| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Utility Distribution Panel Market Size 2024 |

USD 2,811.99 Million |

| Utility Distribution Panel Market, CAGR |

4.74% |

| Utility Distribution Panel Market Size 2032 |

USD 4,182.96 Million |

Market Overview

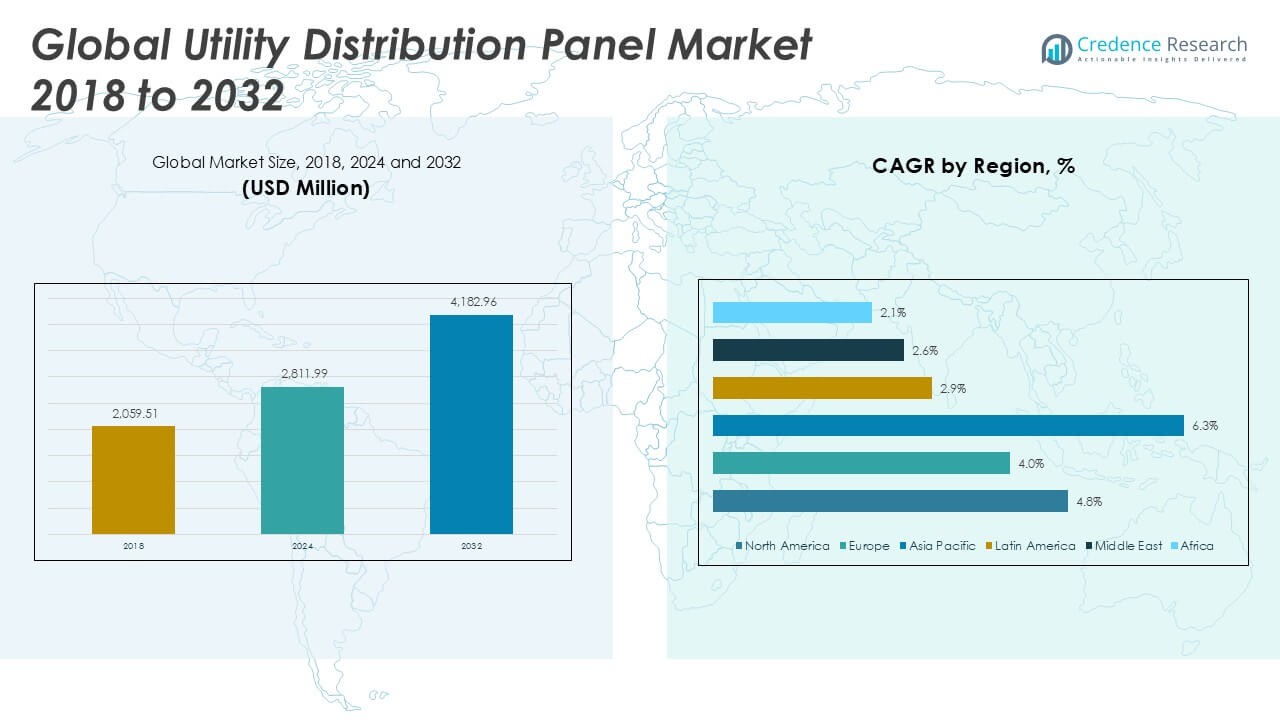

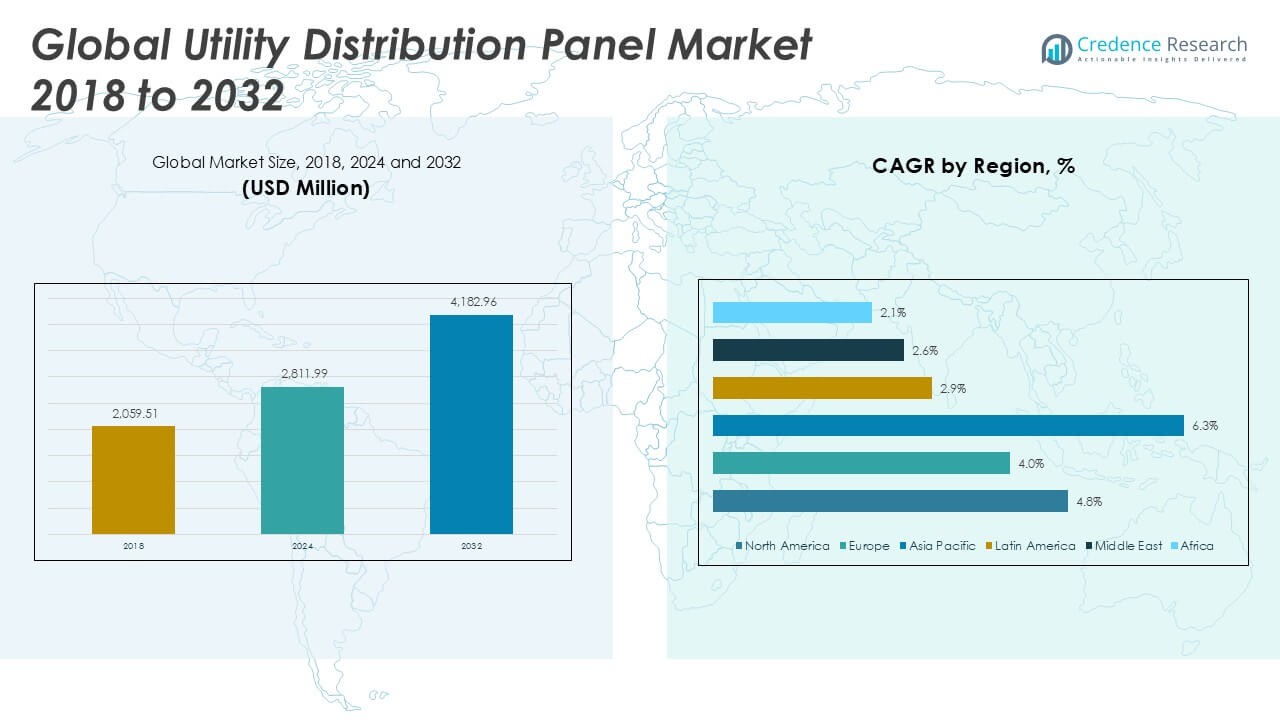

The Utility Distribution Panel Market was valued at USD 2,059.51 million in 2018 and grew to USD 2,811.99 million in 2024. It is anticipated to reach USD 4,182.96 million by 2032, reflecting a compound annual growth rate (CAGR) of 4.74% during the forecast period.

The Utility Distribution Panel Market is experiencing steady growth, driven by the rising demand for reliable electricity distribution infrastructure across residential, commercial, and industrial sectors. Urbanization and rapid expansion of smart grids are prompting utilities to modernize legacy systems and deploy advanced panels with enhanced monitoring and control features. Increasing investments in renewable energy integration and government initiatives supporting energy efficiency further propel market expansion. However, fluctuating raw material prices and the need for skilled workforce in installation and maintenance present challenges. Key trends shaping the market include the adoption of IoT-enabled panels for real-time data analytics, greater focus on modular designs for ease of customization, and heightened emphasis on safety standards. As industries digitize operations, manufacturers are innovating with panels that offer improved energy management, remote diagnostics, and seamless scalability to meet evolving customer requirements, positioning the market for continued advancement.

Geographical analysis of the Utility Distribution Panel Market highlights strong growth in North America, Europe, and Asia Pacific, driven by rapid urbanization, infrastructure modernization, and the rising adoption of smart grid technologies. Countries such as the United States, Germany, China, and India are at the forefront, with substantial investments in power distribution networks and renewable energy integration. The market shows robust demand for advanced, digitalized panels across commercial, industrial, and residential sectors in these regions. Among the key players shaping the competitive landscape are Legrand, ABB, and Eaton, each recognized for their extensive voltage portfolios, continuous product innovation, and global presence. These companies focus on enhancing energy efficiency, safety features, and IoT integration to address evolving industry needs. Their strategic expansions and collaborations support market advancement, ensuring reliable and intelligent power distribution solutions for diverse applications worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Utility Distribution Panel Market was valued at USD 2,811.99 million in 2024 and is projected to reach USD 4,182.96 million by 2032, registering a CAGR of 4.74% during the forecast period.

- The market exhibits steady expansion, driven by rising demand for reliable electricity distribution infrastructure across residential, commercial, and industrial sectors.

- Key drivers include rapid urbanization, increased construction activity, and growing investments in grid modernization and renewable energy integration.

- Notable trends feature the adoption of smart panels equipped with IoT connectivity, modular panel designs for flexible deployment, and a strong industry focus on sustainability and safety standards.

- Leading competitors such as Legrand, ABB, Eaton, and General Electric enhance their global positions through continuous product innovation, expanding digital offerings, and strategic collaborations.

- Market restraints include volatility in raw material prices, supply chain disruptions, and a shortage of skilled labor required to install and maintain advanced panel systems.

- Regionally, North America, Europe, and Asia Pacific dominate the market landscape, supported by government initiatives, strong investments in infrastructure, and rapid adoption of advanced distribution solutions, while emerging regions gradually increase their adoption of reliable power distribution networks.

Market Drivers

Growing Demand for Reliable Power Infrastructure Fuels Market Expansion

The Utility Distribution Panel Market benefits significantly from the global push toward reliable and efficient power distribution. Rapid urbanization and the construction of new residential, commercial, and industrial buildings require robust electrical infrastructure. Governments and private developers are investing in grid modernization projects to reduce power outages and enhance grid resilience. The demand for uninterrupted power supply in critical sectors such as healthcare, data centers, and manufacturing underscores the importance of advanced distribution panels. Upgrading old systems and replacing obsolete equipment remain a priority for utilities to ensure operational reliability. The ongoing focus on infrastructure development drives sustained growth in the market and creates new opportunities for manufacturers and technology providers.

- For instance, ABB upgraded the utility infrastructure for a major data center project in Sweden with 1,200 new low-voltage distribution panels to guarantee power reliability for over 50,000 servers.

Integration of Renewable Energy Sources Accelerates Product Innovation

Rising adoption of renewable energy systems is reshaping requirements for utility distribution panels. Utilities must accommodate distributed energy resources like solar and wind into existing grids, prompting the need for panels with higher flexibility and advanced control features. New regulations and government incentives encourage investment in renewable projects, increasing demand for compatible distribution panels. Product designs now incorporate smart features that support real-time energy monitoring and facilitate seamless integration of variable power sources. The Utility Distribution Panel Market responds by offering solutions that optimize energy flow and balance supply with fluctuating renewable inputs. Companies that innovate in this area gain a competitive edge by meeting the evolving needs of green energy integration.

- For instance, Eaton supplied 300 customized distribution panels to a solar park in Gujarat, India, supporting the grid integration of 600 megawatts of solar power.

Technological Advancements and Digitalization Drive Market Transformation

Rapid technological advancements shape the future of the Utility Distribution Panel Market by enabling digitalization and enhanced system intelligence. IoT-enabled panels provide real-time monitoring, predictive maintenance, and remote diagnostics, improving operational efficiency for utilities and end users. Digital solutions help manage peak loads and reduce energy losses, supporting grid stability in diverse environments. The trend toward modular and scalable panel designs allows customization for unique project requirements. Technology providers collaborate with utilities to develop panels with advanced communication protocols and cybersecurity features, ensuring safe and secure operations. Embracing digital transformation enables utilities to address increasing complexity in modern power distribution networks.

Stringent Safety Standards and Regulatory Compliance Influence Adoption Rates

Regulatory standards and safety requirements play a pivotal role in the Utility Distribution Panel Market. Authorities enforce rigorous guidelines for panel design, installation, and maintenance to minimize fire hazards, electrical faults, and system downtime. Compliance with international standards such as IEC and UL helps manufacturers expand their reach in global markets. Utilities prefer distribution panels that offer enhanced safety features, including fault detection, arc flash protection, and overload prevention. Growing awareness of workplace safety and the need for uninterrupted service in mission-critical applications elevate demand for compliant products. Manufacturers invest in continuous testing and certification to maintain product reliability and build customer trust.

Market Trends

Adoption of Smart Panels and IoT Integration Enhances Grid Intelligence

The Utility Distribution Panel Market witnesses strong momentum from the widespread adoption of smart panels equipped with IoT connectivity and digital controls. Utilities seek solutions that offer real-time monitoring, remote diagnostics, and predictive maintenance to optimize energy usage and prevent faults. IoT-enabled panels facilitate advanced data collection, supporting grid operators with actionable insights for better load management and resource allocation. The market increasingly favors panels that support automated system upgrades and integration with energy management platforms. It enables faster response to outages and improved asset performance. Smart panel adoption underpins the shift toward intelligent, data-driven utility networks that adapt quickly to fluctuating demands.

- For instance, Legrand deployed its IoT-enabled XL³ panel range across 700 smart buildings in France, delivering over 100,000 real-time data points per building each day.

Emphasis on Modular and Customizable Designs Responds to Evolving Needs

Flexible and modular distribution panel designs are gaining traction in the Utility Distribution Panel Market, driven by the need for scalable and adaptable power infrastructure. Builders and facility managers prefer solutions that can accommodate expanding loads or changing configurations without extensive downtime. Manufacturers respond with modular panels that allow easy customization, quick installation, and simplified maintenance. The trend supports the rapid deployment of new infrastructure projects, including renewable energy sites and smart buildings. Modular designs help reduce project timelines and costs while supporting compliance with diverse regional standards. It ensures that end users achieve greater operational efficiency and adaptability.

- For instance, Hager Group launched a modular panel solution for commercial towers in Dubai, enabling installation time savings of 20 hours per floor across a 48-floor development.

Focus on Sustainability Drives Eco-Friendly Material Use and Energy Efficiency

Environmental considerations influence major trends within the Utility Distribution Panel Market, including the shift toward sustainable materials and higher energy efficiency. Industry participants develop panels using recyclable materials and low-impact manufacturing processes to meet green building standards and regulatory requirements. Energy-efficient panels with advanced insulation, reduced power losses, and improved thermal management align with global sustainability goals. The market observes heightened demand from organizations pursuing LEED certification and similar eco-labels. Sustainable solutions help utilities and developers reduce operational costs and environmental footprints. It positions the market for long-term relevance amid evolving energy transition strategies.

Rising Role of Regulatory Compliance and Enhanced Safety Features

Stringent regulations and heightened safety expectations are shaping innovation trends in the Utility Distribution Panel Market. Product development focuses on integrating advanced safety mechanisms, such as arc fault detection, ground fault protection, and improved overload prevention. Regulators enforce robust standards, prompting manufacturers to prioritize compliance and certification to access new markets. Safety-centric designs meet the growing expectations of critical sectors, including healthcare, transportation, and manufacturing. It drives the integration of features that support operational continuity and risk mitigation. Regulatory alignment and a commitment to product reliability are essential to maintaining competitiveness in this dynamic sector.

Market Challenges Analysis

Volatility in Raw Material Prices and Supply Chain Disruptions Impede Market Stability

Fluctuating prices of raw materials, such as copper, steel, and specialized plastics, present persistent challenges for the Utility Distribution Panel Market. These materials significantly impact overall production costs, forcing manufacturers to adjust pricing strategies and profit margins. Global supply chain disruptions, driven by geopolitical tensions, trade restrictions, or logistical bottlenecks, create uncertainty in the timely delivery of essential components. It affects the ability of market players to fulfill large-scale contracts and meet customer expectations. Long lead times and cost variability can delay infrastructure projects, especially in regions dependent on imported materials. This environment complicates forecasting, resource planning, and competitive positioning for manufacturers.

Shortage of Skilled Labor and Technical Expertise Limits Market Growth Potential

The Utility Distribution Panel Market faces a shortage of skilled labor, which restricts the installation, maintenance, and upgrading of advanced panel systems. Rapid technological advancements require specialized knowledge and continuous training, creating barriers for workforce development. Companies often struggle to attract and retain qualified technicians capable of handling complex digital and IoT-enabled systems. It leads to increased operational costs and potential delays in project execution, particularly for critical infrastructure. Gaps in technical expertise also increase the risk of errors, compromising safety and system reliability. The industry must invest in workforce training programs and partnerships to bridge these gaps and sustain growth momentum.

Market Opportunities

Expansion of Smart Grid Projects and Renewable Integration Presents Growth Prospects

The global expansion of smart grid projects creates promising opportunities for the Utility Distribution Panel Market. Governments and utilities are investing in digital infrastructure to support real-time monitoring, decentralized energy resources, and automated load management. Distribution panels with IoT and smart communication features are in high demand, helping utilities modernize legacy grids. The ongoing integration of renewable energy, such as solar and wind, drives demand for panels capable of handling variable inputs and distributed generation. It positions the market to benefit from sustainability mandates and national energy transition strategies. Manufacturers can capitalize on these trends by offering advanced, grid-compatible panel solutions tailored to evolving utility requirements.

Rising Urbanization and Infrastructure Development Drive Demand for Advanced Solutions

Accelerated urbanization and large-scale infrastructure development provide new avenues for growth in the Utility Distribution Panel Market. Rapid population growth and urban expansion require robust, scalable electrical distribution networks across residential, commercial, and industrial sectors. Developers seek innovative panels with modular designs and enhanced safety features to meet diverse project needs. The market supports smart cities and green building initiatives, opening opportunities to introduce energy-efficient and eco-friendly solutions. It enables manufacturers to form strategic partnerships with construction firms, utilities, and technology providers to access emerging markets. The shift toward digital and sustainable infrastructure unlocks long-term value for industry stakeholders.

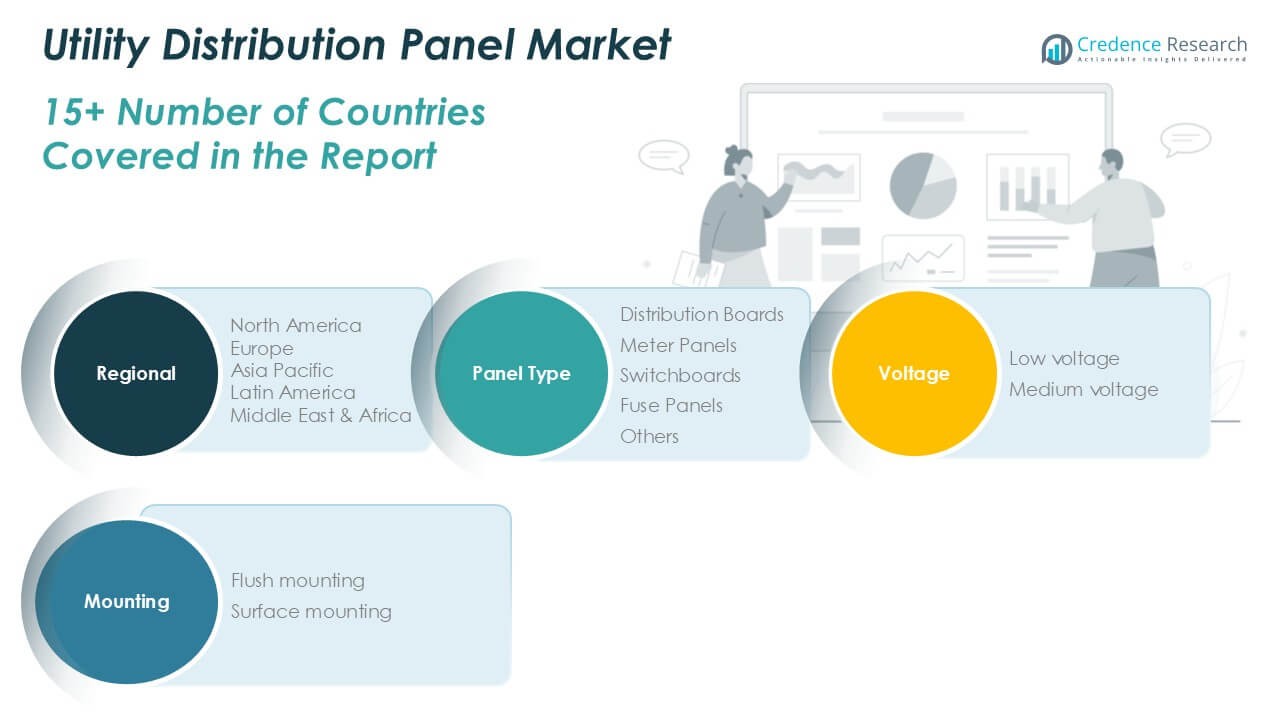

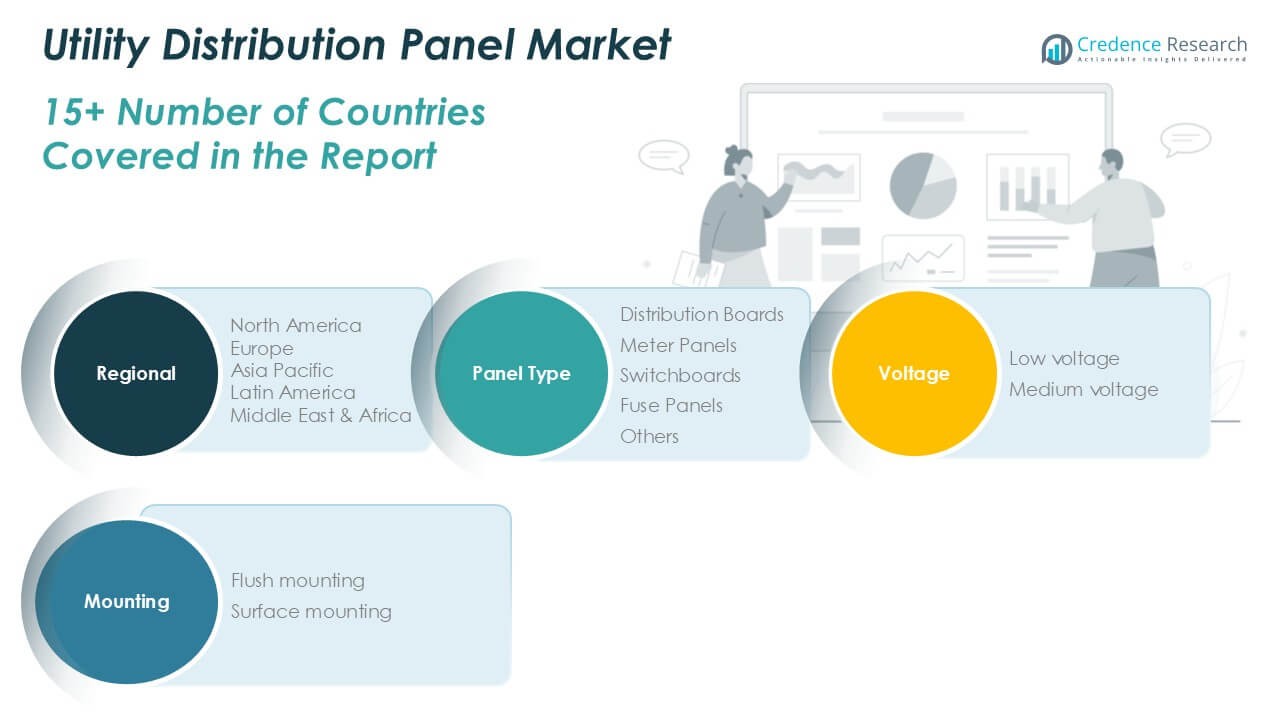

Market Segmentation Analysis:

By Panel Type:

Distribution boards represent the largest share, driven by their widespread use across residential, commercial, and industrial settings. Distribution boards serve as the primary node for power allocation and circuit protection, making them critical to modern electrical infrastructure. Meter panels support utilities and building managers in monitoring energy consumption and facilitating accurate billing, meeting growing demand for efficient energy management. Switchboards deliver reliable switching and control for large electrical systems, supporting complex applications in manufacturing, data centers, and infrastructure projects. Fuse panels, though more traditional, maintain relevance in settings where simplicity and cost-effectiveness matter. The “others” segment covers emerging and customized panel solutions tailored to niche applications, reflecting ongoing innovation and evolving customer needs.

- For instance, Siemens delivered 800 switchboards for a major rail infrastructure project in Spain, supporting power management across 240 kilometers of track.

By Voltage:

Low voltage panels dominate the Utility Distribution Panel Market, fueled by high installation rates in commercial buildings, residential complexes, and light industrial environments. These panels ensure safe power distribution at standard voltage levels and support scalable upgrades for future needs. Medium voltage panels cater to critical applications in industrial facilities, utilities, and large infrastructure projects that require higher capacity and greater fault tolerance. The distinction between low and medium voltage segments enables manufacturers to address a broad range of operational requirements, from household distribution to heavy-duty grid support.

- For instance, General Electric’s medium voltage panels are installed in 1,500 substations across Japan, supporting stable operation for regional utility grids.

By Mounting:

Mounting type further distinguishes market offerings, with flush mounting and surface mounting panels meeting diverse installation preferences. Flush mounting panels, designed to integrate seamlessly within walls or cabinetry, appeal to modern architecture and urban development seeking aesthetic appeal and space optimization. Surface mounting panels provide flexibility for retrofit projects, temporary setups, or facilities where internal wall installation proves impractical. It supports quick access for maintenance and expansion, making surface mounting a preferred choice in industrial or utility environments. Each mounting segment serves unique operational, logistical, and design needs, allowing the market to address the varied requirements of stakeholders across different sectors.

Segments:

Based on Panel Type:

- Distribution Boards

- Meter Panels

- Switchboards

- Fuse Panels

- Others

Based on Voltage:

- Low Voltage

- Medium Voltage

Based on Mounting:

- Flush Mounting

- Surface Mounting

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Utility Distribution Panel Market

North America Utility Distribution Panel Market grew from USD 853.12 million in 2018 to USD 1,152.07 million in 2024 and is projected to reach USD 1,718.77 million by 2032, reflecting a compound annual growth rate (CAGR) of 4.8%. North America is holding a 41% market share. The United States and Canada remain key markets, supported by continuous investments in grid modernization, renewable energy integration, and strong construction activity across urban and suburban areas. The region benefits from strict regulatory standards, a robust technological ecosystem, and early adoption of smart panels. Market players focus on innovative product launches to meet the evolving needs of utilities and commercial customers.

Europe Utility Distribution Panel Market

Europe Utility Distribution Panel Market grew from USD 616.95 million in 2018 to USD 813.60 million in 2024 and is anticipated to reach USD 1,143.34 million by 2032, with a CAGR of 4.0%. Europe accounts for 27% market share. Major countries such as Germany, France, and the United Kingdom drive regional growth, emphasizing energy efficiency, green building standards, and the transition toward decentralized energy systems. EU policies encourage the adoption of sustainable materials and advanced monitoring technologies in distribution panels. Manufacturers benefit from large-scale infrastructure investments and urban redevelopment projects across Western and Central Europe.

Asia Pacific Utility Distribution Panel Market

Asia Pacific Utility Distribution Panel Market grew from USD 406.66 million in 2018 to USD 600.62 million in 2024 and is projected to reach USD 1,009.06 million by 2032, posting the highest CAGR of 6.3%. Asia Pacific holds a 24% market share. China, Japan, and India are major contributors, with rapid industrialization, urban expansion, and significant investments in power infrastructure. The region experiences rising demand for both low and medium voltage panels in residential and commercial segments. Government initiatives supporting electrification and smart grid deployments further accelerate market penetration.

Latin America Utility Distribution Panel Market

Latin America Utility Distribution Panel Market grew from USD 87.43 million in 2018 to USD 117.72 million in 2024 and is estimated to reach USD 152.69 million by 2032, recording a CAGR of 2.9%. Latin America represents a 4% market share. Brazil and Mexico dominate regional sales, driven by ongoing investments in commercial construction and energy sector modernization. Demand for affordable and reliable power distribution solutions increases, with a gradual shift toward digital monitoring capabilities in urban centers.

Middle East Utility Distribution Panel Market

Middle East Utility Distribution Panel Market grew from USD 58.82 million in 2018 to USD 73.54 million in 2024 and is forecast to reach USD 92.67 million by 2032, achieving a CAGR of 2.6%. The Middle East holds a 2% market share. The United Arab Emirates and Saudi Arabia lead regional growth, supported by infrastructure expansion, large-scale construction projects, and national initiatives focused on renewable energy adoption. The market emphasizes panels with advanced safety features to meet the needs of critical sectors like oil and gas and smart city developments.

Africa Utility Distribution Panel Market

Africa Utility Distribution Panel Market grew from USD 36.54 million in 2018 to USD 54.44 million in 2024 and is anticipated to reach USD 66.43 million by 2032, with a CAGR of 2.1%. Africa contributes 2% market share. South Africa, Nigeria, and Egypt are the leading countries, where electrification programs and urbanization spur market activity. The market prioritizes cost-effective and durable panel solutions to support expanding grid networks and rural electrification. Manufacturers target growing infrastructure needs with panels tailored for diverse operating environments and limited maintenance resources.

Key Player Analysis

- Legrand

- Meba Electric Co., Ltd

- ABB

- Ags

- EAMFCO

- ESL POWER SYSTEMS, INC.

- General Electric

- Eaton

- alfanar Group

- Arranger Electric Co., Ltd

- CSE Solutions Pvt. Ltd.

- Hager Group

Competitive Analysis

The competitive landscape of the Utility Distribution Panel Market is characterized by the strong presence of leading players such as Legrand, ABB, Eaton, General Electric, Hager Group, and alfanar Group. These companies hold a dominant position due to their extensive product portfolios, global reach, and established reputations for quality and reliability. They focus on technological innovation, offering advanced panels with IoT connectivity, digital monitoring, and enhanced safety features to meet evolving industry standards and customer expectations. Continuous investments in research and development enable these players to launch new solutions that support smart grids, renewable energy integration, and energy-efficient operations.

Strategic collaborations, mergers, and acquisitions further strengthen their market positions, allowing access to new geographic markets and customer segments. These leading companies leverage their robust distribution networks and technical expertise to provide customized solutions for diverse residential, commercial, and industrial applications. Their emphasis on compliance with international safety and performance standards ensures strong customer trust and brand loyalty. The ongoing digital transformation in utility infrastructure offers these key players opportunities to expand their market share by addressing the increasing demand for intelligent, reliable, and future-ready distribution panel solutions worldwide.

Recent Developments

- In January 2025, Larsen & Toubro’s Power Transmission & Distribution (PT&D) division has secured significant orders in India and the Middle East. To bolster network reliability in India, the company will set up an Advanced Distribution Management System in West Bengal. L&T is internationally executing a 380 kV substation project in Saudi Arabia, a 400 kV substation in Kuwait, and additional extra high voltage substations such as a 400/132 kV substation in Dubai which expands infrastructure development in the region.

- In November 2024, Schneider Electric brought to market the Miluz ZeTa series of switches and sockets which now boast the first integrated Air Quality Indicator (AQI) in the market. This product line is stylish and smart, including options for surge protection and USB A+C ports. It works as part of the Wiser smart home ecosystem, making Miluz ZeTa smarter for modern homes while providing safety, energy efficiency, and upgraded connectivity.

- In November 2023, ABB introduced the Protecta Power panel board for commercial and industrial applications, equipped with digital monitoring, smart breakers, and a compact form factor. It provides reliable and secure power distribution with adaptable configurations, remote monitoring, and sub-metering, enhancing the infrastructure of ABB Smart Buildings.

- In August 2023, Eaton allocated more than USD 500 million to increase the North American manufacturing footprint and amplify production of voltage regulators, transformers, and busway products. These upgrades support increased utility, commercial, and industrial demand while improving manufacturing capacity and supporting grid modernization and infrastructure initiatives.

Market Concentration & Characteristics

The Utility Distribution Panel Market exhibits a moderate to high level of market concentration, with a few multinational corporations such as Legrand, ABB, Eaton, General Electric, and Hager Group commanding significant market share. These companies leverage their technological expertise, global distribution networks, and strong brand reputations to maintain a competitive edge. The market is characterized by steady demand across diverse sectors, including residential, commercial, and industrial applications, driven by the need for reliable power distribution and advanced energy management. It features a trend toward digitalization and smart solutions, with IoT-enabled panels and modular designs gaining traction among customers seeking efficiency, flexibility, and enhanced safety. The market landscape supports both established players and innovative new entrants, though strict regulatory requirements and high standards for quality, safety, and performance create entry barriers. The ability to offer customized solutions and integrate renewable energy sources distinguishes top performers in this evolving and technology-driven industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Panel Type, Voltage, Mounting and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Market adoption of IoT-enabled distribution panels will accelerate decision-making and maintenance efficiency.

- Manufacturers will expand modular panel designs to support scalable infrastructure across various sectors.

- Integration of renewable energy sources will drive demand for panels with advanced load-balancing capabilities.

- Manufacturers will invest in digital platforms to enable remote diagnostics and predictive maintenance.

- Regulatory focus on safety and energy efficiency standards will increase product innovation.

- Manufacturers will form strategic partnerships with utilities and technology firms to develop smart grid solutions.

- Emerging markets in Asia and Africa will attract investment as electrification and urbanization continue.

- Manufacturers will adopt sustainable materials and manufacturing practices to align with environmental goals.

- Workforce training programs will increase to support installation and maintenance of advanced panel systems.

- Competition will intensify as new entrants leverage digital technologies and customization to challenge established players.