Market Overview:

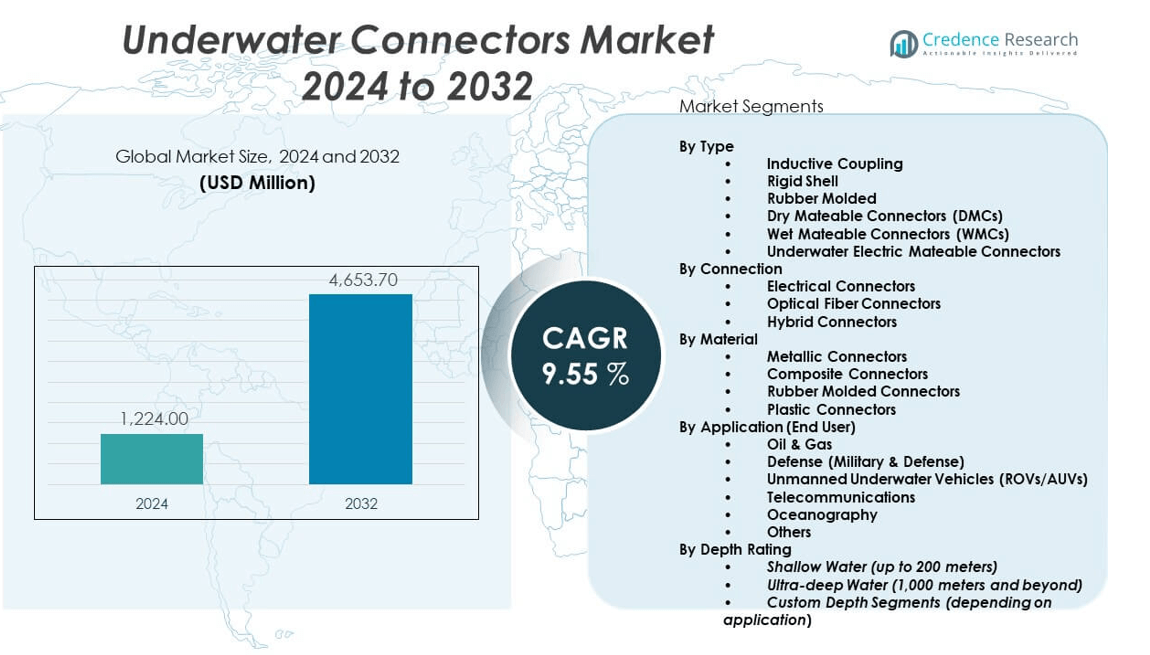

The Underwater Connectors market is projected to grow from USD 1,224 million in 2024 to an estimated USD 2,539.1 million by 2032, with a compound annual growth rate (CAGR) of 9.55% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Underwater Connectors market Size 2024 |

USD 1,224 million |

| Underwater Connectors market, CAGR |

9.55% |

| Underwater Connectors market Size 2032 |

USD 2,539.1 million |

This market is expanding due to the growing deployment of underwater systems for oil and gas exploration, military communications, and oceanographic research. Underwater connectors ensure reliable power and signal transmission in extreme marine environments. Manufacturers are enhancing durability, pressure resistance, and connectivity reliability. Demand continues to rise with the increase in subsea installations and remotely operated vehicles (ROVs), as these applications require robust and waterproof connection solutions to maintain data integrity and operational safety under high pressure and corrosion conditions.

North America leads the underwater connectors market due to advanced offshore infrastructure, naval investments, and technological innovation. Europe holds a strong position, supported by research institutions, maritime surveillance, and renewable energy initiatives. Asia-Pacific is emerging as a major growth region, with countries like China, India, and South Korea increasing offshore energy exploration and marine monitoring projects. Expanding subsea networks and government support for blue economy development are driving adoption in these rapidly industrializing economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Underwater Connectors market is projected to grow from USD 1,224 million in 2024 to USD 2,539.1 million by 2032, registering a CAGR of 9.55% during the forecast period.

- Demand is being driven by increased deployment of underwater systems in oil and gas exploration, military communications, and oceanographic research.

- The market faces restraints related to high design complexity, long product validation cycles, and the need for durable, corrosion-resistant materials under extreme marine conditions.

- Rising use of ROVs and subsea installations is accelerating demand for robust, waterproof connectors that ensure uninterrupted signal and power transmission.

- Manufacturers are focusing on enhancing mechanical strength, sealing capability, and electrical performance to meet operational requirements in deep-sea environments.

- North America leads with 31.5% share, backed by strong naval funding and offshore oil infrastructure; Europe follows at 36.2%, driven by renewable energy projects and marine research.

- Asia Pacific holds 22.7% share and continues to grow with increasing offshore energy development and government support for marine surveillance and blue economy initiatives.

Market Drivers:

Expansion of Offshore Oil and Gas Exploration Is Driving Significant Demand for High-Reliability Underwater Connectors:

The global push for energy security is accelerating offshore oil and gas activities. These projects require robust and high-performance underwater connectors to support subsea control systems and data transmission networks. The harsh conditions at deep-sea levels necessitate connectors that offer durability, high pressure resistance, and long-term stability. The underwater connectors market is benefitting from increased capital expenditure in offshore drilling platforms and subsea production systems. Operators are demanding advanced materials such as titanium and high-strength composites for extended service life. Investments in deep-water and ultra-deep-water fields are expanding the scope of electrical and fiber-optic connectors. Enhanced power and signal transmission requirements across underwater infrastructures are strengthening market relevance. It is witnessing increased adoption in regions such as the Gulf of Mexico, the North Sea, and offshore Brazil.

- For instance, Amphenol Corporation’s Subsea Mateable products are engineered to withstand pressures up to 10,000 psi and are constructed from titanium for superior corrosion resistance, supporting subsea production systems at water depths beyond 3,000 meters.

Growing Deployment of Unmanned Underwater Vehicles (UUVs) Is Fueling the Need for Compact and Durable Connector Solutions:

Unmanned Underwater Vehicles (UUVs), including Autonomous Underwater Vehicles (AUVs) and Remotely Operated Vehicles (ROVs), are being widely used across defense, scientific research, and marine exploration. These vehicles depend on compact and pressure-tolerant connectors to transmit power, data, and signals in deep-sea environments. The underwater connectors market is growing as militaries increase investments in underwater surveillance and mine countermeasure capabilities. Commercial usage in pipeline inspection, offshore maintenance, and underwater archaeology is also expanding connector demand. Design requirements are shifting toward miniaturization, corrosion resistance, and electromagnetic shielding. Higher power densities and hybrid configurations are pushing connector manufacturers to innovate for longer missions and deeper dives. Demand for reliable wet-mate and dry-mate connector technologies continues to rise. It is seeing product diversification based on vehicle class and mission depth.

- For instance, Teledyne Marine’s ODI Wet-Mate hybrid connectors have been deployed in over 2,000 AUV and ROV units globally, designed to operate at depths exceeding 6,000 meters, while providing both power and fiber-optic transmission capabilities in a compact footprint.

Increase in Subsea Communication Infrastructure Development Is Enhancing the Market’s Value Proposition:

The growth of global subsea fiber-optic communication networks is driving consistent demand for high-performance underwater connectors. These components form a critical part of undersea repeaters, branching units, and terminal systems. The underwater connectors market is advancing with large-scale investments in transoceanic data cables and network redundancy projects. Digital transformation and data consumption patterns are pushing telecom operators to expand connectivity across continents. Increased reliance on low-latency subsea networks requires resilient connector technology that can endure decades in oceanic environments. The push for edge computing and hyperscale data centers supports long-term market viability. Integration of optical connectors with minimal signal attenuation is a top priority. It is aligning with the strategic goals of technology providers and infrastructure developers.

Rising Demand in Oceanographic and Environmental Monitoring Programs Is Accelerating Use of Specialized Connectors:

Governments and research organizations are launching large-scale marine observation programs to study ocean health and climate impact. These programs require underwater connectors that can function flawlessly in sensor arrays, seabed monitoring systems, and autonomous stations. The underwater connectors market is expanding with the deployment of long-term moorings, buoys, and submersible equipment across oceans. Precise data acquisition mandates secure electrical and optical interfaces that withstand pressure variations and biofouling. Environmental scientists rely on connectors to support uninterrupted performance for years without maintenance. The need for real-time data transmission in seismic activity and marine biodiversity tracking drives continued innovation. Wet-mateable connectors offer flexibility in servicing and upgrades. It is capturing opportunities through collaboration with ocean research institutions and environmental agencies.

Market Trends:

Integration of Hybrid Connectors Is Gaining Traction Across Marine and Subsea Applications:

The demand for multifunctional solutions is fostering the rise of hybrid connectors that combine electrical, fiber-optic, and fluid transmission in a single unit. These systems reduce installation complexity and support compact design in harsh underwater settings. The underwater connectors market is evolving to accommodate integrated solutions that streamline maintenance and enhance performance. Manufacturers are prioritizing hybrid interfaces for complex ROVs, subsea manifolds, and oilfield sensors. The trend supports better data throughput and operational safety with fewer connection points. Hybrid connectors also help in weight reduction and system optimization. Their deployment enhances plug-and-play compatibility in modular equipment. It is becoming standard in high-capital subsea infrastructure projects requiring efficient and flexible connections.

- For instance, LEMO S.A.’s W Series hybrid connectors are certified for 100,000 mating cycles and are being used in global offshore platforms to simultaneously deliver up to 12 electrical and 4 fiber-optic channels in one assembly, thus minimizing footprint while optimizing operational bandwidth.

Shift Toward Smart and Sensor-Enabled Connectors Is Redefining Performance Monitoring:

Connector technologies are advancing to support real-time diagnostics, predictive maintenance, and remote monitoring capabilities. Smart underwater connectors with built-in sensors offer temperature, pressure, and integrity data to operators. The underwater connectors market is moving toward intelligent components that deliver both connectivity and operational insights. These advancements align with the increasing digitalization of marine assets and offshore platforms. Smart connectors enhance safety and reduce unplanned maintenance costs. Wireless diagnostics and cloud-integrated monitoring are enhancing decision-making. The trend is being adopted by naval defense agencies and energy companies alike. It is transforming conventional connector systems into active contributors to operational efficiency.

- For instance, Eaton Corporation’s Subsea Smart Connectors are embedded with multi-sensing modules capable of monitoring temperature, humidity, and conductor resistance in real time, with data sampling rates of up to 10 times per second, providing continuous asset health insights for operators.

Focus on Environmentally Friendly and Low-Toxicity Materials Is Shaping Product Development:

Environmental regulations and sustainability goals are influencing material selection in underwater connectors. Manufacturers are shifting to halogen-free, recyclable, and non-toxic components to reduce ecological impact. The underwater connectors market is aligning with global efforts to minimize marine pollution and habitat disruption. Biodegradable insulators and anti-biofouling coatings are being incorporated into product designs. These innovations cater to long-term oceanographic equipment and deep-sea exploration units. Demand is also rising for RoHS- and REACH-compliant materials across the defense and energy sectors. It is adapting to evolving environmental norms without compromising connector integrity and reliability.

Adoption of 3D Printing and Advanced Manufacturing for Custom Connector Design:

Manufacturers are leveraging additive manufacturing and computer-aided engineering to produce complex, customized underwater connectors. These technologies allow faster prototyping, design flexibility, and reduced material waste. The underwater connectors market is adopting these innovations to meet application-specific geometries and rapid deployment needs. Aerospace-grade polymers and titanium alloys are being tested through advanced manufacturing methods. Design improvements include tighter sealing systems and modular plug configurations. Companies are also using digital twins to simulate performance before production. It is helping OEMs deliver tailored solutions for unique subsea challenges across energy, telecom, and research domains.

Market Challenges Analysis:

Harsh Operational Environments and Long-Term Durability Expectations Pose Significant Design and Engineering Hurdles:

Underwater connectors must perform under extreme pressure, salinity, and temperature conditions for extended periods. Designing connectors that remain corrosion-resistant and watertight for 20–30 years requires advanced materials and precise engineering. The underwater connectors market faces cost and technical complexity in meeting such stringent performance benchmarks. Even minor connector failure can lead to data loss, safety risks, or high-cost equipment retrieval operations. Manufacturers must balance mechanical strength with compact design, which adds to development time and expense. Validation testing under simulated subsea conditions is resource-intensive and time-consuming. It limits market entry for smaller companies due to capital constraints and R&D challenges. Continuous innovation is necessary to maintain compliance and competitiveness.

High Customization Needs and Long Procurement Cycles Slow Down Scalable Market Growth:

Clients across defense, oil and gas, and telecom sectors often require customized connector solutions tailored to specific platforms and use cases. This need increases design complexity and leads to longer product development cycles. The underwater connectors market must accommodate variable requirements, including mating types, depth ratings, pin counts, and signal formats. Custom manufacturing leads to higher costs and inventory management difficulties. Procurement processes in government and large enterprises involve strict qualification protocols and long approval timelines. These barriers affect supplier responsiveness and delay large-scale deployments. It faces demand volatility and production inefficiencies when multiple variants are required for different systems.

Market Opportunities:

Expansion of Offshore Renewable Energy Projects Is Creating New Revenue Streams for Specialized Connector Manufacturers:

The global shift toward clean energy is accelerating the deployment of offshore wind farms, tidal power systems, and floating solar arrays. These applications require high-performance underwater connectors that can withstand extreme marine environments while ensuring reliable power and data transmission. The underwater connectors market is benefiting from government incentives and private investments in green infrastructure. Connector suppliers have an opportunity to develop corrosion-resistant, high-voltage, and pressure-tolerant solutions tailored to these renewable platforms. Long-term maintenance-free operation is a key requirement, driving interest in sealed and low-maintenance connector types. It is positioning itself to meet these specifications through advanced R&D and collaboration with energy developers. Countries in Europe, Asia, and North America are rapidly expanding offshore renewable capacity, widening the market potential. Connector manufacturers that focus on technical reliability and lifecycle efficiency can capture long-term contracts in this evolving sector.

Increasing Demand for Miniaturized and High-Speed Connectors in Underwater Robotics and Smart Marine Systems:

The proliferation of underwater robotics, including autonomous drones and smart surveillance systems, presents a growing opportunity for compact and high-speed connector technologies. These applications require low-profile connectors capable of transmitting high-resolution imaging, real-time telemetry, and control signals in deep-sea conditions. The underwater connectors market is responding with lightweight materials, hybrid data-power solutions, and improved sealing techniques. It is seeing rising demand from naval operations, environmental monitoring agencies, and scientific research bodies seeking enhanced performance and miniaturization. Real-time data exchange and mission-critical communication depend on connectors that deliver both mechanical robustness and data integrity. Manufacturers offering customizable, plug-and-play designs can differentiate their offerings in this segment. Strong collaboration with robotics OEMs and maritime research institutions supports continuous product development. The expanding use of AI-driven marine technologies will further accelerate adoption of next-generation connectors.

Market Segmentation Analysis:

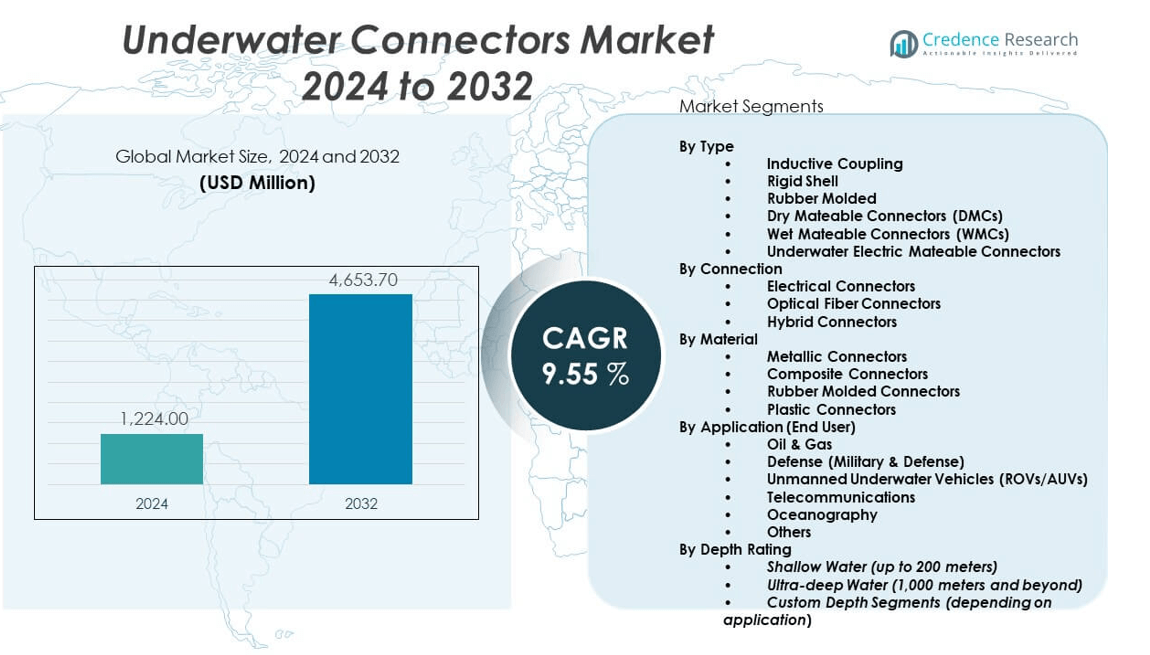

By Type

Wet Mateable Connectors (WMCs) and Dry Mateable Connectors (DMCs) dominate this segment due to their reliability in high-pressure subsea environments. Inductive coupling connectors are gaining attention for contactless data and power transmission, suitable for dynamic applications. Underwater electric mateable connectors support deep-sea robotics and long-duration missions. Rubber molded and rigid shell connectors are commonly used for cost-efficient sealing in standard underwater systems.

- For instance, SEACON’s Minicon series wet-mateable connectors support operational depths up to 6,096 meters and have been qualified for over 500 mating cycles, meeting strict reliability standards for repeated subsea deployments.

By Connection

Electrical connectors account for the largest share, supporting power transfer in offshore drilling, naval operations, and underwater vehicles. Optical fiber connectors are expanding due to the rising need for high-speed, high-bandwidth data transmission in telecom and oceanographic monitoring. Hybrid connectors combine power and data in a single unit, providing compact, versatile solutions for autonomous systems and deep-sea platforms.

- For instance, Glenair’s Series 801 optical fiber connectors enable data rates up to 10 Gbps and can withstand hydrostatic pressures of 5,000 psi, making them ideal for high-speed communication links in ocean observatories and subsea telecom nodes.

By Material

Metallic connectors lead the segment for their robustness and corrosion resistance under harsh subsea conditions. Composite and plastic connectors are preferred where weight reduction and dielectric properties are essential. Rubber molded connectors offer flexibility and pressure sealing, making them suitable for rugged and mobile underwater applications.

By Application (End User)

Oil & gas and defense are the top end users, requiring reliable and high-specification connectors for critical operations. Unmanned underwater vehicles (ROVs/AUVs) and oceanographic systems are driving demand for compact, high-performance connectors. Telecommunications and renewable energy sectors are adopting specialized connectors for stable subsea network deployment and marine equipment integration.

By Depth Rating

Ultra-deep water applications are accelerating demand for durable connectors with pressure resistance beyond 1,000 meters. Shallow water connectors serve in offshore wind farms, coastal surveillance, and research. Custom depth-rated connectors are developed for niche applications requiring precision engineering and tailored performance characteristics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentation:

By Type

- Inductive Coupling

- Rigid Shell

- Rubber Molded

- Dry Mateable Connectors (DMCs)

- Wet Mateable Connectors (WMCs)

- Underwater Electric Mateable Connectors

By Connection

- Electrical Connectors

- Optical Fiber Connectors

- Hybrid Connectors

By Material

- Metallic Connectors

- Composite Connectors

- Rubber Molded Connectors

- Plastic Connectors

By Application (End User)

- Oil & Gas

- Defense (Military & Defense)

- Unmanned Underwater Vehicles (ROVs/AUVs)

- Telecommunications

- Oceanography

- Others

By Depth Rating

- Shallow Water (up to 200 meters)

- Ultra-deep Water (1,000 meters and beyond)

- Custom Depth Segments (depending on application)

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Holds Strong Market Position Driven by Defense and Offshore Oil Investments

North America accounts for 31.5% of the global underwater connectors market share. The region benefits from substantial government funding for underwater defense programs and naval modernization efforts. The United States Navy’s investments in unmanned underwater vehicles (UUVs) and subsea surveillance systems significantly contribute to market demand. Offshore oil and gas activities in the Gulf of Mexico further boost the requirement for high-performance connectors in harsh marine conditions. The presence of key players and advanced R&D facilities supports continuous innovation in connector design and testing. It is also supported by growing use of underwater robotics in marine research and commercial applications.

Europe Leads the Market Due to Strong Offshore Renewable Energy Sector and Research Initiatives

Europe captures the largest share of the underwater connectors market, representing 36.2% of global revenue. The region’s leadership stems from its aggressive push toward offshore wind energy, particularly in the North Sea and Baltic regions. Countries like the UK, Germany, and the Netherlands invest heavily in subsea infrastructure that requires durable and high-voltage connector systems. Leading universities and marine research institutes across Norway and France contribute to technology development and deployment. It also benefits from standardized environmental regulations that promote the use of sustainable and compliant materials. Rising demand in underwater communications and renewable energy storage integration continues to drive regional growth.

Asia Pacific Emerges as a Rapidly Expanding Market Led by Coastal Development and Naval Spending

Asia Pacific holds 22.7% of the underwater connectors market and shows strong growth potential. China, Japan, South Korea, and India are increasing investments in naval defense, underwater monitoring, and autonomous underwater vehicle programs. Coastal infrastructure development and offshore energy exploration projects are expanding across Southeast Asia and Australia. The region’s shipbuilding and underwater robotics sectors are driving demand for reliable and miniaturized connectors. It is supported by government-backed innovation programs and rising collaborations with global connector manufacturers. Asia Pacific’s diverse marine ecosystems and geographic expanse further support long-term demand for scientific observation systems using underwater connectors.

Remaining Regions – Latin America and Middle East & Africa – Together Account for 9.6% of Market Share

Latin America and Middle East & Africa collectively represent a smaller portion of the market but offer niche growth opportunities. Brazil’s deepwater oil reserves and South Africa’s marine research programs generate targeted demand. It is projected that ongoing coastal infrastructure projects and environmental monitoring initiatives will gradually increase adoption in these regions.

Key Player Analysis:

- Amphenol Corporation

- TE Connectivity

- Teledyne Marine

- Eaton Corporation

- LEMO S.A.

- Fischer Connectors SA

- Glenair

- MacArtney Group

- SEACON

- Hydro Group Plc

Competitive Analysis:

The underwater connectors market is characterized by the presence of a few global players with strong technical capabilities and diversified portfolios. Leading companies such as Amphenol Corporation, TE Connectivity, Teledyne Marine, and LEMO S.A. dominate through continuous innovation and strategic partnerships. These firms focus on enhancing product durability, depth ratings, and data transmission capabilities to meet growing demands across oil & gas, defense, and telecommunications sectors. Smaller players and regional specialists contribute by offering custom solutions for niche applications like oceanography and underwater robotics. It remains moderately consolidated, with high barriers to entry due to stringent performance standards, complex engineering requirements, and long qualification cycles.

Recent Developments:

- In March 2025, Amphenol Corporation launched new high-reliability connectors designed specifically for harsh marine environments. These launches emphasize durability and performance, reinforcing Amphenol’s commitment to innovation and its position in underwater communication systems.

- In July 2025, Teledyne Marine highlighted its advanced marine connectors and penetrators, engineered for reliable power and data transmission in the harshest subsea environments. Teledyne’s ongoing development includes supplying state-of-the-art Omicron optical fiber connectors, which were used in the production of a new BBC Studios underwater TV series in early 2025, demonstrating the robustness of its technology in demanding applications.

- In February 2025, Glenair reaffirmed its status as a manufacturer of high-reliability underwater connectors, offering a broad portfolio including dry mate and wet mate products, as well as hybrid connector assemblies. Glenair’s US and UK facilities support short lead times and custom solutions for subsea and naval applications.

- Fischer Connectors SA, in February 2025, announced upcoming launches of three new cable solutions aimed at improving ergonomics and versatility for soldier-worn C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) systems, further advancing their underwater and marine connectivity solutions.

Market Concentration & Characteristics:

The underwater connectors market exhibits moderate concentration with a mix of multinational corporations and specialized vendors. Top-tier companies control a significant portion of the market due to their global distribution networks, IP ownership, and long-standing contracts with defense and energy clients. It is technology-driven, with strong emphasis on customization, longevity, and environmental resilience. Product development cycles are long, and customer relationships tend to be stable due to high reliability requirements. The market favors companies capable of precision engineering and compliance with international marine standards.

Report Coverage:

The research report offers an in-depth analysis based on by type, connection, material, application, depth rating, and connector shape. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will rise from increasing offshore renewable energy projects

- Underwater drones and robotics will drive miniaturized connector innovations

- Defense applications will prioritize high-performance, secure connection systems

- Deep-sea mining and oil exploration will fuel ultra-deep-rated connector adoption

- Growth in subsea fiber-optic networks will expand optical connector demand

- Hybrid connectors will gain traction in compact marine platforms

- Asia-Pacific will emerge as a key manufacturing and consumption hub

- Lifecycle cost optimization will influence material and design innovations

- Smart connectors with diagnostics features will see wider adoption

- Strategic collaborations will intensify across OEMs and marine system integrators