Market Overview

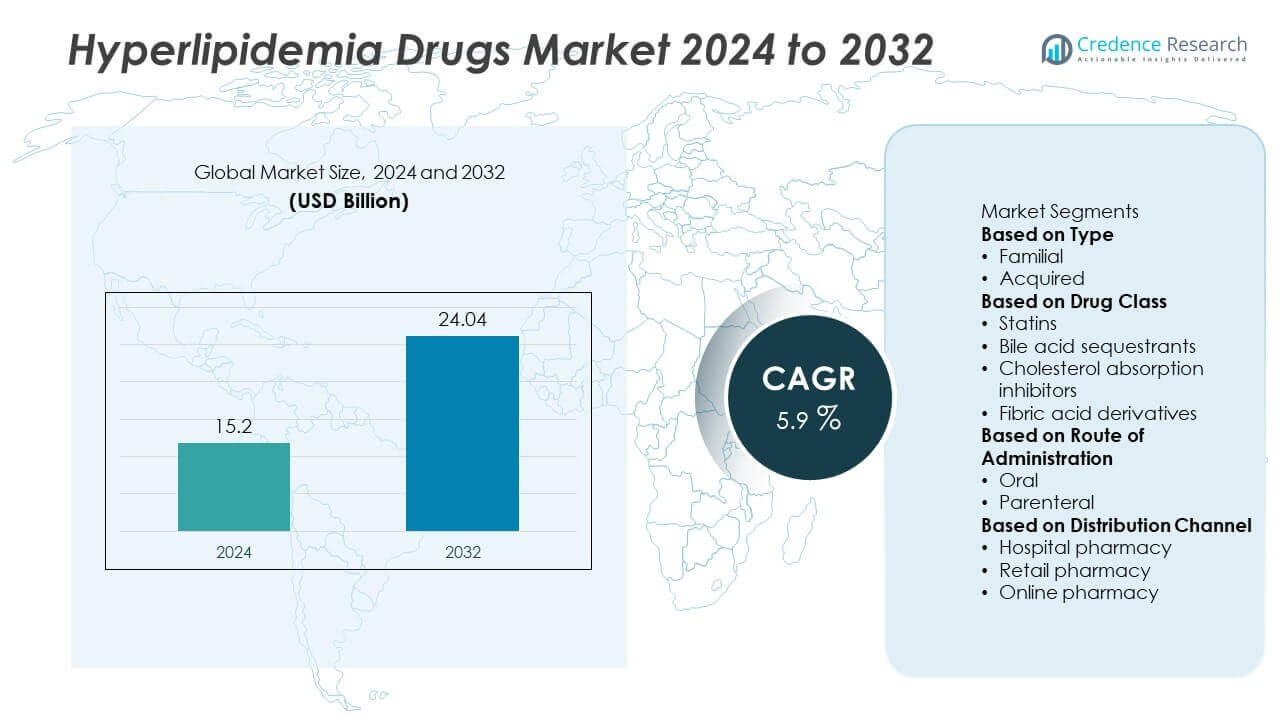

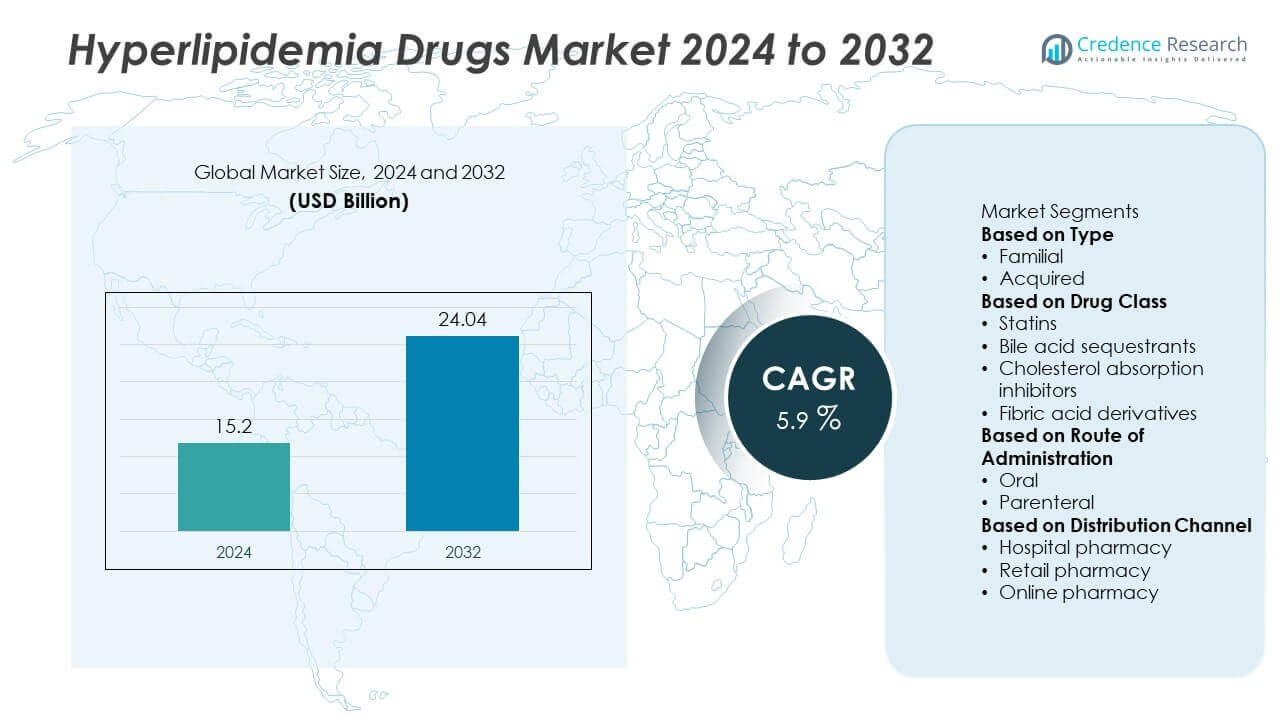

The Hyperlipidemia Drugs market was valued at USD 15.2 billion in 2024 and is projected to reach USD 24.04 billion by 2032, expanding at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hyper Automation Market Size 2024 |

USD 15.2 Billion |

| Hyper Automation Market, CAGR |

5.9% |

| Hyper Automation Market Size 2032 |

USD 24.04 Billion |

The Hyperlipidemia Drugs market is shaped by top players including Johnson & Johnson, F. Hoffmann-La Roche Ltd, Amgen Inc., Eli Lilly and Company, AstraZeneca PLC, Dr. Reddy’s Laboratories Limited, Merck & Co., Inc., Bristol-Myers Squibb Company, Alnylam Pharmaceuticals, Inc., and GSK plc. These companies lead through established statins, innovative PCSK9 inhibitors, and emerging RNA-based therapies. Regionally, North America dominated the market in 2024 with 41% share, supported by strong healthcare infrastructure and early access to biologics. Europe followed with 29%, driven by robust screening programs and treatment guidelines, while Asia-Pacific accounted for 21%, emerging as the fastest-growing region with rising cardiovascular disease prevalence and expanding healthcare access.

Market Insights

Market Insights

- The Hyperlipidemia Drugs market was valued at USD 15.2 billion in 2024 and is projected to reach USD 24.04 billion by 2032, growing at a CAGR of 5.9% during 2024–2032.

- Rising prevalence of cardiovascular diseases and obesity drives demand, with acquired hyperlipidemia leading at 72% share in 2024, supported by growing awareness and screening programs.

- Statins remained the dominant drug class with 61% share, while PCSK9 inhibitors and RNA-based therapies are gaining traction as key trends in advanced treatment options.

- The market is highly competitive with players such as Johnson & Johnson, F. Hoffmann-La Roche Ltd, Amgen Inc., Eli Lilly and Company, AstraZeneca PLC, Dr. Reddy’s Laboratories Limited, Merck & Co., Inc., Bristol-Myers Squibb Company, Alnylam Pharmaceuticals, Inc., and GSK plc focusing on innovation, partnerships, and pipeline expansion.

- Regionally, North America led with 41% share, followed by Europe at 29% and Asia-Pacific at 21%, while Latin America and Middle East & Africa accounted for 6% and 3%, respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The acquired hyperlipidemia segment dominated the market in 2024, accounting for nearly 72% share. Its dominance is driven by lifestyle-related factors such as obesity, poor diet, and sedentary behavior, which contribute significantly to cholesterol abnormalities. The increasing global burden of diabetes and cardiovascular diseases further accelerates the demand for effective treatments. Familial hyperlipidemia, while a smaller segment, remains important due to genetic screening and early interventions. However, the large patient base with acquired conditions continues to sustain strong demand for drug therapies, keeping this segment in the lead.

- For instance, a review of the Dutch familial hypercholesterolemia (FH) cascade screening program found that, on average, approximately eight new FH cases were detected per index patient, although the exact number varies by study [2023, 2024]. A review of the Dutch program further showed that the percentage of treated FH patients increased significantly two years after genetic testing [2011, 2024].

By Drug Class

Statins emerged as the leading drug class, holding over 61% of the Hyperlipidemia Drugs market in 2024. Their dominance is supported by proven efficacy in lowering LDL cholesterol and reducing cardiovascular risks, making them the first-line therapy. The widespread use of generic statins further boosts accessibility and affordability. Other classes, including bile acid sequestrants, cholesterol absorption inhibitors, and fibric acid derivatives, address specific patient groups and combination therapies. However, the established clinical benefits, cost-effectiveness, and high prescription rates ensure statins maintain the largest market share.

- For instance, studies on familial hypercholesterolemia (FH) have shown that a genetic diagnosis can increase the uptake of and adherence to lipid-lowering therapies. A 2018 report found that confirmation of a genetic variant led to a significant effect on patients’ plasma low-density lipoprotein cholesterol (LDL-C) levels.

By Route of Administration

Oral administration led the market in 2024, capturing nearly 85% share. Its dominance is attributed to the convenience of daily oral dosing and high patient adherence, particularly for statins and cholesterol absorption inhibitors. Oral drugs remain the preferred route due to ease of prescribing, low cost, and broad acceptance across patient populations. Parenteral options, including PCSK9 inhibitors, are gaining traction for patients unresponsive to oral therapies, but their high cost limits widespread use. Despite advancements in injectable therapies, oral formulations continue to dominate the hyperlipidemia treatment landscape.

Key Growth Drivers

Rising Prevalence of Cardiovascular Diseases

The growing global burden of cardiovascular diseases remains a primary driver for the hyperlipidemia drugs market. Unhealthy diets, obesity, smoking, and sedentary lifestyles significantly increase cholesterol-related disorders. According to health data, cardiovascular diseases continue to be the leading cause of death worldwide, accounting for millions of cases annually. This rising incidence fuels demand for effective cholesterol-lowering drugs, especially statins and novel biologics. As healthcare systems prioritize preventive care, the need for accessible and effective hyperlipidemia treatments continues to strengthen market growth across developed and emerging regions.

- For instance, global cardiovascular disease prevalence is projected to rise to 1.14 billion cases by 2050, with ischemic heart disease causing nearly 9 million deaths in 2021, underscoring the critical necessity for advanced cholesterol management therapies in medical protocols.

Increasing Awareness and Screening Programs

Expanding awareness campaigns and preventive healthcare initiatives have significantly improved early detection of hyperlipidemia. Governments and healthcare organizations actively promote cholesterol screening, encouraging patients to seek timely treatment. Early diagnosis not only increases drug prescriptions but also drives long-term adherence to therapies. Additionally, employer-led health checkups and insurance incentives for regular screening further boost treatment uptake. With more patients identified at early stages, the market sees consistent demand for both generic statins and advanced therapies, supporting sustainable growth in the hyperlipidemia drugs market.

- For instance, screening programs have been shown to increase the diagnosis rate of hyperlipidemia, facilitating earlier intervention that has been associated with significant, sustained reductions in LDL cholesterol levels over periods ranging from one to several years.

Advancements in Novel Therapeutics

The development of advanced drug classes, such as PCSK9 inhibitors and RNA-based therapies, creates new growth opportunities. These treatments demonstrate superior efficacy in patients resistant to traditional statins or with high genetic risk. Clinical trials highlight their ability to reduce LDL cholesterol to unprecedented levels, improving outcomes for high-risk populations. Pharmaceutical companies are heavily investing in research and partnerships to expand the pipeline of next-generation drugs. These innovations strengthen the market by addressing unmet medical needs and offering effective options beyond conventional therapies.

Key Trends & Opportunities

Rising Demand for Combination Therapies

A key trend in the hyperlipidemia drugs market is the increasing use of combination therapies. Physicians prescribe dual regimens of statins with cholesterol absorption inhibitors or bile acid sequestrants to maximize treatment effectiveness. This approach benefits patients with resistant hyperlipidemia, improving cholesterol management and reducing cardiovascular risks. Pharmaceutical companies are responding by developing fixed-dose combinations that improve compliance and outcomes. The growing adoption of multi-drug regimens creates strong opportunities for manufacturers to expand product portfolios and enhance treatment accessibility.

- For instance, in the IMPROVE-IT clinical trial, Merck’s Vytorin (a combination of ezetimibe and simvastatin) lowered the median time-weighted average low-density lipoprotein (LDL) cholesterol to 1.4 mmol/L compared to 1.8 mmol/L for simvastatin monotherapy, representing an average difference of 0.4 mmol/L.

Expansion of Biologics and Specialty Drugs

The market is witnessing rising adoption of biologics such as PCSK9 inhibitors, driven by their effectiveness in lowering LDL cholesterol levels among high-risk patients. Specialty drugs also gain traction as personalized medicine advances, offering tailored solutions for complex cases like familial hypercholesterolemia. Although high costs limit widespread use, reimbursement policies and greater physician confidence are driving uptake in developed markets. As patents expire for leading biologics, biosimilars are expected to emerge, creating further opportunities while enhancing accessibility in cost-sensitive regions.

- For instance, Amgen’s PCSK9 inhibitor Repatha has been reported to reduce LDL cholesterol by up to 1.5 mmol/L in high-risk patients, showing significant efficacy and helping a substantial patient subset achieve cholesterol targets beyond statins alone.

Key Challenges

High Cost of Advanced Therapies

The high pricing of biologics and specialty drugs poses a major barrier in the hyperlipidemia drugs market. Treatments like PCSK9 inhibitors, though effective, remain unaffordable for many patients, especially in developing economies. Limited reimbursement coverage further restricts access, leading to uneven adoption across regions. Healthcare providers often prefer cost-effective statins, which reduces the potential reach of newer therapies. This cost challenge continues to hinder broad market penetration, forcing companies to focus on pricing strategies and collaborations with payers to improve affordability.

Patient Adherence and Long-Term Compliance Issues

Another critical challenge lies in ensuring patient adherence to long-term hyperlipidemia treatment. Many patients discontinue therapies once cholesterol levels normalize, which raises risks of relapse and cardiovascular events. Side effects associated with statins, such as muscle pain, further contribute to poor compliance. Lack of continuous follow-up and limited patient education exacerbate the issue. Pharmaceutical companies and healthcare providers must invest in adherence programs, digital health tools, and awareness campaigns to address this challenge, ensuring better outcomes and sustained market growth.

Regional Analysis

North America

North America dominated the Hyperlipidemia Drugs market in 2024 with 41% share, driven by high prevalence of cardiovascular diseases and widespread adoption of statins and advanced biologics. Strong healthcare infrastructure, early access to novel therapies, and significant awareness programs further strengthen demand. The U.S. leads with high prescription rates and robust clinical research, while Canada supports adoption through public health initiatives. Favorable reimbursement policies and the presence of major pharmaceutical companies also drive growth. Continued emphasis on preventive healthcare and rising use of PCSK9 inhibitors sustain the region’s leadership.

Europe

Europe accounted for 29% share of the Hyperlipidemia Drugs market in 2024, supported by strict cardiovascular disease management guidelines and high screening rates. Countries such as Germany, the UK, and France drive adoption due to strong healthcare coverage and access to advanced therapies. Widespread prescription of generic statins ensures affordability, while demand for biologics continues to rise in high-risk populations. The region benefits from government-led preventive health initiatives, further increasing early treatment uptake. With growing focus on reducing cardiovascular mortality, Europe remains a key contributor to global hyperlipidemia drug sales.

Asia-Pacific

Asia-Pacific captured 21% share of the Hyperlipidemia Drugs market in 2024 and is projected to be the fastest-growing region. Rising urbanization, changing lifestyles, and a surge in obesity and diabetes cases drive demand for cholesterol-lowering therapies. Countries like China, India, and Japan lead adoption, with expanding healthcare infrastructure and increasing access to generic statins supporting market growth. Government initiatives to reduce cardiovascular burden and rising health awareness encourage higher screening and treatment rates. Though biologics adoption is limited by costs, demand for affordable oral drugs strengthens Asia-Pacific’s growth potential.

Latin America

Latin America represented 6% share of the Hyperlipidemia Drugs market in 2024, driven by growing incidence of obesity and cardiovascular diseases in countries such as Brazil and Mexico. Expanding access to affordable generics and government-led health campaigns support adoption. The region faces challenges from limited healthcare budgets, but increasing investments in digital health programs and preventive screenings are improving awareness and treatment uptake. While use of advanced biologics is restricted due to cost, the demand for statins and cholesterol absorption inhibitors continues to expand steadily across the region.

Middle East & Africa

The Middle East & Africa held 3% share of the Hyperlipidemia Drugs market in 2024, with adoption concentrated in urban centers of the UAE, Saudi Arabia, and South Africa. Rising prevalence of obesity, diabetes, and cardiovascular risk factors fuels demand for cholesterol-lowering therapies. Government initiatives promoting preventive healthcare and early detection programs are boosting treatment penetration. However, limited healthcare resources and affordability constraints hinder widespread access to biologics. Growing availability of generic statins and international collaborations in healthcare infrastructure development are expected to support steady growth in the region.

Market Segmentations:

By Type

By Drug Class

- Statins

- Bile acid sequestrants

- Cholesterol absorption inhibitors

- Fibric acid derivatives

By Route of Administration

By Distribution Channel

- Hospital pharmacy

- Retail pharmacy

- Online pharmacy

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Hyperlipidemia Drugs market includes major players such as Johnson & Johnson, F. Hoffmann-La Roche Ltd, Amgen Inc., Eli Lilly and Company, AstraZeneca PLC, Dr. Reddy’s Laboratories Limited, Merck & Co., Inc., Bristol-Myers Squibb Company, Alnylam Pharmaceuticals, Inc., and GSK plc. These companies drive competition through strong portfolios of statins, biologics, and novel therapies targeting both acquired and familial hyperlipidemia. Leading firms invest heavily in research on PCSK9 inhibitors, RNA-based treatments, and combination drugs to enhance efficacy and address resistant patient groups. Partnerships and acquisitions strengthen market positioning, while generic manufacturers improve accessibility in cost-sensitive regions. Companies also focus on expanding global distribution networks and patient adherence programs to increase long-term treatment compliance. With rising cardiovascular disease prevalence and demand for advanced therapies, competition remains intense, pushing players to differentiate based on clinical outcomes, safety, affordability, and innovative treatment pipelines.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Johnson & Johnson

- Hoffmann-La Roche Ltd

- Amgen Inc.

- Eli Lilly And Company

- AstraZeneca PLC

- Reddy’s Laboratories Limited

- Merck & Co., Inc.

- Bristol-Myers Squibb Company

- Alnylam Pharmaceuticals, Inc.

- GSK plc

Recent Developments

- In August 2025, the FDA expanded Repatha (evolocumab) indication to include adults at increased MACE risk from uncontrolled LDL-C.

- In June 2025, Merck announced positive topline Phase III results for enlicitide decanoate in hyperlipidemia trials

- In March 2025, AstraZeneca’s experimental oral AZD0780 showed ~50.7 % LDL-C reduction at 12 weeks (added to statin).

- In May 2024, Roche’s Tina-quant® Lp(a) assay received FDA Breakthrough Device Designation.

Report Coverage

The research report offers an in-depth analysis based on Type, Drug Class, Route of Administration, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising global cardiovascular disease prevalence.

- Statins will continue to dominate prescriptions due to cost-effectiveness and proven outcomes.

- Biologics such as PCSK9 inhibitors will expand adoption among high-risk patients.

- RNA-based therapies will gain attention as innovative options for resistant cases.

- Combination therapies will rise to improve treatment outcomes and adherence.

- Emerging biosimilars will increase accessibility of advanced biologics in cost-sensitive markets.

- Asia-Pacific will record the fastest growth supported by expanding healthcare access.

- Preventive screening programs will drive earlier diagnosis and long-term therapy adoption.

- Pharmaceutical companies will invest in R&D to develop safer and more effective drugs.

- Patient adherence programs and digital health tools will shape future treatment compliance.

Market Insights

Market Insights