Market Overview

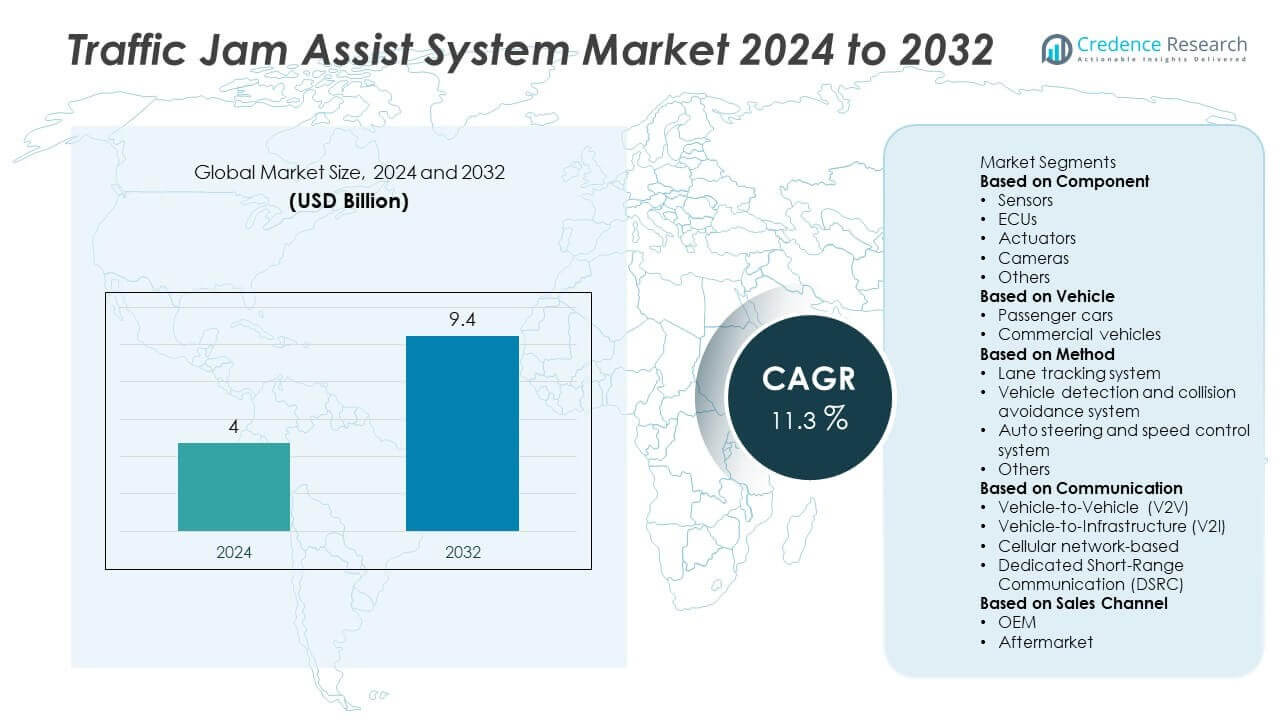

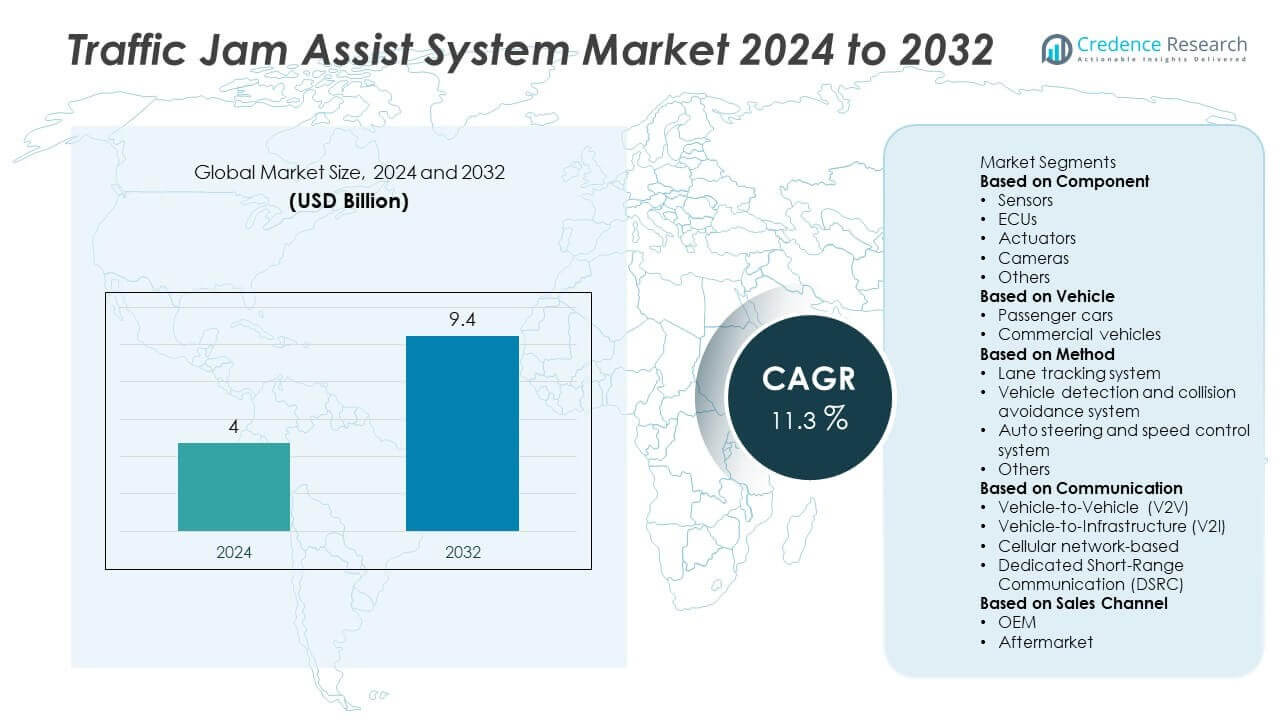

Traffic Jam Assist System Market size was valued at USD 4 billion in 2024 and is projected to reach USD 9.4 billion by 2032, growing at a CAGR of 11.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Traffic Jam Assist System Market Size 2024 |

USD 4 Billion |

| Traffic Jam Assist System Market, CAGR |

11.3% |

| Traffic Jam Assist System Market Size 2032 |

USD 9.4 Billion |

The Traffic Jam Assist System Market grows through rising demand for advanced driver assistance technologies, stricter safety regulations, and increasing urban congestion. Automakers integrate traffic jam assist to enhance comfort, reduce driver fatigue, and improve safety in slow-moving traffic.

The Traffic Jam Assist System Market demonstrates strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, each contributing through distinct growth factors. North America leads adoption through advanced automotive infrastructure, high consumer awareness, and strict road safety regulations that encourage integration of semi-autonomous driving features. Europe emphasizes regulatory compliance and technological innovation, with Germany, France, and the United Kingdom driving widespread adoption across luxury and mass-market vehicles. Asia-Pacific records rapid growth, supported by strong automotive manufacturing in China, Japan, and South Korea, as well as rising urban congestion in India and Southeast Asia. Latin America and the Middle East & Africa show gradual adoption, fueled by luxury vehicle imports and smart mobility initiatives. Key players shaping the market include Bosch, Continental, Aptiv PLC, and Mobileye, all of which focus on advancing AI-driven systems, sensor fusion, and collaborative innovation with global automakers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Traffic Jam Assist System Market was valued at USD 4 billion in 2024 and is projected to reach USD 9.4 billion by 2032, at a CAGR of 11.3%.

- Growth is driven by rising demand for advanced driver assistance systems that improve safety, reduce fatigue, and manage vehicle control in urban congestion.

- Key trends include the integration of AI and machine learning, the expansion of semi-autonomous driving features into mid-range vehicles, and rising collaborations between automakers and technology providers.

- Competitive dynamics feature leading companies such as Bosch, Continental, Aptiv PLC, and Mobileye, which focus on AI-driven systems, sensor fusion, and scalable solutions for both premium and mass-market vehicles.

- Market restraints include high system implementation costs, technical complexity, and varying regulatory frameworks that limit global standardization and slow adoption in emerging economies.

- Regional analysis highlights North America and Europe as leaders due to advanced automotive infrastructure and regulatory support, while Asia-Pacific shows the fastest growth driven by vehicle production and urbanization.

- Overall, the Traffic Jam Assist System Market demonstrates resilience through innovation, strategic partnerships, and continuous expansion into new vehicle categories, reinforcing its role in the evolution of intelligent mobility worldwide.

Market Drivers

Rising Demand for Advanced Driver Assistance Systems

The Traffic Jam Assist System Market grows through increasing adoption of advanced driver assistance technologies. Rising vehicle congestion in urban areas drives demand for semi-autonomous features that reduce driver fatigue. It improves safety by managing acceleration, braking, and steering in slow traffic. Automakers integrate such systems to enhance vehicle value and meet customer expectations. Growing awareness of road safety strengthens interest in intelligent driving technologies. The focus on convenience and efficiency positions traffic jam assist as a key feature in modern vehicles.

- For instance, the Volkswagen Group has intensified its collaboration with Mobileye for its premium brands, including Porsche, Audi, Bentley, and Lamborghini. Based on the Mobileye SuperVision and Chauffeur platforms, these brands will implement advanced features for highway and urban driving.

Stringent Safety Regulations and Government Policies

Regulatory mandates push adoption of advanced safety systems across automotive markets. Governments emphasize reducing traffic accidents through intelligent driver assistance solutions. The Traffic Jam Assist System Market benefits from compliance with safety frameworks such as Euro NCAP and NHTSA standards. Automakers prioritize these technologies to achieve higher safety ratings. It also supports regulatory goals for accident reduction in high-density traffic areas. These policies ensure consistent demand from manufacturers aiming to align with safety standards.

- For instance, in August 2025 Bosch and CARIAD advanced their AI-based automated driving software stack—targeting Level 2 and Level 3 functionality—with testing in hundreds of vehicles (like the VW ID.Buzz and Audi Q8) across Europe, Japan, and the U.S., aiming for production deployment starting mid-2026 in Volkswagen Group’s new software-defined architecture.

Integration of AI and Sensor Fusion Technologies

Advancements in artificial intelligence, sensor fusion, and machine learning drive market growth. Traffic jam assist relies on radar, cameras, and LiDAR for accurate environment detection. It improves vehicle control by processing real-time traffic data. The integration of AI enhances decision-making, enabling smoother lane-keeping and adaptive cruise functions. Automakers adopt these innovations to deliver advanced user experience. Continuous development in intelligent sensing platforms strengthens the performance of traffic jam assist systems.

Growing Consumer Demand for Comfort and Convenience

Rising consumer preference for convenience-based driving features fuels adoption. The Traffic Jam Assist System Market addresses this demand by offering stress-free navigation in traffic congestion. It enhances comfort by reducing the need for manual braking and steering during slow commutes. Luxury and premium car segments lead adoption, but mid-range vehicles increasingly feature such systems. It boosts driver satisfaction and supports brand loyalty. The convenience factor positions traffic jam assist as a desirable automotive feature across segments.

Market Trends

Expansion of Semi-Autonomous Driving Features

The Traffic Jam Assist System Market reflects a strong trend toward semi-autonomous driving technologies. Automakers integrate advanced driver assistance features to reduce stress in congested traffic. It combines adaptive cruise control and lane-keeping to create a safer driving environment. Consumers increasingly value partial automation as a bridge to fully autonomous vehicles. The trend gains momentum with OEMs deploying traffic jam assist in both luxury and mid-segment cars. This adoption positions the system as a mainstream mobility solution.

- For instance, Aptiv’s autonomous ride program in Las Vegas delivered over 100,000 paid self-driving rides with a human safety driver behind the wheel, drawing from real-world deployment data in partnership with Lyft. Aptiv and Lyft announced this milestone in February 2020, reporting that 98% of passengers rated the experience 5-out-of-5 stars.

Integration of AI and Machine Learning in Vehicle Systems

AI and machine learning enhance the intelligence of modern driving assistance platforms. The Traffic Jam Assist System Market benefits from real-time data processing that improves accuracy and responsiveness. It supports predictive adjustments in braking and steering, enhancing safety in unpredictable conditions. Automakers use AI-driven algorithms to refine system performance over time. The integration ensures adaptability across diverse driving environments. This trend underscores the shift toward smarter, self-learning vehicle technologies.

- For instance, ZF’s AI-enabled cloud validation tool, ZF Annotate, accelerates ADAS sensor validation by up to 10 times faster while reducing costs by 80%, streamlining development cycles for modules including traffic jam assist—from Level 2+ to Level 5 systems.

Rising Collaboration Between Automakers and Technology Providers

Partnerships between automotive manufacturers and tech companies continue to expand. The Traffic Jam Assist System Market advances through joint development of sensors, processors, and software platforms. It enables rapid innovation while lowering development costs for OEMs. Tech companies contribute expertise in AI, LiDAR, and vision systems that enhance accuracy. Automakers leverage these collaborations to differentiate product offerings. The trend highlights cross-industry cooperation as a driver of competitive advantage.

Growing Availability in Mid-Range Vehicle Segments

Traffic jam assist was once limited to premium and luxury vehicles. The Traffic Jam Assist System Market now expands into mid-range models to address wider consumer demand. It broadens accessibility by making convenience and safety features more affordable. Automakers integrate scaled-down versions of the system in compact cars and SUVs. This democratization supports wider adoption across diverse demographics. The trend strengthens the role of traffic jam assist as a core automotive feature.

Market Challenges Analysis

High Implementation Costs and Technical Complexity

The Traffic Jam Assist System Market faces challenges from high implementation costs and technical complexity. Advanced sensors, radars, and AI-driven processors increase production expenses for automakers. It raises the overall vehicle price, limiting adoption among cost-sensitive buyers. Smaller manufacturers struggle to balance affordability with system integration. Continuous updates to hardware and software add further investment requirements. These cost-related barriers slow mass adoption, especially in emerging markets where purchasing power is limited.

Regulatory Uncertainty and Consumer Trust Issues

Unclear regulations on semi-autonomous driving features hinder widespread deployment. The Traffic Jam Assist System Market must align with safety standards that differ across regions. It creates challenges for OEMs aiming to develop standardized platforms. Consumer trust also remains a barrier, as drivers show reluctance in relying fully on automated systems. Concerns about reliability in complex traffic conditions intensify hesitation. Building confidence requires proven safety records, transparent regulations, and broader public awareness.

Market Opportunities

Rising Adoption of Autonomous and Connected Vehicle Technologies

The Traffic Jam Assist System Market presents strong opportunities with the global shift toward autonomous and connected vehicles. Automakers invest heavily in advanced driver assistance platforms to strengthen brand competitiveness. It supports smoother integration with vehicle-to-vehicle and vehicle-to-infrastructure communication. The growing demand for safer, more efficient mobility solutions aligns with system capabilities. Governments encourage adoption by funding smart mobility initiatives and supporting intelligent transportation systems. These factors create a favorable environment for large-scale deployment.

Expanding Penetration in Mass-Market Vehicle Segments

Wider adoption of driver assistance features in affordable models opens new growth potential. The Traffic Jam Assist System Market can expand beyond premium vehicles into compact and mid-range cars. It provides automakers with opportunities to attract broader consumer demographics. Rising urban congestion in emerging economies strengthens demand for accessible solutions. Cost reductions through economies of scale and technological advancements further improve feasibility. These developments position traffic jam assist as a mainstream automotive feature worldwide.

Market Segmentation Analysis:

By Component

The Traffic Jam Assist System Market segments by component into hardware, software, and services. Hardware dominates due to the extensive use of sensors, radars, cameras, and LiDAR for real-time monitoring. It ensures accurate detection of vehicles, lanes, and obstacles in dense traffic. Software plays a growing role, enabling advanced algorithms and AI integration for decision-making and predictive responses. It enhances adaptability across diverse traffic environments and strengthens driver safety. Services such as maintenance, calibration, and software updates support long-term system performance. Together, these components establish a balanced ecosystem for reliable deployment.

- For instance, in November 2023, Valeo announced it had produced its 20 millionth front camera system incorporating Mobileye EyeQ technology. The company did, produce its 100 millionth camera overall in April 2022. Valeo’s front camera systems are deployed globally in advanced driver-assistance systems (ADAS) solutions, many of which enable functions like traffic jam assist through lane detection and adaptive cruise control integration.

By Vehicle

Segmentation by vehicle highlights passenger cars and commercial vehicles as key categories. Passenger cars lead adoption, driven by strong demand for comfort, convenience, and safety features. It records high penetration in luxury and premium vehicles, with increasing integration in mid-range models. Commercial vehicles show growing adoption to reduce driver fatigue during long congested routes. The emphasis on fleet safety and regulatory compliance supports system deployment across buses and delivery vehicles. Both categories highlight traffic jam assist as a practical solution for modern mobility.

- For instance, Mercedes-Benz enhanced its Level 3 Drive Pilot system in December 2024, securing approval to operate at speeds up to 95 km/h across the full 13,191 km of Germany’s Autobahn network. The system, available on S-Class and EQS models, employs more than 35 sensors—including cameras, radars, ultrasonic sensors, and LiDAR—and can be updated via over-the-air or at workshops at no extra cost to owners.

By Method

The market segments by method into autonomous and semi-autonomous systems. Semi-autonomous platforms currently dominate due to regulatory approvals and consumer trust in partial automation. It supports features such as adaptive cruise control and lane-keeping assistance under driver supervision. Autonomous methods gain traction with advancements in AI and sensor fusion, offering higher levels of independence. Ongoing trials and pilot projects strengthen confidence in fully automated solutions. The evolution of both methods ensures adaptability across vehicle categories and consumer needs. This segmentation demonstrates how traffic jam assist technologies align with the gradual transition toward full vehicle autonomy.

Segments:

Based on Component

- Sensors

- ECUs

- Actuators

- Cameras

- Others

Based on Vehicle

- Passenger cars

- Commercial vehicles

Based on Method

- Lane tracking system

- Vehicle detection and collision avoidance system

- Auto steering and speed control system

- Others

Based on Communication

- Vehicle-to-Vehicle (V2V)

- Vehicle-to-Infrastructure (V2I)

- Cellular network-based

- Dedicated Short-Range Communication (DSRC)

Based on Sales Channel

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest position in the Traffic Jam Assist System Market with a market share of 35% in 2024. The region benefits from early adoption of advanced driver assistance technologies and strong automotive innovation. Automakers in the United States integrate traffic jam assist into both premium and mid-range vehicles to enhance customer appeal. It gains support from strict road safety regulations that encourage automation and intelligent mobility solutions. Canada contributes through demand for connected cars and government initiatives on road safety modernization. High consumer awareness and strong presence of technology providers accelerate deployment across the region. The established infrastructure for autonomous driving further strengthens North America’s leadership position.

Europe

Europe represents a market share of 30% in 2024, supported by stringent regulatory frameworks and consumer preference for advanced safety features. Euro NCAP safety ratings and strict emission standards push automakers to adopt intelligent systems at scale. Germany, France, and the United Kingdom drive demand through integration of traffic jam assist in luxury and mass-market vehicles. It aligns with Europe’s focus on reducing road accidents and promoting semi-autonomous driving features. Consumers in the region show higher trust in intelligent mobility, reinforcing demand across vehicle categories. Partnerships between OEMs and technology suppliers further improve system performance and innovation. Europe maintains a strong position as a hub for automotive and safety technology advancements.

Asia-Pacific

Asia-Pacific accounts for 22% of the global market share in 2024, reflecting its rapid expansion across major automotive markets. China leads adoption with government initiatives for smart mobility and strong demand for connected vehicles. Japan and South Korea enhance the region’s position through advanced automotive manufacturing and strong R&D investment. It also records growing adoption in India and Southeast Asia, where rising congestion fuels demand for intelligent assistance systems. Expanding passenger car sales, particularly in premium and luxury segments, strengthen adoption. Asia-Pacific is expected to grow at the fastest pace due to its large population base, rising incomes, and ongoing investment in automotive innovation.

Latin America

Latin America secures a market share of 8% in 2024, driven primarily by Brazil and Mexico. Rising urban congestion and consumer demand for comfort-oriented technologies support adoption of semi-autonomous features. Imports of luxury and high-end vehicles equipped with traffic jam assist also contribute to market growth. It faces challenges such as high system costs and limited infrastructure for advanced mobility solutions. Governments are working to modernize transport systems and introduce road safety standards, creating growth potential. The region is witnessing gradual adoption as global automakers expand product offerings tailored to regional needs.

Middle East & Africa

The Middle East & Africa hold the smallest market share at 5% in 2024, but show emerging potential. Gulf nations such as Saudi Arabia and the United Arab Emirates dominate regional adoption, supported by smart city projects and demand for luxury vehicles. South Africa records modest growth through integration of driver assistance features in urban centers. It faces barriers such as low awareness and high costs that limit broad-scale penetration. However, investments in connected vehicle infrastructure and diversification strategies provide long-term opportunities. The region is gradually positioning itself as a future growth market for intelligent mobility technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hitachi Astemo

- Mobileye

- Volkswagen

- Aptiv PLC

- Bosch

- Magna International

- Valeo

- Continental

- ZF Friedrichshafen

- NXP Semiconductors

Competitive Analysis

The competitive landscape of the Traffic Jam Assist System Market features leading players such as Aptiv PLC, Bosch, Continental, Hitachi Astemo, Magna International, Mobileye, NXP Semiconductors, Valeo, Volkswagen, and ZF Friedrichshafen. These companies drive innovation by focusing on advanced driver assistance technologies that combine AI, machine learning, and sensor fusion to deliver safer and more efficient mobility solutions. They prioritize integration of radar, cameras, and LiDAR to enhance system accuracy and reliability in complex traffic conditions. Strategic collaborations between OEMs and technology suppliers accelerate product development and expand adoption across both premium and mid-range vehicle segments. Investments in R&D emphasize improved software algorithms, cost reduction, and compliance with evolving safety regulations. Automakers leverage these partnerships to gain competitive advantages while addressing growing consumer demand for comfort and convenience. The strong presence of these players across global markets ensures robust competition, with differentiation achieved through technological leadership, scalable solutions, and strategic alliances that shape the future of semi-autonomous driving.

Recent Developments

- In June 2025, Hitachi Astemo sponsored the Automotive Summit 2025 to showcase its latest advancements in 360-degree 3D sensing and Smart Brake (brake-by-wire) systems designed for advanced driver assistance in congested traffic conditions.

- In March 2025, Volkswagen announced a collaboration with Mobileye and Valeo to integrate Level 2+ ADAS—including traffic-jam assist, driver monitoring, and hands-free driving—in upcoming high-volume models. Valeo contributes ECUs and sensors; Mobileye brings cameras, radar, and mapping tech.

- In January 2025, At CES 2025, Aptiv debuted its Gen 6 ADAS platform, featuring “hands-off urban assist” to improve traffic-jam handling through integrated AI/ML, a birds-eye-view camera, and ultrashort-range radar for 360-degree sensing and blind-spot elimination

- In 2023, Mobileye launched its SuperVision™ system offering traffic-jam assist among other features like autonomous lane changing and hazard detection.

Report Coverage

The research report offers an in-depth analysis based on Component, Vehicle, Method, Communication, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with growing demand for semi-autonomous driving features in urban areas.

- AI and machine learning will enhance system accuracy, decision-making, and overall performance.

- Wider integration of traffic jam assist in mid-range vehicles will increase accessibility.

- Partnerships between automakers and technology providers will accelerate product development.

- Advances in sensor fusion using radar, LiDAR, and cameras will improve reliability.

- Regulatory frameworks will encourage adoption by setting stricter road safety standards.

- Rising e-mobility adoption will support system integration in electric and hybrid vehicles.

- Consumer preference for convenience and comfort will drive higher adoption rates.

- Emerging markets in Asia-Pacific and Latin America will contribute to strong growth.

- Continuous innovation in cost reduction will make systems more affordable for mass markets.