| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Textile Finishing Chemicals Market Size 2024 |

USD 8,164.8 million |

| Textile Finishing Chemicals Market, CAGR |

5.43% |

| Textile Finishing Chemicals Market Size 2032 |

USD 12,437.1 million |

Market Overview

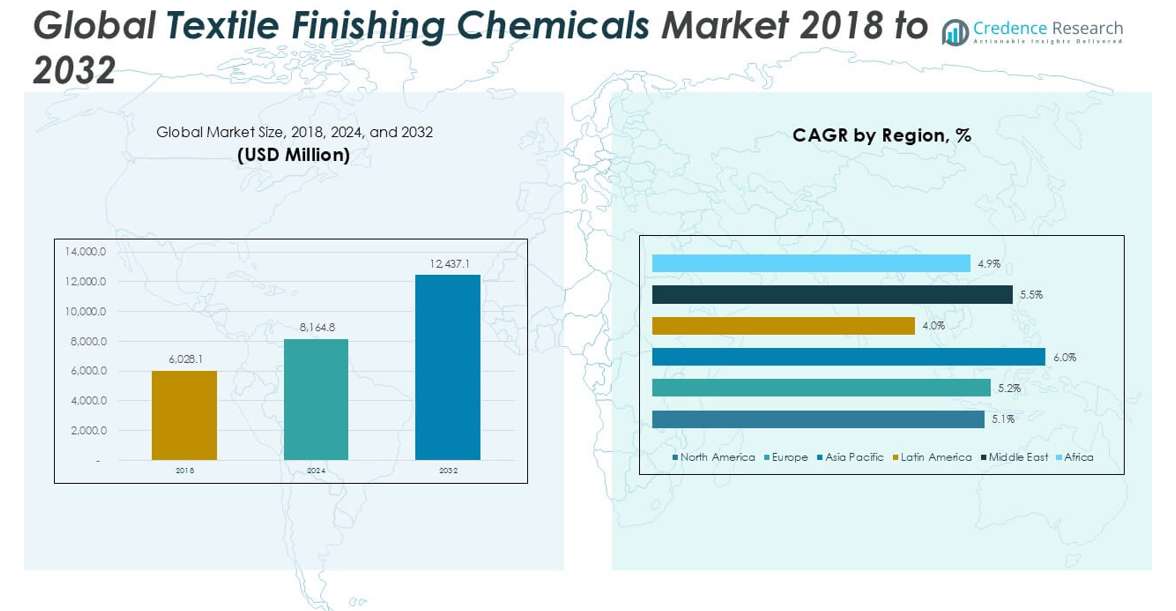

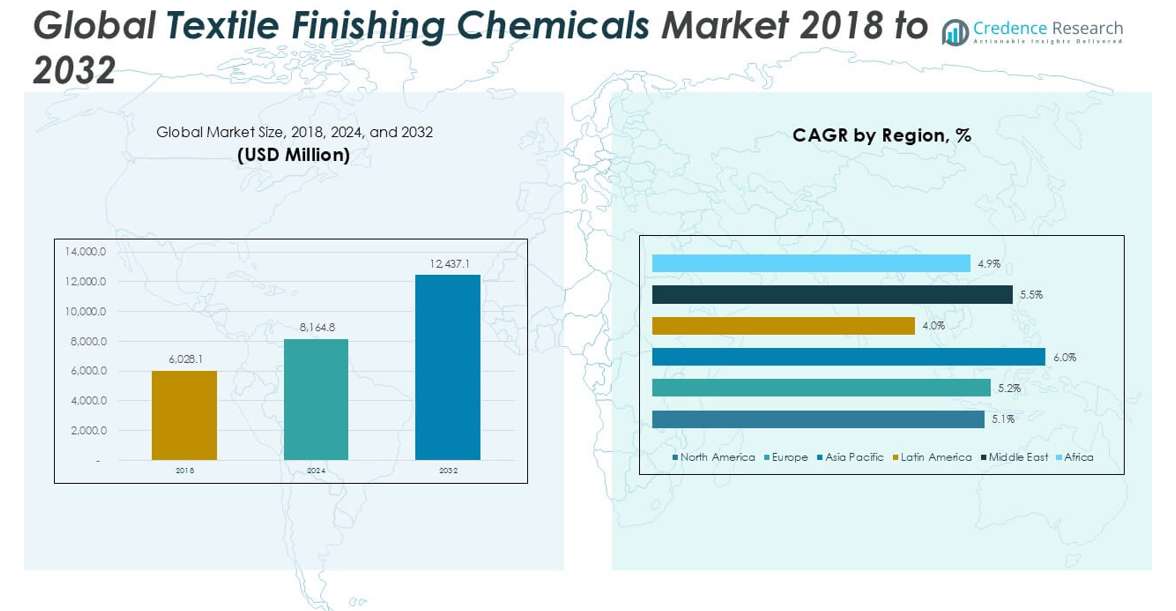

The Global Textile Finishing Chemicals Market is projected to grow from USD 8,164.8 million in 2024 to an estimated USD 12,437.1 million by 2032, with a compound annual growth rate (CAGR) of 5.43% from 2025 to 2032.

Growing awareness of textile quality, coupled with demand for performance-enhancing treatments, is fueling the adoption of advanced finishing chemicals. Trends such as functional clothing, sustainable textile processing, and technical textiles for automotive, healthcare, and sportswear sectors are driving market expansion. In addition, the industry is witnessing increased investment in eco-friendly and bio-based chemicals, encouraged by stringent environmental regulations and consumer preference for sustainable products. Innovation in nanotechnology and microencapsulation is also influencing product development in textile finishing.

Geographically, the Asia-Pacific region dominates the global market due to its large textile manufacturing base, particularly in countries like China, India, and Bangladesh. North America and Europe follow, driven by demand for high-performance and sustainable textiles. Key players operating in the market include Huntsman Corporation, Archroma, Solvay, Evonik Industries, The Dow Chemical Company, Rudolf Group, and Wacker Chemie AG. These companies are focusing on R\&D and strategic collaborations to develop innovative, eco-friendly solutions and strengthen their global footprint.

Market Insights

- The market is projected to grow from USD 8,164.8 million in 2024 to USD 12,437.1 million by 2032, at a CAGR of 5.43%.

- Increasing demand for functional textiles with properties like wrinkle resistance, water repellency, and antimicrobial protection is fueling market growth.

- Rising adoption of eco-friendly and bio-based finishing chemicals due to stricter environmental regulations is transforming industry practices.

- Technological advancements such as nanotechnology and smart finishes are expanding application potential across healthcare, sportswear, and technical textiles.

- Stringent environmental regulations and high compliance costs pose significant challenges, especially for small and mid-sized manufacturers.

- Asia-Pacific holds the largest market share, led by China, India, and Bangladesh, driven by large-scale textile manufacturing and exports.

- North America and Europe follow with strong demand for sustainable and high-performance textiles, supported by advanced R\&D and strict regulatory frameworks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Functional and High-Performance Textiles

The Global Textile Finishing Chemicals Market is witnessing strong demand due to the growing preference for functional and high-performance textiles across various industries. Consumers now expect features like water repellency, wrinkle resistance, antimicrobial protection, and flame retardancy in garments and home textiles. Industries such as sportswear, healthcare, and automotive require fabrics with enhanced durability and performance. This shift in demand encourages textile manufacturers to invest in specialized finishing chemicals. The trend is more prominent in developed regions where consumers are willing to pay a premium for enhanced functionality. Manufacturers are increasingly focusing on customized chemical formulations to cater to specific end-use requirements.

- For instance, a 2023 industry survey reported that over 1.6 million metric tons of functional finishing chemicals—covering water repellents, flame retardants, and antimicrobial agents—were consumed globally in the production of high-performance textiles for sportswear, healthcare, and automotive sectors.

Increased Focus on Sustainable and Eco-Friendly Solutions

The market is experiencing a clear shift toward sustainable textile finishing chemicals due to stringent environmental regulations and consumer awareness. Regulatory bodies across Europe, North America, and parts of Asia are enforcing limits on hazardous chemicals used in textile processing. This is pushing manufacturers to develop bio-based and biodegradable alternatives that meet safety standards without compromising performance. Brands and retailers are aligning with global sustainability goals, making eco-friendly finishing chemicals a core part of their sourcing criteria. It drives innovation in non-toxic, energy-efficient, and water-saving formulations. The market benefits from growing demand for textiles that are both high-performing and environmentally responsible.

- For instance, according to a 2023 report by the European Chemicals Agency, more than 460,000 metric tons of bio-based and eco-friendly textile finishing chemicals were adopted by textile manufacturers in Europe and North America, reflecting the rapid uptake of sustainable solutions in response to regulatory and consumer pressures.

Expansion of the Global Textile and Apparel Industry

Rapid urbanization, rising disposable incomes, and evolving fashion trends continue to expand the global textile and apparel industry, positively impacting the demand for finishing chemicals. Emerging economies, especially in Asia-Pacific and Latin America, are experiencing a surge in textile production. It creates significant opportunities for finishing chemical manufacturers to serve both domestic and export markets. The shift in global supply chains and increased capacity in low-cost manufacturing countries further amplify market potential. Export-oriented textile clusters are investing in modern chemical treatments to meet international quality standards. This structural growth in textile output strengthens the foundation of the finishing chemicals market.

Technological Advancements in Chemical Formulations

Ongoing research and development in textile chemistry have led to the introduction of advanced, multifunctional finishing chemicals. These innovations offer benefits like enhanced wash durability, better fabric feel, and compatibility with digital textile printing. It helps manufacturers reduce processing time and improve production efficiency. The integration of nanotechnology and smart coatings is opening new frontiers in technical textiles. Companies are also leveraging automation and precision dispensing systems to optimize chemical usage. The market benefits from the continuous efforts to reduce resource consumption and environmental impact while enhancing product performance. This innovation-driven environment sustains long-term growth in the textile finishing chemicals sector.

Market Trends

Shift Toward Bio-Based and Non-Toxic Finishing Agents

The market is witnessing a significant shift toward bio-based and non-toxic finishing agents to meet growing environmental and safety demands. Textile manufacturers are adopting green chemistry to eliminate harmful substances like formaldehyde and heavy metals. Plant-derived softeners, water-based repellents, and biodegradable coatings are gaining traction across apparel and home textile segments. Regulatory frameworks such as REACH and ZDHC are accelerating the adoption of sustainable alternatives. The trend is supported by rising consumer demand for safer, skin-friendly, and environmentally responsible textiles. The Global Textile Finishing Chemicals Market is evolving to align with clean-label expectations and sustainability goals.

- For instance, a 2024 industry survey found that more than 1,200 textile manufacturing facilities worldwide have switched to formaldehyde-free and biodegradable finishing agents, with over 350,000 tons of plant-based softeners and water-based repellents used annually in the production of apparel and home textiles.

Increased Adoption of Smart and Responsive Finishes

Smart textile technologies are influencing the demand for finishing chemicals that respond to environmental stimuli. Treatments that react to temperature, moisture, or UV exposure are gaining popularity in sportswear, medical textiles, and military applications. Manufacturers are integrating phase-change materials, odor-neutralizing agents, and color-changing coatings into fabric finishes. It enhances user comfort, safety, and functionality while offering high market differentiation. This trend is supported by R\&D investments in functional textiles and nanotechnology. Finishing chemical suppliers are developing new formulations to enable these smart textile capabilities at commercial scale.

- For instance, industry data from 2024 shows that over 180 million garments featuring smart or responsive finishes—such as moisture-activated cooling or UV-responsive color change—were produced globally, with more than 2,500 textile manufacturers adopting these advanced finishing technologies in their product lines.

Growing Integration of Digital and Sustainable Processes

The push toward digital textile printing is driving the need for compatible finishing chemicals that maintain print integrity and durability. This shift allows for reduced water consumption and lower energy usage compared to conventional processes. Textile processors are using pre- and post-treatment chemicals tailored for digital workflows to improve color vibrancy and fabric feel. It reflects the broader industry move toward sustainable and flexible manufacturing methods. Finishing chemical producers are expanding their product lines to support this transition. The digital revolution is reshaping production practices across the textile finishing value chain.

Increased Emphasis on Circular Economy Models

Circular economy principles are becoming central to innovation in textile finishing chemicals. Brands are demanding finishes that support fiber recyclability, reuse, and end-of-life biodegradability. Chemical manufacturers are focusing on products that do not hinder fabric breakdown or recyclability in mechanical and chemical recycling systems. It aligns with global efforts to reduce textile waste and promote resource efficiency. Collaborations across the supply chain are enabling new finishing technologies that fit circular design strategies. This trend is redefining product development priorities in the textile chemical sector.

Market Challenges

Stringent Environmental Regulations and Compliance Costs

Environmental regulations continue to pose a major challenge for the Global Textile Finishing Chemicals Market. Governments across key regions are tightening restrictions on hazardous chemicals and wastewater discharge. Compliance with these norms requires substantial investment in R\&D, reformulation, and upgraded wastewater treatment facilities. Smaller manufacturers often struggle to meet these standards due to limited resources. Delays in product approval and certification further hinder time-to-market for new formulations. It increases operational costs and reduces profit margins, especially in highly regulated markets such as Europe and North America.

- For instance, in 2024, more than 2,800 textile finishing chemical manufacturers in Europe and North America reported delays of up to 14 months in product approvals due to stricter environmental compliance checks, with over 900 small and medium-sized companies citing additional annual compliance costs exceeding $250,000 for wastewater treatment upgrades and chemical reformulation, according to procurement data and government regulatory filings

Volatility in Raw Material Prices and Supply Chain Disruptions

Fluctuating raw material prices and supply chain instability affect the profitability and planning capabilities of textile chemical manufacturers. Key raw materials, including solvents, resins, and surfactants, are subject to global price swings driven by crude oil trends and geopolitical tensions. It disrupts production schedules and challenges long-term contract pricing with textile processors. The COVID-19 pandemic and recent geopolitical events have exposed vulnerabilities in global supply chains. Manufacturers face delays in raw material availability, increased freight costs, and inconsistent delivery timelines. These factors impact the overall stability and growth potential of the textile finishing chemicals sector

Market Opportunities

Expansion of Sustainable and Bio-Based Chemical Offerings

The Global Textile Finishing Chemicals Market can capitalize on growing demand for eco-safe solutions in textile processing. It encourages chemical makers to develop bio-based softeners, water-based repellents, and biodegradable coatings. Partnerships with recycling and wastewater treatment firms can accelerate deployment of green formulations. Research in biotechnology and enzymatic finishes can unlock lower-energy processes and reduce waste. Customizable formulas for brand-specific sustainability targets create new revenue streams. End-users in apparel and home textiles seek certified eco-friendly chemicals for product differentiation.

Penetration into Emerging Markets and Technical Textile Segments

Rising textile production in Asia-Pacific and Latin America offers significant growth paths. The Global Textile Finishing Chemicals Market can leverage new manufacturing hubs in countries such as Vietnam, Bangladesh, and Turkey. It can provide tailored finishing chemicals that address local fiber blends and climatic conditions. Collaborations with digital printing machine suppliers can deliver integrated chemical and equipment packages. Development of smart finishes for medical, automotive, and protective textiles can command premium pricing. Targeting technical textile segments such as geotextiles and filtration media can further diversify applications.

Market Segmentation Analysis

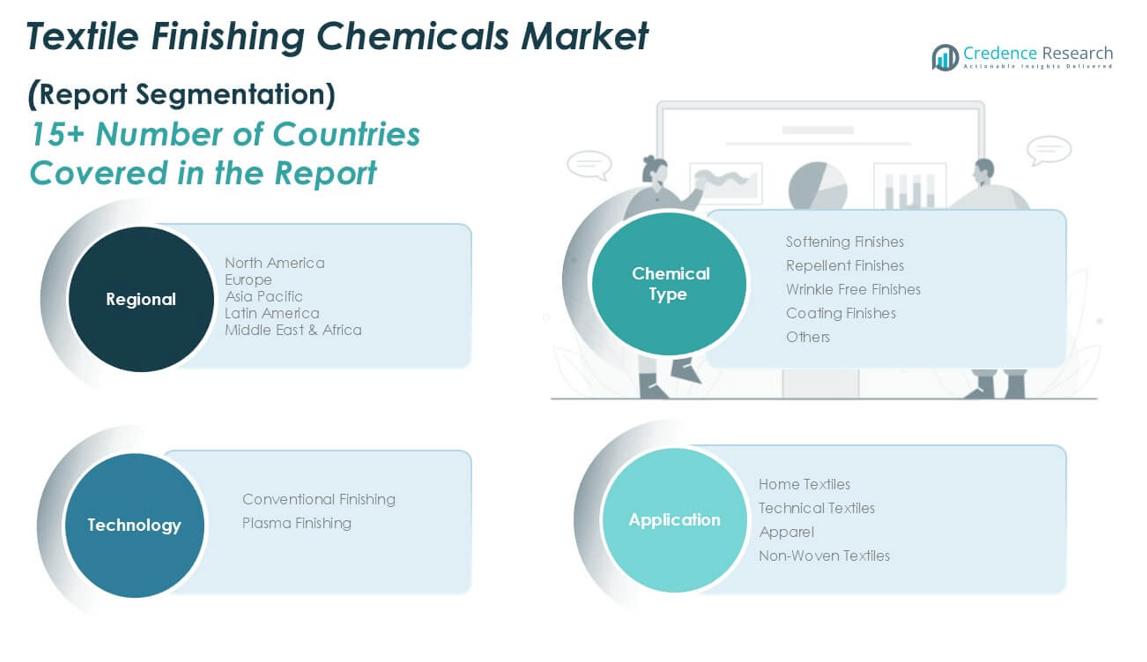

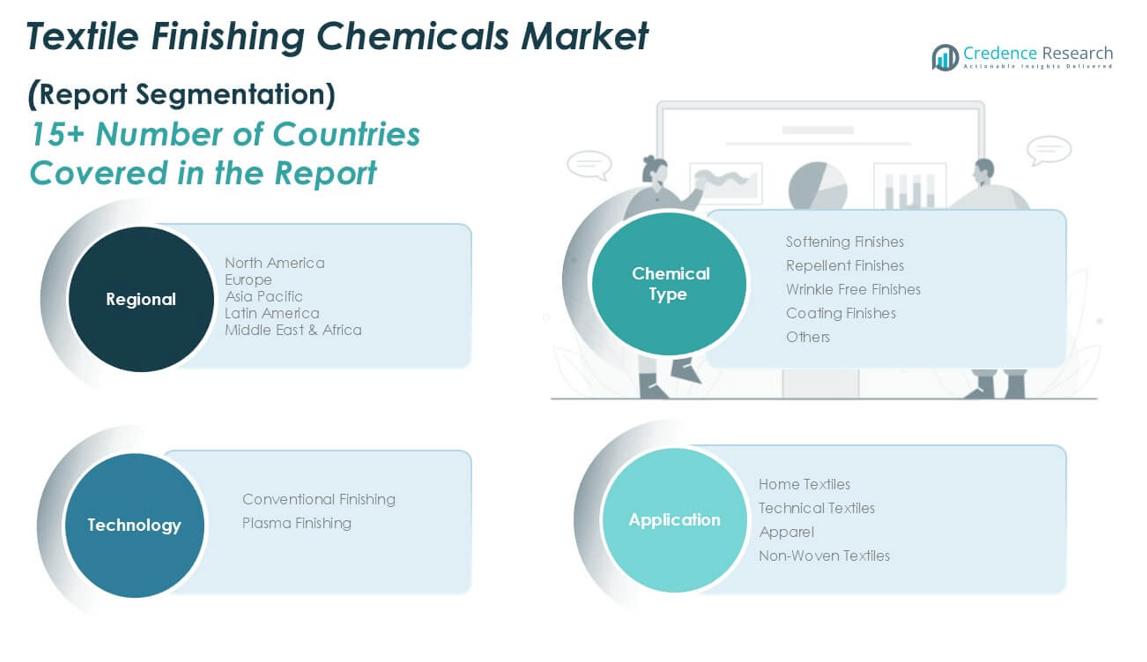

By Chemical Type

The Global Textile Finishing Chemicals Market is segmented by chemical type into softening finishes, repellent finishes, wrinkle-free finishes, coating finishes, and others. Softening finishes hold a significant share due to their widespread use in improving fabric feel and comfort. Repellent finishes, including water, oil, and stain-resistant treatments, are in high demand across technical and outdoor textiles. Wrinkle-free finishes are gaining traction in casual and formal wear segments, driven by consumer preference for low-maintenance clothing. Coating finishes are extensively used in industrial applications where enhanced performance characteristics are required. The “others” category includes antimicrobial, anti-odor, and UV-protective finishes, which are becoming increasingly relevant in healthcare and activewear sectors.

- For instance, more than 1,200,000 metric tons of textile finishing chemicals—including softening, repellent, and antimicrobial agents—were consumed globally, with Asia Pacific accounting for the largest share due to its extensive textile manufacturing base.

By Technology

The market is classified by technology into conventional finishing and plasma finishing. Conventional finishing dominates due to its long-established presence, cost efficiency, and compatibility with mass textile production. It includes pad-dry-cure, spray, and foam finishing processes commonly used across large-scale mills. Plasma finishing, though still emerging, is gaining attention for its eco-friendly profile and ability to modify surface properties without affecting bulk fabric characteristics. It offers a waterless and chemical-reduced alternative, making it suitable for sustainable textile production. Growing investment in clean technology and innovation could accelerate the adoption of plasma techniques in the coming years.

- For instance, over 2,500 textile manufacturing facilities had adopted plasma finishing equipment for pilot or full-scale production, reflecting the technology’s growing role in sustainable textile processing.

By Application

By application, the Global Textile Finishing Chemicals Market is segmented into home textiles, technical textiles, apparel, and non-woven textiles. Apparel remains the leading application segment, driven by continuous demand for comfort, performance, and aesthetic finishes. Home textiles, including bedding and upholstery, show steady growth supported by real estate development and consumer lifestyle upgrades. Technical textiles, such as those used in automotive, medical, and protective clothing, represent a high-growth area due to increased functionality requirements. Non-woven textiles are gaining traction in hygiene products and industrial uses, further expanding market reach.

Segments

Based on Chemical Type

- Softening Finishes

- Repellent Finishes

- Wrinkle Free Finishes

- Coating Finishes

- Others

Based on Technology

- Conventional Finishing

- Plasma Finishing

Based on Application

- Home Textiles

- Technical Textiles

- Apparel

- Non

- -Woven Textiles

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Textile Finishing Chemicals Market

The North America Textile Finishing Chemicals Market is projected to grow from USD 1,658.86 million in 2024 to USD 2,460.06 million by 2032, registering a CAGR of 5.1%. The region accounted for approximately 20.3% of the global market share in 2024. Growth is driven by demand for high-quality apparel, home textiles, and technical fabrics in the U.S. and Canada. Consumer awareness around sustainable and functional textiles is pushing manufacturers to invest in advanced finishing technologies. The strong presence of established chemical companies and rising demand for non-toxic and performance-enhancing chemicals support market development. It continues to benefit from innovations aligned with environmental compliance standards.

Europe Textile Finishing Chemicals Market

Europe’s market is estimated at USD 1,841.29 million in 2024 and forecast to reach USD 2,748.60 million by 2032, expanding at a CAGR of 5.2%. With a market share of 22.6% in 2024, Europe remains a key hub for sustainable textile innovation. Regulatory initiatives such as REACH and increasing consumer preference for eco-labeled products are influencing chemical usage across the region. Germany, Italy, and France lead in technical and fashion textiles, fueling the demand for finishing chemicals. The market benefits from widespread adoption of wrinkle-free, water-repellent, and anti-odor finishes. It shows strong traction in functional and recyclable textile segments.

Asia Pacific Textile Finishing Chemicals Market

Asia Pacific leads the global Textile Finishing Chemicals Market with a market value of USD 3,125.97 million in 2024, expected to rise to USD 4,974.85 million by 2032, growing at a CAGR of 6.0%. The region accounted for the largest market share of 38.3% in 2024. China, India, Bangladesh, and Vietnam serve as major textile manufacturing hubs, driving large-scale demand for finishing chemicals. Export-oriented production and increasing adoption of advanced technologies support regional growth. Rising income levels and urbanization are boosting demand for performance-based textiles. It remains a core production base for global apparel and home textile supply chains.

Latin America Textile Finishing Chemicals Market

The Latin America market is projected to increase from USD 454.90 million in 2024 to USD 621.86 million by 2032, at a CAGR of 4.0%. It held a market share of 5.6% in 2024. Brazil and Mexico dominate regional textile production, creating steady demand for finishing chemicals. Growth is supported by expanding apparel exports, especially to North America and Europe. Investments in modernization of textile mills and compliance with global quality standards are gaining pace. The market is gradually embracing eco-friendly and durable finishing agents. It continues to evolve in response to international sourcing requirements.

Middle East Textile Finishing Chemicals Market

The Middle East market is valued at USD 701.71 million in 2024, expected to reach USD 1,074.57 million by 2032, reflecting a CAGR of 5.5%. It represented 8.6% of the global share in 2024. The UAE, Saudi Arabia, and Turkey are major contributors to textile production and export. Industrial expansion and government support for non-oil sectors are fueling the region’s textile ecosystem. Demand for functional textiles in military, healthcare, and hospitality sectors is increasing. It shows potential for growth in specialty chemical applications that meet international environmental criteria. Water-efficient and energy-saving finishing processes are gaining popularity.

Africa Textile Finishing Chemicals Market

Africa’s market is set to grow from USD 382.11 million in 2024 to USD 557.18 million by 2032, at a CAGR of 4.9%, accounting for a market share of 4.7% in 2024. Countries like Egypt, Ethiopia, and South Africa are emerging as important players in textile and garment manufacturing. Government initiatives and foreign investments are boosting the region’s production capacity. The market is witnessing gradual adoption of modern finishing processes in response to rising exports. Limited infrastructure and environmental challenges still constrain rapid adoption of advanced chemicals. It offers long-term potential with growing awareness of product quality and sustainability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key players

- Huntsman Corporation

- Wacker Chemie AG

- The Dow Chemical Company

- Archroma

- Evonik Industries

- Dupont

- Solvay SA

- Tanatex Chemicals B.V

- Dystar Singapore PTE Ltd.

- Shin-Etsu Chemical

- Toray Industries

- Resil Chemicals Pvt. Ltd.

Competitive Analysis

The Global Textile Finishing Chemicals Market is highly competitive, marked by the presence of multinational players with strong R\&D capabilities and broad product portfolios. Companies like Huntsman Corporation, Wacker Chemie AG, and The Dow Chemical Company lead the market through consistent innovation and global supply chains. Archroma and Tanatex Chemicals are strengthening their positions through eco-friendly and specialty chemical offerings. Regional players like Resil Chemicals and Dystar Singapore PTE Ltd. are focusing on customized solutions to meet specific textile processing needs. It is characterized by mergers, acquisitions, and partnerships aimed at expanding technological capabilities and geographic presence. Sustainability-driven innovation and regulatory compliance remain central to competitive differentiation.

Recent Developments

- In July-September 2025, Archroma, BW Converting, and Monforts collaborated on trials using Baldwin TexCoat™ G4 technology with Archroma’s water-based chemicals. The focus was on achieving energy savings and the planned late 2025 commercial launch of a hydrophilic softener. This partnership aims to drive transformative change in dyeing and finishing processes, resulting in lower consumption of resources and increased productivity.

Market Concentration and Characteristics

The Global Textile Finishing Chemicals Market demonstrates moderate to high market concentration, with a mix of global chemical giants and specialized regional players. It is characterized by strong focus on innovation, regulatory compliance, and sustainability. Leading companies maintain competitive advantage through extensive product portfolios, global distribution networks, and strategic partnerships. The market relies heavily on research and development to introduce performance-enhancing and eco-friendly formulations. It shows high entry barriers due to capital-intensive production, stringent environmental standards, and evolving customer requirements. Long-term contracts with textile manufacturers and customized chemical solutions contribute to sustained competitiveness across key regions

Report Coverage

The research report offers an in-depth analysis based on Chemical Type, Technology, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to benefit from increasing demand for wrinkle-free, water-repellent, and antimicrobial finishes across apparel and home textile sectors.

- Manufacturers will invest heavily in bio-based, non-toxic, and biodegradable formulations to meet growing environmental regulations and consumer expectations.

- The integration of smart finishes, including thermo-responsive and moisture-management chemicals, will create new revenue opportunities in medical, sportswear, and defense applications.

- Advancements in digital textile printing and automation will support the use of finishing chemicals that enhance color fastness and reduce resource consumption.

- Finishing chemicals tailored for high-performance textiles in automotive, construction, and industrial filtration will experience strong growth.

- Top companies will prioritize R\&D to develop multi-functional and environmentally compliant chemical solutions that meet industry-specific needs.

- Asia-Pacific will not only maintain its dominance in production but will also emerge as a key center for sustainable finishing innovations due to favorable policies and investments.

- The use of digital platforms and AI in inventory management, chemical dosing, and production monitoring will streamline operations and improve efficiency.

- Manufacturers will develop finishing chemicals compatible with fiber recycling and biodegradability, aligning with global circular economy goals.

- The market will witness more partnerships, acquisitions, and joint ventures as companies seek to expand geographic presence and enhance technological capabilities.