a recurring challenge. Clients often face budgetary constraints when fuel expenses surge, reducing rental demand. Maintenance, logistics, and transportation of large equipment add to the cost burden. This issue forces providers to balance competitive pricing with profitability while managing client expectations.

Stringent Environmental Regulations and Emission Concerns

Tightening global regulations on emissions create compliance challenges for rental providers. The standby power rental market relies on generators that produce greenhouse gases, which often conflict with sustainability goals and legal requirements. It compels companies to invest in advanced, eco-friendly systems, increasing initial costs and reducing short-term margins. Smaller providers struggle to keep pace with regulatory shifts. Growing environmental awareness among customers further intensifies the need for greener solutions, reshaping competition across the industry.

Market Opportunities

Rising Adoption of Sustainable and Hybrid Power Solutions

The standby power rental market presents significant opportunities through the integration of renewable energy and hybrid solutions. It allows businesses to align with global sustainability targets while lowering operating costs. Hybrid systems that combine solar, battery storage, and fuel-efficient generators attract industries seeking greener alternatives. Governments encourage clean energy adoption with favorable policies, creating a supportive environment for innovation. Rental providers that invest in eco-friendly fleets gain a competitive advantage and strengthen customer loyalty.

Expanding Demand Across Emerging Economies and Infrastructure Projects

Rapid industrialization and infrastructure development in emerging markets create strong opportunities for rental providers. The standby power rental market supports construction sites, mining projects, and expanding urban infrastructure where grid stability remains limited. It benefits from rising demand in Asia Pacific, Africa, and Latin America, where governments prioritize large-scale projects. Growth in data centers and telecom networks further fuels long-term opportunities. Providers offering scalable, reliable, and cost-effective rental solutions capture growing market share.

Market Segmentation Analysis:

By Power Rating

The standby power rental market segments by power rating into ≤75 kVA, >75 kVA–375 kVA, >375 kVA–750 kVA, and >750 kVA units. It serves diverse applications ranging from small-scale commercial needs to large industrial operations. Low-capacity units find use in telecom and small businesses, while medium ranges dominate construction and utilities. High-capacity systems above 750 kVA cater to data centers, oil and gas, and mining operations, supporting critical functions that demand continuous large-scale backup power.

- For instance, for high-capacity systems >750 kVA, Aggreko deployed multiple 2.5 MW diesel generators at a Silicon Valley data center, supporting critical IT infrastructure with continuous backup during grid outages.

By End Use

End-use segmentation highlights telecom, data centers, healthcare, oil and gas, electric utilities, offshore, manufacturing, construction, mining, marine, and others. The standby power rental market supports telecom and data centers with consistent demand for uninterrupted connectivity and operations. It addresses healthcare facilities where reliability ensures patient safety. Oil and gas, utilities, and offshore industries rely on high-power systems, while construction and mining require scalable solutions. Manufacturing and marine sectors further strengthen rental adoption for operational resilience.

- For instance, Caterpillar provided mobile power rental units for mining operations in Western Australia, enabling 24/7 operations in remote sites where no permanent grid exists.

By Fuel

Fuel-based segmentation includes diesel, gas, and others. Diesel dominates the standby power rental market due to reliability, availability, and suitability for high-load applications. It remains the primary choice for industries requiring instant and durable backup solutions. Gas-powered rentals grow with rising sustainability concerns and regulatory support for cleaner energy alternatives. Other fuels, including hybrid systems, attract interest as companies explore eco-friendly and cost-effective solutions to meet both environmental and operational requirements.

Segments:

Based on Power Rating

- ≤ 75 kVA

- > 75 kVA – 375 kVA

- > 375 kVA – 750 kVA

- > 750 kVA

Based on End Use

- Telecom

- Data Center

- Healthcare

- Oil & Gas

- Electric Utilities

- Offshore

- Manufacturing

- Construction

- Mining

- Marine

- Others

Based on Fuel

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 32% share of the standby power rental market, supported by strong demand from data centers, healthcare, and commercial sectors. It benefits from frequent weather-related outages and an aging grid that drives reliance on rental systems. Oil and gas operations in the United States also generate consistent demand. The region adopts advanced hybrid and low-emission generators in line with sustainability regulations. It remains a mature market where innovation and service quality drive competition.

Europe

Europe accounts for 24% share of the standby power rental market, influenced by strict environmental standards and a focus on green energy adoption. It benefits from demand across healthcare, utilities, and large-scale events requiring reliable backup power. Data center expansion across Germany, the UK, and Nordic countries strengthens the market. Rental providers invest in low-noise and fuel-efficient systems to meet local regulations. It positions itself as a sustainability-driven region with steady long-term growth.

Asia Pacific

Asia Pacific leads with 28% share of the standby power rental market, driven by rapid industrialization, urbanization, and infrastructure projects. It serves construction, telecom, and mining sectors where grid reliability remains limited. Countries like China, India, and Southeast Asian nations adopt rental solutions to manage peak demand and outages. Growth in manufacturing hubs and large commercial facilities accelerates adoption. It remains the fastest-growing region with strong opportunities for global and local rental providers.

Latin America

Latin America represents 9% share of the standby power rental market, supported by infrastructure development and expanding energy projects. It serves construction and mining sectors in Brazil, Chile, and Mexico where temporary power is vital. Frequent blackouts and regional grid instability also increase rental demand. The healthcare and telecom industries contribute to steady growth. It shows rising adoption of diesel and hybrid systems, positioning the region as a developing but promising market.

Middle East & Africa

The Middle East & Africa holds 7% share of the standby power rental market, supported by oil and gas, utilities, and construction industries. It addresses the need for reliable backup in areas with limited grid access. The UAE, Saudi Arabia, and South Africa emerge as key demand centers. Data center growth and large infrastructure projects strengthen adoption. It depends on diesel-based rentals but shows gradual interest in gas and hybrid solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Rehlko

- BPC Power Rentals

- Aggreko

- Finning International

- Al Faris

- Modern Hiring Service

- HIMOINSA

- Caterpillar

- Herc Rentals

- Bredenoord

- Cummins

- Atlas Copco

Competitive Analysis

The standby power rental market demonstrates strong competition with global and regional players focusing on reliability, technological advancements, and service efficiency. It is characterized by the presence of established companies such as Aggreko, Atlas Copco, Caterpillar, Cummins, and HIMOINSA, which dominate through extensive fleets, global networks, and integrated digital solutions. Players like Finning International, Herc Rentals, and Bredenoord strengthen their positions by targeting diverse industries including construction, data centers, and oil and gas with scalable rental offerings. Regional companies such as Al Faris, Rehlko, and Modern Hiring Service enhance market diversity by providing localized expertise, competitive pricing, and customer-centric solutions. BPC Power Rentals builds market presence through tailored offerings across sectors requiring short-term and emergency backup power. Competition centers on expanding hybrid and sustainable rental solutions, integrating IoT-enabled monitoring, and offering flexible contracts to capture evolving customer preferences. It remains a fragmented but growth-driven sector where providers differentiate through innovation, energy efficiency, and customized services aligned with global sustainability and reliability demands.

Recent Developments

- On April 28, 2025, Worldwide Power Products launched an affiliate company called Worldwide Power Distribution (WPD). This expansion focuses on power distribution equipment rentals across the United States, offering equipment such as transformers, distribution panels, automatic transfer switches, and motor starters.

- In February 2025, Sandbrook Capital acquired Intellirent from Electro Rent. This acquisition focuses on electrical-test equipment rentals that support power grid modernization, aligning with growing infrastructure renewal needs.

- In August 2025, Aggreko launched a 400 kW Tier 4 Final Diesel Generator in North America, expanding its cleaner “Greener Upgrades” portfolio.

- In February 2025, Cummins acquired First Mode’s assets, advancing hybrid and hydrogen retrofit solutions for mining and rail, with pilot deployment planned in Chile.

Market Concentration & Characteristics

The standby power rental market displays a moderately fragmented structure with the presence of both global leaders and regional providers competing across diverse industries. It is defined by a balance between large multinational companies such as Aggreko, Caterpillar, Cummins, and Atlas Copco that leverage scale, advanced technology, and global networks, and smaller regional firms that compete through localized expertise, cost-effective offerings, and flexible contracts. The market emphasizes service quality, fuel efficiency, and rapid deployment capabilities as key differentiators. It evolves with growing emphasis on hybrid and renewable-powered systems, digital monitoring, and compliance with stricter emission standards. Competitive intensity remains high, driven by the need to provide scalable solutions for critical applications including data centers, healthcare, oil and gas, and construction. The standby power rental market demonstrates resilience through its ability to adapt to fluctuating fuel prices, regulatory pressures, and customer preferences while maintaining steady demand across mature and emerging economies.

Report Coverage

The research report offers an in-depth analysis based on Power Rating, End-Use, Fuel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for standby power rentals will rise with increasing grid instability and frequent weather-related outages.

- Adoption of hybrid systems combining diesel, gas, and renewable energy will expand across industries.

- Digital monitoring and IoT-enabled platforms will become standard features for improving efficiency and reliability.

- Data centers and telecom networks will remain major growth drivers due to rising connectivity needs.

- Healthcare facilities will increasingly depend on rental systems to ensure uninterrupted patient care.

- Construction and mining projects in emerging economies will generate steady demand for scalable power solutions.

- Providers will focus on developing eco-friendly and fuel-efficient generators to meet environmental regulations.

- Regional players will strengthen market presence through competitive pricing and customized services.

- Strategic partnerships and fleet expansions will define competition among leading global companies.

- The market will evolve toward sustainability, flexibility, and advanced technology integration to meet diverse industry requirements.