Market Overview:

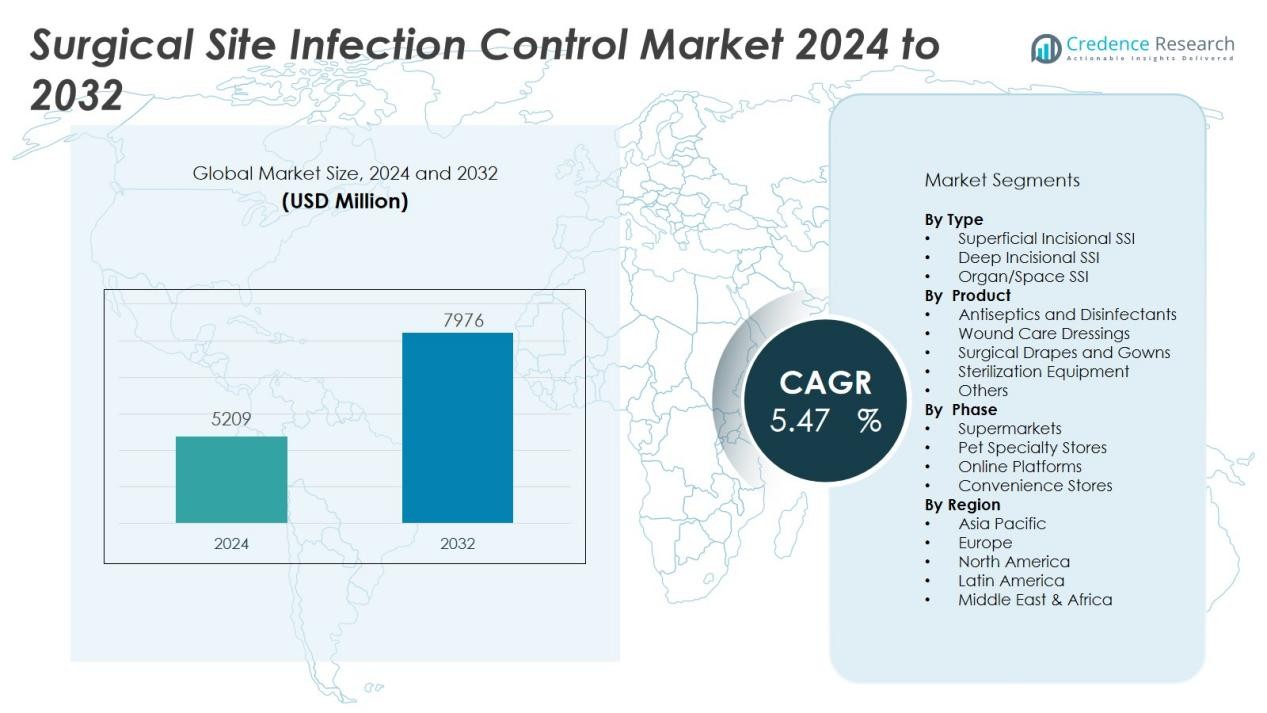

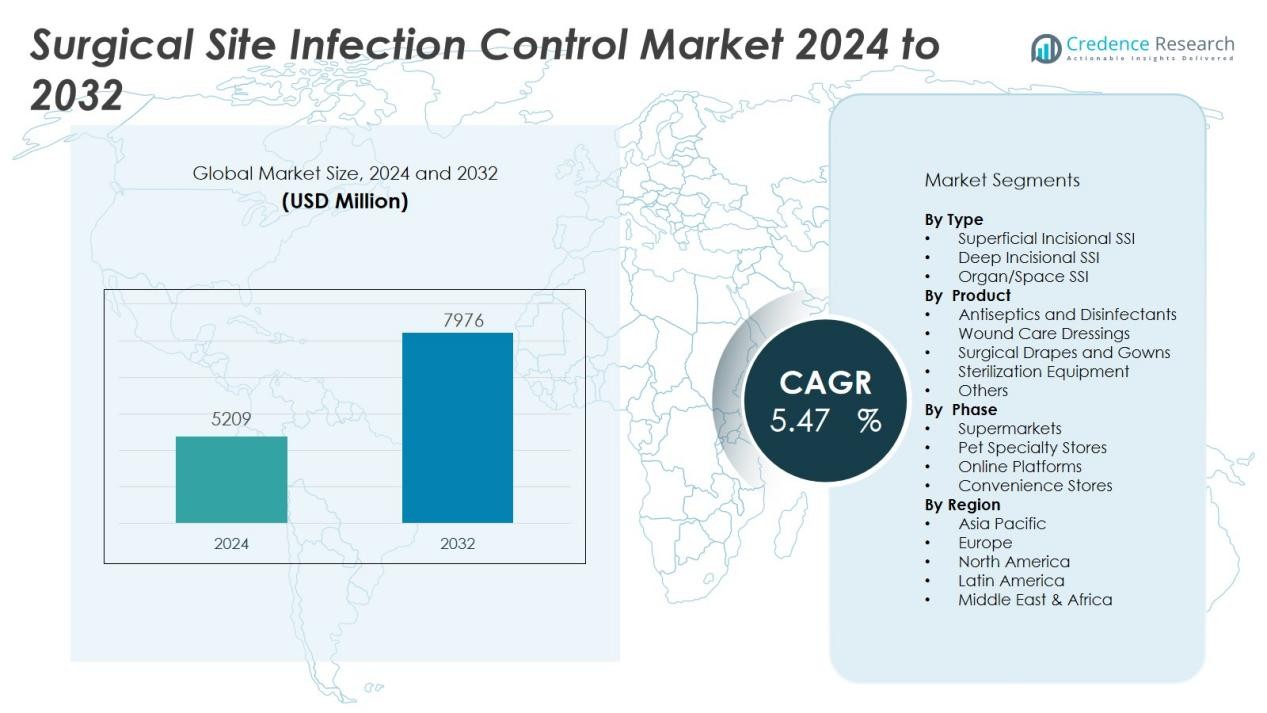

The Surgical Site Infection Control Market size was valued at USD 5209 million in 2024 and is anticipated to reach USD 7976 million by 2032, at a CAGR of 5.47 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Surgical Site Infection Control Market Size 2024 |

USD 5209 Million |

| Surgical Site Infection Control Market, CAGR |

5.47 % |

| Surgical Site Infection Control Market Size 2032 |

USD 7976 Million |

Key drivers shaping the surgical site infection control market include growing healthcare expenditure, expanding geriatric population, and a rise in chronic diseases requiring surgical intervention. Stringent regulatory guidelines from global health agencies and efforts to reduce HAIs are compelling hospitals to invest in advanced sterilization equipment and infection prevention technologies. The integration of evidence-based protocols and compliance with infection control standards have become critical to improving patient outcomes and minimizing post-operative complications.

Regionally, North America dominates the surgical site infection control market due to well-established healthcare infrastructure, high surgical procedure rates, and strong regulatory enforcement. Europe holds a significant share, supported by government initiatives and hospital hygiene mandates. The Asia-Pacific region is witnessing rapid growth, driven by healthcare modernization, rising surgical demand, and increased awareness in countries such as China, India, and Japan.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The market was valued at USD 5,209 million in 2024 and is projected to reach USD 7,976 million by 2032, driven by rising surgical procedures and infection control initiatives.

- Aging populations and chronic diseases such as diabetes and cardiovascular conditions continue to elevate surgical volumes globally.

- Regulatory bodies including the CDC and WHO enforce strict disinfection and sterilization standards, accelerating adoption of advanced infection control technologies.

- Hospitals prioritize automated sterilization systems, antimicrobial dressings, and disposable drapes to reduce contamination risks and improve patient safety.

- Budget constraints and lack of reimbursement policies in low-income regions limit access to high-cost infection prevention tools.

- North America holds 38% of the market, supported by strong healthcare infrastructure and stringent infection surveillance regulations.

- Asia-Pacific shows fastest growth due to increasing healthcare investments, surgical demand, and awareness in countries like China, India, and Japan.

Market Drivers:

Rising Surgical Volumes and Aging Population Drive Demand for Infection Control:

The increase in surgical procedures globally, particularly among aging populations, fuels the demand for infection control measures. Rising incidences of chronic illnesses such as cardiovascular disease, diabetes, and cancer have led to higher surgical intervention rates. The surgical site infection control market benefits from this surge, with hospitals prioritizing infection prevention to reduce complications. The need to maintain surgical success rates and minimize postoperative risks continues to strengthen the market’s foundation.

Stringent Regulatory Standards and Hospital Protocols Encourage Adoption:

Government and health organizations have introduced strict guidelines to curb hospital-acquired infections. Institutions like the CDC, WHO, and FDA mandate compliance with sterilization protocols, antiseptic practices, and disinfection standards. The surgical site infection control market responds to these regulations by offering advanced antimicrobial products and sterilization technologies. It reinforces healthcare providers’ efforts to meet performance benchmarks and avoid penalties linked to infection rates.

- For instance, according to the CDC’s National Healthcare Safety Network, 49 U.S. states performed better on at least three types of healthcare-associated infection benchmarks in 2023 compared to the 2015 baseline, demonstrating the positive impact of regulatory-driven adoption of advanced technologies and protocols.

Technological Advancements in Sterilization and Antiseptic Solutions Support Growth:

Innovation in disinfection technologies, such as automated sterilizers, antimicrobial-coated surgical tools, and next-generation antiseptic agents, supports the market’s expansion. These advancements improve infection prevention outcomes and enhance clinical efficiency. The surgical site infection control market benefits from the development of single-use products and minimally invasive solutions designed to reduce contamination risks. It aligns with hospitals’ goals to improve safety and reduce reliance on traditional manual cleaning processes.

- For instance, the STERIS AMSCO 600 Medium Steam Sterilizer can process up to 375 pounds of instruments per cycle, allowing for high-throughput sterilization in a compact footprint and significantly streamlining hospital operations.

Growing Awareness and Training Programs Improve Compliance:

Healthcare professionals and administrative bodies are investing in training programs to reinforce best practices in infection control. Increased awareness about the economic burden and patient impact of surgical site infections drives proactive prevention strategies. The surgical site infection control market gains momentum as institutions implement standardized protocols and continuous education. It ensures sustained focus on infection control across public and private healthcare sectors.

Market Trends:

Integration of Antimicrobial Technologies in Surgical Products Enhances Infection Control:

The adoption of antimicrobial coatings and materials in surgical drapes, sutures, dressings, and instrument trays is transforming infection prevention. Hospitals are investing in products that incorporate silver, iodine, and chlorhexidine to actively prevent microbial growth at the surgical site. These innovations extend the protective effect beyond the operating room and reduce the likelihood of bacterial colonization. The surgical site infection control market is evolving to include more targeted and sustained-release antiseptic solutions. It reflects a broader trend of embedding infection resistance directly into surgical tools and consumables. Manufacturers continue to launch next-generation products that improve patient safety and reduce the need for postoperative interventions.

- For instance, Germitec Chronos UV-C disinfection system, FDA-cleared in the US, can disinfect ultrasound probes in just 90 seconds per cycle using UV-C light, helping facilities reduce turnaround time and minimize infection risk[1].

Automation and Data-Driven Sterilization Improve Infection Surveillance:

Hospitals are adopting automated sterilization systems and real-time monitoring technologies to enhance procedural efficiency and compliance. These systems provide consistent decontamination outcomes and minimize human error in sterilization workflows. The surgical site infection control market benefits from the integration of software platforms that track infection trends, manage protocol adherence, and generate audit-ready documentation. It supports infection control teams with actionable insights and helps institutions maintain regulatory compliance. Demand for centralized tracking of surgical site infections is rising, prompting the integration of AI-based risk prediction models into hospital systems. These digital tools play a growing role in early detection and proactive prevention strategies.

- For instance, the Mayo Clinic developed a deep learning AI model trained on over 20,000 images from more than 6,000 patients, attaining 94% accuracy in identifying surgical incisions and an 81% area under the curve (AUC) for surgical site infection detection from patient-submitted photographs, substantially speeding up home-based SSI monitoring.

Market Challenges Analysis:

High Cost of Advanced Infection Control Solutions Limits Accessibility:

The adoption of technologically advanced surgical site infection control products often involves significant upfront costs. Many healthcare facilities, especially in low- and middle-income regions, face budget constraints that hinder investment in premium sterilization systems and antimicrobial consumables. The surgical site infection control market must address affordability challenges to achieve broader penetration. Limited reimbursement policies for infection prevention tools further complicate purchasing decisions. Hospitals may delay upgrades or continue using outdated practices, which undermines infection control efforts. Balancing cost-efficiency with clinical efficacy remains a key concern for procurement teams.

Lack of Standardized Protocols and Skilled Personnel Affects Implementation:

Variability in infection control practices across regions and institutions creates inconsistencies in outcomes. The absence of uniform guidelines and insufficient training among healthcare workers reduce the effectiveness of infection prevention strategies. The surgical site infection control market experiences slower growth in areas where awareness and compliance remain low. Inadequate infrastructure, such as limited access to clean water and sterilization facilities, further hampers efforts in resource-constrained settings. It highlights the need for coordinated policy support and sustained workforce education. Strengthening institutional commitment and technical capability is essential to overcome these barriers.

Market Opportunities:

Rising Surgical Volumes in Emerging Economies Create Growth Prospects:

Expanding healthcare infrastructure and increasing access to surgical care in emerging markets offer strong growth potential. Countries in Asia-Pacific, Latin America, and the Middle East are investing in hospitals, surgical centers, and infection control protocols. The surgical site infection control market stands to benefit from government initiatives promoting patient safety and healthcare quality. Growing medical tourism in these regions further increases the demand for standardized infection prevention practices. Vendors can capitalize on this trend by offering cost-effective, scalable solutions tailored to local needs. Partnerships with public health agencies and private hospital networks will accelerate market entry and expansion.

Innovation in Minimally Invasive and Disposable Technologies Unlocks New Avenues:

The shift toward minimally invasive procedures reduces recovery times but requires stringent infection control due to limited surgical exposure. This trend fuels demand for precision-engineered, single-use devices that minimize contamination risk. The surgical site infection control market is positioned to grow through development of disposable drapes, antimicrobial sealants, and smart sterilization tools. It also opens opportunities for digital solutions that integrate with surgical workflow management systems. Startups and established players investing in R&D can address evolving clinical needs and gain a competitive edge. Continuous innovation aligned with clinical efficiency will drive future market growth.

Market Segmentation Analysis:

By Type:

The surgical site infection control market includes two primary types: superficial and deep incisional infections. Superficial infections dominate due to their high frequency in routine surgeries and faster clinical detection. Healthcare providers focus on early intervention through topical antimicrobials and post-operative monitoring. Deep incisional and organ/space infections require more complex management, increasing demand for advanced sterilization and systemic antibiotic therapies. Both types drive the need for preventive strategies at multiple points in the surgical workflow.

- For example, Banner Health, a multi-state hospital system, implemented a preoperative antibiotic bundle that led to a 32.8% reduction in SSI rates for hip arthroplasty procedures across over 57,000 surgeries between 2019 and 2023.

By Product:

The market segments by product into antiseptics and disinfectants, wound care dressings, surgical drapes, sterilization equipment, and others. Antiseptics and disinfectants hold a major share due to their widespread use in pre- and post-operative procedures. Wound care dressings are gaining traction for their role in protecting surgical sites and supporting healing. Hospitals and surgical centers are increasing their adoption of disposable surgical drapes to reduce cross-contamination. It shows steady demand for sterilization systems integrated with automated features for operational efficiency.

By Phase:

Phases in the surgical site infection control market include preoperative, intraoperative, and postoperative. Preoperative phase leads in usage, with antiseptic preparation and surgical planning minimizing contamination risk. Intraoperative products such as barrier drapes, sterile instruments, and air filtration systems are critical for maintaining a contamination-free environment. Postoperative phase focuses on wound care and infection surveillance, using dressings and monitoring tools to ensure recovery without complications. Each phase contributes to a comprehensive infection prevention protocol.

- For instance, the mPOWEr mobile wound-check application, tested with vascular surgery patients in the United States, enabled 81.8% of wound images to be sufficient for remote diagnosis and improved early detection of infection within the first 14 days post-discharge.

Segmentations:

By Type:

- Superficial Incisional SSI

- Deep Incisional SSI

- Organ/Space SSI

By Product:

- Antiseptics and Disinfectants

- Wound Care Dressings

- Surgical Drapes and Gowns

- Sterilization Equipment

- Others

By Phase:

- Preoperative

- Intraoperative

- Postoperative

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America:

North America holds 38% share of the surgical site infection control market, driven by advanced healthcare systems and strict regulatory compliance. The region benefits from high surgical volumes, well-established infection surveillance programs, and early adoption of antimicrobial technologies. Government agencies such as the CDC and CMS enforce performance standards that accelerate market demand. Hospitals invest heavily in sterilization equipment, disposable consumables, and staff training programs to reduce infection risks. The presence of leading medical device manufacturers also supports rapid product deployment and clinical integration. Strong reimbursement policies and ongoing research funding sustain innovation and adoption across the region.

Europe :

Europe accounts for 28% share of the surgical site infection control market, supported by national infection control strategies and well-funded public health systems. Countries such as Germany, France, and the UK have mandated infection prevention protocols across healthcare institutions. It benefits from a collaborative regulatory environment that emphasizes quality care and patient safety. The European Centre for Disease Prevention and Control (ECDC) plays a key role in guiding infection reduction practices. High awareness and training among clinical staff contribute to the steady demand for disinfection systems, antimicrobial dressings, and compliance monitoring tools. Continued investments in healthcare modernization reinforce regional growth prospects.

Asia-Pacific :

Asia-Pacific is witnessing rapid growth in the surgical site infection control market, fueled by expanding healthcare access and infrastructure development. Increasing surgical volumes in India, China, Japan, and Southeast Asia create strong demand for infection control solutions. Public and private investments in hospital capacity and surgical technologies support market expansion. Governments are launching awareness campaigns and funding hygiene initiatives to reduce healthcare-associated infections. The region also presents opportunities for localized manufacturing and cost-effective product innovations. Growing medical tourism and an aging population further drive the regional market trajectory.

Key Player Analysis:

- 3M

- AMERICAN POLYFILM INC.

- Getinge Group

- Dickinson and Company

- ANSELL LTD.

- Belimed AG

- BIOMÉRIEUX

- Dickinson and Company)

- Becton

- Covalon Technologies Ltd.

- Johnson & Johnson

Competitive Analysis:

The surgical site infection control market features a competitive landscape dominated by global healthcare companies and specialized infection prevention solution providers. Key players include 3M, AMERICAN POLYFILM INC., Getinge Group, Becton, Dickinson and Company, Johnson & Johnson, ANSELL LTD., and Belimed AG. It exhibits a mix of innovation-led competition and regional expansion strategies. Companies focus on product diversification, ranging from antiseptics and surgical drapes to automated sterilization equipment. Strategic mergers, partnerships with hospitals, and regulatory approvals are central to gaining market presence. Continuous investment in R&D supports development of advanced antimicrobial technologies and user-friendly disinfection systems. Market leaders emphasize compliance with global safety standards and tailor offerings for both developed and emerging healthcare markets.

Recent Developments:

- In December 2024, 3M announced a strategic licensing agreement with US Conec for Expanded Beam Optical Interconnect technology.

- In June 2024,Getinge launched its XEN product line in the US, comprising 16 advanced chemical solutions for sterile processing in healthcare settings.

- In March 2024, Getinge introduced the Corin Operating Table and Ezea surgical light at the AORN conference, focusing on efficiency and safety.

Market Concentration & Characteristics:

The surgical site infection control market demonstrates moderate concentration, with key players holding significant global presence through diverse product portfolios and strategic partnerships. It features a mix of multinational corporations and regional manufacturers competing across antiseptics, sterilization products, and antimicrobial dressings. The market is innovation-driven, with companies investing in R&D to enhance efficacy, usability, and compliance with evolving regulatory standards. It favors companies that offer integrated solutions combining surgical consumables, automated disinfection systems, and digital monitoring tools. Pricing pressure and procurement complexity in public healthcare systems influence competitive dynamics. The market’s growth relies on technological advancement, clinical outcomes, and brand reliability, making differentiation through performance and value essential for sustained leadership.

Report Coverage:

The research report offers an in-depth analysis based on Type, Product, Phase and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Adoption of antimicrobial-coated surgical consumables continues to accelerate, enhancing intraoperative infection prevention protocols.

- Hospitals expand investments in automated sterilization equipment to ensure consistent decontamination outcomes and reduce manual workload.

- Integration of real‑time surveillance software and AI‑based analytics facilitates early detection and risk prediction for surgical site infections.

- Manufacturers launch disposable, single‑use devices and sealants design to minimize cross‑contamination and streamline sterilization workflows.

- Public health agencies strengthen infection prevention mandates, driving demand for standardized compliance tools and training resources.

- Rising focus on value‑based care prompts healthcare providers to prioritize technologies that improve outcomes and reduce postoperative complications.

- Regional expansion in emerging economies presents opportunities for affordable, scalable infection control solutions tailored to local infrastructure.

- Collaboration between device makers and digital health firms accelerates development of sensor‑enabled products and IoT‑based tracking systems.

- Regulatory frameworks evolve to include performance metrics for infection control technologies across hospital accreditation and reimbursement schemes.

- Growing emphasis on antimicrobial stewardship encourages adoption of targeted antiseptic protocols and innovations that reduce antibiotic dependency.