Market Overview:

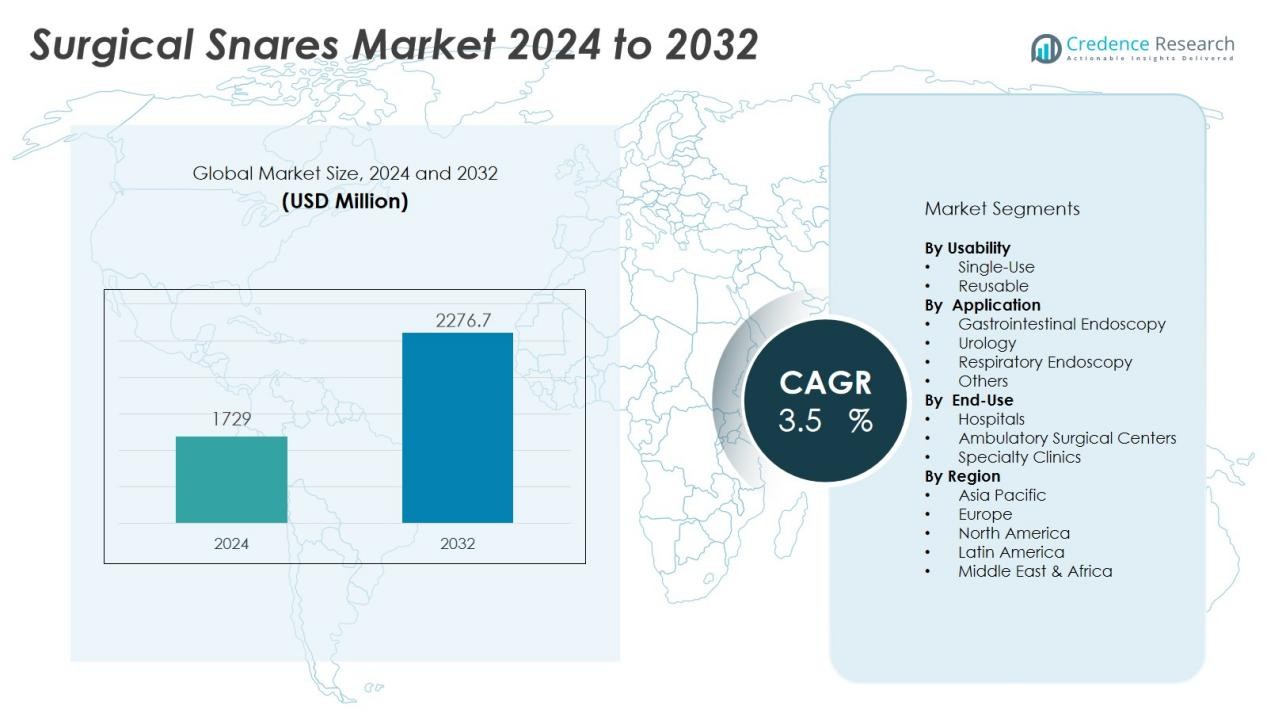

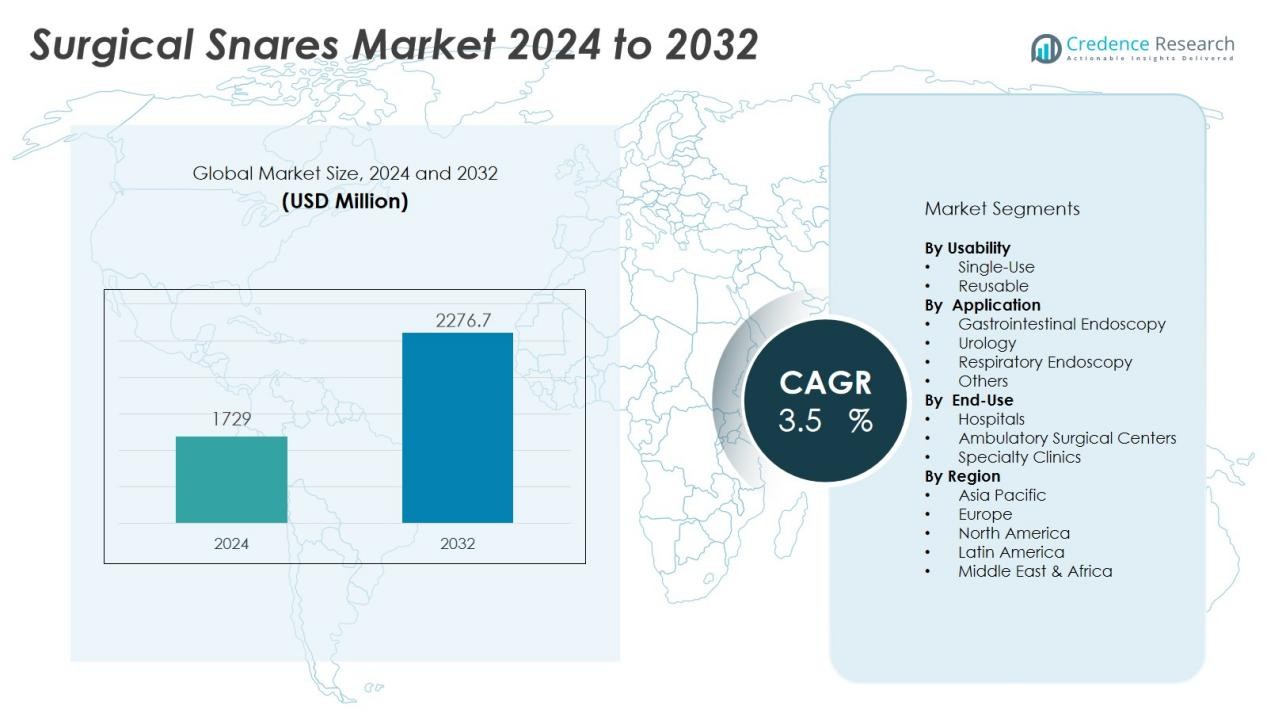

The Surgical Snares Market size was valued at USD 1729 million in 2024 and is anticipated to reach USD 2276.7 million by 2032, at a CAGR of 3.5 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Surgical Snares Market Size 2024 |

USD 1729 Million |

| Surgical Snares Market, CAGR |

3.5 % |

| Surgical Snares Market Size 2032 |

USD 2276.7 Million |

Key drivers of the surgical snares market include the rising global burden of gastrointestinal disorders, colorectal cancer, and age-related complications requiring polypectomy. Healthcare providers are increasingly adopting endoscopic interventions due to faster recovery, reduced surgical trauma, and lower risk of complications. Technological innovations in snare design—such as rotatable snares, single-use variants, and enhanced control mechanisms—have improved precision, safety, and ease of use, boosting adoption across surgical specialties. The growing demand for cost-effective, disposable devices to prevent cross-contamination also strengthens market dynamics.

North America holds the largest share of the surgical snares market due to its advanced healthcare infrastructure, high prevalence of colorectal screening programs, and early adoption of minimally invasive technologies. Asia-Pacific is expected to witness the fastest growth, driven by rising healthcare expenditure, expanding endoscopy procedures, and increasing awareness in countries such as China, India, and Japan.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The surgical snares market was valued at USD 1,729 million in 2024 and is projected to reach USD 2,276.7 million by 2032.

- Rising prevalence of gastrointestinal disorders and colorectal cancer is increasing demand for polypectomy procedures using surgical snares.

- Surge in minimally invasive surgeries across hospitals and outpatient centers is accelerating the adoption of advanced snares.

- Technological innovations such as rotatable and single-use snares with enhanced control are improving procedural outcomes.

- High device cost and limited access in low-income regions continue to hinder adoption and restrict market penetration.

- North America led the market with a 38% share in 2024, driven by early adoption of endoscopy and robust healthcare systems.

- Asia-Pacific is expected to witness the fastest growth, supported by rising healthcare investments and expanding screening programs.

Market Drivers:

Rising Incidence of Gastrointestinal and Colorectal Disorders Increases Demand for Surgical Snares:

The surgical snares market is gaining momentum due to the growing prevalence of gastrointestinal conditions such as colorectal cancer, inflammatory bowel disease, and polyps. These conditions often require polypectomy and tissue resection, which rely heavily on snare-based procedures. Increased screening initiatives and early diagnosis further drive the use of endoscopic tools in clinical settings. Healthcare providers are incorporating advanced surgical snares to enhance procedural outcomes and reduce the risk of complications.

Shift Toward Minimally Invasive Procedures Enhances Market Growth:

Minimally invasive surgeries have become standard practice across multiple specialties due to their shorter recovery times and reduced patient trauma. The surgical snares market benefits from this shift, with snares playing a critical role in endoscopic procedures. Surgeons prefer these devices for their precision and ease of use during tissue removal. Hospitals and outpatient centers are investing in disposable snares to support infection control protocols and streamline workflow efficiency.

- For instance, Olympus endoscopes are used in a substantial portion of the approximately 51 million colonoscopies performed for colon cancer diagnostics and treatment worldwide each year, with a significant proportion utilizing Olympus-brand snares for polyp removal.

Technological Advancements in Snare Design Support Adoption:

Innovations in snare design are improving procedural accuracy and physician control. Manufacturers are introducing rotatable, hexagonal loop, and single-use snares with enhanced torque and cutting capabilities. These improvements allow clinicians to manage complex polyp removal and foreign body extraction with greater safety. The surgical snares market reflects this trend, with increasing product approvals and strategic product development initiatives.

- For instance, Boston Scientific’s Single-Use Rotatable Snare provides 360-degree rotation for accessing difficult polyps, with available loop widths of 13mm and 20mm, significantly enhancing maneuverability during endoscopic procedures.

Expanding Geriatric Population Drives Surgical Procedure Volumes:

The aging global population contributes significantly to rising surgical volumes, particularly in gastrointestinal and colorectal interventions. Older adults face higher risks of developing polyps and malignancies, increasing demand for effective diagnostic and therapeutic procedures. It supports growth in the surgical snares market by reinforcing the need for endoscopic interventions. Healthcare systems are scaling up endoscopy units to meet the procedural demands of this demographic trend.

Market Trends:

Increasing Preference for Disposable and Single-Use Snares Enhances Infection Control and Efficiency:

Healthcare facilities are shifting toward disposable and single-use surgical snares to reduce cross-contamination risks and meet sterilization standards. These devices eliminate the need for reprocessing, lowering operational costs and turnaround times in high-volume settings. Manufacturers are responding with innovative product lines designed for single-use, offering a range of loop shapes and sizes to accommodate various procedures. Hospitals and ambulatory surgery centers are adopting these snares to align with strict infection prevention protocols. The surgical snares market reflects this transition, with disposable variants gaining preference in both developed and emerging regions. It supports procedural consistency and improves safety for patients and providers alike.

- For instance, Boston Scientific’s Captivator II Single-Use Snare offers both hot and cold snaring in one device, with stiff, rounded loops available in seven sizes from 10mm to 33mm.

Integration of Electrosurgical Capabilities and Rotational Control Improves Surgical Precision:

The demand for multifunctional snares with electrosurgical compatibility is rising, driven by the need for effective tissue resection and hemostasis in a single tool. Advanced snares now offer rotational control, enabling surgeons to position the loop accurately during complex polypectomy procedures. These enhancements reduce procedural time and improve outcomes, particularly in anatomically challenging cases. Leading manufacturers are investing in R&D to incorporate ergonomic designs, flexible sheath materials, and enhanced torque response. The surgical snares market continues to evolve with these innovations, expanding its application across gastrointestinal, pulmonary, and urological procedures. It strengthens the clinical utility of snares in advanced endoscopic practices.

- For instance, Cook Medical’s Soft AcuSnare® features a 240cm Teflon® sheath engineered for smooth insertion, and incorporates a braided stainless steel wire with nitinol, delivering precise and concise excision and improved flexibility in endoscopic procedures.

Market Challenges Analysis:

High Cost of Advanced Snares and Limited Access in Low-Income Regions Restrain Market Penetration:

The adoption of technologically advanced surgical snares remains limited in low- and middle-income countries due to high product costs and inadequate reimbursement systems. Healthcare providers in these regions often rely on reusable instruments, which may pose sterilization challenges. Limited endoscopy infrastructure and shortage of skilled professionals further hinder procedural volumes. The surgical snares market faces difficulties in expanding to underserved areas where affordability and accessibility remain critical issues. It restricts the widespread adoption of modern snares and delays improvements in patient outcomes. Market growth depends on cost-effective product offerings and strategic collaborations to bridge these gaps.

Regulatory Hurdles and Device Approval Timelines Impede Product Launches:

Strict regulatory frameworks and extended approval timelines create barriers for manufacturers introducing new snare technologies. Compliance with diverse regional standards requires significant time and resources, especially for small and mid-sized companies. Delays in product commercialization can impact competitive positioning and revenue forecasts. The surgical snares market must navigate complex clinical trial requirements and safety validations before devices reach healthcare settings. It challenges innovation cycles and increases pressure on R&D budgets. Timely regulatory alignment and streamlined approval processes are essential for sustained product development.

Market Opportunities:

Rising Demand for Outpatient Endoscopic Procedures Creates Growth Potential:

The growing shift toward outpatient and ambulatory surgical centers presents strong opportunities for the surgical snares market. Healthcare systems aim to reduce inpatient costs and improve patient turnover by adopting minimally invasive techniques in outpatient settings. Surgical snares enable efficient polypectomies and foreign body removals with minimal recovery time, making them ideal for these facilities. It supports market expansion through increased procedural volumes and standardized care delivery. Manufacturers can capitalize by offering compact, easy-to-use snares tailored for outpatient workflows. Demand for disposable snares in these settings further strengthens the growth outlook.

Untapped Emerging Markets Offer Pathways for Expansion and Product Adoption:

Emerging economies across Asia-Pacific, Latin America, and Africa provide promising avenues for market growth due to rising healthcare investments and procedural awareness. Governments are increasing support for gastrointestinal disease screening and early cancer detection programs, boosting endoscopic intervention rates. The surgical snares market has an opportunity to expand its footprint through localized manufacturing, distributor partnerships, and training programs. It can address regional needs by offering cost-effective, durable, and regulatory-compliant snare solutions. Companies that align product offerings with regional healthcare capabilities can gain competitive advantage. Expanding healthcare access in these regions will drive long-term market sustainability.

Market Segmentation Analysis:

By Usability:

The surgical snares market is segmented into reusable and single-use snares. Single-use snares dominate the segment due to rising concerns over cross-contamination and increased demand for sterile, ready-to-use instruments. Healthcare facilities prefer disposable options for high-throughput environments such as ambulatory surgical centers. It supports reduced turnaround time and eliminates reprocessing costs. Reusable snares still hold relevance in resource-constrained settings where cost control is critical.

- For instance, Boston Scientific’s Captivator™ single-use polypectomy snare achieved a 99.2% polyp retrieval rate in a multicenter evaluation of more than 400 patients, underscoring the effectiveness and safety benefits of disposables in GI procedures.

By Application:

Based on application, the market includes gastrointestinal endoscopy, urology, respiratory endoscopy, and others. Gastrointestinal endoscopy leads this segment due to high procedure volumes for polyp removal and colorectal screenings. It continues to expand with the growing prevalence of colorectal cancer and advancements in diagnostic endoscopy. Urology and respiratory applications are emerging segments as snares become integral to broader therapeutic uses. These segments gain traction with technological improvements and rising clinical adoption.

- For instance, gastrointestinal lesion management, a recent trial showed that snare tip endoscopic submucosal dissection performed by two experienced endoscopists achieved en bloc resection in 99 out of 121 patients with advanced colon lesions, with six recurrences detected at follow-up colonoscopy—illustrating both safety and efficiency.

By End-Use:

The end-use segment comprises hospitals, ambulatory surgical centers, and specialty clinics. Hospitals hold the largest share due to their comprehensive surgical infrastructure and access to advanced snare technologies. The surgical snares market benefits from procedural growth in outpatient and ambulatory surgical centers, which emphasize efficiency and cost-effectiveness. Specialty clinics represent a smaller but growing segment, driven by increased adoption of minimally invasive treatments in decentralized healthcare settings.

Segmentations:

By Usability:

By Application:

- Gastrointestinal Endoscopy

- Urology

- Respiratory Endoscopy

- Others

By End-Use:

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America :

North America accounted for 38% share of the surgical snares market in 2024. It maintains its lead due to widespread adoption of endoscopic procedures and strong focus on preventive healthcare. The region benefits from early implementation of colorectal cancer screening programs, which drive demand for polypectomy tools. Hospitals and outpatient centers in the U.S. and Canada continue to invest in disposable and advanced snares to meet infection control standards. Favorable reimbursement policies and a skilled clinical workforce support sustained procedural volumes. It remains a key region for product innovation, clinical trials, and strategic partnerships.

Europe :

Europe held 29% share of the surgical snares market in 2024. Public health systems across Germany, France, and the UK actively promote early detection of gastrointestinal conditions, boosting endoscopic procedure volumes. The presence of well-regulated medical device markets encourages the adoption of single-use snares that align with safety and sustainability goals. Hospitals in the region prioritize precision tools for minimally invasive interventions, driving demand for snares with advanced control features. It benefits from strong collaboration between manufacturers and academic institutions to develop procedure-specific solutions. Regulatory compliance and structured procurement processes shape purchasing behavior in this region.

Asia-Pacific :

Asia-Pacific is expected to register the highest growth rate in the surgical snares market during the forecast period. Rising healthcare expenditure in China, India, Japan, and Southeast Asia is expanding access to diagnostic and therapeutic endoscopy. Growing awareness of gastrointestinal health, coupled with increasing adoption of screening programs, drives procedural growth across both public and private healthcare settings. The region attracts investment from global manufacturers looking to establish local production and distribution. It benefits from the rising demand for affordable, high-quality single-use devices tailored to regional clinical needs. Demographic trends and rapid infrastructure development continue to strengthen its market position.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Medtronic

- Hill-Rom Holdings, Inc.

- Sklar Surgical Instruments

- Olympus Corporation

- Cook

- Boston Scientific Corporation

- Medline Industries, Inc.

- CONMED Corporation

- Avalign Technologies

- Steris (U.S.)

- Merit Medical Systems

Competitive Analysis:

The surgical snares market is moderately competitive, led by a mix of global medtech companies and specialized instrument manufacturers. Key players include Medtronic, Hill-Rom Holdings, Inc., Sklar Surgical Instruments, Olympus Corporation, Cook, Boston Scientific Corporation, Medline Industries, Inc., and CONMED Corporation. These companies focus on expanding their product portfolios through innovation in loop design, ergonomics, and electrosurgical compatibility. It benefits from continuous R&D investment, with players introducing advanced, single-use snares tailored for various endoscopic applications. Strategic mergers, acquisitions, and distribution agreements strengthen market presence and expand global reach. Companies prioritize regulatory compliance and clinical validation to differentiate their offerings in hospital and outpatient settings. Pricing strategies and localized manufacturing help address demand across both developed and emerging markets.

Recent Developments:

- In July, 2025, Medtronic and Philips announced a new multi-year strategic partnership to expand access to advanced patient monitoring technologies, initially focusing on the North American market.

- In July 2025, Medtronic and Philips began a multi-year strategic partnership to expand access to advanced patient monitoring technologies, initially in the North American market.

- In July, 2025, Olympus entered a strategic partnership with Revival Healthcare Capital to co-found Swan EndoSurgical, aiming to develop an innovative endoluminal robotic system for less invasive gastrointestinal treatments.

Market Concentration & Characteristics:

The surgical snares market shows moderate concentration, with a mix of global and regional players competing across price, product innovation, and distribution reach. Leading companies focus on expanding their single-use and specialty snare portfolios while securing regulatory approvals in key markets. It is characterized by continuous technological advancements, demand for infection control compliance, and increasing preference for minimally invasive tools. Distributors and OEMs play a crucial role in emerging markets, where cost sensitivity influences purchasing decisions. The market favors manufacturers that offer high-quality, user-friendly snares supported by strong clinical evidence and post-sales service. Competitive dynamics are shaped by strategic collaborations, product differentiation, and responsiveness to evolving surgical standards.

Report Coverage:

The research report offers an in-depth analysis based on Usability, Application, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Manufacturers continue to introduce single-use snares with expanded loop configurations and improved safety margins.

- Electrosurgical snares gain traction thanks to enhanced hemostasis and reduced tool-switching during procedures.

- Smart snares incorporating sensor feedback draw interest for higher procedural accuracy and real-time diagnostics.

- Growing adoption of snares in pulmonary and urological endoscopy creates new application avenues.

- Surgeons expect tighter torque control and flexible sheath technologies to enhance precision.

- Hospital systems prioritize snares designed for fast loading and efficient workflows in high-volume settings.

- Industry partnerships with academic centers accelerate clinical validation and product adoption.

- Manufacturers target emerging regions with affordable, regulatory-compliant snares and local distribution networks.

- Training programs for physicians emphasize the benefits of advanced snares in outpatient endoscopy environments.

- Sustainability gains importance; developers explore biodegradable or recyclable materials for future product designs.