Market Overview

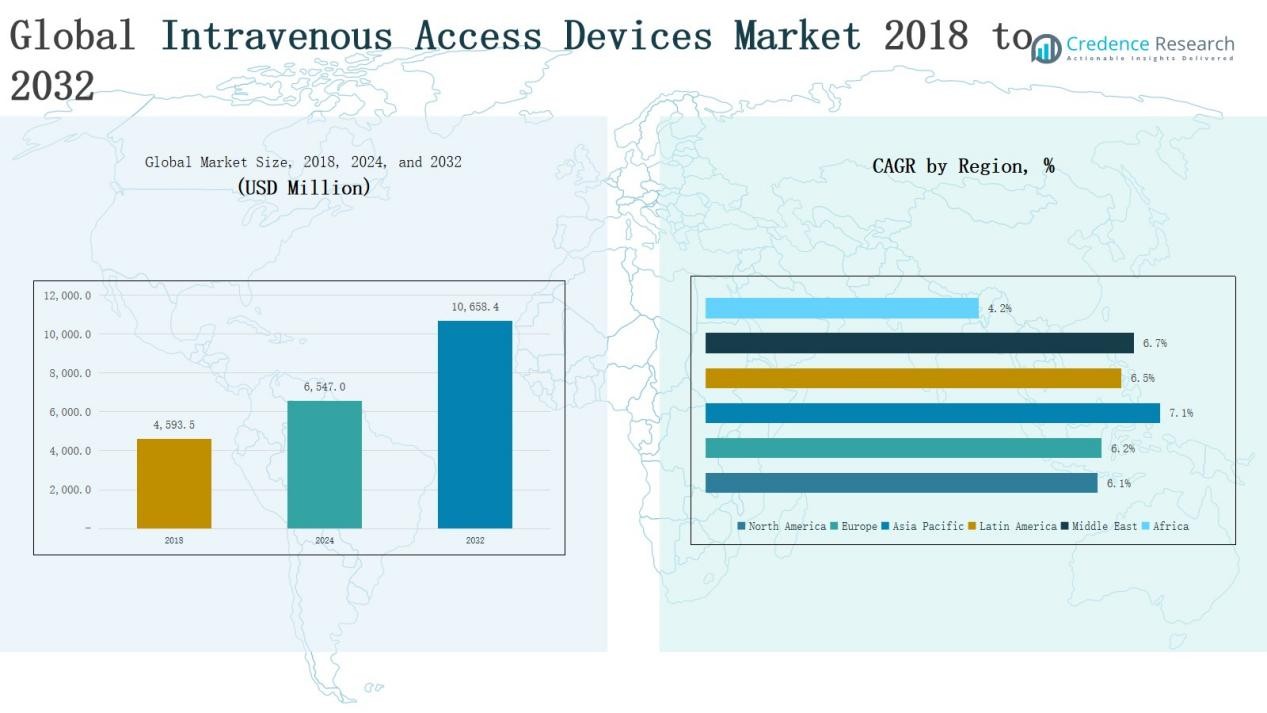

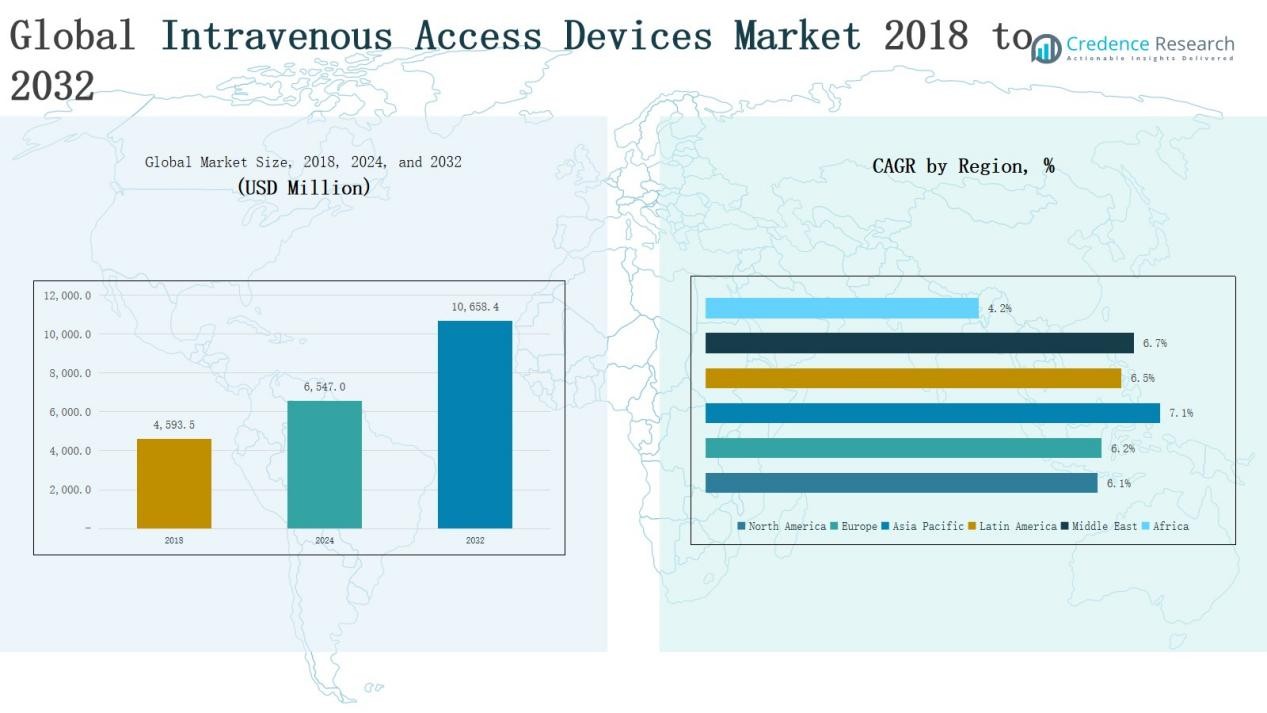

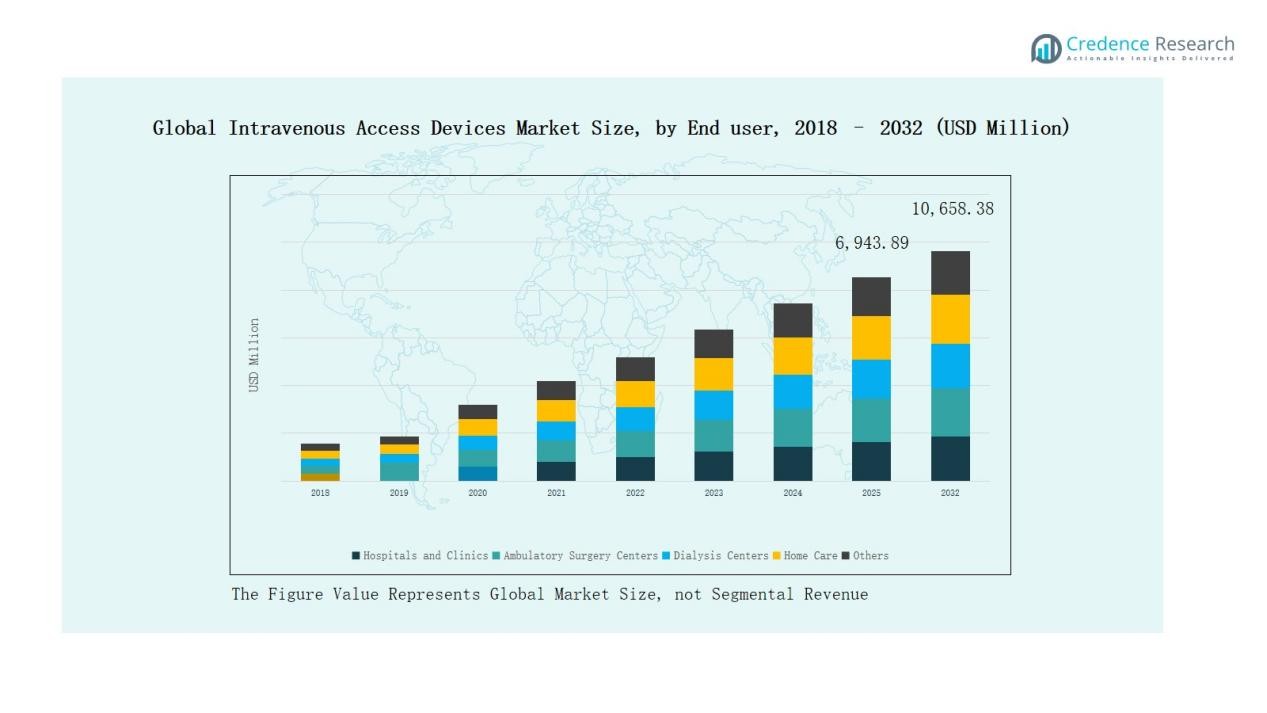

Global Intravenous Access Devices Market size was valued at USD 4,593.5 million in 2018 to USD 6,547.0 million in 2024 and is anticipated to reach USD 10,658.4 million by 2032, at a CAGR of 6.31% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Intravenous Access Devices Market Size 2024 |

USD 6,547.0 Million |

| Intravenous Access Devices Market, CAGR |

6.31% |

| Intravenous Access Devices Market Size 2032 |

USD 10,658.4 Million |

The Global Intravenous Access Devices Market is shaped by leading companies including Baxter International, B. Braun Medical, Becton Dickinson (BD), Medtronic, Teleflex, Nipro Medical, Cook, Edward Life Sciences, and GE Healthcare. These players maintain strong positions through broad product portfolios, continuous investment in research and development, and strategic collaborations aimed at advancing safety and infection-prevention technologies. Their focus on innovation, cost-effective solutions, and global distribution networks enables them to address both developed and emerging healthcare markets. Regionally, North America led the market in 2024 with a 34.9% share, driven by advanced infrastructure, strong R&D capabilities, and high demand for chronic disease management solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Intravenous Access Devices Market grew from USD 4,593.5 million in 2018 to USD 6,547.0 million in 2024 and is projected to reach USD 10,658.4 million by 2032 at a CAGR of 31%.

- Peripheral vascular access systems led with 62% share in 2024, driven by widespread use in short-term therapies, with peripheral catheters dominating due to ease of insertion and cost efficiency.

- Medication administration accounted for 46% share in 2024, supported by rising oncology drug infusions, hospitalizations, and increasing demand for biologics, while fluid and nutrition therapy followed closely.

- Hospitals and clinics captured 54% share in 2024, reflecting their central role in surgeries, intensive care, and emergency care, with ambulatory centers and dialysis centers emerging as fast-growing segments.

Market Segment Insights

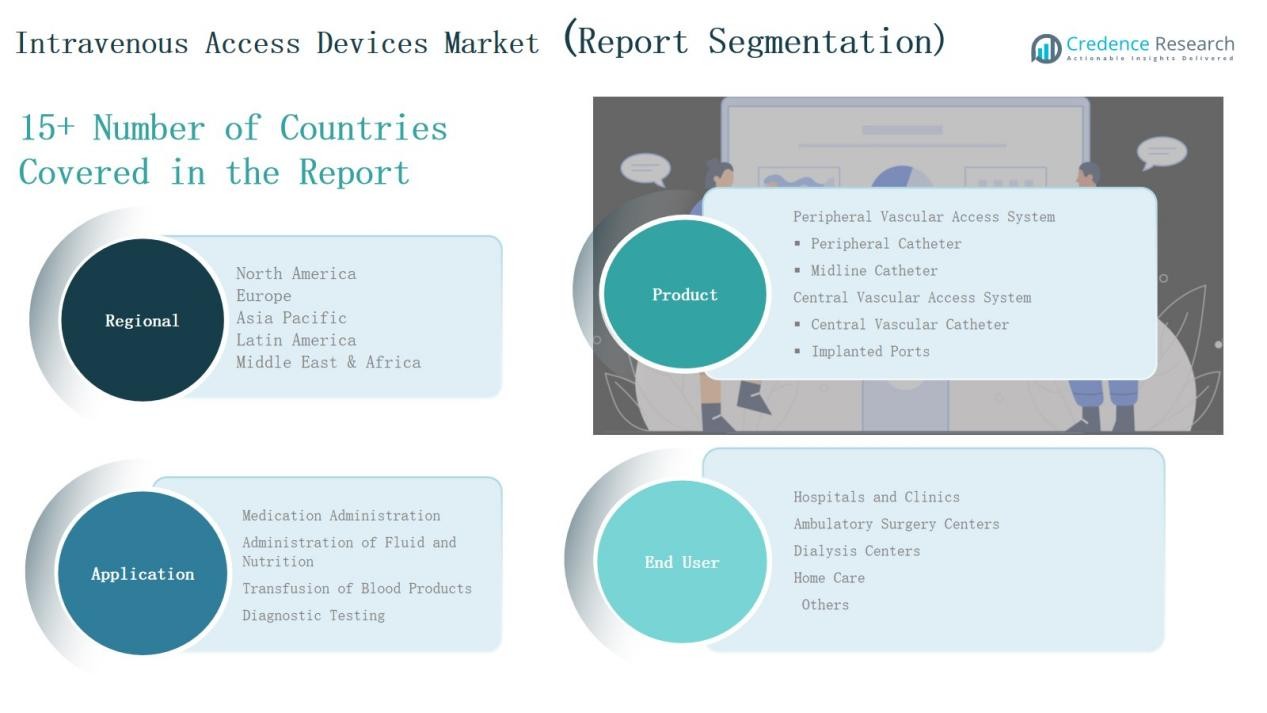

By Product

Peripheral vascular access systems lead the market with nearly 62% share in 2024, supported by their widespread use in short-term therapies and lower procedural risks. Within this, peripheral catheters remain the most preferred devices due to ease of insertion, cost-effectiveness, and broad application across emergency and inpatient care. Central vascular access systems, including central catheters and implanted ports, capture a smaller but significant portion, driven by rising use in oncology and long-term treatments.

- For instance, BD introduced the BD® Intraosseous Vascular Access System designed for emergency care scenarios where traditional IV access is not feasible. This device features multiple needle lengths and a powered driver with a rechargeable battery lasting up to 12 times longer than competitors, facilitating rapid vascular access in critical situations.

By Application

Medication administration dominates with 46% share in 2024, driven by high global demand for intravenous drug delivery in chronic and acute disease management. The segment benefits from increasing hospitalizations, oncology drug infusions, and expansion of biologics. Administration of fluid and nutrition follows closely, supported by rising prevalence of gastrointestinal disorders and malnutrition cases requiring parenteral nutrition support.

- For instance, B. Braun launched its latest Next Generation Space infusion pump platform in Europe, designed for oncology and critical care drug administration.

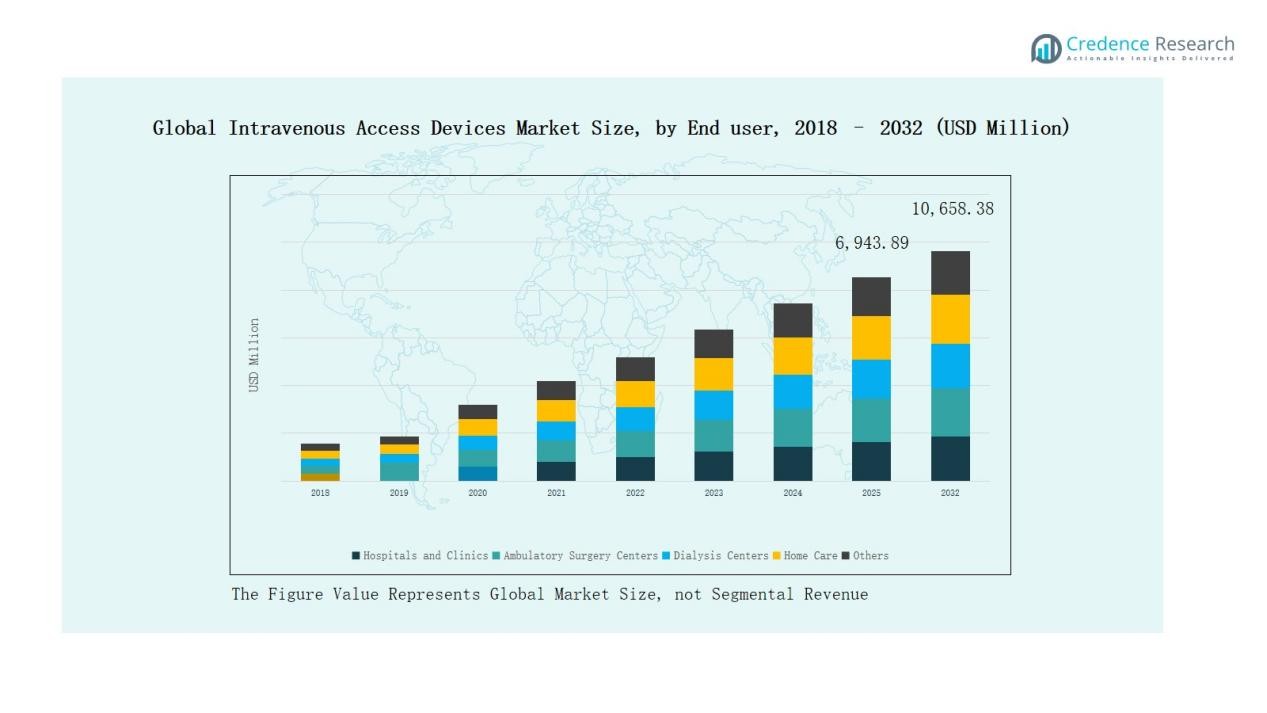

By End User

Hospitals and clinics hold the largest share at 54% in 2024, reflecting their central role in surgeries, intensive care, and complex disease management. Growing adoption of advanced intravenous devices for oncology, dialysis, and emergency care strengthens this dominance. Ambulatory surgery centers and dialysis centers represent fast-growing segments, driven by rising preference for outpatient care and increased chronic kidney disease prevalence. Home care adoption also expands steadily, supported by advancements in portable IV access systems.

Key Growth Drivers

Rising Burden of Chronic Diseases

The growing prevalence of chronic diseases such as cancer, cardiovascular disorders, and diabetes significantly drives the intravenous access devices market. Patients with these conditions often require frequent intravenous therapies, including chemotherapy, fluid replacement, and long-term drug delivery. Increasing hospitalization rates and a rising geriatric population further expand device adoption. The demand is also fueled by the preference for minimally invasive procedures, making intravenous access a critical component of modern healthcare delivery worldwide.

- For instance, BD (Becton, Dickinson and Company) launched the BD Neopak™ 2.25 mL prefillable syringe, designed for injectable biologics and chronic disease therapies.

Expansion of Outpatient and Home Care Services

The rapid expansion of ambulatory surgery centers and home healthcare is boosting device demand. Patients increasingly prefer outpatient services due to cost savings and convenience, leading to higher use of portable and easy-to-insert intravenous devices. The shift is supported by technological innovations that enable safe self-administration of drugs and nutrition at home. As chronic disease management transitions beyond hospitals, intravenous access devices are playing a vital role in expanding treatment availability.

- For instance, B. Braun Medical launched the Introcan Safety IV Catheter StraightHub, specifically engineered for ease of insertion in ambulatory and home-care settings.

Technological Advancements in Device Design

Continuous advancements in catheter materials, safety features, and device designs are propelling market growth. Needleless connectors, antimicrobial coatings, and ultrasound-guided insertion techniques are improving patient safety and reducing infection risks. Manufacturers are investing in innovations that enhance ease of use, lower complication rates, and support long-term implantation. These improvements are increasing adoption among healthcare professionals while addressing patient comfort. Such advancements align with regulatory emphasis on reducing hospital-acquired infections and improving treatment outcomes.

Key Trends & Opportunities

Growing Adoption of Implantable Ports and Midline Catheters

Implantable ports and midline catheters are gaining traction due to their ability to support long-term therapies while minimizing repeated needle punctures. Their adoption is particularly strong in oncology and chronic care, where frequent access is required. Improved device durability and lower infection risks compared to traditional methods create new opportunities. Rising cancer prevalence, along with growing acceptance of personalized therapies, positions these sub-segments as important growth areas for the global intravenous access devices market.

- For instance, AngioDynamics received FDA clearance for its BioFlo Midline Catheter with Endexo technology, designed to reduce thrombus accumulation on catheter surfaces, improving safety in extended vascular access cases.

Integration of Smart Technologies in IV Devices

The integration of smart technologies such as digital monitoring systems and connected infusion devices offers significant opportunities. These innovations enable real-time tracking of infusion parameters, early detection of complications, and better compliance in home care settings. Hospitals are adopting smart intravenous systems to reduce errors and improve efficiency. As healthcare shifts toward digitalization and remote monitoring, manufacturers offering connected IV devices can capture strong demand from both advanced and emerging healthcare markets.

- For instance, B. Braun introduced its Outlook ES Safety Infusion System with DoseTrac Enterprise software, allowing hospitals to remotely monitor infusion pump performance and compliance

Key Challenges

Risk of Infections and Complications

A major challenge for intravenous access devices is the high risk of bloodstream infections and related complications. Central line-associated bloodstream infections (CLABSIs) continue to cause significant morbidity and increase healthcare costs. Despite advancements in antimicrobial coatings and insertion techniques, infection prevention remains difficult in resource-limited settings. This challenge necessitates continuous innovation and strict adherence to guidelines, as infection-related concerns can limit adoption, especially in home care and outpatient environments.

Stringent Regulatory and Compliance Requirements

Manufacturers face stringent regulatory approval processes and compliance requirements, which slow product launches and increase development costs. Authorities such as the FDA and EMA mandate rigorous clinical evidence to ensure safety and efficacy. Variations in regulatory frameworks across regions further complicate market entry for global players. These compliance challenges can delay commercialization, restrict small manufacturers, and impact overall innovation speed in the intravenous access devices market.

Rising Cost Pressures and Reimbursement Constraints

The growing focus on cost containment in healthcare systems poses a challenge to widespread device adoption. Hospitals and clinics are under pressure to reduce expenses, leading to preference for cost-effective alternatives over advanced devices. Reimbursement limitations for newer technologies further hinder uptake, especially in emerging markets. Price-sensitive environments make it difficult for manufacturers to balance innovation with affordability. Addressing cost pressures while maintaining quality remains a critical hurdle for market growth.

Regional Analysis

North America

North America dominated the market with revenues of USD 1,750.11 million in 2018, rising to USD 2,463.54 million in 2024 and projected to reach USD 3,943.60 million by 2032, at a 6.1% CAGR. The region held the largest 34.9% share in 2024, supported by advanced healthcare infrastructure, strong adoption of innovative IV devices, and rising chronic disease prevalence. The U.S. leads due to high R&D investment and favorable reimbursement policies, while Canada and Mexico contribute steadily through growing healthcare spending and outpatient care adoption.

Europe

Europe generated USD 1,374.37 million in 2018, increasing to USD 1,941.46 million in 2024, and is expected to reach USD 3,122.91 million by 2032 at a 6.2% CAGR. The region accounted for 27.5% of global share in 2024, driven by high chronic disease incidence, strong hospital networks, and focus on infection prevention. Germany, the UK, and France lead the market, while Italy and Spain show notable growth in outpatient treatments. Regulatory emphasis on patient safety further supports demand for advanced catheters and needleless connectors.

Asia Pacific

Asia Pacific recorded USD 868.17 million in 2018, rising to USD 1,293.22 million in 2024, and forecasted to reach USD 2,226.54 million by 2032, the fastest growth at 7.1% CAGR. Holding 18.3% share in 2024, the region benefits from rising healthcare expenditure, expanding hospital infrastructure, and increasing cases of cancer and infectious diseases. China and India dominate due to large patient bases, while Japan and South Korea drive adoption of advanced IV devices. Government healthcare investments and medical tourism expansion strengthen the region’s outlook.

Latin America

Latin America generated USD 260.45 million in 2018, advancing to USD 374.30 million in 2024, and projected to reach USD 616.05 million by 2032 at a 6.5% CAGR. The region accounted for 7.3% of the global share in 2024. Brazil leads, supported by a large healthcare sector and rising chronic disease burden, while Argentina and Mexico contribute through increasing investments in care facilities. Despite pricing pressures and limited reimbursement, the growth of ambulatory centers and infusion therapies offers opportunities.

Middle East

The Middle East market was valued at USD 219.57 million in 2018, increasing to USD 319.12 million in 2024, and is projected to reach USD 532.92 million by 2032 at a 6.7% CAGR. With a 6.3% share in 2024, growth is driven by expanding hospital infrastructure in GCC countries, rising cancer cases, and medical tourism in the UAE. Israel and Turkey are emerging contributors with growing adoption of advanced IV access devices. Regulatory inconsistencies remain a challenge but ongoing investments sustain momentum.

Africa

Africa stood at USD 120.81 million in 2018, rising to USD 155.35 million in 2024, and forecasted to reach USD 216.37 million by 2032, at a modest 4.2% CAGR. The region captured only 4.2% of the global share in 2024, reflecting limited healthcare infrastructure and affordability challenges. South Africa leads adoption, followed by Egypt, while the rest of Africa lags due to access and cost barriers. Donor-funded programs and government healthcare initiatives are slowly improving access to IV therapies, offering gradual growth potential.

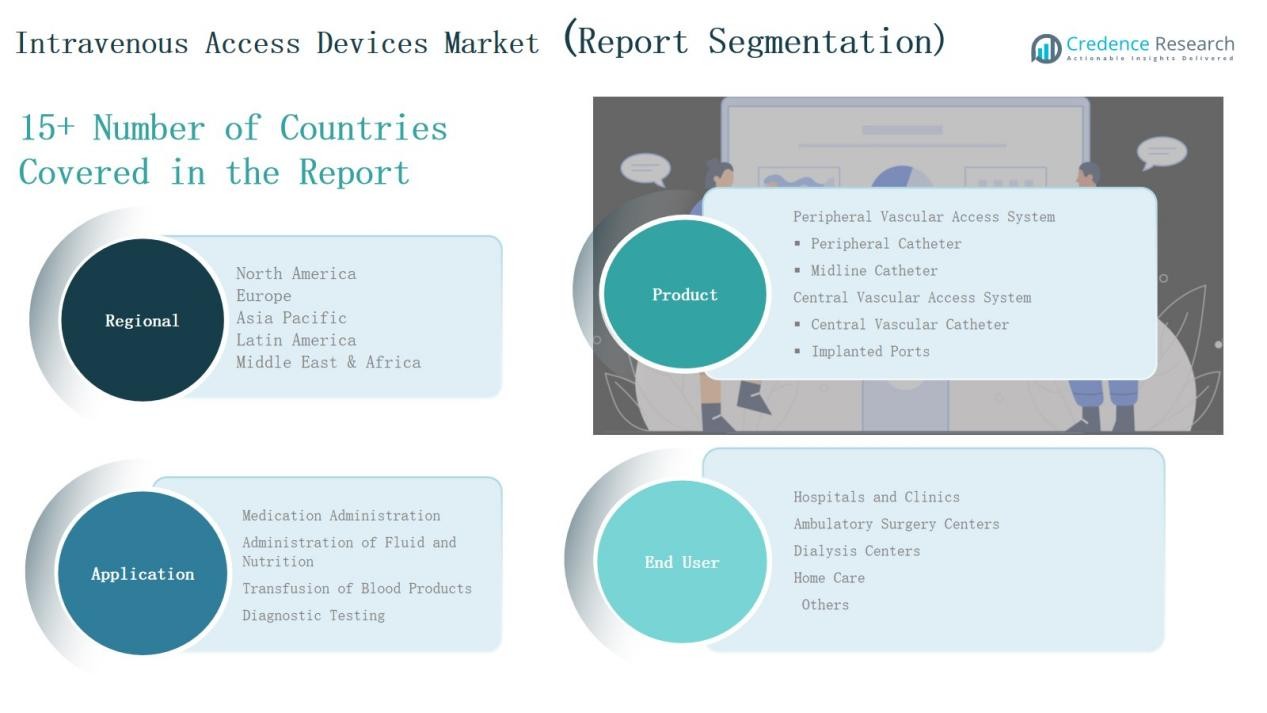

Market Segmentations:

By Product

Peripheral Vascular Access System

- Peripheral Catheter

- Midline Catheter

Central Vascular Access System

- Central Vascular Catheter

- Implanted Ports

By Application

- Medication Administration

- Administration of Fluid and Nutrition

- Transfusion of Blood Products

- Diagnostic Testing

By End User

- Hospitals and Clinics

- Ambulatory Surgery Centers

- Dialysis Centers

- Home Care

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Global Intravenous Access Devices Market is characterized by the presence of multinational corporations and regional players competing on product innovation, pricing, and distribution strength. Leading companies such as Baxter International, B. Braun Medical, Becton Dickinson (BD), Medtronic, Teleflex, Nipro Medical, and Cook dominate the market with extensive portfolios covering peripheral and central vascular access systems. These players emphasize technological advancements, including antimicrobial coatings, safety-engineered catheters, and needleless connectors, to reduce infection risks and enhance patient outcomes. Strategic mergers, acquisitions, and partnerships strengthen global reach, while continuous investment in R&D supports long-term growth. Regional players focus on cost-effective solutions and localized distribution to capture emerging markets. Market concentration remains moderate, with global leaders holding significant share in developed regions, while fragmented competition in Asia Pacific and Latin America fosters innovation and competitive pricing. Overall, the landscape reflects a balance of global dominance and regional agility.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Baxter International, Inc.

- Braun Medical, Inc.

- Becton Dickinson and Company (BD)

- Edward Life Sciences Corporation

- GE Healthcare, Inc.

- Medtronic Plc

- Nipro Medical Corporation

- Teleflex Medical

- Cook

- Others

Recent Developments

- In July 2025, Teleflex completed the acquisition of BIOTRONIK’s Vascular Intervention business for about €760 million, expanding its interventional and cath lab access portfolio.

- In March 2025, SK Capital made a strategic investment in Spectrum Vascular, which had earlier acquired vascular access product lines from Cook Medical and AngioDynamics.

- In October 2024, Becton Dickinson (BD) introduced an enhanced intraosseous vascular access system featuring integrated passive needle tip safety for critical care.

- In November 2023, Becton Dickinson (BD) introduced the PIVO Pro, a needle-free blood collection device that integrates with various peripheral IV catheters, including the Nexiva system.

Report Coverage

The research report offers an in-depth analysis based on Product , Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for intravenous access devices will rise with growing chronic disease prevalence.

- Hospitals and clinics will remain the primary end users due to high patient volumes.

- Home care adoption will expand as portable and user-friendly devices gain traction.

- Peripheral catheters will continue leading usage for short-term therapies.

- Central vascular devices will grow with rising cancer and long-term treatment needs.

- Infection-prevention features will become standard in new product development.

- Emerging markets will drive growth through healthcare infrastructure investments.

- Smart and connected IV systems will enhance monitoring and safety.

- Partnerships between global leaders and regional players will strengthen distribution.

- Regulatory focus on patient safety will accelerate adoption of advanced devices.