| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Specialty Bakery Market Size 2024 |

USD6,272.17 million |

| U.S. Specialty Bakery Market, CAGR |

4.65% |

| U.S. Specialty Bakery Market Size 2032 |

USD9,022.21 million |

Market Overview

The U.S. Specialty Bakery Market is projected to grow from USD6,272.17 million in 2024 to an estimated USD9,022.21 million based on 2032, with a compound annual growth rate (CAGR) of 4.65% from 2025 to 2032. This growth trajectory reflects increasing consumer interest in premium, artisanal, and health-conscious baked goods, including gluten-free, vegan, and low-sugar products.

Key market drivers include heightened awareness of health and wellness, which is encouraging consumers to seek bakery products that align with dietary goals. Demand for plant-based and allergen-free ingredients is rising, as is the appeal of products with high protein content, ancient grains, and natural sweeteners. Trends such as personalization, premiumization, and the use of locally sourced ingredients are reshaping product portfolios. Furthermore, the surge in e-commerce and direct-to-consumer bakery models has enabled niche players to access wider customer bases and expand their brand visibility.

Geographically, urban regions such as California, New York, and Illinois are key markets due to their diverse, health-conscious populations and thriving food culture. The Midwest and Southern states are also witnessing increased demand, particularly through retail expansion and café chains. Leading players in the U.S. Specialty Bakery Market include Flowers Foods, Inc., Grupo Bimbo, Canyon Bakehouse LLC, Aspire Bakeries, and Cargill, Incorporated, all of which continue to invest in R&D and product diversification to maintain competitiveness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. Specialty Bakery Market is projected to grow from USD 6,272.17 million in 2024 to USD 9,022.21 million by 2032, at a CAGR of 4.65%.

- Rising consumer preference for gluten-free, vegan, and low-sugar products is fueling the demand for specialty bakery items.

- Clean-label trends and growing health awareness are encouraging product innovation and portfolio diversification.

- High production costs and limited scalability for artisanal goods remain key challenges for smaller manufacturers.

- Short shelf life and distribution complexities hinder market expansion, particularly in e-commerce and distant regions.

- California, New York, and Illinois lead market share due to diverse, health-conscious populations and strong food culture.

- The Midwest and Southern regions are emerging as high-potential markets, driven by café expansion and retail growth.

Report Scope

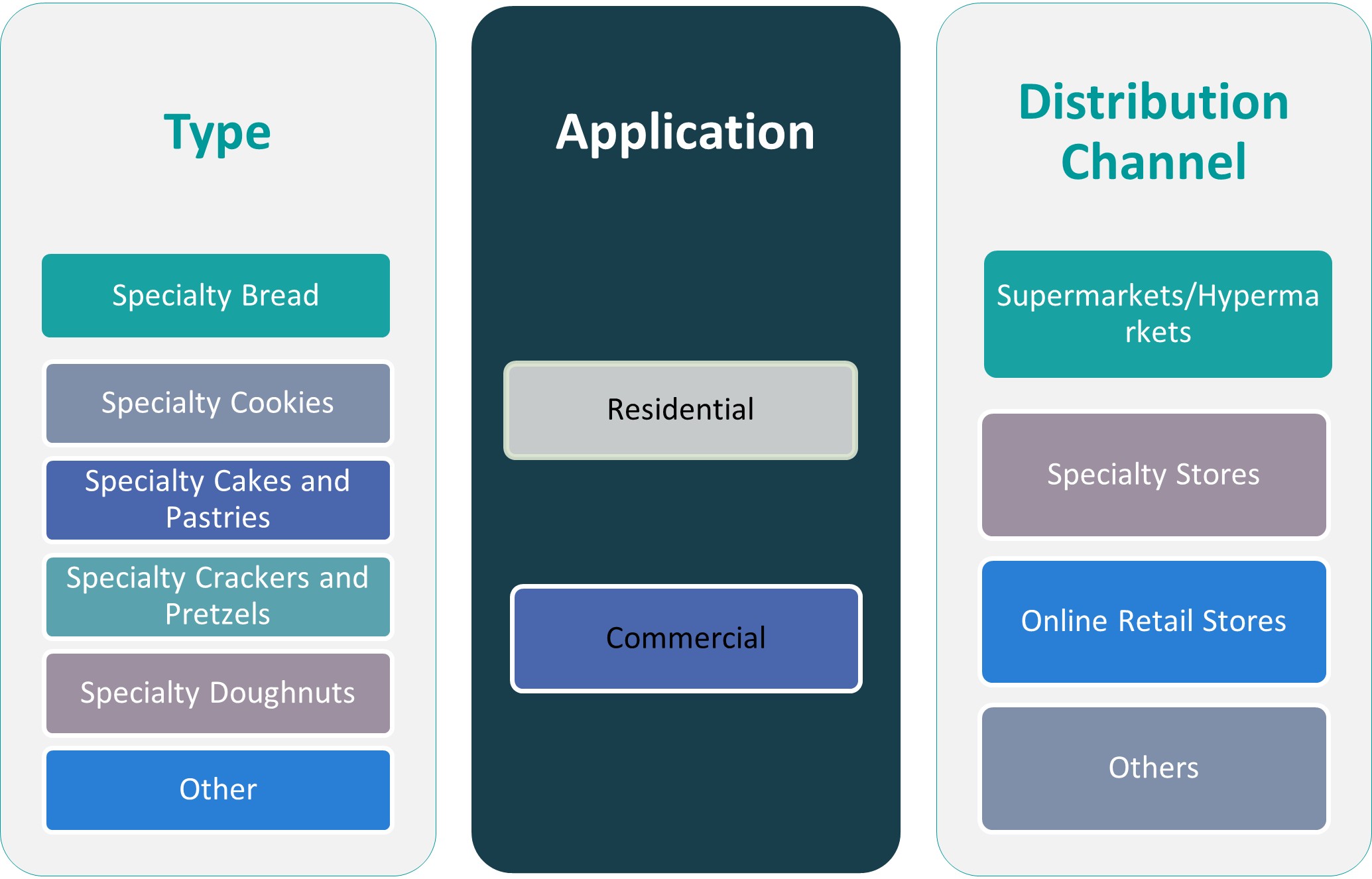

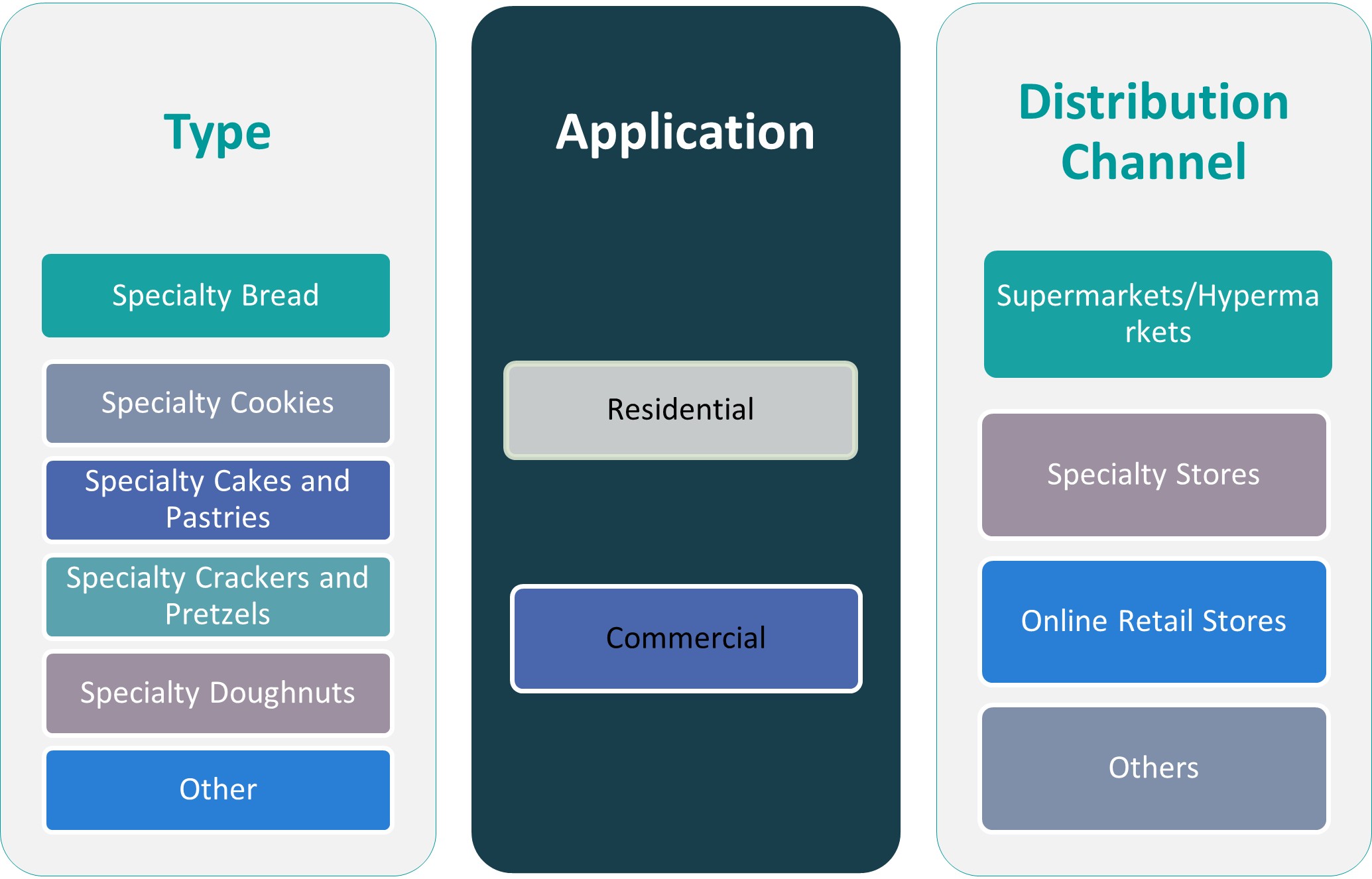

This report segments the U.S. Specialty Bakery Market as follows:

Market Drivers

Rising Health and Wellness Consciousness Among Consumers

The growing emphasis on health and wellness has significantly influenced consumer preferences in the U.S. bakery market. As more individuals adopt healthier lifestyles, there is a marked shift toward products that offer nutritional benefits without compromising on taste. For instance, Cargill’s bakery insights report highlights that consumers are increasingly seeking bakery products with functional benefits, such as high fiber, protein enrichment, and immunity-supporting ingredients. Specialty bakery items—such as gluten-free breads, sugar-free pastries, keto-friendly desserts, and high-fiber baked goods—are experiencing increasing demand due to their alignment with health-conscious eating habits. Consumers with specific dietary needs, such as those managing diabetes, celiac disease, or lactose intolerance, are actively seeking bakery options tailored to their requirements. For instance, FMCG Gurus’ report on bakery trends indicates that a significant portion of consumers are avoiding specific ingredients to improve digestive health and overall wellness. Moreover, the COVID-19 pandemic accelerated awareness of the role diet plays in supporting immunity and overall well-being. This has led to a broader interest in functional bakery items fortified with ingredients like seeds, nuts, probiotics, and ancient grains. Bakeries are reformulating products using whole wheat, almond flour, and plant-based alternatives, while eliminating preservatives, trans fats, and artificial additives. These developments have redefined what consumers expect from bakery items, creating robust growth opportunities for specialty offerings that prioritize clean-label ingredients and health benefits.

Surge in Demand for Premium and Artisanal Products

Consumers in the U.S. are increasingly willing to pay a premium for bakery products that offer perceived value, superior quality, and unique experiences. Artisanal bread, handcrafted pastries, and gourmet desserts are becoming more popular due to their small-batch production, authenticity, and distinct flavor profiles. The appeal of craftsmanship and innovation drives consumers toward bakeries that emphasize traditional methods, high-quality ingredients, and creative presentation. For instance, Pristine Market Insights highlights that consumers are increasingly drawn to bakery products made with organic and locally sourced ingredients, reinforcing the demand for premium baked goods. Premiumization is not limited to ingredients; it also encompasses product packaging, sustainability, and brand storytelling. As consumers seek bakery items that resonate with personal values such as ethical sourcing and transparency, brands that incorporate organic, non-GMO, or locally sourced ingredients gain a competitive edge. Additionally, the experience of indulgence and novelty plays a critical role—especially among younger demographics—prompting manufacturers to launch limited-edition items, seasonal flavors, and visually appealing baked goods designed for social sharing. This growing appetite for premium experiences has led mainstream brands and boutique bakeries alike to diversify their offerings and enhance brand positioning.

Growing Popularity of Plant-Based and Allergen-Free Alternatives

The expanding population of vegans, vegetarians, and flexitarians in the U.S. is driving demand for plant-based bakery alternatives. Consumers are actively seeking out egg-free, dairy-free, and fully vegan bakery items, fueled by ethical, environmental, and health motivations. Similarly, the rising incidence of food allergies and intolerances is leading to increased consumption of allergen-free products. Specialty bakeries are catering to these needs by eliminating common allergens such as nuts, soy, and gluten while still maintaining desirable taste and texture. Innovation in plant-based ingredient substitutes—such as aquafaba for eggs, oat and almond milk for dairy, and coconut oil for butter—has allowed bakeries to replicate traditional recipes with improved nutritional profiles. In parallel, the demand for grain-free and paleo-friendly products has driven the use of cassava flour, chickpea flour, and flaxseed-based blends. These innovations not only broaden the target audience for specialty baked goods but also enhance product accessibility for individuals with dietary restrictions. Manufacturers that clearly label allergen content and certify their products through third-party organizations are particularly favored by health-conscious and safety-oriented consumers.

Expansion of Distribution Channels and E-commerce Integration

The proliferation of distribution channels has significantly bolstered the reach and availability of specialty bakery products across the U.S. While traditional bakery outlets and supermarkets remain important sales avenues, the increasing presence of specialty bakery items in convenience stores, cafés, and organic food chains has widened their accessibility. In addition, partnerships with health food retailers, meal kit services, and subscription boxes have created new opportunities for niche brands to gain visibility and establish loyal customer bases. E-commerce and direct-to-consumer (DTC) models have further revolutionized market access. Online ordering, home delivery, and mobile app-based subscriptions have become integral for modern consumers who value convenience and variety. Bakeries leveraging digital platforms benefit from data analytics, which helps them tailor offerings and marketing strategies based on consumer behavior. Moreover, social media marketing has become a powerful tool for small and independent specialty bakeries to showcase their creations, engage with followers, and build strong brand communities. The ability to reach geographically dispersed consumers without relying solely on brick-and-mortar stores has played a key role in driving market expansion and brand differentiation.

Market Trends

Increased Demand for Clean-Label and Natural Ingredients

Consumers are becoming increasingly selective about the ingredients used in the products they consume, and this shift is significantly impacting the U.S. specialty bakery market. Clean-label trends emphasize transparency, minimal processing, and the exclusion of artificial additives, preservatives, and genetically modified organisms (GMOs). For instance, 51% of U.S. consumers actively seek clean-label packaged foods, according to Packaged Facts. Shoppers are prioritizing recognizable, whole-food ingredients such as whole grains, unrefined sugars, and organic flours. Specialty bakeries are responding by reformulating offerings to align with these expectations, focusing on simple, natural compositions. This trend is not just about what is included but also what is excluded—such as artificial colorings, hydrogenated oils, and synthetic emulsifiers. Labels highlighting terms like “no artificial ingredients,” “non-GMO,” and “certified organic” appeal to discerning consumers looking for healthier choices. In response, bakeries are increasingly partnering with certified suppliers and emphasizing traceability in sourcing. The U.S. organic food sector continues to thrive, with sales reaching $61.67 billion in 2022, reflecting a strong demand for organic and natural clean-label bakery ingredients. As consumers associate clean-label products with higher quality and better nutrition, bakeries that prioritize ingredient integrity enjoy stronger customer loyalty and brand trust. This movement continues to shape product development and is expected to remain a defining trend in the specialty bakery space for the foreseeable future.

Growth of Functional and Nutrient-Enriched Bakery Products

The integration of functional ingredients into baked goods is gaining strong traction in the U.S. specialty bakery market. Consumers are no longer viewing baked items purely as indulgences; instead, they are seeking products that deliver health benefits alongside taste and convenience. For instance, the global functional bakery ingredients market reflected the increasing consumer awareness of health and wellness. This shift is driving innovation around nutrient-enriched offerings that support digestion, immunity, heart health, and energy metabolism. Functional bakery products now include ingredients such as omega-3 fatty acids, plant-based proteins, fiber-rich seeds, prebiotics, and adaptogens. Specialty bakeries are capitalizing on this trend by introducing products like protein-packed muffins, fiber-enhanced breads, and probiotic-infused pastries. These offerings align well with the busy lifestyles of health-focused individuals who want convenient snacks that provide lasting satiety and nutritional value. Moreover, functional bakery items are increasingly popular among fitness enthusiasts and those managing chronic health conditions. Packaging plays a vital role, often highlighting specific health claims and certifications to boost consumer confidence. The demand for functional food ingredients, including bakery applications, continues to rise, with more than 65% of global consumers preferring functional foods that support immune health, digestion, and cardiovascular well-being. This trend reflects a broader convergence of the bakery and wellness sectors. As food becomes more personalized and purpose-driven, the demand for functional baked goods is expected to grow, compelling manufacturers to balance nutrition with indulgence in product innovation strategies.

Rising Popularity of Plant-Based and Vegan Bakery Options

Plant-based eating is transitioning from niche to mainstream, with a significant impact on the U.S. specialty bakery market. Motivated by health, environmental sustainability, and ethical concerns, consumers are increasingly embracing vegan lifestyles or adopting flexitarian diets. In response, specialty bakeries are diversifying their product lines with plant-based alternatives that eliminate traditional animal-derived ingredients like eggs, butter, and dairy. These include vegan cookies, eggless cakes, dairy-free croissants, and fully plant-based breads. Advances in food science have made it possible to achieve rich textures and flavors using alternatives such as almond or oat milk, coconut oil, flax eggs, and aquafaba. The result is an expanding array of bakery goods that meet the expectations of both vegans and non-vegans. Major bakery brands and local artisans alike are innovating with unique flavor profiles, superfood inclusions, and allergen-friendly recipes to attract a wider audience. This trend is especially pronounced among younger demographics and urban consumers who are vocal about sustainability and ingredient transparency. Marketing strategies often highlight plant-based credentials through certifications, social media content, and collaborations with vegan influencers. As demand continues to climb, plant-based offerings are becoming a core component of the specialty bakery landscape in the U.S.

Digital Transformation and Direct-to-Consumer Growth

Digitalization is transforming how specialty bakeries interact with customers, distribute products, and grow their brands. The rise of e-commerce platforms and food delivery apps has enabled bakeries to reach customers directly, bypassing traditional retail limitations. Direct-to-consumer (DTC) models, subscription boxes, and online storefronts allow bakeries to offer personalized experiences, timely promotions, and broader geographic reach. This trend gained momentum during the COVID-19 pandemic and has since become a staple strategy for growth. Bakeries are investing in user-friendly websites, integrated payment systems, and data analytics to enhance customer engagement. Many leverage social media platforms like Instagram and TikTok to showcase products, engage with followers, and build communities around their brand identities. Additionally, bakeries are utilizing digital tools to test new products, gather feedback, and refine offerings based on real-time customer insights. Digital transformation has also encouraged the development of virtual baking classes, loyalty programs, and curated bundles to enhance value. This approach resonates with digitally savvy consumers who prioritize convenience, transparency, and connection. As online ordering and home delivery become permanent expectations, specialty bakeries that embrace digital innovation stand to significantly increase market share and deepen customer relationships.

Market Challenges

High Production Costs and Limited Scalability

One of the primary challenges confronting the U.S. specialty bakery market is the high cost associated with producing premium, health-focused baked goods. Specialty ingredients such as gluten-free flours, plant-based dairy alternatives, organic produce, and functional additives come at a significantly higher price point compared to conventional materials. In addition, maintaining clean-label standards often requires advanced processing techniques, careful sourcing, and third-party certifications, all of which contribute to elevated operational expenses. For small and mid-sized bakeries, these financial pressures are compounded by the difficulty in scaling production while maintaining artisanal quality and ingredient integrity. For instance, a specialty bakery brand reported that the cost of organic and gluten-free flour increased due to supply chain disruptions, leading to higher production expenses. This forced the company to adjust its pricing strategy while exploring alternative ingredient sourcing to maintain profitability. As demand rises, manufacturers may struggle to meet volume expectations without compromising on freshness, consistency, or sustainability standards. Unlike mass-produced baked goods, specialty products often lack the economies of scale necessary to reduce per-unit costs. This can lead to higher retail prices, limiting accessibility for cost-conscious consumers and potentially constraining broader market penetration.

Short Shelf Life and Logistical Complexities

Specialty bakery products—particularly those made without preservatives or artificial additives—often have a shorter shelf life than conventional alternatives. This creates logistical challenges related to inventory management, distribution, and waste reduction. Fresh products must be delivered quickly to maintain quality, increasing dependency on efficient cold-chain logistics and tight supply schedules. For retailers and online distributors, handling perishable goods with narrow delivery windows requires precise coordination and incurs higher transportation costs. Additionally, geographic expansion becomes more complicated as maintaining product freshness across longer distances requires advanced storage and handling infrastructure. These complexities pose barriers for emerging brands looking to expand beyond local or regional markets. As a result, many specialty bakeries face difficulty in optimizing supply chains, balancing freshness with availability, and reducing operational inefficiencies that could impact profitability.

Market Opportunities

Expansion into Health-Focused and Functional Product Lines

The growing emphasis on preventive health and nutritional well-being presents a strong opportunity for specialty bakeries to diversify their portfolios with functional baked goods. Consumers increasingly seek products that support digestive health, energy balance, heart wellness, and immune function. This creates demand for items fortified with superfoods, protein, prebiotics, fiber, and other nutrient-dense ingredients. By incorporating flaxseed, chia, oats, turmeric, and plant-based proteins into bakery formulations, companies can attract health-conscious segments and differentiate their offerings. Furthermore, there is rising interest in bakery items catering to specific dietary lifestyles such as keto, paleo, and low-carb. Capitalizing on this trend allows manufacturers to build brand loyalty and command premium pricing, particularly among fitness enthusiasts, aging populations, and wellness-driven consumers.

Growth Potential in E-Commerce and Subscription Models

The increasing consumer reliance on digital platforms for food purchases presents a significant opportunity for specialty bakeries to scale through e-commerce and direct-to-consumer (DTC) channels. Online platforms enable bakeries to reach customers beyond geographic limitations, introduce customizable offerings, and create subscription-based services for consistent revenue streams. Personalized bakery boxes, limited-edition drops, and seasonal assortments can help maintain consumer engagement and brand differentiation. Additionally, leveraging data analytics from digital interactions allows brands to refine product strategies, marketing efforts, and supply chain efficiency. As consumers continue to value convenience and digital accessibility, online distribution presents a scalable, cost-effective route for specialty bakeries to drive growth and long-term customer retention.

Market Segmentation Analysis

By Type

The U.S. specialty bakery market is segmented by type into specialty bread, specialty cookies, specialty cakes and pastries, specialty crackers and pretzels, and others. Specialty bread represents a significant portion of the market, driven by consumer preference for healthier alternatives such as multigrain, gluten-free, and sourdough varieties. Specialty cookies are witnessing strong demand among younger demographics and individuals seeking indulgent yet portion-controlled snacks. Cakes and pastries continue to maintain a steady market presence due to high consumption during celebrations, holidays, and personal indulgence. Meanwhile, specialty crackers and pretzels are gaining popularity as convenient, savory snacking options, especially those offering low-fat, high-protein, or clean-label attributes. The “others” segment includes niche offerings such as ethnic baked goods and low-carb innovations, contributing to market diversity and experimentation.

By Application

Based on application, the market is categorized into residential and commercial segments. The residential segment is growing due to rising interest in at-home consumption of premium and health-oriented baked goods, driven by evolving dietary habits and increased awareness of food quality. On the other hand, the commercial segment—which includes cafés, restaurants, hotels, and catering services—remains dominant. This segment benefits from the expanding foodservice industry and growing preference for high-quality baked offerings in quick-service and specialty outlets, particularly in urban centers

Segments

Based on Type

- Specialty Bread

- Specialty Cookies

- Specialty Cakes and Pastries

- Specialty Crackers and Pretzels

- Others

Based on Application

- Residential

- Commercial

- Based on Distrbution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail Stores

- Others

Based on Region

- California

- New York

- Texas

- Florida

Regional Analysis

Western region (34.2%)

The Western region holds the largest market share, accounting for 34.2% of the total U.S. specialty bakery market in 2024. States like California, Oregon, and Washington are key contributors due to their health-conscious populations, high income levels, and strong inclination toward organic and plant-based food products. The region’s diverse demographic and high rate of vegan and gluten-free consumers has fostered a favorable environment for specialty bakery innovation. Moreover, the presence of artisanal bakeries and sustainable brands aligns with consumer values around clean-label and locally sourced ingredients

Southern region (27.6%)

The Southern region follows closely, representing 27.6% of the market share. Texas, Florida, and Georgia lead demand in this region, where a growing urban population and expanding foodservice industry are fueling consumption. Specialty bakery products in the South are increasingly popular in both commercial and residential applications, particularly among younger consumers seeking premium, indulgent, and convenience-based offerings. The rapid growth of supermarket chains and café culture further supports the segment’s expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key players

- Rich Products Corporation

- Flowers Foods

- Mondelez International

- Kellanova

- General Mills

Competitive Analysis

The U.S. specialty bakery market is highly competitive, with major players focusing on innovation, product diversification, and brand positioning to maintain market share. Rich Products Corporation leads through a robust portfolio of frozen and ready-to-bake items, targeting foodservice and retail sectors. Flowers Foods capitalizes on its strong distribution network and popular brands to offer health-conscious bakery options. Mondelez International leverages its global presence and marketing strength to introduce indulgent, premium snacks tailored to evolving consumer tastes. Kellanova, formed from the snacking division of Kellogg, brings strategic focus to plant-based and functional baked goods. General Mills enhances competitiveness through acquisitions and innovation in gluten-free, organic, and high-fiber bakery lines. All key players are investing in sustainability, digital transformation, and clean-label products to meet rising consumer expectations and differentiate themselves in an increasingly health-driven and convenience-focused market landscape.

Recent Developments

- In May 2025, Flowers Foods launched an expanded 2025 product lineup—new flatbreads, small‑loaf varieties, keto buns, muffins, and multipacks—targeting both value‑seekers and better‑for‑you consumers.

- In Q1 2025, Mondelez maintained its guidance—5% organic net‑revenue growth and continued investment in recyclable packaging—despite cocoa‑cost inflation, affirming resilience in its baked‑snacks portfolio.

- In May 1, 2025, Kellanova’s Q1 FY2025 net sales fell 3.7% to \$3.08 billion—missed Street estimates—reflecting US spending moderation on breakfast cereals and ready‑to‑eat snacks.

- In March 19, 2025, General Mills Foodservice published “Bread and Beyond: In‑Store Bakery Trends,” spotlighting clean‑label, better‑for‑you, and experiential bakery formats for retail bakeries.

Market Concentration and Characteristics

The U.S. specialty bakery market exhibits a moderately concentrated structure, characterized by the presence of both established multinational corporations and a growing number of regional and artisanal players. Major companies like Rich Products Corporation, Flowers Foods, Mondelez International, Kellanova, and General Mills hold significant market share due to their broad distribution networks, extensive product portfolios, and brand recognition. However, the market also maintains a fragmented edge, driven by consumer preference for localized, artisanal, and health-oriented offerings, allowing small bakeries and niche brands to thrive. The market is defined by high product differentiation, continuous innovation in health-focused and clean-label formulations, and growing demand for convenience-driven and functional baked goods. This dynamic environment encourages strategic partnerships, product innovation, and agile responses to shifting dietary trends, making adaptability a key characteristic for sustained growth in the specialty bakery segment.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly focus on health-conscious bakery items, including low-sugar, gluten-free, and high-protein products. Consumers will prioritize functional benefits and clean-label ingredients, driving innovation in product formulations.

- Demand for vegan and allergen-free baked goods will accelerate as dietary preferences evolve. Bakeries will adopt plant-based alternatives to meet ethical and health-driven expectations.

- Online retail and subscription-based bakery models will see significant growth due to convenience and personalization. Brands will leverage digital platforms to expand reach and enhance consumer engagement

- Consumers will continue favoring handcrafted, small-batch bakery items with unique flavors and authentic appeal. This trend will benefit local bakeries and premium segments targeting quality-conscious buyers.

- Bakeries will integrate superfoods, prebiotics, and protein sources into everyday bakery items. Functional nutrition will become a key differentiator in a competitive landscape.

- Sustainability will become central to brand value, with emphasis on eco-friendly packaging and responsibly sourced ingredients. Companies will invest in transparent supply chains to build consumer trust.

- Technology will enable better shelf-life management, texture enhancement, and alternative ingredient development. R\&D investment will be critical for maintaining product quality and differentiation.

- Specialty bakeries will explore regional flavors and ethnic-inspired baked goods to cater to a diverse population. This strategy will help brands tap into new customer bases and broaden appeal.

- Customization of flavors, ingredients, and packaging will attract consumers seeking tailored food experiences. Tech-enabled bakeries will gain a competitive edge in offering flexible product options.

- Key players will pursue mergers, acquisitions, and strategic alliances to consolidate market share and expand product portfolios. Collaboration across foodservice, retail, and tech sectors will shape future growth.