Market Overview

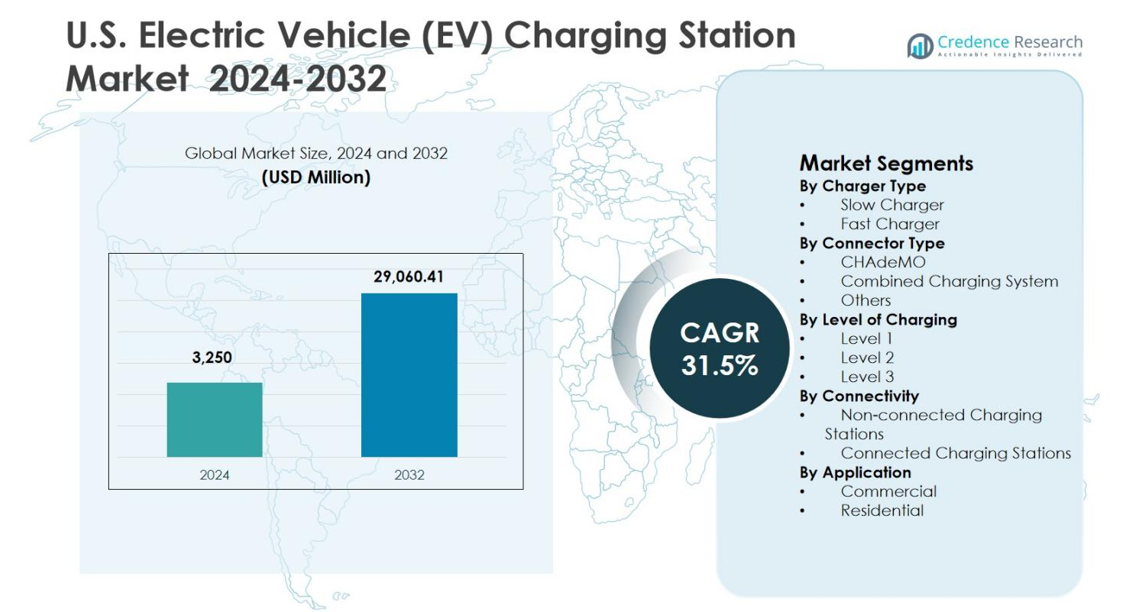

The U.S. Electric Vehicle (EV) Charging Station Market size was valued at USD 3,250 million in 2024 and is anticipated to reach USD 29,060.41 million by 2032, expanding at a CAGR of 31.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Electric Vehicle (EV) Charging Station Market Size 2024 |

USD 3,250 million |

| U.S. Electric Vehicle (EV) Charging Station Market , CAGR |

31.5% |

| U.S. Electric Vehicle (EV) Charging Station Market Size 2032 |

USD 29,060.41 million |

The U.S. Electric Vehicle (EV) Charging Station Market is shaped by the strong presence of leading players such as ChargePoint, Inc., Tesla, Inc., ABB Ltd., bp pulse, General Electric Company, Delta Electronics, Inc., EVgo, Blink Charging, SemaConnect, and Webasto Group, which actively focus on network expansion, fast-charging deployment, and software-enabled charging solutions. These companies invest in public, commercial, and fleet-focused infrastructure to enhance accessibility and charging reliability nationwide. Regionally, the West region dominated the U.S. Electric Vehicle (EV) Charging Station Market with a 38.7% market share in 2024, driven by high EV adoption, supportive clean-energy policies, and dense charging networks across states such as California, Washington, and Oregon, positioning it as the primary growth engine of the market.

Market Insights

- Valued at USD 3,250 million in 2024, the U.S. Electric Vehicle (EV) Charging Station Market is projected to reach USD 29,060.41 million by 2032, expanding at a CAGR of 31.5% during the forecast period.

- Market expansion is driven by accelerating electric vehicle adoption, strong federal and state incentives, and increasing investments in public, residential, and workplace charging infrastructure.

- Deployment trends highlight Fast Chargers as the dominant segment with 2% share, while the Combined Charging System leads connector types with 58.6% share, and Level 2 charging accounts for 46.9% share in 2024.

- Industry dynamics are shaped by network expansion and technology upgrades from ChargePoint, Tesla, ABB, bp pulse, GE, Delta Electronics, EVgo, Blink Charging, SemaConnect, and Webasto Group.

- Regionally, the West led with 7% share in 2024, followed by the South at 22.7%, the Northeast at 21.4%, and the Midwest at 17.2%, reflecting uneven infrastructure maturity across the U.S.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Charger Type:

The U.S. Electric Vehicle (EV) Charging Station Market, by charger type, is led by the Fast Charger segment, which accounted for 64.2% market share in 2024, driven by rising demand for reduced charging time and the expansion of highway and urban fast-charging corridors. Fast chargers are increasingly deployed across commercial locations, fleet depots, and public charging networks to support long-distance travel and high vehicle utilization. The growing adoption of DC fast charging by OEMs, increasing federal infrastructure funding, and strong preference for convenience among consumers continue to reinforce the dominance of the fast charger segment.

- For instance, Amazon has equipped several large U.S. delivery stations with 70 or more charging points to support over 100 Rivian electric vans, combining Level 2 units with strategically placed DC fast chargers so vans can recover up to 80% charge in about 30 minutes between multi‑shift delivery cycles.

By Connector Type:

By connector type, the Combined Charging System (CCS) segment dominated the U.S. Electric Vehicle (EV) Charging Station Market with a 58.6% market share in 2024, supported by its wide compatibility with major North American and European EV manufacturers. CCS enables both AC and DC charging through a single connector, making it a preferred standard for public and commercial charging installations. The dominance of CCS is further driven by regulatory alignment, automaker standardization strategies, and large-scale deployment by charging network operators, ensuring interoperability, scalability, and long-term infrastructure reliability across the U.S. market.

- For instance, ChargePoint deploys CCS-compatible Express Plus stations up to 500 kW through 125 NEVI-funded sites, including recent Interstate 95 openings in Rhode Island.

By Level of Charging:

Based on the level of charging, Level 2 charging stations held the dominant position in the U.S. Electric Vehicle (EV) Charging Station Market, capturing 46.9% market share in 2024. This dominance is attributed to widespread installation across residential complexes, workplaces, retail centers, and public parking facilities. Level 2 chargers offer a balanced combination of moderate charging speed, cost efficiency, and ease of installation compared to Level 3 systems. Government incentives, utility programs, and increasing adoption in multi-unit dwellings continue to drive sustained growth of the Level 2 segment.

Key Growth Drivers

Rapid Growth in Electric Vehicle Adoption

The U.S. Electric Vehicle (EV) Charging Station Market is strongly driven by the accelerating adoption of electric vehicles across passenger, commercial, and fleet segments. Rising consumer awareness of environmental sustainability, declining battery costs, and expanding EV model availability are encouraging higher vehicle penetration. As EV ownership increases, the need for reliable and accessible charging infrastructure intensifies across residential, workplace, and public locations. This sustained rise in EV parc directly fuels large-scale deployment of charging stations to support daily commuting, long-distance travel, and commercial fleet operations.

- For instance, Tesla operates 2,892 Supercharger stations with 34,980 DC fast-charging ports in the U.S., providing high-speed highway and urban coverage that underpins long-distance and intercity EV travel.

Strong Government Support and Infrastructure Funding

Federal and state-level initiatives play a critical role in advancing the U.S. Electric Vehicle (EV) Charging Station Market. Programs such as public infrastructure grants, tax credits, and utility-backed incentives are accelerating charging station installations nationwide. Policy frameworks focused on reducing carbon emissions and promoting clean transportation have strengthened investment confidence among private players. Additionally, funding allocated for highway corridor electrification and underserved communities is driving widespread deployment, ensuring equitable access to charging infrastructure and supporting long-term market expansion.

- For instance, the federal Alternative Fuel Vehicle Refueling Property Credit (30C) now allows businesses and tax‑exempt entities to claim up to 30 percent of eligible EV charging project costs, capped at 100,000 dollars per charging port in qualifying low‑income or non‑urban census tracts, substantially improving the economics of private investment in public or workplace charging.

Expansion of Commercial and Fleet Charging Networks

The rapid electrification of commercial fleets, including logistics, ride-hailing, public transit, and delivery services, is a major growth catalyst for the U.S. Electric Vehicle (EV) Charging Station Market. Fleet operators require high-capacity, reliable, and fast charging solutions to maintain operational efficiency and minimize downtime. This demand is driving investments in depot-based and high-power public charging networks. Partnerships between charging providers, fleet operators, and energy companies further strengthen infrastructure scalability and reinforce sustained market growth.

Key Trends & Opportunities

Deployment of High-Power and Ultra-Fast Charging Technologies

The U.S. Electric Vehicle (EV) Charging Station Market is witnessing a strong shift toward high-power and ultra-fast charging solutions. Charging providers are increasingly installing Level 3 and DC fast chargers to meet consumer expectations for shorter charging times. This trend creates opportunities for technology providers offering advanced power electronics, thermal management, and grid integration solutions. High-power charging hubs along highways and urban centers are enhancing user convenience while unlocking new revenue streams for network operators.

- For instance, EVgo partnered with Pilot Company and General Motors to deploy over 200 sites featuring 350 kW DC fast chargers across nearly 40 states by mid-2025, with more than 850 stalls now operational at Pilot and Flying J travel centers along interstate highways.

Integration of Renewable Energy and Smart Charging Solutions

The integration of renewable energy sources and smart charging technologies presents significant opportunities in the U.S. Electric Vehicle (EV) Charging Station Market. Charging stations are increasingly paired with solar power, battery storage, and energy management systems to reduce grid strain and operating costs. Smart charging software enables load balancing, dynamic pricing, and demand response participation. These advancements improve grid resilience, support sustainability goals, and create value-added services for utilities, businesses, and end users.

- For instance, Envision Solar’s EV ARC™ system deploys off-grid solar-powered charging stations across the U.S. and Canada in partnership with ChargePoint. The patented EnvisionTrak™ technology tracks the sun to generate 18-25% more electricity than fixed arrays, powering up to 150 miles of daily EV driving with stored energy for nighttime use.

Key Challenges

High Installation and Grid Upgrade Costs

High upfront installation costs remain a major challenge for the U.S. Electric Vehicle (EV) Charging Station Market. Expenses related to land acquisition, electrical upgrades, permitting, and grid interconnection significantly increase project timelines and capital requirements. Fast and ultra-fast charging stations require substantial power capacity, often necessitating transformer upgrades and utility coordination. These financial and logistical barriers can slow deployment, particularly in rural areas and small commercial locations with limited infrastructure readiness.

Grid Capacity Constraints and Operational Reliability

Grid capacity limitations and operational reliability issues pose challenges to the U.S. Electric Vehicle (EV) Charging Station Market. Rapid expansion of charging networks increases demand on local distribution systems, leading to congestion and voltage instability in certain regions. Inconsistent uptime, maintenance requirements, and interoperability issues also affect user experience. Addressing these challenges requires coordinated planning between utilities, charging operators, and regulators to ensure reliable power supply, standardization, and long-term infrastructure resilience.

Regional Analysis

West

The U.S. Electric Vehicle (EV) Charging Station Market in the West region held 38.7% market share in 2024, supported by strong EV adoption, advanced clean-energy policies, and dense charging infrastructure across states such as California, Washington, and Oregon. High consumer awareness, zero-emission mandates, and extensive public–private investments continue to drive charging station deployment. The region benefits from widespread fast-charging networks, strong utility participation, and early adoption of smart-charging technologies, reinforcing its leadership position and accelerating the transition toward electrified transportation systems.

Northeast

The Northeast accounted for 21.4% market share in 2024 in the U.S. Electric Vehicle (EV) Charging Station Market, driven by urban density, state-level climate initiatives, and growing public transit electrification. States including New York and Massachusetts actively promote EV adoption through incentives and infrastructure funding. The high concentration of multi-unit residential buildings supports demand for Level 2 and public charging solutions. Expanding workplace charging programs and municipal investments continue to strengthen charging accessibility across metropolitan and suburban areas.

Midwest

The Midwest region captured 17.2% market share in 2024 within the U.S. Electric Vehicle (EV) Charging Station Market, supported by increasing EV adoption, automotive manufacturing presence, and expanding interstate charging corridors. States such as Michigan, Illinois, and Ohio are investing in highway fast-charging networks to support long-distance travel and regional connectivity. Utility-led infrastructure programs and growing commercial fleet electrification contribute to steady market growth. The region is also benefiting from rising investments in manufacturing-linked charging infrastructure.

South

The South held 22.7% market share in 2024 in the U.S. Electric Vehicle (EV) Charging Station Market, driven by rising EV adoption, urban expansion, and growing investments in public charging infrastructure. States such as Texas, Florida, and Georgia are witnessing rapid deployment of fast and Level 2 charging stations across retail centers, workplaces, and residential developments. Favorable economic growth, expanding logistics fleets, and utility modernization initiatives continue to improve charging accessibility, supporting strong market momentum across the southern United States.

Market Segmentations:

By Charger Type

- Slow Charger

- Fast Charger

By Connector Type

- CHAdeMO

- Combined Charging System

- Others

By Level of Charging

By Connectivity

- Non-connected Charging Stations

- Connected Charging Stations

By Application

By Geography

- West

- Northeast

- Midwest

- South

Competitive Landscape

Competitive landscape analysis of the U.S. Electric Vehicle (EV) Charging Station Market highlights the strong presence of key players including ChargePoint, Inc., Tesla, Inc., ABB Ltd., bp pulse, General Electric Company, Delta Electronics, Inc., EVgo, Blink Charging, SemaConnect, and Webasto Group. The market is characterized by rapid network expansion, technology differentiation, and strategic collaborations aimed at strengthening geographic coverage and charging speed capabilities. Leading companies focus on deploying fast and ultra-fast charging solutions, enhancing software platforms, and integrating smart energy management systems. Partnerships with utilities, fleet operators, and retail chains play a critical role in improving accessibility and utilization rates. Continuous investments in interoperability, reliability, and user experience are shaping competition, while mergers, acquisitions, and long-term service agreements are enabling players to scale operations and maintain strong positioning in an increasingly infrastructure-intensive market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ABB Ltd.

- SemaConnect Inc.

- Delta Electronics, Inc.

- Tesla, Inc.

- bp pulse

- General Electric Company

- Webasto Group

- ChargePoint, Inc.

- ClipperCreek, Inc.

- Leviton Manufacturing Co., Inc.

Recent Developments

- In December 2025, EVgo Inc. partnered with Miller Electric Company to deploy more than 40% of its charging stations using domestically manufactured prefabricated modular skids, accelerating installations and cutting costs.

- In November 2025, Jolt acquired Volta’s 3,000 EV charging network in the U.S. from Shell to expand its operations.

- In April 2025, ChargePoint announced a new AC Level 2 charging product architecture featuring bidirectional charging and speeds up to double typical rates, with North American models arriving by end of 2025.

- In May 2025, Eaton and ChargePoint established a partnership to integrate EV charging with infrastructure solutions, co-developing bidirectional and V2X technologies for U.S. deployments

Report Coverage

The research report offers an in-depth analysis based on Charger Type, Connector Type, Level of Charging, Connectivity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The U.S. Electric Vehicle (EV) Charging Station Market will continue to expand rapidly, supported by sustained growth in electric vehicle adoption across all vehicle segments.

- Public and private investments will accelerate nationwide charging infrastructure deployment, particularly along highways and in urban centers.

- Fast and ultra-fast charging stations will gain wider adoption to meet consumer demand for reduced charging time.

- Residential and workplace charging installations will increase with rising EV ownership in multi-unit housing and commercial facilities.

- Fleet electrification will drive demand for high-capacity and depot-based charging solutions.

- Smart charging and software-driven energy management will enhance network efficiency and grid stability.

- Integration of renewable energy and energy storage with charging stations will support sustainability goals.

- Standardization and interoperability of connectors and payment systems will improve user experience.

- Utility participation and grid modernization initiatives will strengthen charging reliability and scalability.

- Strategic partnerships and consolidation among charging providers will shape long-term market structure.