Market Overview:

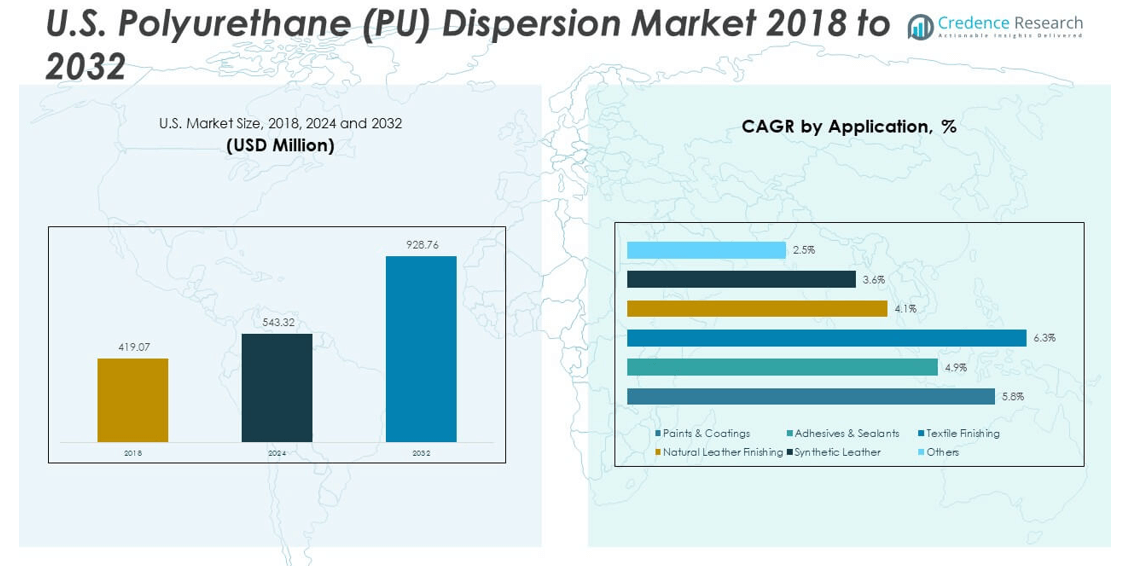

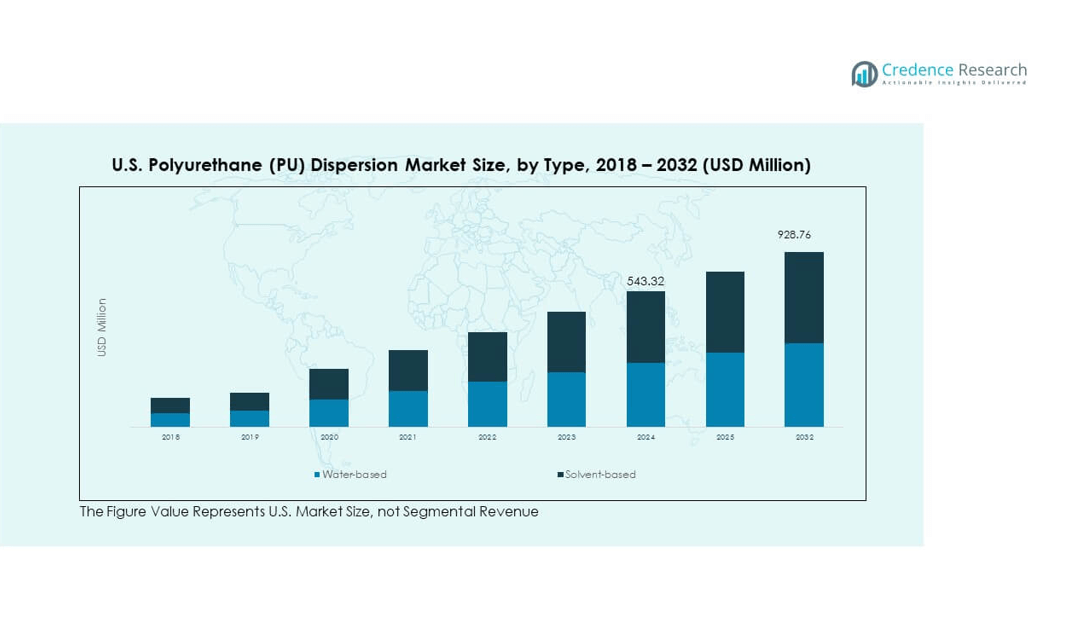

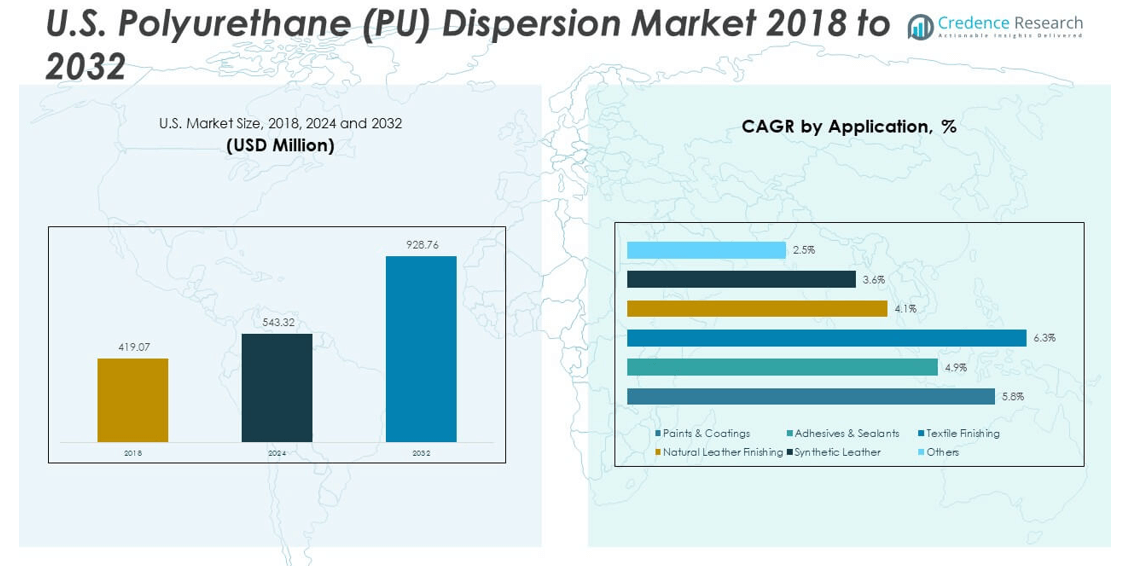

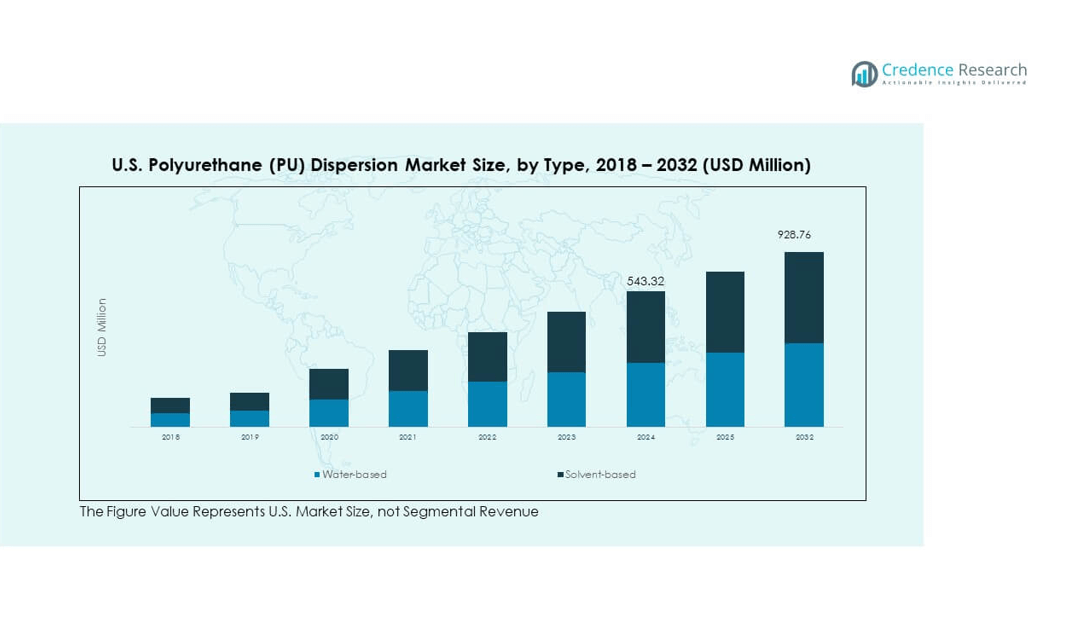

The U.S. Polyurethane Dispersion Market size was valued at USD 419.07 million in 2018 to USD 543.32 million in 2024 and is anticipated to reach USD 928.76 million by 2032, at a CAGR of 6.93% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Polyurethane Dispersion Market Size 2024 |

USD 543.32 million |

| U.S. Polyurethane Dispersion Market, CAGR |

6.93% |

| U.S. Polyurethane Dispersion Market Size 2032 |

USD 928.76 million |

Market growth is driven by rising demand for eco-friendly and high-performance materials across industries. Manufacturers prioritize water-based dispersions to meet stringent environmental regulations and reduce volatile organic compound emissions. The automotive, textile, furniture, and packaging industries rely on polyurethane dispersions for durability, flexibility, and resistance benefits. It gains momentum from increasing adoption in sustainable infrastructure projects and green building practices. Ongoing product innovations support specialized uses in coatings, adhesives, and synthetic leather. Companies focusing on compliance and performance enhancement continue to strengthen their market presence.

The U.S. Polyurethane Dispersion Market demonstrates strong regional diversity shaped by industrial strengths and sustainability priorities. The Midwest leads with high consumption supported by the automotive and manufacturing sectors, while the Northeast benefits from construction and packaging demand. It expands in the South due to rapid urbanization and strong furniture production. The West emerges as a hub for sustainability-led growth, with California driving green adoption. Each region’s industrial base influences application focus, creating a balanced growth pattern. This distribution ensures the market sustains momentum across diverse geographies.

Market Insights:

- The U.S. Polyurethane Dispersion Market was valued at USD 419.07 million in 2018, reached USD 543.32 million in 2024, and is projected to hit USD 928.76 million by 2032, registering a CAGR of 6.93%.

- The Midwest holds 28% share, driven by strong automotive and manufacturing bases; the South accounts for 27%, supported by construction and furniture demand; while the Northeast secures 22% share, led by packaging and specialty coatings.

- The West, with 23% share, emerges as the fastest-growing region due to California’s sustainability-led initiatives and green building adoption.

- Water-based dispersions dominate the product mix with 62% share in 2024, supported by regulatory compliance and eco-friendly adoption across industries.

- Solvent-based dispersions hold 38% share in 2024, maintaining presence in sectors requiring high durability and chemical resistance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Eco-Friendly Coatings and Adhesives:

The U.S. Polyurethane Dispersion Market experiences strong growth due to rising demand for eco-friendly coatings and adhesives. Increasing environmental regulations encourage manufacturers to adopt water-based dispersions instead of solvent-based options. It benefits from reduced volatile organic compound emissions, aligning with sustainability goals. Consumers and businesses prioritize safer materials that ensure worker safety and environmental protection. This regulatory and consumer shift strengthens adoption across multiple industries. Companies leverage this demand by introducing innovative formulations to meet diverse performance needs. Growth in end-use sectors, including construction and automotive, amplifies overall expansion.

- For instance, The Dow Chemical Company developed its BLUEWAVE process enabling production of waterborne alkyd dispersions with up to 60% solids without modifying the resin, which delivers performance on par with solventborne systems while significantly reducing VOC emissions. Growth in end-use sectors, including construction and automotive, amplifies overall expansion.

Expanding Adoption in Automotive and Textile Applications:

Automotive and textile industries drive substantial demand for polyurethane dispersions across the U.S. market. It provides durable, abrasion-resistant, and flexible coatings for vehicles and fabrics. Rising consumer preference for high-performance textiles and durable vehicle finishes boosts adoption. The automotive industry requires advanced coatings that enhance vehicle durability and meet sustainability standards. Textile manufacturers favor dispersions for softness, elasticity, and resistance benefits. Growing investments in U.S. manufacturing facilities expand domestic availability of these products. This sector-specific adoption reinforces steady demand and supports consistent market growth.

- For instance, Lubrizol’s Aptalon™ technology delivers 2K performance with 1K systems, including high-solid-content polyurethane dispersions that reduce the number of layers in multilayer automotive coatings while offering outstanding chemical and abrasion resistance. This sector-specific adoption reinforces steady demand and supports consistent market growth.

Strong Uptake in Furniture and Packaging Sectors:

The furniture and packaging sectors significantly boost the U.S. Polyurethane Dispersion Market. Furniture manufacturers prefer dispersions for finishes that combine durability with aesthetic appeal. Packaging companies adopt them for coatings that enhance printability, flexibility, and product protection. Rising consumer demand for sustainable and recyclable packaging fuels broader usage. The furniture industry benefits from dispersions that provide scratch resistance and long-lasting finishes. Growth in e-commerce expands packaging demand, supporting higher consumption of polyurethane dispersions. This combined impact from furniture and packaging ensures sustained demand. It strengthens market presence across consumer-facing industries.

Regulatory Support for Sustainable Alternatives:

Supportive regulations accelerate adoption of polyurethane dispersions across multiple applications. U.S. policies promote reduced emissions and safer chemical usage in industrial processes. This legal framework encourages manufacturers to shift toward sustainable alternatives. It creates an environment where water-based dispersions replace traditional solvent-based solutions. The regulatory push increases innovation investment by major producers in the country. Companies that comply with standards gain a competitive advantage and market share. Regulatory alignment with consumer demand strengthens overall growth momentum across industries. This combined effect reinforces long-term expansion in the U.S. market.

Market Trends:

Rising Focus on Bio-Based Polyurethane Dispersions:

The U.S. Polyurethane Dispersion Market shows a clear trend toward bio-based alternatives. Companies invest heavily in developing dispersions sourced from renewable raw materials. This focus aligns with global sustainability goals and reduces dependence on petrochemical feedstocks. Bio-based dispersions attract manufacturers aiming to enhance green credentials and market appeal. They are increasingly preferred in industries seeking carbon footprint reduction. R&D investments in renewable chemistry further accelerate the availability of bio-based products. This trend drives innovation and ensures broader acceptance across industrial and consumer applications.

- For instance, Huntsman Corporation won the 2021 Polyurethane Innovation Award for its PurActive™ controlled-release fertilizer coating built with its RIMLINE® polyurethane system. This bio-based technology addresses sustainability challenges and boosts agricultural productivity efficiently. R&D investments in renewable chemistry further accelerate availability of bio-based products, driving innovation and broad acceptance.

Integration of Polyurethane Dispersions in Advanced Textiles:

Advanced textiles represent a fast-growing trend in the U.S. Polyurethane Dispersion Market. Manufacturers incorporate dispersions into fabrics to improve elasticity, waterproofing, and breathability. High-performance textiles for sportswear, protective clothing, and healthcare applications increasingly adopt these coatings. Consumers prefer durable and functional fabrics that withstand heavy use. It creates strong opportunities for polyurethane dispersions in technical textile production. Expanding fashion innovation also strengthens adoption of specialized finishes. This integration ensures ongoing relevance of dispersions in evolving textile needs.

- For instance, Michelman’s Michem® Dispersion Urethane products enhance toughness, scratch resistance, water resistance, and flexibility in industrial wood and textile coatings, showing non-volatile solids between 57-59% and a viscosity range of 200-1500 cps, evidencing their robust performance properties. Expanding fashion innovation also strengthens adoption of specialized finishes, ensuring ongoing relevance in evolving textile needs.

Growing Role of Polyurethane Dispersions in Smart Coatings:

Smart coatings represent an emerging trend shaping the U.S. Polyurethane Dispersion Market. Dispersions enable coatings with self-healing, antimicrobial, and anti-scratch properties. Manufacturers in electronics, automotive, and construction adopt these smart solutions. Rising demand for high-value coatings drives continuous research in this field. It allows companies to differentiate products with advanced performance features. Smart coatings extend product life cycles and enhance sustainability. This trend reflects broader industry shifts toward advanced material science. Dispersions play a vital role in enabling this technological advancement.

Expansion of Water-Based Polyurethane Dispersions in Printing Inks:

Printing ink applications represent a growing trend in the U.S. Polyurethane Dispersion Market. Water-based dispersions provide flexibility, gloss, and resistance features critical for packaging. Rising demand for eco-friendly printing solutions fuels this expansion. Companies in food, beverage, and consumer goods sectors adopt these inks. It ensures compliance with safety standards while meeting branding needs. E-commerce growth supports higher consumption of printed packaging materials. The trend strengthens cross-industry reliance on polyurethane dispersions. Printing ink applications continue to expand their role within the market.

Market Challenges Analysis:

High Production Costs and Raw Material Volatility:

The U.S. Polyurethane Dispersion Market faces challenges due to high production costs and volatile raw material prices. Petroleum-based feedstock prices fluctuate significantly, creating uncertainty for manufacturers. It directly impacts product pricing and profitability in competitive industries. High investment requirements for advanced production technologies add further pressure. Small and medium enterprises struggle to maintain margins amid rising costs. Demand consistency is disrupted by supply chain limitations and global resource competition. These factors limit expansion opportunities for certain market players. Addressing cost and supply issues remains a priority for sustainable growth.

Competition from Alternative Coating Technologies:

The U.S. Polyurethane Dispersion Market encounters stiff competition from alternative coating technologies. Epoxy, acrylic, and other advanced formulations often provide cost-effective or specialized solutions. It challenges polyurethane dispersions in price-sensitive sectors like packaging and furniture. Manufacturers face difficulty differentiating dispersions without significant R&D investment. Customer preference shifts toward alternatives with faster application or curing properties. This competitive environment forces companies to innovate aggressively. High performance standards set by competing technologies pressure polyurethane suppliers to improve. Overcoming these competitive forces requires strategic partnerships and technological advancements.

Market Opportunities:

Rising Demand in Green Building and Infrastructure Projects:

The U.S. Polyurethane Dispersion Market benefits from opportunities in green building and infrastructure initiatives. Builders prefer eco-friendly coatings and adhesives that meet strict sustainability standards. Government programs promote adoption of safer materials in construction projects. It creates growing demand across residential, commercial, and public infrastructure segments. Rising consumer awareness of energy-efficient buildings supports higher adoption. Companies offering dispersions tailored to construction needs secure long-term growth. These opportunities strengthen the role of dispersions in eco-conscious infrastructure development.

Expansion Potential in Specialty Applications and High-Value Industries:

Specialty applications present new opportunities in the U.S. Polyurethane Dispersion Market. High-value industries, including electronics, aerospace, and healthcare, adopt dispersions for unique requirements. It offers flexibility, abrasion resistance, and safety benefits critical for these sectors. Specialty coatings expand application beyond traditional markets, ensuring diversified growth. Emerging demand for lightweight and sustainable materials supports innovation in this field. Companies focusing on niche solutions capture premium segments with strong growth potential. This opportunity encourages sustained investment and technological progress within the industry.

Market Segmentation Analysis:

By Product Segment

The U.S. Polyurethane Dispersion Market is segmented into water-based and solvent-based dispersions. Water-based dispersions dominate due to their low volatile organic compound emissions and compliance with environmental regulations. It is widely adopted across industries seeking sustainable solutions without compromising performance. Demand for water-based formulations grows in construction, automotive, and furniture, where eco-friendly materials hold importance. Solvent-based dispersions retain relevance in applications requiring superior chemical and mechanical resistance. They serve niche industries where durability and high-performance coatings are prioritized. This balance between water-based and solvent-based categories ensures continued product diversification in the market.

- For instance, BASF’s Joncryl® U 4501 is a self-crosslinking polyurethane dispersion for interior flooring applications with 36% non-volatile content, 187% elongation at break, and tensile strength of 28.4 MPa, designed for excellent abrasion and chemical resistance while remaining low in VOC content. This balance between water-based and solvent-based categories ensures continued product diversification in the market.

By Application Segment

The U.S. Polyurethane Dispersion Market covers paints and coatings, adhesives and sealants, textile finishing, natural leather finishing, synthetic leather, and others. Paints and coatings hold a significant share, driven by their extensive use in construction, packaging, and automotive industries. Adhesives and sealants follow, supported by rising demand for durable bonding in furniture, footwear, and industrial goods. Textile finishing and leather finishing applications expand with growing interest in flexible, abrasion-resistant, and high-quality finishes. Synthetic leather gains traction as a sustainable and cost-effective alternative to natural leather in automotive and fashion industries. Other applications, including specialty coatings and inks, strengthen market versatility. This broad adoption across industries underlines the market’s steady growth path.

- For instance, Chase Corporation offers waterborne polyurethane dispersions with VOC content typically less than 50 grams per liter and tensile elongation values up to 550%, serving industrial and consumer coatings with reliable quality and technical support. This broad adoption across industries underlines the market’s steady growth path.

Segmentation:

By Product Segment

- Water-based Dispersion

- Solvent-based Dispersion

By Application Segment

- Paints & Coatings

- Adhesives & Sealants

- Textile Finishing

- Natural Leather Finishing

- Synthetic Leather

- Others

Regional Analysis:

Northeast Region

The Northeast accounts for 22% share of the U.S. Polyurethane Dispersion Market, supported by a strong concentration of industries such as packaging, textiles, and specialty coatings. Urban centers like New York and Boston drive demand through construction and infrastructure upgrades. It benefits from rising interest in eco-friendly building materials and regulatory frameworks encouraging sustainable coatings. Universities and research hubs in this region also foster innovation in advanced polyurethane dispersion formulations. Growth in textile finishing and leather applications finds support from fashion-driven markets. The Northeast remains a steady contributor with balanced demand across multiple end-use sectors.

Midwest Region

The Midwest holds 28% share of the U.S. Polyurethane Dispersion Market, led by its strong manufacturing and automotive industries. States such as Michigan, Ohio, and Illinois serve as key hubs for industrial and automotive applications. It witnesses high adoption of water-based dispersions in paints, coatings, and adhesives, aligning with sustainability initiatives in manufacturing. Furniture and packaging industries add further momentum to regional consumption. The Midwest also benefits from its position as a logistics center, ensuring efficient distribution. This manufacturing-driven growth keeps the region at the forefront of adoption trends.

South and West Regions

The South contributes 27% share of the U.S. Polyurethane Dispersion Market, driven by construction, furniture, and packaging industries. Expanding urbanization in states like Texas and Florida boosts demand for eco-friendly coatings and adhesives. It thrives in sectors requiring durable materials that support long-term performance. The West accounts for 23% share, led by California’s strong sustainability agenda and emphasis on green building solutions. Advanced applications in textiles, synthetic leather, and specialty coatings are expanding in this region. The South and West together showcase diverse drivers, from infrastructure expansion to sustainability leadership, ensuring long-term growth opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The U.S. Polyurethane Dispersion Market is highly competitive, with leading players focusing on innovation, sustainability, and expansion. Key companies include The Dow Chemical Company, The Lubrizol Corporation, BASF SE, Huntsman Corporation, Michelman Inc., Chase Corporation, and 3M. It is shaped by product differentiation, regulatory compliance, and investments in bio-based dispersions. Companies aim to strengthen market presence through mergers, partnerships, and new product launches. Strong R&D capabilities support specialized applications in coatings, adhesives, and synthetic leather. Competitive strategies are aligned with rising demand for eco-friendly solutions across industries.

Recent Developments:

- In July 2025, The Lubrizol Corporation launched Sancure™ 942, a high-solid-content waterborne polyurethane dispersion designed for high-performance wood coatings with excellent wear resistance, chemical durability, and adhesion, aimed at residential and commercial wood finishes. This product increases coating efficiency with fewer required applications and reduced emissions during transportation due to its high solids content.

- In March 2025, Huntsman Corporation showcased a new coating system named POLYRESYST® S4010C containing up to 20% circular content made from bio-based and recycled materials. This innovative system provides enhanced elongation and durability without compromising tensile strength, aimed at protective coating applications.

- In August 2024, BASF SE partnered with STOCKMEIER Urethanes USA, Inc., to offer more sustainable polyurethane playground and recreational surfacing products using bio-circular feedstock-based MDI. This collaboration highlights BASF’s commitment to sustainability and net-zero emissions by 2050 through development of lower carbon footprint raw materials.

Report Coverage:

The research report offers an in-depth analysis based on product and application segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for bio-based polyurethane dispersions will continue to grow across applications.

- Water-based dispersions will remain dominant due to regulatory and environmental requirements.

- Automotive and textile industries will expand usage for durable and flexible coatings.

- Green building initiatives will strengthen demand for sustainable adhesives and sealants.

- Advancements in smart coatings will create new opportunities for dispersions.

- Synthetic leather adoption will rise as industries seek cost-effective alternatives.

- Regional growth will diversify, with the West leading in sustainability adoption.

- Packaging industries will increase reliance on eco-friendly dispersions.

- Innovation in specialty applications like electronics and healthcare will expand usage.

- Strategic partnerships and mergers will shape competitive dynamics and market positioning.