Market Overview

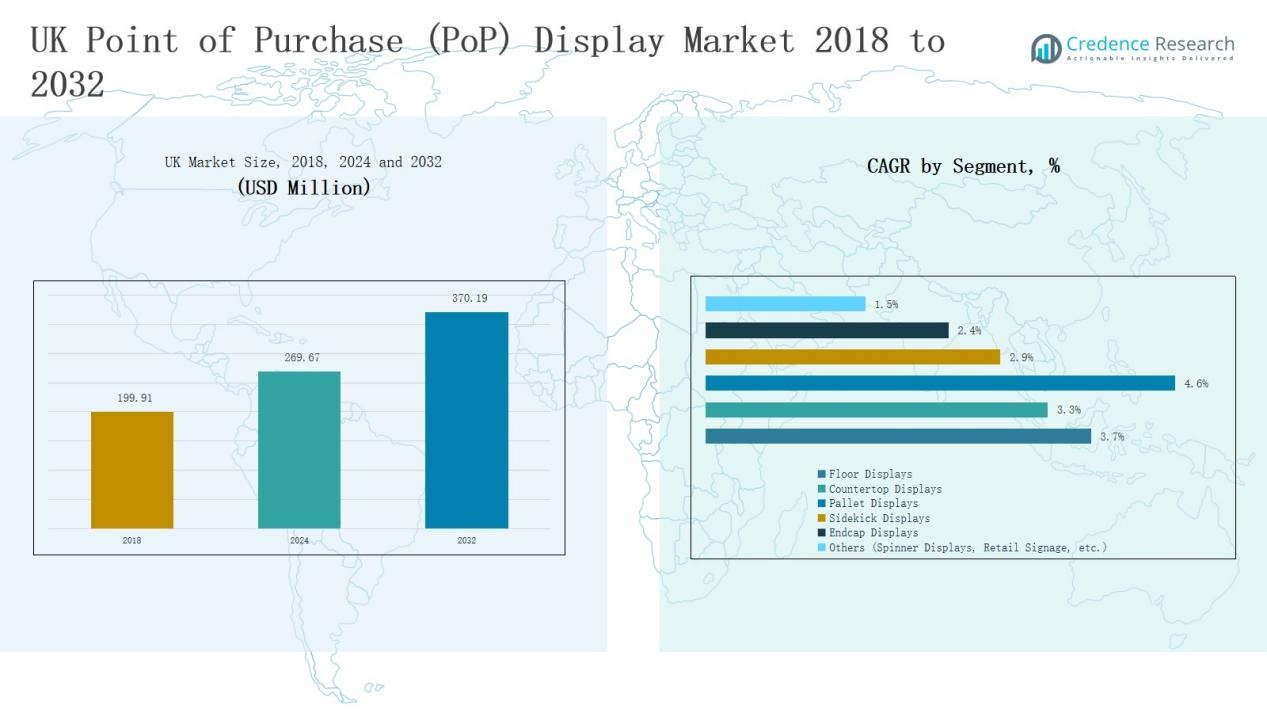

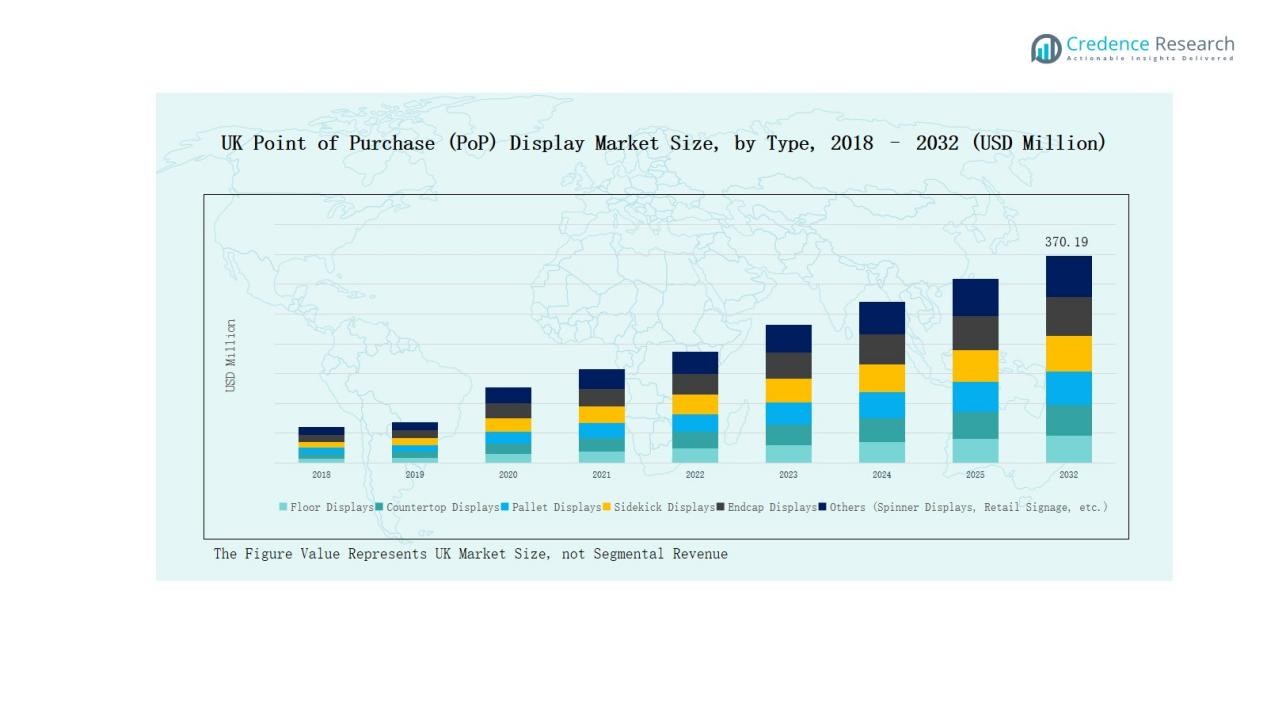

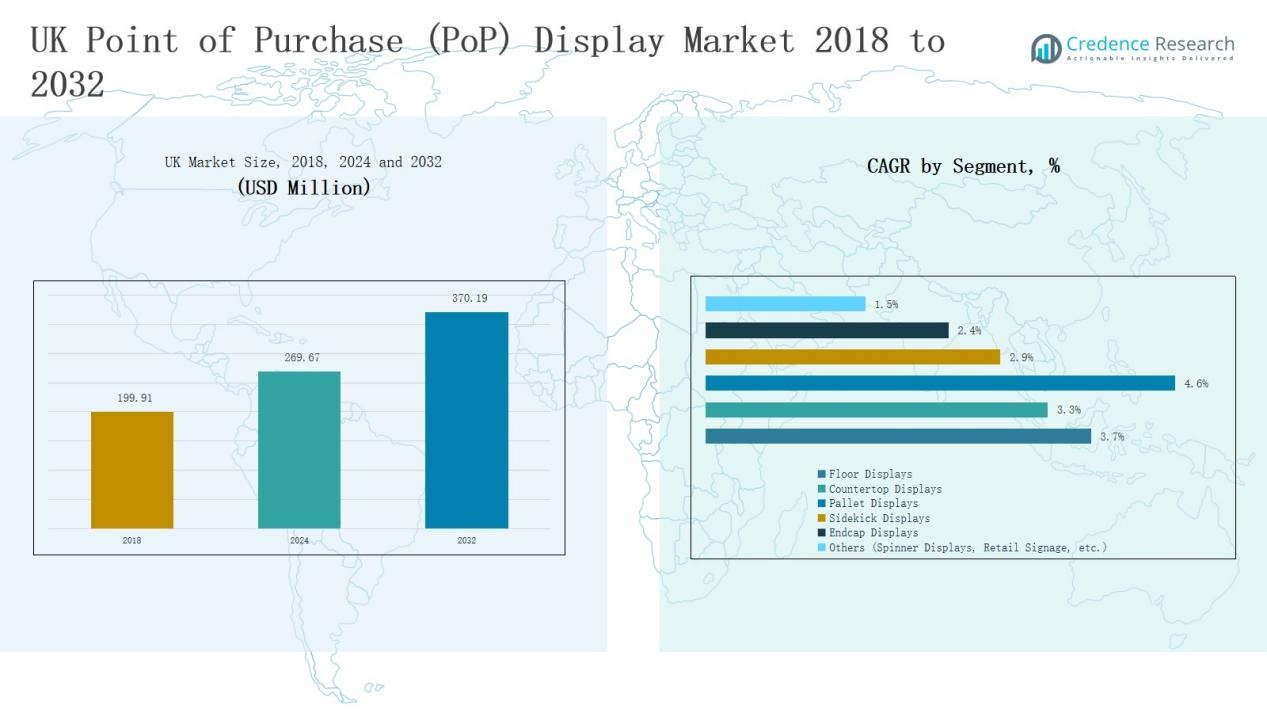

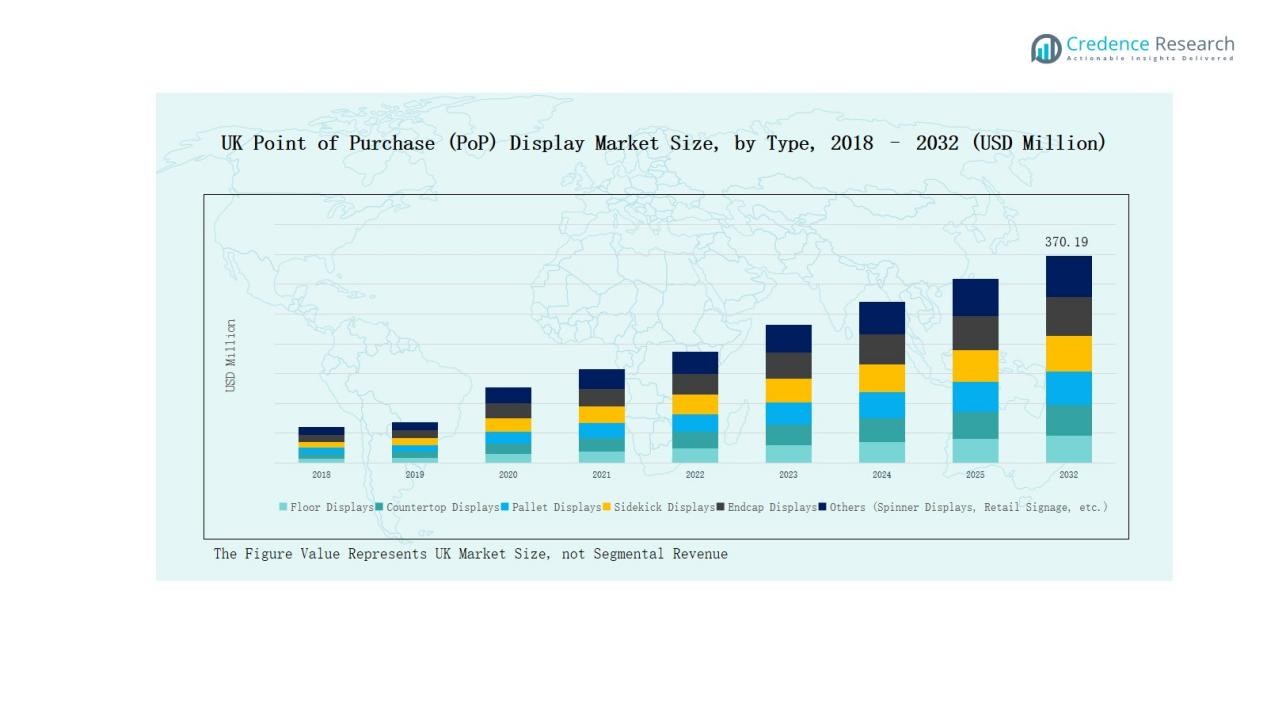

UK Point of Purchase (PoP) Display Market size was valued at USD 199.91 million in 2018 to USD 269.67 million in 2024 and is anticipated to reach USD 370.19 million by 2032, at a CAGR of 3.76% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Point of Purchase (PoP) Display Market Size 2024 |

USD 269.67 Million |

| UK Point of Purchase (PoP) Display Market, CAGR |

3.76% |

| UK Point of Purchase (PoP) Display Market Size 2032 |

USD 370.19 Million |

The UK Point of Purchase (PoP) Display Market is driven by leading players such as POP Display UK Ltd, Service Graphics, shopPOPdisplays, Display Developments, UK POS, Mid-West Displays, T3 Systems, Image4, Unibox, and Display Wizard. These companies strengthen competitiveness through product innovation, sustainable material use, and tailored solutions across food, beverage, cosmetics, and electronics segments. Service Graphics and POP Display UK Ltd maintain strong national presence, while Unibox and Image4 focus on premium and modular systems for long-term retail partnerships. Regionally, England commanded the largest share at 58% in 2024, supported by its dense retail infrastructure, strong FMCG penetration, and higher consumer spending compared to Scotland, Wales, and Northern Ireland.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK Point of Purchase (PoP) Display Market grew from USD 199.91 million in 2018 to USD 269.67 million in 2024 and is expected to reach USD 370.19 million by 2032, expanding at a CAGR of 3.76%.

- Floor displays led with 34% share in 2024, driven by supermarkets and hypermarkets, while countertop displays captured 22% share through impulse promotions near checkout zones.

- Food and beverage dominated with 38% share in 2024, supported by packaged food and beverage sales, followed by cosmetics and personal care at 21% and pharmaceuticals at 15%.

- Temporary displays held 61% share in 2024, favored for cost-effective seasonal promotions, while permanent displays retained 39% share through brand-focused investments in premium retail environments.

- England commanded 58% market share in 2024, followed by Scotland at 16%, Wales at 14%, and Northern Ireland at 12%, with strong demand led by food and FMCG products.

Market Segment Insights

By Type

Floor displays accounted for the largest share of 34% in the UK Point of Purchase (PoP) Display Market in 2024. Their dominance is supported by wide usage across supermarkets, hypermarkets, and convenience stores to promote high-volume consumer goods. Countertop displays held 22% share, driven by impulse product promotions near checkout counters. Pallet displays captured 18% share, benefiting from bulk product visibility in retail warehouses. Sidekick and endcap displays together contributed 20%, highlighting their role in targeted promotions and seasonal campaigns. Other formats, including spinner displays and signage, held the remaining 6%.

- For instance, Costco UK used pallet displays for bulk Unilever household products, reinforcing warehouse‑style mass promotion strategies.

By Application

The food & beverage segment dominated with 38% share of the UK Point of Purchase (PoP) Display Market in 2024. Rising demand for ready-to-eat products, packaged foods, and beverages drove the use of floor and pallet displays in grocery and retail outlets. Cosmetics & personal care followed with 21% share, supported by high reliance on countertop and sidekick displays for impulse and premium products. Pharmaceuticals held 15% share, reflecting growing consumer awareness for OTC medicines and supplements. Electronics and automotive accounted for 13% and 7% respectively, while home furnishings stood at 4%. Other categories, including sports and wine displays, held 2%.

By Style

Temporary POP displays commanded 61% share in the UK Point of Purchase (PoP) Display Market in 2024. Their strong adoption is linked to cost-effectiveness, seasonal promotions, and flexible placement in retail environments. Retailers favor temporary displays for short-term campaigns and frequent product launches, particularly in the food and cosmetics segments. Permanent POP displays held 39% share, sustained by long-term brand visibility and higher durability. Premium retailers and electronics companies invest in permanent displays to enhance customer engagement and reinforce brand identity within stores.

- For instance, Samsung UK partnered with Currys to install permanent in-store display fixtures for its Galaxy AI smartphones, designed to provide interactive demonstrations and sustained visibility.

Key Growth Drivers

Rising Retail Expansion and Consumer Goods Demand

The UK Point of Purchase (PoP) Display Market benefits from rapid retail expansion and growing consumer goods demand. Supermarkets, hypermarkets, and convenience stores continue to increase shelf space, boosting demand for floor and pallet displays. High competition among FMCG brands also intensifies the use of customized displays to attract attention and drive impulse buying. Retail consolidation and store modernization further encourage adoption, with retailers prioritizing impactful product placements to maximize sales conversions. This dynamic strengthens PoP displays as critical in-store marketing tools.

Increased Brand Marketing Investments

Brands across food, beverage, cosmetics, and consumer electronics are investing heavily in in-store marketing strategies. PoP displays offer direct consumer engagement, helping brands achieve visibility during critical purchasing decisions. Temporary and countertop displays, in particular, align with frequent promotions, new product launches, and seasonal campaigns. With rising competition across categories, companies prioritize differentiated retail marketing formats. In-store branding budgets are increasingly directed toward innovative PoP solutions, supporting growth in both temporary and permanent display categories across the UK market.

- For instance, Samsung Electronics UK partnered with Currys to introduce modular end-cap PoP displays demonstrating its Galaxy Z Fold5, enabling hands-on product experience within high-footfall electronics stores.

Growing Influence of Consumer Behavior and Impulse Purchases

Impulse-driven purchases remain a key driver in the UK Point of Purchase (PoP) Display Market. Retailers leverage countertop and endcap displays to capture last-minute consumer decisions near checkout zones. Increasing consumer preference for attractive and accessible product placements fuels demand for innovative display designs. Eye-catching layouts, digital integration, and sustainable materials amplify engagement, leading to higher conversion rates. As shopping behaviors evolve toward convenience and instant gratification, PoP displays continue to serve as vital touchpoints shaping consumer buying journeys in physical retail stores.

- For instance, Smurfit Kappa launched its corrugated Shelf Facer solution in the UK, designed to boost impulse buying by pushing products to the front of retail shelves to improve accessibility and visibility.

Key Trends & Opportunities

Shift Toward Sustainable Display Materials

Sustainability has emerged as a significant trend shaping the UK PoP display market. Retailers and brands are transitioning to recyclable and eco-friendly materials such as corrugated board, cardboard composites, and biodegradable plastics. This transition aligns with government regulations and consumer expectations for environmentally responsible products. The opportunity lies in offering innovative, green alternatives without compromising durability and design appeal. Companies investing in sustainable materials strengthen their market position while meeting corporate social responsibility and retailer compliance requirements.

- For instance, DS Smith introduced its R8 innovation program in the UK, focusing on 100% recyclable corrugated cardboard PoP displays designed for circular reuse.

Integration of Digital and Interactive Technologies

The adoption of digital displays and interactive technologies offers new opportunities for market growth. Retailers are integrating QR codes, LED screens, and motion sensors into PoP displays to enhance customer engagement. These innovations create personalized experiences, provide real-time promotions, and improve brand recall. Electronics and premium cosmetics brands lead in adopting interactive displays, creating differentiated in-store marketing experiences. The opportunity for suppliers lies in combining physical display functionality with digital engagement, allowing retailers to maximize consumer influence at the point of purchase.

- For instance, Samsung Electronics introduced digital signage solutions with AI‑powered audience analytics, enabling retailers to trigger targeted promotions through interactive LED displays in shopping malls.

Key Challenges

High Competition from E-Commerce Channels

The expansion of e-commerce continues to challenge the UK Point of Purchase (PoP) Display Market. Online platforms provide convenience, wide product availability, and competitive pricing, reducing foot traffic in physical stores. As consumer shopping shifts online, retailers face difficulties in justifying large-scale investments in in-store displays. To counter this, PoP suppliers must innovate with hybrid approaches linking physical and digital experiences, ensuring stores maintain relevance. The competitive pressure from online channels remains a persistent hurdle for the market.

Rising Raw Material Costs and Supply Chain Disruptions

Volatility in raw material prices, particularly corrugated board, plastics, and metals, poses challenges for PoP display manufacturers. Fluctuations in energy and transportation costs further increase production expenses, squeezing profit margins. Supply chain disruptions, including delays and shortages, impact timely delivery of displays for seasonal campaigns. Retailers often demand cost-effective solutions, pressuring manufacturers to absorb rising costs or innovate with alternative materials. Managing pricing while maintaining quality and sustainability remains a complex challenge across the UK PoP display ecosystem.

Short Lifecycle of Temporary Displays

Temporary PoP displays, which dominate the market, have short lifecycles, creating challenges in terms of cost-efficiency and waste management. Frequent replacements for seasonal promotions or short campaigns increase operational costs for retailers and suppliers. Disposal concerns also arise as sustainability regulations tighten in the UK. While temporary displays offer flexibility, their limited durability and rapid turnover strain profitability. Manufacturers face growing pressure to design displays that balance low-cost efficiency with longer usability and environmental compliance requirements.

Regional Analysis

England

England accounted for 58% share of the UK Point of Purchase (PoP) Display Market in 2024. Strong retail infrastructure, including supermarkets, hypermarkets, and specialty stores, drives significant adoption of floor and pallet displays. London’s status as a commercial hub encourages brands to invest in innovative and premium displays for consumer engagement. The food and beverage segment leads in demand, supported by fast-moving consumer goods and seasonal promotions. Cosmetics and electronics sectors also expand display use in urban centers. England continues to set market standards due to concentrated retail activity and high consumer spending power.

Scotland

Scotland held 16% share of the UK Point of Purchase (PoP) Display Market in 2024. Growth in this region is supported by expanding supermarkets and retail chains, especially in cities such as Glasgow and Edinburgh. The market benefits from increasing demand for food, beverage, and pharmaceutical displays across convenience stores. Seasonal promotions, including festivals and tourism-driven retail activity, boost temporary display adoption. Retailers focus on countertop and sidekick displays to capture impulse purchases in high-traffic areas. Scotland’s market reflects steady adoption trends, supported by regional retail development and consumer demand shifts.

Wales

Wales represented 14% share of the UK Point of Purchase (PoP) Display Market in 2024. Retail growth in urban centers such as Cardiff and Swansea supports display adoption, particularly in the food and beverage category. Corrugated board and temporary displays dominate due to cost efficiency and alignment with short-term campaigns. Pharmaceuticals and personal care products also contribute to demand, with countertop displays gaining traction in smaller retail outlets. Rising focus on sustainable materials aligns with government policies and consumer preferences. Wales strengthens its market role by prioritizing flexible and eco-friendly display solutions.

Northern Ireland

Northern Ireland accounted for 12% share of the UK Point of Purchase (PoP) Display Market in 2024. Retail demand is concentrated in Belfast and surrounding areas, where supermarkets and specialty stores invest in PoP displays. Food and beverage remains the leading segment, supported by increasing reliance on floor and endcap displays. Cross-border retail activity with Ireland influences display adoption, particularly in wholesale and discount outlets. Retailers emphasize durable and low-cost formats to maintain competitiveness. Northern Ireland contributes steadily to overall growth, reflecting its role as a strategic regional market within the UK.

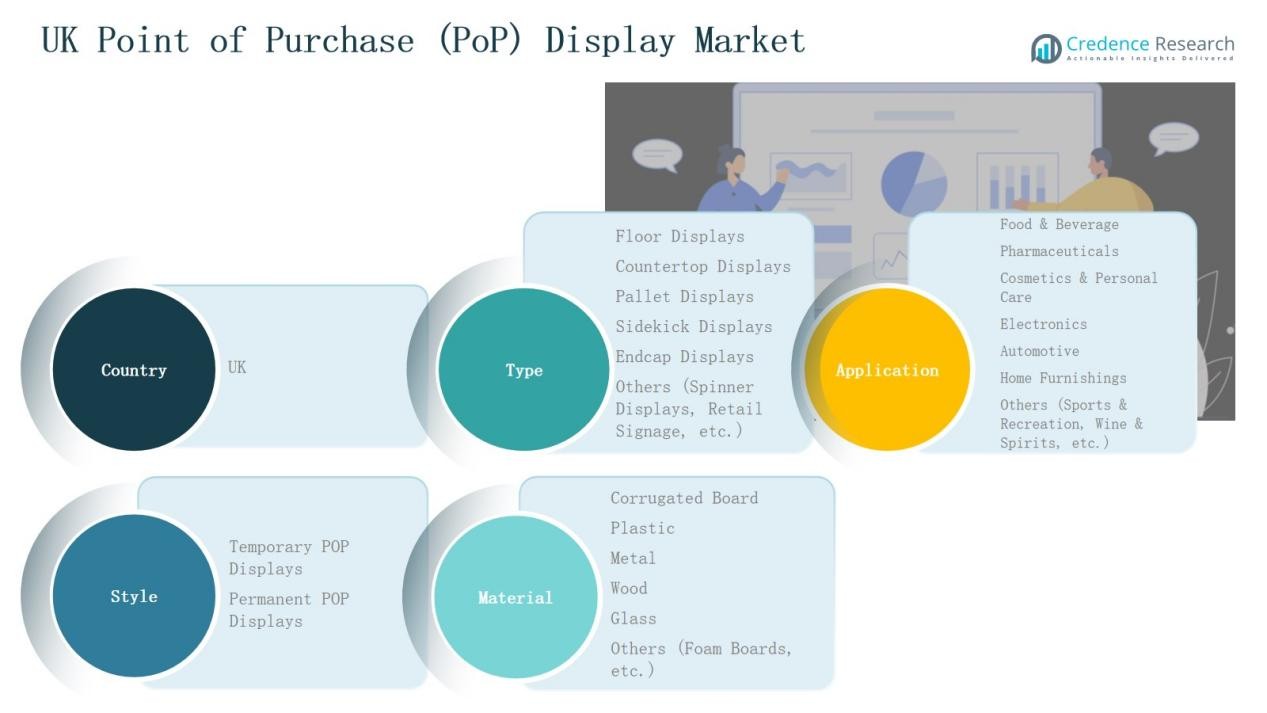

Market Segmentations:

By Type

- Floor Displays

- Countertop Displays

- Pallet Displays

- Sidekick Displays

- Endcap Displays

- Others (Spinner Displays, Retail Signage, etc.)

By Application

- Food & Beverage

- Pharmaceuticals

- Cosmetics & Personal Care

- Electronics

- Automotive

- Home Furnishings

- Others (Sports & Recreation, Wine & Spirits, etc.)

By Style

- Temporary POP Displays

- Permanent POP Displays

By Material

- Corrugated Board

- Plastic

- Metal

- Wood

- Glass

- Others (Foam Boards, etc.)

By Region

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The UK Point of Purchase (PoP) Display Market is characterized by strong competition among established manufacturers, specialized service providers, and retail-focused design firms. Key players such as POP Display UK Ltd, Service Graphics, shopPOPdisplays, Display Developments, and UK POS dominate the market through broad product portfolios and nationwide service networks. These companies focus on innovation, customization, and sustainability to meet diverse client requirements across food, beverage, cosmetics, and electronics segments. Mid-sized firms including Mid-West Displays, T3 Systems, and Display Wizard enhance market competitiveness by offering flexible solutions tailored for small and mid-scale retailers. Unibox and Image4 strengthen their position through premium and modular display systems, targeting long-term partnerships with leading retail brands. Intense competition drives continuous innovation in material use, particularly recyclable corrugated board and eco-friendly plastics. The market reflects a balance of cost-driven solutions for temporary displays and premium, durable designs for permanent installations, supporting both short-term campaigns and long-term brand visibility.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In September 2024, L’Occitane Travel Retail launched a Sol de Janeiro pop-up display at London Heathrow Airport as part of its summer campaign, featuring immersive and tropical-themed PoP activations.

- In June 2025, POP Display launched a new heat-bent POS display service made from recycled RPET (recycled PET), reinforcing its commitment to eco-friendly production practices.

- In 2024, Service Graphics installed advanced printing and finishing equipment at its Edinburgh branch through a technology partnership with Konica Minolta, boosting its regional production efficiency.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Style, Material and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Retailers will increase adoption of sustainable display materials to meet environmental regulations.

- Demand for temporary displays will rise with seasonal campaigns and frequent product launches.

- Permanent displays will gain traction in premium retail and electronics segments for brand visibility.

- Digital and interactive technologies will enhance customer engagement at in-store touchpoints.

- Food and beverage will remain the dominant application segment, driving continuous display demand.

- Cosmetics and personal care displays will expand with growing consumer focus on lifestyle products.

- Countertop and endcap displays will see higher usage to capture impulse-driven purchases.

- Supply chain partnerships will strengthen to ensure timely delivery of customized displays.

- Small and mid-sized retailers will adopt cost-efficient corrugated and cardboard display formats.

- Investments in modular and recyclable designs will shape the long-term competitiveness of market players.