| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

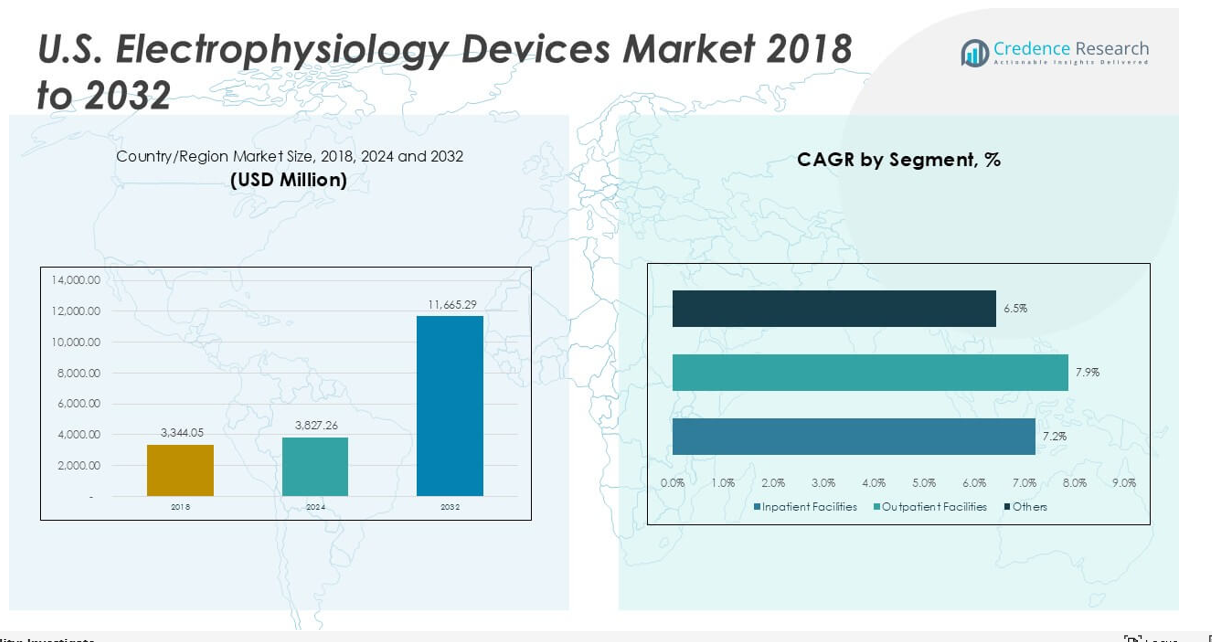

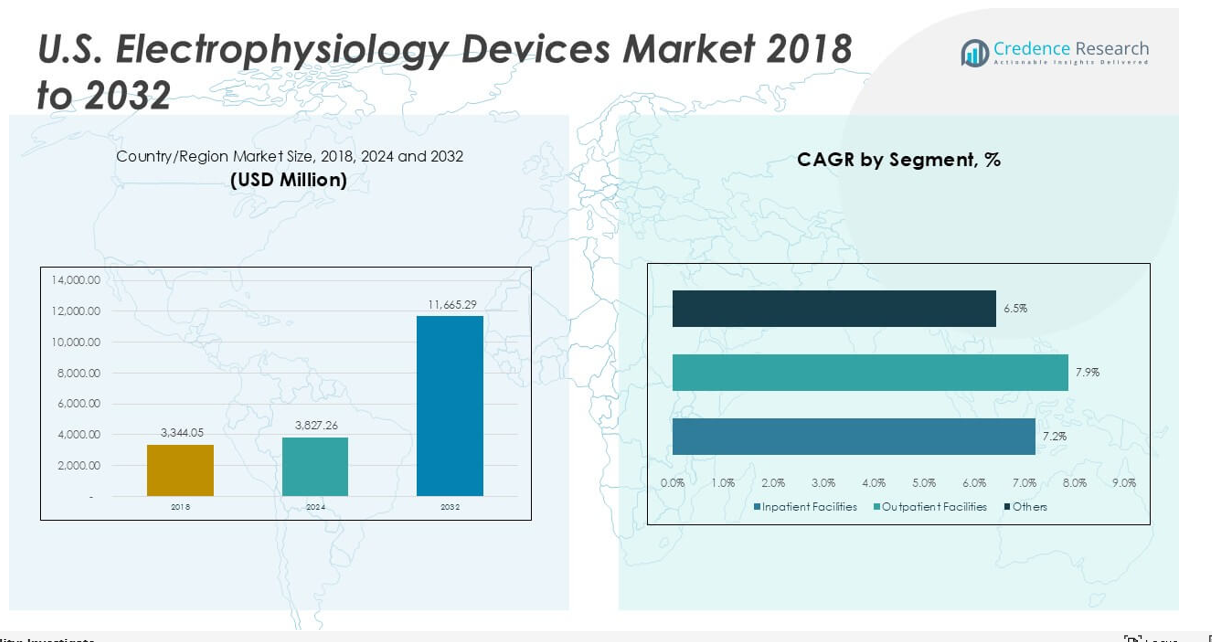

| U.S. Electrophysiology Devices Market Size 2024 |

USD 3,827.26 million |

| U.S. Electrophysiology Devices Market, CAGR |

14.95% |

| U.S. Electrophysiology Devices Market Size 2032 |

USD 11,665.29 million |

Market Overview

U.S. Electrophysiology Devices Market size was valued at USD 3,344.05 million in 2023 to USD 3,827.26 million in 2024 and is anticipated to reach USD 11,665.29 million by 2032, at a CAGR of 14.95% during the forecast period.

The U.S. Electrophysiology Devices Market experiences robust growth driven by the rising prevalence of cardiac arrhythmias, increasing adoption of minimally invasive procedures, and ongoing technological advancements in mapping and ablation devices. An aging population, growing awareness about early diagnosis, and improved healthcare infrastructure further accelerate market expansion. Demand for advanced electrophysiology solutions continues to rise as hospitals and specialty clinics seek more accurate and efficient diagnostic and treatment tools. Industry innovation focuses on real-time 3D mapping, integration of artificial intelligence, and development of safer, more effective catheter technologies, supporting improved patient outcomes and shorter recovery times. At the same time, favorable reimbursement policies and increased investments in research and development fuel the adoption of next-generation electrophysiology devices. These trends underscore a shift toward patient-centric and precision-driven care, positioning the market for sustained growth over the coming years.

The geographical analysis of the U.S. Electrophysiology Devices Market highlights diverse regional demand driven by variations in healthcare infrastructure, population demographics, and clinical adoption rates. Regions with advanced medical facilities and research centers demonstrate higher uptake of cutting-edge electrophysiology technologies. Leading players in the market include Boston Scientific Corp., Medtronic, Abbott, and Biosense Webster. These companies maintain strong positions through continuous innovation, extensive product portfolios, and strategic collaborations with healthcare providers. They focus on developing advanced ablation catheters, diagnostic tools, and integrated digital solutions to meet evolving clinical needs. Their robust R&D investments and global reach support sustained growth and competitive advantage in the U.S. electrophysiology space.

Market Insights

The U.S. Electrophysiology Devices Market was valued at USD 3,827.26 million in 2024 and is projected to reach USD 11,665.29 million by 2032, growing at a CAGR of 14.95%.

· Rising prevalence of cardiac arrhythmias and increasing demand for early diagnosis drive market growth, supported by an aging population and improved healthcare awareness.

· The market trends show growing adoption of advanced mapping and ablation technologies, integration of artificial intelligence, and a shift toward minimally invasive and outpatient procedures.

· Key players such as Boston Scientific Corp., Medtronic, Abbott, and Biosense Webster dominate the competitive landscape through continuous innovation and strategic partnerships.

· High costs of devices and reimbursement complexities pose significant challenges, limiting market penetration especially in smaller healthcare facilities.

· Regulatory hurdles and the need for skilled electrophysiologists further restrain rapid adoption of new technologies across regions.

· Regionally, the Western United States leads in market adoption due to advanced healthcare infrastructure, followed by the Midwestern and Southern regions, while the Northeastern U.S. focuses on innovation and clinical research.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Incidence of Cardiac Arrhythmias and Demand for Early Diagnosis

The increasing prevalence of cardiac arrhythmias, including atrial fibrillation and ventricular tachycardia, continues to drive significant demand in the U.S. Electrophysiology Devices Market. Physicians and healthcare providers prioritize early diagnosis and intervention to reduce morbidity and improve long-term outcomes. Advancements in screening programs and public health campaigns raise awareness among at-risk populations, contributing to early detection rates. Hospitals and clinics invest in state-of-the-art diagnostic equipment, which allows for quicker and more accurate assessment of electrophysiological disorders. This heightened focus on proactive cardiac care supports the rapid adoption of advanced devices. The market responds to clinical demand with solutions that enhance precision in both diagnosis and treatment.

- For instance, the CDC estimates that by 2030, approximately 12.1 million Americans will be diagnosed with atrial fibrillation, increasing the need for advanced electrophysiology solutions.

Shift Toward Minimally Invasive Procedures and Patient-Centric Care

Minimally invasive electrophysiology procedures gain traction due to shorter hospital stays, reduced risk of complications, and faster patient recovery. The U.S. Electrophysiology Devices Market benefits from the growing preference for catheter-based interventions over traditional surgical methods. Patients and healthcare providers value innovations that reduce procedural pain and accelerate the return to normal activity. Medical device manufacturers introduce technologies that improve navigation and visualization within the heart, making procedures safer and more efficient. The trend toward patient-centric care leads to greater adoption of user-friendly, minimally invasive devices. These factors collectively increase procedure volumes in hospitals and outpatient centers.

- For instance, the demand for minimally invasive cardiac ablation procedures has surged by 55% in recent years, reflecting a shift toward patient-centric care.

Technological Advancements and Integration of Digital Solutions

Rapid technological innovation serves as a key growth driver for the U.S. Electrophysiology Devices Market. The integration of artificial intelligence, advanced 3D mapping, and robotic navigation enhances procedural accuracy and reduces operator dependency. Device manufacturers invest in research and development to bring safer and more effective solutions to market. Digital platforms enable real-time data sharing, remote monitoring, and personalized treatment planning, improving patient outcomes. Hospitals and clinics leverage these innovations to streamline workflow and increase procedural success rates. Ongoing technological improvements shape the competitive landscape and fuel market expansion.

Supportive Healthcare Policies, Reimbursement, and Investment Climate

Favorable healthcare policies and reimbursement frameworks support growth in the U.S. Electrophysiology Devices Market. Government initiatives and private insurers recognize the importance of timely electrophysiology procedures for reducing overall healthcare costs. Funding for cardiac care infrastructure and research increases access to advanced technologies. Hospital administrators allocate budgets for capital equipment upgrades to stay current with regulatory requirements. Investments from both public and private sectors enable ongoing device development and deployment. A stable regulatory environment and positive investment climate underpin sustained market growth.

Market Trends

Increasing Adoption of Advanced Mapping and Ablation Technologies

The U.S. Electrophysiology Devices Market shows a clear trend toward the adoption of advanced mapping and ablation technologies. These innovations provide greater precision in identifying and treating cardiac arrhythmias. Medical centers prioritize equipment that offers real-time, high-resolution 3D imaging to improve procedural outcomes. Manufacturers focus on developing user-friendly devices that reduce procedure time and enhance safety. This shift encourages more widespread use of catheter ablation as a preferred treatment. The demand for devices with enhanced energy delivery options, such as cryoablation and radiofrequency, continues to rise. It reflects a market driven by clinical efficacy and patient safety.

- For instance, the rise in atrial fibrillation cases, estimated to impact nearly 25% of the adult population, has escalated the demand for advanced diagnostic and treatment solutions.

Integration of Artificial Intelligence and Digital Health Solutions

Artificial intelligence (AI) and digital health solutions gain momentum within the U.S. Electrophysiology Devices Market. AI-powered algorithms assist physicians in interpreting complex electrophysiological data and predicting arrhythmia recurrence. Remote monitoring platforms improve patient follow-up and enable early intervention. The use of cloud-based systems allows for seamless data sharing between healthcare providers. These digital advancements improve workflow efficiency and decision-making accuracy during procedures. Market players invest heavily in software development to complement hardware offerings. This trend supports the evolution of electrophysiology toward more personalized and data-driven care.

- For instance, AI-powered predictive models showcase superior accuracy, improving traditional metrics by 15-25%.

Growing Focus on Minimally Invasive and Outpatient Procedures

Minimally invasive procedures continue to gain traction, supported by the trend toward outpatient care in the U.S. Electrophysiology Devices Market. Hospitals and specialized clinics expand their capabilities to perform electrophysiology interventions outside traditional inpatient settings. This shift reduces costs and improves patient convenience without compromising quality. Devices designed for easier catheter navigation and reduced procedural complexity facilitate this transition. The trend reflects broader healthcare goals of improving access and efficiency. It encourages innovation in portable and compact electrophysiology systems. Growing patient preference for less invasive treatments drives market dynamics.

Increasing Collaboration Between Device Manufacturers and Healthcare Providers

Collaboration between device manufacturers and healthcare providers emerges as a significant trend in the U.S. Electrophysiology Devices Market. Joint efforts focus on clinical trials, real-world data collection, and post-market surveillance to demonstrate device effectiveness. These partnerships accelerate product development cycles and ensure alignment with clinical needs. Training programs and educational initiatives support physician adoption of new technologies. This cooperation improves device usability and optimizes procedural outcomes. It also facilitates regulatory approvals and reimbursement processes. The trend promotes a more integrated and responsive market environment.

Market Challenges Analysis

High Costs and Reimbursement Complexities Limit Market Expansion

The U.S. Electrophysiology Devices Market faces significant challenges due to high device costs and complex reimbursement policies. Advanced electrophysiology equipment involves substantial capital investment, which can restrict adoption, especially among smaller healthcare providers. Insurance reimbursement rates vary widely across regions and payers, creating uncertainty for hospitals and clinics. This variability delays procurement decisions and slows market growth. Cost containment pressures in healthcare systems force providers to prioritize budget allocation carefully. It complicates the acquisition of cutting-edge technologies despite their clinical benefits. Manufacturers must balance innovation with affordability to expand market reach.

- For instance, the cost of advanced electrophysiology mapping systems can exceed hundreds of thousands of dollars, limiting accessibility for smaller hospitals.

Regulatory Hurdles and Clinical Adoption Barriers Impede Growth

Stringent regulatory requirements pose challenges for the U.S. Electrophysiology Devices Market, lengthening time-to-market for new products. The approval process demands extensive clinical data, which increases development costs and risks. Healthcare providers may hesitate to adopt new technologies without clear evidence of superiority over existing solutions. Training requirements for complex electrophysiology devices further slow adoption rates. Limited availability of skilled electrophysiologists in some regions restricts procedure volumes. Market players face pressure to provide comprehensive support and education to overcome these barriers. It highlights the need for streamlined regulatory pathways and enhanced clinical collaboration.

Market Opportunities

Expansion Potential Through Technological Innovation and AI Integration

The U.S. Electrophysiology Devices Market holds substantial opportunity in advancing technological innovation and integrating artificial intelligence (AI). It can leverage AI to enhance diagnostic accuracy, optimize procedural efficiency, and personalize treatment plans. Emerging technologies such as robotic navigation and real-time 3D imaging provide new avenues for device improvement. Continuous development of safer and more effective ablation catheters promises to expand treatment options. Investment in research and development creates potential for breakthrough solutions that address unmet clinical needs. Collaborations between technology firms and medical device manufacturers can accelerate innovation and commercialization. These advancements offer strong growth potential for market participants.

Growing Demand for Minimally Invasive Procedures and Outpatient Care Facilities

The increasing preference for minimally invasive electrophysiology procedures and outpatient care centers opens new growth avenues for the U.S. Electrophysiology Devices Market. It can capitalize on trends favoring reduced hospitalization times and improved patient comfort. Portable and compact device designs enable wider deployment beyond traditional hospital settings. Expansion into outpatient clinics and ambulatory surgery centers can increase procedure accessibility and volume. Rising patient awareness and demand for safer treatments create opportunities for market penetration. Developing training programs for healthcare professionals supports adoption of advanced devices. This trend aligns with broader healthcare goals and positions the market for sustained expansion.

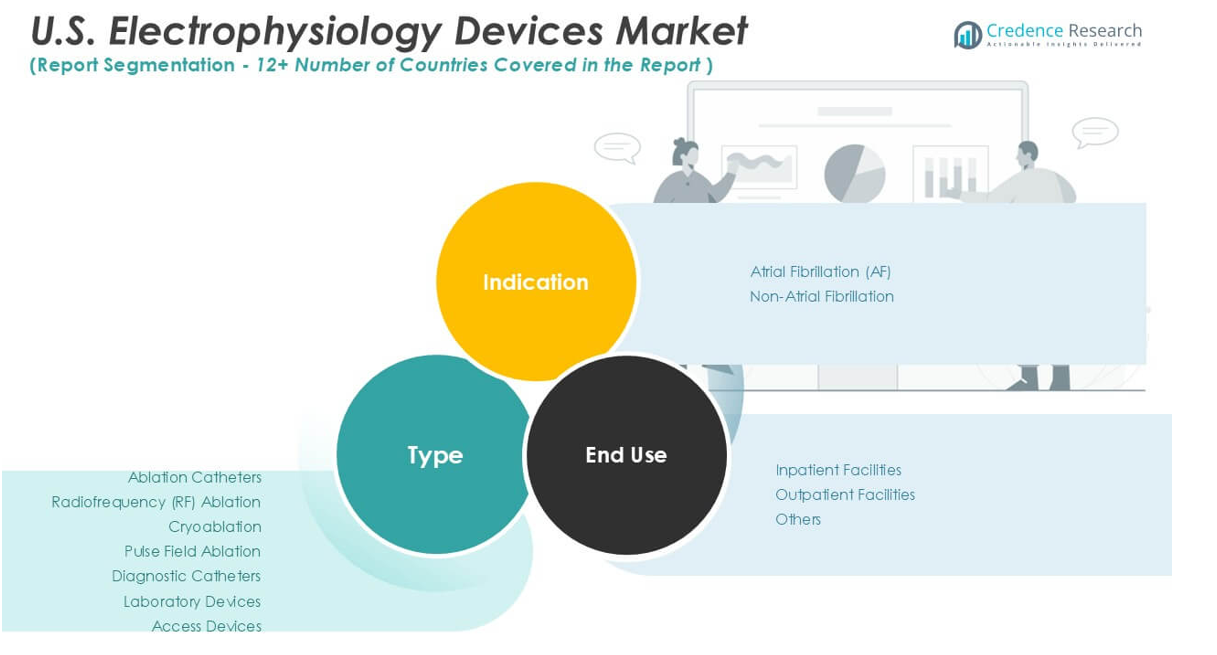

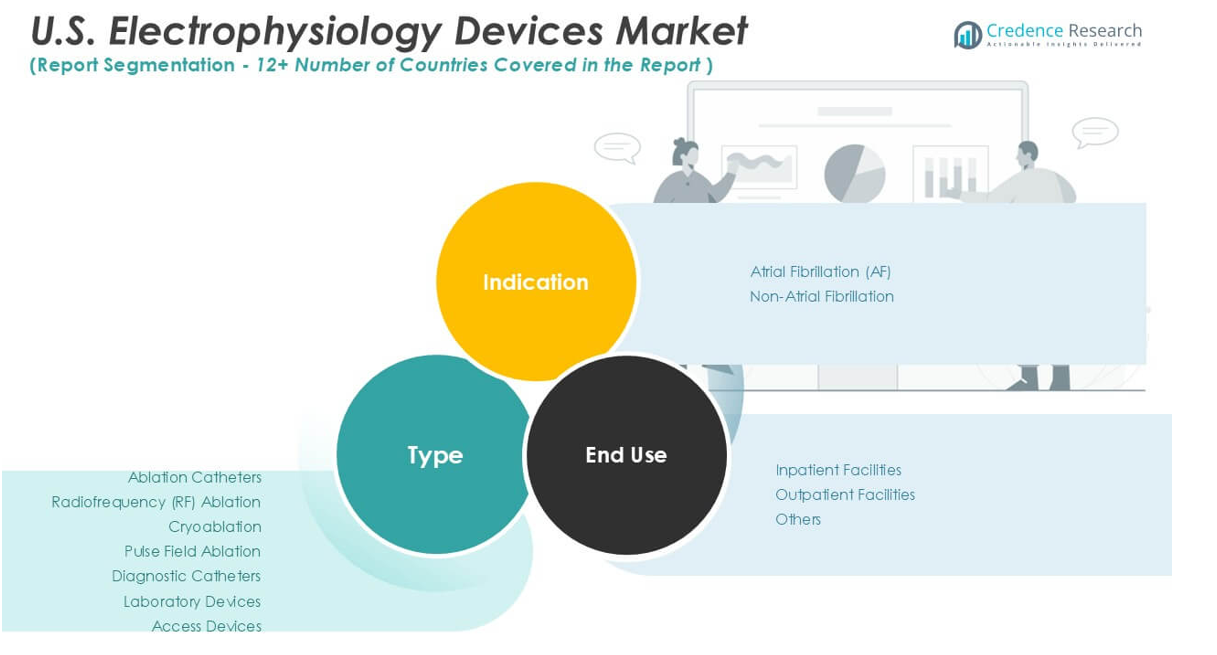

Market Segmentation Analysis:

By Type:

the market includes ablation catheters, diagnostic catheters, laboratory devices, and access devices. Ablation catheters dominate the market due to their critical role in treating arrhythmias. Within this segment, radiofrequency (RF) ablation leads owing to its widespread clinical acceptance and proven efficacy. Cryoablation follows closely, favored for its safety profile in specific patient groups. Pulse field ablation, a newer technology, gains traction for its precision and reduced collateral tissue damage. Diagnostic catheters support accurate mapping and diagnosis, forming a significant portion of device utilization. Laboratory devices and access devices play essential supportive roles in electrophysiology procedures, contributing to the overall market growth by enabling improved procedural efficiency and patient safety.

By Indication:

The market divides into atrial fibrillation (AF) and non-atrial fibrillation segments. Atrial fibrillation holds the largest market share due to its high prevalence and increasing diagnosis rates in the U.S. It drives demand for advanced electrophysiology devices aimed at effective rhythm control and stroke risk reduction. The non-atrial fibrillation segment includes ventricular tachycardia, supraventricular tachycardia, and other arrhythmias, representing a growing opportunity for device manufacturers as awareness and treatment rates rise.

By End-Use:

Regarding end-use, the market segments into inpatient facilities, outpatient facilities, and others. Inpatient facilities, including hospitals and specialized cardiac centers, account for the majority of electrophysiology device usage due to complex procedure requirements. However, outpatient facilities demonstrate rapid growth fueled by trends toward minimally invasive procedures and cost-effective care delivery. The expansion of ambulatory surgery centers and outpatient clinics increases accessibility to electrophysiology treatments. The ‘others’ category includes research institutions and diagnostic labs that contribute to device demand for clinical studies and diagnostic purposes.

Segments:

Based on Type:

- Ablation Catheters

- Radiofrequency (RF) Ablation

- Cryoablation

- Pulse Field Ablation

- Diagnostic Catheters

- Laboratory Devices

- Access Devices

Based on Indication:

- Atrial Fibrillation (AF)

- Non-Atrial Fibrillation

Based on End-Use:

- Inpatient Facilities

- Outpatient Facilities

- Others

Based on the Geography:

- Western United States

- Midwestern United States

- Southern United States

- Northeastern United States

Regional Analysis

Western United States

The Western United States leads with the largest market share, accounting for approximately 32% of the total market. This region benefits from a high concentration of advanced medical centers and research institutions, particularly in states like California and Washington. These facilities actively adopt cutting-edge electrophysiology technologies, supported by strong healthcare funding and a focus on innovative cardiac care. The Western U.S. also experiences significant demand due to its sizable and aging population, increasing the prevalence of arrhythmia cases that require sophisticated electrophysiology devices. Healthcare providers in this region emphasize minimally invasive procedures and digital health integration, driving growth in electrophysiology device adoption.

Midwestern United States

The Midwestern United States holds the second-largest share, representing about 27% of the U.S. Electrophysiology Devices Market. The Midwest is characterized by a robust network of community hospitals and specialized cardiac care centers spread across states such as Illinois, Ohio, and Minnesota. These institutions invest in modern electrophysiology equipment to address growing cardiovascular disease rates linked to lifestyle and demographic factors. The region also benefits from improving healthcare access in rural areas through outpatient and ambulatory care centers, increasing procedural volumes for electrophysiology devices. Midwestern healthcare providers focus on balancing cost-effective care delivery with advanced treatment options, creating opportunities for device manufacturers to introduce both innovative and affordable solutions.

Southern United States

In the Southern United States, the market share accounts for approximately 23%. This region includes a diverse healthcare landscape with a mix of urban centers and underserved rural populations. States like Texas and Florida lead in electrophysiology device demand due to high incidences of atrial fibrillation and other arrhythmias, fueled by an aging population and increasing cardiovascular risk factors such as obesity and diabetes. The Southern region witnesses growing investment in outpatient care facilities, enabling wider access to minimally invasive electrophysiology procedures. Healthcare providers emphasize expanding infrastructure and training programs to improve procedural outcomes and patient safety. Market players focus on developing devices suited to the regional demand for versatile and easy-to-use solutions that can function effectively in varied clinical settings.

Northeastern United States

The Northeastern United States accounts for roughly 18% of the market share, the smallest among the four regions but maintains steady growth. This region benefits from dense urban populations and some of the nation’s leading academic medical centers located in states such as New York, Massachusetts, and Pennsylvania. The Northeast leads in early adoption of advanced electrophysiology devices, supported by substantial investments in research, clinical trials, and healthcare innovation. Providers prioritize integrating digital health tools and AI-assisted technologies to enhance procedural success and patient monitoring. Although the market share is smaller relative to other regions, the Northeastern U.S. serves as a critical hub for clinical advancements that influence national electrophysiology device trends. Its strong focus on academic excellence and innovation continues to attract device manufacturers seeking collaboration and pilot opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Boston Scientific Corp.

- Medtronic

- Abbott

- Biosense Webster

- General Electric Company

- Siemens Healthcare AG

Competitive Analysis

The U.S. Electrophysiology Devices Market features intense competition among leading players, including Boston Scientific Corp., Medtronic, Abbott, and Biosense Webster. These companies maintain strong market positions through continuous innovation, diversified product portfolios, and strategic collaborations with healthcare providers. These key players invest heavily in clinical trials and product development to stay ahead in the evolving market. They also engage in acquisitions and partnerships to broaden their technological capabilities and market reach. Pricing strategies and reimbursement support further enhance their competitiveness, enabling broader adoption across inpatient and outpatient settings. Robust distribution networks and comprehensive training programs facilitate device adoption by electrophysiologists. Collectively, these factors contribute to a highly dynamic and competitive landscape, driving continuous improvements in electrophysiology treatment options in the U.S. market.

Recent Developments

- In August 2023, Biosense Webster received approval for various atrial fibrillation ablation products that can be utilized in a workflow without fluoroscopy during catheter ablation procedures.

- In August 2023, Boston Scientific Corporation (US) launched the POLARx cryoablation system. This system is used to treat patients with paroxysmal atrial fibrillation.

- In May 2023 Abbott Laboratories launched the Tactiflex ablation catheter which is sensor-enabled and it is used to treat the most common abnormal heart rhythm.

Market Concentration & Characteristics

The U.S. Electrophysiology Devices Market exhibits a moderately concentrated structure dominated by a few key players such as Boston Scientific Corp., Medtronic, Abbott, and Biosense Webster. These companies control a significant portion of the market through strong brand recognition, extensive product portfolios, and continuous innovation. It features high entry barriers due to the substantial investment required in research, development, and regulatory compliance. The market emphasizes advanced technology development, including sophisticated ablation catheters and digital integration, which favors established players with robust R&D capabilities. Customer loyalty and long-term contracts with hospitals and healthcare providers further strengthen the market position of leading companies. Competition centers on technological advancements, pricing strategies, and after-sales support. Smaller firms face challenges in scaling due to stringent regulatory requirements and the need for clinical validation. The market’s characteristics reflect a balance between innovation-driven growth and regulatory complexity, shaping a competitive environment that rewards both technological excellence and strategic partnerships.

Report Coverage

The research report offers an in-depth analysis based on Type, Indication, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The U.S. electrophysiology devices market is expected to witness steady growth driven by the rising prevalence of cardiac arrhythmias.

- Increased adoption of minimally invasive procedures will boost the demand for advanced electrophysiology devices.

- Growing awareness among patients and physicians about early diagnosis of heart rhythm disorders will support market expansion.

- Technological advancements in mapping systems and ablation catheters will enhance treatment precision and outcomes.

- The rising geriatric population in the U.S. will increase the need for effective cardiac monitoring and intervention tools.

- Integration of artificial intelligence and digital health tools into electrophysiology devices will streamline workflows and improve diagnosis.

- Expanding healthcare infrastructure and increasing investments in cardiac care facilities will drive market demand.

- Favorable reimbursement policies for electrophysiology procedures will encourage more patients to seek treatment.

- Strategic collaborations and product innovations by key players will foster competition and market innovation.

- Regulatory approvals of new and improved electrophysiology devices will accelerate their availability and clinical adoption.