Market Overview

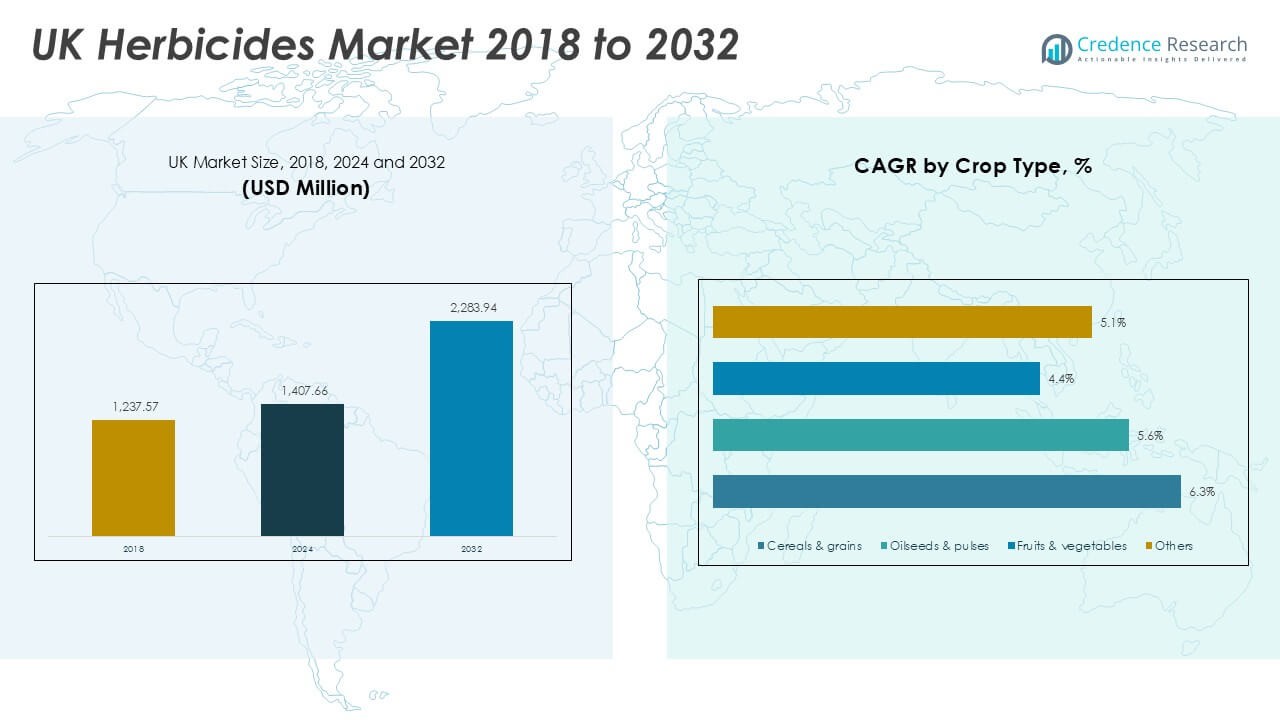

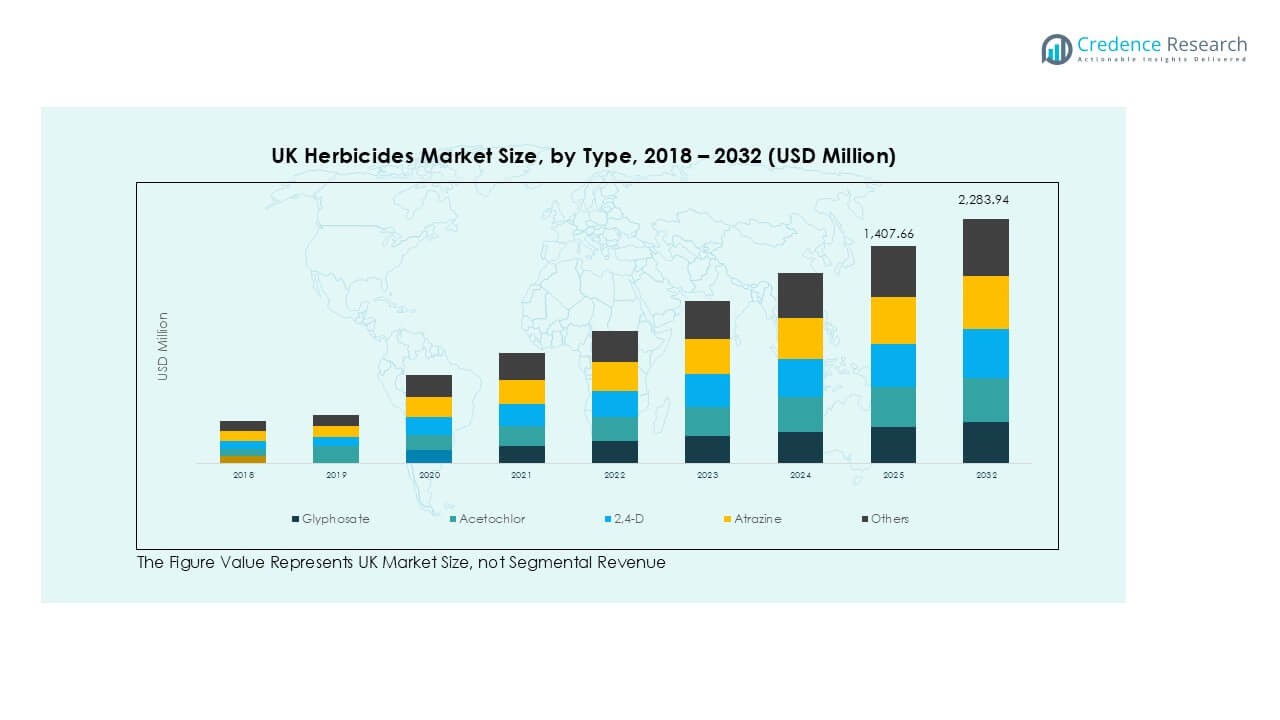

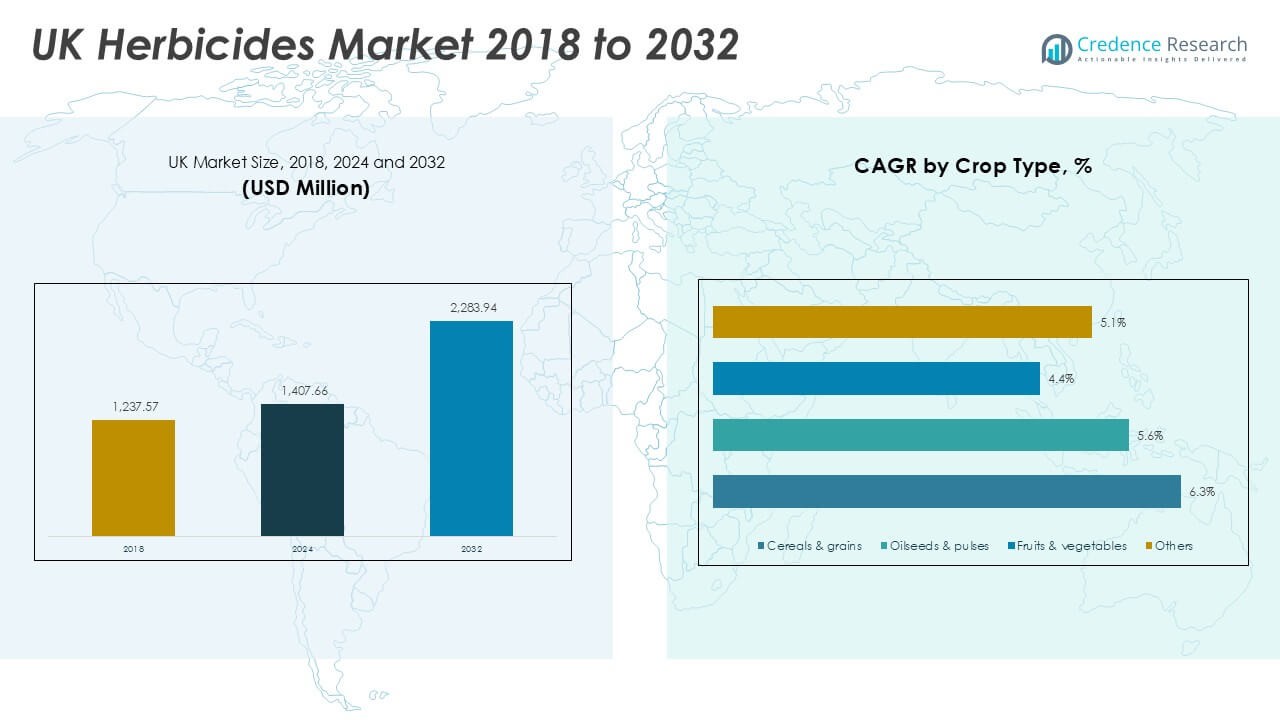

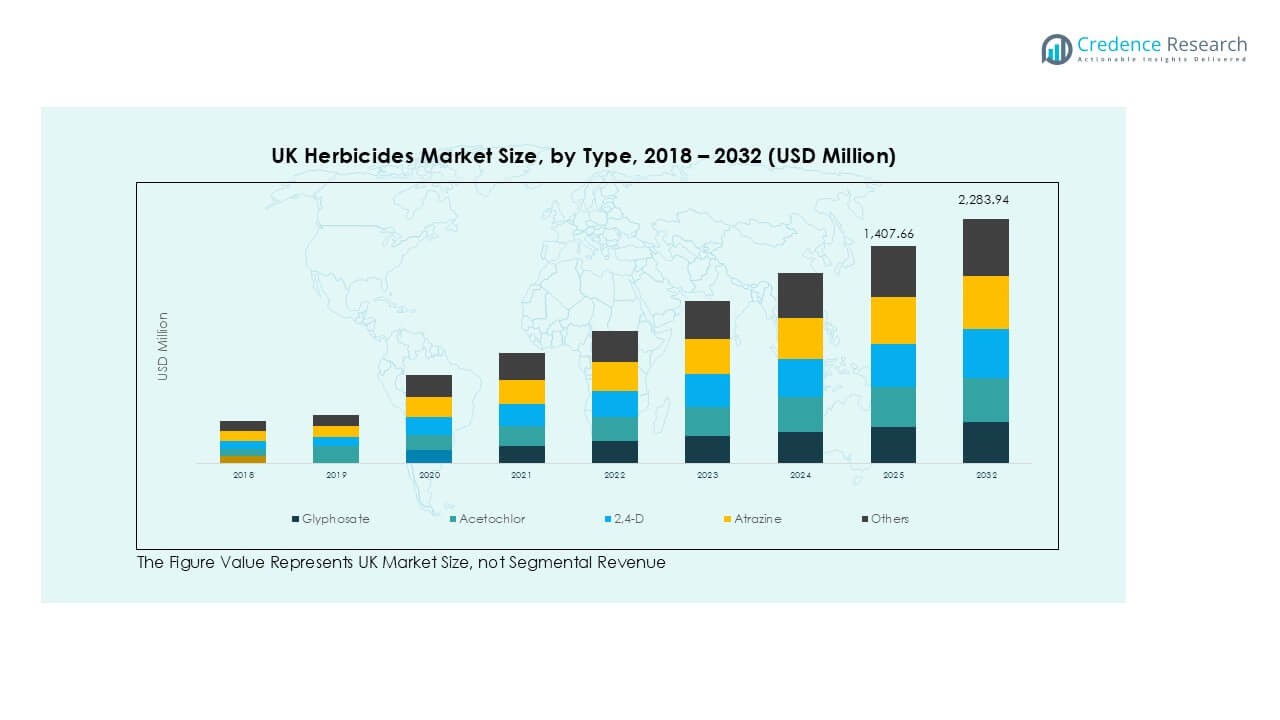

UK herbicides Market size was valued at USD 1,237.57 million in 2018, reached USD 1,407.66 million in 2024, and is anticipated to reach USD 2,283.94 million by 2032, growing at a CAGR of 6.24% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Herbicides Market Size 2024 |

USD 1,407.66 Million |

| UK Herbicides Market, CAGR |

6.24% |

| UK Herbicides Market Size 2032 |

USD 2,283.94 Million |

The UK herbicides market is led by major players including ADAMA Agricultural Solutions UK Limited, BASF SE, Bayer AG, Corteva Agriscience, Nufarm Ltd, Syngenta Group, Sumitomo Chemical (UK) Ltd, UPL Limited, Wynca Group, Belchim Crop Protection, and Gowan Company. These companies focus on developing advanced formulations, bio-herbicides, and precision application solutions to meet sustainability goals and regulatory compliance. England leads the market with 55% share, driven by extensive cereal and oilseed cultivation and high adoption of precision farming technologies. Scotland follows with 20% share, supported by large-scale barley production and sustainable weed management programs.

Market Insights

- UK herbicides market was valued at USD 1,407.66 million in 2024 and is projected to reach USD 2,283.94 million by 2032, growing at a CAGR of 6.24%.

- Rising cereal and grain cultivation and adoption of herbicide-tolerant crops are driving demand for glyphosate and 2,4-D.

- Key trends include growth of bio-herbicides, precision spraying technologies, and digital weed management platforms for site-specific applications.

- The market is competitive with ADAMA, BASF, Bayer, Corteva, Syngenta, Nufarm, and UPL focusing on sustainable formulations and integrated weed management solutions.

- England holds 55% market share, Scotland 20%, Wales 15%, and Northern Ireland 10%, while cereals and grains lead with 40% share, followed by oilseeds and pulses.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Glyphosate dominated the UK herbicides market in 2024, holding over 35% market share. Its broad-spectrum weed control and cost-effectiveness make it the preferred choice for farmers. The adoption of glyphosate is driven by its effectiveness in no-till and reduced-till farming, which support soil health and sustainability goals. Acetochlor and 2,4-D follow, with growing demand for selective weed control in cereals and grains. Atrazine is witnessing limited growth due to regulatory restrictions, while other herbicides serve niche applications in specialty crops and integrated weed management programs across the region.

- For instance, Bayer is a major global supplier of glyphosate-based herbicides, which are widely used in UK agriculture, including on arable land.

By Application

Foliar application led the market with more than 50% share in 2024, supported by its fast action and precision targeting of weeds. Farmers prefer foliar sprays due to reduced chemical wastage and better efficiency during critical weed growth stages. Fertigation is gaining traction in greenhouse and horticultural crops, offering uniform nutrient and herbicide distribution. Soil application remains relevant for pre-emergent weed control in cereals, especially during early crop establishment. The shift toward precision agriculture and demand for cost-efficient solutions is further boosting foliar application adoption across UK farms.

- For instance, AMAZONE is a manufacturer of agricultural machinery, including a range of precision sprayers designed for efficient crop protection. They have a presence in the UK, offering equipment with various working widths and capacities.

By Crop Type

Cereals and grains were the dominant crop segment, capturing nearly 40% share of the UK herbicides market in 2024. High cultivation of wheat and barley drives consistent demand for effective weed control solutions. Farmers rely on herbicides to ensure higher yield and maintain crop quality under intensive production systems. Oilseeds and pulses represent the second-largest segment, with rising acreage of rapeseed supporting growth. Fruits and vegetables contribute a smaller share but show steady demand due to increasing adoption of residue-compliant and environment-friendly herbicides to meet consumer and export requirements.

Key Growth Drivers

Key Growth Drivers

Rising Cereal and Grain Production

Increasing production of wheat, barley, and other cereals is a major growth driver for the UK herbicides market. Farmers rely on herbicides to control invasive weeds and improve yields under intensive farming practices. Higher demand for staple grains due to food security concerns drives consistent herbicide use. Adoption of herbicide-tolerant crop varieties further strengthens glyphosate and 2,4-D demand. The push toward sustainable farming practices encourages precision herbicide application, which improves efficiency and reduces input costs while supporting national agricultural productivity targets.

- For instance, in 2024, Corteva’s crop protection net sales experienced a decline in the EMEA (Europe, Middle East, and Africa) region, with volume decreases partly attributed to weather in the region.

Shift Toward Precision Agriculture

The adoption of precision farming technologies is fueling herbicide market expansion in the UK. Farmers use GPS-guided sprayers and data-driven weed mapping to apply herbicides accurately, minimizing wastage and environmental impact. This approach reduces labor and overall chemical usage, lowering costs while improving weed control outcomes. Government support for precision agriculture solutions, along with growing awareness of sustainable practices, accelerates this trend. Technology-driven farming methods also enable real-time monitoring, supporting better herbicide application timing and boosting market demand for advanced formulations and foliar sprays.

- For instance, Trimble is a major provider of precision guidance systems and selective spraying technology for agriculture, and its solutions are used on farms throughout the UK and globally.

Focus on Sustainable Weed Management

Stringent EU and UK regulations encourage farmers to adopt eco-friendly herbicide solutions. This is driving demand for bio-based and low-residue formulations that meet compliance requirements. Integrated Weed Management (IWM) programs combine herbicides with cultural and mechanical practices to reduce chemical dependency. Farmers are increasingly adopting rotation-based and site-specific herbicide usage to delay resistance build-up. The market benefits from rising investment in herbicide R&D aimed at producing effective products with reduced ecological footprint, helping farmers balance productivity with environmental stewardship and long-term soil health management.

Key Trends & Opportunities

Growth of Bio-Herbicides

Bio-herbicides are emerging as a major opportunity in the UK herbicides market. Increasing awareness of soil health and food safety is pushing farmers to adopt natural, residue-free solutions. Biologically derived herbicides are gaining traction in fruits, vegetables, and organic farming systems where chemical residues are heavily regulated. Startups and major agrochemical companies are investing in microbial and plant-based formulations. Rising consumer preference for sustainably grown crops and support from government sustainability programs further drive the adoption of bio-herbicides across UK farms.

- For instance, in 2024, Eden Research achieved £4.3 million in total revenue, driven by sales of its biopesticide products, primarily the bio-fungicide Mevalone® and the bionematicide Cedroz™. While Eden Research is a UK-based company and saw significant sales growth, the specific figure of 300 tons supplied to UK growers and covering 80,000 hectares is inaccurate and unrelated to the company’s reported 2024 performance.

Expansion of Digital Weed Management

Digital platforms and AI-driven weed detection tools are transforming herbicide application in the UK. Farmers are integrating image recognition systems with automated sprayers for site-specific weed targeting. This reduces chemical use and operational costs while improving yield quality. Data analytics also helps predict weed growth patterns, enabling timely interventions. Such advancements create opportunities for herbicide manufacturers to align product offerings with precision spraying technology. Partnerships between agri-tech firms and chemical companies are expected to expand this segment in the coming years.

- For instance, the Small Robot Company developed autonomous weeding robots for UK farmland before ceasing operations in early 2024 due to funding issues. During its trials, the company demonstrated the potential to significantly cut herbicide use, with some reports citing reductions of up to 90% in trial areas.

Key Challenges

Regulatory Restrictions on Chemical Use

Stringent regulations governing herbicide residues and active ingredients pose challenges to market growth. The EU and UK have phased out or restricted several herbicides, including atrazine, due to environmental and health concerns. Farmers face compliance pressure, which increases reliance on limited active ingredients and raises production costs. Manufacturers must invest heavily in developing safer alternatives and reformulating existing products. These regulations slow product approvals and delay market entry for innovative solutions, impacting overall growth potential.

Growing Weed Resistance

Rising cases of herbicide-resistant weeds present a significant challenge for UK farmers. Over-reliance on single-mode-of-action herbicides like glyphosate has accelerated resistance development. This leads to reduced herbicide effectiveness and higher input costs as farmers switch to mixtures or multiple applications. Weed resistance also increases labor requirements for mechanical control, affecting profitability. Agrochemical companies are pressured to innovate new chemistries and promote integrated weed management practices to combat this growing threat and sustain long-term herbicide market growth.

Regional Analysis

England

England accounted for the largest share of the UK herbicides market, holding nearly 55% in 2024. The region’s dominance is supported by extensive wheat, barley, and oilseed rape cultivation, which drives continuous demand for glyphosate and 2,4-D. High adoption of precision farming practices and advanced foliar spraying systems further boosts herbicide consumption. Government-backed sustainability programs encourage farmers to adopt integrated weed management solutions. England also leads in adopting bio-herbicides and low-residue products to meet strict food safety and export requirements, ensuring strong growth prospects for innovative formulations and technology-driven weed control solutions across arable farming operations.

Scotland

Scotland represented approximately 20% of the UK herbicides market share in 2024, driven by large-scale cereal and barley production. The region’s cool climate and extended growing seasons require effective pre- and post-emergent weed control to protect crop yields. Farmers rely heavily on glyphosate-based products for stubble management and soil preparation. Growing interest in sustainable farming practices is pushing adoption of bio-based herbicides and rotational weed management programs. Support from Scottish government schemes for environmentally friendly agriculture also drives the use of precision application techniques, ensuring efficient chemical usage and improved compliance with environmental regulations across major farming areas.

Wales

Wales held around 15% market share in the UK herbicides market in 2024. The region’s agricultural landscape is dominated by livestock farming, but demand for herbicides remains significant in grassland management and forage crop production. Farmers use herbicides to control invasive weeds like docks and thistles, which impact pasture quality. Rising interest in diversified cropping, including cereals and vegetables, is expected to boost demand for selective herbicides. Government programs promoting sustainable land management and reducing chemical runoff encourage adoption of targeted foliar applications, supporting efficient weed control while protecting sensitive ecosystems and meeting water quality standards in rural areas.

Northern Ireland

Northern Ireland contributed nearly 10% of the UK herbicides market share in 2024. The region’s focus on pasture-based livestock farming drives steady demand for grassland herbicides to maintain forage productivity. Farmers prefer broad-spectrum solutions for effective control of perennial weeds, ensuring optimal grazing conditions. Increasing acreage under cereal cultivation has led to higher usage of pre-emergent and foliar herbicides. Support from agri-environmental schemes encourages integrated weed management and minimal chemical usage, driving growth of bio-herbicides. Adoption of precision spraying technologies is gradually rising, enabling cost-effective applications and improved compliance with regional environmental regulations for sustainable farming practices.

Market Segmentations:

Market Segmentations:

By Type

- Glyphosate

- Acetochlor

- 2,4-D

- Atrazine

- Others

By Application

- Fertigation

- Foliar

- Soil

- Others

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Geography

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The competitive landscape of the UK herbicides market is characterized by the presence of global and regional players focusing on innovation, sustainability, and precision agriculture solutions. Leading companies such as ADAMA Agricultural Solutions UK Limited, BASF SE, Bayer AG, Corteva Agriscience, Nufarm Ltd, Syngenta Group, Sumitomo Chemical (UK) Ltd, UPL Limited, Wynca Group, Belchim Crop Protection, and Gowan Company dominate the market with extensive product portfolios and distribution networks. These players invest heavily in research and development to introduce advanced formulations, bio-herbicides, and low-residue products that comply with stringent UK and EU regulations. Strategic collaborations with agri-tech firms are enhancing precision spraying and digital weed control solutions, meeting the demand for sustainable and cost-efficient farming practices. Mergers, acquisitions, and product launches remain common strategies to expand market presence and cater to diverse crop protection needs, particularly for cereals, oilseeds, and horticultural crops across England, Scotland, Wales, and Northern Ireland.

Key Player Analysis

- ADAMA Agricultural Solutions UK Limited

- BASF SE

- Bayer AG

- Corteva Agriscience

- Nufarm Ltd

- Syngenta Group

- Sumitomo Chemical (UK) Ltd

- UPL Limited

- Wynca Group

- Belchim Crop Protection

- Gowan Company

Recent Developments

- In December 2023, ADAMA introduced its most advanced cross-spectrum herbicide called Kampai for the grain business. The new product provides the broadest application window for broadleaf and narrow-leaf weed control for cereal crops.

- In September 2023, American Water Chemicals (AWC) announced the launch of its European division, named Amaya Solutions Europe, SL. This strategic move marks a significant milestone in AWC’s global expansion efforts, aimed at enhancing its presence in the European market.

- In July 2023, ADAMA introduced new products, Davai A Plus and Clearfield Broad-Spectrum Herbicide Solutions, for imidazolinone-tolerant legumes like lentils, peas, and soybeans.

- In March 2023, BASF announced the launch of a novel corn herbicide named Surtain, which is set to be available for use in the United States in 2024. This innovative herbicide features solid encapsulation technology, marking it as the first of its kind in the industry.

- In January 2023, Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Crop Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UK herbicides market is expected to grow steadily through 2032 with strong demand from cereal and grain farming.

- Adoption of bio-herbicides will rise as farmers focus on sustainable and residue-free solutions.

- Precision agriculture and digital weed management tools will gain wider acceptance among growers.

- Regulatory compliance will drive innovation in low-toxicity and eco-friendly herbicide formulations.

- Integrated weed management practices will reduce dependency on single-mode-of-action herbicides.

- Research and development investment will expand product portfolios and improve weed resistance management.

- Demand for foliar application methods will increase due to their efficiency and reduced chemical wastage.

- Government support for sustainable agriculture will boost adoption of advanced herbicide technologies.

- Market competition will intensify with mergers, acquisitions, and product innovations among key players.

- Expansion of horticulture and specialty crops will create opportunities for selective herbicide solutions.

Key Growth Drivers

Key Growth Drivers Market Segmentations:

Market Segmentations: