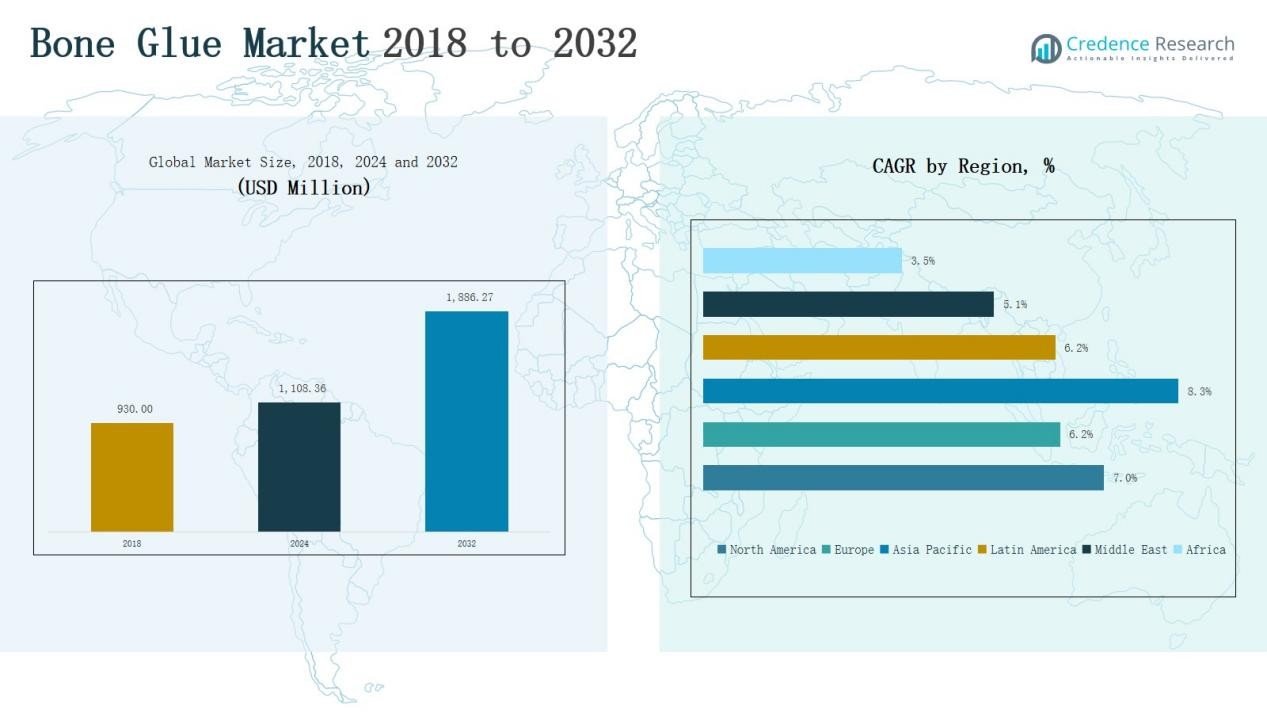

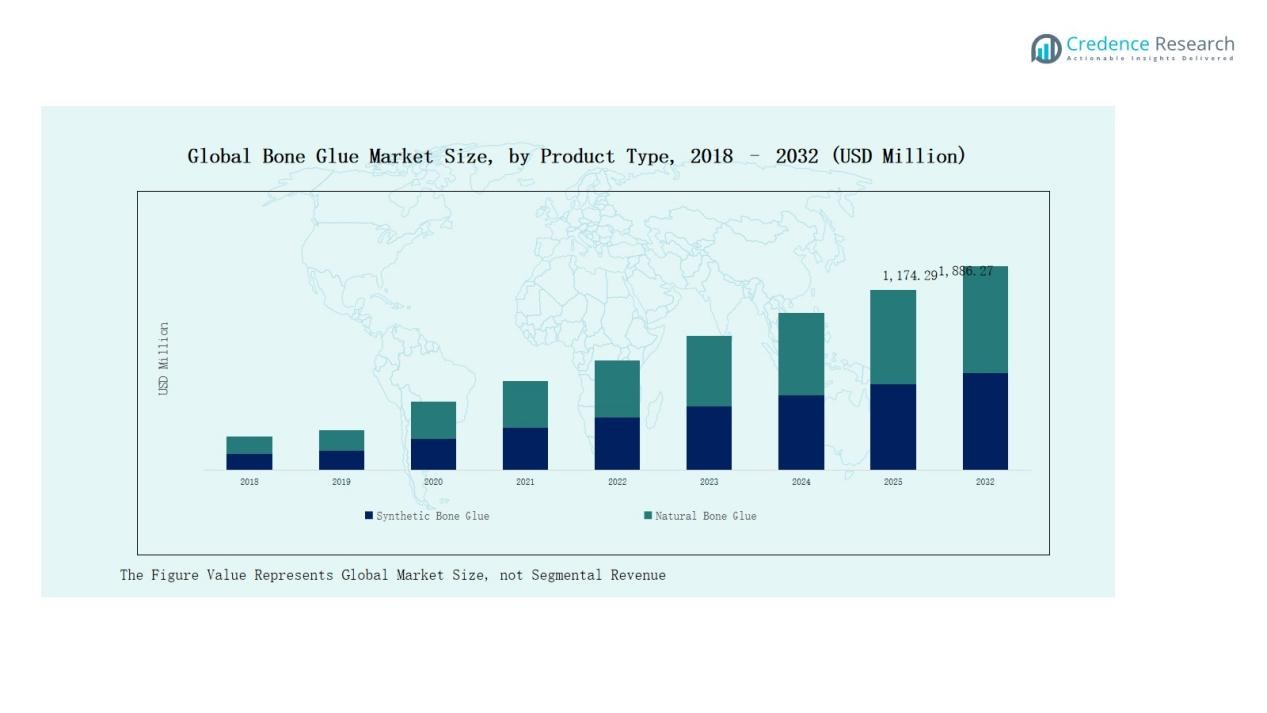

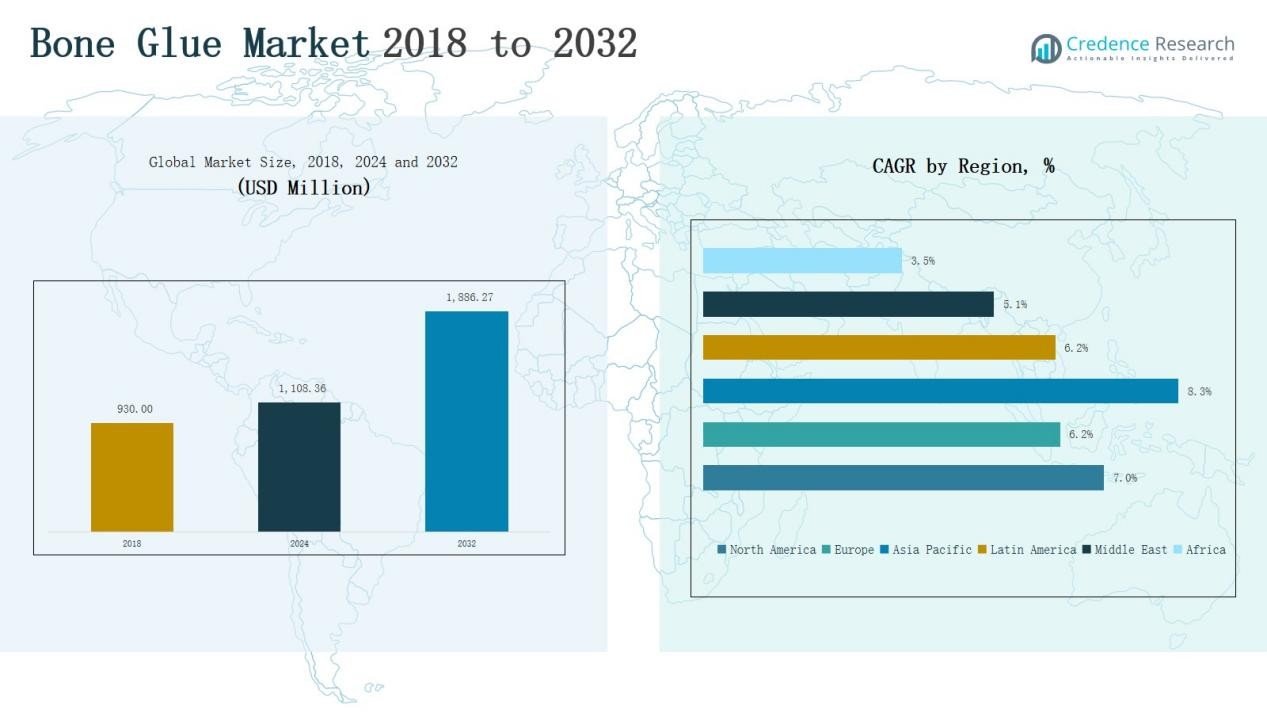

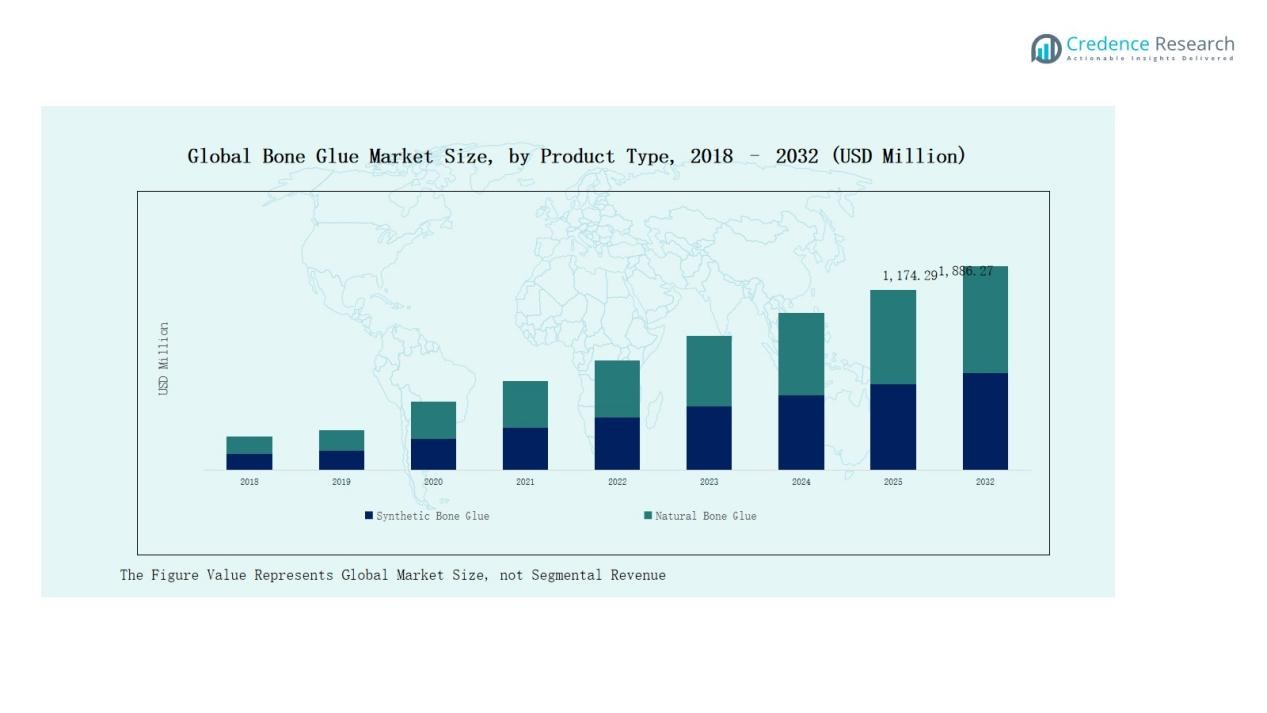

Bone Glue Market size was valued at USD 930.00 million in 2018, reached USD 1,108.36 million in 2024, and is anticipated to reach USD 1,886.27 million by 2032, at a CAGR of 7.01% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bone Glue Market Size 2024 |

USD 1,108.36 Million |

| Bone Glue Market, CAGR |

7.01% |

| Bone Glue Market Size 2032 |

USD 1,886.27 Million |

The Bone Glue Market is shaped by prominent players such as Cryolife, St. Jude Medical, Integra Lifesciences Corporation, Johnson & Johnson, B. Braun Melsungen AG, Cohera Medical Inc., LaunchPad Medical, Chemence Medical Inc., DENTSPLY SIRONA Inc., Baxter International Inc., and Tissuemed Ltd. These companies compete through product innovation, strategic partnerships, and advancements in biomaterials to strengthen their market presence. Among regions, North America led the market in 2024 with a 37.9% share, driven by advanced healthcare infrastructure, strong adoption of synthetic adhesives, and favorable reimbursement policies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Bone Glue Market grew from USD 930.00 million in 2018 to USD 1,108.36 million in 2024 and is projected to reach USD 1,886.27 million by 2032 at a 7.01% CAGR.

- Synthetic bone glue held over 60% share in 2024, driven by strong biocompatibility, adhesive strength, reduced infection risks, and rising adoption in orthopedic and trauma surgeries.

- The orthopedic application segment led with 35% share in 2024, supported by aging populations, fracture cases, and demand for minimally invasive bone fixation procedures globally.

- Hospitals accounted for nearly 50% share in 2024, benefiting from advanced surgical infrastructure, large patient inflow, and greater access to innovative adhesive solutions.

- North America led with 37.9% share in 2024, valued at USD 420.73 million, supported by advanced healthcare systems, high orthopedic cases, and strong adoption of synthetic adhesives.

Market Segment Insights

By Product Type

Synthetic bone glue accounted for the dominant share of over 60% in 2024 due to its superior adhesive strength, biocompatibility, and consistent performance in surgical applications. Surgeons prefer synthetic formulations as they reduce infection risks and offer faster recovery. Growing investments in biomaterial innovations and rising adoption in advanced orthopedic and trauma surgeries further strengthen this segment’s position. Natural bone glue continues to serve niche uses but faces challenges in scalability and long-term stability.

- For instance, Johnson & Johnson’s Ethicon division expanded its lineup of synthetic adhesive technologies, focusing on formulations designed to improve wound closure and postoperative recovery.

By Application

The orthopedic segment held the largest share at 35% in 2024, supported by the growing burden of bone fractures, degenerative disorders, and an aging population. Increasing demand for minimally invasive procedures drives greater use of bone glue in fracture fixation and bone grafting. Arthroplasty and trauma applications follow closely, reflecting rising hip and knee replacements and accident-related injuries. Expanding sports medicine and spine surgeries also contribute to demand, but orthopedic procedures remain the leading revenue generator.

- For instance, Medtronic utilizes its StealthStation surgical navigation system to improve minimally invasive spine and vertebral compression fracture treatments performed with its Kyphon bone cement delivery systems.

By End-user

Hospitals captured nearly 50% of the market share in 2024, driven by advanced surgical infrastructure, skilled orthopedic surgeons, and higher patient inflow for complex procedures. Hospitals dominate adoption due to their access to innovative bone adhesives and capacity for large-volume surgeries, including trauma and arthroplasty cases. Specialty clinics are expanding steadily with outpatient services and targeted treatments, while ASCs gain momentum as cost-effective care providers, particularly in developed markets, offering quicker turnaround and reduced hospitalization costs.

Key Growth Drivers

Rising Prevalence of Bone-Related Disorders

The increasing incidence of bone fractures, osteoporosis, and degenerative bone diseases fuels demand for bone glue. Aging populations in developed and emerging regions are especially prone to fractures and joint conditions requiring surgical intervention. This rising patient base boosts adoption of bone adhesives as an alternative to traditional fixation methods. Improved clinical outcomes and reduced recovery times further accelerate the shift toward bone glue in orthopedic and trauma care settings worldwide.

- For instance, RevBio Inc. initiated a clinical trial in the U.S. for its bone adhesive, Tetranite®, to evaluate its safety and effectiveness in cranial bone defect repairs.

Advancements in Biomaterials and Surgical Technology

Continuous improvements in biomaterial engineering enhance the effectiveness and safety of bone adhesives. Synthetic formulations now offer higher bonding strength, biocompatibility, and faster resorption, making them suitable for complex surgical cases. Surgeons adopt these innovations as they simplify procedures and minimize complications. In addition, robotic and minimally invasive surgeries increasingly incorporate bone glue for precision fixation, widening the application scope. These advancements provide manufacturers with strong opportunities to expand their product portfolios and penetrate new markets.

- For instance, PBC Biomed is leading a consortium to develop a bone adhesive aimed at treating osteoporotic fractures, focusing on reducing operating times and infection risks while promoting tissue regeneration.

Growth in Sports Injuries and Arthroplasty Procedures

Rising participation in sports and physical activities has increased the occurrence of injuries, particularly ligament and bone fractures. Similarly, arthroplasty procedures for hip and knee replacements are expanding rapidly due to lifestyle-related joint disorders. Bone glue plays a vital role in stabilizing implants and repairing injuries in these treatments. Hospitals and specialty clinics prefer adhesives for their ability to speed up patient recovery. The growing demand in these applications establishes a robust driver for market growth.

Key Trends & Opportunities

Shift Toward Minimally Invasive Procedures

Healthcare systems are prioritizing minimally invasive surgeries to reduce hospital stays and recovery periods. Bone glue integrates well into these procedures by offering rapid fixation without bulky hardware. This trend opens opportunities for adhesive-based solutions across orthopedics, arthroplasty, and spine surgeries. Companies investing in minimally invasive compatible adhesives are likely to gain competitive advantage, especially as patients increasingly demand faster healing and less invasive treatment options.

- For instance, Baxter International received FDA clearance for its PerClot absorbable hemostatic powder, intended to support effective blood management during minimally invasive operations.

Expansion in Emerging Healthcare Markets

Rapid growth in healthcare infrastructure across Asia Pacific, Latin America, and the Middle East creates significant opportunities. Rising disposable incomes, improving access to advanced surgeries, and government focus on modernizing hospitals boost adoption of bone glue. Local and international manufacturers benefit from establishing partnerships, expanding distribution networks, and launching cost-effective solutions. These regions are expected to emerge as high-growth markets, with unmet needs in trauma and orthopedic surgeries driving long-term demand.

- For instance, B. Braun Medical cooperated with the Indonesian Ministry of Health to identify training needs for healthcare professionals, following its investments in a new manufacturing facility to boost the local supply of medical products like sterile injections.

Key Challenges

High Cost of Advanced Bone Adhesives

Despite their benefits, synthetic bone glues remain expensive compared to conventional fixation techniques such as screws or plates. Limited reimbursement coverage in several regions further restricts adoption. Smaller hospitals and clinics in cost-sensitive markets often avoid using advanced adhesives due to budget constraints. This price barrier continues to challenge broader market penetration and slows down uptake among developing economies.

Stringent Regulatory Approval Processes

Bone glue products must undergo rigorous safety and efficacy testing before commercialization. Regulatory pathways are lengthy and costly, often delaying product launches. Stringent compliance requirements across regions like the U.S. and Europe also add complexity for manufacturers. These regulatory hurdles increase development timelines and costs, limiting innovation speed and affecting smaller players’ ability to compete with established companies.

Limited Awareness Among Surgeons and Patients

In many regions, surgeons and patients still prefer traditional fixation methods over adhesives due to familiarity and trust. Lack of awareness about the benefits of bone glue, such as reduced recovery time and improved biocompatibility, hampers adoption. Educational efforts, clinical training, and evidence-based demonstrations are needed to overcome this challenge. Without targeted initiatives, the market may experience slower acceptance outside major hospitals and advanced healthcare centers.

Regional Analysis

North America

North America led the Bone Glue Market with a 37.9% share in 2024, valued at USD 420.73 million. The market was worth USD 357.12 million in 2018 and is projected to reach USD 715.09 million by 2032, growing at a CAGR of 7.0%. Strong healthcare infrastructure, high incidence of orthopedic conditions, and rapid adoption of synthetic bone adhesives drive regional growth. The U.S. dominates demand due to advanced surgical procedures and favorable reimbursement policies, consolidating North America’s leadership position in the global market.

Europe

Europe accounted for a 24.6% share in 2024, with market value rising from USD 238.45 million in 2018 to USD 272.85 million in 2024. It is expected to reach USD 437.90 million by 2032 at a CAGR of 6.2%. Growth is supported by an aging population, high rates of hip and knee replacements, and strong presence of medical device manufacturers. Germany, France, and the UK are the leading contributors, driven by robust healthcare systems and growing demand for minimally invasive orthopedic procedures across the region.

Asia Pacific

Asia Pacific captured a 26.0% share in 2024, with market size expanding from USD 229.25 million in 2018 to USD 285.23 million in 2024. By 2032, it is projected to reach USD 535.33 million, advancing at the fastest CAGR of 8.3%. Rising healthcare investments, increasing incidence of sports injuries, and growing access to advanced surgical treatments drive strong demand. China, India, and Japan are key contributors, supported by expanding hospital networks, medical tourism, and higher adoption of innovative biomaterials, positioning Asia Pacific as the fastest-growing region.

Latin America

Latin America held a 7.4% share in 2024, valued at USD 79.13 million, up from USD 66.96 million in 2018. The market is expected to reach USD 126.14 million by 2032 at a CAGR of 6.2%. Growth is driven by expanding healthcare coverage, rising trauma cases, and increased demand for cost-effective surgical solutions. Brazil leads the region, supported by its advanced medical infrastructure, while Mexico and Argentina show growing adoption due to improving access to orthopedic treatments and government-led healthcare initiatives.

Middle East

The Middle East represented a 2.6% share in 2024, valued at USD 28.37 million, compared to USD 26.04 million in 2018. It is projected to reach USD 41.70 million by 2032 with a CAGR of 5.1%. Demand is fueled by healthcare modernization efforts, rising cases of road traffic accidents, and adoption of advanced adhesives in trauma care. GCC countries, especially Saudi Arabia and the UAE, dominate the market due to high healthcare spending, while Turkey shows notable growth supported by expanding orthopedic procedure volumes.

Africa

Africa accounted for a 1.5% share in 2024, valued at USD 22.06 million, up from USD 12.18 million in 2018. The market is projected to reach USD 30.12 million by 2032, recording the slowest CAGR of 3.5%. Limited healthcare access and lower affordability restrict faster adoption. However, increasing awareness of advanced surgical solutions and improving healthcare investments in South Africa and Egypt are driving gradual growth. Demand remains centered in urban hospitals, with rural areas still reliant on traditional treatment methods.

Market Segmentations:

By Product Type

- Synthetic Bone Glue

- Natural Bone Glue

By Application

- Orthopedic

- Arthroplasty

- Sports Injuries

- Spine Surgeries

- Trauma

By End-user

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers (ASCs)

By Region

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The Bone Glue Market is moderately consolidated, with global and regional players competing through product innovation, partnerships, and portfolio expansion. Leading companies such as Cryolife, St. Jude Medical, Integra Lifesciences, Johnson & Johnson, and B. Braun Melsungen AG dominate with strong brand presence, advanced biomaterial technologies, and broad distribution networks. Emerging players like LaunchPad Medical and Cohera Medical are focusing on specialized adhesives designed for minimally invasive and orthopedic procedures, enhancing competition. Continuous R&D investment remains central, as firms aim to improve bonding strength, biocompatibility, and surgical outcomes. Strategic mergers and acquisitions, such as collaborations with hospitals and research institutions, support market expansion and clinical validation. Meanwhile, cost competitiveness and regulatory compliance shape differentiation, especially for regional firms in Asia Pacific and Latin America. With growing demand in trauma, sports injuries, and arthroplasty, the market remains attractive for both established leaders and innovative startups pursuing high-growth opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Cryolife

- Jude Medical, Inc.

- Luna Innovations Incorporated

- Integra Lifesciences Corporation

- Johnson & Johnson

- Cohera Medical Inc.

- Braun Melsungen AG

- R. Bard Inc.

- LaunchPad Medical

- Chemence Medical Inc.

- DENTSPLY SIRONA Inc.

- Baxter International Inc.

- Tissuemed Ltd.

Recent Developments

- In 2024, the bone adhesive OsStic®, developed through a collaboration between Dublin City University (DCU) and PBC Biomed, received a Breakthrough Device Designation from the U.S. Food and Drug Administration (FDA).

- In January 2024, Biomimetic Innovations received FDA Breakthrough Device designation for its injectable bone filler.

- In September 2023, HippoFi partnered with Zimmer Biomet to launch a synthetic biomaterial under PUR Biologics.

- In January 2024, Enovis acquired LimaCorporate S.p.A., boosting its footprint in orthopedic biomaterials (which may intersect with adhesive / fixation segments).

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise with the increasing prevalence of orthopedic disorders worldwide.

- Synthetic bone glue will continue to dominate due to improved biocompatibility and strength.

- Adoption will grow in minimally invasive surgeries across developed and emerging regions.

- Sports medicine applications will expand as injury cases increase with active lifestyles.

- Hospitals will remain the leading end-users, supported by advanced surgical facilities.

- Asia Pacific will emerge as the fastest-growing region due to expanding healthcare access.

- Partnerships between manufacturers and healthcare providers will drive product innovation.

- Regulatory approvals will remain critical for global market expansion and new product launches.

- Education and awareness programs will enhance acceptance among surgeons and patients.

- Competitive intensity will increase as startups and established players focus on biomaterial advancements.