Market Overview

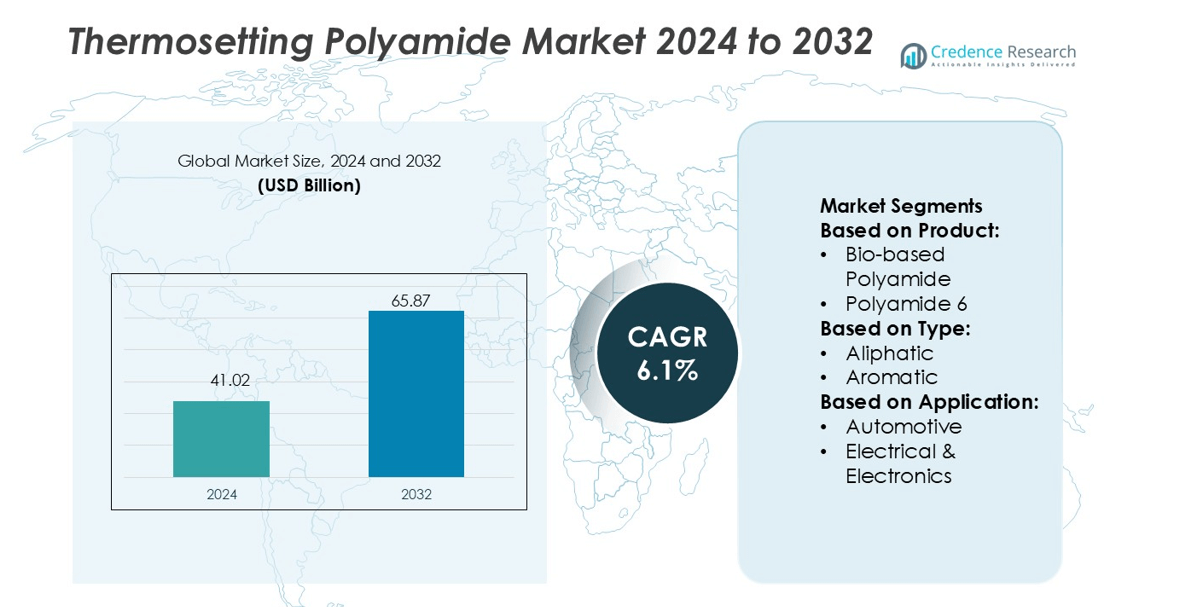

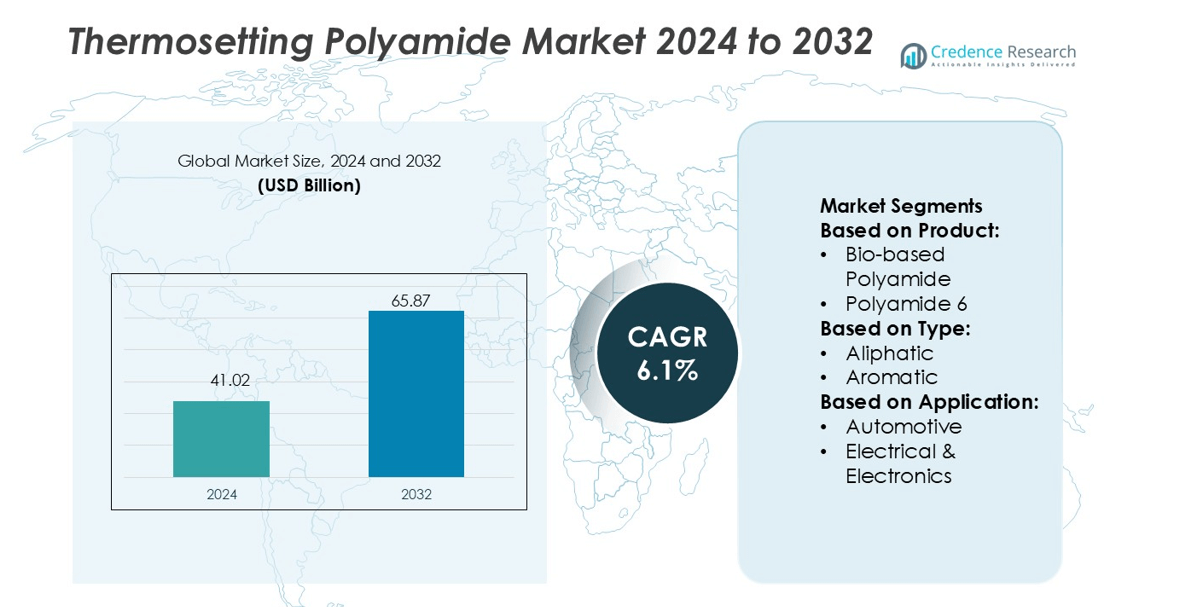

Thermosetting Polyamide Market size was valued USD 41.02 billion in 2024 and is anticipated to reach USD 65.87 billion by 2032, at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Thermosetting Polyamide Market Size 2024 |

USD 41.02 billion |

| Thermosetting Polyamide Market, CAGR |

6.1% |

| Thermosetting Polyamide Market Size 2032 |

USD 65.87 billion |

The thermosetting polyamide market features strong competition from major players offering high-strength, heat-resistant compounds for automotive, electronics, and industrial applications. Leading companies supply specialty grades that support lightweight parts, flame resistance, and chemical durability. Innovation in bio-based and recyclable materials continues to strengthen market differentiation. Asia-Pacific remains the dominant regional market, capturing 35% of global share due to large-scale automotive production, growing electronics manufacturing, and rapid industrial expansion. Strategic partnerships with OEMs, capacity expansion, and localized product development help companies secure long-term demand across key Asian economies.

Market Insights

- Thermosetting Polyamide Market size was valued at USD 41.02 billion in 2024 and is expected to reach USD 65.87 billion by 2032, at a CAGR of 6.1%.

- Demand rises as automotive and electrical manufacturers use heat-resistant and lightweight compounds for connectors, engine parts, and high-temperature components, supporting better fuel efficiency and durability.

- Bio-based and recyclable polyamide grades gain attention as industries shift toward sustainable materials and stricter environmental regulations encourage greener product development.

- Competition intensifies as major companies expand R&D, build regional production units, and collaborate with OEMs to supply specialty grades for electric vehicles, industrial machinery, and miniaturized electronics.

- Asia-Pacific leads with 35% share due to strong automotive and electronics output, while segments such as electrical and electronics hold a significant share as they adopt thermosetting polyamides for compact, flame-resistant components.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Polyamide 66 holds the dominant share in the product segment, supported by high tensile strength, heat resistance, and suitability for load-bearing components. Manufacturers in automotive, electronics, and industrial machinery prefer PA66 for gears, connectors, and structural parts exposed to mechanical stress. Its durability, chemical resistance, and dimensional stability make it the material of choice for under-the-hood systems and high-temperature assemblies. Specialty polyamides also gain steady demand in coatings and advanced composites, while bio-based polyamides attract interest from sustainability-focused brands seeking lightweight, eco-friendly alternatives.

- For instance, RTP Company commercialized PA66 compounds reinforced with 30% glass fiber, enabling tensile strength values reaching 220 MPa, as confirmed through ISO 527 mechanical testing in its material data sheets.

By Type

Aliphatic thermosetting polyamides account for the largest share due to strong mechanical performance, moisture resistance, and processing flexibility. These grades support applications in industrial fasteners, electrical components, and automotive parts that require reliable structural integrity. Aliphatic types also blend effectively with reinforcing fibers, improving stiffness in lightweight assemblies. Aromatic polyamides grow at a faster rate, driven by superior thermal stability and flame-resistant behavior that suits aerospace, electronics, and specialty coatings.

- For instance, LANXESS’s Durethan® AKV35XTS2 (a PA 66 reinforced with 35 % glass fibre) maintains continuous use temperatures of up to 230 °C, surpassing previous stabilised grades.

By Applications

Engineering plastics form the dominant segment, expanding with rising use in machinery components, reinforced composites, and industrial tools. Thermosetting polyamides deliver long service life, creep resistance, and dimensional accuracy under continuous load, making them valuable for high-performance assemblies. Automotive remains another key consumer due to demand for lightweight engine components and metal-replacement parts. Electrical and electronics applications gain traction with growth in connectors, PCBs, and insulation materials that require heat and chemical resistance. Consumer appliances, packaging, and general molded goods continue to adopt thermosetting polyamides for durability and precision.

Key Growth Drivers

Rising Use in High-Performance Engineering Plastics

Thermosetting polyamides support exceptional heat resistance, dimensional stability, and mechanical strength. Automotive, aerospace, and industrial machinery manufacturers use these materials to replace metal parts and reduce component weight. The demand rises in engines, electric motor housings, connectors, and fuel systems where high thermal stability is critical. Growing electric vehicle manufacturing accelerates adoption due to better resistance to wear, lubricants, and high voltage conditions. OEMs prefer these polymers for improved durability and reduced maintenance. As lightweighting and thermal performance gain importance, demand for thermosetting polyamides strengthens across precision engineering applications.

- For instance, Helios Lifestyle Private Limited supplies grooming tools under the Bombay Shaving Company brand that use stainless-steel blades, and while the exact precision varies by model, some models, like the Power Play NXT Beard Trimmer, use a 600 mAh rechargeable battery supporting 80 to 90 minutes of continuous trimming. Other models, such as the Power Styler Beard Trimmer, can offer up to 120 minutes of runtime.

Increasing Adoption in Electrical and Electronics

Thermosetting polyamides support insulation, flame resistance, and lower moisture absorption. Electronics and semiconductor manufacturers use them in circuit breakers, relays, connectors, and high-temperature insulators. The shift toward miniaturized electronic devices increases demand for materials with higher thermal endurance and dimensional accuracy. Consumer electronics, LED lighting, and smart home devices drive new applications. Growth in 5G infrastructure, robotics, and industrial automation boosts usage of durable components. Companies also invest in halogen-free, RoHS-compliant formulations to meet environmental and safety standards. The electronics sector continues to contribute a large part of future consumption.

- For instance, Evonik’s VESTAMID® HTplus polyamide grades achieve a comparative tracking index (CTI) of 600 volts and maintain continuous service temperatures up to 200 °C, while passing UL 94 V-0 flame testing at 0.4 mm thickness, as reported in Evonik’s technical data documentation.

Preference for Sustainable and Bio-Based Chemistry

Bio-based thermosetting polyamides gain traction as industries reduce dependency on petroleum-based feedstock. Manufacturers adopt renewable sources such as castor oil, sebacic acid, and plant-derived monomers. Improved mechanical strength, heat stability, and lower carbon footprint make bio-based grades competitive with synthetic polymers. Automakers and consumer goods brands use sustainable materials to meet global regulations on emissions and hazardous substances. This trend encourages investment in green chemistry and recycling-friendly thermoset systems. Growing consumer preference for eco-friendly products supports long-term demand for bio-based polyamides.

Key Trends & Opportunities

Expansion of Lightweight Automotive Components

OEMs replace metal and bulky engineering plastics with high-strength thermosetting polyamides. The trend supports lightweight vehicles, lower fuel consumption, and improved thermal management. Electric and hybrid vehicles increase demand for heat-resistant battery casings, connectors, and high-voltage insulation. Advancements in molding and hybrid composite technology create new design opportunities. Autonomous vehicle systems and advanced driver assistance modules require heat-stable connectors and housings. The automotive industry remains one of the strongest opportunity areas for thermosetting polyamide suppliers.

- For instance, BASF SE has advanced its polyamide portfolio with its Ultramid® A3WG6 PA66-GF30 grade, which features a tensile modulus of 10 000 MPa in dry condition, and 7 200 MPa after conditioning.

Growth of High-Temperature Industrial Applications

Industrial equipment, chemical processing units, and oil and gas machinery require materials with strong resistance to wear, corrosion, and extreme heat. Thermosetting polyamides perform well in valves, seals, gears, and friction components. Manufacturers expand production of specialty grades for harsh environments. Additive manufacturing and precision molding support custom component designs. More investments in industrial automation also increase the need for durable polymer parts. Suppliers offering specialized, high-performance formulations are likely to gain competitive advantage.

- For instance, Arkema’s Rilsan® HT grade CMNO exhibits a melting temperature of 255 °C, a tensile modulus of 2400 MPa, and a yield stress of 64 MPa in ISO 527 testing, according to Arkema’s published data sheets.

Innovation in Composites and Hybrid Materials

Composite manufacturers blend thermosetting polyamides with carbon fibers, glass fibers, and advanced additives. These hybrids deliver superior strength, low density, and better thermal behavior for aerospace, defense, and marine applications. The trend supports automated manufacturing and faster part production. Lightweight composites replace metal structures in aircraft cabins, drones, and industrial machinery. Growing research into recyclable and repairable thermoset systems opens new commercial opportunities. Companies focus on long-life materials with reduced maintenance cost.

Key Challenges

High Processing and Production Costs

Thermosetting polyamides require specialized molding systems, curing processes, and advanced fillers, increasing overall manufacturing costs. Small and mid-scale manufacturers find investment in high-temperature processing equipment difficult. Raw material cost volatility also affects pricing, especially for specialty grades. High tooling and development costs limit adoption in price-sensitive segments. Cheaper alternatives like standard engineering plastics challenge the market in low-demand applications. Cost reduction and scalable production remain ongoing challenges for suppliers.

Limited Recyclability and Disposal Issues

Thermosetting polyamides are cross-linked materials that cannot be easily re-melted or reprocessed. Disposal and end-of-life waste management remain concerns for regulators and manufacturers. Industries seek recyclable thermosets or bio-based alternatives, but large-scale adoption is still in development. Growing environmental laws may restrict non-recyclable polymers in certain regions. The challenge becomes more prominent as sustainability targets rise. Companies invest in chemical recycling and eco-friendly formulations to address these limitations.

Regional Analysis

North America

North America holds a strong share of the thermosetting polyamide market, capturing nearly 31% of global revenue. The region benefits from advanced automotive manufacturing, aerospace component production, and high adoption of engineering plastics across industrial machinery. The United States leads consumption due to strong demand for lightweight vehicle parts, durable connectors, and heat-resistant components in electronics. Investments in electric vehicles, smart manufacturing, and 5G infrastructure expand material usage. Strict fuel-efficiency and safety regulations further support adoption. Growing interest in recyclable and bio-based polyamides also drives product development across major producers and research institutions in the region.

Europe

Europe accounts for roughly 28% share of the market, supported by strong automotive production and a well-established electrical and electronics sector. Germany, France, and Italy are key users in engine components, e-mobility platforms, and precision industrial equipment. Strict regulations on emissions, sustainability, and chemical compliance push manufacturers toward advanced, high-performance polymer solutions. Aerospace and railway industries increase use of lightweight thermosetting polyamides in interior and structural parts. Investments in green chemistry and bio-based polyamides continue to rise across the region. Europe remains a stable, innovation-focused market with strong material engineering capabilities.

Asia-Pacific

Asia-Pacific holds the largest market share at approximately 35%, driven by rapid industrialization, expanding automotive manufacturing, and electronics production. China, Japan, and South Korea remain major contributors due to strong domestic manufacturing bases and export-oriented industries. Thermosetting polyamides are widely used in semiconductors, consumer electronics, electric vehicles, and industrial machinery. Rising demand for lightweight components and miniaturized electronic devices supports consumption. Government incentives promoting electric mobility and smart factories enable further market growth. Increasing investment in advanced molding systems and specialty polymers strengthens regional supply capabilities. Asia-Pacific remains the fastest-growing regional market.

Latin America

Latin America secures nearly 4% of global market share, with growth led by Brazil and Mexico. Automotive assembly plants, consumer goods manufacturing, and small-scale electronics production support the use of thermosetting polyamides. The region sees increasing adoption of lightweight plastics in vehicles to reduce fuel consumption and improve durability. Local demand for industrial machinery components also contributes to steady consumption. However, limited domestic polymer production and reliance on imports restrict faster expansion. Rising investments in renewable energy, automotive electronics, and industrial automation present constructive future growth opportunities for regional suppliers and distributors.

Middle East & Africa

Middle East & Africa holds close to 2% market share and remains a smaller but emerging consumer base. Oil & gas, industrial equipment, and electrical infrastructure projects drive demand for durable, heat-resistant polymer components. The UAE and Saudi Arabia invest in advanced manufacturing and automotive assembly, improving material usage. Import dependency and limited processing capabilities slow market progress, but industrial diversification strategies create new opportunities. Growing interest in smart grids, aerospace maintenance, and electric mobility gradually expands application areas. The region shows long-term potential as industrial modernization accelerates across key economies.

Market Segmentations:

By Product:

- Bio-based Polyamide

- Polyamide 6

By Type:

By Application:

- Automotive

- Electrical & Electronics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the thermosetting polyamide market includes RTP Company, LANXESS Corporation, Nexeo Plastics, Evonik Industries, NYCOA, BASF SE, PolyOne Corporation (Avient), Arkema, Solvay S.A., and LG Chem. The thermosetting polyamide market shows strong competition driven by innovation, advanced material engineering, and expanding end-use applications. Manufacturers focus on developing high-temperature, flame-resistant, and chemically stable grades for automotive, electronics, and industrial machinery. The shift toward lightweight vehicles, miniaturized devices, and durable high-performance components pushes suppliers to offer custom formulations and improved processing technologies. Many companies invest in bio-based chemistry and recyclable thermoset systems to meet sustainability regulations and reduce carbon footprint. Regional expansion, technical service centers, and partnerships with OEMs help strengthen supply chains. Continuous R&D, material optimization, and specialized product portfolios remain the core strategies shaping the competitive environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- RTP Company

- LANXESS Corporation

- Nexeo Plastics

- Evonik Industries

- NYCOA

- BASF SE

- PolyOne Corporation (Avient)

- Arkema

- Solvay S.A.

- LG Chem

Recent Developments

- In September 2025, BASF SE launched Ultramid H33 L, a thermoplastic polyamide with high water permeability for artificial sausage casings. The hydrophilic properties of Ultramid H enable smoke aromas to penetrate the casing and reach the sausage products during the smoking process.

- In April 2025, Mitsubishi Chemical announced the expansion of flame-retardant compound production capacity in China and France; these compounds (often used in cable sheathing, electronics) use thermoplastics and polymers in their formulations.

- In May 2024, SABIC showcased its plastic innovations and circular solutions at NPE2024, including work under its TRUCIRCLE™ and BLUEHERO™ initiatives to promote sustainability and electrification in plastic products.

- In April 2024, DOMO Chemicals, a prominent global player in the engineering materials sector specializing in polyamides, inaugurated a new production plant for TECHNYL polyamides in Haiyan, Jiaxing, Zhejiang, China.

Report Coverage

The research report offers an in-depth analysis based on Product, Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise in electric vehicles for heat-resistant connectors and battery components.

- Electronics manufacturers will adopt more thermosetting polyamides for miniaturized, high-temperature devices.

- Bio-based and recyclable grades will gain traction due to sustainability regulations.

- Aerospace and defense applications will expand with lightweight, high-strength composite parts.

- Industrial automation will drive use in gears, seals, and wear-resistant machinery components.

- New molding technologies will reduce processing time and increase design flexibility.

- Material suppliers will invest in regional production to shorten supply chains.

- Partnerships with OEMs will increase for customized performance-grade compounds.

- Regulatory pressure will boost development of halogen-free and eco-compliant formulations.

- R&D will enhance mechanical strength, thermal stability, and lifespan for advanced engineering applications.