| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Ultrafast CT Scan Devices Market Size 2024 |

USD 403.72 Million |

| UK Ultrafast CT Scan Devices Market, CAGR |

6.16% |

| UK Ultrafast CT Scan Devices Market Size 2032 |

USD 651.34 Million |

Market Overview

The UK Ultrafast CT Scan Devices Market is projected to grow from USD 403.72 million in 2024 to an estimated USD 651.34 million by 2032, with a compound annual growth rate (CAGR) of 6.16% from 2025 to 2032. The rising demand for advanced diagnostic imaging technologies and the increasing incidence of cardiovascular and oncological disorders are propelling the market’s expansion.

Market drivers include the growing elderly population and the subsequent rise in chronic disease cases requiring rapid and precise diagnostics. Technological advancements, such as the integration of artificial intelligence (AI) for automated image interpretation, are enhancing the utility and appeal of ultrafast CT devices. Trends indicate a shift toward minimally invasive diagnostics and the increasing adoption of hybrid imaging modalities to support personalized treatment planning.

Geographically, England dominates the UK ultrafast CT scan devices market, driven by higher healthcare spending and the concentration of advanced medical institutions. Scotland and Wales are also witnessing growing adoption due to improved healthcare access and regional government initiatives. Key players shaping the market include Siemens Healthineers, GE Healthcare, Canon Medical Systems, and Philips Healthcare, all of whom continue to invest in R&D and strategic partnerships to strengthen their presence and technological edge in the UK market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK Ultrafast CT Scan Devices Market is expected to grow from USD 403.72 million in 2024 to USD 651.34 million by 2032, with a CAGR of 6.16% from 2025 to 2032.

- The Global Ultrafast CT Scan Devices Market is projected to grow from USD 9,765.51 million in 2024 to an estimated USD 15,858.58 million by 2032, with a compound annual growth rate (CAGR) of 6.25% from 2025 to 2032.

- Ultrafast CT scanners, offering superior imaging speed and accuracy, are gaining popularity across hospitals and diagnostic centers for their ability to capture high-resolution images in milliseconds.

- The increasing incidence of cardiovascular and oncological disorders, along with an aging population, is driving the demand for rapid, precise diagnostic technologies like ultrafast CT scanners.

- Artificial intelligence is enhancing the appeal of ultrafast CT devices by automating image interpretation and improving diagnostic accuracy, contributing to market growth.

- There is a shift towards minimally invasive diagnostic techniques, with increasing adoption of hybrid imaging modalities to support personalized treatment planning.

- England dominates the market due to a higher concentration of advanced medical institutions, while Scotland and Wales are experiencing growth driven by government healthcare initiatives.

- Ongoing investments in healthcare infrastructure and NHS modernization initiatives support the adoption of ultrafast CT devices across the UK, ensuring sustained market expansion.

Report Scope

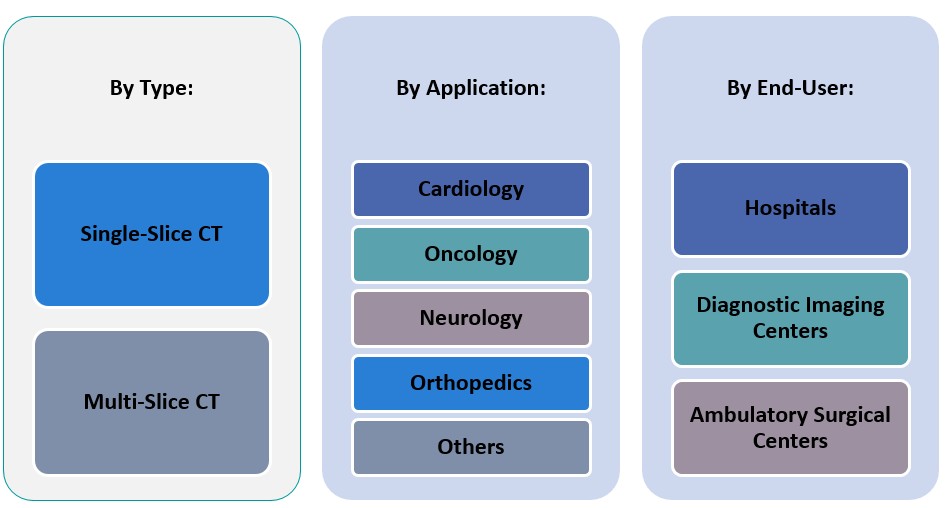

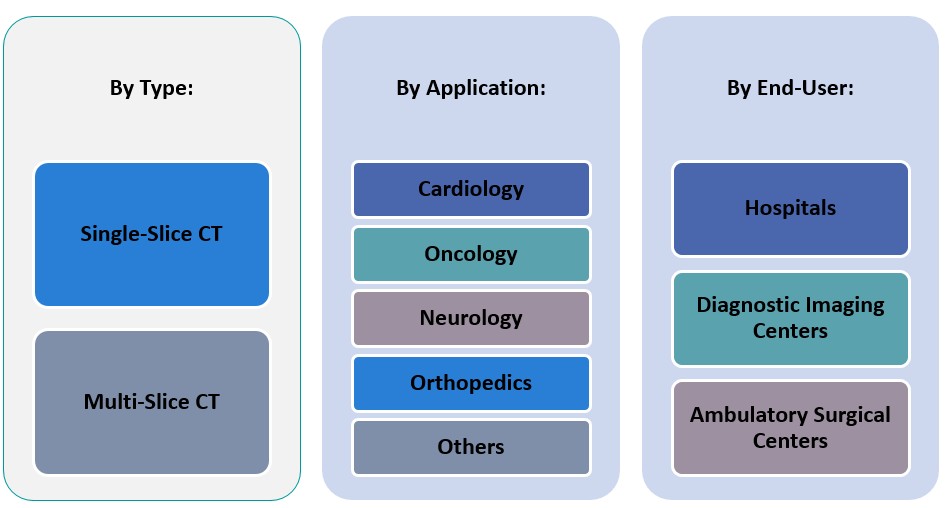

This report segments the UK Ultrafast CT Scan Devices Market as follows:

Market Drivers

Rising Prevalence of Chronic Diseases and Aging Population

The UK’s rapidly aging population is a significant driver for the ultrafast CT scan devices market. As individuals age, they become increasingly susceptible to chronic conditions such as cardiovascular diseases, cancer, and neurological disorders, all of which require advanced diagnostic imaging for timely detection and treatment. For instance, the number of people aged 65 years and older is projected to rise substantially by 2032, further increasing the demand for healthcare services, including diagnostic imaging. Ultrafast CT scanners, with their ability to produce high-quality images quickly, play a vital role in diagnosing life-threatening conditions at an early stage. Early diagnosis facilitated by ultrafast imaging supports better treatment outcomes, minimizes the burden on healthcare systems, and enhances patient quality of life. This demographic trend, combined with the growing incidence of complex, multi-morbid cases, reinforces the necessity for highly efficient and accurate imaging technologies, positioning ultrafast CT scanners as an essential tool in modern UK healthcare.

Technological Advancements and Integration of Artificial Intelligence

Technological innovations have significantly enhanced the capabilities of CT scan devices, particularly ultrafast variants. Continuous improvements in detector technology, image reconstruction algorithms, and dose reduction techniques have made modern CT scanners faster, more accurate, and safer for patients. The integration of artificial intelligence (AI) into CT imaging systems is revolutionizing diagnostic processes by automating image analysis, improving diagnostic accuracy, and reducing the workload for radiologists. AI-enabled ultrafast CT scanners can quickly differentiate between normal and abnormal tissues, flag potential issues, and assist in triaging cases that require urgent attention. For example, AI-driven solutions developed by Siemens Healthineers and GE Healthcare are enabling faster image processing and actionable insights, helping radiologists prioritize urgent cases effectively. As hospitals and diagnostic centers increasingly prioritize efficiency, accuracy, and patient safety, the demand for technologically advanced ultrafast CT devices continues to rise across the UK.

Increasing Emphasis on Early Diagnosis and Preventive Healthcare

The shift towards preventive healthcare strategies in the UK is significantly boosting the demand for advanced diagnostic tools like ultrafast CT scan devices. The National Health Service (NHS) and other healthcare providers are placing greater emphasis on early detection of diseases to improve patient outcomes and reduce long-term treatment costs. Ultrafast CT imaging offers the ability to detect abnormalities, including small tumors, vascular blockages, and organ injuries, at very early stages when interventions are most effective. Screening programs for conditions such as lung cancer and coronary artery disease are incorporating CT scans more frequently as part of their protocols. For example, targeted lung health checks and low-dose CT scan initiatives aim to identify lung cancer at an earlier, more treatable stage. The speed, low radiation exposure, and high precision of ultrafast CT scanners make them ideal for routine screening programs and preventive diagnostic services. As healthcare systems strive to curb the burden of advanced-stage diseases, the strategic role of ultrafast CT devices in facilitating early intervention becomes increasingly critical, driving sustained growth in market demand.

Government Initiatives and Healthcare Infrastructure Modernization

Government policies and initiatives aimed at upgrading healthcare infrastructure are providing a strong impetus to the UK ultrafast CT scan devices market. Substantial investments under frameworks such as the NHS Long Term Plan and the Health Infrastructure Plan are intended to modernize diagnostic facilities, integrate advanced technologies, and reduce waiting times for imaging services. The UK government has also introduced targeted funding schemes to enhance diagnostic imaging capacities across the NHS, such as the Community Diagnostic Centres (CDC) program, which focuses on improving access to fast and effective diagnostic services outside of traditional hospital settings. These initiatives prioritize the acquisition of state-of-the-art imaging equipment, including ultrafast CT scanners, to meet the growing demand for high-quality diagnostic services. Furthermore, partnerships between the government and private sector players are accelerating the deployment of next-generation medical imaging technologies. The policy-driven modernization of healthcare infrastructure, combined with strategic investments in cutting-edge diagnostic equipment, is creating a favorable environment for the sustained adoption and expansion of ultrafast CT scan technologies across the UK.

Market Trends

Integration of Artificial Intelligence and Machine Learning

One of the most prominent trends shaping the UK Ultrafast CT Scan Devices Market is the growing integration of artificial intelligence (AI) and machine learning (ML) technologies into imaging systems. Leading manufacturers are embedding AI algorithms to automate image reconstruction, enhance diagnostic accuracy, and facilitate real-time decision-making. AI-enabled ultrafast CT scanners have demonstrated the ability to detect anomalies and classify tissues with precision, as seen in systems developed by companies like Siemens Healthineers. The NHS has implemented AI-driven CT solutions in several pilot programs to address radiologist shortages and improve operational efficiency. Machine learning models trained on extensive datasets have been shown to improve image clarity and optimize radiation doses, ensuring better patient safety without compromising image quality. Regulatory bodies such as the Medicines and Healthcare products Regulatory Agency (MHRA) are actively supporting the safe adoption of AI in healthcare, further driving this trend. For instance, Siemens Healthineers has reported that their AI-powered CT scanners can reduce reporting turnaround times by up to 30 minutes.

Growing Adoption of Low-Dose CT Scanning Techniques

The focus on patient safety and the need to minimize radiation exposure have accelerated the adoption of low-dose CT scanning techniques across the UK. Ultrafast CT devices now incorporate advanced dose-reduction technologies, such as iterative reconstruction algorithms and automatic exposure control, which have been validated in clinical settings to produce high-quality imaging at significantly lower radiation doses. For instance, campaigns like “Image Gently” and “Image Wisely” have successfully raised awareness about radiation safety, influencing healthcare institutions to prioritize low-dose imaging solutions. Additionally, the Royal College of Radiologists has issued guidelines emphasizing the importance of safer imaging practices. These advancements have enabled healthcare providers to expand the use of CT imaging to broader patient groups, including pediatric and oncology patients, while maintaining a strong commitment to safety and clinical excellence. For instance, low-dose CT techniques can reduce radiation exposure by up to 50% compared to conventional methods.

Expansion of Community Diagnostic Centres (CDCs) and Decentralized Imaging

The UK government’s push to decentralize diagnostic services through the establishment of Community Diagnostic Centres (CDCs) is driving a major shift in how ultrafast CT scan devices are deployed. CDCs are designed to offer patients faster and more convenient access to a wide range of diagnostic tests, including CT scans, outside of traditional hospital environments. By equipping CDCs with state-of-the-art ultrafast CT scanners, healthcare authorities aim to reduce hospital backlogs, shorten waiting times, and improve early diagnosis rates for serious conditions such as cancer and cardiovascular disease. The trend toward decentralized imaging aligns with broader healthcare goals of enhancing accessibility, reducing system pressures, and providing more patient-centric services. Manufacturers are responding to this trend by developing compact, mobile, and more easily installable ultrafast CT solutions that can be quickly deployed in diverse healthcare settings. As the number of CDCs continues to grow under NHS initiatives, the demand for flexible, efficient ultrafast CT scanners is expected to increase substantially, reshaping the landscape of diagnostic imaging in the UK.

Rise in Demand for Cardiac and Oncology Imaging Applications

The rising incidence of cardiovascular diseases and cancers is fueling increased demand for specialized ultrafast CT imaging applications across the UK. Ultrafast CT scanners are particularly valuable in cardiac imaging due to their ability to capture high-resolution images of the rapidly moving heart within a single heartbeat. They enable non-invasive coronary artery evaluations, calcium scoring, and early detection of structural abnormalities, helping to prevent severe cardiac events. In oncology, ultrafast CT devices play a critical role in tumor detection, staging, treatment planning, and monitoring therapeutic responses. Innovations in dual-energy CT and spectral imaging are further enhancing the capabilities of ultrafast CT devices in characterizing tissue types and differentiating between benign and malignant lesions. Healthcare providers are increasingly investing in specialized CT applications to support precision medicine approaches, where treatments are tailored to the specific conditions of individual patients. This growing emphasis on specialized imaging capabilities is creating new opportunities for manufacturers to develop and market ultrafast CT solutions that address the unique needs of cardiology and oncology practices in the UK healthcare system.

Market Challenges

High Cost of Equipment and Budget Constraints in Public Healthcare

The high cost associated with the procurement, installation, and maintenance of ultrafast CT scan devices poses a significant challenge in the UK market. Advanced ultrafast CT scanners, equipped with state-of-the-art features such as artificial intelligence integration, dual-energy imaging, and low-dose radiation technology, come with substantial price tags. For instance, the NHS has faced challenges in acquiring these devices due to budgetary constraints, despite government initiatives aimed at modernizing diagnostic infrastructure. Operational expenses such as specialized training for radiologists and technicians, regular system upgrades, and ongoing service contracts further add to the financial burden. Smaller hospitals and community healthcare centers, especially in rural areas, may find it difficult to justify the investment unless heavily subsidized. This financial challenge restricts market penetration, limits accessibility in certain regions, and slows the widespread integration of ultrafast CT technology across the UK healthcare system.

Shortage of Skilled Radiology Workforce and Increasing Workload Pressures

The shortage of trained radiologists and imaging specialists is another major challenge facing the UK ultrafast CT scan devices market. Even with access to cutting-edge imaging technology, the lack of sufficient skilled personnel to operate ultrafast CT systems and accurately interpret results undermines the potential benefits these devices offer. According to the Royal College of Radiologists, the UK faces a consistent shortfall of consultant radiologists, with demand growing faster than workforce supply. This shortage leads to increased workload pressures on existing staff, longer patient waiting times, and delayed diagnoses, ultimately affecting healthcare outcomes. Although technological advances like AI-assisted imaging aim to alleviate some of this burden, human expertise remains essential for quality assurance, complex case analysis, and patient communication. Without addressing workforce development, training, and retention, the effective utilization of ultrafast CT scan devices across the UK healthcare system will continue to encounter significant operational obstacles.

Market Opportunities

Expansion of Preventive Healthcare and Screening Programs

The growing emphasis on preventive healthcare across the UK presents a significant opportunity for the ultrafast CT scan devices market. Government initiatives aimed at early detection of critical illnesses, such as cancer and cardiovascular diseases, are increasing the demand for rapid and accurate diagnostic imaging. Programs like targeted lung health checks and cardiovascular risk assessments are expanding nationwide, encouraging greater use of low-dose, high-speed CT imaging for screening purposes. Ultrafast CT devices, with their ability to deliver quick, precise results while minimizing radiation exposure, are ideally positioned to support this healthcare shift. Additionally, as screening programs extend to broader demographics and incorporate more regular monitoring protocols, healthcare providers will require scalable imaging solutions. This environment creates robust opportunities for manufacturers to offer tailored ultrafast CT solutions that meet preventive healthcare objectives while supporting the NHS’s long-term plans for reducing the burden of advanced-stage diseases.

Technological Innovation Driving New Clinical Applications

Rapid technological advancements are opening new clinical application areas for ultrafast CT scan devices, creating fresh market growth avenues. Innovations such as dual-energy CT, spectral imaging, and AI-driven analytics enhance the diagnostic value of CT scans beyond traditional imaging uses. These technologies enable more detailed tissue characterization, improved cardiac imaging, and non-invasive assessment of metabolic and functional changes, extending ultrafast CT’s utility in oncology, neurology, and emergency medicine. With an increasing focus on precision medicine and minimally invasive diagnostics, healthcare providers are seeking solutions that deliver deeper clinical insights while improving patient outcomes. Manufacturers who invest in developing versatile ultrafast CT platforms with multi-specialty capabilities will be well-positioned to capitalize on the growing demand for advanced diagnostic imaging across a wider range of therapeutic areas in the UK.

Market Segmentation Analysis

By Type

The UK Ultrafast CT Scan Devices Market is segmented into Single-Slice CT and Multi-Slice CT scanners. Single-Slice CT scanners, typically less expensive and simpler in design, are commonly used for general diagnostic purposes where high-speed imaging is not essential. However, Multi-Slice CT scanners dominate the market due to their ability to capture more detailed images and perform faster scans, which are critical for advanced diagnostics in complex conditions such as cardiac and oncological imaging. Multi-Slice CT scanners can obtain multiple slices of the body in one rotation, enabling high-speed imaging with enhanced resolution. This capability makes them particularly valuable in areas requiring rapid diagnostics, such as emergency care and high-volume screening programs. As the demand for precision diagnostics and fast turnaround times grows, Multi-Slice CT scanners are expected to continue dominating the market due to their superior imaging capabilities and efficiency.

By Application

The primary applications of ultrafast CT scan devices in the UK include cardiology, oncology, neurology, orthopedics, and other fields. In cardiology, ultrafast CT scanners are increasingly used to assess coronary artery disease, enabling detailed visualization of blood vessels and aiding in the early detection of heart conditions. In oncology, the ability of ultrafast CT scanners to detect and stage tumors quickly makes them invaluable for cancer diagnosis and treatment planning. Neurology applications are also significant, with ultrafast CT providing high-quality imaging to diagnose brain-related conditions such as strokes, tumors, and neurodegenerative diseases. Orthopedics relies on these devices for precise imaging of bone structures, joint conditions, and spinal issues, ensuring timely and accurate diagnoses. Other applications include the use of ultrafast CT in trauma care, abdominal imaging, and lung disease diagnosis. The growing need for early and accurate diagnostics in these diverse medical fields ensures the steady growth of the market across all application segments.

Segments

Based on Type

- Single-Slice CT

- Multi-Slice CT

Based on Application

- Cardiology

- Oncology

- Neurology

- Orthopedics

- Others

Based on End User

- Hospitals

- Diagnostic Imaging Centers

- Ambulatory Surgical Centers

Based on Region

- England

- Scotland

- Wales

- Northern Ireland

Regional Analysis

England (70%)

England holds the largest market share, accounting for approximately 70% of the total UK ultrafast CT scan devices market. This is due to the concentration of advanced medical facilities, research institutions, and healthcare infrastructure in major cities such as London, Manchester, and Birmingham. England’s healthcare system, especially the NHS, is heavily invested in modernizing diagnostic technologies to reduce waiting times and enhance diagnostic accuracy. Additionally, high population density and a large number of specialized healthcare centers contribute to the increased demand for ultrafast CT devices. The government’s ongoing efforts to improve diagnostic capabilities through initiatives like the NHS Long-Term Plan and the establishment of Community Diagnostic Centres (CDCs) have further boosted the adoption of advanced imaging technologies.

Scotland (15%)

Scotland is the second-largest region in the UK market, with an estimated market share of 15%. While it has fewer healthcare facilities compared to England, Scotland benefits from strong government support for healthcare innovation, particularly in medical imaging. The Scottish Government has invested in expanding diagnostic services and upgrading medical equipment, including ultrafast CT scanners, to improve early detection of diseases such as cancer and heart disease. Furthermore, Scotland’s emphasis on healthcare accessibility in rural areas and its commitment to reducing healthcare disparities between urban and rural populations also drive the adoption of these devices.

Key players

- Siemens Healthineers

- Philips Healthcare

- Canon Medical Systems Corporation

- GE HealthCare

- Fujifilm Holdings Corporation

- Hitachi Healthcare

- Shimadzu Corporation

- Carestream Health

- Esaote SpA

- Agfa HealthCare

Competitive Analysis

The UK Ultrafast CT Scan Devices Market is highly competitive, with key players like Siemens Healthineers, Philips Healthcare, and GE HealthCare leading the market with advanced imaging technologies and strong brand recognition. These companies dominate with their comprehensive product portfolios, which include state-of-the-art ultrafast CT devices that cater to diverse healthcare needs. Canon Medical Systems and Fujifilm Holdings bring strong competition with their innovative imaging solutions, often focusing on image clarity, safety features, and cost-effectiveness. Smaller players like Hitachi Healthcare, Shimadzu Corporation, and Carestream Health continue to make their mark by offering specialized, user-friendly systems that address the growing demand for accessible diagnostic imaging. Esaote SpA and Agfa HealthCare further contribute with affordable solutions and robust customer support, capturing market share in niche segments. Competitive strategies primarily revolve around technological advancements, partnerships, and aggressive pricing to stay ahead in this rapidly evolving market.

Recent Developments

- In February 2024, Canon Medical Systems Corporation completed its second global installation of a photon-counting CT system at Radboud University Medical Center in the Netherlands, initiating clinical research led by Prof. Mathias Prokop.

- In December 2024, Samsung Medison showcased an enhanced portfolio at RSNA 2024, including the floor-mounted digital X-ray GF 85 and a pediatric cardiac-specific ultrasound probe.

- In December 2024, United Imaging Healthcare introduced the uMI Panvivo PET/CT system at RSNA 2024, featuring industry-leading NEMA PET spatial resolution and AI-driven 3D camera technology.

- In March 2025, Mindray Medical International introduced the Resona A20 at ECR 2025, featuring Acoustic Intelligence Technology to elevate ultrasound imaging capabilities.

- In March 2025, Shimadzu Corporation celebrated its 150th anniversary and opened a new R&D center in Boston, focusing on customer-oriented development to expand business in the pharmaceutical field.

- In February 2025, Esaote SpA presented integrated medical imaging solutions and unveiled innovations in ultrasound technology at ECR 2025, emphasizing AI integration to optimize workflows and improve image quality.

- In March 2025, Agfa HealthCare showcased the next generation of Enterprise Imaging at ECR 2025, focusing on innovations that support a more sustainable future for clinical teams.

Market Concentration and Characteristics

The UK Ultrafast CT Scan Devices Market exhibits moderate market concentration, with a few dominant players such as Siemens Healthineers, Philips Healthcare, and GE HealthCare controlling a significant share. These companies lead through their advanced technologies, extensive product portfolios, and strong brand recognition. However, the market also features a variety of smaller players, such as Canon Medical Systems and Fujifilm Holdings, which offer competitive solutions in niche segments. The market is characterized by rapid technological advancements, including the integration of AI, low-dose imaging, and enhanced speed, which drive continuous innovation. Furthermore, the shift toward preventive healthcare and early diagnosis is pushing companies to offer cost-effective, high-performance systems. The competitive landscape is marked by strong R&D investments, strategic partnerships, and increasing government support for healthcare infrastructure modernization, ensuring sustained growth and innovation across the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see significant progress in CT scanning technologies, including faster imaging and enhanced resolution, improving diagnostic accuracy and patient care.

- AI and machine learning will play a key role in improving image interpretation, automating processes, and enhancing diagnostic accuracy, which will become standard in ultrafast CT devices.

- With a focus on early disease detection, preventive healthcare initiatives will drive greater adoption of ultrafast CT devices for screening purposes, particularly in cancer and cardiovascular diseases.

- Government support for CDCs will boost the adoption of ultrafast CT scanners in decentralized healthcare settings, improving access to diagnostic imaging across the UK.

- As radiation safety becomes a priority, the demand for low-dose CT scanners will rise, enabling the UK healthcare system to offer safer imaging solutions without compromising diagnostic capabilities.

- With cardiovascular diseases on the rise, ultrafast CT will become increasingly important in the early detection and management of heart conditions, helping improve patient outcomes.

- Technological advancements and mobile CT scanners will enable broader access to ultrafast imaging services in rural and underserved areas, addressing healthcare disparities.

- The rise of hybrid imaging systems, combining ultrafast CT with other modalities like PET and MRI, will offer comprehensive diagnostic insights, attracting more healthcare facilities.

- Stronger regulatory frameworks and government funding aimed at upgrading healthcare infrastructure will drive the increased adoption of ultrafast CT technology across the UK.

- AI will optimize radiology workflows, reducing radiologist burnout and improving turnaround times for diagnostic results, enhancing the efficiency of ultrafast CT utilization in clinical settings.