Market Overview:

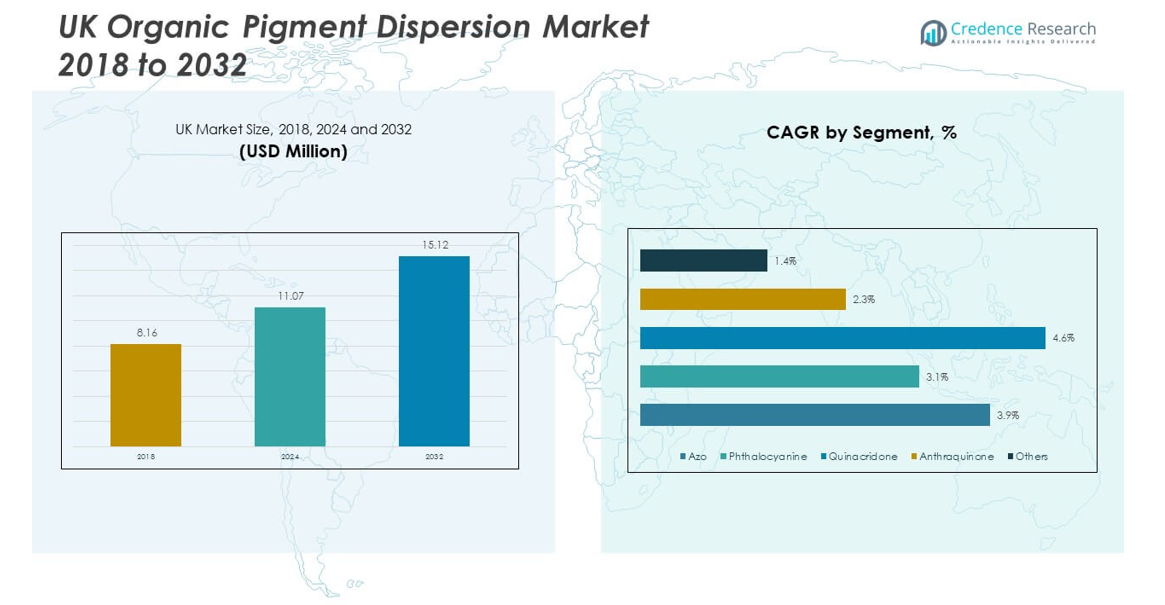

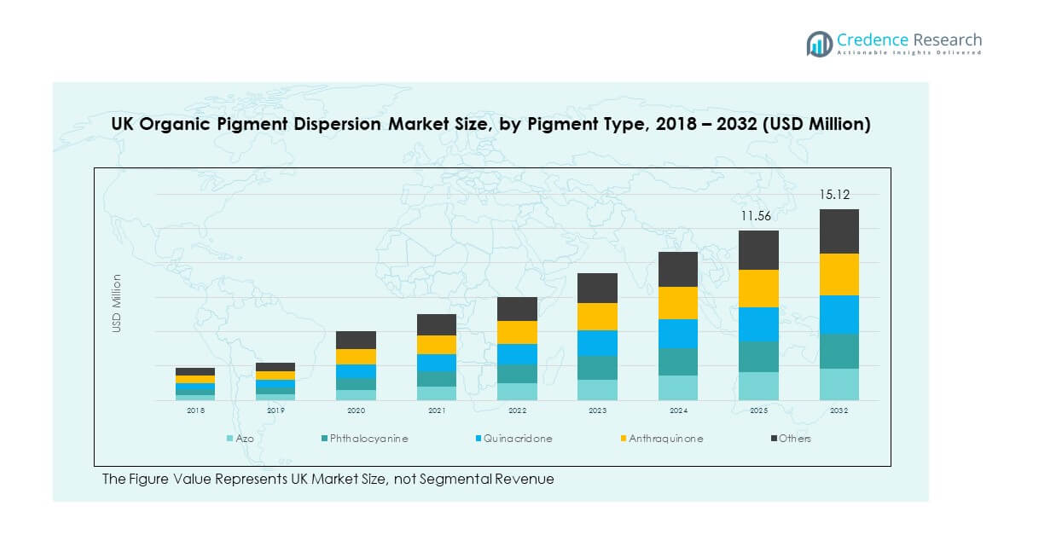

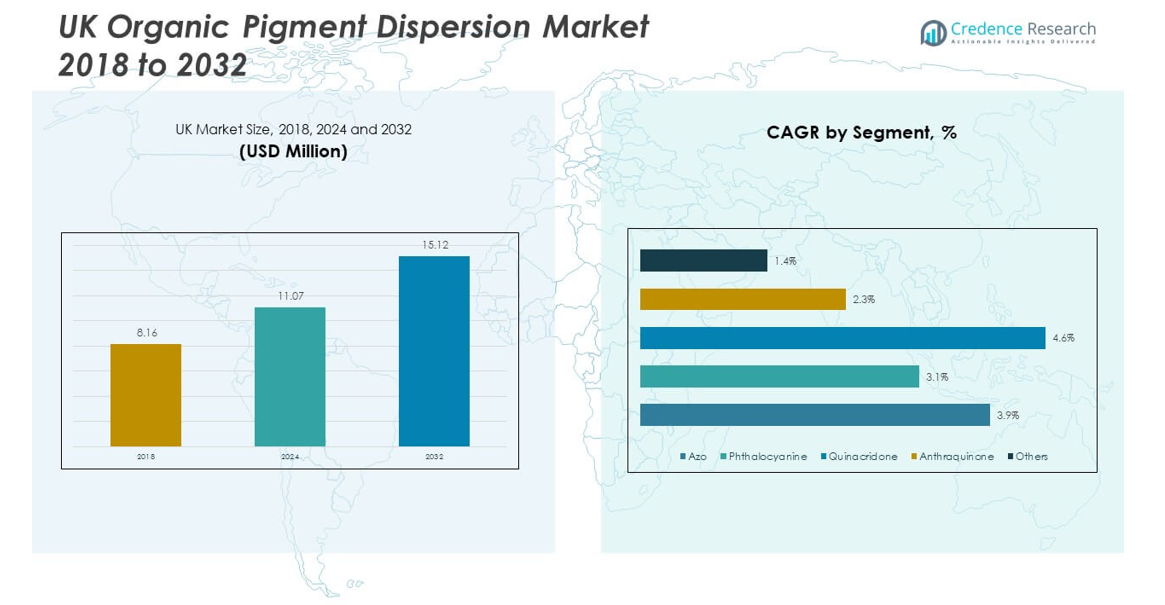

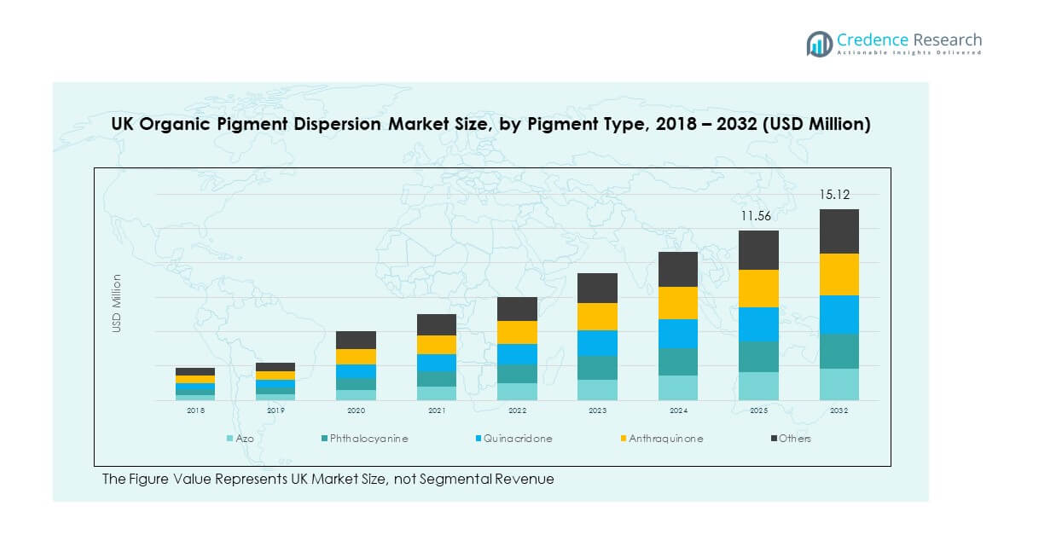

The UK Organic Pigment Dispersion Market size was valued at USD 8.16 million in 2018 to USD 11.07 million in 2024 and is anticipated to reach USD 15.12 million by 2032, at a CAGR of 3.90% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Organic Pigment Dispersion Market Size 2024 |

USD 11.07 million |

| UK Organic Pigment Dispersion Market, CAGR |

3.90% |

| UK Organic Pigment Dispersion Market Size 2032 |

USD 15.12 million |

The market is driven by rising demand for eco-friendly pigments in packaging, automotive, construction, and printing industries. Stringent environmental regulations encourage companies to replace synthetic pigments with sustainable alternatives. Manufacturers are focusing on bio-based raw materials and advanced dispersion technologies to meet industrial needs. Growth in e-commerce, coupled with increasing consumer preference for sustainable packaging, enhances demand further. Automotive and construction sectors adopt dispersions for coatings and plastics due to their durability and stability. The cosmetics and textile industries also embrace eco-friendly formulations, widening market adoption.

Regionally, England leads the market with strong industrial bases in automotive, packaging, and coatings. Scotland follows with rising adoption in construction and research-led innovations in pigment applications. Wales shows growth potential in textiles and consumer goods packaging, while Northern Ireland advances in coatings and plastic processing. The UK Organic Pigment Dispersion Market benefits from nationwide regulatory compliance and growing consumer awareness of sustainability. Established regions drive consistent demand, while emerging subregions contribute through localized manufacturing and niche applications. This balance creates opportunities for both established players and new entrants.

Market Insights

- The UK Organic Pigment Dispersion Market was valued at USD 8.16 million in 2018, reached USD 11.07 million in 2024, and is projected to hit USD 15.12 million by 2032, growing at a CAGR of 3.90%.

- England holds 52% share due to strong bases in packaging, printing, and automotive, followed by Scotland at 21% driven by coatings and research, and Wales at 15% supported by textiles and packaging.

- Northern Ireland, with 12% share, is the fastest-growing region supported by demand in coatings and plastics along with sustainability-driven initiatives.

- Azo pigments dominate with 37% share in 2024, supported by their broad application in printing inks and coatings.

- Phthalocyanine pigments account for 28% share, driven by high stability and wide use in plastics and packaging.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Eco-Friendly Pigments Across Industries

The UK Organic Pigment Dispersion Market grows as industries prioritize sustainable and eco-friendly colorants. Environmental regulations encourage companies to shift from synthetic pigments to organic dispersions. Packaging and automotive sectors adopt these materials to align with consumer demand for safer and greener solutions. Printing applications also see significant use due to enhanced stability and low toxicity. The focus on reducing hazardous waste and volatile emissions drives higher adoption. Growing awareness of environmental sustainability supports long-term growth in this market. Manufacturers invest in improving performance consistency and dispersion stability. The market sustains momentum through regulatory compliance and consumer-driven demand.

Expansion in Packaging and Printing Applications

The market benefits from rising demand in flexible packaging and high-quality printing. Strong growth in e-commerce increases the need for durable, vibrant packaging materials. Organic pigment dispersions deliver better printability and resistance, making them suitable for packaging that requires visual appeal. The UK Organic Pigment Dispersion Market secures growth through brand-driven packaging innovations. Companies in the retail and FMCG sectors emphasize shelf appeal, further pushing demand. The printing industry favors dispersions that provide sharpness and brightness across multiple substrates. It gains support from advanced printing technologies in the UK. These factors ensure consistent adoption across packaging-related end uses.

- For example, BASF’s Joncryl® FLX EB 5500 is a water-based resin for EB curing, designed for surface printing on polyethylene and polypropylene. It provides excellent resistance and printability, making it suitable for heavy-duty and food-related packaging such as sacks, shopping bags, and freezer bags.

Automotive and Construction Industry Adoption

The automotive industry integrates organic pigment dispersions into coatings and plastics for durability. The construction sector employs them in decorative paints, architectural coatings, and protective applications. Their high dispersion stability and resistance to fading make them effective in outdoor environments. The UK Organic Pigment Dispersion Market secures relevance with these applications. Demand rises as automakers invest in sustainable coatings aligned with regulatory guidelines. Construction growth in residential and commercial projects enhances consumption. It also benefits from demand for weather-resistant, eco-compliant coatings. These factors secure long-term opportunities for manufacturers across multiple industrial applications.

Technological Advancements and Product Innovations

Innovation in production techniques strengthens pigment performance and dispersion quality. New bio-based raw materials reduce reliance on petrochemical sources, improving sustainability. Technological progress supports consistency in particle size distribution, color intensity, and stability. The UK Organic Pigment Dispersion Market grows as research introduces high-performance dispersions tailored for diverse applications. Companies explore energy-efficient processing and digital color matching systems to improve efficiency. It builds demand from industries seeking advanced materials for quality improvement. Manufacturers focus on aligning innovations with circular economy principles. Continuous R&D investments sustain market expansion and competitiveness.

- For example, Sun Chemical’s Microlith® solid pigment dispersions feature reduced particle size that creates transparent effects. The product family is offered for both water-based and solvent-based systems and delivers outstanding fastness compared to dyes, supporting use in printing and coatings.

Market Trends

Shift Toward Bio-Based and Renewable Raw Materials

A clear trend is the adoption of bio-based feedstocks in dispersion production. The UK Organic Pigment Dispersion Market reflects this transition as firms reduce dependence on fossil-based inputs. Renewable alternatives help reduce carbon emissions and improve product safety. Companies seek certifications and eco-labels to appeal to environmentally conscious buyers. It supports compliance with national and EU sustainability directives. Market participants emphasize the traceability of raw materials to assure end-users. Rising preference for bio-based products strengthens long-term acceptance. This trend aligns sustainability goals with corporate innovation strategies.

- For example, Clariant launched the Cosmenyl® 100 aqueous pigment dispersions with a next-generation preservation system free from O-PP, MIT, and parabens. The range complies with European Cosmetics Regulation No. 1223/2009 and is designed for safe coloration in home and personal care products.

Integration of Digital Printing Technologies

The printing industry continues to embrace advanced digital printing methods. The UK Organic Pigment Dispersion Market benefits as dispersions compatible with inkjet and high-resolution systems gain traction. Digital printing applications demand dispersions with excellent stability, quick drying, and vivid color output. It supports the production of customized and short-run prints for packaging and advertising. Growth in on-demand printing further drives dispersion use. Companies upgrade formulations to match new printer requirements. This trend enhances the precision and efficiency of printing workflows. The market maintains adaptability with technological adoption.

Focus on High-Performance Functional Dispersions

Manufacturers emphasize functional properties such as UV resistance, heat stability, and chemical resilience. The UK Organic Pigment Dispersion Market sees growth in dispersions offering extended durability across harsh environments. Industries including construction, automotive, and textiles prefer these specialized solutions. It helps companies address quality concerns while maintaining environmental standards. Advanced formulations meet strict outdoor performance expectations. Companies highlight these features to differentiate from low-cost substitutes. This trend sustains demand in sectors prioritizing long-term material stability. Market competitiveness grows through the availability of performance-oriented pigment dispersions.

- For example, Heubach offers Colanyl® Oxide Black IR 531, a ready-use aqueous pigment dispersion designed for IR-reflective performance. It delivers enhanced solar reflectivity through optimized pigment particle structure and suits exterior facade coatings. The Colanyl range is APEO-free, binder-free and built for water-based, low-VOC systems. It exhibits excellent stability, weather resistance, and colorfastness under stringent industry and EN standards.

Adoption of Automation and Smart Manufacturing

Automation and smart technologies reshape production processes for dispersions. The UK Organic Pigment Dispersion Market benefits as manufacturers integrate digital monitoring and automated systems. These tools enhance efficiency, reduce energy consumption, and maintain consistent quality. It ensures accurate pigment dispersion and reduces production waste. Data-driven insights optimize workflows and detect early faults in processes. Firms integrate AI-based systems for predictive maintenance and quality assurance. The trend strengthens productivity while lowering costs in the long run. Adoption of Industry 4.0 practices reinforces competitiveness among market players.

Market Challenges Analysis

Price Sensitivity and Raw Material Volatility

The market faces pricing pressure due to fluctuating raw material costs. The UK Organic Pigment Dispersion Market experiences challenges in maintaining profit margins during supply chain disruptions. Dependence on bio-based and petrochemical inputs increases vulnerability to cost swings. Price-sensitive buyers in packaging and printing industries limit upward price adjustments. It makes consistent profitability difficult for manufacturers. Smaller firms struggle with balancing sustainable production costs against customer expectations. Market competition intensifies as buyers compare price-performance ratios. Rising input costs restrict rapid adoption despite growing environmental awareness.

Stringent Regulations and Competitive Pressure

Strict environmental regulations demand continuous compliance investments by manufacturers. The UK Organic Pigment Dispersion Market must adapt to evolving EU and national safety standards. Compliance requires costly upgrades in production and waste management systems. It places pressure on smaller firms with limited resources. Competition from low-cost Asian producers adds further difficulty. Market participants also face the challenge of counterfeit and substandard products. These issues impact credibility and hinder innovation-led growth. Sustaining compliance and competitive strength becomes a key challenge for established players.

Market Opportunities

Rising Adoption in Sustainable Packaging Solutions

Growing demand for sustainable packaging opens new avenues for pigment dispersions. The UK Organic Pigment Dispersion Market gains relevance as firms design recyclable and eco-friendly packaging materials. Consumer preference for green packaging drives growth across retail and e-commerce. It supports broader adoption of high-quality dispersions in flexible and rigid packaging formats. Companies invest in partnerships with packaging firms to deliver innovative color solutions. Regulatory push for reducing single-use plastics strengthens this opportunity. These factors encourage steady adoption across packaging-focused applications. Market participants leverage innovation to capture rising demand.

Growing Potential in Advanced Coatings and Specialty Applications

Opportunities emerge in high-performance coatings and specialty use cases. The UK Organic Pigment Dispersion Market benefits from innovation in automotive and construction coatings. Demand for weather-resistant, durable, and eco-compliant dispersions supports this trend. It positions pigment dispersions as vital for long-lasting surface finishes. Textiles, consumer goods, and electronics also expand their adoption. Emerging applications in smart materials and eco-textiles highlight further growth. Companies pursue R&D investments to address niche and specialized requirements. These segments present long-term opportunities for market expansion.

Market Segmentation Analysis

By pigment type, Azo pigments account for a significant share due to their wide use in printing and coatings. Phthalocyanine pigments hold strong demand driven by their stability and brightness in plastics and packaging. Quinacridone pigments support premium applications requiring high weather resistance and color strength. Anthraquinone pigments serve specialty uses in textiles and cosmetics, where vivid shades are critical. The UK Organic Pigment Dispersion Market also includes other pigment categories that provide customized solutions for niche applications. It maintains diversity in pigment offerings, ensuring adaptability to varied industrial requirements.

- For example, Phthalocyanine blue pigments are widely used in plastic packaging and printing inks because of their vivid color strength and durability. They remain a key choice in the UK market for applications requiring stable and long-lasting coloration.

By application, printing inks dominate owing to high demand from packaging, publishing, and advertising. Paints and coatings represent a major segment, supported by growth in construction and automotive industries. Plastics and polymers integrate dispersions for color stability and durability, securing consistent market relevance. Textiles utilize pigments for sustainable dyeing and fashion-focused designs. Cosmetics form an emerging segment with rising demand for safe and eco-compliant formulations. The UK Organic Pigment Dispersion Market also records demand across other applications such as specialty consumer goods. It secures expansion by serving both traditional and emerging application areas.

- For example, Clariant’s quinacridone and high-performance pigment dispersions are documented for use in automotive paints, offering excellent weathering resistance and strong tinting strength for durable exterior finishes. They are also applied in plastics and polymers to ensure long-term color stability and durability.

Segmentation

By Pigment Type

- Azo

- Phthalocyanine

- Quinacridone

- Anthraquinone

- Others

By Application

- Printing Inks

- Paints & Coatings

- Plastics & Polymers

- Textiles

- Cosmetics

- Others

Regonal Analysi

England: Leading Market Share

England holds the dominant position in the UK Organic Pigment Dispersion Market, accounting for 52% of the total share. Strong industrial bases in packaging, printing, and automotive sectors fuel consistent demand. Companies in London, Manchester, and Birmingham drive adoption with advanced manufacturing capabilities. England’s strict regulatory compliance on eco-friendly products further supports market growth. It benefits from large-scale packaging operations that require sustainable pigment dispersions. Rising consumer preference for green packaging across retail strengthens England’s leadership. The subregion maintains momentum through innovation and strong end-user demand.

Scotland: Expanding Industrial Adoption

Scotland secures 21% of the market share, supported by its growing chemicals and coatings industry. Local manufacturers prioritize environmentally safe pigments in architectural coatings and printing inks. The UK Organic Pigment Dispersion Market benefits as Scotland emphasizes sustainable construction and infrastructure projects. Printing applications for publishing and textiles also boost demand. It strengthens its presence with rising adoption of dispersions in specialty applications. Academic and research institutions in Scotland collaborate with companies to drive innovations. These initiatives support future growth and competitiveness.

Wales and Northern Ireland: Emerging Growth Regions

Wales accounts for 15% of the market share, while Northern Ireland contributes 12%. Wales shows growth through expansion in consumer goods packaging and textiles, with companies adopting pigments for eco-friendly products. Northern Ireland advances with investments in coatings and plastic applications, securing consistent growth momentum. The UK Organic Pigment Dispersion Market sees opportunities in these subregions through local adoption of dispersions in cosmetics and specialty sectors. It also benefits from government-backed initiatives promoting sustainable manufacturing. Together, Wales and Northern Ireland represent vital emerging regions with expanding applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Clariant AG

- Heubach GmbH

- Lanxess AG

- Venator Materials PLC

- Cabot Corporation

- Ferro Corporation

- DIC Corporation

- Sudarshan Chemical Industries

- Heubach Group

Competitive Analysis

The UK Organic Pigment Dispersion Market is defined by strong competition among global and regional players. BASF SE, Clariant AG, and Lanxess AG hold significant shares through their broad product portfolios and strong R&D capabilities. It gains further competitiveness from DIC Corporation and Sudarshan Chemical Industries, which provide innovative and cost-effective dispersion solutions. Companies like Venator Materials PLC and Heubach GmbH maintain relevance through sustainable production and advanced pigment technologies. Smaller regional firms face challenges competing with global leaders but continue to serve niche markets effectively. The industry witnesses steady product launches, partnerships, and acquisitions aimed at expanding geographic reach and application coverage. Firms compete on sustainability credentials, pricing strategies, and technical performance, making innovation and compliance essential to sustain market leadership.

Recent Developments

- In March 2025, Sudarshan Chemical Industries Limited announced the completion of its acquisition of the Germany-based Heubach Group, merging operations and capabilities to form a global pigment leader with a strong presence in major regions, including the UK and broader Europe.

- In July 2025, Sun Chemical, a wholly owned subsidiary of DIC Corporation, launched a new effect pigment called Chione Electric Amber SB90D, expanding its Chione Electric product line with a shimmering amber hue. This pigment is designed for vegan beauty products in cosmetics, skin, and sun care, offering enhanced chroma, UV stability, and non-staining properties.

Report Coverage

The research report offers an in-depth analysis based on Pigment Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UK Organic Pigment Dispersion Market will expand with rising adoption in sustainable packaging solutions.

- Growing use in automotive coatings and construction applications will support continued industrial relevance.

- Demand from printing inks will remain stable as digital and high-resolution printing gain traction.

- Increased focus on bio-based raw materials will push manufacturers to innovate greener product lines.

- Smart manufacturing and automation will optimize production efficiency and reduce environmental footprint.

- Strategic collaborations between producers and research institutions will drive advanced pigment technologies.

- Market growth will align with stricter environmental regulations and stronger compliance standards.

- Rising consumer demand for eco-friendly textiles and cosmetics will open new application areas.

- Competition among global leaders and regional players will intensify innovation-led differentiation.

- Expanding adoption across emerging regions like Wales and Northern Ireland will strengthen overall market footprint.