Market Overview:

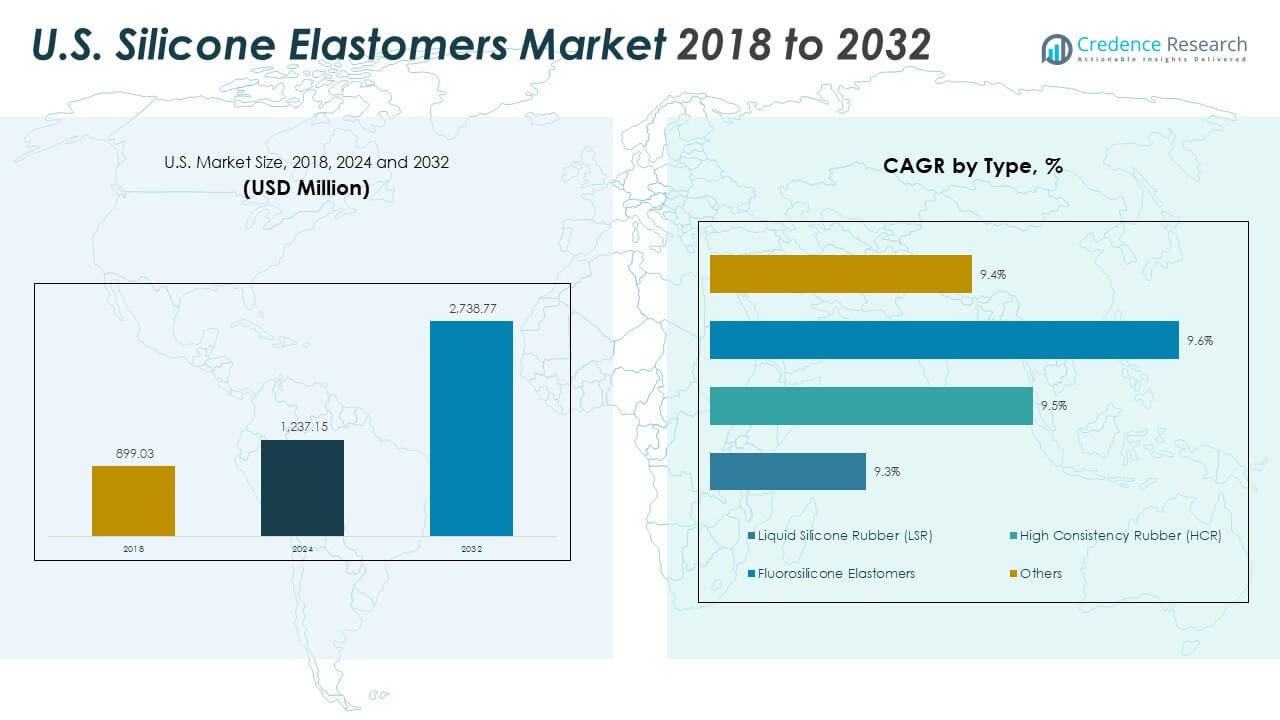

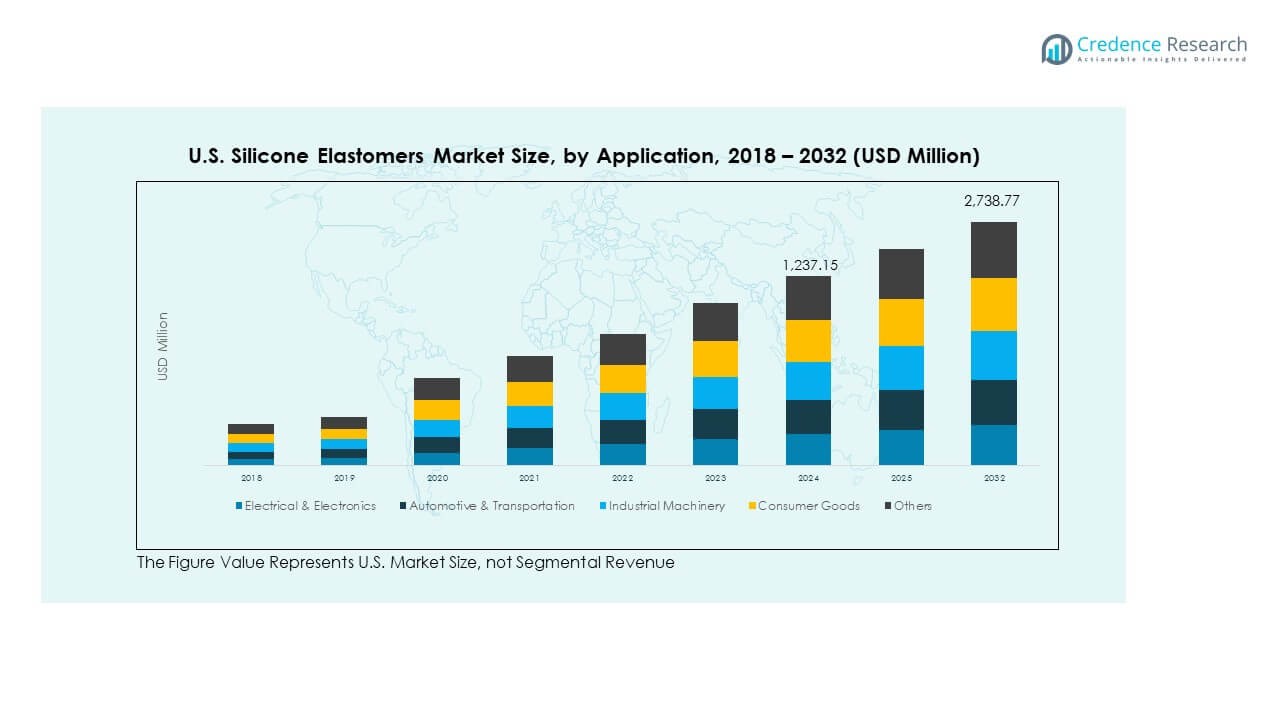

The U.S. Silicone Elastomers Market size was valued at USD 899.03 million in 2018 to USD 1,237.15 million in 2024 and is anticipated to reach USD 2,738.77 million by 2032, at a CAGR of 10.44% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Silicone Elastomers Market Size 2024 |

USD 1,237.15 Million |

| U.S. Silicone Elastomers Market, CAGR |

10.44% |

| U.S. Silicone Elastomers Market Size 2032 |

USD 2,738.77 Million |

The market growth is driven by the rising adoption of silicone elastomers in medical devices, automotive components, and consumer electronics. Healthcare applications are expanding rapidly, supported by silicone’s biocompatibility and flexibility in wearable devices and implants. In the automotive industry, these materials enhance performance in gaskets, seals, and insulation systems. The growing focus on energy efficiency and sustainable materials is encouraging product innovation. Advancements in liquid silicone rubber formulations are further increasing their manufacturing efficiency and quality consistency.

Regionally, the Southern U.S. leads the market due to strong automotive and industrial manufacturing bases. The Midwest follows with significant demand from healthcare and electronics industries. Western states like California are emerging as innovation hubs, driven by technological development and clean energy projects. The Northeast contributes steadily, supported by construction and consumer goods sectors. Each region benefits from expanding end-use industries and localized R&D investments, reinforcing the overall market trajectory.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. Silicone Elastomers Market was valued at USD 899.03 million in 2018, reached USD 1,237.15 million in 2024, and is projected to attain USD 2,738.77 million by 2032, expanding at a CAGR of 10.44% during the forecast period.

- The Southern region leads with a 38% share, supported by a strong automotive base and industrial manufacturing clusters, while the Midwestern region follows with 31%, driven by healthcare and electronics production.

- The Western and Northeastern regions collectively account for 31%, benefiting from technological innovation, advanced materials research, and renewable energy infrastructure growth.

- The Western region is the fastest-growing area with a 31% share, supported by semiconductor, aerospace, and clean energy projects that emphasize precision manufacturing and sustainable materials.

- By application, Automotive & Transportation and Electrical & Electronics segments jointly dominate the market, representing over 55% of total demand due to the need for heat-resistant, insulating, and durable silicone materials.

Market Drivers

Rising Demand for Medical-Grade Silicone in Healthcare Applications

The U.S. Silicone Elastomers Market is experiencing strong growth due to its expanding use in healthcare applications. Silicone elastomers provide biocompatibility, flexibility, and thermal stability, making them ideal for medical implants, catheters, and wearable devices. Growing awareness of infection control and advancements in medical device manufacturing support product innovation. Manufacturers focus on producing hypoallergenic and sterilizable silicone grades to meet FDA and ISO standards. It benefits from high product reliability, driving adoption across hospitals and clinics. Aging populations and chronic diseases are increasing the need for medical devices. Continuous R&D investment ensures better performance and long-term patient safety.

Increasing Utilization in Automotive and Transportation Components

The automotive sector drives steady demand for silicone elastomers due to their heat resistance and flexibility. These materials enhance vehicle performance by improving insulation, sealing, and vibration damping. Automakers use them in engine gaskets, turbocharger hoses, and sensor encapsulation to ensure durability under extreme temperatures. It gains traction as electric vehicle manufacturing accelerates, requiring advanced sealing materials. Silicone elastomers also support lightweighting initiatives to reduce fuel consumption. Tier-1 suppliers invest in high-performance silicone blends to meet safety and emission regulations. The shift toward electric mobility boosts applications in battery modules and charging systems.

Expanding Role in Electronics and Electrical Insulation Materials

Electronics manufacturing is a major driver for silicone elastomers due to their superior dielectric and thermal stability properties. They protect sensitive components from moisture, dust, and vibration, enhancing device reliability. The material’s resistance to UV and ozone exposure ensures long service life. It benefits from the rapid expansion of consumer electronics, telecommunications, and renewable energy systems. Silicone-based coatings and encapsulants are used in semiconductors, LEDs, and solar panels. The miniaturization trend in electronics creates demand for thinner, more precise silicone solutions. Manufacturers are innovating with low-voltage and high-transparency grades for specialized electronic assemblies.

- For instance, Momentive’s SFR100 silicone fluid is publicly highlighted as providing enhanced fire safety and mechanical performance for EV battery housings in the latest e-mobility product literature, reflecting verified, direct company communication with the automotive sector.

Growing Adoption in Construction and Industrial Machinery Applications

Silicone elastomers are increasingly used in construction and industrial equipment due to their weather resistance and mechanical strength. The material’s ability to withstand extreme environments supports its use in sealing, glazing, and vibration control. It enables longer maintenance intervals and enhanced structural integrity in modern buildings. It also aids industrial machinery in reducing noise and friction under continuous operation. Energy-efficient construction trends encourage the use of silicone-based sealants and adhesives. Manufacturers develop formulations that comply with environmental safety standards. The focus on durability and energy conservation drives silicone elastomer adoption in infrastructure development projects.

- For example, in 2024, Shin-Etsu Chemical Co., Ltd. officially announced the development and commercialization of the KRW-6000 Series, described as the industry’s first water-based, fast-curing silicone resin. This innovation was specifically designed to eliminate the need for emulsifiers and organic solvents, improving environmental safety, durability, and weather resistance in construction coatings and exterior materials.

Market Trends

Innovation in High-Performance Silicone Formulations for Specialized Applications

The U.S. Silicone Elastomers Market is witnessing innovations focused on performance-enhanced grades tailored for specific sectors. Companies invest in developing formulations that maintain elasticity under high stress and temperature. The introduction of self-healing and low-viscosity silicones broadens usage in complex applications. It benefits from enhanced product lifespans and cost-efficiency. Manufacturers employ advanced curing technologies to achieve better precision molding. The use of nano-reinforcement techniques improves tensile and tear strength. Continuous research ensures product differentiation across automotive, electronics, and healthcare domains.

Integration of Sustainable Manufacturing and Green Chemistry Approaches

Sustainability is shaping market trends through eco-friendly production methods and renewable feedstock use. Manufacturers are replacing solvent-based systems with waterborne silicone formulations to reduce emissions. It gains momentum through the push for carbon-neutral manufacturing processes. Companies focus on recycling silicone waste and optimizing curing energy consumption. The shift toward bio-based silicone elastomers aligns with corporate sustainability goals. Government initiatives promoting green materials accelerate adoption across industries. Continuous improvement in lifecycle performance supports long-term environmental benefits.

Rising Adoption of Liquid Silicone Rubber (LSR) in Precision Manufacturing

Liquid Silicone Rubber is becoming the preferred material in sectors requiring high precision and automation. Its ability to mold intricate shapes with tight tolerances supports medical and electronics production. It enhances throughput and reduces manufacturing cycle times. It also improves component quality by minimizing flash and post-processing needs. The growth of LSR-based injection molding technologies increases product scalability. Demand from miniaturized medical devices and optical components continues to rise. The integration of digital molding systems supports consistency and traceability in production.

- For instance, Wacker Chemie’s ELASTOSIL® and SILPURAN® silicone ranges comply with ISO 10993 and USP Class VI standards and are produced under Class 8 clean room conditions for medical tubing, wearables, and adhesives. The ELASTOSIL® eco line uses bio-methanol feedstock to enhance sustainability while maintaining full traceability for medical device manufacturing, as confirmed in Wacker’s February 2025 press release.

Digital Transformation and Industry 4.0 Integration in Production Lines

Manufacturers are integrating automation and digital monitoring to improve process efficiency and product quality. The adoption of smart manufacturing enables real-time data tracking and predictive maintenance. It helps optimize material flow and reduce energy consumption during curing. AI-driven quality inspection tools detect micro-defects in molded silicone components. Industry 4.0 strategies also support batch consistency and faster product customization. The growing use of robotics enhances safety and productivity in silicone manufacturing plants. The trend reflects a shift toward intelligent and adaptive production ecosystem.

- For instance, Elkem Silicones received the 2025 Ringier Technology Innovation Award for its BLUESIL™ LSR 3935, a liquid silicone rubber designed for high-voltage connectors in new energy vehicles, which demonstrated long-term waterproof sealing and thermal stability across hardness ranges from ShA20 to ShA60.

Market Challenges Analysis

Fluctuating Raw Material Costs and Supply Chain Vulnerabilities

The U.S. Silicone Elastomers Market faces cost fluctuations due to dependence on silicon-based raw materials. Supply chain disruptions and energy price variations affect material availability and production stability. It struggles with sourcing challenges linked to global trade restrictions and geopolitical issues. Manufacturers must balance costs while maintaining product quality and compliance. Limited domestic supply of key intermediates adds pressure to pricing structures. Smaller producers often face tighter margins during economic volatility. Diversification of raw material sources and long-term supplier partnerships are essential to reduce risks.

Stringent Environmental Regulations and Complex Processing Requirements

Strict environmental regulations on chemical composition and emissions impact silicone manufacturing operations. Compliance with standards such as REACH and EPA mandates adds operational complexity. It requires continuous adaptation of production processes to meet safety and sustainability goals. Complex curing and compounding methods demand skilled labor and advanced infrastructure. High capital investment for new equipment limits entry for smaller firms. Waste management of silicone by-products remains an ongoing technical challenge. Companies are investing in closed-loop systems and low-emission technologies to meet environmental expectations.

Market Opportunities

Rising Demand for Advanced Materials in Electric Vehicles and Renewable Energy

The U.S. Silicone Elastomers Market presents strong opportunities in electric mobility and clean energy sectors. Silicone elastomers enhance the performance and safety of EV battery systems through superior insulation. It supports renewable energy by improving the durability of solar modules and wind turbine components. Growing federal incentives for EVs drive higher production of silicone-based components. Lightweight and high-temperature-resistant materials reduce maintenance in next-generation vehicles. Expansion of energy storage and power distribution infrastructure will further expand demand. Partnerships between silicone producers and EV manufacturers enhance product development efficiency.

Growth Potential in Smart Healthcare Devices and Wearable Technologies

Expanding digital healthcare technologies create new opportunities for silicone elastomers. The material’s flexibility and skin compatibility make it ideal for sensors and medical wearables. It supports innovation in drug delivery patches and diagnostic devices. Increasing investments in home healthcare solutions boost product adoption. Continuous R&D enables integration with biosensors for continuous monitoring systems. The development of transparent and soft silicone films enhances user comfort. Collaboration between healthcare device manufacturers and material specialists fosters advanced design possibilities.

Market Segmentation Analysis

By Type

The U.S. Silicone Elastomers Market is segmented by type into Liquid Silicone Rubber (LSR), High Consistency Rubber (HCR), Fluorosilicone Elastomers, and others. LSR dominates due to its flexibility, purity, and suitability for precision molding used in medical and electronic components. HCR maintains a strong position in industrial and automotive sealing because of its durability and tensile strength. Fluorosilicone elastomers gain demand from aerospace and fuel-handling systems for their chemical resistance. Specialty elastomers under others include customized blends designed for performance under extreme environmental conditions. Each segment serves distinct end-use needs across manufacturing, healthcare, and transportation.

- For instance, fluorosilicone rubber compounds are widely used in aerospace seals and O-rings for their strong resistance to fuels, oils, and solvents. RD Rubber Technology confirms their suitability for demanding aerospace applications, highlighting performance stability across extreme environments in its technical publications on high-performance sealing.

By Application

The market by application includes Electrical & Electronics, Automotive & Transportation, Industrial Machinery, Consumer Goods, Construction, and others. Electrical & Electronics represent a major share due to silicone’s insulating and thermal protection properties in semiconductors, cables, and LED systems. Automotive & Transportation benefit from growing EV production and advanced sealing applications. Industrial Machinery uses silicone elastomers for vibration control and mechanical safety. Consumer Goods adopt silicone for durable, skin-safe products. Construction applications rely on silicone sealants for weatherproofing and structural bonding. Other sectors, such as aerospace and defense, continue to integrate silicone elastomers into high-performance applications.

- For instance, Parker Hannifin’s Parofluor® Ultra FFKM compounds are engineered for extreme sealing environments, offering high resistance to heat and aggressive chemicals. Parker identifies aerospace among key application areas for these materials, highlighting their proven durability and reliability in demanding sealing systems.

Segmentation

By Type

- Liquid Silicone Rubber (LSR)

- High Consistency Rubber (HCR)

- Fluorosilicone Elastomers

- Others

By Application

- Electrical & Electronics

- Automotive & Transportation

- Industrial Machinery

- Consumer Goods

- Construction

- Others

Regional Analysis

Dominance of the Southern Region Driven by Automotive and Manufacturing Growth (38% Share)

The Southern region holds the largest 38% share in the U.S. Silicone Elastomers Market, driven by strong automotive manufacturing and industrial base. Texas, Alabama, and Tennessee host major vehicle production and supplier facilities that rely on silicone components for sealing and insulation. The region benefits from access to raw materials and logistics networks supporting large-scale distribution. It experiences continuous investment in electric vehicle infrastructure, fueling demand for high-performance silicone materials. Expanding construction and energy projects also strengthen silicone consumption. It remains the production hub for silicone-based compounds used in industrial machinery and automotive applications.

Midwestern Region Gaining Momentum through Healthcare and Electronics Industries (31% Share)

The Midwest accounts for a 31% market share, led by the presence of advanced healthcare, electronics, and industrial equipment manufacturing clusters. States such as Ohio, Michigan, and Illinois are investing in medical device production that uses medical-grade silicone elastomers for tubing and implants. It benefits from collaboration between healthcare manufacturers and material innovators. The growing use of silicone in robotics and process automation supports regional industrial demand. Electronics assembly operations across the Great Lakes region further enhance silicone consumption for insulation and encapsulation. The Midwest’s diversified manufacturing ecosystem positions it as a steady growth contributor.

Western and Northeastern Regions Expanding through Innovation and Technology Integration (31% Share)

The combined Western and Northeastern regions hold a 31% share, driven by technology integration and innovation-led industries. California’s thriving semiconductor, aerospace, and renewable energy sectors utilize silicone elastomers in precision manufacturing. The U.S. Silicone Elastomers Market benefits from the high concentration of tech-driven enterprises and R&D facilities. The Northeast, including New York and Massachusetts, emphasizes medical and consumer goods production using advanced silicone formulations. These regions focus on sustainability, bio-based materials, and smart manufacturing processes. Continuous investments in renewable infrastructure and advanced electronics sustain future expansion across both subregions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dow Inc. (USA)

- Wacker Chemie AG

- Momentive Performance Materials Inc.

- Shin-Etsu Chemical Co., Ltd.

- China National Bluestar (Group) Co., Ltd.

- Zhejiang Xinan Chemical Industrial Group Co., Ltd.

- Elkem ASA

- Stockwell Elastomerics

- Specialty Silicone Products, Inc.

- KCC Corporation

- Reiss Manufacturing Inc.

- Quantum Silicones, LLC

- Avantor Performance Materials, LLC

- Rogers Corporation

- Nusil Technology LLC

Competitive Analysis

The U.S. Silicone Elastomers Market features strong competition among global and domestic manufacturers focusing on innovation, quality, and application-specific customization. Leading companies such as Dow Inc., Wacker Chemie AG, Momentive Performance Materials, Elkem ASA, and Shin-Etsu Chemical Co., Ltd. dominate through diversified product portfolios and technical expertise. It is influenced by ongoing R&D to develop high-performance and eco-friendly silicone grades. Companies emphasize automation, advanced curing processes, and recycling capabilities to improve production efficiency. Strategic collaborations with automotive, healthcare, and electronics manufacturers strengthen value-chain integration. Continuous investment in regional expansion and sustainable manufacturing gives key players a competitive edge.

Recent Developments

- In September 2025, Freudenberg Sealing Technologies announced the acquisition of DMH Group, marking a notable step in expanding their elastomer and sealing solutions portfolio throughout North America. This acquisition enables Freudenberg to diversify into advanced silicone elastomer capabilities and reinforces its market presence across critical industrial sectors.

- In June 2025, Dow unveiled its new low carbon silicone elastomer blends under the Decarbia platform at the Suppliers’ Day in New York City. As part of this launch, the company introduced targeted products for beauty and personal care applications such as conditioners, styling agents, and film formers for color cosmetics and sun care, accompanied by an innovative formulation kit designed to elevate consumer routines.

- In January 2024, SIGMA Engineering and Momentive formed a partnership to enhance the silicone processing industry by supplying precise material data for Liquid Silicone Rubber (LSR) injection molding in the U.S., enabling more accurate simulations and fostering manufacturing innovation in elastomer applications.

Report Coverage

The research report offers an in-depth analysis based on Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising adoption of medical-grade silicone will strengthen applications in healthcare and wearable technology.

- Growing investment in electric vehicles will expand demand for high-temperature-resistant silicone components.

- Technological innovation in liquid silicone rubber will improve precision molding and automation efficiency.

- Increasing renewable energy installations will boost silicone use in solar and wind equipment insulation.

- Expansion of smart manufacturing and Industry 4.0 practices will enhance silicone production efficiency.

- Rising focus on sustainability will drive development of eco-friendly and bio-based silicone formulations.

- Strong growth in electronics and semiconductor fabrication will support long-term market demand.

- Expanding construction activity and infrastructure modernization will sustain silicone demand in sealing and bonding.

- Continuous R&D efforts will yield new silicone grades with enhanced performance and recyclability.

- Strategic collaborations among producers and end-users will improve product innovation and market reach.