Market Overview:

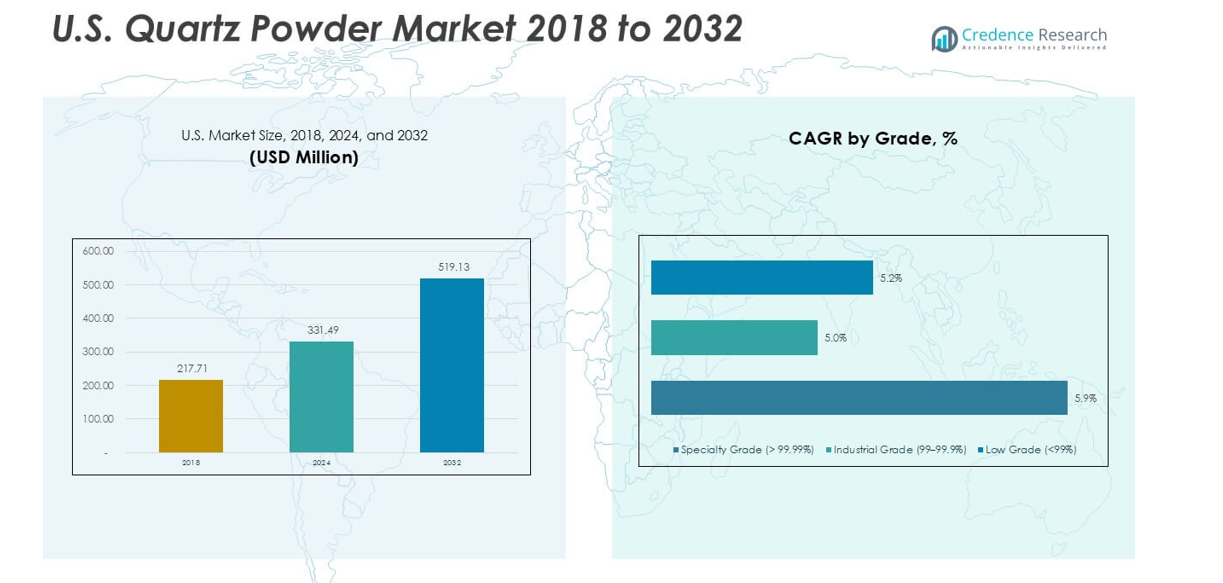

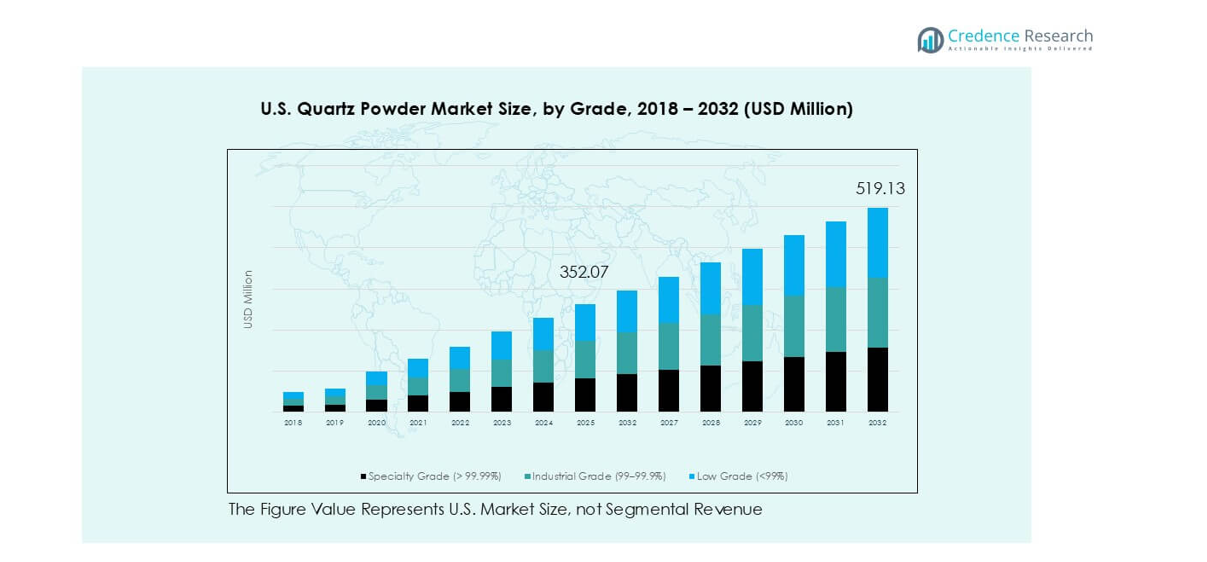

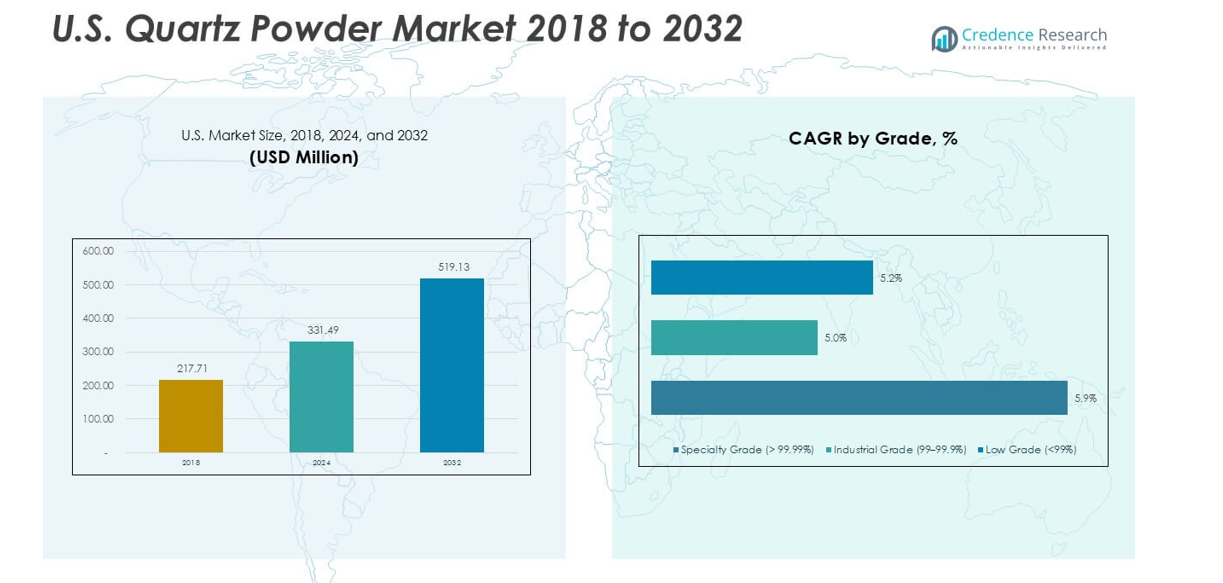

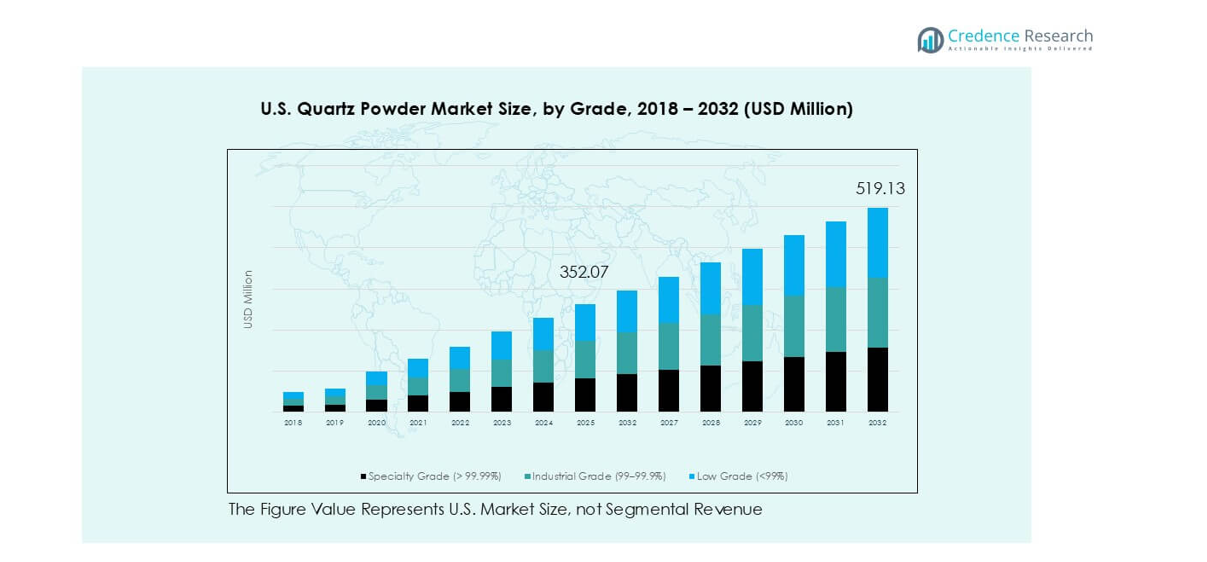

The U.S. quartz powder market size was valued at USD 217.71 million in 2018, reached USD 331.49 million in 2024, and is anticipated to reach USD 519.13 million by 2032, growing at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Quartz Powder Market Size 2024 |

USD 331.49 million |

| U.S. Quartz Powder Market, CAGR |

5.7% |

| U.S. Quartz Powder Market Size 2032 |

USD 519.13 million |

The U.S. quartz powder market is led by major players such as Sibelco, Imerys S.A., Quarzwerke Group, Tanvi Mines & Minerals, and The Sharad Group, which collectively account for a significant share of total production. These companies focus on high-purity quartz for semiconductor, solar, and advanced glass applications, supported by modern refining and automation technologies. Domestic producers like Eon Enterprises and R.K. Phosphates Pvt. Ltd. strengthen regional supply through customized industrial-grade products. Regionally, the South dominated the market with a 32% share in 2024, driven by expanding semiconductor and solar manufacturing facilities, followed by the Midwest with 24%, supported by robust industrial and construction activity.

Market Insights

- The U.S. quartz powder market was valued at USD 331.49 million in 2024 and is projected to reach USD 519.13 million by 2032, growing at a CAGR of 5.7%.

- Market growth is driven by the rising demand from semiconductor and solar industries, where high-purity quartz is essential for wafers, photovoltaic cells, and optical components.

- Key trends include automation in processing, advanced purification technologies, and a shift toward ultra-high-purity grades for electronics and renewable energy applications.

- The market is moderately consolidated, with key players such as Sibelco, Imerys S.A., Quarzwerke Group, and Tanvi Mines & Minerals focusing on process efficiency and regional expansion.

- Regionally, the South led with 32% share, followed by the Midwest with 24%, while by grade, the specialty segment accounted for 47% due to its role in semiconductor and solar manuacturing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Grade

The specialty grade segment dominated the U.S. quartz powder market in 2024 with a 47% share. Its high purity level above 99.99% makes it essential for semiconductor manufacturing, photovoltaic cells, and optical fiber production. Growth in domestic chip fabrication projects under the CHIPS and Science Act is driving steady demand for ultra-pure quartz. Industrial grade quartz, holding a strong secondary position, is widely used in glass and ceramics manufacturing due to its balanced cost and quality. The rising use of refined quartz in LED and solar glass applications further boosts market expansion.

- For instance, The Quartz Corp supplies high-purity quartz exceeding 99.999% SiO₂ for Intel’s semiconductor fabs in Arizona, meeting advanced node process requirements below 10 nm through strict particle size and impurity control.

By Application

The electronics and semiconductors segment accounted for the largest share of 38% in 2024. Demand is driven by increasing semiconductor output, 5G infrastructure expansion, and electric vehicle component manufacturing. Quartz powder’s superior dielectric strength and thermal resistance make it critical for producing wafers and integrated circuits. The glass and ceramics segment follows closely, supported by architectural glass and advanced ceramic demand. Additionally, rising adoption of high-performance coatings and adhesives containing quartz fillers enhances growth across paints, construction, and oilfield applications.

- For instance, HPQ Silicon, in collaboration with PyroGenesis, is developing the PUREVAP™ Quartz Reduction Reactor (QRR) technology, which transforms quartz (SiO2) into high-purity silicon (Si) in a single step. While HPQ has previously demonstrated the production of 99.99%+ (4N+) purity silicon at a lab scale and is working towards it at a pilot scale, recent pilot plant tests verified the production of 3N+ (99.9%+) purity silicon.

Key Growth Drivers

Increasing Demand from Semiconductor and Electronics Manufacturing

The U.S. quartz powder market is expanding rapidly due to strong growth in the semiconductor and electronics sectors. High-purity quartz is a vital raw material for producing silicon wafers, integrated circuits, and optical components. With the U.S. ramping up domestic chip production through initiatives like the CHIPS and Science Act, consumption of ultra-pure quartz has surged. Leading manufacturers such as Intel and TSMC are investing in advanced fabs across Arizona, Ohio, and Texas. This has intensified demand for specialty-grade quartz with superior thermal and dielectric properties, ensuring consistent supply for microelectronics and solar-grade silicon applications.

- For instance, Intel’s $20+ billion fab projects in Ohio will require a supply of high-purity quartz to support wafer etching and lithography processes.

Expansion in Solar Energy and Photovoltaic Applications

Rising investments in renewable energy are fueling quartz powder consumption in photovoltaic manufacturing. Quartz is essential for producing solar glass, crucibles, and silicon feedstock, which are core components of solar panels. The U.S. Department of Energy’s programs promoting domestic solar module production have accelerated demand for high-purity quartz. States such as California and Texas are expanding solar farms, increasing quartz use in tempered glass and encapsulation materials. As energy transition policies encourage large-scale renewable projects, quartz producers are adopting automation and refining processes to meet the stringent quality standards of the solar sector.

- For instance, HPQ Silicon Inc. has been developing a pilot plant for its PUREVAP™ Quartz Reduction Reactor to create high-purity silicon for applications such as solar technology.

Growth in Advanced Glass and Ceramics Manufacturing

The rising demand for durable, transparent, and thermally resistant materials in construction, automotive, and consumer products is supporting quartz powder use in glass and ceramics production. Specialty glass for architecture, smart windows, and automotive applications depends heavily on quartz for strength and clarity. Ceramics reinforced with quartz provide high temperature resistance and hardness, suitable for aerospace and defense uses. With infrastructure modernization and housing projects increasing, manufacturers are integrating micronized quartz for improved surface finish and durability. Continuous R&D in nano-structured and high-transparency glass materials also presents long-term opportunities for quartz suppliers.

Key Trends & Opportunities

Shift Toward Ultra-High-Purity Quartz Production

A key trend in the U.S. market is the growing shift toward ultra-high-purity quartz production. The semiconductor and photovoltaic sectors demand materials with impurity levels below 50 ppm, driving investments in advanced refining methods like plasma fusion and flotation. Automation and optical sorting systems ensure consistent particle size and purity. Companies are scaling cleanroom-grade production to cater to advanced electronics and solar-grade applications. This trend supports higher margins and competitive differentiation, particularly as the U.S. seeks to localize semiconductor material supply chains.

- For instance, HPQ Silicon’s PUREVAP™ technology has achieved the one-step conversion of quartz to silicon with a purity of 99.99% (4N+), and its long-term goal is to reach the higher purity levels required for semiconductor-grade applications.

Integration of Smart Processing and Quality Control Systems

Quartz producers are increasingly adopting AI-driven and automated processing systems for quality control and operational efficiency. Smart optical sensors and spectroscopic analysis tools detect micro-level impurities during processing. This enhances product uniformity and reduces waste. Companies are leveraging digital twin technology for predictive maintenance and process optimization. These advancements are helping U.S. producers compete with Asian suppliers by improving precision, reducing lead times, and meeting strict customer specifications in semiconductor and optics applications.

Key Challenges

Supply Chain Dependence and Raw Material Costs

The U.S. quartz powder industry faces challenges due to limited domestic raw quartz deposits suitable for ultra-high-purity processing. Dependence on imports from countries like Norway and India increases supply risk and cost volatility. Fluctuations in logistics, trade tariffs, and mining regulations can impact material availability. Producers are investing in local sourcing and recycling initiatives to reduce reliance on imported feedstock. However, scaling domestic high-purity quartz mining and purification remains capital-intensive, posing a significant challenge to market expansion.

Environmental Regulations and Energy-Intensive Processing

Quartz purification and refinement are energy-intensive, often involving high-temperature fusion and chemical leaching processes that generate emissions. Stringent environmental regulations on waste management and energy use are increasing operational costs for U.S. producers. Compliance with EPA and state-level industrial emission standards requires continuous investment in cleaner technologies and waste treatment systems. Although sustainable practices are being adopted, balancing profitability with eco-friendly production remains difficult. These regulatory pressures could limit smaller manufacturers’ ability to compete with larger, integrated players.

Regional Analysis

Northeast

The Northeast held a 21% share of the U.S. quartz powder market in 2024. The region’s dominance stems from the presence of established glass, ceramics, and semiconductor component manufacturers across New York, Massachusetts, and Pennsylvania. Strong demand for high-purity quartz in optical fiber and microelectronics production supports market growth. Continuous infrastructure renovation and advanced construction projects in metropolitan areas are driving industrial-grade quartz consumption. Additionally, research centers focusing on photonics and material sciences contribute to rising specialty-grade quartz adoption for laboratory and high-performance optical applications.

Midwest

The Midwest accounted for a 24% share in 2024, supported by a strong manufacturing and industrial base. States such as Ohio, Illinois, and Michigan host several electronics and solar equipment manufacturers using quartz powder in component fabrication. Expanding renewable energy installations and industrial glass production further enhance market prospects. The growing use of quartz-based fillers in construction materials and coatings supports steady regional demand. Investments in semiconductor facilities and high-tech ceramics manufacturing continue to strengthen the Midwest’s role as a key quartz-processing and consumption hub in the U.S.

South

The South region led the U.S. quartz powder market with a 32% share in 2024. Texas and North Carolina are central to the region’s dominance, driven by expanding semiconductor, solar, and construction industries. High-purity quartz demand is growing due to new wafer fabs and photovoltaic module manufacturing facilities. Rapid industrialization, rising infrastructure investments, and energy projects in the Gulf Coast states are boosting industrial-grade quartz use. Moreover, proximity to raw material suppliers and efficient logistics networks enhances the competitiveness of quartz manufacturers operating in the region.

West

The West region captured a 23% share of the market in 2024, driven by advanced electronics, solar energy, and architectural glass industries in California, Arizona, and Oregon. The presence of leading solar panel manufacturers and semiconductor fabrication plants supports specialty-grade quartz consumption. High construction activity, particularly in sustainable and smart building projects, fuels additional demand. The region also benefits from active R&D in renewable technologies and material science. Continuous adoption of automation and environmentally efficient production methods strengthens the West’s position as a technology-driven consumer of quartz powder.

Market Segmentations:

By Grade

- Specialty Grade (> 99.99%)

- Industrial Grade (99–99.9%)

- Low Grade (<99%)

By Application

- Electronics & Semiconductors

- Glass & Ceramics

- Paints, Coatings & Adhesives

- Construction Materials

- Oil and Gas

- Others

By Geography

- Northeast

- Midwest

- South

- West

Competitive Landscape

The U.S. quartz powder market features a moderately consolidated competitive landscape, with both global and domestic players focusing on high-purity product development and technological refinement. Companies such as Sibelco, Imerys S.A., and Quarzwerke Group lead through strong production capabilities, advanced processing technologies, and established distribution networks. Domestic participants like Tanvi Mines & Minerals, Eon Enterprises, and The Sharad Group strengthen competition through tailored product offerings for the glass, ceramics, and semiconductor sectors. Strategic partnerships, investments in purification technologies, and automation adoption are key competitive strategies. Players increasingly emphasize sustainability, energy efficiency, and local sourcing to align with regulatory standards and reduce import dependency, enhancing long-term market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2024, Caesarstone introduced The Time Collection, which included ten new items, seven of which were new Porcelain colors and three Mineral Surfaces. These Mineral Surfaces represent a big step forward in surface design and are a testament to Caesarstone’s latest innovation. Using its vast expertise and advanced technology, the company has developed surfaces that combine minerals like Feldspar and Quartz with recycled content to create surfaces that are better performing and better for the environment.

- In January 2023, Caesarstone Ltd. declared the launch of its line of multi-material surfaces, which includes porcelain and natural stone in addition to outdoor quartz.

- In December 2022, Kyocera Corporation announced its purpose to invest 1.3 trillion yen ($9.78 billion), or through March 2026, in novel chip component manufacturing and the evolution of other sectors of its capabilities.

Report Coverage

The research report offers an in-depth analysis based on Grade, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The U.S. quartz powder market will experience steady growth driven by semiconductor and solar applications.

- Domestic production of high-purity quartz will rise to reduce reliance on imports.

- Investments in advanced refining and plasma fusion technologies will enhance material quality.

- Expansion of solar photovoltaic manufacturing will create strong demand for specialty-grade quartz.

- Semiconductor policy incentives will boost local quartz supply chain development.

- Manufacturers will adopt AI-based process monitoring and automation for precision control.

- Sustainability initiatives will encourage cleaner and energy-efficient quartz processing methods.

- The construction and glass industries will continue contributing to steady industrial-grade quartz consumption.

- Strategic collaborations among mining and processing firms will strengthen regional market presence.

- Increasing R&D in nano-structured and optical-grade quartz will open new growth opportunities across advanced industries.