Market Overview

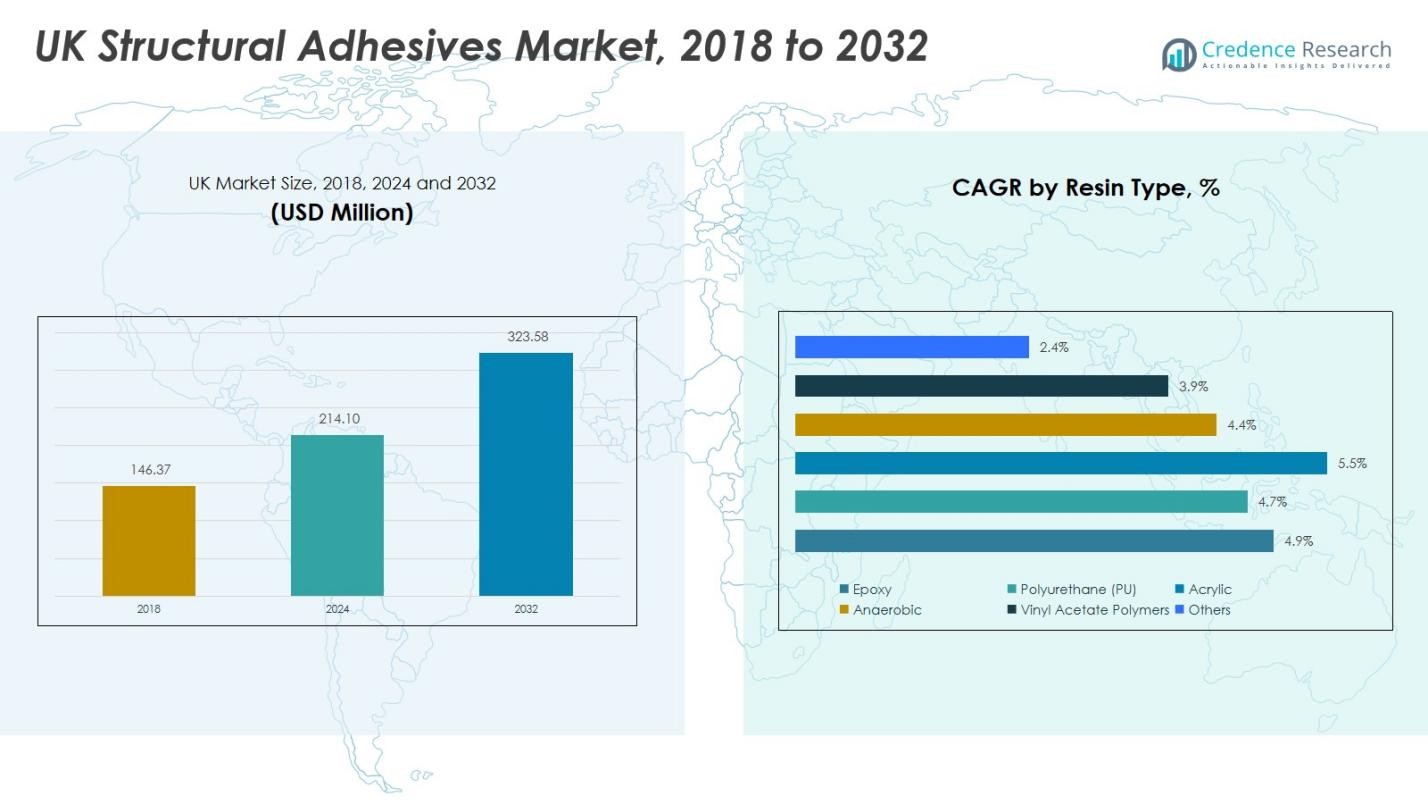

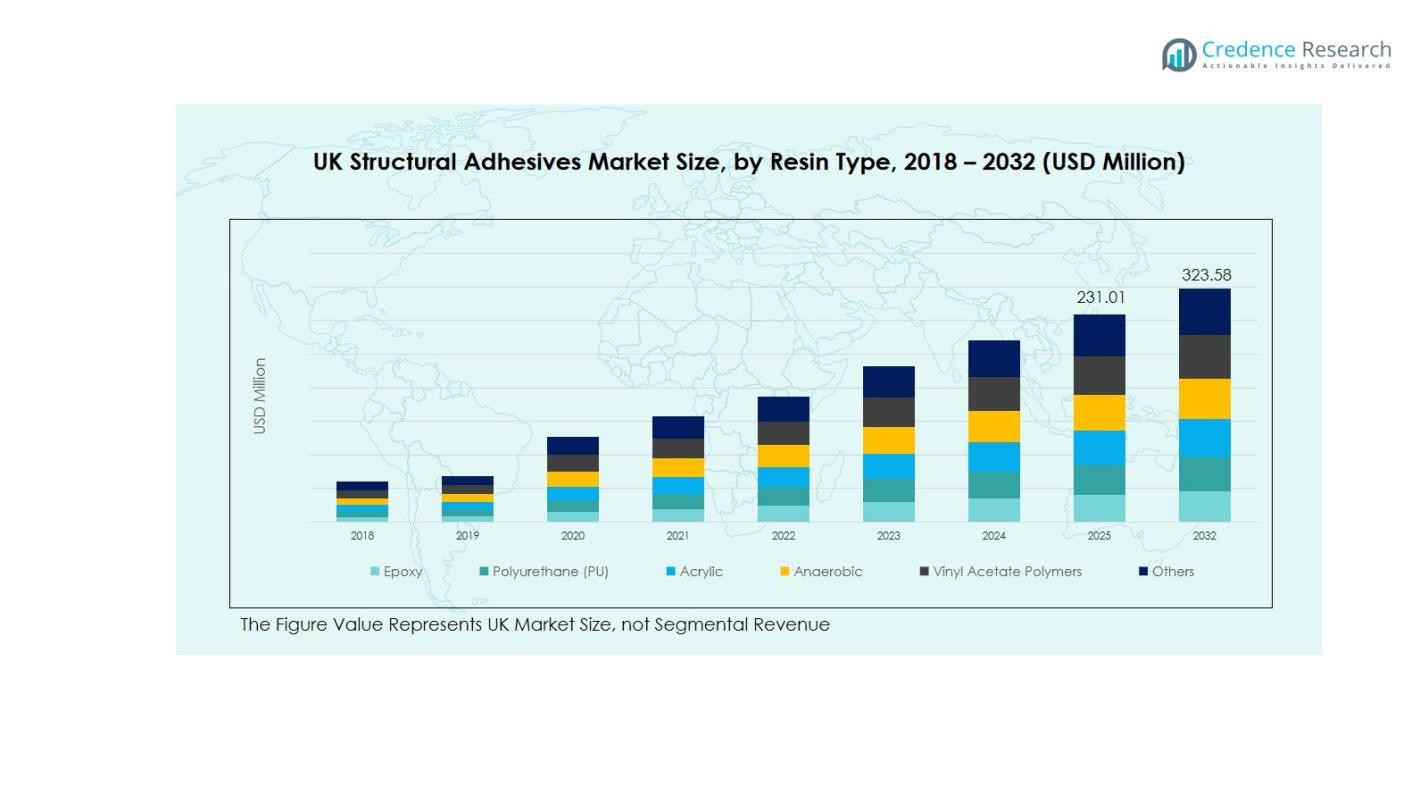

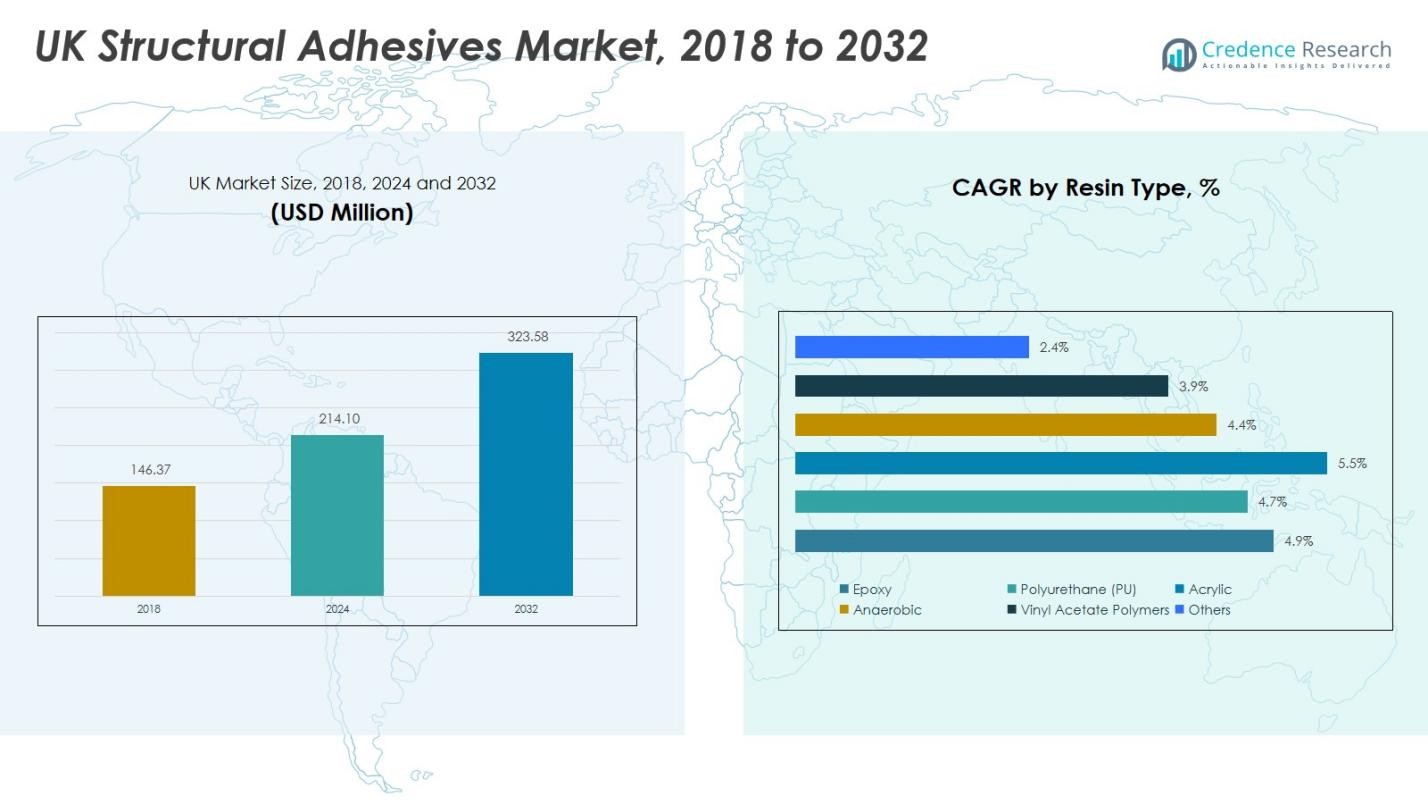

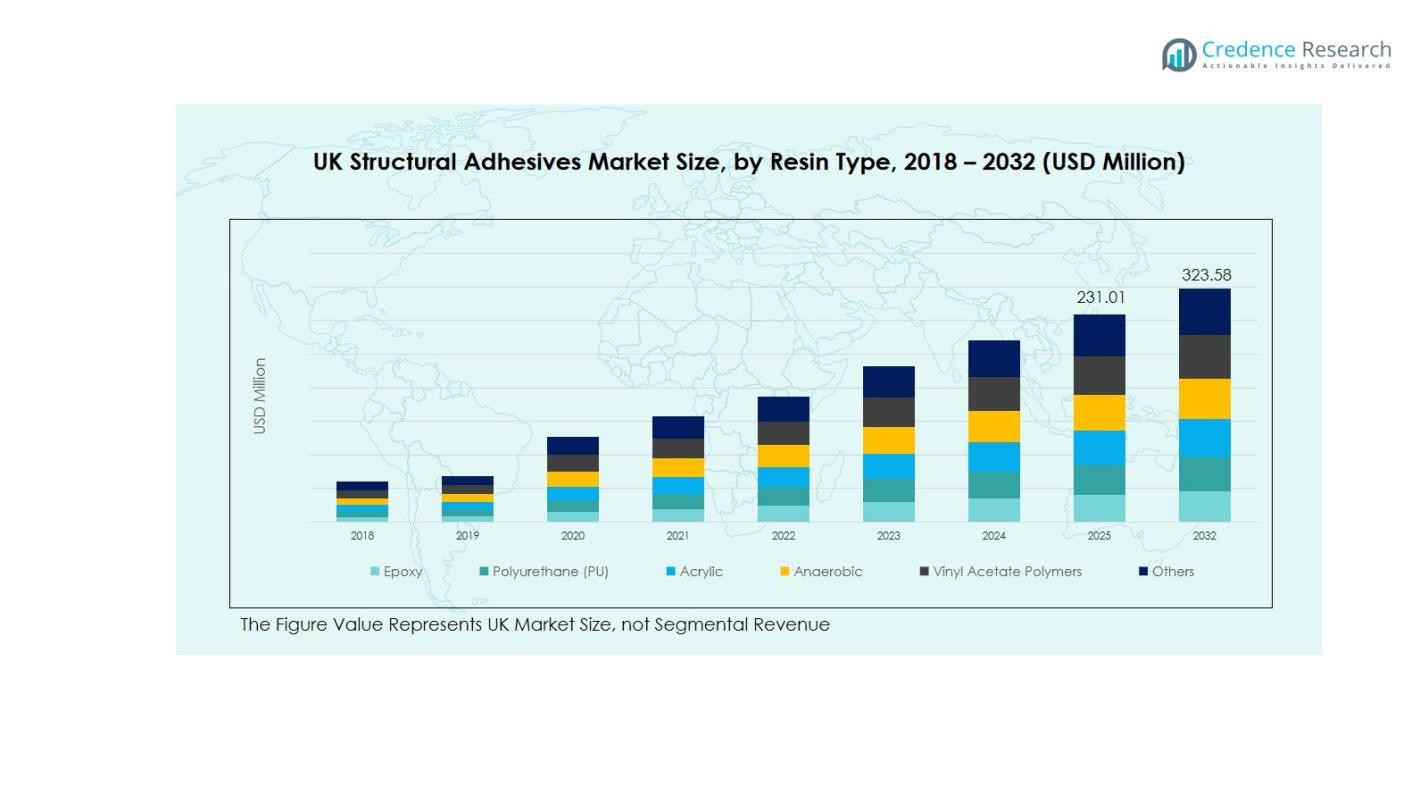

UK Structural Adhesives Market size was valued at USD 146.37 Million in 2018, increased to USD 214.10 Million in 2024, and is anticipated to reach USD 323.58 Million by 2032, growing at a CAGR of 4.93% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Structural Adhesives Market Size 2024 |

USD 214.10 Million |

| UK Structural Adhesives Market, CAGR |

4.93% |

| UK Structural Adhesives Market Size 2032 |

USD 323.58 Million |

The UK Structural Adhesives Market is highly competitive, with leading players including Henkel AG & Co. KGaA, Sika AG, RPM International Inc., Huntsman Corporation, Arkema S.A., H.B. Fuller Company, Dow Inc., 3M Company, Lord Corporation, and L&L Products, Inc. These companies leverage strong product portfolios, advanced adhesive technologies, and extensive distribution networks to maintain market dominance. Strategic initiatives such as mergers, acquisitions, partnerships, and continuous R&D investments enable them to enhance performance, develop eco-friendly solutions, and expand their regional reach. England emerges as the leading region in the UK Structural Adhesives Market, commanding a significant 55% of total revenue, driven by robust automotive, aerospace, and construction sectors. High adoption of epoxy and polyurethane adhesives across metal, composite, and plastic substrates further strengthens England’s market position, supporting long-term growth and reinforcing its prominence within the UK structural adhesives landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK Structural Adhesives Market was valued at USD 214.10 Million in 2024 and is projected to reach USD 323.58 Million by 2032, growing at a CAGR of 4.93%.

- Rising demand from automotive, aerospace, and construction sectors drives growth, as manufacturers adopt lightweight materials and high-performance adhesives for better fuel efficiency, structural integrity, and assembly efficiency.

- Market trends indicate a shift toward eco-friendly and water-based adhesives, along with growing adoption of composite materials in industrial and transportation applications, presenting opportunities for advanced epoxy and polyurethane formulations.

- The competitive landscape is dominated by Henkel AG & Co. KGaA, Sika AG, RPM International Inc., Huntsman Corporation, Arkema S.A., H.B. Fuller Company, Dow Inc., 3M Company, Lord Corporation, and L&L Products, Inc., who focus on R&D, partnerships, and innovative product offerings.

- England leads regional demand with 55% market share, followed by Scotland (15%), Wales (10%), Northern Ireland (8%), and other regions (12%), while epoxy resins and metal substrates are the dominant segments.

Market Segmentation Analysis:

By Resin Type:

The epoxy resin segment dominates the UK structural adhesives market, accounting for approximately 38% of the total revenue. Its superior mechanical strength, chemical resistance, and versatility across industries, including automotive and aerospace, drive its widespread adoption. Polyurethane (PU) and acrylic resins follow, offering flexibility and fast-curing properties suitable for specialized applications. Anaerobic and vinyl acetate polymers cater to niche markets, while others capture smaller shares. Overall, rising demand for durable bonding solutions in automotive assembly, infrastructure, and industrial manufacturing continues to propel the epoxy segment, reinforcing its leading position in the resin-type category.

For instance, Henkel’s Loctite epoxy adhesives are extensively used in automotive metal bonding, providing high durability to withstand harsh conditions.

By Substrate:

Metal substrates represent the dominant sub-segment, contributing nearly 45% of UK structural adhesives market revenue. The growth is primarily fueled by increasing use of lightweight metals in automotive and aerospace applications, requiring strong adhesive bonding to replace traditional mechanical fasteners. Composites and wood substrates are gaining traction due to rising adoption in construction and furniture sectors, while plastics hold a moderate share, driven by electronic and packaging applications. The demand for enhanced structural integrity, corrosion resistance, and assembly efficiency remains the key driver supporting metal as the leading substrate in the UK market.

For instance, Sika’s SikaPower® epoxy adhesives, based on SmartCore® technology, provide exceptional fatigue resistance and superior corrosion protection for metal-to-metal bonding in lightweight structures, supporting automotive manufacturers in reducing vehicle weight while maintaining strength.

By Technology:

Solvent-based adhesives hold a leading share of around 42% in the UK market, favored for their robust bonding performance across metals, composites, and plastics. Their fast curing, high strength, and adaptability in high-stress applications make them widely adopted in automotive, aerospace, and industrial sectors. Water-based adhesives are growing steadily due to environmental regulations and the demand for eco-friendly solutions, while other technologies, including hot-melt and UV-curable adhesives, cater to niche applications. Increasing emphasis on sustainable manufacturing, efficiency, and high-performance bonding drives the dominance of solvent-based technologies in the UK structural adhesives market.

Key Growth Drivers

Rising Automotive & Aerospace Production

The expansion of the automotive and aerospace sectors in the UK significantly drives demand for structural adhesives. Increasing use of lightweight materials like aluminum and composites in vehicle and aircraft manufacturing requires high-strength bonding solutions to replace traditional mechanical fasteners. This shift enhances fuel efficiency and structural performance, promoting the adoption of epoxy and polyurethane adhesives. Additionally, stringent safety and emission standards necessitate durable and reliable adhesive solutions, further propelling market growth and reinforcing the prominence of structural adhesives across transportation industries.

For instance, companies like ThreeBond have developed acrylic-based structural adhesives specifically engineered to provide robust bonding for lightweight automotive materials such as aluminum and carbon fiber-reinforced polymers, enhancing crash safety and corrosion resistance.

Infrastructure and Construction Development

Ongoing infrastructure projects and modern construction practices in the UK contribute to market growth. Structural adhesives are increasingly preferred over mechanical fasteners for bonding metals, composites, and wood due to their strength, durability, and ability to reduce assembly time. Applications in bridges, buildings, and industrial facilities drive the demand for water-based and solvent-based adhesives. The push toward sustainable construction materials and efficient assembly processes supports higher adoption rates, making construction a critical growth driver for the UK structural adhesives market.

For instance, Structural Adhesives Ltd developed an A2 Fire Rated Epoxy Adhesive recognized with the King’s Award for Enterprise in Innovation, used to enhance fire safety in high-rise buildings and critical infrastructure.

Technological Advancements in Adhesives

Innovations in adhesive chemistry and formulation have expanded the application range of structural adhesives. Advanced epoxy, acrylic, and polyurethane adhesives now offer faster curing times, higher mechanical strength, and improved chemical resistance. These technological developments enable bonding of diverse substrates like metals, composites, and plastics across automotive, aerospace, and industrial sectors. As manufacturers seek reliable and high-performance solutions for lightweight and complex assemblies, the continuous enhancement of adhesive technologies fuels market expansion and reinforces adoption across multiple end-use industries.

Key Trends & Opportunities

Shift Toward Eco-Friendly Adhesives

Sustainability is reshaping the UK structural adhesives market, with a growing preference for water-based and low-VOC adhesives. Environmental regulations and corporate sustainability goals encourage manufacturers to adopt eco-friendly solutions without compromising performance. This trend creates opportunities for R&D investments in green adhesive formulations and enables companies to differentiate their product offerings. The shift toward environmentally responsible adhesives aligns with consumer expectations and regulatory compliance, presenting significant growth potential for players focusing on sustainable and high-performance adhesive solutions.

For instance, DuPont developed MEGUM™ W 9500, a heat-reactive, water-based adhesive delivering strong bonds with reduced harmful emissions.

Expansion in Composite Material Applications

The increasing use of composite materials across automotive, aerospace, and industrial sectors presents substantial opportunities for structural adhesives. Composites require specialized bonding solutions to maintain strength, flexibility, and durability, driving demand for advanced epoxy and polyurethane adhesives. As manufacturers prioritize lightweight and energy-efficient materials, the market can capitalize on adhesives that deliver reliable performance in complex assemblies. Growth in composite adoption across emerging applications, such as electric vehicles and renewable energy components, further strengthens the market outlook for structural adhesives in the UK.

For instance, Boeing’s 787 Dreamliner incorporates about 50% of its structure by weight using carbon fiber-reinforced polymer composites, enhancing fuel efficiency by 20-30%, which necessitates strong, durable adhesives to maintain structural integrity.

Key Challenges

High Cost of Advanced Adhesives

The premium pricing of high-performance structural adhesives, such as advanced epoxies and polyurethanes, limits adoption among small and medium enterprises. While these adhesives offer superior strength and chemical resistance, the high cost can deter cost-sensitive manufacturers from replacing traditional bonding methods. This challenge constrains market penetration in certain segments, particularly where budget limitations outweigh performance requirements. Companies must balance innovation with affordability to expand adoption while maintaining profitability in the competitive UK structural adhesives market.

Stringent Regulatory Compliance

Compliance with environmental and safety regulations poses challenges for structural adhesive manufacturers. VOC emissions, chemical content restrictions, and workplace safety standards require continuous formulation adjustments and testing, increasing production complexity and costs. Failure to meet regulatory requirements can result in penalties and market restrictions. Navigating this regulatory landscape while maintaining product performance and market competitiveness remains a key challenge, necessitating strategic investments in R&D and quality assurance for sustained growth in the UK market.

Regional Analysis

England

England dominates the UK structural adhesives market, accounting for 55% of total revenue. The region’s robust automotive, aerospace, and construction industries drive strong demand for high-performance adhesives. Manufacturers increasingly adopt epoxy and polyurethane adhesives for metal, composite, and plastic substrates to improve assembly efficiency and structural strength. Rising investment in infrastructure projects and transportation networks further fuels market growth. The presence of major adhesive manufacturers and R&D centers in England supports product innovation and distribution. Increasing adoption of eco-friendly and water-based adhesives in industrial and commercial applications reinforces England’s leading position in the UK market.

Scotland

Scotland holds a 15% share of the UK structural adhesives market, driven by growth in construction, renewable energy, and aerospace sectors. Structural adhesives are widely used for bonding metals, composites, and wood in industrial and infrastructure projects. Rising government initiatives to promote sustainable construction practices favor the adoption of water-based and low-VOC adhesives. The region’s emphasis on renewable energy installations, such as wind and offshore projects, requires high-strength bonding solutions for durable performance. Additionally, the presence of small-to-medium adhesive manufacturers catering to specialized applications supports market expansion in Scotland.

Wales

Wales contributes 10% to the UK structural adhesives market, largely supported by construction, automotive component manufacturing, and industrial applications. Structural adhesives are increasingly used to join metals, composites, and plastics, replacing traditional mechanical fasteners. The growth is driven by ongoing infrastructure development and industrial modernization projects. Rising demand for lightweight, high-performance bonding solutions in automotive and aerospace sectors also supports market expansion. The adoption of eco-friendly and solvent-free adhesive technologies aligns with regional sustainability goals, further strengthening market penetration. Wales continues to show steady growth due to government-backed development programs and rising industrial investments.

Northern Ireland

Northern Ireland accounts for 8% of the UK structural adhesives market, with growth fueled by manufacturing, construction, and aerospace sectors. Structural adhesives are preferred for joining metals, plastics, and composites in transportation and industrial assemblies. Government incentives supporting industrial modernization and sustainable construction practices drive demand for high-performance adhesives. Adoption of water-based and solvent-based adhesives is increasing, with epoxy and polyurethane dominating the market. The presence of regional manufacturers and growing demand from small-to-medium enterprises for reliable bonding solutions further supports market expansion. Northern Ireland demonstrates consistent growth potential within the UK structural adhesives landscape.

Other Regions

Other regions in the UK, including smaller industrial hubs and offshore installations, contribute 12% of the total market share. Demand is primarily driven by niche applications in industrial manufacturing, electronics, and specialized construction projects. Structural adhesives are increasingly adopted for bonding metals, composites, and plastics where high performance and durability are required. Growth in these regions is supported by local manufacturing activities, renewable energy projects, and the adoption of eco-friendly adhesive technologies. The focus on innovation, sustainable solutions, and high-strength bonding in emerging industrial sectors continues to enhance market opportunities across other UK regions.

Market Segmentations:

By Resin Type:

- Epoxy

- Polyurethane (PU)

- Acrylic

- Anaerobic

- Vinyl Acetate Polymers

- Others

By Substrate:

- Metal

- Composite

- Wood

- Plastic

- Others

By Technology:

- Solvent-based

- Water-based

- Others

By Application:

- Automotive & Transportation

- Aerospace

- Building & Construction

- Electronics

- Industrial Manufacturing

- Others

By Region:

- England

- Scotland

- Wales

- Northern Ireland

- Other Regions

Competitive Landscape

The competitive landscape of the UK structural adhesives market includes major players such as Henkel AG & Co. KGaA, Sika AG, RPM International Inc., Huntsman Corporation, Arkema S.A., H.B. Fuller Company, Dow Inc., 3M Company, Lord Corporation, and L&L Products, Inc. These companies dominate the market through strong product portfolios, extensive distribution networks, and continuous innovation in adhesive technologies. Strategic initiatives such as mergers, acquisitions, and partnerships enhance their market reach and technological capabilities. The market is characterized by high competition in epoxy and polyurethane segments, with companies focusing on developing eco-friendly, high-performance adhesives to meet evolving industrial and regulatory requirements. Investment in R&D to improve curing times, bonding strength, and substrate compatibility remains a key differentiator. Additionally, regional presence and tailored solutions for automotive, aerospace, and construction sectors strengthen the competitive positioning of these leading players in the UK market.

Key Player Analysis

Recent Developments

- In March 2023, TECHSiL Ltd acquired Eurobond Adhesives to strengthen its product portfolio and expand its presence in the UK structural adhesives market.

- In June 2024, Meridian Adhesives Group expanded its UK footprint by acquiring Bondloc UK Ltd, a specialty adhesive manufacturer.

- In January 2025, Eurobond Adhesives, a division of the TECHSiL Group, unveiled innovative solutions at the Sign & Digital UK 2025 event, featuring its new hot melt adhesive, tecbond® 248.

Report Coverage

The research report offers an in-depth analysis based on Resin Type, Substrate, Technology, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UK structural adhesives market is expected to grow steadily due to rising demand from automotive and aerospace sectors.

- Increasing adoption of lightweight materials in vehicles and aircraft will boost demand for high-performance adhesives.

- Expansion of infrastructure and construction projects across the UK will support market growth.

- Eco-friendly and water-based adhesives will gain traction as sustainability regulations tighten.

- Technological advancements in adhesive formulations will enhance bonding strength, curing time, and substrate compatibility.

- Rising use of composite materials in industrial and transportation applications will create new market opportunities.

- Small and medium enterprises are increasingly adopting structural adhesives for cost-effective and efficient assembly processes.

- The demand for adhesives in electronics and industrial manufacturing sectors will continue to grow.

- Strategic collaborations, partnerships, and R&D investments by key players will strengthen market competitiveness.

- Focus on lightweight, durable, and high-performance bonding solutions will drive long-term market expansion.