Market Overview:

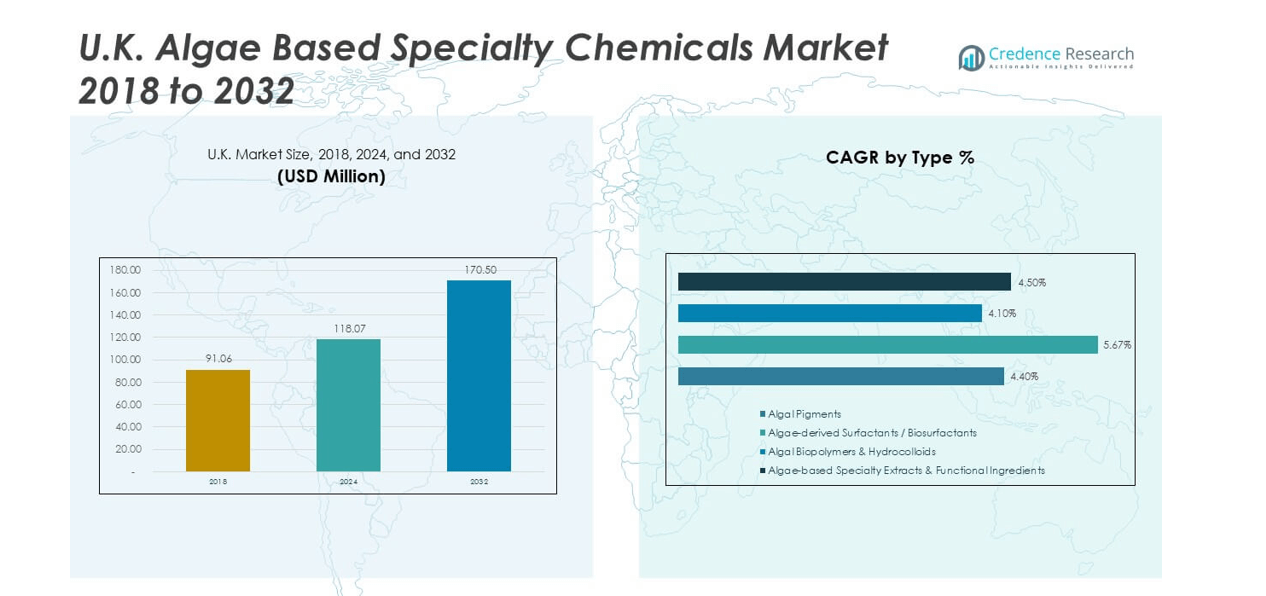

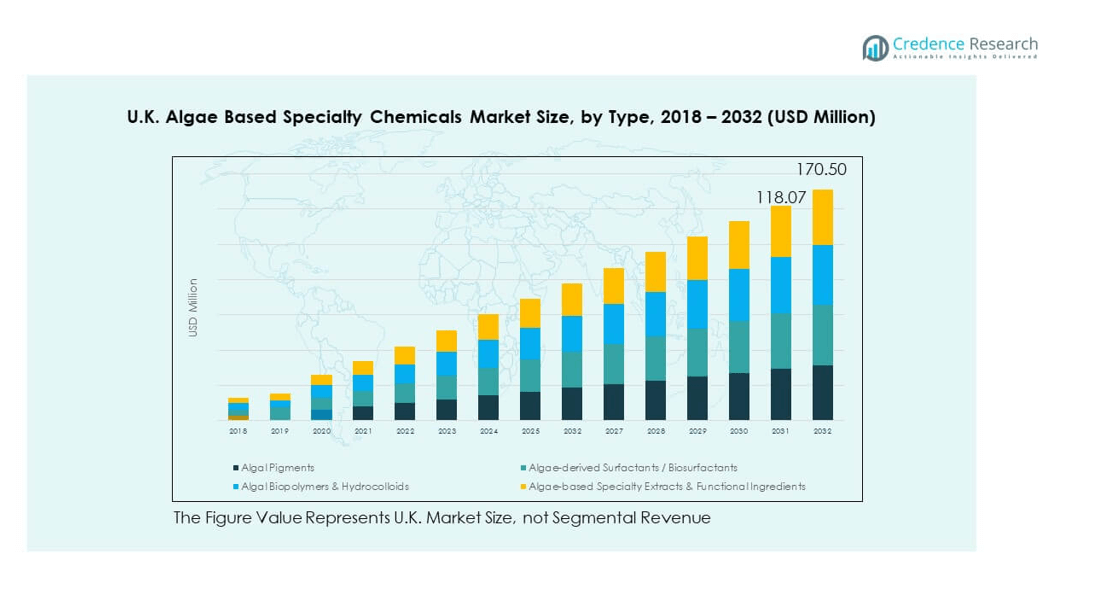

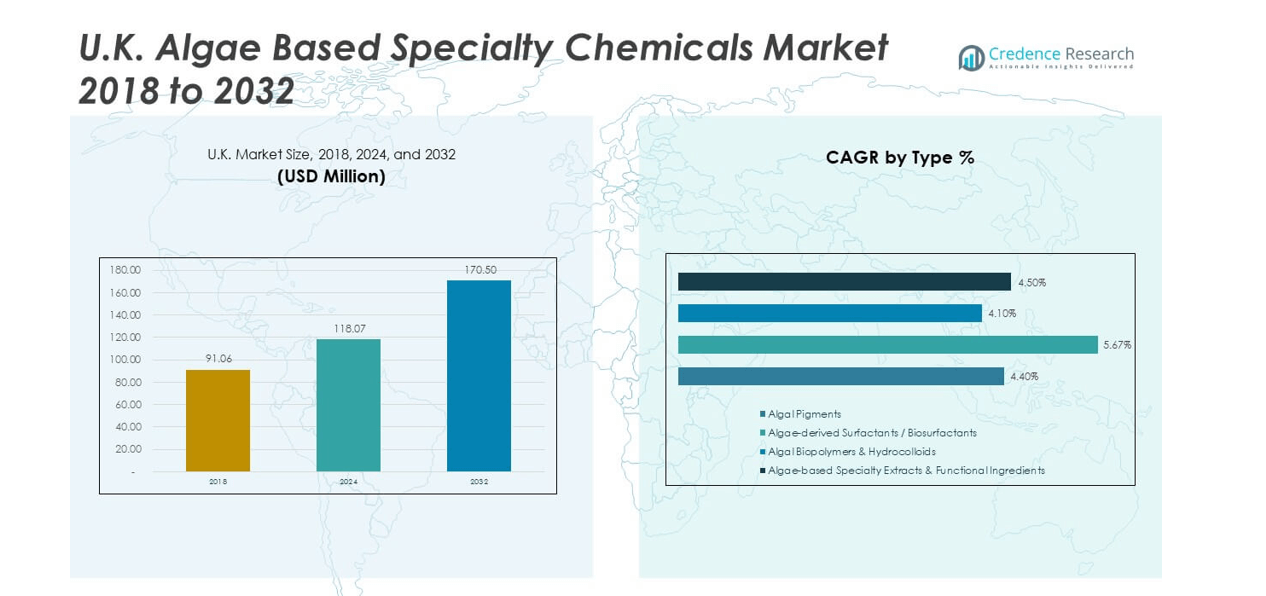

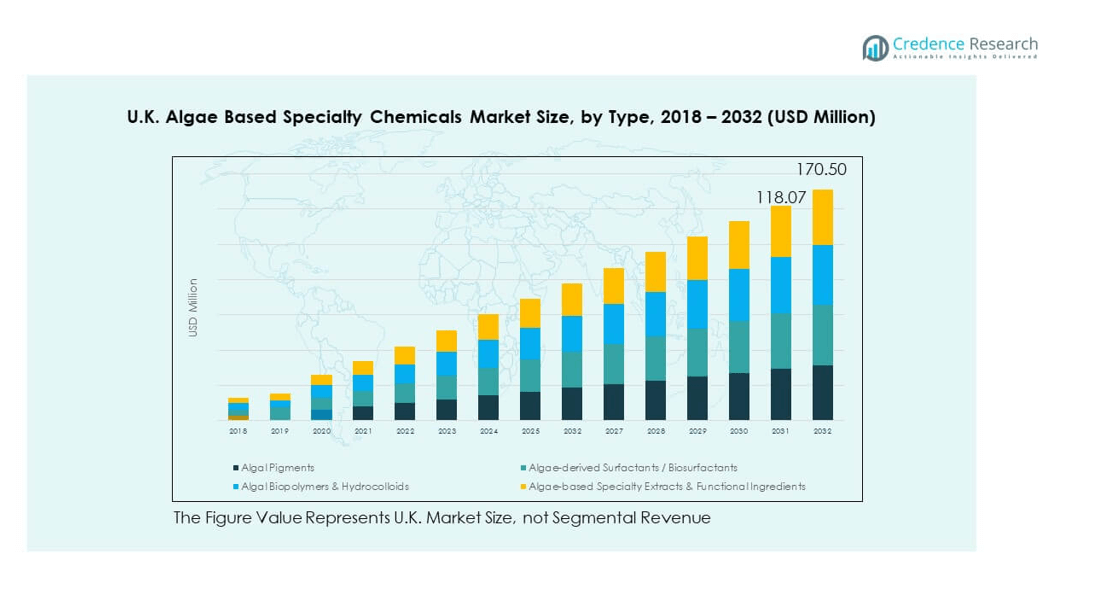

The UK Algae Based Specialty Chemicals Market size was valued at USD 91.06 million in 2018 to USD 118.07 million in 2024 and is anticipated to reach USD 170.5 million by 2032, at a CAGR of 5.09% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Algae Based Specialty Chemicals Market Size 2024 |

USD 118.07 million |

| UK Algae Based Specialty Chemicals Market, CAGR |

5.09% |

| UK Algae Based Specialty Chemicals Market Size 2032 |

USD 170.5 million |

The market is driven by rising demand for sustainable and bio-based alternatives across industries such as food, nutraceuticals, cosmetics, and pharmaceuticals. It benefits from growing consumer preference for natural ingredients, clean-label products, and environmentally responsible solutions. Technological advancements in algae cultivation and processing enhance product quality and scalability, making algae-based chemicals more viable for commercial adoption. Supportive government policies targeting green chemistry and reduced carbon footprints further strengthen market momentum.

Regionally, England leads the market with its strong biotechnology ecosystem, industrial adoption, and research-driven collaborations between universities and private companies. Scotland shows rapid growth, leveraging its aquaculture and marine biotechnology strengths to expand algae-based solutions. Wales and Northern Ireland are emerging players, driven by policy support for renewable resources and innovation hubs targeting niche applications. Together, these subregions contribute to a competitive and diversified market landscape, positioning the UK as a key hub in Europe’s sustainable specialty chemicals sector.

Market Insights

- The UK Algae Based Specialty Chemicals Market was valued at USD 91.06 million in 2018, reached USD 118.07 million in 2024, and is projected to attain USD 170.5 million by 2032, growing at a CAGR of 5.09%.

- England holds 48% of the market share, driven by advanced biotech clusters and industrial demand, while Scotland follows with 27% due to its strong aquaculture base, and Wales/Northern Ireland together account for 25%, supported by renewable resource initiatives.

- Scotland is the fastest-growing subregion with a 27% share, leveraging marine biotechnology expertise and aquaculture applications to expand algae-based solutions.

- Algal pigments account for 35% of the market, supported by applications in cosmetics, food, and nutraceuticals that demand natural and stable colorants.

- Algal biopolymers and hydrocolloids contribute 30%, driven by rising adoption in sustainable packaging and food formulations that require stability and functionality.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Bio-Based Ingredients Across Multiple Industries

The UK Algae Based Specialty Chemicals Market benefits from strong demand across personal care, pharmaceuticals, food, and industrial sectors. Companies prioritize natural ingredients to replace petroleum-derived chemicals. It is supported by consumers seeking eco-friendly alternatives aligned with sustainability goals. Regulatory pressure for greener raw materials pushes manufacturers toward algae-based solutions. Producers invest in scalable cultivation and extraction technologies to meet this demand. Corporate sustainability commitments further amplify adoption in product portfolios. Government-backed environmental targets reinforce reliance on renewable chemical sources. Continuous preference for clean-label products secures algae-based chemicals as strategic substitutes.

Technological Advancements Supporting Efficient Production and Scalability

Modern innovations in algae cultivation systems strengthen cost efficiency and enhance product quality. The UK Algae Based Specialty Chemicals Market gains from controlled photobioreactor technologies that allow consistent output. It ensures better yield of pigments, proteins, and functional compounds. Automation and AI-driven monitoring create precision in harvesting and processing stages. Manufacturers expand pilot-scale projects into commercial facilities with improved operational viability. Research partnerships with universities support breakthroughs in cultivation techniques. Energy-efficient downstream processing reduces waste and strengthens sustainability credentials. Businesses scale production faster to meet growing regional and global demand.

- For example, Varicon Aqua, headquartered in the UK, is a leading manufacturer of photobioreactors such as the Phyco-Range systems, which are designed to provide controlled environments for algae cultivation. These closed-system technologies are used in research and commercial projects across Europe to support the production of pigments and bioactive compounds.

Regulatory Policies Encouraging Green Chemistry Adoption

Policy frameworks in the UK emphasize sustainability and carbon reduction strategies. The UK Algae Based Specialty Chemicals Market grows due to compliance needs from strict environmental laws. It benefits manufacturers adopting natural inputs for cleaner production cycles. Regulators promote alternatives to hazardous chemicals in consumer and industrial goods. Alignment with European green strategies amplifies research funding opportunities. Corporate responsibility programs gain value when linked to policy-driven eco mandates. New certifications for bio-based inputs create market access advantages. Environmental compliance combined with financial incentives drives faster adoption of algae-derived inputs.

Shifting Consumer Preferences Toward Health and Sustainability

Consumer behavior strongly supports natural and plant-based products. The UK Algae Based Specialty Chemicals Market aligns with lifestyle changes favoring wellness and eco-conscious choices. It responds to the demand for safer cosmetics, functional foods, and supplements. Algae-derived omega-3 and pigments gain traction due to proven health benefits. Social media awareness drives acceptance of bio-based alternatives. Clean-label and transparent sourcing boost consumer confidence. Global health trends enhance the adoption of algae-based formulations in nutrition and pharmaceuticals. Growing interest in ethical consumption reinforces demand across retail and healthcare applications.

- For example, in December 2024, Nature’s Bounty introduced a Plant-Based Omega-3 supplement made with 1,000 mg of algal oil per softgel, delivering around 520 mg of EPA and DHA omega-3s. The product was launched in major U.S. retail outlets including Amazon, CVS, and Walgreens.

Market Trends

Integration of Algae Chemicals in High-Performance Materials

The UK Algae Based Specialty Chemicals Market experiences demand for algae-derived compounds in packaging, coatings, and specialty polymers. It reflects the push for biodegradable and renewable inputs in materials engineering. Brands introduce algae-based bioplastics to reduce dependence on fossil fuels. Performance testing validates algae materials for industrial durability and commercial viability. Companies highlight sustainable product attributes in branding strategies. Collaborative projects with chemical producers strengthen development of high-performance green alternatives. This integration boosts industry credibility and adoption rates. Growing awareness supports algae inputs in manufacturing innovation pipelines.

- For example, Notpla, a UK-based company, has developed home-compostable seaweed-based packaging recognized under the EU Single-Use Plastics Directive. By 2025, it has replaced more than 21.5 million single-use plastic items across Europe.

Expansion of Functional Ingredients in Personal Care Formulations

Cosmetic and skincare brands embrace algae-derived pigments, moisturizers, and antioxidants. The UK Algae Based Specialty Chemicals Market benefits from rising inclusion of bio-actives in premium formulations. It strengthens claims on natural sourcing and advanced functionality. Product launches highlight stability, texture enhancement, and UV protection properties. Consumer trends prioritize safe and effective natural alternatives over synthetic chemicals. Industry leaders integrate algae molecules to maintain competitiveness in beauty markets. Dermatological research validates the benefits of algae ingredients. Continuous innovation ensures consistent market penetration in global cosmetics.

Adoption of Algae Solutions in Aquaculture and Feed Applications

Aquafeed producers incorporate algae-derived DHA and omega-3 to replace fish oil. The UK Algae Based Specialty Chemicals Market strengthens its role in sustainable aquaculture systems. It ensures stability in feed supply while reducing pressure on marine resources. Large feed companies expand algae integration to meet nutritional demands. Consumer demand for sustainable seafood accelerates adoption of algae inputs. Partnerships between algae producers and feed manufacturers support steady scaling. Sustainability certifications amplify commercial acceptance. Aquaculture industry growth aligns with algae-based ingredient integration.

Investment in Algae Biotechnology Startups and Research Partnerships

Investors focus on biotech startups developing innovative algae-based solutions. The UK Algae Based Specialty Chemicals Market benefits from financing aimed at scaling new technologies. It supports early-stage ventures working on pigments, oils, and bio-surfactants. Research institutions collaborate with private companies to accelerate breakthroughs. Public funding programs enable pilot and demonstration projects. Corporate partnerships expand commercialization of novel algae products. Venture capital inflow fuels competitive advantage in global markets. Ongoing investments strengthen long-term innovation and market resilience.

- For example, MiAlgae, a Scottish biotech startup, raised £14 million in September 2024 to develop an industrial-scale facility in Scotland. It uses whisky-industry by-products to cultivate microalgae rich in marine omega-3s and proved its technology at commercial scale through its demonstrator site in Balfron, Stirlingshire.

Market Challenges Analysis

High Production Costs and Technical Complexities in Cultivation

The UK Algae Based Specialty Chemicals Market faces cost barriers linked to cultivation, harvesting, and extraction. It requires capital-intensive infrastructure for photobioreactors and controlled environments. Technical challenges in maintaining consistent yield hinder scalability. Energy-intensive downstream processing limits cost competitiveness with synthetic chemicals. Market players struggle to balance production costs with consumer price sensitivity. Limited economies of scale impact profitability. Supply chain inefficiencies add complexity to expansion strategies. Smaller producers face greater financial constraints, slowing broader adoption.

Regulatory Uncertainty and Market Awareness Barriers

The UK Algae Based Specialty Chemicals Market encounters challenges from evolving regulations on bio-based products. It must adapt to shifting standards for food, cosmetics, and pharmaceutical approvals. Lack of harmonized international frameworks creates compliance complexity. Low consumer awareness about algae benefits reduces adoption speed. Misconceptions about algae safety and performance delay market penetration. Companies invest heavily in education and marketing to build trust. Navigating diverse approval processes prolongs commercialization timelines. Regulatory unpredictability limits investment confidence in the long-term sector outlook.

Market Opportunities

Expansion into High-Value Nutraceutical and Pharmaceutical Applications

The UK Algae Based Specialty Chemicals Market presents opportunities in nutraceuticals and pharmaceuticals. It leverages algae-derived omega-3, polysaccharides, and antioxidants with proven health benefits. Companies can expand portfolios into supplements, therapeutic formulations, and functional foods. Rising consumer health consciousness creates sustained demand for algae-derived compounds. Research in drug delivery and bioactive ingredients unlocks new market potential. Companies investing in clinical validation will secure competitive positioning.

Growth in Sustainable Packaging and Industrial Material Applications

The UK Algae Based Specialty Chemicals Market also opens opportunities in sustainable packaging and coatings. It enables replacement of petrochemical-derived inputs with renewable alternatives. Brands seek biodegradable and circular solutions for regulatory compliance. Market players expanding algae-based bioplastics and specialty materials will capture industrial contracts. Collaboration with packaging firms and retailers can scale market visibility. Ongoing sustainability agendas ensure long-term expansion opportunities.

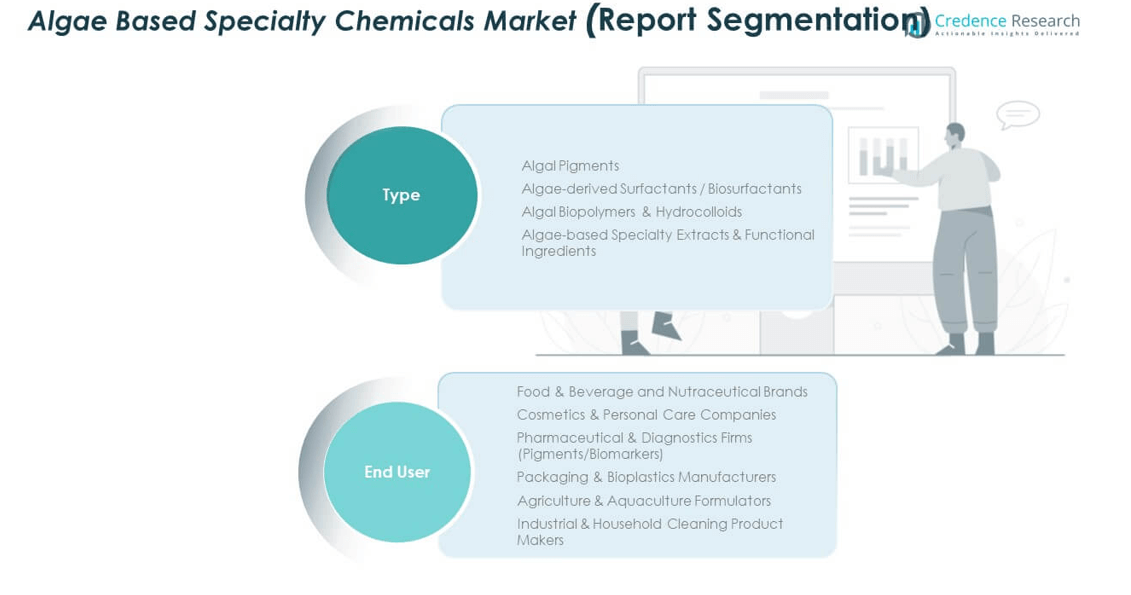

Market Segmentation Analysis

By type, algal pigments hold a leading position in the UK Algae Based Specialty Chemicals Market, supported by their widespread use in cosmetics, nutraceuticals, and food coloring. It benefits from increasing demand for natural and stable colorants. Algae-derived surfactants and biosurfactants gain traction in household and personal care products due to their biodegradability and performance efficiency. Algal biopolymers and hydrocolloids show strong adoption in food and packaging applications where texture, stability, and sustainability are critical. Specialty extracts and functional ingredients capture growth across pharmaceuticals and health supplements, leveraging their antioxidant and bioactive properties.

- For example, Kelpi, based in Bristol UK, secured £4.35 million in funding in mid-2024 to scale up its seaweed-based biomaterial technology. The investment will support manufacturing pilots, regulatory approval of its coatings for paper and card, and is already backing commercial contracts with major brands.

By end user, food and beverage and nutraceutical brands form a dominant segment, relying on algae-derived compounds for clean-label and functional product innovation. Cosmetics and personal care companies expand usage of algae-based pigments and moisturizers to support consumer preference for natural formulations. Pharmaceutical and diagnostics firms adopt pigments and biomarkers for therapeutic and analytical use. Packaging and bioplastics manufacturers integrate algae-based biopolymers into sustainable packaging solutions. Agriculture and aquaculture formulators incorporate algae inputs into feed and crop-enhancement products. Industrial and household cleaning product makers employ algae-derived biosurfactants to replace synthetic chemicals and comply with environmental standards.

- For example, Living Ink produces Algae Black™ pigment using algae biomass waste, replacing petroleum-based colorants with a carbon-negative alternative. Every 45 pounds of their Algae Ink keeps 22.5 pounds of petroleum from use.

Segmentation

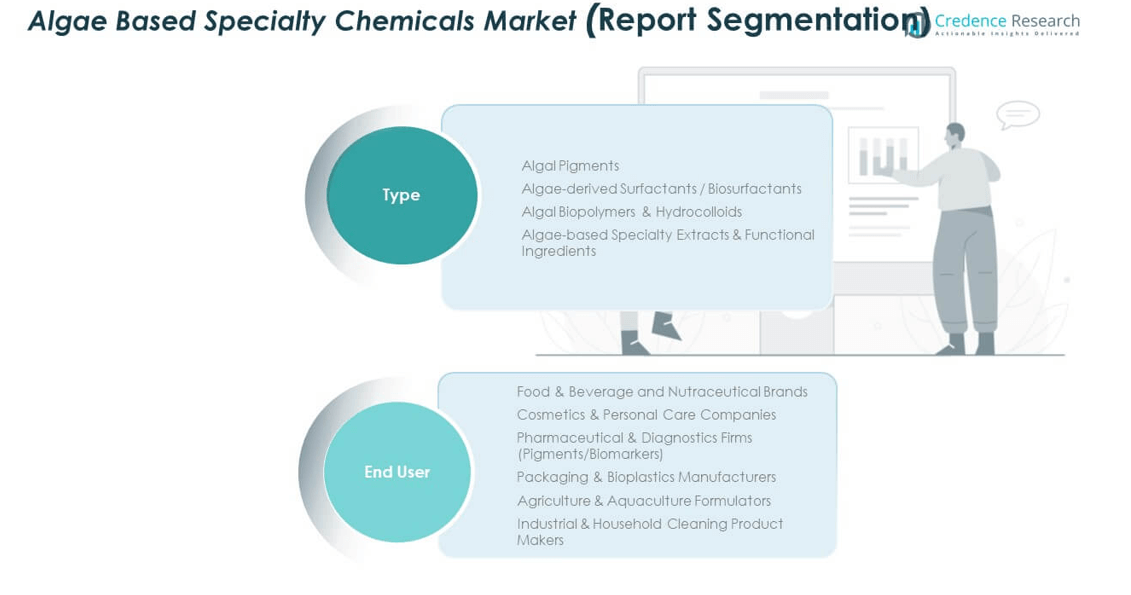

By Type

- Algal Pigments

- Algae-derived Surfactants / Biosurfactants

- Algal Biopolymers & Hydrocolloids

- Algae-based Specialty Extracts & Functional Ingredients

By End User

- Food & Beverage and Nutraceutical Brands

- Cosmetics & Personal Care Companies

- Pharmaceutical & Diagnostics Firms (Pigments/Biomarkers)

- Packaging & Bioplastics Manufacturers

- Agriculture & Aquaculture Formulators

- Industrial & Household Cleaning Product Makers

Regional Analysis

England

England holds the largest share of the UK Algae Based Specialty Chemicals Market at 48%. It benefits from strong biotech clusters, advanced research facilities, and significant industrial demand. Cosmetic, food, and pharmaceutical companies in London and the Southeast lead adoption of algae-based compounds. Universities and private firms collaborate on innovations in pigments, biopolymers, and bio-surfactants. Government programs focused on low-carbon strategies create a favorable regulatory environment. It continues to attract investments from global players seeking entry into sustainable chemistry markets.

Scotland

Scotland accounts for 27% of the UK Algae Based Specialty Chemicals Market, driven by its established aquaculture and marine biotechnology sector. The region leverages coastal resources and expertise in algae cultivation. Companies in aquafeed and nutraceutical industries rely on algae-derived DHA and pigments. Research hubs in Aberdeen and Edinburgh provide a strong scientific base. Policies supporting marine bioeconomy growth strengthen commercial adoption. It is positioned as a leading subregion for sustainable algae production in Europe.

Wales and Northern Ireland

Wales and Northern Ireland together represent 25% of the UK Algae Based Specialty Chemicals Market. Wales benefits from government-backed initiatives encouraging renewable resource use in industrial applications. Northern Ireland contributes through agricultural and bio-based feedstock projects. Demand grows for algae in packaging, functional foods, and personal care products. Emerging startups focus on specialty extracts targeting health and cosmetic markets. The combined subregions gain traction through innovation hubs and cross-border collaborations. It strengthens overall UK competitiveness in sustainable specialty chemicals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CABB Chemicals

- BASF SE

- I.D. Parry (Parry Nutraceuticals)

- Cyanotech Corporation

- Earthrise Nutritionals

- Algatechnologies (Algatech)

- CP Kelco

- Cargill

- AlgaEnergy

- Other Key Players

Competitive Analysis

The UK Algae Based Specialty Chemicals Market features a blend of multinational corporations and regional innovators competing for growth. It is shaped by established players such as BASF SE, CABB Chemicals, and Cargill, alongside niche algae specialists like Algatechnologies, AlgaEnergy, and Parry Nutraceuticals. Competition centers on product differentiation, technological advancements in cultivation and extraction, and strategic partnerships with downstream industries. Companies invest in expanding their product portfolios to meet rising demand in food, cosmetics, pharmaceuticals, and packaging. Research-driven firms in the UK collaborate with global suppliers to scale commercial operations. Mergers, acquisitions, and new product launches remain key strategies for gaining share. The market continues to evolve as consumer awareness, sustainability commitments, and regulatory standards drive innovation and competitive positioning.

Recent Developments

- In June 2025, CABB Group entered into a strategic partnership with Finnish company Origin by Ocean to establish a first-of-its-kind algae biorefinery at CABB’s site in Kokkola, Finland. This facility will leverage Origin by Ocean’s patented technology to process invasive brown seaweed (sargassum) into high-value ingredients like alginate and fucoidan, supporting sustainable chemical production across cosmetics and other consumer sectors.

- In February 2025, GC Rieber VivoMega announced the launch of its new algae-based DHA and EPA product, Algae 1060 TG Premium, targeting the specialty chemicals and nutritional supplements sector in the UK. This product is designed for easy incorporation in various supplement formulations and offers a cost-effective solution for delivering omega-3 fatty acids from algae, allowing manufacturers to provide plant-based options for health-conscious consumers.

Report Coverage

The research report offers an in-depth analysis based on Type and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UK Algae Based Specialty Chemicals Market will expand through increasing integration of algae-derived inputs in premium personal care products.

- Growth will be fueled by consumer demand for plant-based alternatives in nutraceutical and functional food applications.

- Industrial adoption of algae biopolymers will strengthen as companies seek sustainable packaging and material solutions.

- Pharmaceuticals will explore algae-based pigments and bioactive compounds for advanced therapeutic and diagnostic use.

- Research investments will focus on scaling photobioreactor and open-pond systems for improved cost efficiency.

- Strategic collaborations between universities and companies will accelerate innovations in bio-surfactants and hydrocolloids.

- Aquaculture demand will rise as algae-derived DHA replaces marine oils in sustainable fish feed.

- Government sustainability policies will support market entry for eco-certified algae-based products.

- Competition will intensify as multinational chemical companies expand portfolios alongside specialized algae firms.

- International collaborations will open export opportunities, strengthening the UK’s role in the global algae-based chemicals sector.