Market Overview:

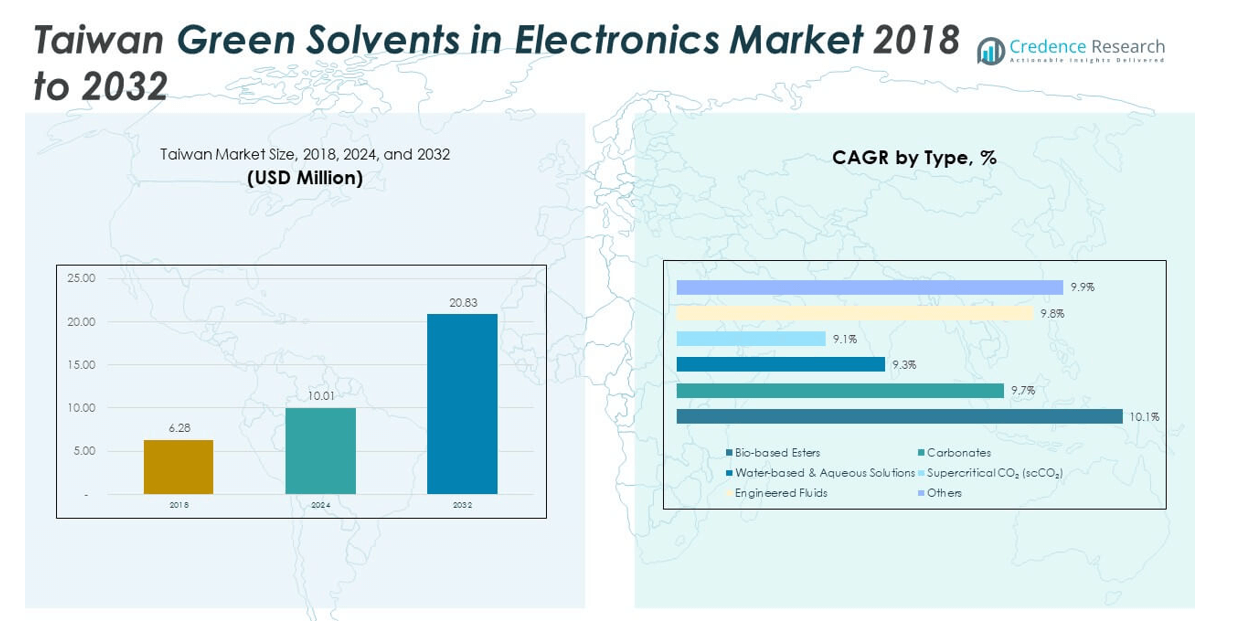

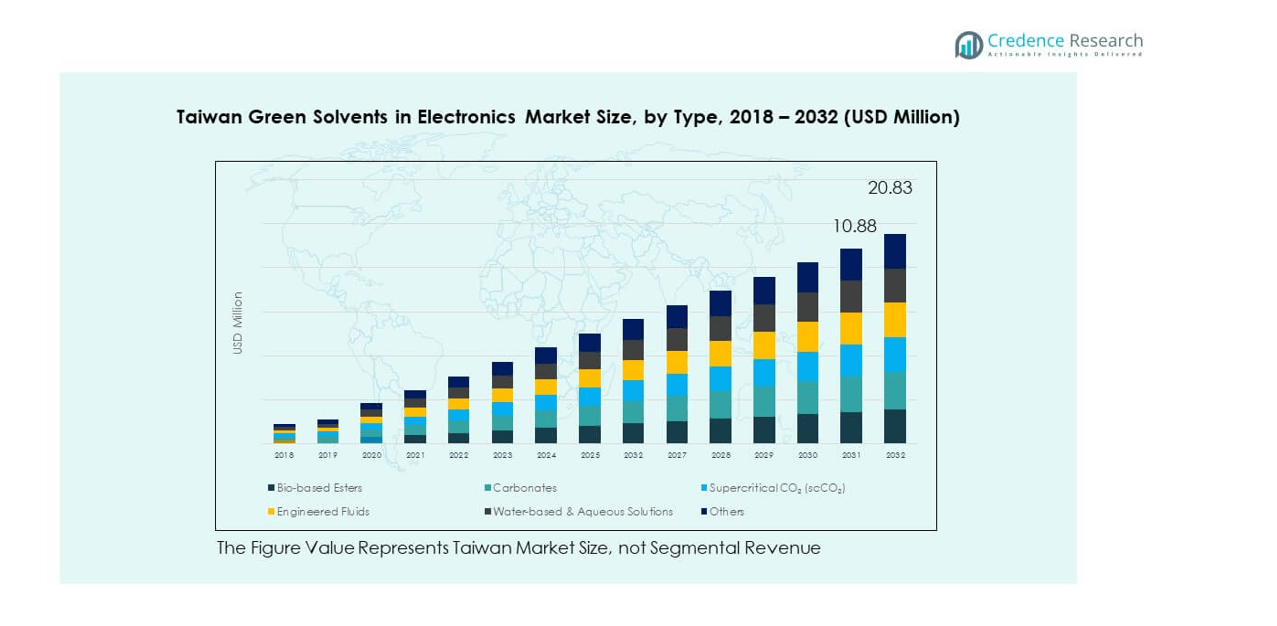

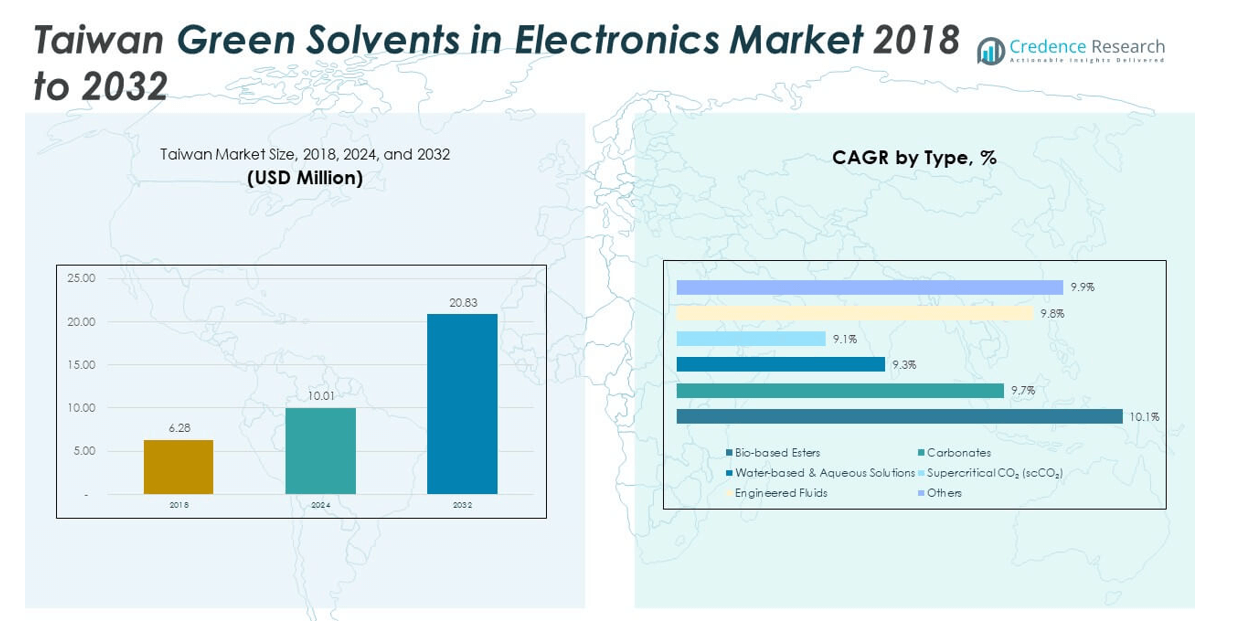

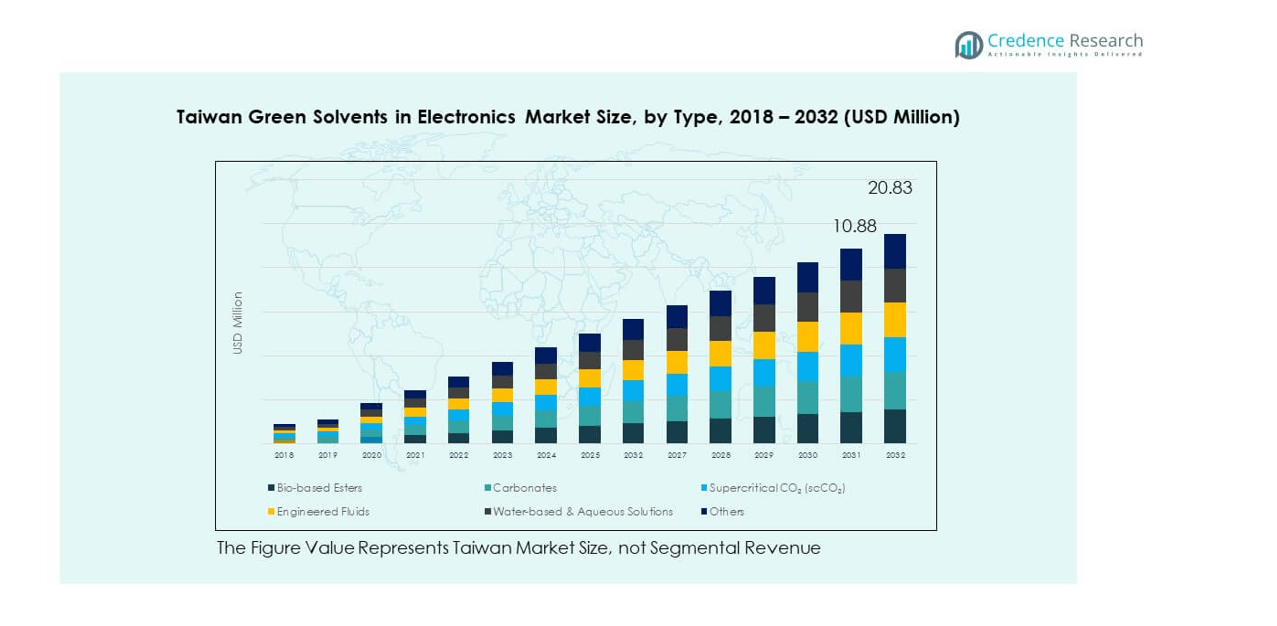

The Taiwan Green Solvents in Electronics Market size was valued at USD 6.28 million in 2018 to USD 10.01 million in 2024 and is anticipated to reach USD 20.83 million by 2032, at a CAGR of 3.80% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Taiwan Green Solvents in Electronics Market Size 2024 |

USD 10.01 million |

| Taiwan Green Solvents in Electronics Market, CAGR |

3.80% |

| Taiwan Green Solvents in Electronics Market Size 2032 |

USD 20.83 million |

Growing environmental regulations and rising awareness of sustainable practices are key drivers of this market. Electronics manufacturers are adopting green solvents to reduce hazardous emissions and comply with strict environmental standards. The shift toward eco-friendly materials is also driven by consumer demand for sustainable electronics. Green solvents offer better safety, recyclability, and lower toxicity compared to traditional chemicals, making them suitable for printed circuit boards, semiconductors, and display panels. Increasing R&D efforts to enhance solvent performance further accelerate adoption in the electronics sector.

Regionally, Taiwan leads as a manufacturing hub in Asia due to its strong semiconductor and electronics base. Neighboring countries such as China and South Korea are also emerging, driven by large-scale production facilities and government support for sustainable practices. Meanwhile, markets in Southeast Asia are gaining traction as demand for eco-friendly solutions rises. Taiwan maintains its lead through innovation, established supply chains, and compliance with international sustainability benchmarks.

Market Insights:

- The Taiwan Green Solvents in Electronics Market was valued at USD 6.28 million in 2018, reached USD 10.01 million in 2024, and is projected to hit USD 20.83 million by 2032, expanding at a CAGR of 3.80%.

- Northern Taiwan held 42% share in 2024, driven by its semiconductor hub; Central Taiwan captured 33%, supported by display and PCB clusters; and Southern Taiwan accounted for 25%, backed by battery and specialty cleaning applications.

- Southern Taiwan is expected to grow fastest, holding 25% share, due to rising investments in energy storage and advanced cleaning services.

- Among type segments, bio-based esters led with around 30% share in 2024, driven by strong adoption in semiconductors and displays.

- Carbonates represented nearly 25% share in 2024, supported by battery production and energy storage demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Regulatory Pressure For Environmentally Safe Electronics Production:

The Taiwan Green Solvents in Electronics Market is strongly influenced by regulatory standards driving sustainable practices. Government authorities are tightening rules on toxic chemicals used in manufacturing processes. Compliance requirements encourage companies to adopt green solvents to reduce emissions. The market benefits from consistent monitoring of industrial pollution levels. Firms invest in alternatives that meet safety and environmental benchmarks. This ensures competitiveness in both domestic and export markets. It enables Taiwan to align with global sustainability norms and gain investor confidence.

- For instance, Vertec BioSolvents Inc. manufactures bio-based solvents composed of ethyl lactate, soy methyl esters, d-limonene, and ethanol, with zero hazardous air pollutants and no ozone-depleting chemicals, continuously reducing toxic emissions in industry processes while maintaining solvent performance.

Increasing Consumer Awareness Of Eco-Friendly Electronics Products:

Consumers in Taiwan are showing a stronger preference for sustainable devices. The shift in awareness accelerates the demand for electronics manufactured with green solvents. Companies highlight eco-friendly production in marketing strategies to gain customer trust. Brands that adopt such practices gain an edge over traditional competitors. The use of solvents with lower toxicity reassures buyers of safer products. This consumer-driven push fuels steady adoption across applications. It allows firms to combine compliance with customer loyalty in long-term growth.

- For instance, Lotte Chemical Titan secured a three-year naphtha supply agreement with Aramco Trading Singapore for 300,000 to 400,000 tonnes annually, ensuring feedstock consistency for its petrochemical production from July 2025 to June 2028. This provides stability for the company, especially as it has faced recent financial pressures and operational challenges, including the shutdown of one of its naphtha crackers in late 2024 due to poor market conditions.

Rising Adoption Across Semiconductor And Display Manufacturing Units:

The semiconductor and display industry in Taiwan is expanding its use of green solvents. Companies employ solvents in cleaning, coating, and etching activities. Their ability to reduce harmful emissions makes them a preferred choice. The demand grows as global buyers demand greener supply chains. Taiwan’s position as a hub for electronics manufacturing strengthens adoption. Green solvents improve workplace safety while maintaining product performance. It supports sustainable production goals and protects the reputation of local industries.

Growing R&D Investment To Enhance Solvent Efficiency And Safety:

Research and development programs focus on enhancing solvent properties. Innovation in formulation leads to higher efficiency and reliability. Manufacturers design advanced solutions that meet technical requirements of electronics production. Universities and corporate labs collaborate on sustainable chemistry projects. These developments ensure continuous improvement in solvent applications. Firms secure patents to gain competitive advantage in global markets. It allows Taiwan to establish leadership in green chemistry within electronics applications.

Market Trends:

Integration Of Bio-Based And Renewable Raw Materials In Solvent Formulations:

The Taiwan Green Solvents in Electronics Market shows a clear trend toward bio-based inputs. Companies are sourcing raw materials from renewable agricultural products. This reduces dependency on petroleum-derived chemicals. Bio-based solvents appeal to both regulators and eco-conscious buyers. Such innovations highlight Taiwan’s commitment to green chemistry. Firms actively promote these formulations as safer alternatives. It sets a foundation for circular economy practices in electronics.

- For instance, Vertec BioSolvents emphasizes feedstocks such as corn, soybeans, citrus fruits, and wood by-products, sourcing renewable inputs that reduce petroleum dependence. Their patented proprietary blends demonstrate high solvent efficacy without hazardous components, reinforcing Taiwan’s green chemistry leadership and circular economy ambitions by integrating measurable biodegradability and renewable carbon cycles.

Rising Adoption Of Green Solvents In Precision Cleaning Applications:

Manufacturers are shifting to green solvents for precision cleaning of delicate components. Their low toxicity and high efficiency improve process outcomes. Semiconductor fabs prefer these solvents for advanced wafer fabrication steps. Use in printed circuit boards ensures better worker safety. Companies report enhanced performance in fine cleaning tasks. Growing miniaturization of devices increases demand for precision solutions. It accelerates the replacement of traditional solvents across operations.

Expansion Of Partnerships Between Chemical Firms And Electronics Producers:

Electronics producers in Taiwan partner with chemical firms for solvent innovation. These collaborations enable rapid commercialization of green solutions. Joint ventures focus on tailored formulations for specialized processes. Chemical suppliers co-develop solutions with device makers for large-scale use. Partnerships reduce cost of innovation while sharing technical expertise. This creates a stronger ecosystem for sustainable manufacturing. It also ensures Taiwan’s supply chains remain resilient and forward-looking.

Adoption Of Circular Economy Models To Reuse And Recycle Solvents:

Firms in Taiwan adopt closed-loop systems for solvent recycling. Recycling technologies minimize waste and operational costs. Solvent recovery systems support compliance with environmental standards. These initiatives align with global sustainability expectations. Industries benefit from lower costs and improved resource management. Recycling also reduces pressure on imports of chemical raw materials. It positions Taiwan as a regional leader in circular green manufacturing.

Market Challenges Analysis:

High Production Cost And Technical Barriers To Large-Scale Adoption:

The Taiwan Green Solvents in Electronics Market faces cost-related challenges. Producing eco-friendly solvents often requires expensive raw materials and advanced processing. Small and mid-sized firms struggle with capital investments for adoption. Technical barriers exist in scaling solvent use without impacting performance. Manufacturers often face resistance when replacing well-established conventional chemicals. This slows the pace of widespread adoption. It requires government incentives or subsidies to ease transition costs.

Limited Awareness And Slow Transition In Traditional Electronics Units:

Electronics firms rooted in conventional practices often resist adopting green solvents. Lack of awareness of long-term benefits hampers their adoption rate. Traditional units remain cautious about investing in new production processes. In many cases, firms prioritize immediate cost savings over sustainability. This creates an uneven pace of transition within the industry. It limits overall market penetration in early growth phases. Overcoming this requires training programs, awareness campaigns, and long-term cost analysis.

Market Opportunities:

Expansion Of Sustainable Electronics Exports Into Global Markets:

The Taiwan Green Solvents in Electronics Market benefits from opportunities in exports. Global buyers are demanding eco-certified electronics with lower environmental impact. Taiwanese firms can capitalize by aligning products with green solvent-based production. This enables stronger presence in markets with strict environmental regulations. It supports brand reputation and opens new trade opportunities. Export growth strengthens Taiwan’s role as a responsible electronics hub. It positions local firms for global leadership in sustainable electronics.

Growing Investment In Green Manufacturing Facilities Across Taiwan:

Investors show interest in funding green electronics manufacturing units. Facilities designed with eco-friendly solvents gain priority in long-term planning. Government support adds momentum through favorable policies. Expansion of green manufacturing parks boosts adoption rates. These facilities attract global clients seeking sustainable supply chains. It helps establish Taiwan as a regional hub for advanced eco-friendly electronics. It ensures long-term competitiveness in a highly regulated global environment.

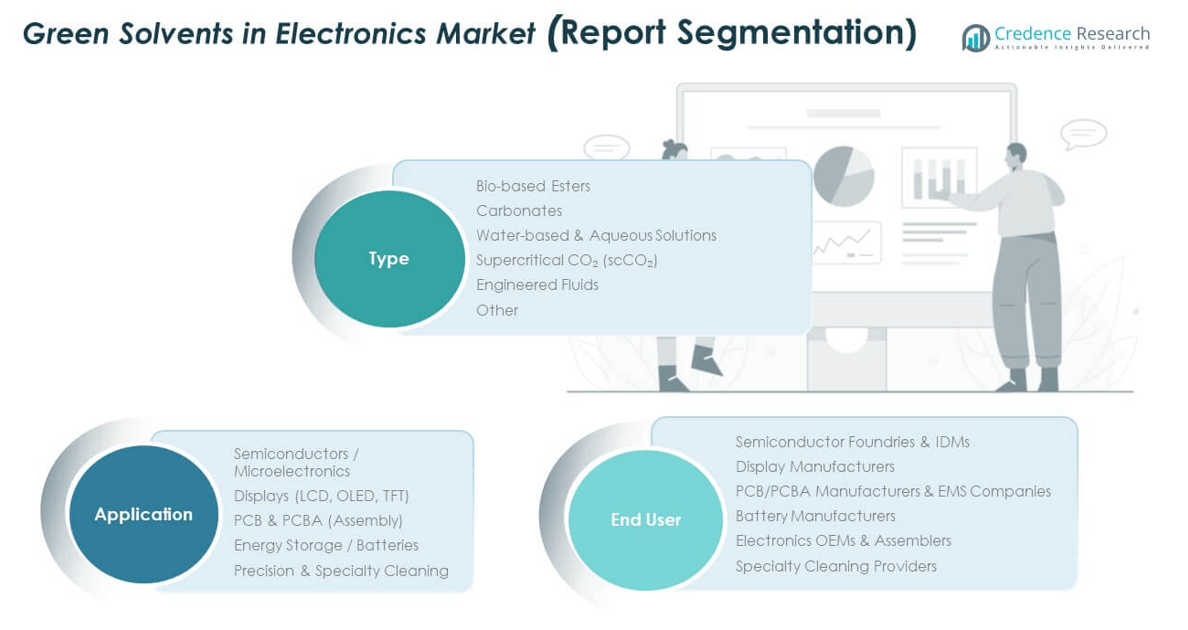

Market Segmentation Analysis:

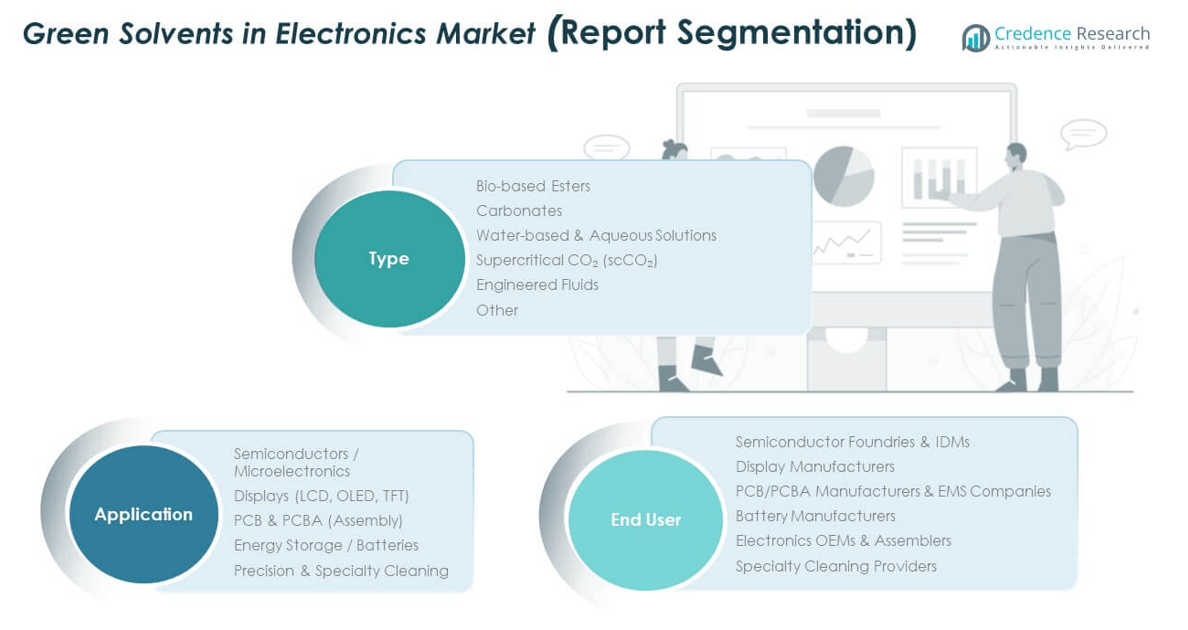

By Type

The Taiwan Green Solvents in Electronics Market is segmented into bio-based esters, carbonates, water-based and aqueous solutions, supercritical CO₂, engineered fluids, and others. Bio-based esters are gaining strong adoption due to their biodegradability and safer handling properties. Carbonates are valued for use in battery applications, supporting energy storage demand. Water-based solutions are popular in cleaning processes where safety and cost efficiency are critical. Supercritical CO₂ shows potential in precision cleaning and niche semiconductor use. Engineered fluids serve high-performance applications requiring thermal stability.

- For instance, bio-based esters like those produced by Vertec BioSolvents deliver biodegradability and safer handling, substituting petrochemical solvents in industries demanding high environmental standards. Lotte Chemical’s secured naphtha volumes support carbonate solvent applications, critical for battery-related energy storage technologies.

By Application

Applications span semiconductors, displays, PCB & PCBA, energy storage, and precision cleaning. Semiconductors and microelectronics dominate due to Taiwan’s established position as a global manufacturing hub. Display production, including LCD, OLED, and TFT, presents strong opportunities with sustainability goals in panel manufacturing. PCB and PCBA use solvents for assembly and coating. Batteries represent a fast-growing segment due to rising electric mobility and energy storage demand. Precision and specialty cleaning highlight niche but expanding uses.

- For instance, Corbion’s investments into bio-solvents tailored to semiconductor cleaning and coating contribute to sustainability goals in display and PCB manufacturing. Meanwhile, growing electric mobility pressures battery solvent demand where Lotte Chemical supports feedstock supply, ensuring scalable green solvent availability for emerging tech.

By End User

End users include semiconductor foundries, display manufacturers, PCB/PCBA companies, battery producers, electronics OEMs, and cleaning providers. Semiconductor foundries and IDMs lead demand, supported by the country’s role in global chip production. Display manufacturers increasingly adopt green solvents to align with eco-certification requirements. PCB and EMS companies integrate them into production for compliance and efficiency. Battery manufacturers favor carbonate solvents for cell fabrication. Electronics OEMs and assemblers adopt solvents to strengthen sustainability credentials. Specialty cleaning providers use them to enhance process safety and reduce emissions.

Segmentation:

By Type

- Bio-based Esters

- Carbonates

- Water-based & Aqueous Solutions

- Supercritical CO₂ (scCO₂)

- Engineered Fluids

- Others

By Application

- Semiconductors / Microelectronics

- Displays (LCD, OLED, TFT)

- PCB & PCBA (Assembly)

- Energy Storage / Batteries

- Precision & Specialty Cleaning

By End User

- Semiconductor Foundries & IDMs

- Display Manufacturers

- PCB/PCBA Manufacturers & EMS Companies

- Battery Manufacturers

- Electronics OEMs & Assemblers

- Specialty Cleaning Providers

By Geography

- Taiwan (domestic focus, with trade & export emphasis)

- Imports by region

- Exports by region

Regional Analysis:

Northern Taiwan Driving Demand Through Semiconductor Hubs

Northern Taiwan holds the largest share of the Taiwan Green Solvents in Electronics Market at nearly 42% in 2024. This region is home to major semiconductor foundries and integrated device manufacturers, making it the backbone of electronics production. Green solvents are widely used in wafer fabrication, precision cleaning, and microelectronics assembly. Strong infrastructure, advanced R&D centers, and access to skilled labor reinforce its leadership. It benefits from strong government support for sustainable semiconductor manufacturing. The concentration of leading technology parks further sustains adoption in this area.

Central Taiwan Strengthening With Display And PCB Manufacturing

Central Taiwan accounted for about 33% of the market share in 2024. The region is recognized for its robust display production, including LCD and OLED panels, and growing PCB and PCBA manufacturing clusters. Green solvents are adopted to meet global supply chain sustainability standards and enhance worker safety. Firms in this region integrate bio-based esters and water-based solutions to improve efficiency in assembly and coating. It plays a crucial role in linking upstream chemical suppliers with downstream electronics manufacturers. Expanding demand from international buyers further supports its importance.

Southern Taiwan Emerging With Battery And Specialty Applications

Southern Taiwan represented close to 25% of the market in 2024, driven by battery production and specialty cleaning services. The rise of electric vehicles and energy storage solutions boosts carbonate solvent adoption in this region. Manufacturers also focus on advanced cleaning processes for high-value electronics components. Industrial zones in the south provide cost advantages for setting up green chemical facilities. It continues to attract investment from domestic and foreign players looking to scale production. The region is expected to expand steadily as battery and energy storage applications gain traction.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- CT Chem

- Vertec BioSolvents Inc.

- Godavari Biorefineries Ltd.

- Galactic

- Kindun Chemical Co.

- Lotte Chemical

- Corbion N.V.

- Green Chemical Inc.

- Merck KGaA

- BASF SE

- Dow Inc.

- SK Chemicals

- Other Key Players

Competitive Analysis:

The Taiwan Green Solvents in Electronics Market is moderately consolidated, with a mix of international and domestic players competing across niche applications. Global leaders such as BASF SE, Merck KGaA, Dow Inc., and SK Chemicals maintain a strong presence by offering diverse solvent portfolios and investing in R&D. Local firms like CT Chem and Kindun Chemical Co. focus on supplying tailored solutions to semiconductor and PCB manufacturers. Competition is shaped by technological innovation, sustainability credentials, and alignment with regulatory standards. Companies prioritize partnerships with electronics producers to secure long-term contracts. It is witnessing continuous innovation in bio-based esters and carbonate formulations to meet the demands of semiconductor and display industries.

Recent Developments:

- In August 2025, Corbion N.V. entered into a partnership with BRAIN Biotech AG to innovate nature-based ingredient technologies. This collaboration focuses on developing novel biobased antimicrobial compounds, advancing bio-solvent technologies that align with sustainability in the electronics and related markets.

- In June 2025, Lotte Chemical Titan (Malaysia) signed a significant three-year naphtha purchase agreement with Saudi Aramco Trading Singapore, strengthening its feedstock supply chain. This deal ensures a consistent supply of 300,000 to 400,000 tonnes of naphtha annually through June 2028, supporting Lotte Chemical’s operations and sustainability efforts in chemical production relevant to solvent applications.

- Godavari Biorefineries Ltd. announced in December 2024 an investment in a new corn/grain-based distillery aiming to enhance ethanol production. This move supports their commitment to bio-based chemicals and green solvents, promoting sustainable industrial chemical manufacturing.

Report Coverage:

The research report offers an in-depth analysis based on type, application, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for bio-based solvents will rise due to increasing focus on eco-friendly electronics.

- Semiconductor foundries will remain the dominant end-user segment supported by large-scale production.

- Display manufacturers will adopt green solvents to meet global certification requirements.

- PCB and PCBA manufacturers will integrate water-based solutions to enhance safety.

- Battery producers will expand carbonate solvent usage to support energy storage growth.

- Northern Taiwan will sustain leadership as the hub for semiconductor-driven demand.

- Central Taiwan will strengthen with display and PCB manufacturing clusters.

- Southern Taiwan will expand faster with growth in batteries and specialty cleaning.

- Partnerships between chemical firms and electronics producers will accelerate product innovation.

- R&D investments will ensure improved solvent efficiency and performance across applications.