| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Medical Device Contract Manufacturing Market Size 2024 |

USD 2,182.37 Million |

| UK Medical Device Contract Manufacturing Market, CAGR |

11.26% |

| UK Medical Device Contract Manufacturing Market Size 2032 |

USD 5,122.90 Million |

Market Overview

UK Medical Device Contract Manufacturing Market size was valued at USD 2,182.37 million in 2024 and is anticipated to reach USD 5,122.90 million by 2032, at a CAGR of 11.26% during the forecast period (2024-2032).

The UK Medical Device Contract Manufacturing market is driven by several key factors, including the rising demand for advanced medical devices, technological innovations, and the growing trend of outsourcing manufacturing to specialized firms. As healthcare providers and companies seek cost-effective and efficient solutions, contract manufacturers offer expertise in product design, development, and production, enabling businesses to focus on their core competencies. Additionally, regulatory compliance and quality assurance remain essential drivers, with manufacturers adhering to stringent standards to ensure product safety. The increasing adoption of automation and advanced manufacturing techniques, such as 3D printing and robotics, further accelerates market growth by enhancing production efficiency and reducing time-to-market. Furthermore, the aging population and the growing prevalence of chronic diseases are fueling the demand for innovative medical devices, which, in turn, drives the need for contract manufacturing services. These factors collectively contribute to the robust expansion of the market over the forecast period.

Geographical analysis of the UK Medical Device Contract Manufacturing market reveals key regional hubs such as London, Manchester, Birmingham, and Scotland, each playing a crucial role in the industry’s growth. London, with its strong healthcare infrastructure and access to top-tier medical research, remains a dominant player. Manchester is emerging as a key center for innovation, particularly in diagnostic and imaging devices. Birmingham, with its historical manufacturing expertise, focuses on precision medical components and devices. Scotland, renowned for its strength in life sciences, continues to expand its role in producing medical implants and orthopedics. Key players in the market include companies like Guerbet, Renishaw, Consort Medical, Synnovia, and Vygon. These companies are integral to the market’s development, driving innovation, maintaining high-quality manufacturing standards, and capitalizing on advancements in technology to meet the growing demand for advanced medical devices across the UK.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK Medical Device Contract Manufacturing market was valued at USD 2,182.37 million in 2024 and is projected to reach USD 5,122.90 million by 2032, growing at a CAGR of 11.26% from 2024 to 2032.

- The global medical device contract manufacturing market was valued at USD 79,181.52 million in 2024 and is expected to reach USD 1,90,413.88 million by 2032, growing at a CAGR of 11.59% during the forecast period (2024-2032).

- Increasing demand for advanced medical devices is driving market growth, with a focus on high-tech, wearable, and diagnostic devices.

- Technological innovations such as 3D printing, AI, and automation are enhancing production efficiency and precision, contributing to market expansion.

- The growing trend of outsourcing manufacturing to specialized contract manufacturers helps companies reduce costs and focus on core operations.

- Regulatory compliance and quality assurance remain key challenges, with manufacturers needing to adhere to stringent standards.

- Regional growth is notable in London, Manchester, Birmingham, and Scotland, each contributing significantly to the market through specialized manufacturing capabilities.

- Key players like Guerbet, Renishaw, Consort Medical, Synnovia, and Vygon are competitive drivers, focusing on innovation and market expansion.

Report Scope

This report segments the UK Medical Device Contract Manufacturing market as follows:

Market Drivers

Rising Demand for Advanced Medical Devices

The growing demand for advanced medical devices is a primary driver of the UK Medical Device Contract Manufacturing market. For instance, the UK medical device sector is evolving with advancements in wearable health monitors, diagnostic equipment, and minimally invasive surgical tools. As the healthcare sector continues to evolve, there is an increasing need for specialized manufacturing processes that can accommodate the complexity and innovation of modern medical technologies. Contract manufacturers play a pivotal role in this space by providing the expertise, resources, and scalability required to meet the demands of the healthcare market. The shift towards more sophisticated, high-quality medical devices necessitates a robust and agile manufacturing infrastructure, which contract manufacturers are uniquely positioned to deliver.

Cost Efficiency and Outsourcing Trends

Outsourcing medical device manufacturing to specialized contract manufacturers is becoming an increasingly popular strategy for healthcare companies in the UK. This approach allows businesses to focus on their core competencies such as research and development, marketing, and distribution, while leaving manufacturing to experts with the necessary capabilities and resources. By outsourcing production, companies can achieve cost savings, reduce overhead, and streamline operations. Moreover, contract manufacturers offer flexibility in production volumes, enabling clients to scale operations according to market demands. This trend has been particularly beneficial for small and medium-sized enterprises (SMEs) in the medical device sector, allowing them to compete with larger firms by leveraging external expertise without the need for significant capital investment in manufacturing infrastructure.

Technological Advancements and Automation

The integration of automation and advanced manufacturing technologies is driving growth in the UK Medical Device Contract Manufacturing market. For instance, the UK medical device industry is integrating robotics, 3D printing, and AI into manufacturing processes to enhance efficiency and precision. Automation reduces human error, increases throughput, and improves product consistency, ensuring that manufacturers meet the stringent regulatory standards set by authorities such as the UK’s Medicines and Healthcare products Regulatory Agency (MHRA) and the European Medicines Agency (EMA). As these technologies continue to advance, the ability to produce complex, high-quality devices at lower costs will further stimulate demand for contract manufacturing services.

Aging Population and Prevalence of Chronic Diseases

The aging population in the UK, coupled with the increasing prevalence of chronic diseases, is another significant driver of the medical device market. As the population ages, there is a greater need for healthcare solutions, including devices designed for elderly care, chronic disease management, and rehabilitation. Conditions such as diabetes, cardiovascular diseases, and orthopedic disorders are on the rise, driving the demand for specialized medical devices tailored to these needs. Contract manufacturers are well-positioned to support the development and production of such devices, offering both innovation and capacity to meet the growing demand. Furthermore, the increased focus on personalized healthcare solutions requires contract manufacturers to be agile in adapting to new trends and providing customized products for specific patient needs. This demographic shift ensures sustained growth in the demand for medical devices and, by extension, the contract manufacturing services that produce them.

Market Trends

Shift Towards Customization and Personalized Devices

A key trend in the UK Medical Device Contract Manufacturing market is the growing demand for customization and personalized medical devices. As healthcare becomes increasingly patient-centric, there is a greater emphasis on products that cater to individual patient needs. Contract manufacturers are increasingly providing tailored solutions for devices such as implants, prosthetics, and diagnostic equipment. For instance, the UK medical device sector is increasingly adopting 3D printing technology to create patient-specific implants and prosthetics. Personalized medicine, which focuses on delivering treatments and devices that are uniquely suited to the genetic profile or condition of a patient, is reshaping the medical device landscape. Contract manufacturers are adapting by offering flexible production processes that allow for the rapid prototyping and small-batch production of customized devices.

Regulatory Compliance and Quality Assurance

Regulatory compliance remains a critical trend in the UK Medical Device Contract Manufacturing market. For instance, the UK medical device sector operates under stringent regulations from the MHRA and EMA, requiring rigorous testing and documentation. Contract manufacturers are focusing more on ensuring that their products meet the necessary regulatory requirements, including quality control measures, testing protocols, and documentation processes. Manufacturers are investing in sophisticated systems to track and manage compliance throughout the entire product lifecycle, from design to production and post-market surveillance. Additionally, regulatory changes and updates are prompting manufacturers to adapt and implement new practices to stay compliant. As regulations become more complex and detailed, the ability of contract manufacturers to navigate these challenges and maintain high standards of product quality will be a key competitive differentiator in the market.

Integration of Digital Technologies and Smart Devices

The incorporation of digital technologies and the rise of smart medical devices represent a significant trend in the UK Medical Device Contract Manufacturing sector. Devices equipped with sensors, connectivity features, and advanced analytics are becoming increasingly prevalent in healthcare settings. Wearable health monitors, remote patient monitoring systems, and mobile health applications are driving demand for innovative manufacturing solutions. Contract manufacturers are responding to this trend by integrating digital capabilities into their production processes. This includes the use of Internet of Things (IoT) technology, which allows devices to collect and transmit real-time data, and the development of software-integrated medical devices that offer enhanced functionality. The ability to manufacture these complex, high-tech devices is crucial for contract manufacturers, and they are investing in new technologies to support the production of such cutting-edge products.

Sustainability and Eco-Friendly Manufacturing Practices

Sustainability is becoming an increasingly important consideration in the UK Medical Device Contract Manufacturing market. As environmental concerns grow globally, there is a rising demand for eco-friendly manufacturing practices and sustainable medical devices. Companies are placing greater emphasis on reducing the environmental impact of production processes, such as by using recyclable materials, reducing waste, and lowering carbon footprints. Contract manufacturers are responding to these demands by adopting green manufacturing technologies and sourcing environmentally friendly materials. The shift towards sustainability not only helps reduce the environmental impact but also aligns with regulatory trends that increasingly prioritize environmental responsibility. As both consumers and healthcare organizations become more environmentally conscious, the demand for sustainable products and manufacturing practices will continue to shape the market.

Market Challenges Analysis

Regulatory Compliance and Complex Approval Processes

One of the primary challenges faced by the UK Medical Device Contract Manufacturing market is the increasingly complex regulatory landscape. For instance, the UK medical device sector operates under stringent regulatory frameworks set by the MHRA and EMA. The evolving nature of these regulations, coupled with frequent updates and changes, makes it challenging for manufacturers to maintain compliance. For contract manufacturers, ensuring that devices meet all safety, quality, and documentation standards across multiple markets requires robust systems and continuous monitoring. Failing to adhere to these regulations can result in delayed product approvals, costly recalls, or even legal consequences, all of which can impact the manufacturer’s reputation and bottom line. Navigating these regulatory hurdles requires significant expertise and resources, making compliance a critical challenge in the industry.

Supply Chain Disruptions and Material Shortages

Another significant challenge for the UK Medical Device Contract Manufacturing market is supply chain disruptions and material shortages. The global medical device supply chain is complex, involving the procurement of specialized components and raw materials from various sources. Recent events, such as the COVID-19 pandemic, have highlighted vulnerabilities in global supply chains, leading to delays and increased costs. Shortages of critical materials, including specialized plastics, metals, and electronic components, can delay production timelines and increase costs for contract manufacturers. Additionally, fluctuations in material prices and transportation costs can further complicate production planning and budgeting. These supply chain issues create uncertainty and operational risks for manufacturers, requiring them to adopt more resilient and flexible strategies to manage their sourcing and inventory.

Market Opportunities

The UK Medical Device Contract Manufacturing market presents significant opportunities driven by the increasing demand for advanced medical technologies. As the healthcare sector continues to innovate, there is a growing need for specialized manufacturing services to support the development of new devices, such as wearables, diagnostic tools, and minimally invasive surgical instruments. Contract manufacturers are well-positioned to capitalize on this demand by providing the technical expertise and scalability required to produce complex, high-quality medical devices. Additionally, the rise of personalized medicine, where treatments and devices are tailored to individual patient needs, opens up further opportunities for contract manufacturers to offer customized production services. By leveraging advanced technologies such as 3D printing and digital manufacturing, contract manufacturers can support the creation of patient-specific devices, thereby expanding their market potential.

Furthermore, the aging population in the UK and the increasing prevalence of chronic diseases present significant growth opportunities for contract manufacturers. As the demand for medical devices designed for elderly care, disease management, and rehabilitation continues to rise, there is an opportunity for contract manufacturers to develop and produce specialized devices to address these needs. This demographic shift not only increases the demand for healthcare solutions but also encourages innovation in device design and functionality. By investing in technologies that enable faster production, greater customization, and more efficient manufacturing processes, contract manufacturers can position themselves to meet the evolving demands of the healthcare market. These opportunities, coupled with the increasing trend of outsourcing manufacturing, position the UK Medical Device Contract Manufacturing sector for substantial growth over the coming years.

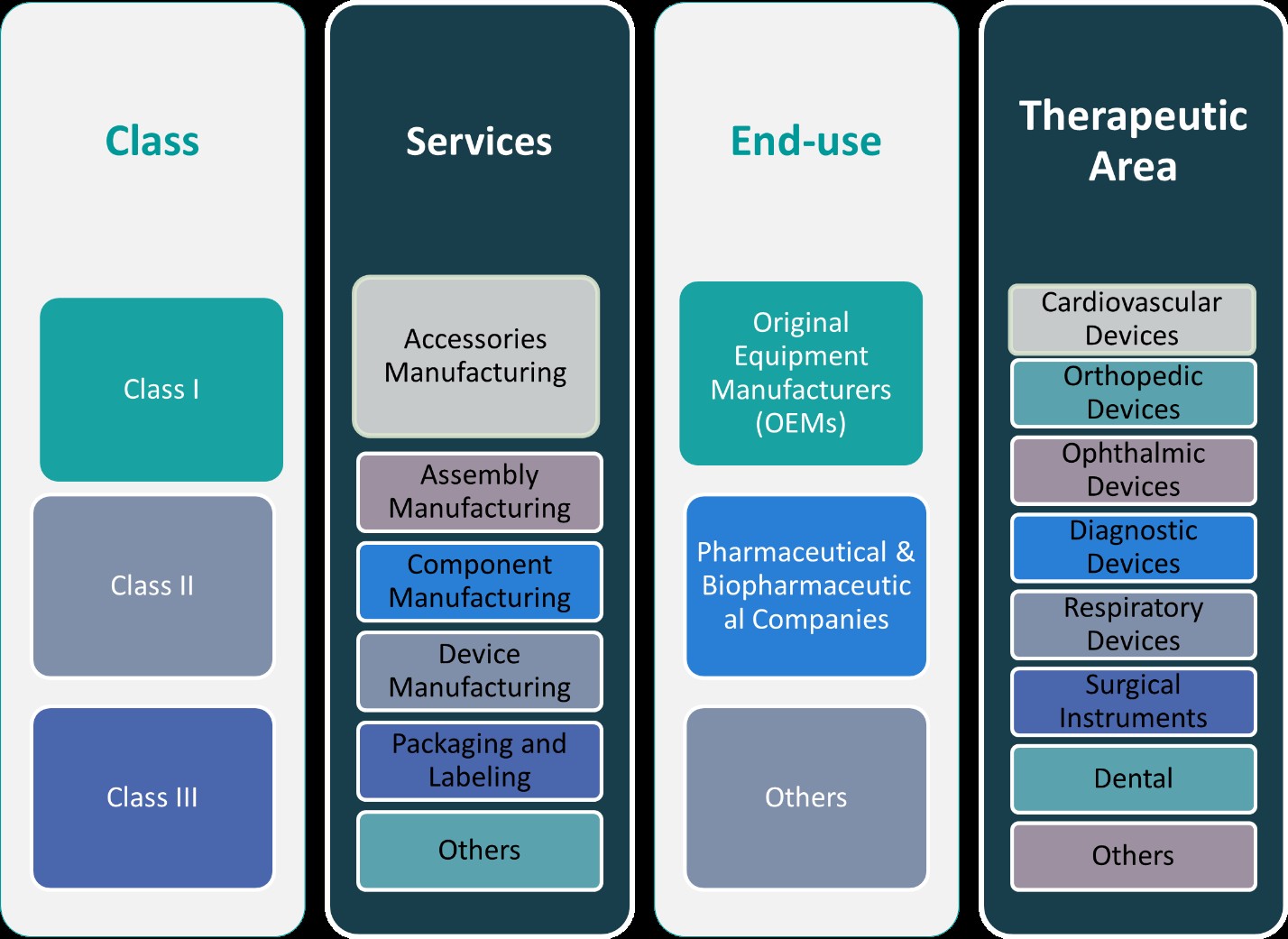

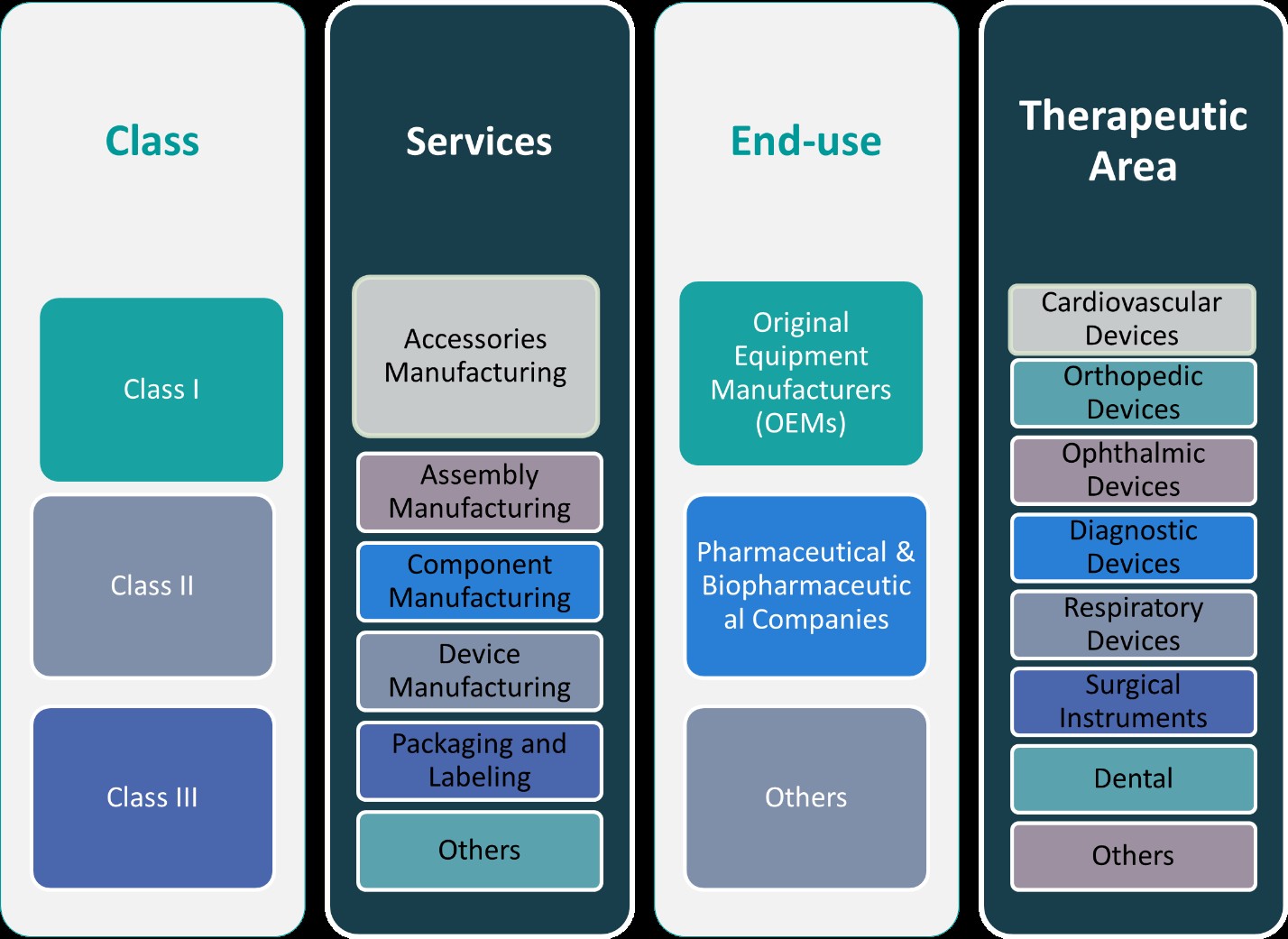

Market Segmentation Analysis:

By Class:

The UK Medical Device Contract Manufacturing market is segmented into three classes—Class I, Class II, and Class III—each with distinct regulatory and manufacturing requirements. Class I devices are low-risk products that typically do not require extensive regulatory oversight, allowing for simpler manufacturing processes. These include items such as non-invasive diagnostic devices, medical gloves, and bandages. Class II devices, which are considered medium-risk, require more regulatory scrutiny and include products such as infusion pumps, diagnostic equipment, and surgical instruments. These devices often require more sophisticated manufacturing techniques and higher-quality materials to meet regulatory standards. Class III devices, the highest-risk category, include life-sustaining or life-supporting devices such as pacemakers, heart valves, and implanted devices. The manufacturing of Class III devices involves the most stringent regulatory requirements and advanced manufacturing technologies. This market segmentation provides contract manufacturers the opportunity to specialize in different device categories, leveraging their expertise to cater to specific regulatory needs and product complexities.

By Services:

The UK Medical Device Contract Manufacturing market is also segmented by the services offered, which include accessories manufacturing, assembly manufacturing, component manufacturing, device manufacturing, and packaging and labeling. Accessories manufacturing focuses on producing supplementary items like cables, batteries, and connectors that support the functionality of medical devices. Assembly manufacturing involves the final assembly of medical devices, where various components are put together to create the finished product. Component manufacturing includes the production of individual parts, such as sensors, microchips, and casing materials, which are essential to the device’s operation. Device manufacturing refers to the complete production of medical devices, encompassing design, development, and final assembly. Packaging and labeling services ensure that medical devices are properly packaged to meet regulatory standards and include clear labeling with usage instructions and safety information. Other services may include testing, sterilization, and post-production support. This segmentation allows contract manufacturers to offer tailored solutions across the production lifecycle, enabling them to meet diverse client needs in the medical device industry.

Segments:

Based on Class:

- Class I

- Class II

- Class III

Based on Services:

- Accessories Manufacturing

- Assembly Manufacturing

- Component Manufacturing

- Device Manufacturing

- Packaging and Labelling

- Others

Based on End- Use:

- Original Equipment Manufacturers (OEMs)

- Pharmaceutical & Biopharmaceutical Companies

- Others

Based on Therapeutic Area:

- Cardiovascular Devices

- Orthopedic Devices

- Ophthalmic Devices

- Diagnostic Devices

- Respiratory Devices

- Surgical Instruments

- Dental

- Others

Based on the Geography:

- London

- Manchester

- Birmingham

- Scotland

Regional Analysis

London

London holds the largest share of the market, with approximately 35% of the total market size. As the capital and a global healthcare center, London benefits from its access to cutting-edge medical research, a highly skilled workforce, and robust healthcare infrastructure. The city’s proximity to leading hospitals, universities, and medical research institutions makes it an attractive location for both contract manufacturers and medical device companies. Furthermore, London is home to a significant number of multinational companies, enhancing its role as a critical player in the medical device manufacturing sector.

Manchester

Manchester accounts for around 25% of the UK Medical Device Contract Manufacturing market, emerging as a key manufacturing and innovation hub. The city has a strong presence in medical technology, particularly in the development of diagnostic and imaging devices. Manchester’s established manufacturing base, along with its access to a skilled workforce in engineering and life sciences, positions it as a critical regional player. Furthermore, the presence of prominent academic institutions, such as the University of Manchester, fosters innovation and collaboration between industry and academia, driving the growth of medical device manufacturing in the region.

Birmingham

Birmingham holds a market share of approximately 20%, making it one of the leading regions for medical device contract manufacturing in the UK. Known for its historical expertise in manufacturing and engineering, Birmingham has leveraged its strong industrial foundation to become a significant player in the medical device sector. The region specializes in the production of medical components, assemblies, and high-precision devices. Its strategic location, well-connected transport infrastructure, and access to skilled labor contribute to its competitiveness in the medical device contract manufacturing market.

Scotland

Scotland, with a market share of around 15%, is also a vital region in the UK Medical Device Contract Manufacturing market. The country has seen substantial growth in its life sciences and biotechnology sectors, attracting investments in medical device manufacturing. Scotland’s strengths lie in its focus on innovation, particularly in areas such as orthopedics, medical implants, and personalized medicine. The Scottish government’s support for the healthcare sector, along with access to world-class research facilities and institutions like the University of Edinburgh, has made the region an attractive location for medical device companies and contract manufacturers alike. The region’s market share is expected to grow further as the sector continues to expand.

Key Player Analysis

- Guerbet

- Renishaw

- Consort Medical

- Synnovia

- Vygon

Competitive Analysis

The UK Medical Device Contract Manufacturing market is highly competitive, with several leading players driving innovation and shaping industry dynamics. Companies like Guerbet, Renishaw, Consort Medical, Synnovia, and Vygon are at the forefront, offering diverse capabilities and expertise in the production of medical devices. Leading manufacturers focus on advanced technologies such as automation, 3D printing, and AI integration to improve production efficiency, reduce time-to-market, and ensure high-quality standards. Additionally, a strong emphasis on regulatory compliance and meeting the stringent requirements set by authorities like the MHRA and EMA is a critical differentiator in the market. Manufacturers are increasingly investing in R&D to create innovative devices that address specific healthcare needs, such as personalized medicine, wearables, and minimally invasive surgical tools. The competition is also fueled by the rising demand for outsourcing, as medical device companies seek cost-effective and scalable manufacturing solutions. To maintain a competitive edge, players are continuously enhancing their operational efficiency, expanding their service portfolios, and forming strategic partnerships within the healthcare sector.

Recent Developments

- In February 2025, Jabil completed the acquisition of Pii, a contract development and manufacturing organization (CDMO) specializing in aseptic filling, lyophilization, and oral solid dose manufacturing.

- In November 2024, Integer completed the sale of its non-medical Electrochem business for $50 million, making it a pure-play medical technology company and allowing it to redeploy capital into high-growth medtech markets.

- In October 2024, At CPHI Milan 2024, Thermo Fisher launched its Accelerator Drug Development platform, a 360° CDMO and CRO offering. This service provides customizable manufacturing, clinical research, and supply chain solutions for small molecules, biologics, and cell and gene therapies, covering the full drug development lifecycle.

Market Concentration & Characteristics

The UK Medical Device Contract Manufacturing market exhibits moderate concentration, with a mix of large, well-established companies and smaller, specialized firms. While a few major players dominate the market, particularly in high-precision manufacturing and advanced technologies, smaller firms carve out niches in specific segments such as disposable devices or specialized components. The market is characterized by a strong emphasis on regulatory compliance, quality assurance, and adherence to stringent standards set by bodies like the MHRA and EMA. Manufacturers in this space must possess advanced technical capabilities, such as automation, 3D printing, and AI, to remain competitive and meet the increasing demand for innovative and high-quality medical devices. The market is highly dynamic, with ongoing trends such as outsourcing, increasing demand for personalized medical devices, and technological advancements shaping the competitive landscape. This blend of concentration and specialization creates a competitive environment where companies must continually innovate to retain market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Class, Services, End-Use, Therapeutic Area and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UK medical device contract manufacturing sector is expected to grow due to increasing demand for innovative healthcare solutions.

- Advances in technology, including AI and 3D printing, will drive the development of more customized and efficient medical devices.

- Regulatory compliance requirements are anticipated to become stricter, pushing manufacturers to invest in quality control and risk management.

- The rise of personalized medicine will create new opportunities for manufacturers to produce bespoke devices for individual patients.

- The UK’s departure from the EU will lead to a shift in supply chain strategies, with manufacturers exploring alternative sourcing and distribution channels.

- Increased focus on sustainability will encourage medical device manufacturers to adopt greener practices and eco-friendly materials.

- The growing prevalence of chronic diseases will boost the demand for monitoring devices, resulting in higher production volumes.

- Strategic partnerships and collaborations between contract manufacturers and medical device companies will help drive innovation and reduce time-to-market.

- Investment in automation and smart manufacturing processes will enhance production efficiency and reduce costs.

- The global demand for minimally invasive surgical devices is expected to expand, providing growth opportunities for UK-based manufacturers.