Market Overview

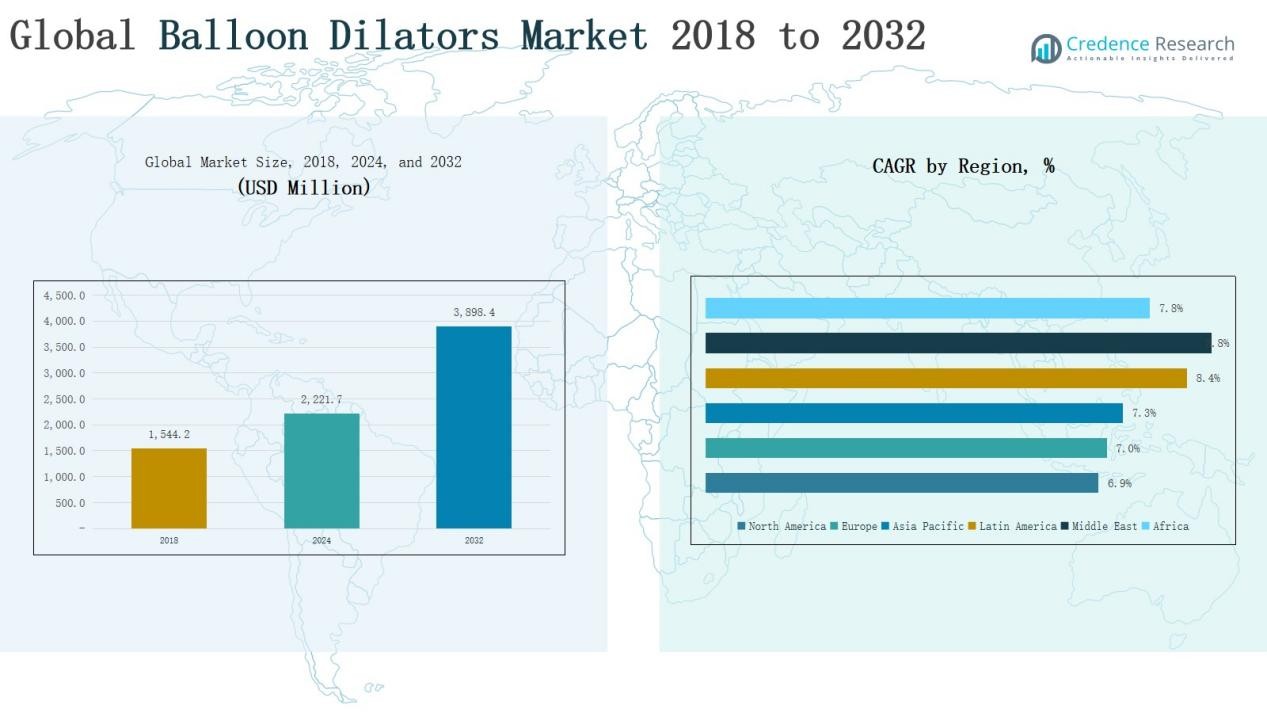

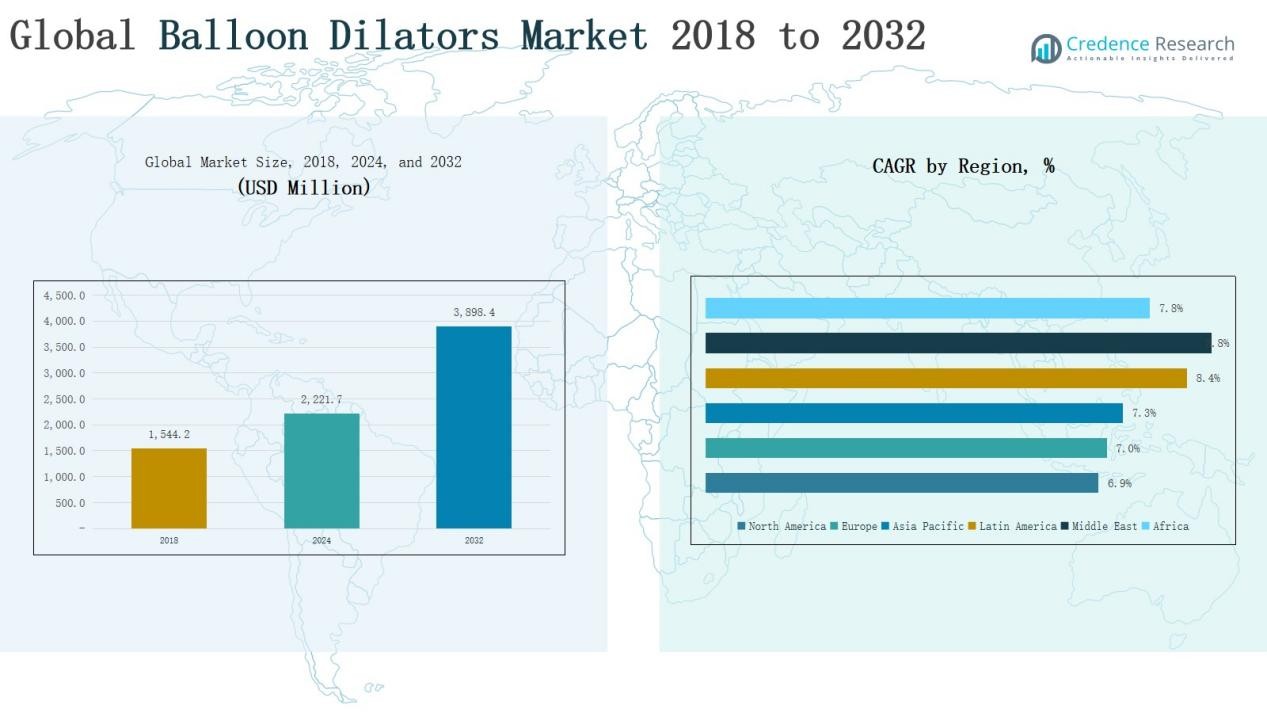

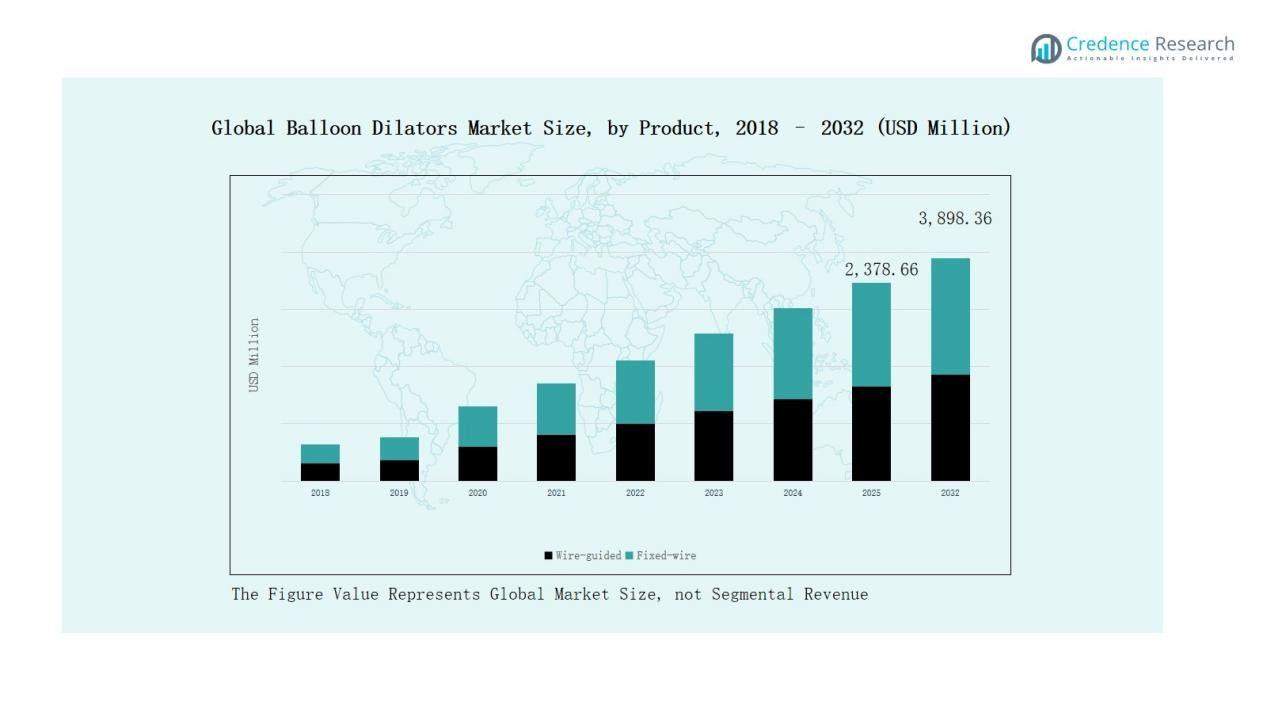

Global Balloon Dilators Market size was valued at USD 1,544.2 million in 2018 to USD 2,221.7million in 2024 and is anticipated to reach USD 3,898.4 million by 2032, at a CAGR of 7.31 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Balloon Dilators Market Size 2024 |

USD 2,221.7 Million |

| Balloon Dilators Market, CAGR |

7.31 % |

| Balloon Dilators Market Size 2032 |

USD 3,898.4 Million |

The Global Balloon Dilators Market is shaped by leading players such as Boston Scientific Corporation, Medtronic plc, Cook Medical, B. Braun Melsungen, CONMED Corporation, Merit Medical Systems, Karl Storz GmbH, Smiths Medical, Cordis Corporation, and AMG International. These companies maintain strong market positions through diverse product portfolios, technological advancements, and global distribution networks. They focus on innovation in balloon design, material improvements, and precision systems to enhance procedural safety and outcomes. Regionally, Europe led the market in 2024 with a 31% share, supported by advanced healthcare infrastructure, high procedural volumes in interventional cardiology, and favorable adoption of minimally invasive treatments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Balloon Dilators Market grew from USD 1,544.2 million in 2018 to USD 2,221.7 million in 2024 and is projected at USD 3,898.4 million by 2032.

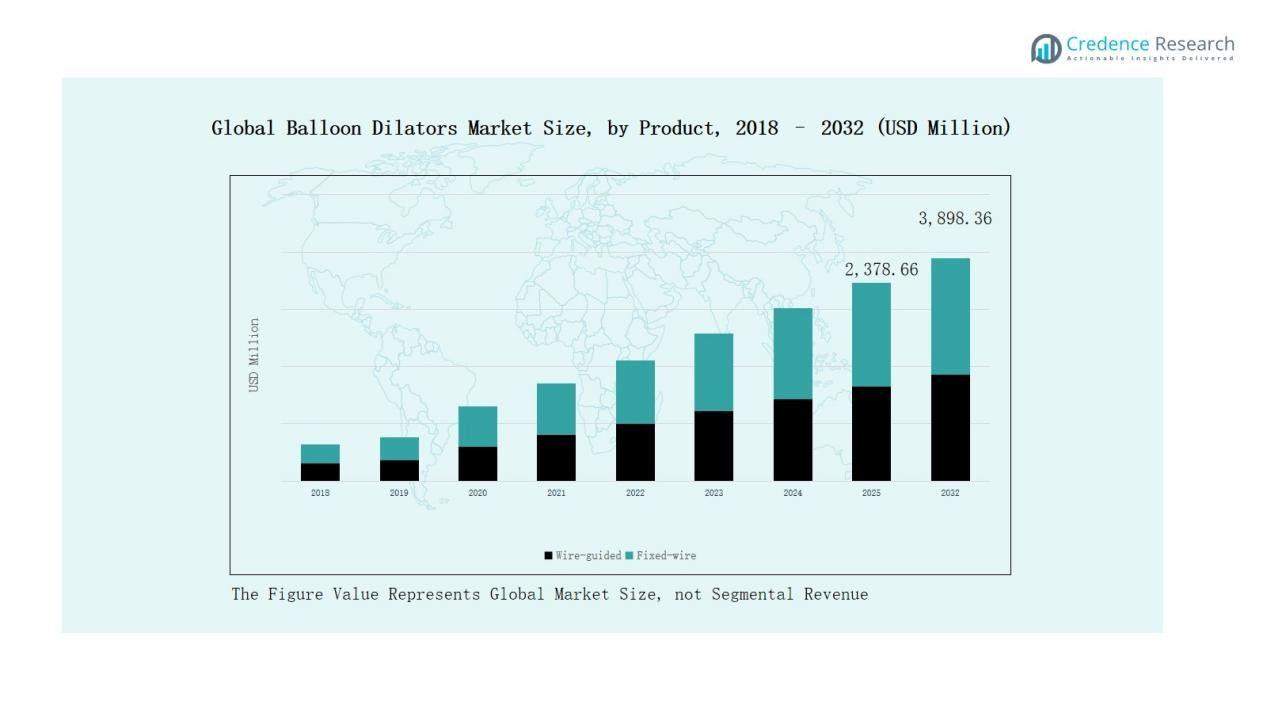

- Wire-guided balloon dilators dominated with 62% share in 2024, preferred for precision in interventional cardiology and gastroenterology, while fixed-wire held 38% share in cost-sensitive settings.

- Interventional cardiology led applications with 41% share in 2024, followed by peripheral intervention at 23%, gastroenterology and hepatology at 17%, and oncology plus surgery at 19%.

- Hospitals accounted for the largest share with 68% in 2024, ambulatory surgical centers held 22%, while specialty clinics and research centers comprised the remaining 10%.

- Europe led with 31% share in 2024, followed by Asia Pacific at 29%, North America at 26%, while Latin America, the Middle East, and Africa together contributed the remaining 14%.

Market Segment Insights

By Product

The wire-guided balloon dilators segment dominates the Global Balloon Dilators Market, accounting for nearly 62% share in 2024. Their leadership stems from widespread adoption in interventional cardiology and gastroenterology procedures, where precision and navigational control are critical. Wire-guided systems reduce procedural complications, improve placement accuracy, and support complex interventions, driving consistent preference over fixed-wire devices. The fixed-wire balloon dilators segment, holding about 38% share, remains relevant in cost-sensitive settings due to their ease of use and affordability.

- For instance, Boston Scientific reported strong demand for its CRE™ Wireguided Balloon Dilatation Catheter, highlighting its use in gastroenterology for controlled dilation and reduced perforation risk.

By Application

Interventional cardiology represents the largest application, contributing 41% share in 2024, supported by rising prevalence of coronary artery disease and growing adoption of minimally invasive angioplasty procedures. The demand for balloon dilators in this segment is driven by technological innovations and expanding access to advanced cardiac care worldwide. Peripheral intervention holds a significant 23% share, reflecting increased procedures for peripheral arterial diseases. Gastroenterology and hepatology contribute 17% share, supported by higher usage in endoscopic strictures. Interventional oncology and cardiovascular surgery together account for the remaining 19%, fueled by expanding applications in tumor treatment and surgical dilation.

- For instance, Abbott reported that its Xience™ family of drug‑eluting stents had been used in more than 15 million patients globally, underscoring the rising adoption of interventional cardiology procedures.

By End User

Hospitals lead the end-user segment with 68% market share in 2024, as they house advanced infrastructure, skilled professionals, and perform the majority of high-volume interventional procedures. The presence of specialized cardiology, gastroenterology, and oncology units further strengthens their role. Ambulatory surgical centers (ASCs) represent 22% share, benefiting from a shift toward outpatient procedures, cost efficiency, and reduced patient recovery times. The others category, including specialty clinics and research centers, holds the remaining 10%, driven by targeted adoption in niche healthcare environments.

Key Growth Drivers

Rising Prevalence of Cardiovascular and Gastrointestinal Disorders

The growing global burden of cardiovascular diseases and gastrointestinal conditions continues to drive the demand for balloon dilators. Increasing cases of coronary artery disease, peripheral artery disease, and esophageal strictures have expanded the need for minimally invasive interventions. Balloon dilators provide safe and effective treatment options that reduce surgical risks and recovery time. The expanding aging population further amplifies procedure volumes, as elderly patients represent the largest pool for interventional cardiology and gastroenterology procedures, fueling steady market growth.

- For instance, Abbott Laboratories advanced drug-coated balloon technology, enhancing safety and efficiency in coronary artery disease interventions, with increased use documented in 2024 clinical data.

Advancements in Minimally Invasive Technologies

Technological innovation in minimally invasive treatment techniques has significantly boosted the adoption of balloon dilators. Improvements such as high-compliance balloon materials, enhanced guidewire compatibility, and precision inflation systems have increased procedural success rates. Physicians are increasingly favoring balloon dilators for safe dilation with reduced trauma and enhanced patient comfort. Growing investments in product R&D by major medical device companies support the development of next-generation dilators, offering improved flexibility, accuracy, and efficacy, thereby accelerating global market penetration across multiple specialties.

- For instance, Medtronic introduced its NuVENT™ EM Balloon Sinus Dilation System with advanced pressure-controlled inflation, enabling ENT surgeons to treat sinus outflow obstructions with greater accuracy and minimal tissue trauma.

Expansion of Healthcare Infrastructure in Emerging Markets

Developing regions such as Asia-Pacific, Latin America, and the Middle East are witnessing rapid growth in healthcare infrastructure. Rising investments in hospital facilities, increased access to interventional cardiology and gastroenterology units, and supportive government initiatives have expanded procedure volumes. Growing medical tourism and higher awareness of advanced treatment options further drive balloon dilator adoption. In addition, improving insurance coverage and public-private partnerships in emerging economies have made minimally invasive procedures more accessible, positioning these regions as high-potential growth hubs for market players.

Key Trends & Opportunities

Shift Toward Outpatient and Ambulatory Settings

A key trend shaping the balloon dilators market is the growing shift from inpatient hospital procedures to outpatient and ambulatory settings. Ambulatory surgical centers are gaining traction due to their cost efficiency, reduced waiting times, and shorter recovery periods. This trend creates opportunities for manufacturers to design user-friendly, cost-effective, and portable dilator systems tailored to outpatient needs. With healthcare systems emphasizing cost containment and patient convenience, balloon dilator usage in non-hospital environments is expected to expand rapidly in the forecast period.

- For instance, Boston Scientific’s CRE PRO Wireguided Balloon Dilatation Catheter, used in endoscopic procedures, has features that contribute to improved procedural efficiency and ease of placement, which helps to support faster patient throughput.

Integration of Digital Technologies and Imaging Solutions

The integration of advanced imaging modalities and digital guidance tools with balloon dilators is emerging as a major opportunity. Enhanced visualization during procedures improves accuracy in placement and inflation, reducing complications and improving clinical outcomes. Companies are exploring partnerships with imaging and navigation technology providers to create comprehensive solutions. This trend also supports the growing demand for precision medicine, as it enables more tailored treatment approaches. As adoption of AI and real-time imaging increases, balloon dilators will see greater demand in complex procedures.

- For instance, Abbott has received FDA clearance for its AI-powered imaging software, Ultreon™ 1.0. The technology merges optical coherence tomography (OCT) with automation, providing step-by-step guidance and enhanced visualization for optimizing patient outcomes in coronary interventions.

Key Challenges

High Cost of Advanced Balloon Dilators

The elevated cost of advanced balloon dilators and related procedures remains a critical barrier, particularly in price-sensitive markets. Hospitals and healthcare providers in developing regions often face budget constraints, limiting widespread adoption. Additionally, reimbursement challenges in certain countries exacerbate the problem. The lack of cost-effective alternatives restricts accessibility for a large patient base, slowing market penetration. This cost barrier poses challenges for manufacturers aiming to expand reach while balancing innovation and affordability.

Regulatory Compliance and Product Approval Hurdles

Balloon dilators are classified as high-risk medical devices, requiring stringent regulatory approvals before commercialization. Lengthy approval timelines, complex clinical trial requirements, and evolving regulatory frameworks create entry barriers for new products. Compliance with international standards and safety protocols also increases operational costs for manufacturers. Smaller and mid-sized companies often struggle to meet these requirements, limiting their competitiveness. These regulatory hurdles delay product launches and hinder faster market growth, particularly in regions with diverse and evolving compliance structures.

Risk of Complications and Alternative Treatment Options

Although balloon dilators are widely adopted, the risk of complications such as vessel rupture, restenosis, or perforation limits broader use. Concerns about patient safety make physicians cautious in certain cases, particularly for high-risk patients. Furthermore, the availability of alternative treatment methods, including stent placement, drug-eluting technologies, and surgical interventions, poses competitive pressure. Continuous need for specialized training and skill development also adds to adoption challenges. These factors collectively restrain the expansion of balloon dilator usage in certain clinical scenarios.

Regional Analysis

North America

The North America balloon dilators market was valued at USD 305.45 million in 2018 and rose to USD 428.89 million in 2024, representing 26% of global share. Growth is driven by advanced healthcare infrastructure, high prevalence of cardiovascular diseases, and strong adoption of minimally invasive procedures. The U.S. leads due to favorable reimbursement and a high number of interventional specialists. With a CAGR of 6.9%, the market is projected to reach USD 727.82 million by 2032, reinforcing North America’s role as a core revenue generator.

Europe

Europe accounted for USD 462.04 million in 2018 and expanded to USD 653.70 million in 2024, contributing 31% share of the global market. Strong adoption of interventional cardiology and gastroenterology procedures, along with supportive policies for minimally invasive care, drives demand. Germany, the UK, and France remain key revenue contributors. The market is forecasted to reach USD 1,121.17 million by 2032, growing at a CAGR of 7.0%, solidifying Europe’s leadership through sustained clinical adoption and patient demand.

Asia Pacific

Asia Pacific generated USD 555.93 million in 2018 and increased to USD 798.88 million in 2024, securing 29% global market share. Growth is supported by a large patient pool, expanding hospital infrastructure, and rising prevalence of cardiovascular and gastrointestinal disorders. China, India, and Japan lead adoption, while Southeast Asia shows emerging demand. With the fastest CAGR of 7.3%, the region is projected to reach USD 1,399.51 million by 2032, positioning Asia Pacific as the leading growth hub for balloon dilators.

Latin America

Latin America reported USD 106.55 million in 2018, advancing to USD 163.77 million in 2024, capturing 6% of the global market. Brazil dominates, driven by expanding private healthcare and increasing demand for interventional cardiology procedures. Argentina and other markets contribute modestly due to cost challenges. The region is expected to grow at a CAGR of 8.4%, reaching USD 311.87 million by 2032, supported by rising healthcare investments and improved insurance coverage.

Middle East

The Middle East balloon dilators market was valued at USD 73.82 million in 2018 and grew to USD 116.77 million in 2024, representing 5% global share. GCC nations lead with strong healthcare investments, followed by Israel and Turkey with advanced treatment adoption. Government-driven infrastructure expansion and increasing patient inflow for specialized care support demand. With the highest CAGR of 8.8%, the market is projected to reach USD 229.61 million by 2032, highlighting the region’s rapid evolution in advanced interventional treatments.

Africa

Africa accounted for USD 40.46 million in 2018 and expanded to USD 59.73 million in 2024, representing 3% global share. South Africa and Egypt dominate the market, benefiting from rising healthcare investments and gradual adoption of interventional cardiology. Other African countries face accessibility challenges but are improving through international collaborations and non-governmental health initiatives. The region is expected to grow at a CAGR of 7.8%, reaching USD 108.37 million by 2032, reflecting gradual but steady expansion of advanced medical technologies.

Market Segmentations:

By Product

- Wire-guided Balloon Dilators

- Fixed-wire Balloon Dilators

By Application

- Interventional Cardiology

- Peripheral Intervention

- Gastroenterology and Hepatology

- Interventional Oncology

- Cardiovascular Surgery

By End User

- Hospitals

- Ambulatory Surgical Centers

- Others

By Region

- North America(U.S., Canada, Mexico)

- Europe(UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific(China, Japan, South Korea, India, Australia, Southeast Asia, Rest of APAC)

- Latin America(Brazil, Argentina, Rest of Latin America)

- Middle East(GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa(South Africa, Egypt, Rest of Africa)

Competitive Landscape

The Global Balloon Dilators Market is moderately consolidated, with leading multinational companies holding significant market share through broad product portfolios and established distribution networks. Key players such as Boston Scientific Corporation, Medtronic plc, Cook Medical, B. Braun Melsungen, and CONMED Corporation dominate the competitive space by offering advanced, clinically validated balloon dilator solutions. These companies focus on continuous innovation, integrating improved balloon materials, enhanced guidewire compatibility, and precision inflation technologies to strengthen clinical outcomes. Strategic initiatives, including mergers, acquisitions, and collaborations, are common as firms aim to expand geographical reach and diversify applications across cardiology, gastroenterology, and oncology. Mid-tier and regional manufacturers, including Merit Medical Systems, Karl Storz, and Smiths Medical, compete by offering cost-effective and niche solutions, particularly in emerging markets. Increasing competition is also observed from local players that provide affordable alternatives tailored to regional needs. The competitive landscape is expected to intensify as demand rises in Asia-Pacific, Latin America, and the Middle East.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- AMG International

- Braun Melsungen

- CONMED Corporation

- Boston Scientific Corporation

- Cook Medical

- Cordis Corporation

- Karl Storz GmbH

- Medtronic plc

- Merit Medical Systems, Inc.

- Smiths Medical

- Other Key Players

Recent Developments

- In November 2023, Boston Scientific completed the acquisition of Relevant Medsystems, expanding their chronic pain and vascular treatment portfolio.

- In April 2025, Cagent Vascular partnered with 3comma Medical to expand international distribution of the Serranator PTA Serration Balloon product family across EU and MENA regions.

- In January 2025, Medtronic entered a distribution agreement with Contego Medical to exclusively distribute its carotid and peripheral vascular portfolio, including post-dilation balloons, in the United States.

- In September 2024, Quasar Medical acquired Ridgeback Technologies to strengthen its balloon catheter R&D and manufacturing capabilities.

Report Coverage

The research report offers an in-depth analysis based on Product , Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for balloon dilators will rise with increasing prevalence of cardiovascular and gastrointestinal diseases.

- Minimally invasive procedures will continue to drive adoption across cardiology and gastroenterology applications.

- Hospitals will remain the primary end users due to high procedure volumes and advanced facilities.

- Ambulatory surgical centers will gain importance as outpatient care expands globally.

- Emerging markets will offer significant growth opportunities through improving healthcare infrastructure.

- Technological advancements will enhance precision, safety, and effectiveness of balloon dilators.

- Strategic collaborations between device makers and healthcare providers will expand market penetration.

- Competition from alternative treatment options will shape product innovation and pricing strategies.

- Regulatory compliance will remain a critical factor influencing product approvals and launches.

- Rising healthcare investments in Asia Pacific, Latin America, and the Middle East will strengthen global adoption.