Market Overview

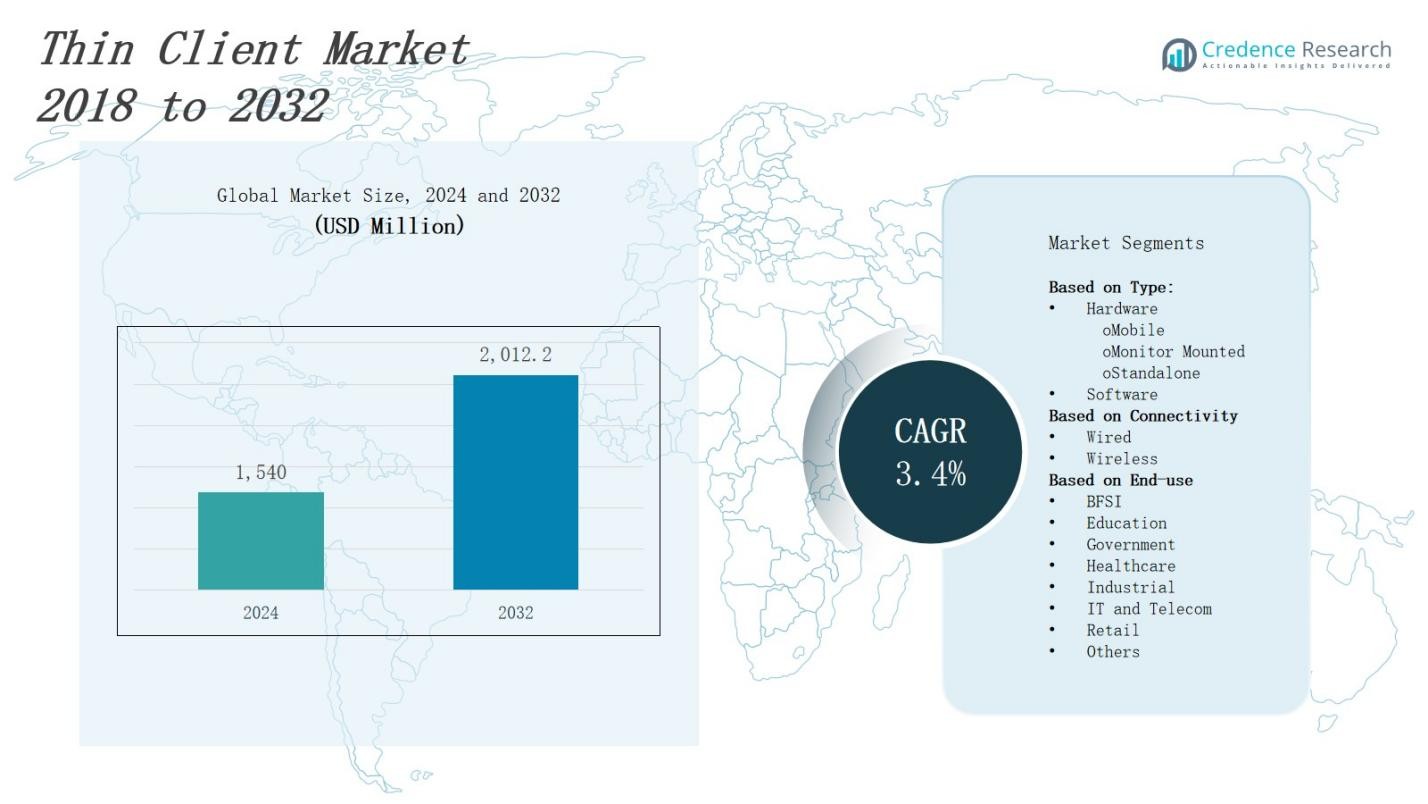

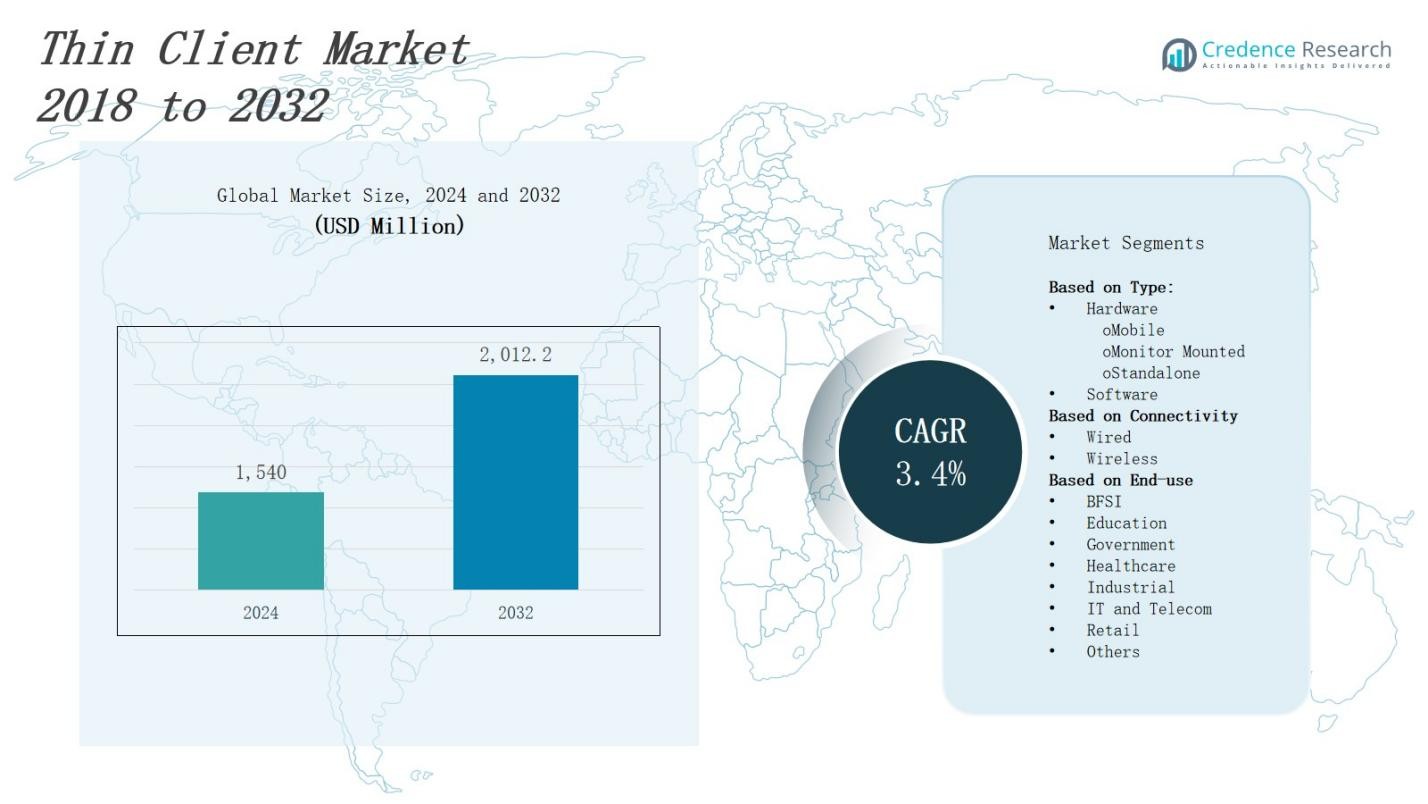

The Thin Client Market is projected to grow from USD 1,540 million in 2024 to USD 2,012.2 million by 2032, expanding at a CAGR of 3.4%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Thin Client Market Size 2024 |

USD 1,540 Million |

| Thin Client Market, CAGR |

3.4% |

| Thin Client Market Size 2032 |

USD 2,012.2 Million |

The thin client market grows driven by increasing demand for cost-effective, secure, and energy-efficient computing solutions across enterprises. Rising adoption of cloud computing and virtualization technologies encourages organizations to deploy thin clients for centralized management and reduced IT complexity. Enhanced data security and lower maintenance costs further promote thin client usage. Additionally, the shift toward remote work and digital transformation accelerates thin client integration in various industries. Innovations in hardware design and support for diverse operating systems expand application scope. Growing awareness of environmental sustainability also drives demand for low-power, eco-friendly thin client devices, reinforcing market growth and technological advancement.

The thin client market spans key regions including North America, Europe, Asia-Pacific, and the Rest of the World, with North America leading in adoption due to advanced IT infrastructure and cloud integration. Europe follows, driven by strict data security regulations, while Asia-Pacific experiences rapid growth fueled by digitalization and government initiatives. The Rest of the World shows emerging potential with increasing IT investments. Key players such as HP Inc., Dell Technologies, Lenovo Group Ltd., Acer Inc., Fujitsu Ltd., Cisco Systems Inc., IGEL, and Advantech Co. Ltd. dominate the market through innovation and regional expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The thin client market is projected to grow from USD 1,540 million in 2024 to USD 2,012.2 million by 2032, with a CAGR of 3.4%.

- Increasing demand for cost-effective, secure, and energy-efficient computing solutions drives market growth across enterprises.

- Rising adoption of cloud computing and virtualization encourages organizations to deploy thin clients for centralized management and reduced IT complexity.

- The global shift toward remote work and digital transformation accelerates thin client integration across industries.

- Sustainability concerns promote thin clients due to their low power consumption and reduced environmental impact.

- Market challenges include limited compatibility with legacy applications and dependence on stable network connectivity for optimal performance.

- North America leads with 35% market share, followed by Europe at 28%, Asia-Pacific at 25%, and the Rest of the World at 12%, reflecting varied adoption and infrastructure maturity.

Market Drivers

Rising Demand for Cost-Effective and Secure Computing Solutions

The thin client market benefits from growing enterprise demand for cost-efficient computing infrastructure. Organizations seek solutions that reduce hardware expenses and simplify IT management. Thin clients offer centralized control, minimizing risks related to data breaches and unauthorized access. Their ability to store minimal data locally enhances security, especially in regulated industries. Companies prioritize protecting sensitive information while lowering operational costs. This balance drives the adoption of thin client systems across multiple sectors. It provides a scalable approach for managing distributed workforces securely and efficiently.

- For instance, IGEL Technologies reported that clients using their thin client solutions experienced a 30% reduction in hardware maintenance costs alongside improved endpoint security.

Increased Adoption of Cloud Computing and Virtualization Technologies

Cloud computing and virtualization technologies play a crucial role in driving thin client market growth. These technologies enable remote access to centralized servers, allowing thin clients to function as lightweight endpoints. Enterprises invest heavily in virtual desktop infrastructure (VDI) to enhance flexibility and reduce hardware dependency. Thin clients complement these infrastructures by providing reliable, low-maintenance access points. The integration improves resource utilization and operational agility. It enables organizations to support remote workforces with minimal IT complexity and higher performance consistency.

- For instance, Dell Technologies reported that thin clients consume up to 80% less power than traditional desktops, making them ideal for energy-sensitive environments utilizing VDI.

Growing Remote Work and Digital Transformation Initiatives

The global shift toward remote work significantly influences the thin client market expansion. Organizations adopt digital transformation strategies to ensure business continuity and enhance productivity outside traditional office environments. Thin clients facilitate secure, manageable access to corporate resources from various locations. It helps businesses maintain data integrity while enabling seamless connectivity for remote employees. The demand for flexible work solutions and robust IT infrastructure encourages enterprises to deploy thin client devices. This trend accelerates adoption across industries seeking reliable remote computing options.

Focus on Sustainability and Energy Efficiency

Sustainability concerns motivate enterprises to embrace thin clients for their low power consumption and reduced environmental footprint. Thin clients consume significantly less energy than traditional desktops, contributing to cost savings and corporate social responsibility goals. Companies align IT procurement with green initiatives to meet regulatory requirements and improve brand reputation. It promotes the use of energy-efficient technology without compromising performance or security. Growing awareness of environmental impact fosters market growth, positioning thin clients as an eco-friendly computing alternative.

Market Trends

Advancements in Hardware Design and Performance Capabilities

The thin client market experiences significant innovation in hardware design, focusing on enhanced processing power and compact form factors. Manufacturers develop devices that support higher resolution displays and faster connectivity options, improving user experience. It integrates advanced chipsets and memory configurations to handle complex virtual desktop environments efficiently. These improvements enable thin clients to support diverse applications across industries without compromising speed or reliability. Enhanced performance drives wider acceptance in sectors demanding robust computing with minimal physical footprint.

Integration with Artificial Intelligence and Edge Computing Solutions

Integration of artificial intelligence (AI) and edge computing technologies shapes current trends in the thin client market. Thin clients increasingly serve as endpoints that connect with intelligent systems to optimize data processing and reduce latency. It supports real-time analytics and decision-making by leveraging edge computing frameworks closer to data sources. This trend enhances operational efficiency, particularly in manufacturing, healthcare, and retail sectors. By adopting AI-powered capabilities, thin clients contribute to smarter workflows and improved resource allocation within IT infrastructures.

Expansion of Cloud-Based Services and Virtual Desktop Infrastructure (VDI)

Cloud service providers and VDI platforms continue to evolve, influencing thin client market dynamics. Enterprises shift workloads to the cloud, demanding thin clients capable of seamless access to virtual desktops and applications. It enables centralized management and simplified software updates, reducing IT overhead. The growing popularity of hybrid and multi-cloud environments drives demand for thin clients with flexible compatibility. This trend promotes agility in enterprise IT operations, allowing organizations to scale resources efficiently and support diverse user needs.

- For instance, Citrix DaaS supports hybrid deployments with enterprise-grade security and analytics to optimize workflows, delivering consistent user experiences even in low-bandwidth conditions, which is critical for regulated industries needing flexible cloud and on-premises integration.

Focus on Enhanced Security Features and Compliance Standards

Security remains a top priority driving innovation within the thin client market. Manufacturers implement advanced encryption protocols, multi-factor authentication, and secure boot technologies to safeguard data. It aligns with stringent regulatory compliance requirements across industries such as finance, healthcare, and government. Enhanced security features prevent unauthorized access and data leaks in distributed environments. This trend strengthens thin clients’ appeal by addressing rising cybersecurity threats and ensuring adherence to global data protection standards.

- For instance, Citrix integrates multi-factor authentication (MFA) within its thin client sessions to prevent unauthorized access across financial and healthcare client environments, aligning with regulatory mandates.

Market Challenges Analysis

Limited Compatibility with Legacy Applications and Infrastructure Constraints

The thin client market faces challenges due to compatibility issues with legacy software and existing IT infrastructure. Many organizations rely on older applications that thin clients cannot efficiently support, limiting deployment options. It requires additional investments in system upgrades or middleware solutions to bridge compatibility gaps. Resistance to change within IT departments further slows adoption, especially in enterprises with complex, heterogeneous environments. These factors create barriers to integrating thin clients fully, affecting overall market penetration and growth potential.

Dependence on Network Stability and Performance Limitations

Network reliability remains a critical challenge for the thin client market, given its dependence on stable and high-speed connectivity. Poor network conditions can lead to latency, reduced performance, and interrupted user experiences, undermining thin clients’ effectiveness. It necessitates robust IT infrastructure and ongoing monitoring to maintain seamless operation. Organizations in regions with limited broadband access or unstable networks may hesitate to implement thin client solutions. This reliance on network quality restricts broader adoption, particularly in remote or underdeveloped areas.

Market Opportunities

Expansion in Emerging Markets and Increasing IT Infrastructure Investments

The thin client market holds significant opportunities in emerging economies where digital transformation efforts accelerate. Growing investments in IT infrastructure and modernization create demand for cost-effective computing solutions. It offers enterprises a scalable alternative to traditional desktops, reducing upfront hardware costs and simplifying management. Increasing adoption of cloud services in these regions further supports thin client deployment. The expanding middle class and rising awareness about secure computing encourage organizations to explore thin client technology, driving market growth in untapped geographies.

Rising Adoption in Healthcare, Education, and Government Sectors

Healthcare, education, and government sectors present promising growth opportunities for the thin client market. These industries require secure, manageable, and centralized IT solutions to handle sensitive data and ensure regulatory compliance. It enables streamlined access to applications and resources while minimizing security risks and maintenance overhead. Initiatives toward smart campuses, telemedicine, and e-governance increase demand for thin client devices. Expanding digital services and remote access needs in these sectors create new avenues for market penetration and technology adoption.

Market Segmentation Analysis:

By Type

The thin client market divides into hardware and software segments, each addressing specific enterprise needs. Hardware includes mobile, monitor-mounted, and standalone devices designed for various workspace environments and mobility requirements. It provides flexibility for users demanding portability or integrated solutions within desktop setups. The software segment supports device management, security, and virtualization compatibility. This dual segmentation allows organizations to tailor thin client deployments, optimizing performance and operational efficiency across different IT landscapes.

- For instance, Lenovo’s ThinkCentre M625q Thin Client uses an AMD 7th Gen processor and includes fanless design and multiple expansion slots, ideal for energy-efficient, upgradeable office setups.

By Connectivity

Connectivity in the thin client market splits between wired and wireless technologies, catering to different infrastructure demands. Wired connections ensure stable, high-speed data transfer, favored in environments requiring consistent performance and security. Wireless connectivity supports mobility and flexible workspace arrangements, aligning with remote work trends and modern office designs. It enables enterprises to reduce cabling complexity while maintaining access to virtualized desktops. Both connectivity options expand thin client applicability across varied operational contexts and user preferences.

- For instance, VMware’s Horizon Client enables wireless thin client access to virtual desktops, promoting mobility and flexible workspaces, which align with remote work and modern office environments.

By End-Use

The thin client market serves diverse industries, including BFSI, education, government, healthcare, industrial, IT and telecom, retail, and others. It addresses specific requirements such as data security in BFSI, centralized management in education, and compliance in healthcare. Government and industrial sectors benefit from enhanced control and cost savings, while IT and telecom prioritize scalability and network integration. Retail uses thin clients for point-of-sale systems and customer engagement. This broad end-use segmentation underlines the technology’s versatility and growing relevance across key economic sectors.

Segments:

Based on Type:

- Hardware

- Mobile

- Monitor Mounted

- Standalone

- Software

Based on Connectivity

Based on End-use

- BFSI

- Education

- Government

- Healthcare

- Industrial

- IT and Telecom

- Retail

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America leads the thin client market with a 35% share, driven by widespread adoption of cloud computing and virtualization technologies. It hosts many large enterprises investing in digital transformation and IT infrastructure upgrades. The region benefits from advanced network infrastructure and high awareness of data security requirements. It supports remote work models and centralized computing environments, boosting thin client deployments. Strong government initiatives promoting cybersecurity and sustainability also encourage market growth. Leading technology providers continuously innovate to meet evolving enterprise demands, solidifying North America’s dominant position.

Europe

Europe holds a 28% share of the thin client market, supported by increasing investments in digital workplaces and IT modernization projects. It experiences robust demand across BFSI, healthcare, and government sectors, emphasizing secure and compliant IT solutions. It benefits from stringent data protection regulations that drive adoption of centralized computing to reduce data breaches. The region’s focus on energy-efficient technology adoption further fuels demand for thin clients. It encourages enterprises to replace traditional desktops with more sustainable and manageable alternatives. Collaborative efforts between private and public sectors enhance technology penetration.

Asia-Pacific

Asia-Pacific commands a 25% share of the thin client market, reflecting rapid digitalization and rising IT infrastructure spending in emerging economies. It experiences strong growth in education, healthcare, and retail sectors seeking cost-effective computing solutions. It supports expanding cloud adoption and remote work initiatives across urban and semi-urban areas. Increasing government support for smart city projects and digital governance stimulates market demand. The growing middle-class workforce and expanding IT services industry further drive thin client adoption. Local manufacturers and global players compete to capture opportunities in this dynamic region.

Rest of the World

The Rest of the World accounts for 12% of the thin client market, driven by gradual IT infrastructure development and increasing awareness of secure computing solutions. Regions such as Latin America, the Middle East, and Africa present emerging opportunities due to expanding enterprise IT investments. It benefits from growing adoption of cloud services and government digitization initiatives. Infrastructure challenges remain, but improving network connectivity supports gradual market penetration. International vendors increasingly target these markets to expand their global footprint and address evolving IT needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- IGEL

- Chip PC Technologies

- DevonIT

- HP Inc.

- Centerm Information Co. Ltd.

- Lenovo Group Ltd.

- Fujitsu Ltd.

- Acer Inc.

- ASUSTeK Computer Inc.

- Dell Technologies Inc.

- INP Computer Technology Pvt. Ltd.

- Advantech Co. Ltd.

- Cisco Systems Inc.

Competitive Analysis

The thin client market features intense competition among established technology companies and emerging players focusing on innovation and customer-centric solutions. Key companies invest heavily in research and development to enhance device performance, security features, and compatibility with cloud and virtualization platforms. It emphasizes strategic partnerships and acquisitions to expand product portfolios and geographic reach. Vendors differentiate through offering customizable hardware and integrated software solutions tailored to diverse industry needs. Competitive pricing and strong after-sales support remain crucial for market positioning. It faces pressure to address evolving enterprise demands for scalability, energy efficiency, and remote access capabilities. Continuous innovation and agility determine leadership in this dynamic market landscape. Furthermore, companies focus on expanding their presence in emerging markets and adopting sustainable manufacturing practices to meet growing environmental regulations and customer expectations. These efforts collectively strengthen competitive advantage and drive long-term growth.

Recent Developments

- On December 18, 2024, HP launched the HP Elite t660 Thin Client, featuring 13th Gen Intel processors, support for up to four 4K displays, and enhanced security with HP Wolf Security.

- In March 2025, Dell announced an upgrade solution for the OptiPlex 3000 Thin Client, enabling users to transition from Windows 10 IoT Enterprise LTSC 2021 to Windows 11 IoT Enterprise LTSC 2024.

- On February 1, 2024, Lenovo and IGEL expanded their partnership, offering Lenovo devices with integrated IGEL OS licenses globally, enhancing endpoint management and security.

- On January 29, 2024, HP released the HP Elite t755 Thin Client, featuring an AMD Ryzen Embedded V2546 processor, support for up to six 4K displays, and HP ThinPro OS.

Market Concentration & Characteristics

The thin client market exhibits a moderately concentrated competitive landscape dominated by several key technology players focusing on innovation and strategic expansion. It features a mix of global corporations and regional vendors competing through product differentiation, advanced security features, and compatibility with virtualization and cloud platforms. The market values continuous investment in research and development to enhance hardware performance, energy efficiency, and software integration. It faces pressure to adapt quickly to evolving enterprise requirements such as scalability, remote access, and sustainability. Companies emphasize building strong customer relationships and offering comprehensive support services to maintain market share. The presence of customized solutions tailored to specific industry needs further defines the market’s characteristics. Competitive dynamics also include mergers, acquisitions, and partnerships aimed at expanding product portfolios and geographic reach. This combination of focused innovation and strategic alliances shapes the thin client market’s steady growth trajectory.

Report Coverage

The research report offers an in-depth analysis based on Type, Connectivity, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The thin client market will expand with increasing enterprise adoption of cloud and virtualization technologies.

- Organizations will prioritize energy-efficient and eco-friendly thin client devices to meet sustainability goals.

- Remote work trends will drive demand for secure and manageable thin client solutions.

- Vendors will focus on enhancing device performance and compatibility with diverse operating systems.

- Emerging markets will offer significant growth opportunities due to digital transformation initiatives.

- Integration of AI and edge computing will improve thin client functionality and responsiveness.

- Security enhancements will remain critical to address rising cyber threats and compliance requirements.

- Collaboration between technology providers and cloud service platforms will strengthen market offerings.

- Customized solutions for industry-specific applications will increase thin client adoption.

- Ongoing innovation and strategic partnerships will shape the competitive landscape and market growth.