| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Target Drone MarketSize 2024 |

USD 5,315.22 Million |

| Target Drone Market, CAGR |

7.91% |

| Target Drone Market Size 2032 |

USD 10,202.72 Million |

Market Overview:

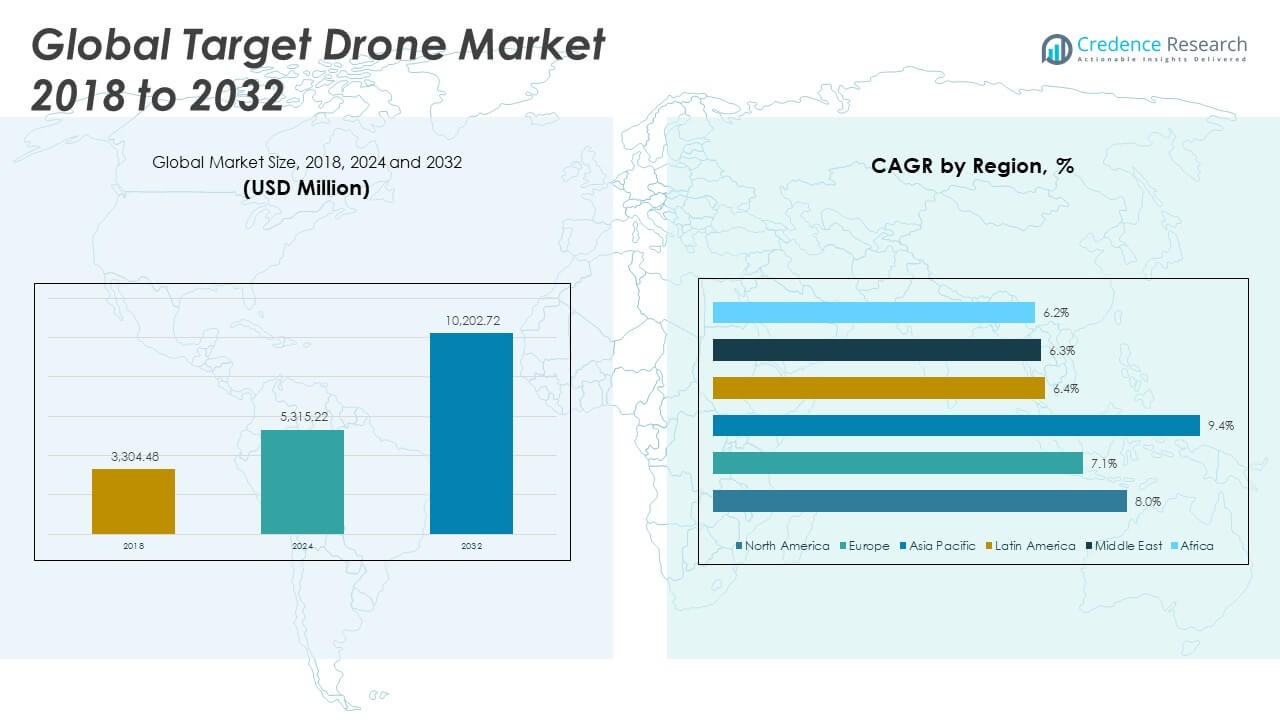

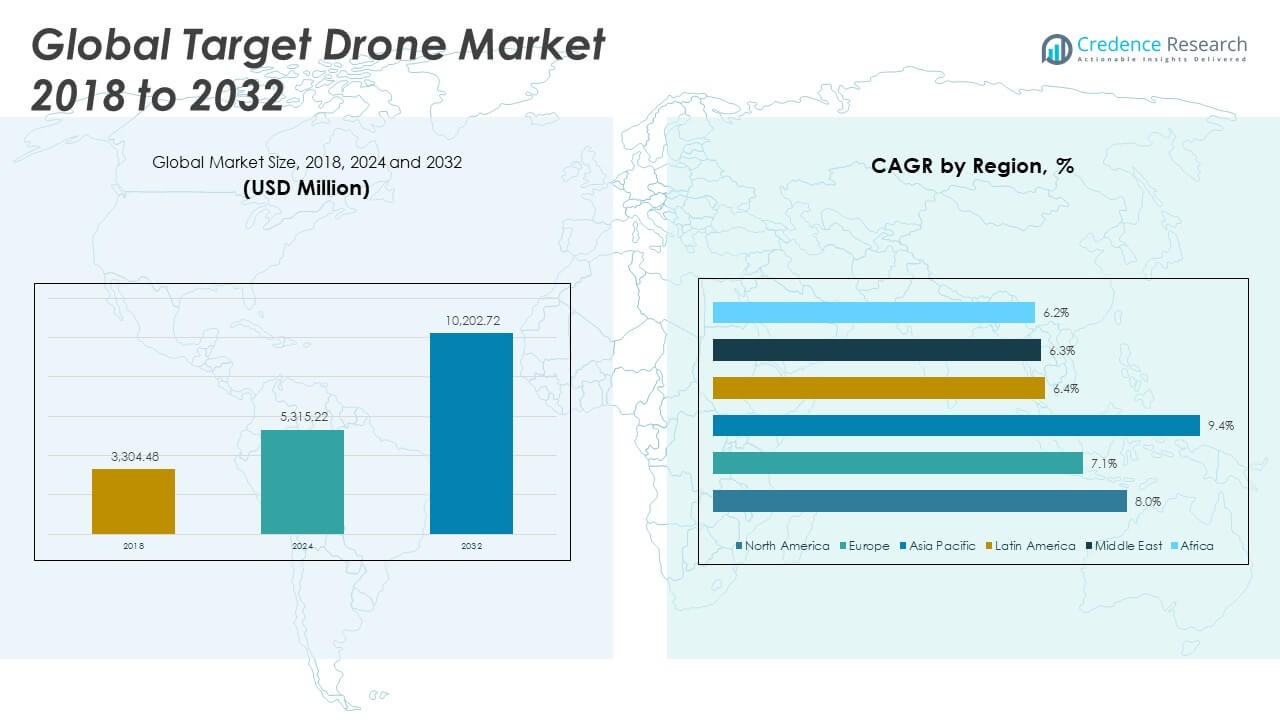

The Global Target Drone Market size was valued at USD 3,304.48 million in 2018 to USD 5,315.22 million in 2024 and is anticipated to reach USD 10,202.72 million by 2032, at a CAGR of 7.91% during the forecast period.

Several key factors are propelling the expansion of the target drone market. Foremost is the heightened emphasis on realistic combat training, necessitating sophisticated simulation tools to prepare armed forces for evolving threats. Target drones serve as essential assets in replicating enemy aircraft and missile threats, enabling comprehensive training and system evaluations. Technological advancements, particularly in autonomous operations and artificial intelligence integration, have enhanced the capabilities of target drones, allowing for more complex and varied training scenarios. Additionally, the versatility of target drones extends beyond military applications, finding roles in homeland security, border surveillance, and disaster response, further broadening their market appeal. The integration of modular payload systems has also enabled customizable mission profiles, expanding their utility across multiple operational environments.

Regionally, North America holds a significant share of the target drone market, attributed to substantial defense expenditures and the presence of leading drone manufacturers. Europe is also witnessing notable growth, driven by collaborative defense initiatives and increased investments in military modernization. Countries like Germany and France are investing in advanced drone technologies to enhance their defense capabilities. In the Asia-Pacific region, rapid economic development and rising security concerns are fueling demand for target drones. Nations such as China and India are expanding their defense budgets, focusing on indigenous drone development to strengthen their military training programs. Regional collaborations and defense exercises are further accelerating the deployment of target drone systems in emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Target Drone Market is projected to grow from USD 5,315.22 million in 2024 to USD 10,202.72 million by 2032, registering a CAGR of 7.91%, driven by rising demand for realistic combat simulations.

- Defense forces worldwide are prioritizing advanced training tools like target drones to enhance operational readiness and reduce risks linked to live training with manned platforms.

- Technological innovation especially in AI, autonomy, and modular payload integration—is significantly improving drone performance and enabling adaptive mission profiles.

- Rising global defense budgets are supporting large-scale procurement of target drones as part of modernization initiatives across land, air, and naval forces.

- Diversification into non-military applications such as homeland security, border surveillance, and disaster simulation is expanding the market’s reach.

- Challenges such as high development costs and complex maintenance needs continue to limit adoption in low-budget regions with underdeveloped defense infrastructure.

- North America holds a leading market share, followed by Europe and Asia Pacific, where growing defense spending and indigenous drone programs are accelerating regional deployment.

Market Drivers:

Emphasis on Realistic Combat Simulation Fuels Market Expansion

Rising demand for enhanced combat training environments is a primary driver of the Global Target Drone Market. Armed forces worldwide increasingly rely on target drones to simulate realistic aerial threats, supporting efficient and safe live-fire exercises. These drones replicate enemy aircraft and missile behavior, enabling personnel to engage in high-fidelity training scenarios. It allows military units to test weapon systems, evaluate response strategies, and sharpen operational readiness. Target drones also contribute to reducing costs associated with manned training exercises and help preserve high-value assets. Their adaptability across multiple training formats strengthens their appeal to defense ministries.

Technological Advancements Enable Superior Performance

Innovations in autonomous systems, artificial intelligence, and data processing are significantly improving the performance of target drones. Enhanced navigation capabilities, real-time telemetry, and programmable flight paths allow drones to mimic complex threat behaviors. Integration of AI facilitates dynamic decision-making, improving realism in simulated combat situations. These advancements contribute to better evaluation of air defense systems and tracking technologies under operational stress. The Global Target Drone Market benefits from continuous R&D investments aimed at improving durability, versatility, and ease of deployment. It supports the evolution of next-generation drones that meet diverse tactical and strategic requirements.

For example, QinetiQ’s Banshee Jet 80+ drone, deployed in 2024, features enhanced navigation capabilities and real-time telemetry, allowing it to mimic complex threat behaviors such as evasive maneuvers and multi-axis flight paths.

Expansion of Defense Budgets Strengthens Procurement

Rising global defense spending continues to support demand for modern training tools such as target drones. Governments are allocating larger portions of military budgets to simulation-based preparedness and advanced system testing. Procurement of target drones aligns with modernization programs across air, naval, and land forces. Nations are prioritizing drone integration into defense strategies to maintain technological superiority and combat readiness. It also reflects a broader shift toward unmanned systems in national defense planning. This sustained funding stream creates favorable conditions for manufacturers to develop and deliver increasingly sophisticated target drone platforms.

For instance, the Indian Ministry of Defence announced the acquisition of 200 new target drones for integration into its training regimens, reflecting a broader shift toward unmanned systems in national defense planning.

Diversification of Applications Broadens Market Base

The use of target drones has expanded beyond traditional military applications, contributing to market growth. Homeland security agencies employ these systems for surveillance, border monitoring, and threat assessment training. Emergency response teams also use drones to simulate high-risk environments for preparedness drills. The Global Target Drone Market benefits from this cross-sector adoption, which enhances product relevance and accelerates innovation. It demonstrates how drones serve as force multipliers across civil and military domains. This growing versatility underscores their strategic value in addressing evolving global security challenges.

Market Trends:

Rising Integration of Artificial Intelligence Enhances Drone Capabilities

Artificial intelligence is emerging as a transformative trend within the Global Target Drone Market. AI enables drones to simulate unpredictable threat behavior, enhancing the realism of combat training exercises. This technology allows for autonomous route adjustments, adaptive flight patterns, and real-time data analysis during training missions. AI-driven drones help military personnel test and calibrate response systems more effectively. It supports the development of smart training platforms that replicate advanced enemy tactics. AI integration also reduces the need for constant human oversight, improving operational efficiency and safety.

Demand for High-Speed and Stealth Capable Drones Increases

Military training protocols increasingly require target drones with high-speed maneuverability and low observability. These drones mimic next-generation aerial threats, including supersonic and stealth aircraft. Manufacturers are responding with designs that feature radar-evading shapes, heat-resistant materials, and afterburner-equipped propulsion systems. This shift reflects the need to prepare armed forces for emerging airspace threats. The Global Target Drone Market benefits from this trend by fostering innovation in aerodynamic engineering and propulsion technologies. It ensures the availability of advanced targets that challenge modern air defense systems under realistic conditions.

The Kratos XQ-58 Valkyrie, for instance, is a stealthy unmanned combat aerial vehicle designed for the U.S. Air Force that demonstrates low observability and high-speed maneuverability.

Modular Payload Configurations Gain Market Traction

Defense forces are demanding target drones with modular payload capabilities to support varied training objectives. Payload flexibility allows integration of radar reflectors, infrared sources, and scoring systems, enabling multi-dimensional evaluation of weapons and sensors. This customization streamlines logistics and extends operational utility across different mission scenarios. It reduces the need for multiple drone platforms by allowing one system to fulfill several roles. The market is witnessing strong adoption of configurable drones that adapt to changing defense needs. Manufacturers are focusing on scalable architecture that supports rapid upgrades and mission-specific enhancements.

- For example, Flyt Aerospace specializes in modular payload, long-endurance drones for U.S. government clients, enabling quick adaptation to different training scenarios.

Growing Focus on Cost-Effective and Reusable Platforms

Cost efficiency and reusability have become key considerations in procurement decisions. Defense organizations prefer target drones that can be recovered, refurbished, and redeployed without compromising training quality. This trend promotes the development of rugged, recoverable drone systems with minimal maintenance requirements. It supports longer operational life cycles and reduces long-term ownership costs. The Global Target Drone Market is aligning with this shift by offering durable platforms with modular repair options. It highlights a broader emphasis on sustainability, affordability, and operational readiness across global defense operations.

Market Challenges Analysis:

High Development and Maintenance Costs Limit Adoption

The high cost of developing and maintaining advanced target drone systems presents a significant barrier for many defense budgets. Precision engineering, integration of AI, stealth technology, and high-performance materials significantly elevate unit costs. Smaller countries and budget-constrained military organizations often face difficulties in justifying large-scale investments in target drone programs. Maintenance and repair of reusable drones also require specialized skills and infrastructure, which may not be readily available across all regions. The Global Target Drone Market faces hurdles in scaling adoption across developing nations due to these financial constraints. It restricts the market’s full potential in regions with limited technological and economic capacity.

For instance, recent U.S. import tariffs have increased the prices of high-performance drones such as the DJI Matrice 30T and the Autel Robotics EVO Max 4T.

Regulatory and Airspace Restrictions Impede Operations

Strict regulatory frameworks governing the use of unmanned aerial systems can limit the operational deployment of target drones. Airspace restrictions, safety compliance requirements, and certification procedures vary across jurisdictions and can delay procurement and deployment processes. Defense agencies must secure multiple clearances and coordinate with civil aviation authorities, complicating training schedules and increasing administrative burdens. These challenges affect the pace at which new drone technologies are integrated into existing defense programs. The Global Target Drone Market must navigate these operational complexities to ensure smooth implementation and consistent usage. It also increases the need for strong regulatory alignment and international cooperation.

Market Opportunities:

Rising defense modernization initiatives in Asia-Pacific, Latin America, and the Middle East offer significant growth opportunities for the Global Target Drone Market. Governments in these regions are investing in advanced training solutions to strengthen national security and military preparedness. Target drones support these efforts by enabling cost-efficient and effective simulation of aerial threats. It positions drone manufacturers to engage in strategic partnerships, joint ventures, and technology transfers with local defense entities. The increased focus on indigenous manufacturing and capability development amplifies the market’s regional penetration potential. These emerging markets present a strong demand base for scalable and adaptable target drone platforms.

The application of target drones in non-military sectors presents untapped potential for market expansion. Homeland security, law enforcement agencies, and disaster response teams are adopting drones for threat simulation and training exercises. The Global Target Drone Market can leverage this diversification to reduce reliance on traditional defense contracts. It enables stakeholders to align with public safety and emergency management initiatives. This broader scope also fosters product innovation tailored to varied operational requirements. It supports long-term market sustainability across civilian and defense landscapes.

Market Segmentation Analysis:

By target type, the aerial segment holds the dominant position due to its critical role in simulating airborne threats for air defense training and weapon testing. Ground target drones support land-based exercises, while marine targets address naval and coastal defense requirements. The Global Target Drone Market continues to prioritize aerial systems due to their extensive use in training and system calibration programs.

By application, training leads the segment share, driven by rising demand for realistic combat simulations across armed forces. Target and decoy applications follow, supporting missile defense and engagement drills. Reconnaissance drones are gaining traction for intelligence gathering in restricted zones. The “others” category includes roles in border security and law enforcement exercises.

By operation mode, autonomous drones are preferred for their ability to execute complex missions without real-time human input. They enhance safety and efficiency in high-risk environments. Piloted drones retain relevance in scenarios requiring manual oversight or human-in-the-loop decision-making.

By end use, the military and government segment dominates, reflecting large-scale adoption for combat readiness and system testing. The commercial segment is expanding gradually, with applications in homeland security, emergency response, and public safety training. It reflects the market’s widening scope beyond conventional military use cases.

Segmentation:

By Target Segment

By Application Segment

- Training

- Target and Decoy

- Reconnaissance

- Others

By Operation Mode Segment

By End Use Segment

- Military & Government

- Commercial

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America

The North America Target Drone Market size was valued at USD 1,212.06 million in 2018 to USD 1,925.48 million in 2024 and is anticipated to reach USD 3,708.26 million by 2032, at a CAGR of 8.00% during the forecast period. North America holds the largest market share in the Global Target Drone Market, driven by substantial defense spending and the presence of leading aerospace and defense contractors. The United States leads the region with consistent investments in unmanned systems for combat simulation, missile testing, and advanced pilot training. Modernization programs across military branches support the adoption of high-speed, stealth-capable drones. It also benefits from ongoing collaborations between defense agencies and private manufacturers. The regional infrastructure supports large-scale procurement and deployment of target drones across land, sea, and air platforms.

Europe

The Europe Target Drone Market size was valued at USD 957.88 million in 2018 to USD 1,486.37 million in 2024 and is anticipated to reach USD 2,689.89 million by 2032, at a CAGR of 7.10% during the forecast period. Europe commands a significant share of the Global Target Drone Market, supported by cross-border defense programs and modernization initiatives. Countries such as Germany, France, and the UK are enhancing their training and testing capabilities through advanced drone systems. Regional efforts to strengthen missile defense and surveillance networks fuel demand. It benefits from investments in autonomous technologies and increased R&D activities. The European Union’s focus on strengthening indigenous defense production further supports long-term market expansion.

Asia Pacific

The Asia Pacific Target Drone Market size was valued at USD 751.85 million in 2018 to USD 1,295.11 million in 2024 and is anticipated to reach USD 2,768.00 million by 2032, at a CAGR of 9.40% during the forecast period. Asia Pacific is the fastest-growing region in the Global Target Drone Market, driven by rising security concerns, territorial disputes, and growing defense budgets. Countries like China, India, Japan, and South Korea are expanding their military training infrastructure and drone development programs. The region emphasizes indigenous production and procurement of cost-effective and combat-ready drone systems. It also shows increasing interest in AI-integrated and autonomous platforms. Strategic collaborations and defense drills with global allies further contribute to regional market growth.

Latin America

The Latin America Target Drone Market size was valued at USD 167.05 million in 2018 to USD 265.57 million in 2024 and is anticipated to reach USD 455.09 million by 2032, at a CAGR of 6.40% during the forecast period. Latin America holds a smaller share of the Global Target Drone Market, but it shows steady growth through modernization of military and border control operations. Brazil leads the region in drone procurement, with focus on aerial target systems for training and surveillance. Regional governments are gradually investing in cost-effective platforms to support tactical readiness. It benefits from pilot programs in homeland security and defense cooperation agreements with international partners. Infrastructure limitations and procurement costs may restrict faster adoption.

Middle East

The Middle East Target Drone Market size was valued at USD 125.39 million in 2018 to USD 188.90 million in 2024 and is anticipated to reach USD 321.78 million by 2032, at a CAGR of 6.30% during the forecast period. The Middle East plays a growing role in the Global Target Drone Market, supported by geopolitical tensions and increased investment in defense modernization. Countries such as Israel, Saudi Arabia, and the UAE are investing in cutting-edge drone technology for combat training and missile testing. Regional demand focuses on high-speed and stealth drones capable of simulating regional threats. It also benefits from local R&D initiatives and joint ventures with global defense companies. The market reflects rising interest in drone autonomy and precision targeting systems.

Africa

The Africa Target Drone Market size was valued at USD 90.25 million in 2018 to USD 153.79 million in 2024 and is anticipated to reach USD 259.69 million by 2032, at a CAGR of 6.20% during the forecast period. Africa accounts for the smallest share of the Global Target Drone Market but is gradually expanding due to increasing defense awareness. Nations such as South Africa and Egypt lead in drone adoption for training and surveillance applications. The region faces constraints due to budget limitations and infrastructure challenges. It shows potential for growth through international collaborations and donor-funded defense programs. The market is evolving with interest in affordable and rugged drone systems tailored for local operating conditions.

Key Player Analysis:

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- The Boeing Company

- Airbus SE

- BAE Systems plc

- Kratos Defense & Security Solutions, Inc.

- QinetiQ Group plc

- Griffon Aerospace

- Leonardo S.p.A.

- Safran Electronics & Defense

- Canon Medical Systems Corporation

Competitive Analysis:

The Global Target Drone Market features a competitive landscape dominated by established defense contractors and specialized aerospace firms. Key players such as Lockheed Martin Corporation, Northrop Grumman Corporation, and The Boeing Company lead through technological innovation, advanced drone systems, and global defense contracts. Companies like Kratos Defense & Security Solutions, QinetiQ Group plc, and Griffon Aerospace focus on cost-effective and versatile platforms tailored to evolving military needs. The market also includes Airbus SE, BAE Systems plc, and Leonardo S.p.A., which expand their presence through integrated solutions and strategic partnerships. It continues to attract investments in R&D, with firms advancing autonomous capabilities, AI integration, and modular payload designs. Competitive differentiation relies on performance, customization, and operational cost efficiency. The Global Target Drone Market remains dynamic, with manufacturers competing for defense modernization programs and multinational procurement initiatives. Companies are strengthening regional supply chains and enhancing aftersales support to secure long-term contracts and sustain market leadership.

Recent Developments:

- In April 2025, The Boeing Company announced a definitive agreement to sell portions of its Digital Aviation Solutions business including Jeppesen, ForeFlight, AerData, and OzRunways to Thoma Bravo, a leading software investment firm, for $10.55 billion. This transaction, expected to close by the end of 2025, is part of Boeing’s strategy to focus on its core businesses and strengthen its financial position.

- In March 2024, Kratos Defense & Security Solutions, Inc. secured a $57.7 million contract modification from the U.S. Navy to produce 70 BQM-177A surface-launched aerial targets. These high-performance drones are designed to simulate anti-ship missiles, marking the full-rate production of Lot 5 and reinforcing Kratos’ leadership in providing realistic threat simulations for military training and weapons testing.

- In 2024, Northrop Grumman Corporation successfully launched three Medium-Range Ballistic Missile (MRBM) targets for the Aegis Weapon System test. This achievement demonstrates Northrop Grumman’s capabilities in delivering advanced threat-representative targets for defense system evaluation and training.

- In June 2023, Woot Tech Aerospace LLC, a US-based aerospace company, entered into a strategic partnership with Anqa Aerospace, a Saudi Arabia-based aerospace and defense firm, to jointly produce the Firefly series of reconfigurable propeller-driven aerial target drones. This collaboration enables the companies to leverage their combined expertise to develop drones that can be rapidly converted between all-electric eVTOL, piston engine hVTOL, and conventional takeoff CTOL configurations.

Market Concentration & Characteristics:

The Global Target Drone Market exhibits moderate to high market concentration, with a few large defense firms holding significant share due to their technological capabilities, production scale, and defense contracts. It is characterized by high entry barriers, including stringent regulatory requirements, capital-intensive R&D, and the need for specialized manufacturing infrastructure. The market favors companies with proven track records in defense systems integration and aerospace engineering. Product differentiation is driven by drone speed, autonomy, reusability, and simulation accuracy. It also demonstrates a strong focus on innovation, with players continually enhancing AI capabilities, modular payloads, and stealth features. Demand remains contract-driven, with military procurement cycles and strategic alliances influencing competitive positioning. The Global Target Drone Market maintains long development timelines and certification protocols, reinforcing the dominance of established vendors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Target, Application, Operation Mode and End Use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing defense modernization programs will continue to drive demand for advanced target drone systems.

- Adoption of AI and autonomous technologies will enhance drone performance and simulation realism.

- Governments will expand procurement of reusable and cost-efficient drones to optimize training budgets.

- Cross-border defense collaborations are expected to support regional market growth and technology exchange.

- Commercial use cases in homeland security and emergency response will broaden the market scope.

- Manufacturers will focus on modular designs to meet varied mission requirements and reduce logistics complexity.

- Emerging economies will invest in indigenous drone development to strengthen defense independence.

- Regulatory harmonization will play a key role in easing deployment and standardizing performance benchmarks.

- Increased cybersecurity integration will safeguard drone operations against digital threats.

- Long-term contracts and maintenance support services will become critical for sustaining competitive advantage.