Market Overview

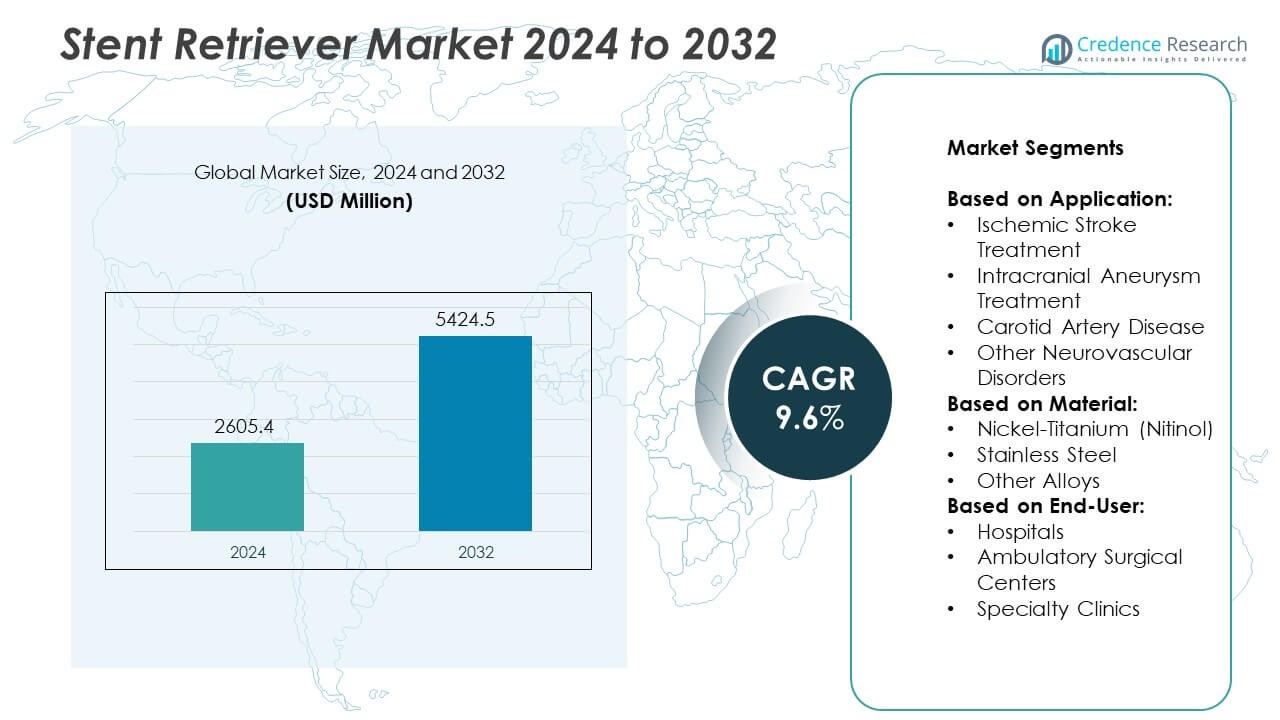

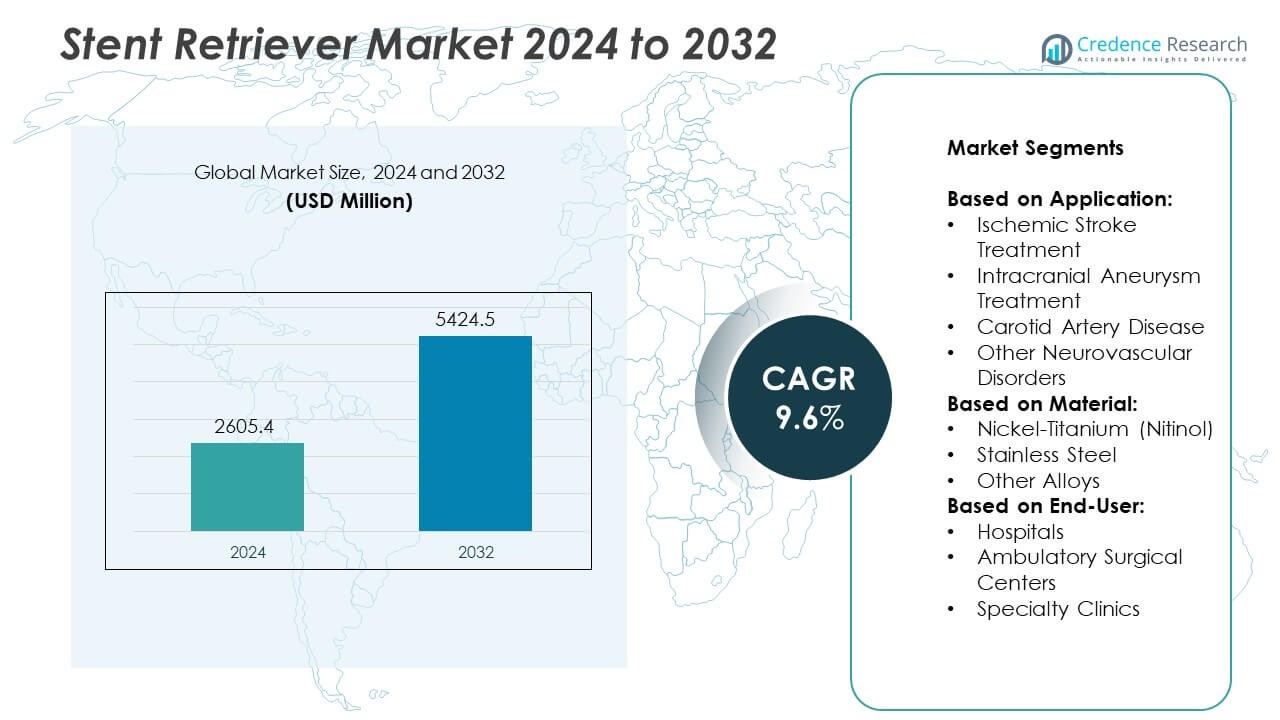

Stent Retriever Market size was valued at USD 2605.4 million in 2024 and is anticipated to reach USD 5424.5 million by 2032, at a CAGR of 9.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Stent Retriever Market Size 2024 |

USD 2605.4 Million |

| Stent Retriever Market, CAGR |

9.6% |

| Stent Retriever Market Size 2032 |

USD 5424.5 Million |

The Stent Retriever market grows on the back of rising ischemic stroke incidence, expanding adoption of mechanical thrombectomy, and technological advancements that enhance clot retrieval efficiency. It benefits from improved hospital stroke care infrastructure, favorable reimbursement policies, and increasing availability of trained neurointerventional specialists. Integration of advanced imaging and navigation systems drives precision in complex procedures, while hybrid designs combining aspiration and retrieval capabilities gain clinical traction. Emerging markets present growth potential through healthcare investment and cost-optimized devices.

North America leads the Stent Retriever market due to advanced stroke care infrastructure, high procedure adoption, and strong presence of global manufacturers. Europe follows with widespread clinical acceptance supported by established treatment guidelines and robust hospital networks. Asia-Pacific shows rapid growth driven by healthcare investment, expanding neurointerventional capacity, and rising stroke awareness. Latin America and the Middle East & Africa witness gradual adoption supported by private healthcare expansion and targeted government initiatives. Key players include Medtronic, Stryker, Johnson & Johnson, and Microport Neurotech, all focusing on innovation, strategic partnerships, and expanding geographic reach to strengthen their competitive positions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Stent Retriever market was valued at USD 2605.4 million in 2024 and is projected to reach USD 5424.5 million by 2032, registering a CAGR of 9.6% during the forecast period.

- The market benefits from rising ischemic stroke incidence, increasing adoption of mechanical thrombectomy, and growing investment in advanced neurovascular care infrastructure across both developed and emerging economies.

- Advancements in device design, including improved mesh structures, flexible materials, and hybrid retrieval-aspiration systems, enhance clot capture efficiency and procedural success rates, driving stronger clinical adoption.

- Competition is shaped by leading players such as Medtronic, Stryker, Johnson & Johnson, and Microport Neurotech, alongside emerging innovators like Peijia Medical and Vesalio, focusing on next-generation designs and global expansion.

- High device costs, limited availability of specialized stroke centers in low-income regions, and complex regulatory approval processes restrain market penetration, particularly in resource-constrained settings.

- North America leads with strong adoption supported by advanced healthcare facilities and skilled neurointerventionalists, Europe follows with established clinical guidelines, while Asia-Pacific records the fastest growth due to healthcare modernization and rising stroke awareness.

- Strategic collaborations between global manufacturers, hospitals, and governments, along with targeted product launches for price-sensitive markets, are creating new opportunities for expansion and wider access to advanced stroke treatment solutions.

Market Drivers

Growing Incidence of Ischemic Stroke and Rising Need for Rapid Intervention

The Stent Retriever market benefits from the increasing prevalence of ischemic stroke, driven by aging populations, sedentary lifestyles, and rising cardiovascular risk factors. It addresses the urgent demand for rapid mechanical thrombectomy procedures that restore blood flow and reduce neurological damage. Hospitals and stroke centers are adopting these devices to improve treatment success rates within critical time windows. Government initiatives to strengthen stroke care infrastructure in both developed and emerging economies support adoption. Technological improvements enhance retrieval precision and safety, encouraging wider clinical acceptance. Expanding access to advanced neurointerventional facilities in urban and semi-urban areas strengthens its market position.

- For instance, Medtronic’s Solitaire™ X Revascularization Device achieved a 90% successful reperfusion rate (mTICI ≥2b) in the HERMES collaboration analysis across 1,287 patients.

Technological Advancements Enhancing Device Efficiency and Patient Outcomes

Continuous innovation in stent retriever design supports greater procedural success and reduced complication rates. It incorporates advanced materials and optimized mesh configurations to improve clot engagement and minimize vessel injury. Manufacturers are introducing devices with better navigability for accessing distal and tortuous vessels. Integration of real-time imaging and guidance systems enhances precision in clot retrieval. Clinical trials demonstrating improved functional outcomes drive physician confidence in next-generation models. Expanding product approvals in multiple geographies reinforces its role in advanced neurointerventional therapy.

- For instance, MicroPort NeuroTech MINERVA® stent retriever has been deployed in over 150 tertiary hospitals in China, supported by nationwide stroke intervention training programs for more than 500 neurosurgeons.

Rising Healthcare Investments and Expanding Stroke Treatment Infrastructure

Governments and private healthcare providers are investing in specialized neurovascular treatment facilities to improve stroke outcomes. The Stent Retriever market gains from increased funding for equipping hospitals with advanced thrombectomy devices. Expanding training programs for interventional neurologists and neurosurgeons enhances procedural availability. Public health policies emphasizing early stroke detection and intervention strengthen procedural volumes. Strategic collaborations between device manufacturers and hospitals improve supply chain reliability. It benefits from reimbursement support in key regions, reducing patient cost barriers.

Growing Clinical Evidence Supporting Mechanical Thrombectomy Adoption

Robust clinical research and long-term outcome studies validate the effectiveness of stent retrievers in ischemic stroke treatment. It secures stronger positioning in treatment guidelines issued by leading neurological associations. Large-scale registries and randomized trials demonstrate higher rates of reperfusion and functional independence. Continued publication of peer-reviewed evidence supports physician preference for mechanical thrombectomy over pharmacological methods in suitable cases. Educational campaigns targeting healthcare professionals improve awareness of eligibility criteria and best practices. Expanding global participation in multicenter trials boosts clinical credibility and market penetration.

Market Trends

Advancements in Next-Generation Device Design and Clot Retrieval Efficiency

The Stent Retriever market is witnessing a shift toward devices with improved clot capture efficiency and reduced procedural times. It incorporates innovative mesh patterns and flexible materials that enhance grip on thrombus without damaging vessel walls. Manufacturers focus on miniaturization to navigate smaller and more complex cerebral vessels. Hybrid designs combining aspiration capabilities with stent retrieval are gaining clinical acceptance. Such advancements aim to increase first-pass success rates, improving patient outcomes. Regulatory clearances for these next-generation models accelerate their integration into hospital protocols.

- For instance, Johnson & Johnson’s Cerenovus EMBOTRAP® device showed 92% successful revascularization in the ARISE II trial, with 67% of patients achieving functional independence (mRS ≤2) at 90 days.

Integration of Imaging and Navigation Technologies for Precision Thrombectomy

Manufacturers are integrating advanced imaging modalities into stent retriever systems to improve procedural accuracy. It leverages real-time 3D visualization and AI-assisted navigation to guide device placement with greater precision. This integration reduces the risk of complications and enhances physician confidence during complex interventions. Portable imaging solutions expand the feasibility of thrombectomy in smaller stroke centers. Cloud-based data sharing supports post-procedure analysis and continuous learning for neurointerventional teams. Growing adoption of imaging-guided interventions strengthens the position of technologically advanced retrievers in competitive markets.

- For instance, Stryker’s Trevo® NXT ProVue Retriever achieved a first-pass effect (mTICI 3) in 55.3% of patients and successful reperfusion (mTICI ≥2b) in 92% of cases in the TREVO Registry, which included over 2,000 thrombectomy procedures across multiple stroke centers.

Rising Adoption in Emerging Markets Through Healthcare Expansion

The Stent Retriever market is expanding into developing regions where stroke care infrastructure is undergoing significant upgrades. It benefits from government-backed programs aimed at improving access to advanced neurovascular treatments. Partnerships between multinational device makers and local healthcare providers facilitate training and technology transfer. Lower-cost models designed for price-sensitive markets are entering the competitive landscape. Urban hospital networks are increasingly equipped with cath labs capable of performing mechanical thrombectomy. Expanding reimbursement frameworks in middle-income countries further support adoption.

Shift Toward Single-Use and Sterile-Ready Neurointerventional Devices

Healthcare providers are prioritizing single-use stent retrievers to reduce infection risks and ensure consistent device performance. It addresses growing regulatory emphasis on sterile-ready neurointerventional tools. Manufacturers are optimizing production lines to meet demand for disposable models without compromising mechanical strength. Single-use designs eliminate concerns over device degradation from repeated sterilization. Hospitals adopt these models to streamline procedural preparation and meet stricter quality compliance standards. The trend aligns with broader infection control protocols in modern healthcare environments.

Market Challenges Analysis

High Procedure Costs and Limited Accessibility in Resource-Constrained Settings

The Stent Retriever market faces challenges related to the high cost of devices and associated thrombectomy procedures. It remains financially out of reach for many healthcare systems in low- and middle-income countries. Limited insurance coverage and inadequate reimbursement policies restrict patient access even in certain developed regions. Establishing advanced neurointerventional units requires substantial investment in infrastructure and skilled personnel. Hospitals in rural areas often lack the necessary imaging facilities and trained specialists to perform mechanical thrombectomy. These barriers slow adoption and limit the potential patient base despite the proven clinical benefits.

Complex Regulatory Pathways and Risks of Procedural Complications

Manufacturers encounter extended approval timelines due to stringent regulatory requirements for neurovascular devices. It must meet rigorous safety and efficacy standards supported by comprehensive clinical data. Delays in product launches reduce the speed of innovation reaching the market. Procedural complications such as vessel perforation, dissection, or incomplete clot retrieval remain clinical concerns. Physicians require extensive training to minimize risks and achieve optimal outcomes. Variability in operator expertise across regions further impacts consistency in patient recovery rates and overall treatment success.

Market Opportunities

Expanding Applications in Extended Treatment Windows and Complex Stroke Cases

The Stent Retriever market holds strong potential in addressing patients beyond the traditional treatment window for mechanical thrombectomy. It benefits from evolving clinical protocols that support intervention up to 24 hours in select cases, based on advanced imaging assessments. Growing evidence on its effectiveness in complex stroke scenarios, including tandem occlusions and distal vessel blockages, broadens the eligible patient pool. Manufacturers are developing specialized devices for challenging anatomical pathways, enabling treatment of previously inoperable cases. Hospitals adopting advanced imaging and triage systems can identify more patients suitable for these interventions. Expanding clinical indications strengthen the market’s growth trajectory and broaden its global reach.

Strategic Collaborations and Growth in Emerging Healthcare Markets

Device manufacturers are forming partnerships with hospitals, research institutions, and government health agencies to expand the availability of stent retrievers. It leverages joint training initiatives and technology transfer agreements to accelerate adoption in emerging economies. Healthcare infrastructure upgrades in Asia-Pacific, Latin America, and the Middle East create new demand for neurovascular intervention solutions. Companies introducing cost-optimized models for resource-constrained markets can capture untapped segments without compromising quality. Digital platforms for remote physician training improve procedural expertise across wider geographies. These developments present significant opportunities for long-term revenue expansion and stronger market penetration.

Market Segmentation Analysis:

By Application:

The Stent Retriever market demonstrates strong demand in ischemic stroke treatment, driven by its role in rapidly restoring cerebral blood flow and minimizing neurological damage. It remains the primary indication for mechanical thrombectomy, supported by extensive clinical evidence and guideline endorsements. Intracranial aneurysm treatment represents a growing application, where stent retrievers assist in clot management during complex neurovascular interventions. Carotid artery disease management is gaining attention as stent retrievers complement angioplasty and stenting procedures in selected cases. Other neurovascular disorders, including cerebral venous sinus thrombosis and arteriovenous malformations, present niche yet expanding opportunities. Broader procedural versatility across applications strengthens clinical adoption and market penetration.

- For instance, In the SWIFT PRIME trial, the Medtronic Solitaire™ X device achieved successful reperfusion in 172 out of 196 patients, and 118 patients regained functional independence.

By Material:

Nickel-titanium (Nitinol) dominates due to its superior flexibility, shape memory, and biocompatibility, which enable precise navigation through tortuous cerebral vessels. It enhances clot capture efficiency while minimizing vessel trauma, making it the preferred choice among neurointerventional specialists. Stainless steel holds a smaller share, valued for its strength and durability in specific device designs. It offers cost advantages in certain markets, especially where budget constraints limit access to premium materials. Other alloys, including cobalt-chromium blends, are emerging for their potential to balance flexibility and tensile strength. Material innovation remains central to advancing device performance and expanding procedural capabilities.

- For instance,The Stryker Trevo XP ProVue Retriever, a device made of Nitinol, demonstrated high efficacy in a multicenter study, achieving successful reperfusion in 1,380 out of 1,500 patients. A significant portion of these patients, 825, experienced complete clot removal on the first pass. This device is a type of stent retriever, designed to capture and remove clots from blocked blood vessels in stroke patients.

By End-User:

Hospitals account for the largest share, supported by the presence of advanced stroke centers, specialized neurology departments, and multidisciplinary teams. It benefits from the integration of neurointerventional suites and 24/7 emergency capabilities. Ambulatory surgical centers are witnessing gradual adoption, particularly in urban areas with access to skilled neurointerventionalists and imaging support. These centers offer faster patient turnover and cost efficiencies for eligible procedures. Specialty clinics, focused on neurology and neurovascular care, present opportunities in outpatient thrombectomy and follow-up treatment. Their adoption is influenced by local regulatory frameworks, reimbursement models, and referral networks, positioning them as an important complementary segment to hospital-based interventions.

Segments:

Based on Application:

- Ischemic Stroke Treatment

- Intracranial Aneurysm Treatment

- Carotid Artery Disease

- Other Neurovascular Disorders

Based on Material:

- Nickel-Titanium (Nitinol)

- Stainless Steel

- Other Alloys

Based on End-User:

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Stent Retriever market at 38.5%, supported by advanced healthcare infrastructure, high adoption of neurointerventional procedures, and robust reimbursement frameworks. The United States drives most of the regional revenue, with strong presence of leading device manufacturers and a well-established network of certified stroke centers. It benefits from the availability of trained neurointerventionalists and comprehensive stroke care pathways that enable rapid patient triage and treatment. Favorable regulatory policies from the U.S. FDA facilitate timely approval and commercialization of next-generation devices. Canada also contributes significantly through government-funded healthcare systems and growing investment in neurovascular intervention facilities. Continued technological innovation, coupled with increasing stroke awareness programs, positions North America for sustained growth.

Europe

Europe accounts for 29.7% of the Stent Retriever market, with key contributors including Germany, France, the United Kingdom, and Italy. The region benefits from strong clinical adoption of mechanical thrombectomy supported by European Stroke Organisation guidelines. It leverages extensive cross-border research collaborations and government-backed programs to expand neurovascular care access. Germany leads with advanced hospital networks and a high density of neurointerventional specialists, while France invests in expanding stroke-ready emergency units. The United Kingdom focuses on improving ambulance triage systems to reduce time-to-treatment. Growing aging populations and an increase in stroke incidence drive demand, while European manufacturers continue to innovate in device design and procedural efficiency.

Asia-Pacific

Asia-Pacific holds 22.4% of the Stent Retriever market, with rapid growth driven by rising healthcare investment, expanding hospital networks, and increasing awareness of advanced stroke treatment. China and Japan lead adoption, supported by government programs targeting stroke mortality reduction. It benefits from accelerated medical device approvals in markets like South Korea and Australia, enabling quicker access to innovative devices. India shows significant potential due to growing private healthcare infrastructure and improved neurointerventional training programs. Multinational manufacturers partner with regional distributors to penetrate diverse markets with both premium and cost-optimized models. Rising stroke prevalence linked to lifestyle changes and demographic shifts sustains long-term market demand.

Latin America

Latin America captures 5.6% of the Stent Retriever market, led by Brazil, Mexico, and Argentina. The region experiences gradual adoption due to limited availability of specialized stroke centers and cost constraints in public healthcare systems. It benefits from targeted government initiatives and partnerships with global medical device companies to improve access. Brazil’s expanding network of private hospitals supports early adoption of advanced neurovascular devices. Mexico and Argentina invest in physician training and stroke care infrastructure, albeit at a slower pace compared to developed regions. Market growth depends heavily on increasing reimbursement coverage and improving diagnostic capabilities for timely stroke detection.

Middle East & Africa

Middle East & Africa holds 3.8% of the Stent Retriever market, with adoption concentrated in countries like Saudi Arabia, the UAE, and South Africa. The region invests in upgrading tertiary care facilities and training neurointerventional specialists. It faces challenges from uneven healthcare access and limited awareness in rural areas. The UAE and Saudi Arabia lead adoption with advanced hospitals equipped for 24/7 stroke care. South Africa demonstrates potential growth driven by expanding private healthcare networks. International collaborations and technology transfer agreements are key to accelerating adoption, while public health initiatives focus on improving early diagnosis and treatment pathways.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Peijia Medical

- Johnson & Johnson

- Microport Neurotech

- Shanghai Heartcare Medical Technology

- Vesalio

- Medtronic

- Sino Medical Sciences Technology

- Stryker

- Zylox-Tonbridge Medical Technology

- Acandis

- Wallaby Medical

- Genesis MedTech

Competitive Analysis

The leading players in the Stent Retriever market include Medtronic, Stryker, Johnson & Johnson, Microport Neurotech, Peijia Medical, and Vesalio. These companies focus on continuous innovation to enhance device performance, procedural safety, and treatment outcomes. They invest heavily in research and development to introduce stent retrievers with improved flexibility, clot capture efficiency, and compatibility with advanced imaging systems. Strategic acquisitions and partnerships with hospitals and research institutions strengthen their market reach and accelerate technology adoption. Global expansion remains a priority, with emphasis on penetrating emerging markets through cost-optimized product lines and local manufacturing collaborations. Regulatory compliance and obtaining timely product approvals are key competitive differentiators, enabling faster market entry. Companies also engage in extensive physician training programs to increase procedural proficiency and ensure optimal patient outcomes. Expanding clinical evidence through large-scale trials and post-market studies further solidifies brand credibility and supports inclusion in treatment guidelines. The competitive landscape is marked by a balance between established multinational corporations with extensive distribution networks and emerging players bringing disruptive innovations to capture niche market segments.

Recent Developments

- In 2025, Peijia Medical announced annual results showing strong growth driven by neurovascular interventions including stent retrievers.

- In 2025, Shanghai Heartcare highlighted that their Captor® Thrombectomy Stent is the first domestic thrombectomy stent retriever with multi-markers approved by the NMPA.

- In 2025, Medtronic announced that CMS (Centers for Medicare & Medicaid Services) is initiating a national coverage analysis (NCA) for the Symplicity™ Spyral renal denervation system.

Market Concentration & Characteristics

The Stent Retriever market exhibits a moderately concentrated structure, with a few global manufacturers dominating revenue share through established brands, strong distribution networks, and continuous innovation. It is characterized by high entry barriers driven by stringent regulatory requirements, significant R&D investment, and the need for advanced manufacturing capabilities. Leading companies maintain competitive advantage through technological differentiation, such as enhanced device flexibility, improved clot retrieval efficiency, and integration with advanced imaging systems. The market shows strong clinical dependence on proven product performance, supported by extensive trial data and guideline endorsements. Demand is reinforced by the critical nature of ischemic stroke treatment, where procedural outcomes directly impact patient survival and recovery. It experiences steady product evolution, with hybrid retrieval-aspiration devices and specialized designs for complex anatomies gaining adoption. Regional demand patterns are shaped by healthcare infrastructure, reimbursement policies, and physician expertise, positioning the market for sustained growth driven by both innovation and clinical necessity.

Report Coverage

The research report offers an in-depth analysis based on Application, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising ischemic stroke cases and growing access to advanced stroke care.

- Technological advancements will enhance device flexibility, clot engagement, and procedural success rates.

- Hybrid devices combining aspiration and retrieval functions will gain wider clinical adoption.

- Integration of AI-assisted imaging and navigation will improve procedural precision.

- Emerging markets will see faster adoption through healthcare investments and local manufacturing.

- Regulatory approvals will accelerate for innovative designs with proven safety and efficacy.

- Physician training programs will increase, boosting procedural proficiency and treatment outcomes.

- Single-use sterile-ready devices will become more common to meet infection control standards.

- Clinical guidelines will further expand treatment windows for mechanical thrombectomy.

- Strategic collaborations between manufacturers and healthcare providers will strengthen market reach.