| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Surgical Video Recording System market Size 2024 |

USD 3,822.83 million |

| Surgical Video Recording System market, CAGR |

7.45% |

| Surgical Video Recording System market Size 2032 |

USD 7,073.72 million |

Market Overview

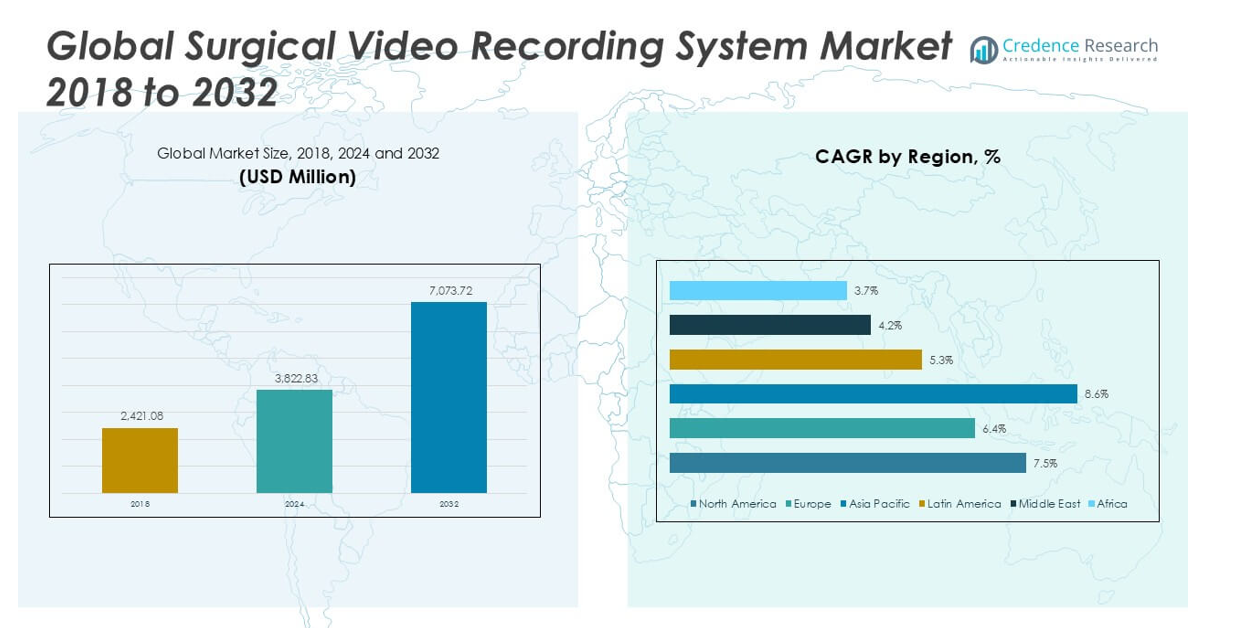

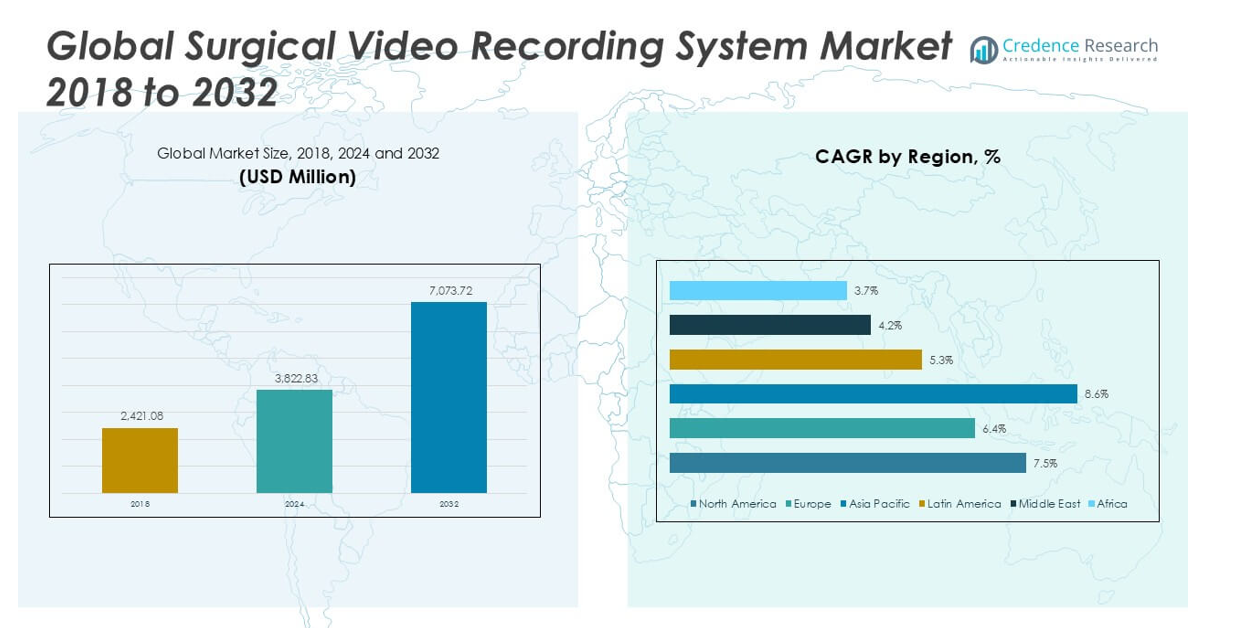

The Surgical Video Recording System market was valued at USD 2,421.08 million in 2018 and reached USD 3,822.83 million in 2024. It is anticipated to reach USD 7,073.72 million by 2032, reflecting a compound annual growth rate (CAGR) of 7.45% during the forecast period.

The Surgical Video Recording System market is experiencing robust growth driven by the increasing adoption of minimally invasive surgical procedures, rising demand for medical documentation, and the need for real-time collaboration and education in healthcare settings. Technological advancements such as high-definition and 4K video capture, integration with hospital information systems, and the use of AI-powered analytics are enhancing the value proposition of these systems. Hospitals and surgical centers prioritize patient safety, quality assurance, and compliance with regulatory standards, which further supports market expansion. Surge in telemedicine, surgical training, and remote consultation applications are shaping industry trends, while growing investments in healthcare infrastructure and digitalization worldwide fuel market momentum. The market is also witnessing rising interest in cloud-based storage solutions and user-friendly interfaces that simplify workflow and improve accessibility, ultimately driving adoption across developed and emerging regions.

The geographical analysis of the Surgical Video Recording System Market highlights robust demand across North America, Europe, and Asia Pacific, where advanced healthcare infrastructure and rapid adoption of digital operating room technologies fuel market growth. North America leads, driven by high investments in hospital modernization and technological innovation, followed closely by key European markets such as Germany and the United Kingdom, which emphasize quality standards and surgical training. Asia Pacific demonstrates significant potential, particularly in China, Japan, and India, supported by rising healthcare spending and government initiatives promoting digitalization. Among key players, Olympus Corporation, Stryker Corporation, and Karl Storz SE & Co. KG stand out for their extensive product portfolios and ongoing innovation in surgical video solutions. These companies leverage strong global distribution networks and partnerships with leading hospitals to maintain their competitive edge and respond to evolving clinical demands across major regions.

Market Insights

- The Surgical Video Recording System Market reached USD 3,822.83 million in 2024 and is projected to achieve USD 7,073.72 million by 2032, registering a CAGR of 7.45%.

- Growing preference for minimally invasive surgeries, rising focus on medical documentation, and demand for real-time collaboration are key drivers of market growth.

- Integration of AI-powered analytics, high-definition and 4K imaging, and user-friendly interfaces represents prominent trends, enhancing operational efficiency and clinical outcomes.

- North America, Europe, and Asia Pacific dominate the market, with North America leading in technological adoption and Asia Pacific showing the fastest growth due to increasing healthcare investments.

- Olympus Corporation, Stryker Corporation, and Karl Storz SE & Co. KG are key players with robust product portfolios, established distribution networks, and a focus on innovation in digital surgical solutions.

- High initial investment, complex integration with hospital IT systems, and stringent data privacy regulations remain significant restraints, limiting adoption in some emerging markets and smaller facilities.

- The market benefits from growing telemedicine, digital healthcare infrastructure development, and strong demand from hospitals and training centers, supporting expansion in both developed and developing regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Minimally Invasive Procedures Accelerates Market Expansion

The Surgical Video Recording System Market is expanding rapidly due to the increasing preference for minimally invasive surgeries. Patients and healthcare providers seek procedures that offer shorter recovery times, reduced risks, and improved outcomes, fueling the need for advanced visual documentation tools. Surgical video recording systems provide critical support by capturing detailed footage, enabling precise surgical interventions and effective postoperative assessments. Hospitals and clinics are investing in high-quality video recording technologies to enhance both patient safety and clinical outcomes. The market benefits from the rising awareness among surgeons about the value of visual data in training, review, and risk management. Minimally invasive surgeries require advanced imaging and visualization, positioning the market for steady growth. It supports the transition to less invasive techniques through reliable documentation and playback capabilities.

- For instance, Stryker’s 1688 AIM 4K platform has been installed in over 4,000 operating rooms globally, providing advanced 4K imaging and documentation for minimally invasive surgery.

Regulatory Pressures and Quality Assurance Mandate Adoption

Strict regulatory requirements and growing emphasis on quality assurance are significant drivers for the Surgical Video Recording System Market. Healthcare authorities worldwide mandate comprehensive documentation to ensure accountability and transparency in surgical procedures. Video recording systems facilitate compliance by providing irrefutable records of every surgical intervention. Hospitals rely on these systems to improve patient safety, resolve disputes, and support continuous improvement in clinical practices. Regulatory bodies recommend or require the integration of such technologies, prompting faster adoption across surgical departments. Quality assurance teams use recorded footage to audit procedures, conduct peer reviews, and identify opportunities for process improvement. It enables healthcare facilities to meet regulatory standards efficiently.

- For instance, Olympus Corporation’s ENDOALPHA system has been integrated in more than 600 hospitals across Europe and Asia, supporting compliance and audit requirements with full digital traceability for every procedure.

Technological Advancements Enhance System Capabilities

Rapid technological innovation propels the Surgical Video Recording System Market forward by improving system functionality and accessibility. Advancements such as high-definition (HD) and 4K imaging, seamless integration with electronic health records (EHR), and AI-powered analytics expand the capabilities of video recording platforms. Surgeons and hospitals gain from enhanced video clarity, secure data management, and advanced search features, which support clinical decision-making and training. Manufacturers focus on developing user-friendly interfaces and interoperable systems to streamline workflows in busy operating rooms. Voice control, cloud-based storage, and real-time streaming features attract wider adoption among healthcare providers. It ensures that video recording systems keep pace with evolving clinical requirements.

Remote Collaboration and Medical Education Drive Market Uptake

Demand for remote collaboration and advanced medical education increases the importance of surgical video recording systems in modern healthcare. Hospitals leverage these systems for telemedicine, remote consultations, and live streaming of surgeries, facilitating real-time expert input and collaborative care. Medical schools and training centers use recorded surgical footage for teaching, simulation, and skill assessment. The market gains momentum from the shift toward digital learning and distance education, particularly in underserved regions. Global investments in healthcare digitalization and infrastructure strengthen this trend. It enhances clinical training and promotes knowledge sharing, supporting higher adoption rates in both developed and emerging markets.

Market Trends

Integration with Artificial Intelligence and Analytics Enhances Value

Artificial intelligence and advanced analytics are transforming the Surgical Video Recording System Market, enabling systems to automatically identify, tag, and segment key events within surgical procedures. Hospitals deploy AI-powered solutions to support real-time decision-making, error detection, and workflow optimization. The integration of analytics assists in converting recorded video into actionable insights, streamlining postoperative assessments and medical audits. Medical professionals utilize these features to improve documentation, boost quality control, and enhance patient safety. The market benefits from AI-driven automation, which minimizes manual tasks and reduces the risk of human error. It helps providers focus on patient care while maintaining comprehensive visual records of each procedure.

- For instance, Sony’s NUCLeUS platform processes and manages more than 200,000 hours of surgical video annually, offering automated tagging and AI-powered scene recognition in over 80 hospitals worldwide.

Adoption of High-Definition and 4K Imaging Raises Standards

The Surgical Video Recording System Market is witnessing strong demand for high-definition (HD) and 4K imaging systems, which deliver exceptional clarity and detail during surgical procedures. Hospitals and surgical centers upgrade to advanced systems to meet the rising expectations for image quality among clinicians. Improved visualization supports precise interventions and enables thorough postoperative reviews. Manufacturers introduce innovative cameras and recording platforms that offer seamless compatibility with existing operating room equipment. The trend toward high-resolution imaging extends to training and education, providing learners with clearer visualizations and better procedural understanding. It elevates the overall standard of care through sharper, more reliable video capture.

- For instance, Karl Storz’s IMAGE1 S 4U system delivers true 4K UHD video at 3840 x 2160 pixels and is deployed in more than 1,000 surgical suites across North America and Europe.

Cloud-Based Storage and Remote Access Gain Traction

Surgeons and healthcare organizations show growing interest in cloud-based storage solutions, which enable secure access to surgical videos from multiple locations. The Surgical Video Recording System Market is moving toward scalable, subscription-based cloud models that facilitate collaboration and simplify data management. Cloud platforms offer encrypted storage, user-friendly retrieval, and disaster recovery features, addressing key concerns about data security and compliance. Remote access capabilities support multi-disciplinary case reviews and international consultations without physical data transfer. Hospitals and clinics embrace these trends to streamline workflows and improve knowledge sharing. It enables seamless access to critical visual data in both clinical and educational settings.

Emphasis on Workflow Integration and User Experience Shapes Innovation

Manufacturers in the Surgical Video Recording System Market focus on designing systems that integrate smoothly with hospital information systems and surgical workflows. Hospitals demand intuitive interfaces and easy-to-use controls that minimize staff training requirements. Solutions that support voice commands, touch screens, and interoperability with other devices see higher adoption rates. Customizable platforms allow healthcare providers to tailor recording and playback functions to specific clinical needs. The market responds to requests for efficient setup, minimal downtime, and reliable performance during critical procedures. It encourages product development that prioritizes usability, operational efficiency, and a positive user experience.

Market Challenges Analysis

High Initial Costs and Complex Integration Limit Widespread Adoption

The Surgical Video Recording System Market faces significant challenges related to high initial investment and complex system integration within existing hospital infrastructure. Hospitals and surgical centers hesitate to allocate budgets for advanced recording technologies due to substantial upfront costs and ongoing maintenance expenses. Integration with legacy equipment, electronic health records, and operating room workflows often requires specialized technical support, leading to potential disruptions in clinical operations. Many facilities encounter delays or technical hurdles when deploying these solutions, which may impact staff productivity and workflow efficiency. Smaller healthcare providers, particularly in emerging markets, struggle to justify or afford such investments. It restricts market penetration and slows the pace of technology adoption.

Data Privacy, Security Concerns, and Regulatory Compliance Hurdles

Ensuring data privacy, security, and regulatory compliance presents ongoing challenges in the Surgical Video Recording System Market. Hospitals must adhere to stringent data protection laws, including patient consent, secure storage, and encrypted transmission of surgical video footage. The risk of unauthorized access or cyberattacks heightens concerns about patient confidentiality and legal liabilities. Maintaining compliance with evolving healthcare regulations demands significant resources, staff training, and regular audits. Complex requirements may deter some organizations from fully implementing these systems or expanding their use. It creates a persistent barrier to widespread adoption, especially where data security infrastructure is limited or regulatory frameworks are strict.

Market Opportunities

Rising Investments in Healthcare Digitalization Create Expansion Pathways

The Surgical Video Recording System Market stands to benefit from rising investments in healthcare digitalization and smart hospital initiatives across the globe. Governments and private organizations prioritize upgrading medical infrastructure, fueling demand for advanced surgical documentation technologies. Integration with electronic health records and telemedicine platforms creates new avenues for system deployment. Hospitals view digital video recording as a valuable asset for improving clinical efficiency, patient outcomes, and regulatory compliance. Demand for robust digital solutions grows in both established and emerging healthcare markets. It opens doors for suppliers and manufacturers to expand their portfolios and reach new customer segments.

Growth in Medical Education and Remote Collaboration Drives Adoption

Expanding opportunities in medical education and remote collaboration support the upward trajectory of the Surgical Video Recording System Market. Medical schools, training centers, and research institutions increasingly adopt these systems for simulation-based learning, live surgery broadcasts, and interactive case reviews. Hospitals and clinics leverage advanced video recording to enable remote consultations and cross-disciplinary collaboration, extending expert input to underserved regions. The need for continuous professional development and global knowledge sharing drives adoption in both developed and developing markets. It positions video recording systems as essential tools for education, innovation, and collaborative care in modern healthcare environments.

Market Segmentation Analysis:

By Type:

The Surgical Video Recording System Market exhibits a diverse product landscape segmented by type, with Full HD, High-definition, and UHD (Ultra High Definition) systems catering to the distinct requirements of healthcare facilities. Full HD systems remain a widely adopted choice in hospitals and clinics, offering a balance of cost-efficiency and reliable image clarity. Healthcare providers select Full HD solutions to fulfill essential recording and documentation needs without incurring the premium costs associated with ultra-high-resolution platforms. The High-definition segment serves institutions seeking advanced visual detail, particularly for complex procedures that demand greater precision and enhanced video quality. Surgeons value the improved visualization and finer detail provided by high-definition systems, making them a preferred option for operating rooms focused on advanced minimally invasive surgeries. UHD (Ultra High Definition) represents the premium segment, capturing rapid growth due to its ability to deliver exceptional clarity, color accuracy, and depth perception.

- For instance, FUJIFILM’s 4K UHD surgical video systems deliver 60 frames per second live streaming and have been installed in more than 200 major hospitals for advanced endoscopy and minimally invasive surgery programs.

By End-User:

The Surgical Video Recording System Market segments into hospital, clinic, and others, each exhibiting unique adoption patterns and demands. Hospitals represent the dominant end-user segment, driven by their comprehensive infrastructure, large-scale procedural volume, and need for integrated solutions that support complex surgeries, training, and regulatory compliance. Large hospitals and academic medical centers lead in adopting advanced video recording systems, leveraging them to enhance patient care, facilitate clinical research, and support surgical education. Clinics, while operating on a smaller scale, show growing interest in cost-effective and easy-to-integrate video recording solutions. Clinics prioritize streamlined systems that deliver high-quality documentation and support for routine procedures, helping them improve patient outcomes and maintain compliance standards. The “Others” segment includes ambulatory surgical centers and specialized medical facilities.

- For instance, CONMED’s Linvatec HD video systems are in use at over 1,500 ambulatory surgical centers globally, chosen for their compact form factor and high-definition image quality.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segments:

Based on Type:

- Full HD

- High-definition

- UHD (Ultra High Definition)

Based on End-User

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Surgical Video Recording System Market

North America Surgical Video Recording System Market grew from USD 970.85 million in 2018 to USD 1,515.62 million in 2024 and is projected to reach USD 2,812.98 million by 2032, reflecting a compound annual growth rate (CAGR) of 7.5%. North America is holding a 40% market share. The United States leads regional demand, supported by strong healthcare infrastructure, widespread adoption of advanced medical technologies, and robust investments in digital operating rooms. Canada also contributes, driven by government funding and technology integration in surgical departments. Hospitals in this region prioritize compliance, training, and high-definition documentation.

Europe Surgical Video Recording System Market

Europe Surgical Video Recording System Market grew from USD 554.56 million in 2018 to USD 836.54 million in 2024 and is expected to reach USD 1,434.74 million by 2032, at a CAGR of 6.4%. Europe is holding an 19% market share. Leading countries include Germany, the United Kingdom, and France, where healthcare modernization and surgical training initiatives drive demand. The region emphasizes quality standards, patient safety, and regulatory compliance. Investments in minimally invasive surgery and technological advancements fuel market growth.

Asia Pacific Surgical Video Recording System Market

Asia Pacific Surgical Video Recording System Market grew from USD 724.08 million in 2018 to USD 1,204.98 million in 2024 and is set to achieve USD 2,425.20 million by 2032, with a CAGR of 8.6%. Asia Pacific is holding a 34% market share. Key contributors are China, Japan, and India, where rapid healthcare infrastructure development, rising surgical volume, and growing medical tourism strengthen demand. Governments support hospital digitalization and telemedicine, which accelerates the adoption of advanced video recording systems.

Latin America Surgical Video Recording System Market

Latin America Surgical Video Recording System Market grew from USD 89.42 million in 2018 to USD 138.95 million in 2024 and is anticipated to reach USD 219.20 million by 2032, at a CAGR of 5.3%. Latin America is holding a 3% market share. Brazil and Mexico lead, benefitting from expanding private healthcare sectors and increasing focus on surgical education. Budget constraints remain a challenge, but hospitals prioritize investments that improve clinical efficiency and documentation quality.

Middle East Surgical Video Recording System Market

Middle East Surgical Video Recording System Market grew from USD 51.33 million in 2018 to USD 71.84 million in 2024 and is forecast to reach USD 104.65 million by 2032, posting a CAGR of 4.2%. The Middle East is holding a 2% market share. Saudi Arabia and the United Arab Emirates spearhead adoption, driven by investments in new hospitals and medical technology. Demand centers on premium healthcare facilities and government initiatives to enhance healthcare quality.

Africa Surgical Video Recording System Market

Africa Surgical Video Recording System Market grew from USD 30.84 million in 2018 to USD 54.89 million in 2024 and is estimated to reach USD 76.96 million by 2032, with a CAGR of 3.7%. Africa is holding a 1% market share. South Africa and Egypt account for the largest shares, supported by improving healthcare access and investments in urban medical centers. The market in Africa faces infrastructure gaps but gains momentum through public and private sector collaboration targeting digital healthcare solutions.

Key Player Analysis

- Olympus Corporation

- Stryker Corporation

- Smith & Nephew plc

- Karl Storz SE & Co. KG

- Medtronic plc

- CONMED Corporation

- Richard Wolf GmbH

- Sony Corporation

- Canon Medical Systems Corporation

- FUJIFILM Holdings Corporation

Competitive Analysis

The Surgical Video Recording System Market features strong competition among leading players such as Olympus Corporation, Stryker Corporation, Smith & Nephew plc, Karl Storz SE & Co. KG, Medtronic plc, CONMED Corporation, Richard Wolf GmbH, Sony Corporation, Canon Medical Systems Corporation, and FUJIFILM Holdings Corporation. These companies hold prominent positions due to their extensive product portfolios, global presence, and investments in research and development. Leading firms emphasize research and development to introduce advanced systems equipped with high-definition and 4K imaging, AI-powered analytics, and seamless integration with hospital IT infrastructure. The market features a strong push toward user-friendly platforms that enhance workflow efficiency and data security. Companies strengthen their positions by building strategic alliances with hospitals, investing in global distribution networks, and adapting solutions to meet specific regulatory and clinical requirements. Intense competition drives continuous improvement in product quality, technical support, and after-sales services. Firms invest in educational initiatives and partnerships to boost product adoption in both established and emerging markets. The competitive environment encourages a focus on delivering value through reliability, technological innovation, and tailored customer support across healthcare settings.

Recent Developments

- In November 2024, Karl Storz announced that its IMAGE1 S CONNECT II camera control unit became the first surgical video system to earn UL 2900-2-1 cybersecurity certification, recognized by the FDA. This certification highlights the system’s advanced cybersecurity protections, addressing growing concerns about medical device security in the operating room.

- In September 2024, Medtronic expanded its AiBLE™ spine surgery ecosystem with new technologies and a partnership with Siemens Healthineers. While the announcement focuses on spine surgery, it signals ongoing innovation in integrated surgical imaging and video recording solutions within Medtronic’s portfolio.

- In September 2024, Olympus launched the VISERA S endoscopic visualization platform and a new 4K camera head (CH-S700-08-LB) for urological and gynecological procedures. This camera, developed with Sony Olympus Medical Solutions, offers 4K white light, 4K Narrow Band Imaging (NBI), and blue light observation, providing enhanced image clarity for early diagnosis and minimally invasive treatment.

- In September 2024, Stryker introduced the 1788 Advanced Imaging Platform in India. This next-generation surgical camera system delivers high-resolution 4K images and advanced fluorescence imaging, supporting clearer perfusion imaging and detailed visualization across multiple surgical specialties.

Market Concentration & Characteristics

The Surgical Video Recording System Market demonstrates moderate to high market concentration, with a small group of established global manufacturers holding significant shares alongside emerging regional participants. The market features strong brand loyalty, with hospitals and surgical centers preferring proven, reliable systems from trusted vendors. It is characterized by rapid innovation, particularly in imaging quality, AI integration, and interoperability with hospital information systems. Leading companies focus on continuous product upgrades and long-term service contracts, securing repeat business from large healthcare institutions. The market demands solutions that combine robust data security, regulatory compliance, and seamless workflow integration. Regional players address localized needs and cost-sensitive segments, fostering competitive diversity. It displays characteristics of high technological advancement, strict quality standards, and a customer base that prioritizes clinical accuracy and operational efficiency.

Report Coverage

The research report offers an in-depth analysis based on Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Market momentum will favor enhanced AI-driven video analytics for smarter procedure documentation.

- Surgeons will adopt higher resolution systems such as 4K and UHD to support precision surgery.

- Cloud-based platforms will gain more ground in surgical video storage and access.

- Integration with electronic health records will streamline data workflows in operating rooms.

- Remote collaboration features will become standard to support telemedicine and distance learning.

- Voice-activated controls and intuitive interfaces will reduce training time and improve OR efficiency.

- Regulatory focus on data privacy will drive adoption of secure, encrypted recording systems.

- Subscription-based service models will offer flexible investment options for healthcare providers.

- Growing demand from emerging markets will spur regional customization and cost-effective solutions.

- Continuous R&D will yield modular systems that adapt to diverse surgical specialties and environments.