Market Overview

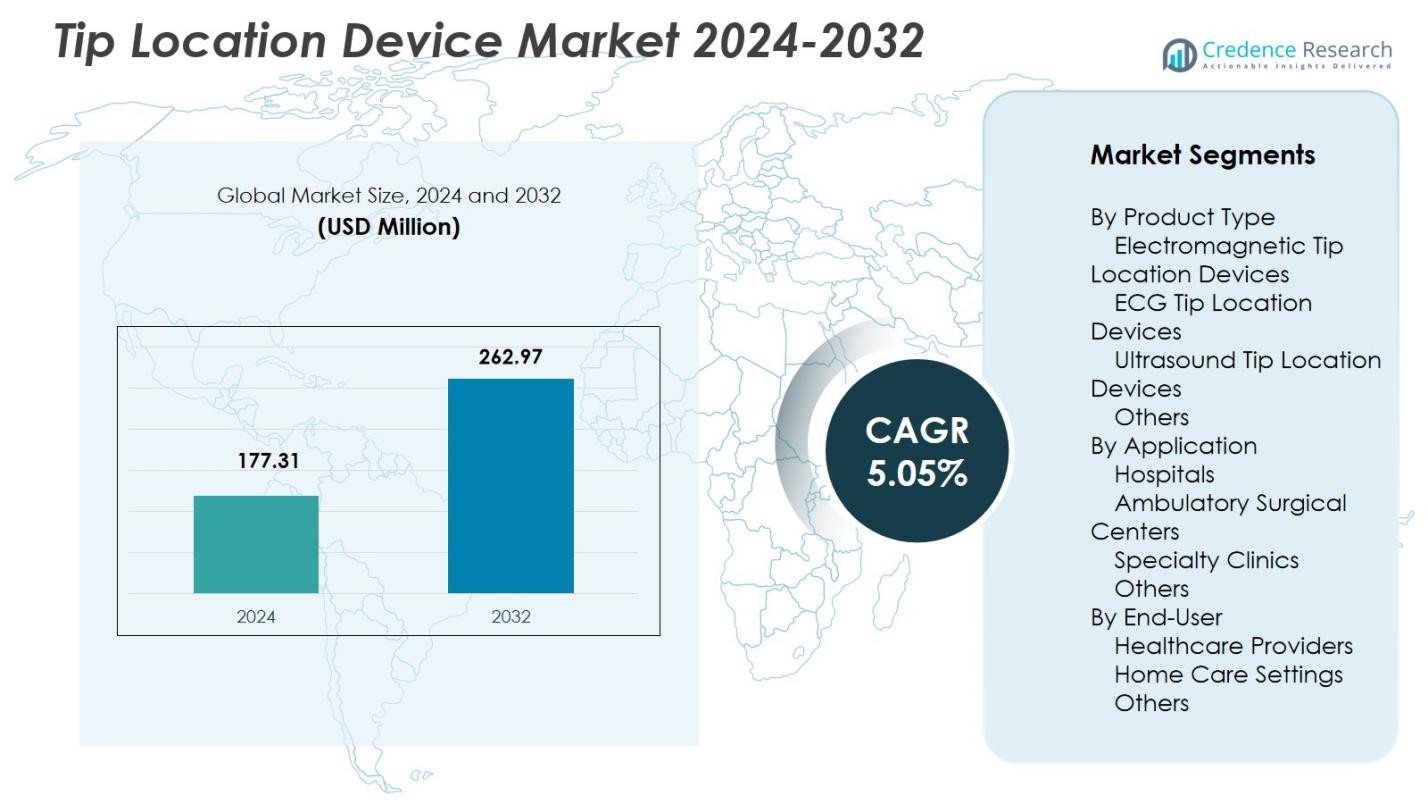

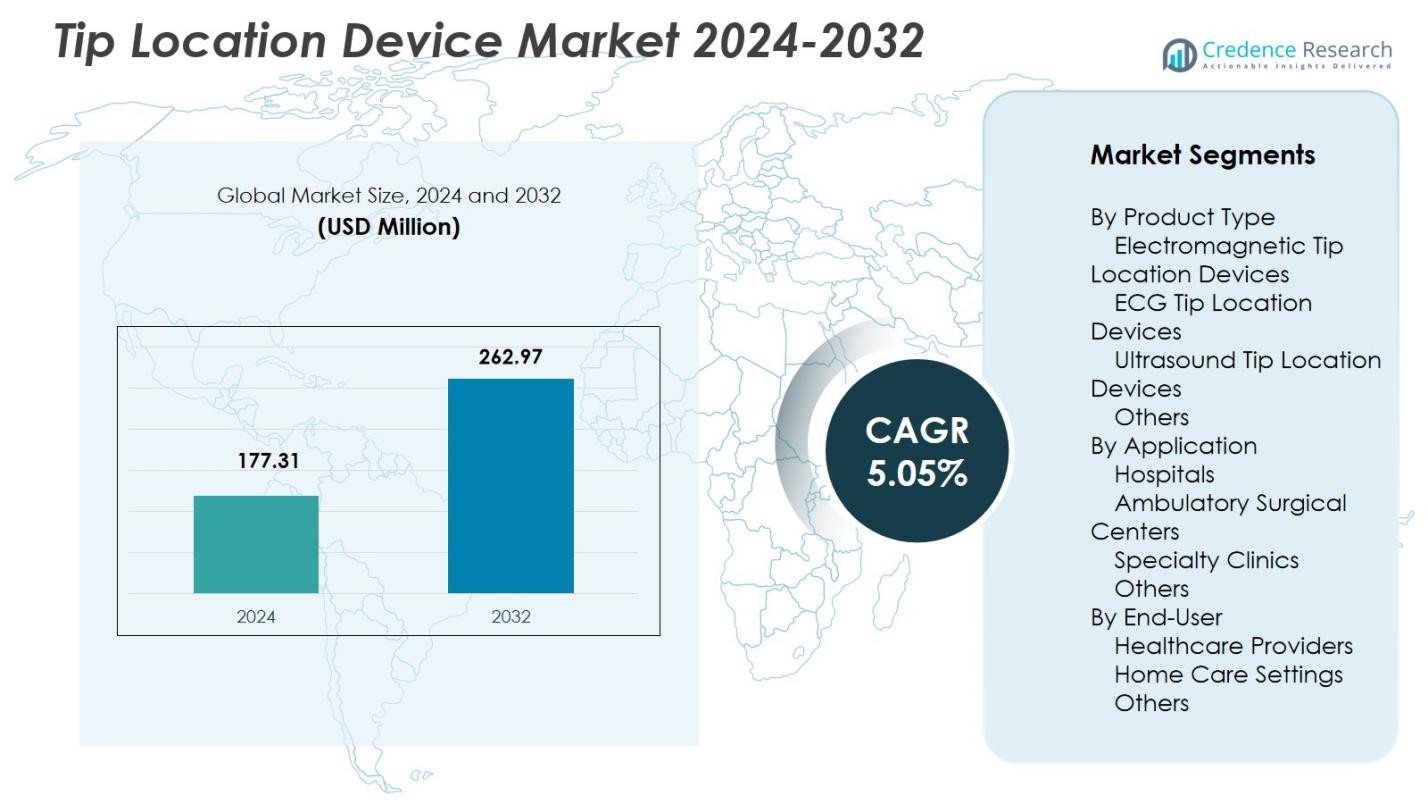

Tip Location Device Market size was valued at USD 177.31 million in 2024 and is anticipated to reach USD 262.97 million by 2032, at a CAGR of 5.05% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tip Location Device Market Size 2024 |

USD 177.31 Million |

| Tip Location Device Market, CAGR |

5.05% |

| Tip Location Device Market Size 2032 |

USD 262.97 Million |

Tip Location Device Market features leading players such as Becton, Dickinson and Company (BD), Teleflex Incorporated, AngioDynamics, Vygon SA, Smiths Medical, Medtronic plc, Boston Scientific Corporation, Cook Medical, and Merit Medical Systems, Inc., all focusing on advancing real-time catheter navigation technologies to enhance accuracy and procedural safety. These companies strengthen their positions through innovation in electromagnetic and ECG-based systems that support radiation-free tip confirmation. North America leads the Tip Location Device Market with 38.6% share in 2024, driven by high adoption rates across hospitals and outpatient centers, supported by strong clinical standards, skilled vascular access teams, and continuous technology integration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Tip Location Device Market is valued at USD 177.31 million in 2024 and will grow at a CAGR of 5.05% through 2032.

- Rising use of PICC and central venous catheters in critical care, oncology, and long-term therapies drives demand for real-time electromagnetic and ECG-based navigation systems that improve placement accuracy and reduce complications.

- A major trend is the shift toward radiation-free catheter confirmation, with electromagnetic devices leading the product segment at 8% share, supported by workflow efficiency and safety benefits.

- Key players such as BD, Teleflex, Medtronic, Cook Medical, and Merit Medical advance innovations that enhance visualization and streamline bedside procedures, though high system costs remain a restraint for smaller facilities.

- North America leads the market with 6% share, followed by Europe at 29.4%, while Asia-Pacific grows rapidly with 22.1% share, supported by expanding healthcare infrastructure and rising adoption of image-guided vascular access.

Market Segmentation Analysis:

By Product Type:

The Tip Location Device Market by product type is led by Electromagnetic Tip Location Devices, holding 41.8% market share in 2024, driven by their superior real-time navigation accuracy and reduced dependence on X-ray confirmation. ECG Tip Location Devices follow due to their cost-efficiency and suitability for bedside procedures, while ultrasound-based systems gain traction in settings prioritizing radiation-free workflows. The growing emphasis on improving catheter placement precision, reducing procedural complications, and enhancing workflow efficiency continues to strengthen demand for electromagnetic systems, solidifying their dominant position within the segment.

- For instance, Teleflex’s Arrow VPS Rhythm DLX Device integrates magnetic tracking with ECG to deliver real-time PICC tip location, working alongside the NaviCurve Stylet for precise navigation and eliminating confirmatory chest X-rays.

By Application:

Within the application segment, Hospitals dominate with a 52.4% market share in 2024, primarily due to the high volume of PICC insertions, availability of trained vascular access teams, and adoption of advanced navigation technologies that improve placement accuracy. Ambulatory surgical centers increasingly adopt these devices to support minimally invasive procedures and reduce postoperative complications, while specialty clinics benefit from improved workflow efficiency. The growing shift toward image-guided vascular access and the need to minimize catheter malposition strongly support hospital leadership in the segment.

- For instance, Teleflex’s Arrow PICC with NaviCurve Stylet reached the superior vena cava on first attempt 90% of the time in a benchtop study simulating difficult vasculature, aiding bedside placements.

By End User:

Among end users, Healthcare Providers account for 63.7% market share in 2024, driven by widespread adoption in hospitals, outpatient centers, and integrated care networks where accurate catheter placement is essential for clinical workflow and patient safety. Home care settings show rising uptake due to the expansion of remote infusion therapies and chronic disease management, supported by compact and user-friendly devices. The demand for precision, reduction in procedure time, and improved clinical outcomes reinforces healthcare providers’ dominance and encourages ongoing adoption of advanced tip location technologies across care environments.

Key Growth Drivers

Increasing Demand for Accurate and Safe Catheter Placement

The Tip Location Device Market is gaining momentum as healthcare facilities prioritize precision and safety in vascular access procedures. Growing adoption of PICC lines and central venous catheters in critical care, oncology, and long-term therapy drives the need for technologies that minimize malposition and related complications. Clinicians increasingly rely on real-time electromagnetic and ECG-based systems to improve placement accuracy, reduce dependence on fluoroscopy, and shorten procedure times. This shift toward safer, image-guided interventions significantly strengthens market growth.

- For instance, BD’s Sherlock 3CG Tip Confirmation System integrates magnetic tracking with ECG to display catheter tip position and P-wave morphology changes on one screen, aiding placement near the cavoatrial junction.

Rising Adoption of Minimally Invasive and Bedside Procedures

The expansion of minimally invasive treatments across hospitals and ambulatory centers boosts the adoption of tip location devices that support efficient bedside catheter placement. These technologies enable clinicians to navigate catheters without traditional imaging rooms, resulting in enhanced workflow efficiency and reduced patient movement. The rise in outpatient infusion therapies, home-based care, and chronic disease management further increases demand for portable and easy-to-use systems. As healthcare models shift toward decentralized care, advanced tip confirmation technologies become essential growth catalysts.

- For instance, AngioDynamics’ Celerity Tip Location System employs the patient’s cardiac electrical activity for real-time PICC tip positioning at bedside, FDA-cleared as an adjunct for adult vascular access.

Technological Advancements Enhancing Navigation Accuracy

Continuous innovation in electromagnetic navigation, waveform analysis, and sensor technology is transforming catheter placement practices. New-generation systems offer higher sensitivity, improved anatomical mapping, and seamless integration with vascular access workflows, allowing clinicians to achieve consistent results across diverse patient populations. Product developments focusing on eliminating radiation exposure, enhancing real-time visualization, and improving ease of use strengthen adoption among healthcare providers. These technological enhancements significantly boost market expansion by supporting better patient outcomes and operational efficiency.

Key Trends & Opportunities

Growing Shift Toward Radiation-Free Vascular Access Solutions

A significant trend shaping the Tip Location Device Market is the move away from fluoroscopy-based confirmation to radiation-free alternatives. Electromagnetic and ECG systems offer safer and faster verification, aligning with global hospital initiatives to reduce radiation exposure for both patients and clinicians. This shift presents opportunities for manufacturers to expand portfolios with advanced, ergonomically designed, and real-time navigation tools. As regulatory bodies emphasize safety and hospitals pursue lower-risk workflows, radiation-free technologies gain substantial long-term growth potential.

- For instance, Vygon’s Vygocard 2 intracavitary ECG tip location system provides non-radiographic, real-time control of central venous catheter tip position by analyzing P‑wave morphology changes, eliminating patient irradiation during placement.

Expansion of Home Infusion Therapy and Remote Care Models

The rapid rise of home-based infusion therapy creates strong opportunities for compact and user-friendly tip location devices. As chronic diseases requiring long-term intravenous therapies increase, healthcare providers seek solutions that ensure accurate catheter placement outside traditional hospital settings. This trend opens avenues for portable systems suitable for visiting nurses and trained caregivers. The shift toward decentralized care, driven by cost efficiency and patient comfort, positions home-based vascular access solutions as a major opportunity for market growth.

- For instance, Navi Medical Technologies’ Neonav ECG tip location system uses real-time signal analysis for CVAD placement, reducing misplacements and X-ray needs in home or bedside settings.

Key Challenges

High Cost of Advanced Navigation Systems

Despite clear clinical benefits, the adoption of advanced electromagnetic and real-time navigation devices is hindered by their high acquisition and maintenance costs. Budget constraints in small hospitals, clinics, and home care programs limit widespread implementation, especially in price-sensitive regions. Facilities often rely on traditional confirmation methods due to lower upfront expenses, slowing transition toward modern navigation technologies. Manufacturers face the challenge of balancing innovation with affordability to increase penetration across diverse healthcare environments.

Limited Skilled Workforce for Specialized Vascular Access Procedures

The effectiveness of tip location devices relies heavily on clinician expertise, and many healthcare settings face shortages of trained vascular access specialists. Inadequate training, inconsistent procedural protocols, and lack of standardized competency programs lead to suboptimal use of advanced navigation systems. This challenge is more pronounced in developing regions where investment in specialized clinical skills remains limited. Addressing workforce gaps through training programs and simplified device interfaces is essential to unlock the market’s full adoption potential.

Regional Analysis

North America

North America leads the Tip Location Device Market with 38.6% market share in 2024, driven by strong adoption of advanced vascular access technologies across hospitals, ambulatory surgical centers, and specialized infusion clinics. High procedural volumes for PICC insertions, well-established clinical guidelines, and widespread availability of trained vascular access teams support regional dominance. The presence of major manufacturers, continuous product innovations, and strong reimbursement frameworks further accelerate market penetration. Growing emphasis on radiation-free catheter confirmation methods continues to strengthen demand, solidifying North America’s position as the largest regional market.

Europe

Europe holds 29.4% market share in 2024, supported by increasing implementation of evidence-based vascular access protocols and rising investments in advanced catheter navigation systems. Hospitals across Western Europe actively adopt electromagnetic and ECG-based devices to reduce malposition rates and improve patient safety. The region benefits from structured training programs for vascular access nurses and strong regulatory focus on minimizing radiation exposure in clinical procedures. Growing demand for minimally invasive and bedside catheter placements, coupled with expanding outpatient infusion services, contributes to steady market growth across major countries including Germany, the U.K., France, and Italy.

Asia-Pacific

Asia-Pacific captures 22.1% market share in 2024, driven by the expansion of healthcare infrastructure, rising hospitalization rates, and increasing adoption of PICC and central line insertions in China, India, Japan, and Southeast Asia. The region experiences rapid modernization of vascular access practices as hospitals shift toward safe, radiation-free navigation technologies. Growing investments in critical care, pediatric care, and oncology further elevate device demand. Despite variability in training and awareness levels, improving clinical standards and rising medical tourism enhance the market outlook, making Asia-Pacific one of the fastest-growing regions for tip location devices.

Latin America

Latin America accounts for 5.8% market share in 2024, supported by increasing uptake of vascular access procedures in urban hospitals and expanding critical care services. Countries such as Brazil, Mexico, and Argentina witness growing awareness of malposition prevention and the clinical value of real-time tip confirmation technologies. Budget constraints and inconsistent training resources limit widespread adoption; however, gradual modernization of healthcare systems and rising demand for minimally invasive therapies create growth opportunities. The shift toward improved patient safety standards and expanding oncology and infusion care services continue to drive market adoption across the region.

Middle East & Africa

The Middle East & Africa region holds 4.1% market share in 2024, driven by growing investments in advanced medical technologies in Gulf countries and the expansion of private healthcare networks. Adoption remains concentrated in tertiary hospitals that prioritize precision in vascular access and seek to reduce complications associated with catheter misplacement. Limited availability of specialized vascular access teams and budget restrictions in several African nations slow overall penetration. Nonetheless, increasing focus on improving critical care capabilities, rising prevalence of chronic diseases, and healthcare modernization initiatives support gradual uptake of tip location devices across the region.

Market Segmentations:

By Product Type

- Electromagnetic Tip Location Devices

- ECG Tip Location Devices

- Ultrasound Tip Location Devices

- Others

By Application

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Others

By End-User

- Healthcare Providers

- Home Care Settings

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the Tip Location Device Market features leading companies such as Becton, Dickinson and Company (BD), Teleflex Incorporated, AngioDynamics, Inc., Vygon SA, C. R. Bard, Inc., Smiths Medical, Medtronic plc, Boston Scientific Corporation, Cook Medical, and Merit Medical Systems, Inc. These players strengthen their market positions through continuous technological advancements, expanding product portfolios, and integration of real-time electromagnetic and ECG-based navigation systems. Manufacturers increasingly focus on improving device accuracy, reducing radiation exposure, and enhancing workflow efficiency to meet evolving clinical needs across hospitals and outpatient settings. Strategic initiatives, including product launches, geographic expansion, and partnerships with healthcare providers, contribute to wider adoption. Companies also emphasize training programs for vascular access teams to drive effective use of advanced tip location technologies. With rising demand for safe and precise catheter placement, industry leaders continue to invest in innovation to maintain strong market competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cook Medical

- Teleflex Incorporated

- Boston Scientific Corporation

- Vygon SA

- Medtronic plc

- Merit Medical Systems, Inc.

- AngioDynamics, Inc.

- Smiths Medical

- Becton, Dickinson and Company (BD)

- C. R. Bard, Inc.

Recent Developments

- In October 2025, Becton, Dickinson and Company (BD) India launched the Sherlock 3CG+ system to enhance PICC line placement accuracy and bedside tip confirmation.

- In July 2025, Piccolo Medical received FDA clearance for its second-generation SmartPICC technology, which uses cardiac activity for real-time catheter tip confirmation and ionic dilution for navigation, eliminating chest X-rays.

- In October 2025, BD India launched the Sherlock 3CG+ Tip Confirmation System, enabling live PICC tracking, navigation, and ECG-based bedside tip confirmation to reduce malpositions during insertions.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as hospitals and clinics prioritize real-time, radiation-free catheter placement technologies.

- Advanced electromagnetic and ECG-based systems will gain broader adoption due to their superior accuracy and workflow efficiency.

- Home infusion therapy growth will drive demand for portable, user-friendly tip location devices suitable for decentralized care models.

- Integration of navigation systems with smart vascular access platforms will enhance clinical decision-making and procedural consistency.

- Increasing focus on reducing catheter-related complications will support wider implementation of standardized tip confirmation protocols.

- Manufacturers will invest more in training and education to address skill gaps among vascular access professionals.

- Emerging markets will experience accelerated adoption as healthcare infrastructure modernizes and clinical safety standards improve.

- Product innovations will emphasize ergonomic design, faster setup, and seamless compatibility with existing care workflows.

- Partnerships between device companies and healthcare networks will strengthen procurement and long-term utilization.

- Regulatory support for radiation-free procedures will reinforce demand for advanced tip location technologies across care settings.