Market Overview

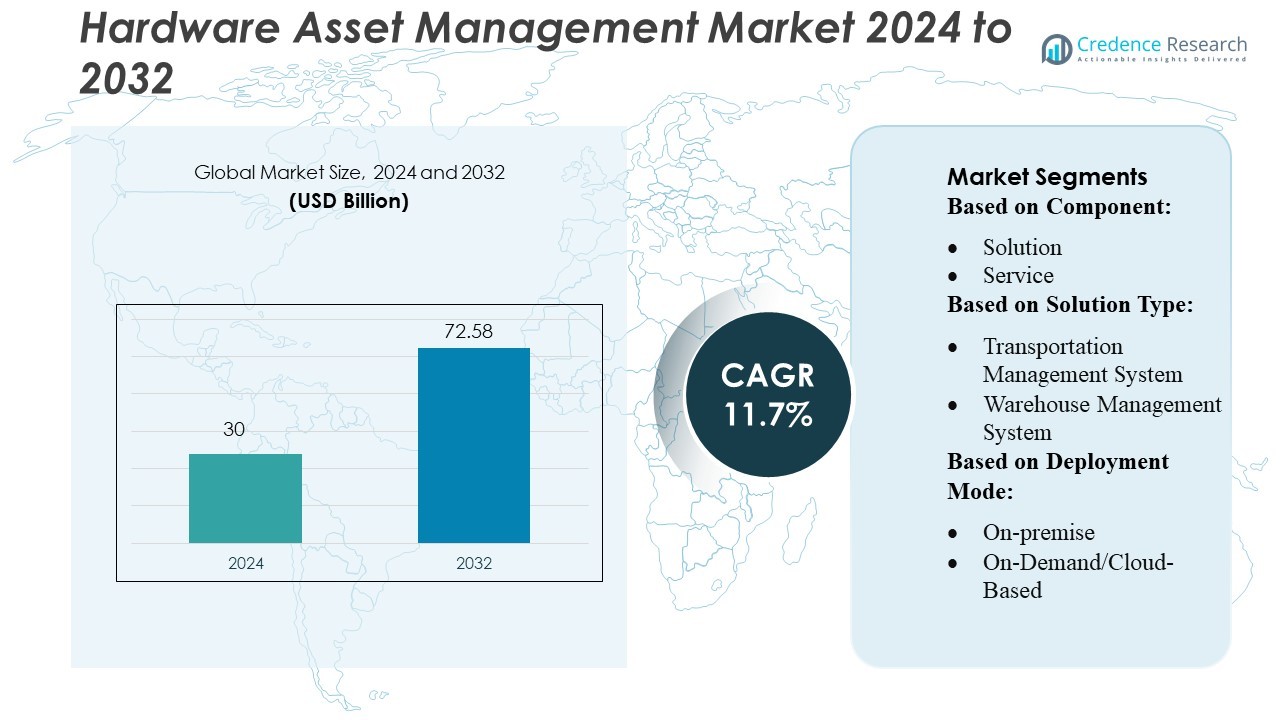

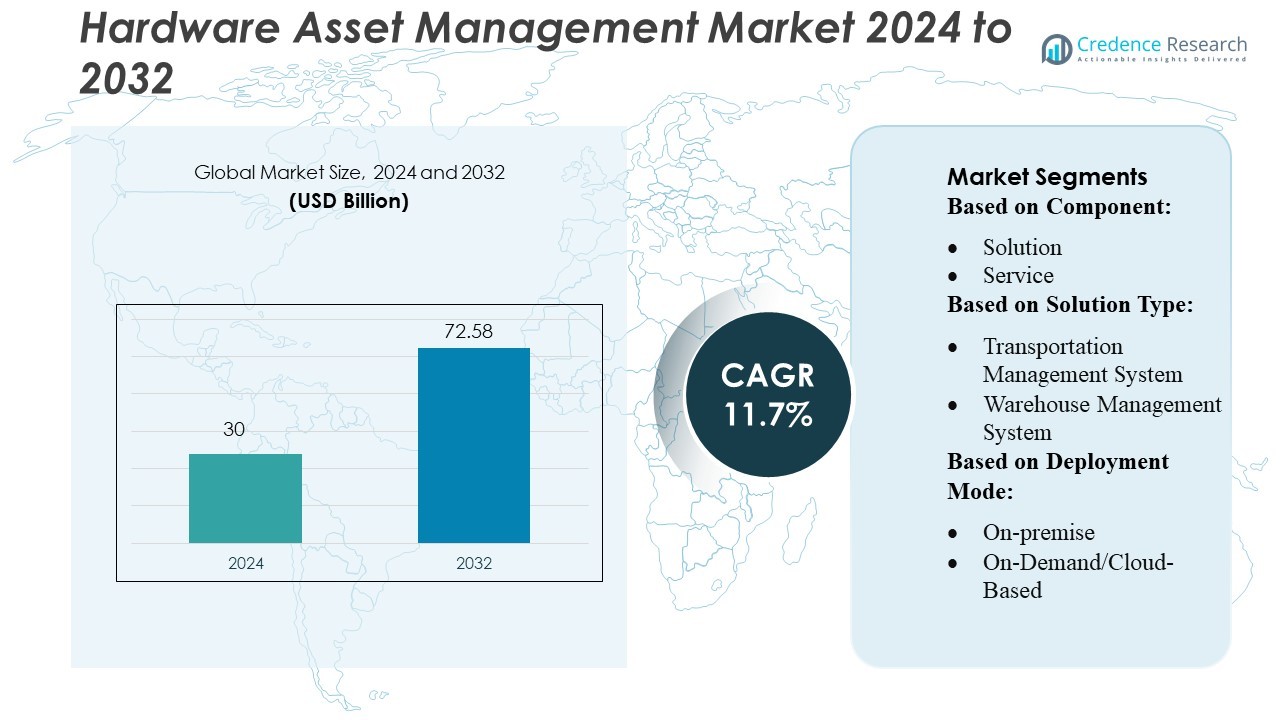

Hardware Asset Management Market size was valued USD 30 billion in 2024 and is anticipated to reach USD 72.58 billion by 2032, at a CAGR of 11.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hardware Asset Management Market Size 2024 |

USD 30 Billion |

| Hardware Asset Management Market, CAGR |

11.7% |

| Hardware Asset Management Market Size 2032 |

USD 72.58 Billion |

The hardware asset management market is shaped by strong competition among major global technology providers that offer advanced lifecycle tracking, cloud-based platforms, and AI-driven analytics. Leading players continuously enhance their solutions with integrated IoT capabilities, predictive maintenance tools, and automated compliance features to support large, distributed enterprise environments. The market’s growth is further supported by strategic partnerships, product expansions, and industry-specific implementations across manufacturing, energy, IT services, and government sectors. North America leads the global hardware asset management market with an estimated 35–38% share, driven by mature digital infrastructure, high cloud adoption, and strong regulatory compliance requirements across enterprises.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Hardware Asset Management Market was valued at USD 30 billion in 2024 and is projected to reach USD 72.58 billion by 2032, registering a strong CAGR of 11.7% during the forecast period.

- Growing demand for real-time asset visibility, automated lifecycle tracking, and cloud-enabled management platforms is driving adoption across large enterprises, particularly in asset-intensive sectors.

- AI-driven analytics, IoT-integrated monitoring, and predictive maintenance are emerging as key market trends, improving operational accuracy and reducing downtime.

- The market remains highly competitive as vendors invest in product innovation, strategic collaborations, and industry-specific solutions, while integration complexity and high deployment costs act as notable restraints.

- North America leads with a 35–38% share, supported by advanced digital infrastructure; the solution segment dominates with the largest share, driven by rising enterprise demand for centralized, scalable asset intelligence systems.

Market Segmentation Analysis:

By Component

The hardware asset management market remains dominated by the solution segment, accounting for the largest market share due to growing enterprise demand for automated tracking, lifecycle management, and compliance auditing. Organizations increasingly prioritize integrated platforms that consolidate asset visibility, reduce operational risk, and enhance ROI. The service segment continues to grow steadily, driven by rising outsourcing of maintenance, configuration, and system optimization tasks. However, solutions hold the lead as enterprises favor scalable, AI-enabled asset intelligence tools that streamline inventory accuracy and reduce downtime across distributed IT and operational environments.

- For instance, Bentley Systems’ AssetWise ALIM enables users to link over 1 million engineering documents and asset records within its connected data environment. By consolidating this wealth of information, organizations reduce operational risk and improve ROI.

By Solution Type

Within solution types, the Warehouse Management System (WMS) segment holds the dominant share, supported by its critical role in real-time inventory tracking, equipment utilization monitoring, and automated data capture. WMS adoption accelerates across manufacturing, logistics, and retail due to rising pressure for faster inventory turns and reduced operational inefficiencies. Transportation Management Systems and Supply Chain Planning follow, driven by the need for synchronized logistics and predictive planning. Procurement and sourcing tools gain traction through spend optimization, while Manufacturing Execution Systems expand with Industry 4.0-driven connectivity and factory-floor asset control.

- For instance, Oracle’s Fusion Cloud Warehouse Management (23C) supports serial-number tracking of up to 25 alphanumeric characters per item, ensuring precise tracking of individual units.

By Deployment Mode

The on-demand/cloud-based segment leads the market with the highest share, propelled by its scalability, lower upfront investment, and seamless integration with multi-site operations. Cloud platforms enable organizations to centralize asset tracking, automate updates, and leverage advanced analytics without complex infrastructure demands. This model also supports rapid deployment and remote access, making it suitable for distributed workforces and global enterprises. While on-premise solutions retain significance among highly regulated sectors seeking greater data control, cloud-based systems dominate due to enhanced flexibility, cost efficiency, and continual innovation through AI, IoT, and automated reporting capabilities.

Key Growth Drivers

- Rising Demand for Real-Time Asset Visibility and Tracking

Organizations increasingly invest in hardware asset management solutions to gain real-time visibility into asset utilization, location, and lifecycle performance. Growing device proliferation across IT, telecom, manufacturing, and logistics intensifies the need for automated tracking systems that reduce downtime, prevent asset loss, and optimize resource allocation. Advanced technologies such as RFID, IoT sensors, and AI-driven analytics further accelerate adoption by enabling continuous monitoring, predictive maintenance, and accurate inventory mapping—significantly improving operational efficiency and cost savings across large, distributed enterprises.

- For instance, ABB’s AC500 CMS module supports up to 16 condition-monitoring sensors per module, enabling continuous tracking of vibration, temperature, and signal data to detect faults before they escalate.

- Expanding Digital Transformation and Cloud Adoption

Accelerated digital transformation initiatives across industries are driving higher investments in centralized asset management platforms that support cloud-based deployment. Enterprises adopt cloud-native solutions to streamline asset data consolidation, automate updates, and scale operations without heavy infrastructure costs. The shift toward hybrid and remote work environments further emphasizes the need for unified asset intelligence systems. As organizations modernize their IT infrastructure, cloud-enabled hardware asset management tools provide enhanced accessibility, integration capabilities, and real-time analytics—positioning them as core components of digital modernization strategies.

- For instance, SAP Asset & Service Manager app empowers more than 500 technicians with persona-based, offline-capable workflows and voice-to-text, camera, and LiDAR scanning functionality.

- Increasing Compliance Requirements and IT Governance Mandates

Growing regulatory and security requirements compel enterprises to implement structured hardware asset management practices that ensure audit readiness, data integrity, and risk mitigation. Industries such as BFSI, healthcare, and government face stringent compliance obligations related to asset ownership, software licensing, data protection, and lifecycle documentation. Automated asset tracking helps organizations maintain accurate audit trails, eliminate unauthorized devices, and reduce vulnerabilities linked to outdated hardware. The rising importance of governance frameworks and cybersecurity resilience continues to strengthen demand for disciplined asset management systems.

Key Trends & Opportunities

1. Integration of AI, Automation, and Predictive Analytics

AI-driven automation is emerging as a major trend, transforming the hardware asset management landscape through predictive analytics, anomaly detection, and automated reconciliation. Organizations increasingly utilize machine learning models to forecast asset failures, optimize refresh cycles, and analyze usage patterns. Automated workflows reduce manual effort and enhance data accuracy, creating opportunities for vendors to develop intelligent asset ecosystems. These advancements also support strategic decision-making, improve lifecycle planning, and unlock new service models that appeal to enterprises seeking next-generation operational optimization.

- For instance, Hexagon AB recently introduced its HxGN APM, which embeds an Asset Twin Library comprising over 200 predefined industrial asset models, covering 1,761 failure modes, 3,928 condition triggers, and 1,375 prescriptive actions.

2. Growing Adoption of IoT-Enabled Asset Ecosystems

IoT integration presents significant opportunity as enterprises deploy sensor-equipped hardware to track environmental conditions, performance metrics, and movement patterns. IoT-enabled ecosystems provide granular insights that enhance asset traceability and maintenance efficiency across warehouses, data centers, and industrial facilities. This trend drives demand for interoperable platforms capable of aggregating vast real-time data streams. As businesses embrace Industry 4.0 and smart infrastructure initiatives, IoT connectivity enables end-to-end asset intelligence, supporting predictive operations and strengthening cross-functional decision-making.

- For instance, GE Digital’s SmartSignal software includes a “time-to-action” forecast analytics model built on over 340 Digital Twin blueprints, enabling users to predict when a piece of equipment will hit alarm thresholds and require remediation.

3. Rising Opportunities in Multi-Site and Remote Workforce Management

The expansion of remote and hybrid work models creates new opportunities for hardware asset management providers. Enterprises face increased complexity in monitoring distributed devices, ensuring secure configurations, and maintaining visibility across geographically dispersed teams. Cloud platforms, automated audit tools, and remote provisioning systems allow organizations to strengthen governance while reducing operational overhead. As multi-site operations expand across global supply chains, solutions supporting remote onboarding, asset delivery tracking, and centralized lifecycle management gain strong market traction.

Key Challenges

- High Implementation Costs and System Complexity

Despite strong demand, many organizations—especially SMEs—face challenges due to the high cost of deploying advanced hardware asset management platforms. Integration with legacy systems, customization needs, and infrastructure upgrades contribute to substantial upfront investment. Additionally, complex IT environments require skilled personnel to manage configuration, data migration, and training. These factors can slow adoption and reduce ROI in the early stages. Vendors must address cost barriers through modular solutions, flexible pricing models, and simplified deployment frameworks.

- Data Accuracy Issues and Integration Limitations

Achieving accurate, unified asset data remains a major challenge due to inconsistent tracking practices, siloed systems, and manual data entry. Inadequate integration between hardware asset management tools and existing IT service management (ITSM), ERP, and procurement platforms leads to duplicated records and incomplete inventories. These issues undermine operational visibility and compliance. Organizations require seamless interoperability and standardized data models to maintain accurate lifecycle information. Vendors that provide robust APIs, automated discovery tools, and real-time synchronization can help overcome these limitations and strengthen.

Regional Analysis

North America

North America holds the largest share of the hardware asset management market at approximately 35–38%, driven by early technology adoption, strong IT governance frameworks, and high demand for automated asset lifecycle solutions. Enterprises across sectors such as BFSI, telecom, and healthcare invest heavily in cloud-based asset intelligence tools to meet compliance and cybersecurity requirements. The region benefits from advanced digital infrastructure, widespread IoT integration, and strong vendor presence, enabling organizations to optimize asset utilization and reduce operational risk. Growing emphasis on remote workforce management further accelerates adoption across mid- and large-scale enterprises.

Europe

Europe accounts for around 25–28% of the global market, supported by stringent regulatory requirements, growing digitalization initiatives, and the rapid expansion of asset-intensive industries. Countries such as Germany, the U.K., and France lead adoption, driven by the need for centralized tracking, audit readiness, and enhanced lifecycle governance. The region’s focus on data protection, sustainability reporting, and IT standardization boosts the demand for automated asset inventory systems. Increasing investments in Industry 4.0, IoT-enabled operations, and cloud transformation continue to strengthen market penetration across manufacturing, automotive, and public sector organizations.

Asia-Pacific

Asia-Pacific represents approximately 22–25% of the market and stands as the fastest-growing region, propelled by rapid industrialization, expanding digital infrastructure, and rising technology investments across China, India, Japan, and Southeast Asia. Enterprises in manufacturing, logistics, and IT services increasingly adopt asset management solutions to enhance operational visibility and support large-scale device deployments. Government-backed digital transformation programs and the proliferation of cloud services further accelerate adoption. As regional businesses modernize their operations and embrace IoT-enabled asset ecosystems, Asia-Pacific is expected to sharply increase its global market share over the forecast period.

Latin America

Latin America captures around 6–8% of the hardware asset management market, with growth driven by increasing digital adoption, modernization of enterprise IT infrastructure, and rising demand for cost-efficient asset tracking solutions. Countries such as Brazil, Mexico, and Chile lead the market, supported by expanding telecom networks and improvements in industrial operations. Organizations focus on reducing asset-related losses and improving budget planning through automated lifecycle monitoring. Although adoption is slower due to economic constraints and limited IT modernization in some regions, growing cloud adoption and digital workforce expansion present strong long-term opportunities.

Middle East & Africa

The Middle East & Africa region holds approximately 4–6% market share, supported by digital transformation initiatives, smart city projects, and rising IT investments across the GCC nations. Organizations in energy, utilities, and government increasingly deploy hardware asset management tools to improve asset utilization and enhance operational transparency. Cloud migration and the expansion of managed service models also contribute to adoption. While some African markets face infrastructure limitations, improved connectivity and enterprise modernization efforts are gradually driving interest. The region’s growing focus on cybersecurity and regulatory compliance will further strengthen market uptake.

Market Segmentations:

By Component:

By Solution Type:

- Transportation Management System

- Warehouse Management System

By Deployment Mode:

- On-premise

- On-Demand/Cloud-Based

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the hardware asset management market features a strong mix of global technology leaders and specialized solution providers, including Bentley Systems, Incorporated; Oracle; ABB; AssetWorks, Inc.; SAP SE; Hexagon AB; General Electric Company; Hitachi, Ltd.; Honeywell International Inc.; and International Business Machines Corporation. the hardware asset management market remains highly dynamic, shaped by rapid technological innovation, increasing digital transformation, and expanding enterprise demand for automated asset lifecycle solutions. Vendors compete by enhancing platform capabilities through AI-driven analytics, IoT integration, and cloud-native architectures that provide real-time visibility, predictive maintenance, and improved compliance tracking. The market also benefits from rising adoption of remote workforce support tools and scalable asset intelligence systems tailored for complex, multi-site operations. Companies strengthen their market presence through strategic partnerships, product enhancements, and industry-specific solutions, creating an environment of continuous innovation and intensifying competition across global industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bentley Systems, Incorporated

- Oracle

- ABB

- AssetWorks, Inc.

- SAP SE

- Hexagon AB

- General Electric Company

- Hitachi, Ltd.

- Honeywell International Inc.

- International Business Machines Corporation

Recent Developments

- In June 2024, International Business Machines Corporation and Telefónica Tech, a digital transformation company, announced a new collaboration agreement to advance the deployment of analytics, AI, and data governance solutions, addressing the constantly evolving needs of enterprises.

- In April 2024, Rockwell Automation, Inc. announced plans to showcase its collaboration with Ericsson through a demonstration of Plex Asset Performance Management (APM) at the Hannover Messe 2024 trade fair. The system, powered by industrial private 5G connectivity, facilitates real-time decision-making and the management of emerging assets, such as Autonomous Mobile Robots (AMRs).

- In March 2024, Cloudera, Inc. unveiled enhancements to its open data lakehouse on the private cloud, aimed at transforming on-premises data capabilities for scalable analytics and AI with enhanced trust. The latest updates would make Cloudera, Inc.

- In March 2024, Adobe Inc. launched a new set of suites aimed at the enterprise sector, enabling brands to achieve individualized personalization on a large scale by leveraging generative AI and instantaneous insights.

Report Coverage

The research report offers an in-depth analysis based on Component, Solution Type, Deployment Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly adopt AI-driven automation to enhance predictive maintenance and lifecycle optimization.

- Cloud-based asset management platforms will continue to gain dominance due to scalability and lower infrastructure dependency.

- IoT-enabled asset ecosystems will expand, improving real-time tracking and operational visibility across industries.

- Integration with IT service management and ERP systems will strengthen to support unified asset governance.

- Remote and hybrid workforce growth will drive demand for centralized, remotely accessible asset management tools.

- Cybersecurity-focused asset monitoring will become a critical priority for regulated industries.

- Digital twins will be used more widely to simulate asset performance and optimize replacement cycles.

- Industry 4.0 adoption will accelerate investment in automated hardware monitoring across manufacturing and logistics.

- Vendors will focus on modular and customizable platforms to support diverse enterprise requirements.

- Emerging markets will witness rising adoption as digital infrastructure and cloud readiness continue to improve.