Market Overview

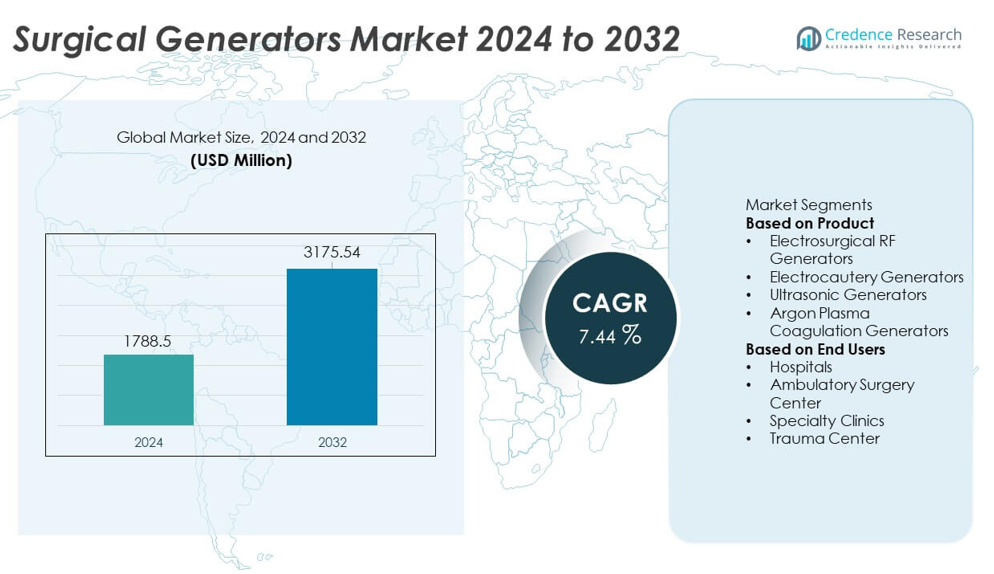

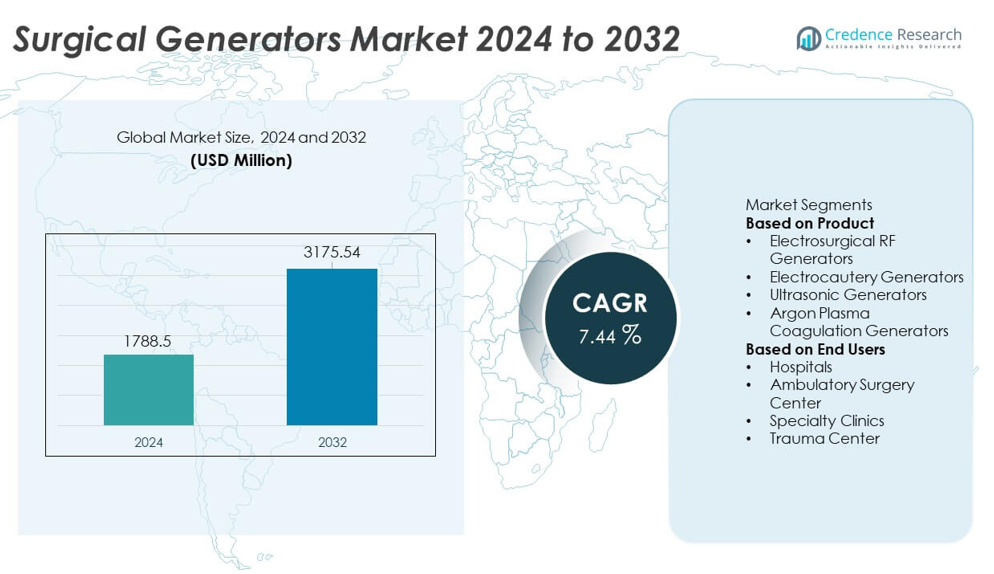

Surgical Generators market size reached USD 1,788.5 million in 2024 and is projected to grow to USD 3,175.54 million by 2032, recording a CAGR of 7.44% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Surgical Generators market Size 2024 |

USD 1,788.5 million |

| Surgical Generators market, CAGR |

7.44% |

| Surgical Generators market Size 2032 |

USD 3,175.54 million |

The Surgical Generators market is shaped by leading players such as Medtronic plc, Ethicon (Johnson & Johnson), Olympus Corporation, CONMED Corporation, Bovie Medical (Apyx Medical), Erbe Elektromedizin GmbH, Smith & Nephew, Stryker Corporation, Karl Storz SE & Co. KG, and B. Braun Melsungen AG, all of whom focus on advancing electrosurgical, ultrasonic, and plasma-based technologies to support precision-driven surgical care. These companies invest in multi-function generators, improved thermal control, and digital integration to enhance operating room efficiency and patient safety. North America leads the market with a 36% share, supported by strong OR modernization, followed by Europe with 30% as hospitals expand minimally invasive surgery capabilities.

Market Insights

- The Surgical Generators market reached USD 1,788.5 million in 2024 and is set to grow at a 7.44% CAGR through 2032, driven by rising global surgical demand.

- Key drivers include increasing adoption of advanced energy-based surgical systems, with Electrosurgical RF Generators holding a 44% share supported by their wide use in cutting and coagulation procedures.

- Market trends highlight strong adoption of minimally invasive surgeries and rapid integration of smart, digitally connected surgical platforms across hospitals and ambulatory centers.

- Competitive activity increases as major players invest in multi-mode, precision-controlled generators, but the market faces restraints from high equipment costs and limited access in low-resource facilities.

- Regionally, North America leads with 36%, Europe holds 30%, and Asia Pacific accounts for 26%, reflecting strong investments in OR modernization and expanding adoption of electrosurgical and ultrasonic systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Electrosurgical RF Generators lead this segment with a 44% share, driven by their wide use in cutting, coagulation, and tissue desiccation across multiple surgical specialties. Hospitals prefer these generators for their precision, adjustable energy output, and compatibility with modern electrosurgical instruments. Electrocautery Generators follow due to strong demand in general surgeries and dermatology procedures. Ultrasonic Generators gain traction for minimally invasive surgeries where reduced thermal damage is critical. Argon Plasma Coagulation Generators continue to expand in gastrointestinal and oncological procedures. Advancements in safety features and energy-control systems further strengthen adoption across operating rooms.

- For instance, Medtronic’s latest Valleylab FT10 energy platform can deliver a maximum power output of 300 watts in Monopolar Cut (Pure) mode, and its TissueFect™ sensing technology monitors tissue impedance changes at a rate of 434,000 times per second.

By End Users

Hospitals dominate the end-user segment with a 58% share, supported by high surgical volume, advanced operating room infrastructure, and strong adoption of energy-based surgical systems. Large multispecialty hospitals invest in electrosurgical and ultrasonic platforms to support complex procedures across cardiology, orthopedics, oncology, and gynecology. Ambulatory Surgery Centers follow as outpatient surgeries grow due to shorter recovery times and lower costs. Specialty Clinics adopt compact generators for dermatology, ENT, and cosmetic procedures. Trauma Centers use high-performance generators for rapid hemostasis and emergency interventions. Rising surgical caseloads and adoption of minimally invasive procedures continue to drive segment growth.

- For instance, CONMED’s System 5000 platform delivers cut/coag modes with power levels reaching 300 watts.

Key Growth Drivers

Rising Surgical Volume and Expansion of Minimally Invasive Procedures

Global surgical volume continues to rise due to growing chronic disease prevalence, aging populations, and expanded access to medical care. Minimally invasive procedures gain strong traction because they reduce patient trauma, shorten recovery time, and lower hospital costs. Surgical generators support these techniques with precise energy delivery for cutting and coagulation. Hospitals upgrade energy-based systems to improve efficiency and reduce intraoperative blood loss. Growing adoption of laparoscopic, robotic, and endoscopic surgeries strengthens demand for advanced RF, ultrasonic, and plasma-based generators, driving significant market growth across both developed and emerging regions.

- For instance, Intuitive Surgical’s da Vinci systems performed approximately 2,286,000 robotic-assisted procedures in 2023.

Advancements in Energy-Based Surgical Technologies

Continuous innovation in electrosurgical, ultrasonic, and plasma energy systems drives strong demand for next-generation surgical generators. Modern devices offer better thermal control, real-time tissue sensing, and improved power modulation, reducing the risk of tissue damage. Surgeons adopt advanced platforms to achieve cleaner cuts, faster coagulation, and enhanced precision. Integration with digital interfaces and smarter safety mechanisms strengthens reliability in operating rooms. Manufacturers invest in multi-mode generators that support multiple surgical specialties, improving device versatility. These advances position energy-based devices as essential tools across operating suites.

- For instance, Ethicon’s ENSEAL X1 Large Jaw technology uses an offset electrode configuration tested for a mean thermal spread measurement of approximately 1.2 mm in benchtop studies.

Increasing Hospital Investments in OR Modernization

Hospitals worldwide invest in upgrading operating room infrastructure to support advanced surgical workflows and safety standards. High-performance surgical generators form a core part of these modernization programs, enabling improved hemostasis, higher accuracy, and reduced procedural complications. Facilities prioritize systems that support minimally invasive, robotic, and high-frequency electrosurgical procedures. Growing focus on patient outcomes, reduced operating time, and streamlined workflow efficiency drives adoption of multifunctional generators. Government healthcare spending and private hospital expansion further contribute to market growth.

Key Trends & Opportunities

Growing Shift Toward Smart, Digitally Connected Surgical Platforms

Digital integration becomes a key trend as hospitals adopt smart surgical generators equipped with automated power adjustment, tissue feedback mechanisms, and real-time monitoring. Connectivity features support data recording, workflow optimization, and improved surgical precision. Integration with imaging and robotic systems creates new opportunities for seamless OR coordination. These advancements enable consistent energy delivery and support predictive maintenance. As operating rooms digitalize, demand rises for intelligent generators capable of enhancing surgical accuracy and safety.

- For instance, Olympus’ ESG-410 system integrates digital interfaces that log up to 50 procedural parameters for OR analytics.

Rising Demand in Ambulatory Surgery Centers and Specialty Clinics

Ambulatory Surgery Centers expand rapidly as patients and healthcare providers shift toward outpatient procedures with lower costs and shorter stays. This trend boosts demand for compact, efficient, and easy-to-use surgical generators. Specialty clinics in dermatology, ENT, gynecology, and cosmetic surgery increasingly adopt portable electrosurgical and ultrasonic systems. Manufacturers capitalize on this opportunity by offering modular, user-friendly generators designed for smaller surgical environments. Growth in outpatient care creates long-term adoption opportunities across both developed and emerging markets.

- For instance, Smith & Nephew’s portable negative pressure wound therapy (NPWT) systems, such as the PICO 7, are supported by a strong clinical evidence base including 65 unique clinical studies and 21 published randomized controlled trials.

Key Challenges

Risks of Thermal Injury and Device-Related Complications

Despite technological improvements, surgical generators still present risks such as unintended thermal injury, stray energy burns, and insulation failure. These risks require strict safety protocols, operator training, and regular equipment verification. Inconsistent device maintenance further increases the likelihood of complications. Hospitals must invest in high-quality accessories and proper grounding techniques to minimize hazards. These safety concerns slow adoption in facilities with limited expertise or insufficient staff training, posing a challenge to wide-scale deployment.

High Equipment Costs and Limited Access in Low-Resource Settings

Advanced surgical generators require significant capital investment, making adoption difficult for hospitals in low- and middle-income regions. High installation, maintenance, and accessory costs restrict widespread use, especially in smaller healthcare facilities. Budget constraints limit access to ultrasonic and argon plasma systems, which are more expensive than traditional electrosurgical units. Limited reimbursement for energy-based procedures further challenges adoption. Addressing these cost barriers requires affordable device offerings and expanded government support for hospital modernization.

Regional Analysis

North America

North America holds a 36% share in the Surgical Generators market, driven by high surgical volume, strong adoption of minimally invasive procedures, and robust hospital investments in advanced operating room technologies. The region benefits from well-established healthcare infrastructure, high awareness of energy-based surgical systems, and rapid integration of digital and robotic platforms. The United States leads with significant demand for RF and ultrasonic generators across cardiology, oncology, and orthopedic procedures. Rising outpatient surgeries and growing use of electrosurgical devices in ambulatory centers further support growth. Continuous innovation and strong presence of global manufacturers reinforce regional dominance.

Europe

Europe accounts for a 30% share, supported by widespread use of energy-based surgical systems across hospitals and specialty clinics. Countries like Germany, France, and the United Kingdom drive strong demand due to high surgical caseloads and well-developed healthcare reimbursement systems. The region focuses on enhancing surgical safety, precision, and workflow efficiency, boosting adoption of electrosurgical and ultrasonic generators. Growing preference for minimally invasive surgeries strengthens demand for advanced coagulation and cutting technologies. Investments in OR modernization and rising adoption of robotic and endoscopic systems further contribute to regional market expansion.

Asia Pacific

Asia Pacific holds a 26% share, driven by expanding healthcare infrastructure, rising chronic disease burden, and increasing surgical volume across China, India, and Japan. Hospitals in the region invest in energy-based devices to support growing demand for laparoscopic, gastrointestinal, and oncology procedures. Government healthcare spending and private hospital expansion accelerate adoption of advanced electrosurgical and ultrasonic generators. Rapid growth in medical tourism and rising preference for minimally invasive procedures further strengthen the market. As surgical capabilities expand, the region emerges as a major growth hub for global manufacturers.

Latin America

Latin America holds a 5% share, supported by growing adoption of electrosurgical and ultrasonic generators in Brazil, Mexico, and Argentina. Demand rises as hospitals upgrade their operating rooms and expand capacity to manage increasing surgical requirements. The region sees stronger uptake in general surgery, gynecology, and gastroenterology applications. Although budget constraints slow adoption of high-end systems, increasing government investment and growth in private healthcare support gradual market expansion. Rising awareness of minimally invasive techniques also drives demand across urban healthcare facilities.

Middle East & Africa

The Middle East & Africa region holds a 3% share, driven by increasing investment in hospital modernization and growing demand for energy-based surgical devices in the UAE, Saudi Arabia, and South Africa. Rising surgical procedures in oncology, cardiology, and gastroenterology support adoption of electrosurgical and ultrasonic generators. However, limited access to advanced technologies in low-resource areas restrains faster growth. Government initiatives to improve surgical infrastructure and expand specialty care services strengthen future potential. Growth remains steady as healthcare systems continue adopting modern surgical tools to improve patient outcomes.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product

- Electrosurgical RF Generators

- Electrocautery Generators

- Ultrasonic Generators

- Argon Plasma Coagulation Generators

By End Users

- Hospitals

- Ambulatory Surgery Center

- Specialty Clinics

- Trauma Center

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape includes major players such as Medtronic plc, Ethicon (Johnson & Johnson), Olympus Corporation, CONMED Corporation, Bovie Medical (Apyx Medical), Erbe Elektromedizin GmbH, Smith & Nephew, Stryker Corporation, Karl Storz SE & Co. KG, and B. Braun Melsungen AG. These companies strengthen their market position by advancing electrosurgical, ultrasonic, and plasma-based generator technologies designed to improve precision, thermal control, and surgical safety. Leading manufacturers invest in R&D to develop multi-mode systems that support a wide range of procedures across general surgery, gynecology, cardiology, oncology, and orthopedics. Strategic partnerships with hospitals and surgical centers help expand product adoption, while continuous upgrades in energy efficiency and tissue-sensing technologies enhance performance. Companies also focus on ergonomic designs, digital integration, and automation features that support smarter operating room workflows. Growing demand for minimally invasive surgeries and modern OR infrastructure continues to intensify competition across global healthcare markets.

Key Player Analysis

- Medtronic plc

- Ethicon (Johnson & Johnson)

- Olympus Corporation

- CONMED Corporation

- Bovie Medical (Apyx Medical)

- Erbe Elektromedizin GmbH

- Smith & Nephew

- Stryker Corporation

- Karl Storz SE & Co. KG

- Braun Melsungen AG

Recent Developments

- In October 2025, Medtronic reiterated this launch, highlighting its TissueFect sensing technology — which automatically adjusts energy output based on tissue type to improve safety and precision.

- In September 2025, Medtronic plc launched two advanced surgical energy generators in India: the Valleylab™ FT10 Electrosurgical Generator (VLFT10FXGEN) and the Valleylab™ FT10 Vessel Sealing Generator (VLFT10LSGEN).

- In August 2023, B. Braun Melsungen AG gained European regulatory approval for a next-generation electrosurgical generator, enabling broader use across EU markets.

Report Coverage

The research report offers an in-depth analysis based on Product, End Users and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of advanced electrosurgical and ultrasonic platforms will rise as hospitals modernize operating rooms.

- Minimally invasive and robotic surgeries will drive demand for precision-controlled surgical generators.

- Digital integration and smart energy management features will become standard in next-generation systems.

- Tissue-sensing and automated power adjustment technologies will improve surgical safety and consistency.

- Ambulatory surgery centers will expand their use of compact, multifunctional generators.

- Growth in oncology, cardiovascular, and gastrointestinal procedures will strengthen demand for energy-based devices.

- Manufacturers will invest in ergonomically designed and workflow-optimized generator systems.

- Emerging markets will increase adoption as healthcare infrastructure and surgical capacity improve.

- Development of hybrid operating rooms will accelerate the need for versatile, multi-mode surgical generators.

- Enhanced training and safety protocols will support broader adoption of high-frequency electrosurgical equipment.