Market Overview

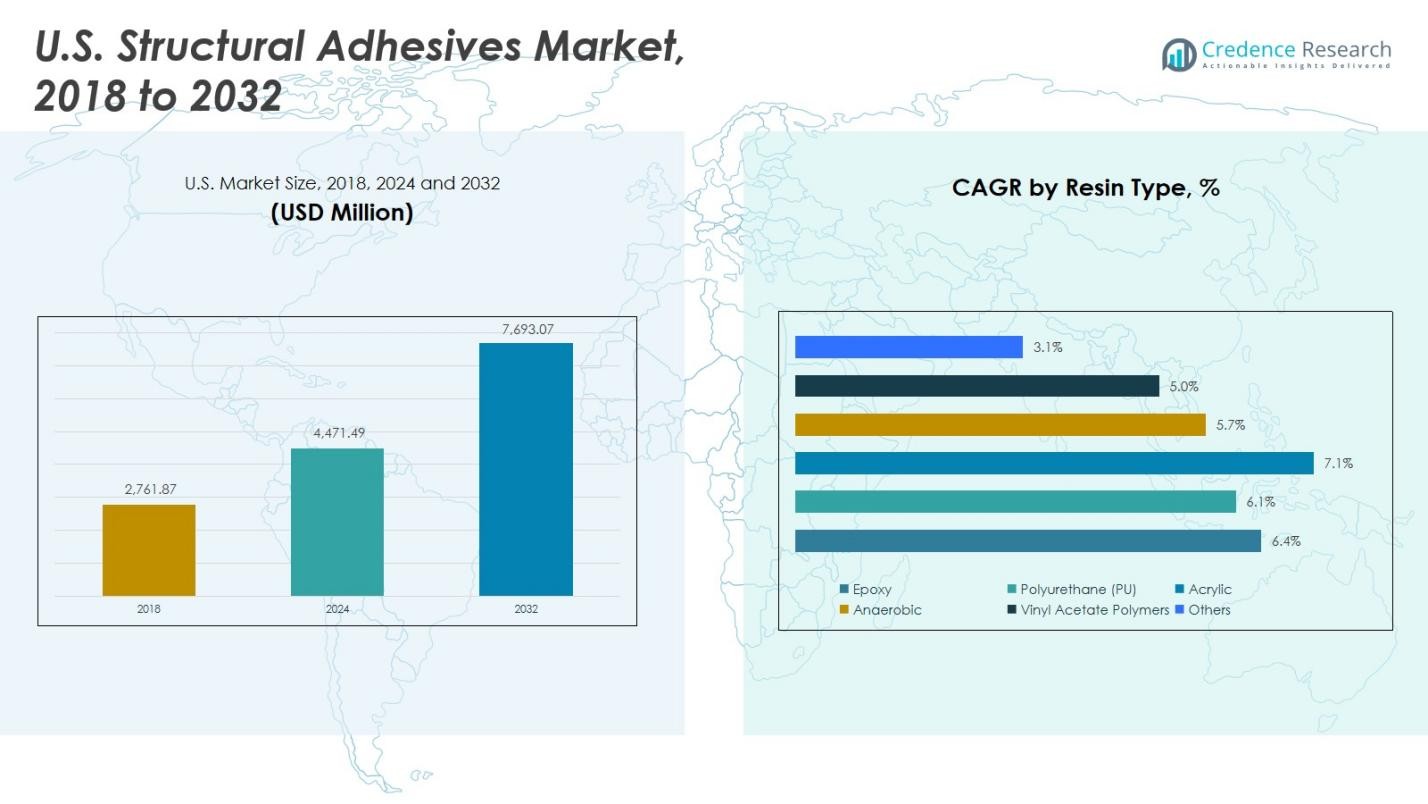

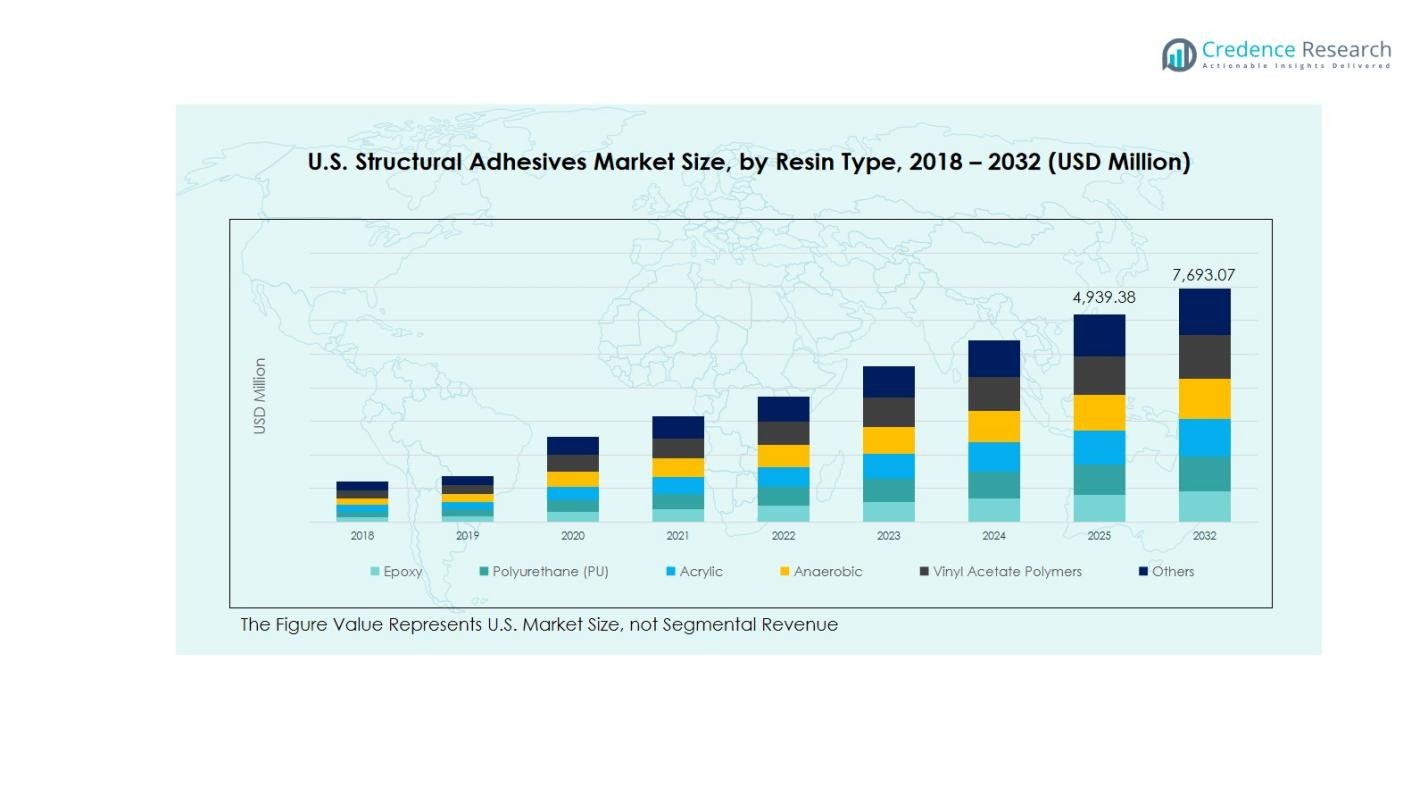

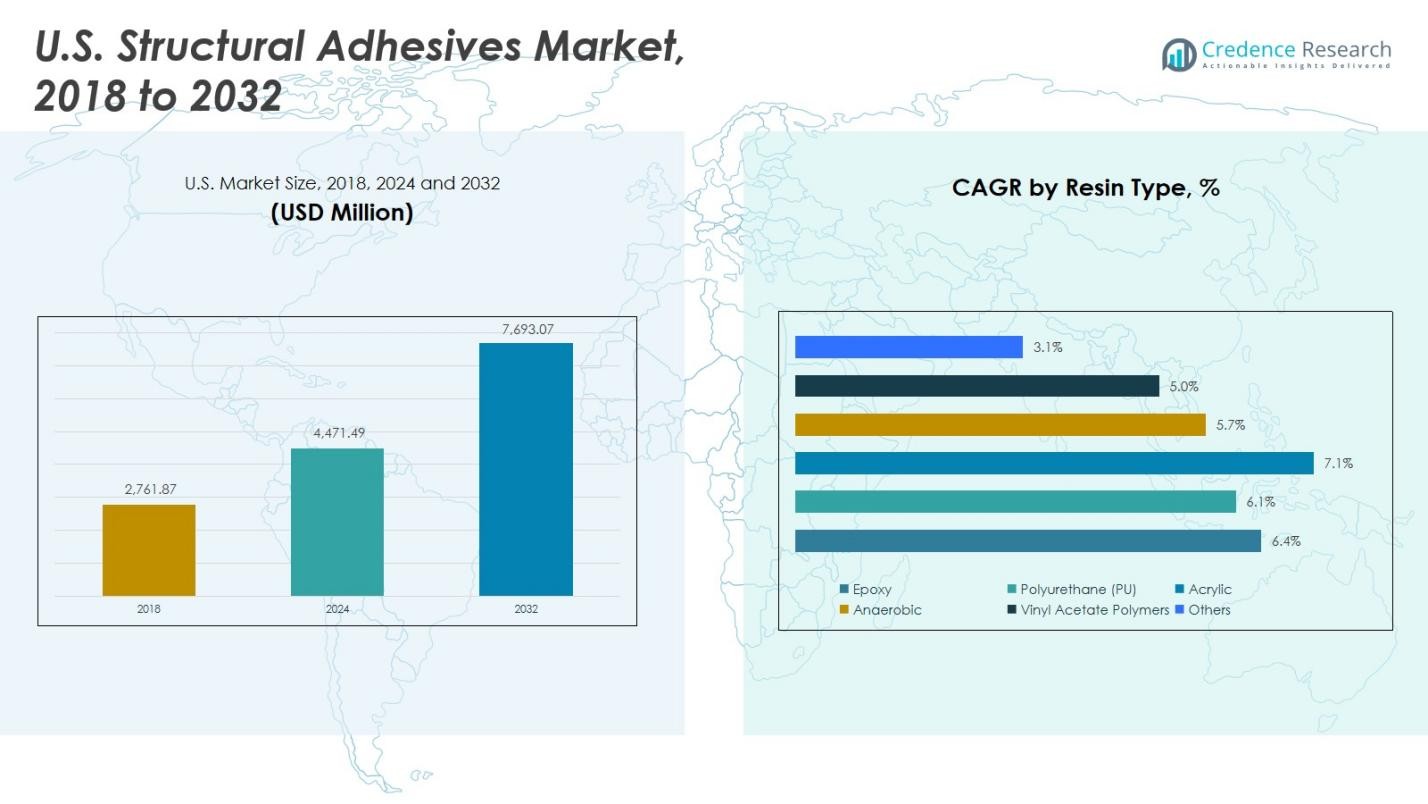

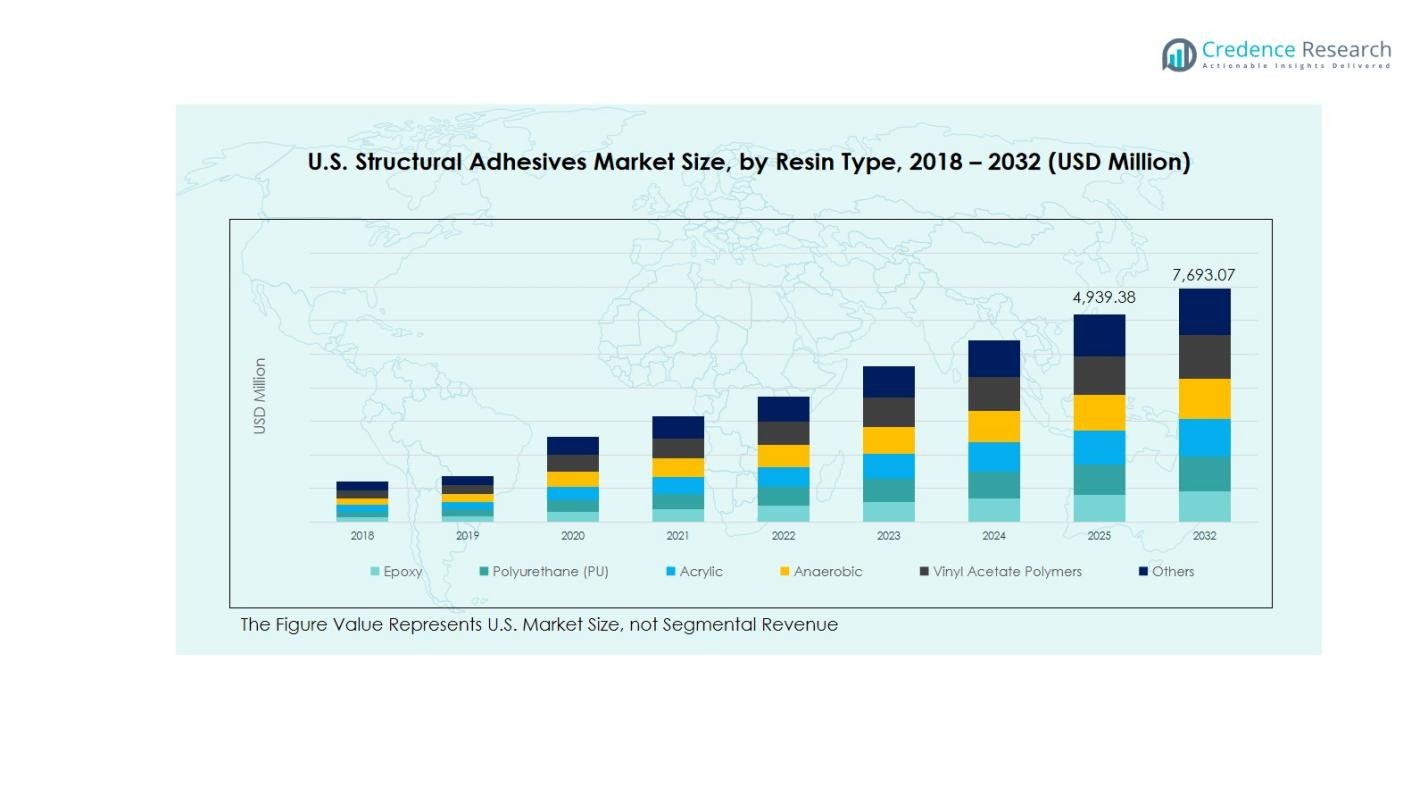

U.S Structural Adhesives Market size was valued at USD 2,761.87 Million in 2018, grew to USD 4,471.49 Million in 2024, and is anticipated to reach USD 7,693.07 Million by 2032, reflecting a CAGR of 6.53% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S Structural Adhesives Market Size 2024 |

USD 4,471.49 Million |

| U.S Structural Adhesives Market, CAGR |

6.53% |

| U.S Structural Adhesives Market Size 2032 |

USD 7,693.07 Million |

The U.S. Structural Adhesives Market is highly competitive, led by major players such as 3M Company, Henkel AG & Co. KGaA, H.B. Fuller Company, Ashland Global Holdings Inc., and Illinois Tool Works Inc. These companies drive market growth through robust product portfolios, continuous innovation, and strategic collaborations, catering to automotive, aerospace, construction, and industrial applications. Their focus on high-performance epoxy, polyurethane, and acrylic adhesives enhances bonding strength, durability, and thermal resistance across diverse substrates. Among U.S. regions, the South commands the largest market share at 30%, driven by strong automotive, aerospace, and industrial manufacturing hubs. Favorable business conditions, advanced infrastructure, and expansion in electric vehicle production further boost adoption in this region, positioning it as a key contributor to the national structural adhesives market while enabling top players to capitalize on long-term growth opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. Structural Adhesives Market was valued at USD 4,471.49 Million in 2024 and is projected to reach USD 7,693.07 Million by 2032, growing at a CAGR of 6.53%. Epoxy adhesives dominate the market with a 45% share, while metal substrates account for 50% of segment revenue.

- Growth is driven by rising demand in automotive, aerospace, and industrial manufacturing sectors, with structural adhesives increasingly replacing mechanical fasteners to reduce weight and enhance durability.

- Key market trends include lightweighting and multi-material integration, along with the shift toward eco-friendly, water-based, and low-VOC adhesives in response to regulatory requirements.

- The market is highly competitive, led by 3M, Henkel AG & Co. KGaA, H.B. Fuller, Ashland Global Holdings, and Illinois Tool Works, focusing on innovation, R&D, and strategic partnerships.

- Regionally, the South leads with a 30% share, followed by the Midwest at 28%, Northeast at 22%, and West at 20%, driven by automotive, aerospace, and industrial hubs.

Market Segmentation Analysis:

By Resin Type:

Epoxy adhesives dominate the U.S. structural adhesives market, capturing approximately 45% of the resin type segment. Their strong bonding performance, chemical resistance, and versatility across industries drive widespread adoption, particularly in automotive, aerospace, and industrial manufacturing. Polyurethane (PU) and acrylic follow, offering flexibility and impact resistance for specialized applications. Anaerobic and vinyl acetate polymers serve niche applications such as metal bonding and wood composites. The market growth in this segment is fueled by increasing demand for durable and lightweight materials, coupled with ongoing innovation in high-performance resin formulations that enhance strength and temperature resistance.

For instance, Permabond’s ET5401 epoxy adhesive is engineered for aerospace applications, enduring continuous temperatures up to 140°C while maintaining toughness and impact resistance on diverse materials like composites and metals.

By Substrate:

Metal is the dominant substrate in the U.S. structural adhesives market, accounting for around 50% of segment revenue. Its prevalence in automotive, aerospace, and industrial machinery applications drives this dominance. Composites and plastics are growing rapidly due to lightweighting trends and increased use in electric vehicles and electronics. Wood remains significant in construction and furniture applications, while others cover niche substrates like glass and ceramics. The market is supported by the need for high-strength, durable bonding solutions that reduce mechanical fasteners and enable complex structural designs, increasing productivity and product longevity.

For instance, 3M’s Scotch-Weld Epoxy Adhesives are widely used in automotive and aerospace sectors due to their high strength and durability on metal substrates.

By Technology:

Solvent-based adhesives hold the largest share in the U.S. structural adhesives market, approximately 55%, due to their high bond strength, fast curing time, and compatibility with metals and composites. Water-based adhesives are gaining traction for eco-friendly applications, particularly in woodworking, construction, and packaging, driven by environmental regulations and sustainability initiatives. Other technologies, including hot-melt and UV-curable adhesives, serve specialized applications requiring precision and speed. Growth in this segment is fueled by industrial automation, increasing demand for high-performance bonding, and the need to balance performance with environmental compliance.

Key Growth Drivers

Rising Demand from Automotive & Transportation Sector

The U.S. structural adhesives market is propelled by growing adoption in the automotive and transportation sector. Manufacturers increasingly use adhesives to replace mechanical fasteners, reduce vehicle weight, and enhance fuel efficiency. Structural adhesives provide high-strength bonding for metals, composites, and plastics, enabling complex designs and improved durability. Expansion in electric and hybrid vehicle production further drives demand, as adhesives offer lightweighting solutions critical for battery integration and energy efficiency, creating sustained growth opportunities for epoxy, polyurethane, and acrylic-based adhesives.

For instance, Master Bond epoxy adhesives are used extensively on aluminum, steel, and composites in vehicle body panels, hoods, and doors, enhancing stiffness and durability while streamlining assembly operations.

Increasing Aerospace & Defense Applications

Aerospace and defense industries significantly contribute to market growth, driven by stringent safety and performance requirements. Structural adhesives are widely used for bonding lightweight composites, metals, and polymers in aircraft, spacecraft, and defense equipment. The need for high-temperature resistance, vibration tolerance, and corrosion protection makes adhesives preferable over traditional fastening methods. Continuous investments in next-generation aircraft, military equipment upgrades, and advanced aerospace composites are fueling demand for high-performance adhesives, supporting innovation and long-term adoption in these sectors.

For instance, Henkel offers one- and two-part epoxy paste adhesives used to bond aluminum, stainless steel, titanium, and composites in aircraft honeycomb structures, providing reinforcement and compression strength with potting compounds tailored for aerospace conditions.

Advancements in Material Technology

Innovation in resin formulations and adhesive technology is a major growth driver. Development of high-performance epoxy, polyurethane, and acrylic adhesives with improved strength, flexibility, and thermal resistance is expanding applications across industries. Water-based and eco-friendly alternatives are gaining traction due to environmental regulations, while UV-curable and fast-setting adhesives improve production efficiency. These technological advancements enable structural bonding in complex geometries, lightweight composites, and multi-material assemblies, increasing the adoption of adhesives over mechanical fasteners and driving sustained market growth.

Key Trends & Opportunities

Lightweighting and Multi-Material Integration

The trend toward lightweight vehicles and electronic devices is creating opportunities for structural adhesives. Adhesives allow the integration of metals, composites, and plastics without compromising structural integrity. Lightweighting reduces energy consumption in transportation and enhances product efficiency in electronics and industrial machinery. The demand for hybrid materials and multi-layer bonding solutions provides growth prospects for high-strength epoxy, polyurethane, and acrylic adhesives, enabling manufacturers to achieve durable, lightweight structures while optimizing production efficiency.

For instance, ThreeBond’s 2249K adhesive, specifically designed for multi-material bonding in electric vehicles, effectively adhering dissimilar materials like steel, aluminum, and carbon fiber reinforced plastics (CFRP), enabling stronger, lightweight vehicle frames while improving manufacturing efficiency.

Sustainability and Eco-Friendly Adhesives

Growing environmental awareness and regulatory pressure are creating opportunities for water-based and low-VOC structural adhesives. Manufacturers are shifting to eco-friendly alternatives without sacrificing performance, particularly in construction, automotive, and packaging applications. Sustainable adhesives reduce environmental impact, improve worker safety, and meet green building certifications, supporting brand compliance and market adoption. The trend toward eco-conscious materials and green production processes is expected to further expand market potential and encourage continuous innovation in environmentally friendly adhesive solutions.

For instance, Sika launched SikaSeal®-106 Construction, a water-based elastic sealant with very low emissions that complies with LEED v4 low-emitting materials credit while offering excellent adhesion and durability for interior and exterior sealing.

Key Challenges

High Raw Material Costs

Fluctuating prices of resin types such as epoxy, polyurethane, and acrylic pose a significant challenge for manufacturers. Rising raw material costs increase production expenses, which can impact pricing strategies and profit margins. Dependence on petrochemical derivatives and global supply chain volatility further exacerbate cost pressures. Companies must balance performance requirements with cost-efficiency while exploring alternative materials and sourcing strategies, creating operational challenges that can slow market expansion and limit adoption, particularly in price-sensitive applications.

Stringent Regulatory Compliance

Structural adhesives face strict environmental and safety regulations in the U.S., particularly regarding VOC emissions and chemical handling. Compliance with EPA, OSHA, and other standards requires additional testing, certification, and investment in low-VOC or water-based formulations. Failure to meet regulatory requirements can lead to penalties, product recalls, or market restrictions, creating hurdles for manufacturers. Adapting production processes, ensuring consistent quality, and maintaining compliance across diverse applications remain critical challenges for sustaining growth in the market.

Regional Analysis

Northeast U.S.

The Northeast U.S. holds a 22% share of the structural adhesives market, driven by high demand from automotive, aerospace, and electronics industries. The presence of major manufacturing hubs, research centers, and defense contractors fuels adoption of high-performance adhesives. Epoxy and polyurethane adhesives dominate due to their superior strength and thermal resistance, widely applied in metal and composite bonding. The region’s focus on innovation, sustainability, and advanced manufacturing techniques supports growth. Expansion in aerospace programs and electric vehicle production further stimulates demand, positioning the Northeast as a key contributor to the national structural adhesives market.

Midwest U.S.

The Midwest accounts for 28% of the U.S. structural adhesives market, led by automotive manufacturing and industrial equipment sectors. Strong metal and composite processing industries drive demand for epoxy and acrylic adhesives, while wood and plastic bonding support construction applications. The presence of tier-one automotive suppliers and large-scale industrial manufacturers encourages adoption of high-strength, solvent-based adhesives. Investment in lightweight materials and multi-substrate bonding solutions is expanding market potential. Government incentives for manufacturing modernization and infrastructure development further stimulate regional growth, making the Midwest a significant market for high-performance structural adhesives.

South U.S.

The South U.S. contributes 30% of the structural adhesives market, driven by a robust automotive, aerospace, and construction base. Major vehicle assembly plants, aerospace manufacturing centers, and industrial hubs increase the adoption of epoxy, polyurethane, and acrylic adhesives. Solvent-based and water-based adhesives are widely used for metal, composite, and wood applications, supporting lightweighting and durability goals. The region benefits from favorable business conditions, logistics infrastructure, and skilled labor, encouraging manufacturers to expand production. Growth in aerospace defense projects, commercial construction, and industrial machinery further strengthens the South’s position as a leading contributor to the U.S. structural adhesives market.

West U.S.

The West U.S. holds a 20% market share, driven by aerospace, electronics, and high-tech manufacturing. California, Washington, and Oregon lead demand for high-performance adhesives due to significant aerospace and electronics clusters. Epoxy and acrylic adhesives dominate, used extensively in metal, composite, and plastic bonding for precision applications. Water-based adhesives are gaining traction in construction and sustainable manufacturing projects. Innovation in lightweight composites and eco-friendly adhesive solutions fuels adoption, supported by research and development activities. Expansion of aerospace programs, industrial automation, and infrastructure projects positions the West as a dynamic market for structural adhesives in the U.S.

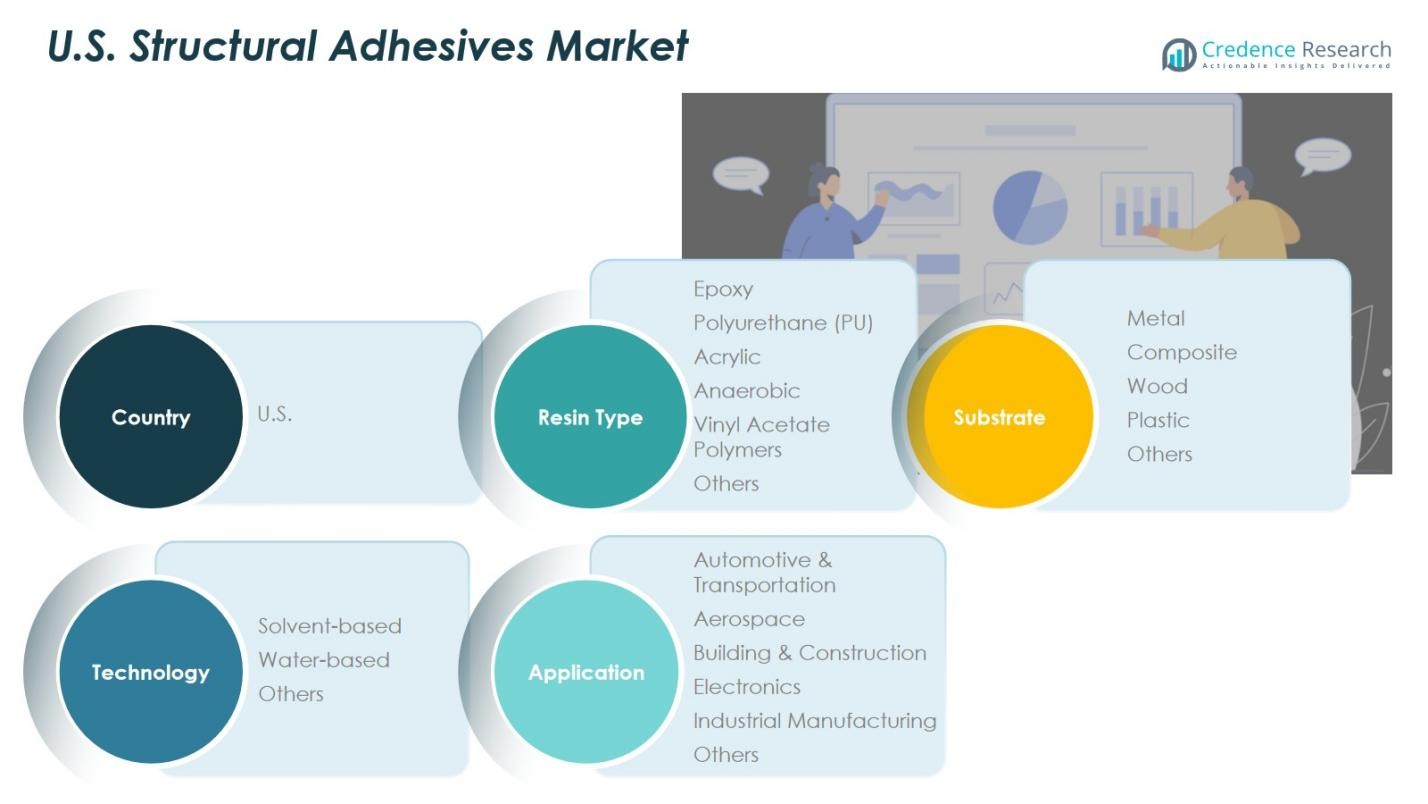

Market Segmentations:

By Resin Type:

- Epoxy

- Polyurethane (PU)

- Acrylic

- Anaerobic

- Vinyl Acetate Polymers

- Others

By Substrate:

- Metal

- Composite

- Wood

- Plastic

- Others

By Technology:

- Solvent-based

- Water-based

- Others

By Application:

- Automotive & Transportation

- Aerospace

- Building & Construction

- Electronics

- Industrial Manufacturing

- Others

By Region:

- Northeast

- Midwest

- South

- West

Competitive Landscape

The competitive landscape of the U.S. structural adhesives market features major players such as 3M Company, Henkel AG & Co. KGaA, H.B. Fuller Company, Ashland Global Holdings Inc., and Illinois Tool Works Inc. These companies lead through strong product portfolios, strategic acquisitions, and continuous innovation in high-performance adhesives. They focus on expanding applications across automotive, aerospace, electronics, and construction sectors while developing eco-friendly and high-strength formulations. Market competition is further intensified by mid-sized and regional players offering specialized solutions for niche applications. Companies are investing in research and development to enhance bonding performance, thermal resistance, and sustainability, while also adopting advanced manufacturing and supply chain strategies to maintain cost efficiency. The focus on mergers, collaborations, and new product launches ensures these players strengthen their market presence, meet evolving customer requirements, and capture growth opportunities in the expanding U.S. structural adhesives market.

Key Player Analysis

- 3M Company

- Ashland Global Holdings Inc.

- B. Fuller Company

- Henkel AG & Co. KGaA

- Illinois Tool Works Inc.

- L&L Products, Inc.

- RPM International Inc.

- Huntsman Corporation

- Lord Corporation

- Dow Inc.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments

- In April 2025, Bertram Capital, a private equity firm, acquired Applied Adhesives, a Minnesota-based distributor and manufacturer of custom adhesive solutions. This acquisition is expected to impact the U.S. cement adhesives market.

- In May 2024, H.B. Fuller expanded its U.S. structural adhesives portfolio by acquiring ND Industries, adding the Vibra-Tite brand, which integrates adhesive and mechanical fastener technologies.

- In June 2023, Park Aerospace Corp. launched Aeroadhere FAE-350-1, a new structural film adhesive designed for bonding primary and secondary aerospace structures.

Report Coverage

The research report offers an in-depth analysis based on Resin Type, Substrate, Technology, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to witness steady growth driven by increasing automotive and aerospace applications.

- High-performance adhesives will see rising adoption for lightweight and multi-material bonding solutions.

- Eco-friendly and water-based adhesives will gain traction due to regulatory compliance and sustainability initiatives.

- Demand for epoxy and polyurethane adhesives will remain dominant across industrial and transportation sectors.

- Expansion of electric and hybrid vehicle production will boost structural adhesive usage.

- Advanced manufacturing and automation will encourage the adoption of fast-curing and precision adhesives.

- Growth in construction and infrastructure projects will increase demand for wood and composite bonding solutions.

- Innovation in adhesive technology will enhance strength, thermal resistance, and versatility.

- Mergers, acquisitions, and collaborations among key players will strengthen market competitiveness.

- The market will benefit from increasing R&D investments and the development of specialty adhesives for niche applications.