Market Overview

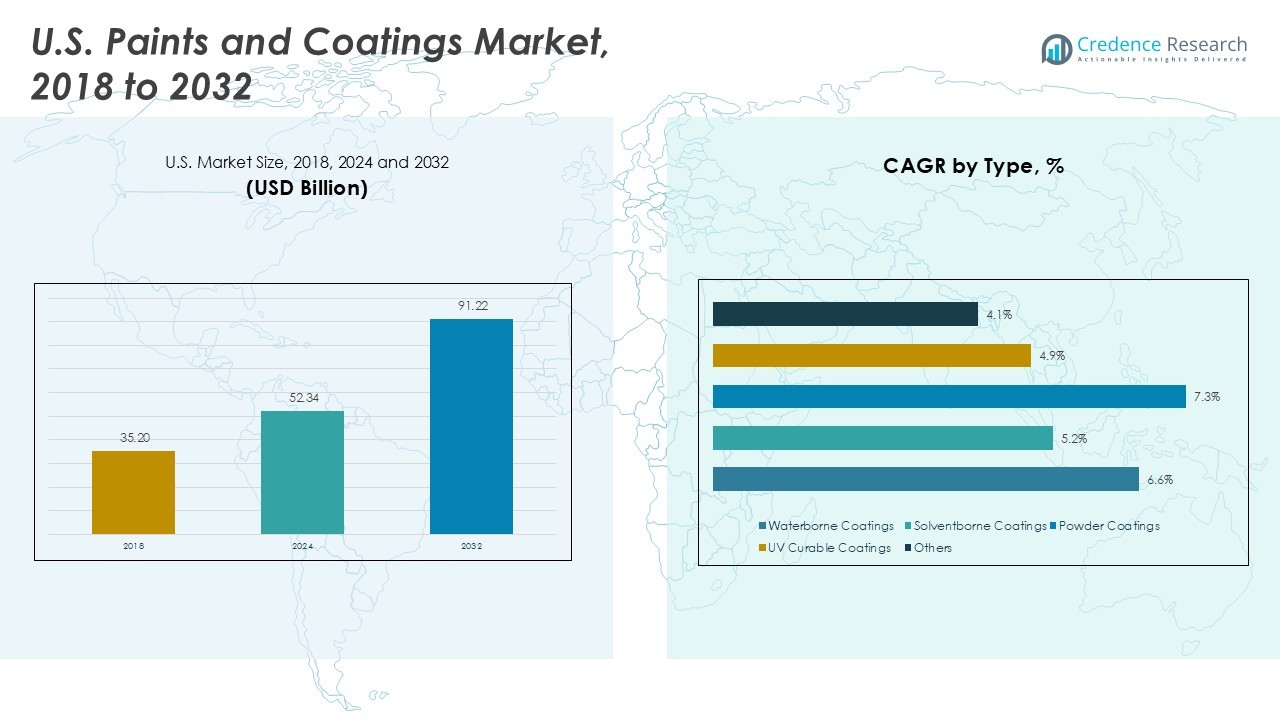

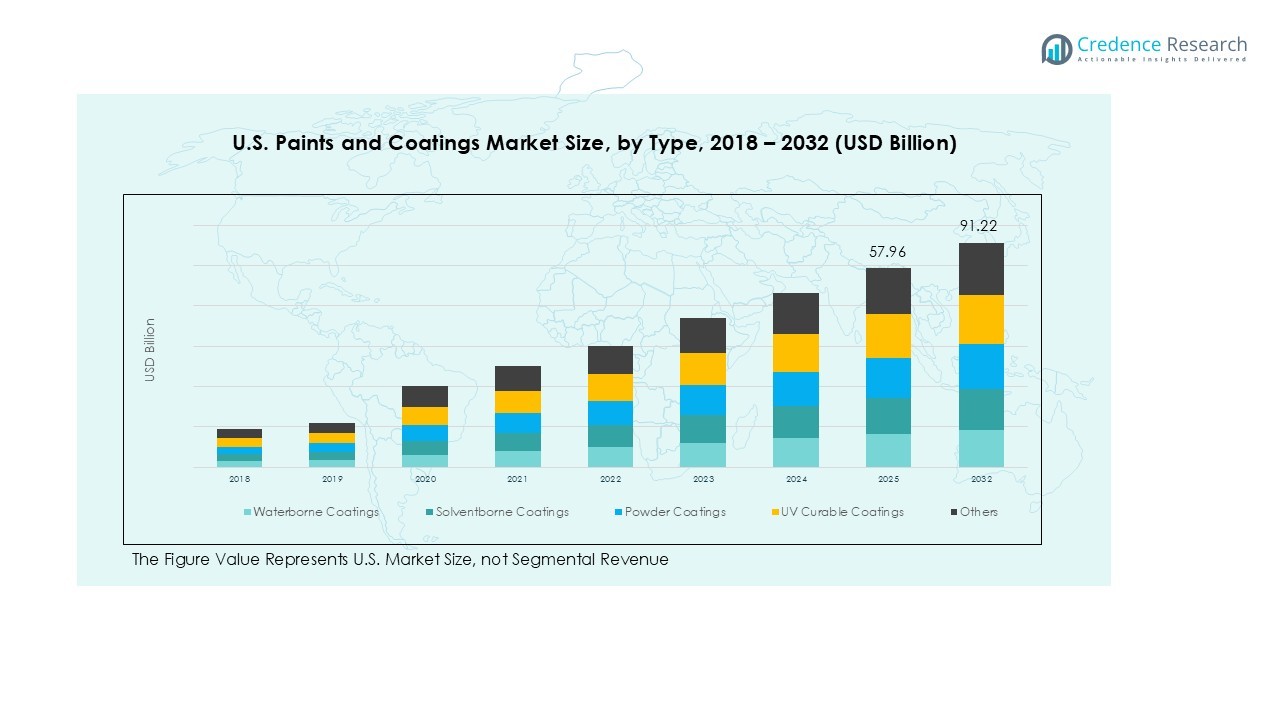

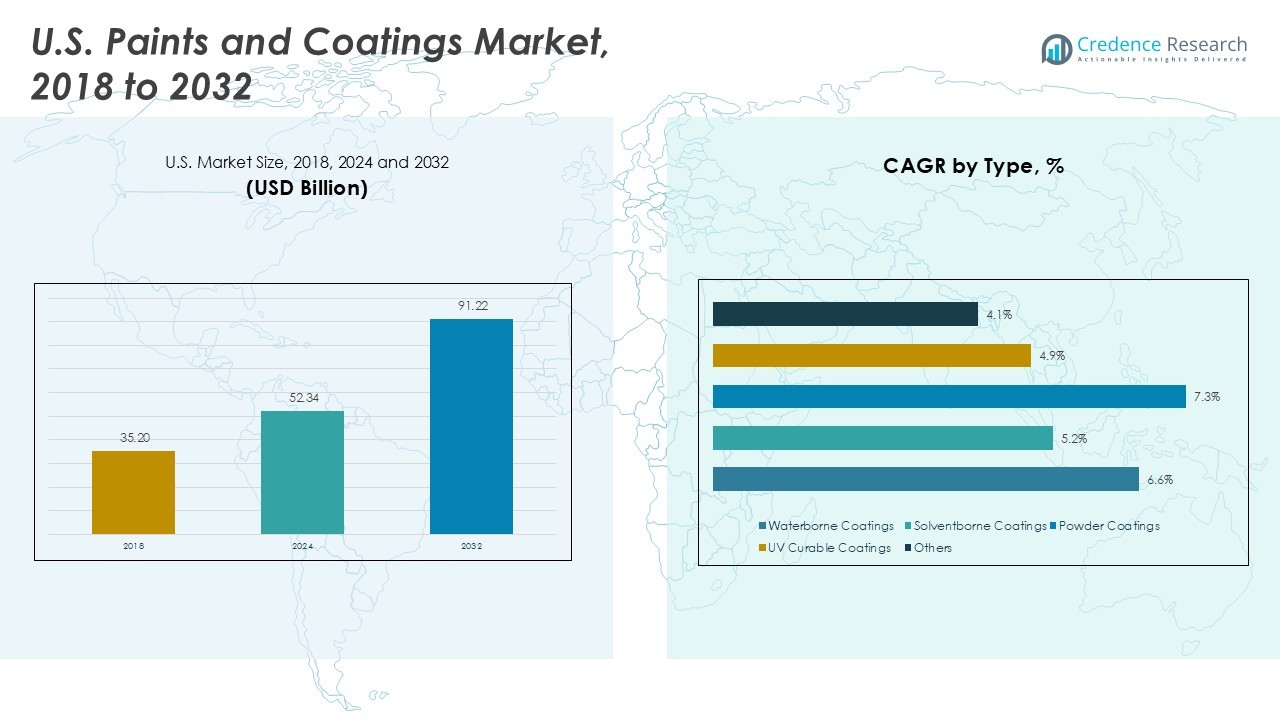

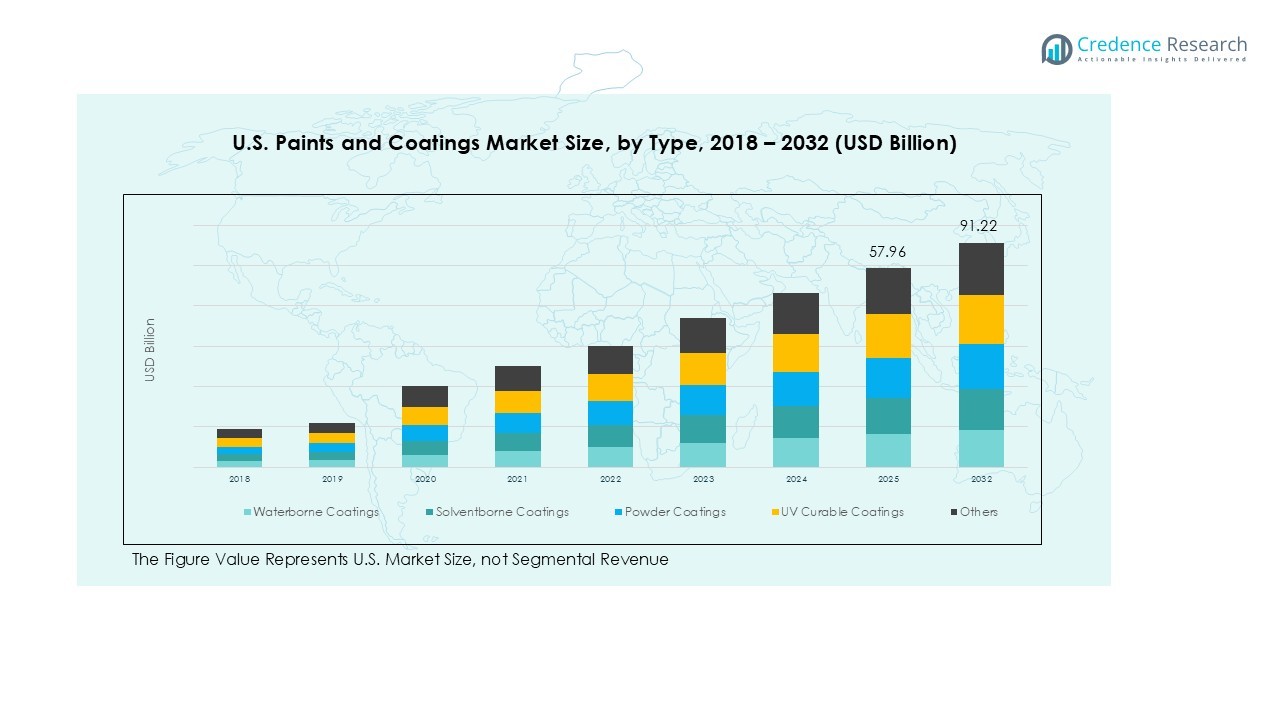

The U.S. Paints and Coatings market size was valued at USD 35.20 billion in 2018 and grew to USD 52.34 billion in 2024. It is anticipated to reach USD 91.22 billion by 2032, registering a CAGR of 6.70% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Paints and Coatings Market Size 2024 |

USD 52.34 Billion |

| U.S. Paints and Coatings Market, CAGR |

6.70% |

| U.S. Paints and Coatings Market Size 2032 |

USD 91.22 Billion |

The U.S. paints and coatings market is dominated by leading players such as Sherwin-Williams, PPG Industries, RPM International Inc., Axalta Coating Systems, Behr Paint Co., Benjamin Moore & Co., Cloverdale Paint, Diamond Vogel, Masco Corporation, and Rust-Oleum Corporation. These companies drive growth through continuous innovation, eco-friendly product offerings, and strategic expansions across the country. Regionally, the Western U.S. leads with a 30% market share, driven by construction, industrial, and automotive demand in states like California and Washington. The South follows with 28%, supported by residential and commercial development in Texas and Florida, while the Midwest holds 22%, propelled by automotive manufacturing hubs and industrial infrastructure. The Northeast accounts for 20%, benefiting from dense urban construction and renovation activities. Collectively, these players and regions shape a competitive and high-growth environment in the U.S. market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. paints and coatings market was valued at USD 52.34 billion in 2024 and is projected to reach USD 91.22 billion by 2032, growing at a CAGR of 6.70% during the forecast period. Waterborne coatings lead the type segment with 42% share, while epoxy coatings dominate the technology segment with 35% share. Residential construction accounts for 38% of end-user demand.

- Strong growth in residential and commercial construction drives demand for both decorative and protective coatings across the U.S., particularly in the West and South regions, which together capture 58% of the total market share.

- Market trends include rising adoption of eco-friendly waterborne and powder coatings, increasing use of smart and self-healing coatings, and digitalization in production and application processes.

- Competitive activity is intense, with Sherwin-Williams, PPG Industries, RPM International, and Axalta leading through product innovation, strategic partnerships, and geographic expansion.

- Challenges include raw material price volatility and strict environmental regulations, which require manufacturers to focus on cost optimization and regulatory compliance across all regions.

Market Segmentation Analysis:

By Type:

In the U.S. Paints and Coatings market, waterborne coatings dominate the type segment, accounting for approximately 42% of the total market share. The growing demand is driven by stringent environmental regulations and a shift toward eco-friendly solutions, as these coatings emit lower VOCs compared to solventborne alternatives. Solventborne coatings hold a significant portion at around 25%, supported by their superior durability and chemical resistance in industrial applications. Powder coatings and UV curable coatings together contribute roughly 20%, favored in automotive and high-performance manufacturing, while the remaining 13% comprises specialty coatings under the “Others” category.

- For instance, Sherwin-Williams expanded its waterborne production capabilities by adding a 600,000-square-foot facility in Statesville, North Carolina, to boost annual output capacity by 200 million liters. This investment supports growing U.S. demand for low-VOC and waterborne formulations across architectural and protective segments.

By Technology:

Epoxy coatings lead the technology segment with an estimated 35% market share, attributed to their excellent corrosion resistance and long-term durability in industrial and infrastructure applications. Polyurethane (PU) coatings follow at 22%, driven by their flexibility and high gloss finish for automotive and commercial construction sectors. Acrylic coatings account for 18%, offering cost-effective solutions with weather resistance, while alkyd and polyester coatings represent 15% collectively, popular in residential applications. The remaining 10% falls under “Others,” including specialty hybrid formulations, which are increasingly adopted for niche applications requiring enhanced chemical or UV resistance.

- For instance, PPG Industries offers a range of high-durability epoxy and polyurea coating systems for infrastructure, such as railroad bridge deck membranes that provide permanent waterproofing and corrosion protection.

By End User Industry:

Residential construction is the largest end-user segment, capturing nearly 38% of the U.S. market, fueled by rising housing projects and renovation activities. Commercial construction follows with 25%, driven by infrastructure development and modern architectural requirements. Automotive coatings hold 18% of the market, supported by growing vehicle production and emphasis on aesthetic finishes. Industrial manufacturing represents 14%, with demand for high-performance protective coatings. The remaining 5% is categorized as “Others,” including marine, aerospace, and specialty applications, reflecting the market’s diversification toward specialized coating solutions.

Key Growth Drivers

Increasing Residential and Commercial Construction Activities

The U.S. paints and coatings market is significantly propelled by rising construction activities across residential and commercial sectors. Expanding urbanization, infrastructure development, and renovation projects drive demand for interior and exterior coatings. Homeowners and developers increasingly prioritize aesthetics, durability, and protective finishes, boosting consumption of both waterborne and solventborne coatings. Government incentives for affordable housing and modern commercial complexes further encourage market expansion, making construction growth a primary driver of revenue across multiple coating types and technologies in the U.S. market.

- For instance, Behr Paint Company is a major manufacturer of paints, primers, and stains for DIY and professional use, with its products sold exclusively through The Home Depot. Its BEHR DYNASTY™ interior line offers high durability and exceptional washability, with some finishes, such as the matte, achieving scrub resistance testing results of over 4,000 cycles per ASTM D2486.

Environmental Regulations and Eco-Friendly Coatings Adoption

Stringent U.S. environmental regulations targeting VOC emissions and hazardous chemicals are fueling the adoption of eco-friendly coatings, particularly waterborne and powder coatings. Manufacturers are investing in low-VOC and sustainable solutions, enhancing compliance while appealing to environmentally conscious consumers. This regulatory push not only reduces harmful emissions but also drives technological innovation, resulting in higher-quality coatings with improved performance and durability. As sustainability remains a priority, regulatory adherence continues to stimulate market growth and shape product development strategies.

- For instance, Axalta Coating Systems offers its Cromax EZ waterborne refinish technology, which provides reduced VOC emissions compared with solventborne systems. This waterborne formulation helps collision centers comply with environmental standards like EPA 40 CFR Part 59 by meeting low VOC regulations.

Automotive and Industrial Manufacturing Demand

The automotive and industrial manufacturing sectors contribute significantly to market growth by demanding high-performance coatings with corrosion resistance, chemical stability, and aesthetic appeal. Rising vehicle production and modernization of industrial facilities increase consumption of epoxy, polyurethane, and UV curable coatings. Innovations in coatings technology, such as scratch-resistant and heat-resistant finishes, further encourage adoption. The need for long-lasting, maintenance-free protective solutions in industrial and automotive applications reinforces market expansion, supporting revenue growth across specialized coatings sub-segments.

Key Trends & Opportunities

Digitalization and Smart Coatings

The U.S. market is witnessing growing interest in smart coatings, including self-healing, anti-microbial, and thermochromic technologies. These innovations provide added value in construction, automotive, and industrial applications, offering enhanced protection and functionality. The integration of digital tools, such as automated application systems and AI-based quality monitoring, streamlines production and reduces operational costs. As consumers and industries seek high-performance, multifunctional coatings, smart coatings represent a significant opportunity for manufacturers to differentiate and expand market share.

- For instance, PPG Industries developed an anti-viral and anti-bacterial paint, PPG Copper Armor™, which contains Corning® Guardiant® technology. This EPA-registered interior paint is proven to kill 99.9% of bacteria and viruses, including SARS-CoV-2, on the painted surface within two hours of exposure.

Expansion of Waterborne and Powder Coatings

Waterborne and powder coatings are increasingly favored due to environmental benefits, improved performance, and regulatory compliance. Their adoption in residential, commercial, and automotive sectors offers a strategic growth avenue, particularly as demand for sustainable and low-maintenance solutions rises. Advancements in formulation technology are enhancing durability, color retention, and ease of application, making these coatings more versatile. Manufacturers leveraging these innovations can capture a larger share of the market while meeting evolving customer expectations for eco-friendly and high-quality finishes.

- For instance, RPM International’s Carboline division offers high-performance industrial coatings that support customers transitioning from solventborne to more efficient systems, resulting in operational improvements.

Key Challenges

Volatile Raw Material Prices

The U.S. paints and coatings industry faces challenges from fluctuating prices of key raw materials, including resins, pigments, and solvents. Price volatility impacts production costs, squeezing profit margins and sometimes delaying projects or reducing demand for premium coatings. Supply chain disruptions and import dependencies exacerbate the issue, requiring manufacturers to adopt strategic sourcing, cost optimization, and inventory management to maintain competitiveness. Managing raw material volatility remains a critical challenge that can influence pricing strategies and overall market growth.

Stringent Regulatory Compliance and Safety Standards

While environmental regulations drive growth, they also present challenges, as manufacturers must continuously comply with strict VOC limits, chemical safety standards, and waste management requirements. Non-compliance risks fines, legal liabilities, and reputational damage, increasing operational costs. Additionally, frequent updates to federal and state regulations require constant monitoring and adaptation. Companies must invest in R&D, reformulation, and testing to ensure product compliance, balancing regulatory obligations with market demand for innovative, cost-effective coatings solutions.

Regional Analysis

Northeast Region

The Northeast U.S. paints and coatings market holds a 20% share, driven by dense urbanization and a high concentration of residential and commercial construction projects. Demand is particularly strong for waterborne and low-VOC coatings due to stringent state environmental regulations. Industrial and automotive sectors also contribute, with epoxy and polyurethane coatings widely adopted for protective and aesthetic purposes. Renovation and infrastructure modernization projects, especially in cities such as New York and Boston, sustain consistent growth. The region’s focus on sustainability, coupled with high consumer preference for premium finishes, reinforces steady revenue expansion across multiple coating types and technologies.

Midwest Region

The Midwest commands a 22% market share in the U.S. paints and coatings sector, supported by a mix of residential, commercial, and industrial activity. Automotive manufacturing hubs, particularly in Michigan, drive significant demand for high-performance coatings, including epoxy and polyurethane formulations. Agricultural and industrial infrastructure projects further contribute to the consumption of durable coatings. Waterborne and powder coatings are gaining popularity as sustainability and low-maintenance requirements increase. Regional growth is also supported by government initiatives to upgrade public infrastructure and commercial facilities, fostering consistent demand across both standard and specialized coating applications.

South Region

The South accounts for 28% of the U.S. paints and coatings market, reflecting rapid urbanization, industrial development, and robust construction activity. Residential and commercial projects in states such as Texas and Florida are major drivers, while industrial manufacturing and automotive sectors further boost consumption. Waterborne and powder coatings dominate, supported by environmental compliance requirements and ease of application in large-scale projects. The region also shows increasing adoption of UV curable and specialty coatings in industrial facilities. Favorable economic conditions, infrastructure growth, and population expansion reinforce the South as a high-growth region within the national paints and coatings market.

West Region

The Western U.S. holds 30% of the paints and coatings market, driven by significant construction, technology, and industrial manufacturing activities in states like California and Washington. Residential renovations and commercial infrastructure expansion fuel demand for premium waterborne and low-VOC coatings. Automotive and aerospace industries contribute to high-value epoxy and polyurethane coatings consumption. Sustainability trends and regulatory compliance remain key growth factors, encouraging adoption of powder and eco-friendly coatings. The region’s focus on innovation and high-quality finishes, combined with strong infrastructure and industrial demand, positions it as the largest contributor to revenue in the U.S. paints and coatings market.

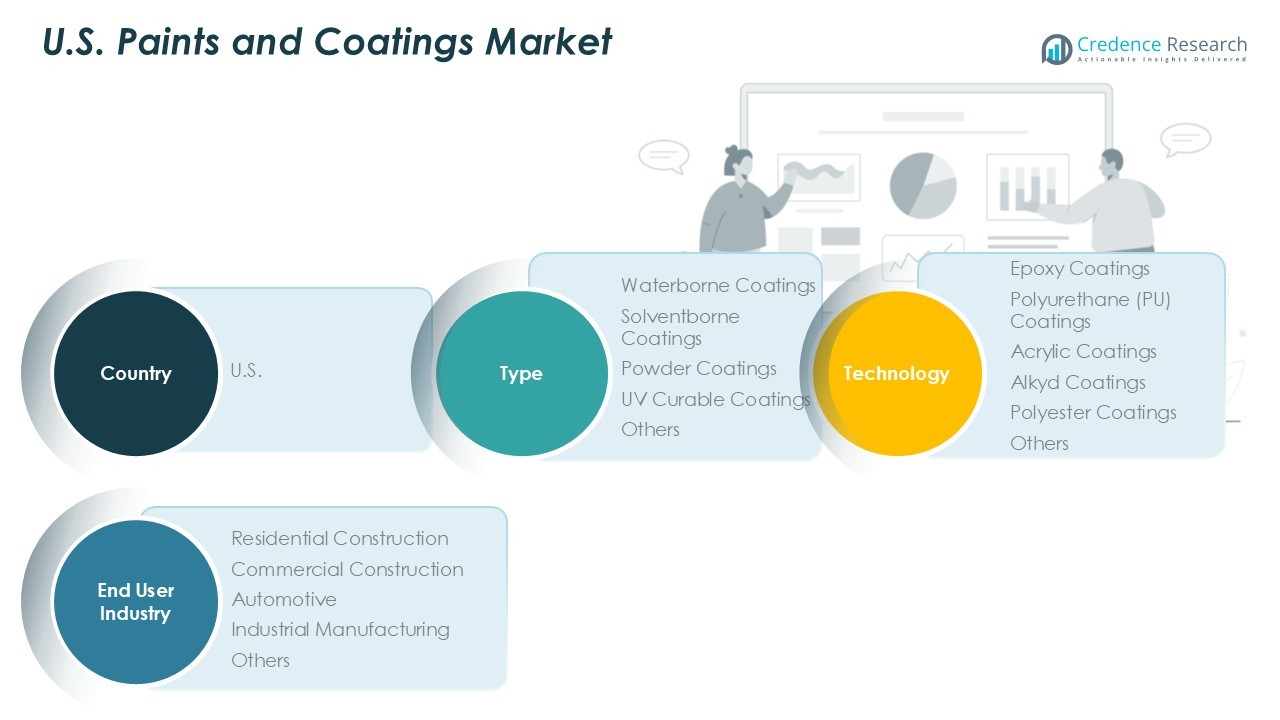

Market Segmentations:

By Type:

- Waterborne Coatings

- Solventborne Coatings

- Powder Coatings

- UV Curable Coatings

- Others

By Technology:

- Epoxy Coatings

- Polyurethane (PU) Coatings

- Acrylic Coatings

- Alkyd Coatings

- Polyester Coatings

- Others

By End User Industry:

- Residential Construction

- Commercial Construction

- Automotive

- Industrial Manufacturing

- Others

By Region

- Northeast

- Midwest

- West

- South

Competitive Landscape

The competitive landscape of the U.S. paints and coatings market is led by key players including Sherwin-Williams, PPG Industries, RPM International Inc., Axalta Coating Systems, Behr Paint Co., Benjamin Moore & Co., Cloverdale Paint, Diamond Vogel, Masco Corporation, and Rust-Oleum Corporation. These companies focus on innovation, product differentiation, and strategic expansions to maintain market leadership. Competition is intensified by investments in eco-friendly, low-VOC, and high-performance coatings to meet evolving consumer and regulatory demands. Players leverage mergers, acquisitions, and partnerships to enhance geographic reach and strengthen distribution networks. Continuous R&D drives new formulations such as waterborne, powder, and UV curable coatings. Additionally, companies are emphasizing digitalization in supply chain management, automated production, and customer engagement, ensuring they can respond quickly to market trends and maintain a competitive edge in a rapidly evolving industry landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sherwin-Williams

- PPG Industries

- RPM International Inc.

- Axalta Coating Systems

- Behr Paint Co.

- Benjamin Moore & Co.

- Cloverdale Paint

- Diamond Vogel

- Masco Corporation

- Rust-Oleum Corporation

Recent Developments

- In October 2025, Sherwin-Williams announced its 2025 Water Infrastructure Impact Awards featuring projects like Sea Oaks water tower.

- In October 2025, Axalta unveiled new coatings for EV battery safety: Alesta® e-PRO FG Black and Dielectric Gray.

- In June 2025, PPG showcased metal-coating innovations and design durability at the AIA Conference.

- In March 2025, Rust-Oleum launched Rust-O, a new spray paint line for artists.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, End User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Waterborne and eco-friendly coatings are expected to gain increased adoption across residential and commercial projects.

- Demand for high-performance epoxy and polyurethane coatings will grow in automotive and industrial sectors.

- Smart coatings with self-healing, anti-microbial, and thermochromic properties will see rising interest.

- Powder and UV curable coatings will expand in industrial manufacturing due to durability and low maintenance benefits.

- Residential construction will continue to drive the largest share of end-user demand.

- Growth in commercial infrastructure and renovation projects will support consistent market expansion.

- Companies will focus on innovation, product differentiation, and sustainable solutions to remain competitive.

- Digitalization and automated application technologies will enhance efficiency in production and delivery.

- Regional markets in the West and South will maintain dominance due to urbanization and industrial growth.

- Environmental regulations and sustainability trends will guide product development and industry investments.