Market Overview

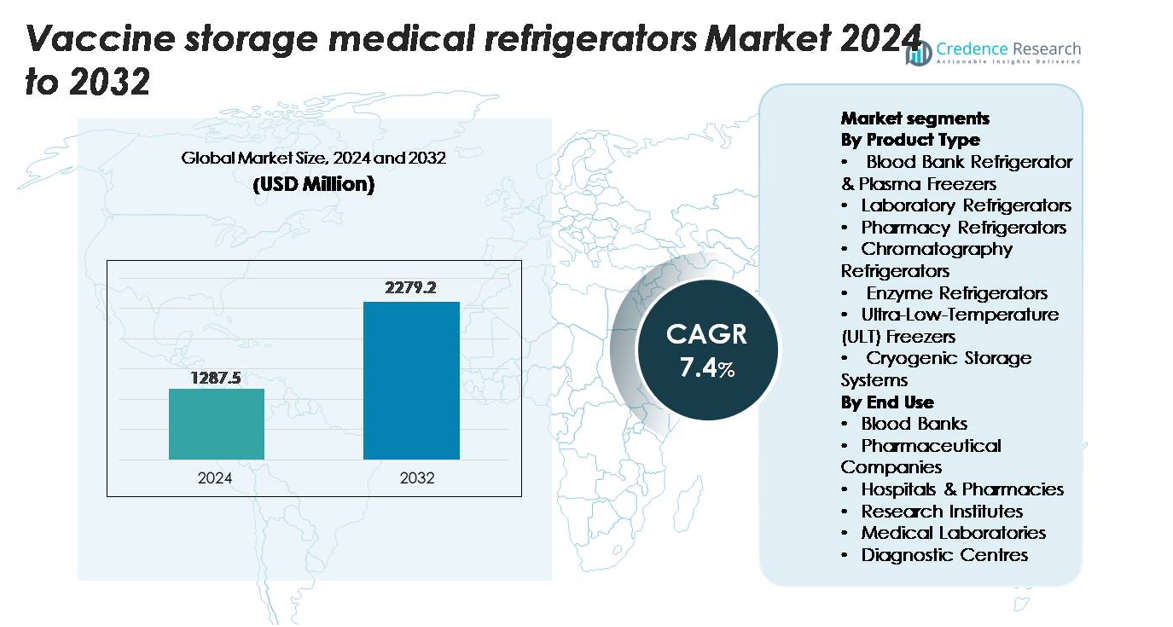

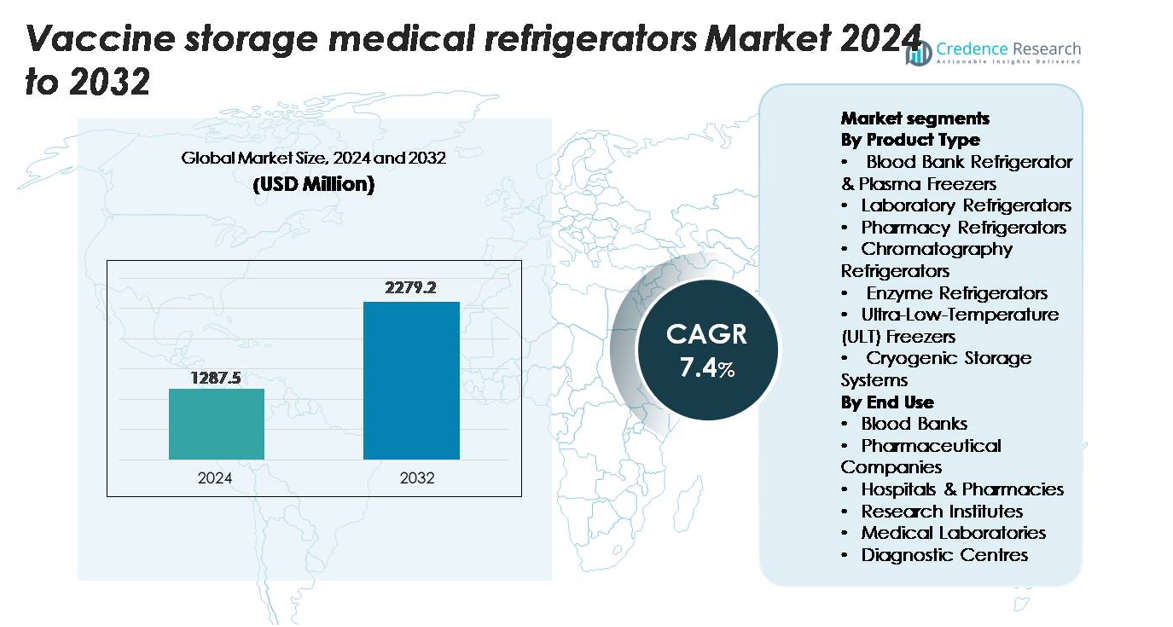

The Global Vaccine Storage Medical Refrigerators market was valued at USD 1,287.5 million in 2024 and is projected to reach USD 2,279.2 million by 2032, expanding at a CAGR of 7.4% throughout the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vaccine Storage Medical Refrigerators Market Size 2024 |

USD 1,287.5 million |

| Vaccine Storage Medical Refrigerators Market, CAGR |

7.4% |

| Vaccine Storage Medical Refrigerators Market Size 2032 |

USD 2,279.2 million |

The vaccine storage medical refrigerators market is shaped by strong participation from global manufacturers such as ARCTIKO, Cardinal Health, Blue Star Limited, Thermo Fisher Scientific, Dulas, Eppendorf, PHC Holdings Corporation, Standex International Corporation, Azenta, and EVERMED, each competing through advancements in temperature stability, ULT performance, and connected monitoring technologies. North America leads the market with an estimated 32–34% share, supported by stringent cold-chain regulations and high adoption of medical-grade and ULT systems. Europe follows with about 28–30%, driven by harmonized compliance standards, robust healthcare infrastructure, and sustained investment in biologics R&D, positioning both regions as core demand centers for advanced vaccine storage solutions.

Market Insights

- The vaccine storage medical refrigerators market reached USD 1,287.5 million in 2024 and is projected to hit USD 2,279.2 million by 2032, registering a 7.4% CAGR during the forecast period.

- Market growth is driven by expanding global immunization programs, rising biologics and mRNA vaccine production, and stricter temperature-control compliance across hospitals, pharmacies, and pharmaceutical manufacturing facilities.

- Key trends include accelerated adoption of ULT and cryogenic systems, increasing integration of IoT-based temperature monitoring, and higher demand for energy-efficient, WHO-PQ-ready medical-grade units across diverse healthcare environments.

- Competition intensifies as players such as Thermo Fisher Scientific, PHC Holdings Corporation, ARCTIKO, Eppendorf, Azenta, and Blue Star Limited focus on precision-control technologies while restraints include high installation costs and challenges in maintaining storage reliability in power-unstable regions.

- Regionally, North America holds 32–34%, followed by Europe at 28–30% and Asia-Pacific at 25–27%; by product type, blood bank and plasma refrigerators lead with ~34–36% share, strengthening overall market momentum.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Across product types, Blood Bank Refrigerators & Plasma Freezers hold the dominant share of the vaccine storage medical refrigerators market, accounting for an estimated 34–36% due to their essential role in handling temperature-sensitive blood derivatives and vaccines within the 2–8°C range. Laboratory and Pharmacy Refrigerators follow, benefiting from expanding hospital dispensing points. Meanwhile, ULT freezers and cryogenic storage systems show the fastest growth as mRNA, viral-vector, and advanced biologic vaccines require −70°C to −150°C conditions. Increasing regulatory emphasis on validated cold-chain equipment further strengthens demand across all high-precision storage categories.

- For instance, PHC Holdings Corporation’s MDF-U731M plasma freezer maintains a uniform –30°C profile with ±1.0°C stability and features a pull-down time of 25 minutes for rapid temperature recovery, ensuring integrity during frequent access.

By End Use

Within end-use segmentation, Hospitals & Pharmacies represent the leading share at approximately 40–42%, driven by their central role in vaccine administration and continuous immunization workloads. Pharmaceutical companies form the next major segment, supported by rising biologics manufacturing and stringent storage compliance across R&D and production sites. Blood Banks maintain stable demand for controlled plasma and vaccine storage, while Research Institutes, Medical Laboratories, and Diagnostic Centres increasingly adopt ULT and cryogenic systems to support vaccine trials and biospecimen preservation. Growth across these segments is propelled by expanding immunization programs and mandatory temperature-monitoring standards.

- For instance, Thermo Scientific’s TSG505 pharmacy-grade refrigerator uses solid-state cooling with temperature stability within ±1°C, supporting reliable storage for clinical, research, and industrial use.

Key Growth Drivers

Expansion of Global Immunization Programs and Cold Chain Modernization

Growing national and international vaccination initiatives continue to strengthen demand for vaccine storage medical refrigerators as governments upgrade cold-chain infrastructure to support wider coverage. Large-scale immunization campaigns for polio, HPV, pneumococcal, influenza, and COVID-19 boosters require reliable 2–8°C storage at all distribution levels, from central hubs to last-mile clinics. Ministries of health and global alliances are investing in standardized refrigeration fleets that ensure temperature stability across diverse climates and remote geographies. The shift toward electronically monitored cold-chain assets equipped with digital sensors, onboard data logging, and remote temperature alerts further accelerates adoption. In emerging economies, donor-funded cold-chain strengthening programs add stimulus, particularly in rural and peri-urban facilities. As vaccination schedules expand and more multidose vials enter routine use, the need for validated, energy-efficient, and continuously monitored storage solutions becomes a structural growth driver for the market worldwide.

- For instance, Dulas has deployed its Solar Direct Drive VC150SDD refrigerator in remote regions, offering 150-liter vaccine capacity and maintaining +4°C stability for over 72 hours during power outages, ensuring uninterrupted cold-chain operations.

Rising Demand for Biologics, mRNA Vaccines, and Advanced Therapeutics

The rapid advancement of biologics and next-generation vaccine technologies significantly increases demand for specialized refrigeration and ultra-low-temperature storage systems. mRNA vaccines, viral-vector platforms, and cell-based formulations require precise temperature control ranging from −20°C to −150°C, driving procurement of ULT freezers and cryogenic units across pharmaceutical companies, CROs, and biotechnology labs. As biotech pipelines diversify, storage needs become more stringent, emphasizing thermal uniformity, rapid pull-down capability, and minimal temperature excursion risk. Increasing global investment in mRNA vaccine plants, genomic research, and clinical development centers also fuels equipment installations. This shift toward temperature-sensitive biologics elevates the importance of validated storage equipment compliant with regulatory requirements for potency preservation. Consequently, high-performance refrigeration systems have become indispensable infrastructure for modern vaccine development and manufacturing, positioning biologics-driven growth as a critical long-term market catalyst.

- For instance, Thermo Fisher Scientific’s TSX60086A ULT freezer supports –86°C set points with an energy consumption of 9.1 kWh/day and temperature uniformity of ±5°C, enabling reliable storage of mRNA vaccine materials.

Strengthening Regulatory Oversight for Vaccine Safety and Temperature Compliance

Stricter global regulations concerning vaccine integrity and temperature maintenance are compelling healthcare facilities to upgrade to certified medical-grade refrigerators. Agencies now require continuous monitoring, calibration, and documented evidence of cold-chain compliance, prompting replacement of domestic-grade units with purpose-built medical models. Accreditation bodies mandate features such as uniform airflow, microprocessor controls, digital alarms, lockable compartments, and stabilized temperature zones to eliminate the risks of freezing, overheating, or excursion-related wastage. These compliance standards apply not only to hospitals but also to pharmacies, diagnostic centers, and immunization outreach programs. As quality audits intensify and penalties for vaccine spoilage grow, healthcare providers increasingly invest in advanced refrigeration systems that offer validated performance. The rising prioritization of vaccine safety, paired with broader accountability for storage conditions, ensures sustained demand for high-precision, regulation-aligned cold-chain equipment.

Key Trends & Opportunities

Rapid Adoption of Smart, Connected, and Energy-Efficient Storage Technologies

A major trend reshaping the vaccine storage industry is the integration of digital and IoT-enabled technologies for real-time monitoring and automated compliance. Medical refrigerators now employ cloud-linked temperature logging, remote alarms, predictive maintenance, and advanced diagnostic functions that reduce human error and protect high-value vaccines. This connectivity supports central monitoring across multi-site hospital networks and national immunization programs. At the same time, energy-efficient compressors, natural refrigerants, and adaptive cooling technologies create opportunities for facilities seeking lower operating costs and greener infrastructure. Manufacturers investing in smart features such as touchscreen interfaces, battery-backed data storage, and automated excursion reporting are well-positioned to capture demand from technologically progressive healthcare systems. As sustainability standards tighten and digital traceability becomes compulsory, the smart-refrigeration segment offers substantial growth potential.

- For instance, Helmer Scientific’s GX Solutions vaccine refrigerators use i.C³® Pro monitoring with 1-minute data logging and remote alarm alerts, while delivering ±1°C temperature uniformity verified under NSF/ANSI 456 performance testing.

Growing Opportunities in Emerging Markets and Last-Mile Cold-Chain Expansion

Emerging economies represent a significant opportunity as governments prioritize modernization of primary healthcare facilities and immunization sites. Remote clinics, rural dispensaries, and community health centers require reliable refrigerators capable of maintaining precise temperatures under unstable grid conditions. This has accelerated demand for solar-powered medical refrigerators, battery-supported units, and hybrid energy systems designed for low-resource environments. International funding bodies continue to support cold-chain scale-up, providing capital for procurement, installation, and field training. As nations expand routine immunization programs and integrate new vaccine types, last-mile refrigeration becomes a strategic priority. Manufacturers offering durable, transport-friendly, and climate-resilient solutions stand to benefit greatly from this long-term expansion trend.

- For instance, B Medical Systems’ VC65-SDD Solar Direct Drive refrigerator delivers a 64.5-liter vaccine load and maintains a stable +4°C for over 100 hours of autonomy during low-sun conditions, a performance validated under WHO PQS code E003/044 testing, making it suitable for last-mile clinics.

Key Challenges

High Installation, Ownership, and Maintenance Costs in Resource-Limited Settings

One of the most persistent challenges for the vaccine storage market is the high cost of procurement, installation, and long-term maintenance associated with medical-grade refrigeration systems. Healthcare facilities—especially in low-income or rural regions—struggle with budget constraints, limited access to spare parts, and insufficient technical capacity for equipment upkeep. ULT freezers and cryogenic systems require robust electrical infrastructure, stable voltage supply, and specialized maintenance expertise, all of which add operational complexity. Additionally, energy consumption and calibration requirements raise total cost of ownership. These financial and logistical barriers slow down adoption, particularly where cold-chain funding is intermittent or donor-dependent. Overcoming this challenge requires cost-optimized models, modular service programs, and broader access to technical support networks.

Risk of Temperature Excursions Due to Power Instability and Human Error

Temperature excursions remain a major challenge across healthcare facilities, often caused by inconsistent power supply, outdated equipment, inadequate monitoring practices, or human handling errors. Power outages, improper door openings, poor load distribution, and incorrect thermostat settings can compromise vaccine potency within minutes. Even with advanced equipment, failures in process discipline or lack of staff training may result in unnoticed temperature deviations. Facilities without automated monitoring face higher risks of vaccine spoilage, wastage, and compliance violations. This challenge is particularly acute in regions with fragile electrical networks. As cold-chain systems expand, ensuring consistently reliable storage conditions requires investment in backup power, continuous monitoring tools, and ongoing workforce training.

Regional Analysis

North America

North America holds the largest share of the vaccine storage medical refrigerators market, supported by advanced healthcare infrastructure, strict CDC-aligned temperature compliance standards, and rapid adoption of ULT and smart-connected refrigeration systems. Strong immunization programs, extensive pharmaceutical R&D, and continuous replacement of legacy cold-chain assets sustain demand across hospitals, pharmacies, and biotech facilities. The presence of leading manufacturers and widespread integration of digital monitoring platforms further strengthens market dominance. Government-backed vaccination initiatives and regulatory emphasis on validated medical-grade storage keep North America at the forefront of high-performance vaccine refrigeration solutions.

Europe

Europe maintains a significant share driven by stringent regulatory frameworks, high vaccination coverage, and rapid modernization of cold-chain infrastructure across public health systems. Hospitals and research institutes increasingly adopt ULT and cryogenic equipment to support expanding biologics and advanced therapy production. The region benefits from strong government funding, energy-efficiency mandates, and facility-level temperature validation requirements. Widespread digitization and harmonized EU standards encourage adoption of monitored, compliance-ready refrigerators. Demand remains concentrated in Germany, the U.K., France, and the Nordics, where healthcare investment and life-science R&D activity are consistently high.

Asia-Pacific

Asia-Pacific exhibits the fastest growth, driven by expanding immunization programs, increasing healthcare expenditure, and large-scale investments in vaccine manufacturing capacity across China, India, South Korea, and Japan. Government-backed cold-chain strengthening initiatives enhance adoption of medical-grade refrigerators in primary and secondary healthcare facilities. Rising biologics production and clinical research activity increase demand for ULT freezers and cryogenic systems. The region’s growing population, urbanization, and pharmaceutical outsourcing accelerate market penetration. Improved electrification and adoption of solar-driven units in remote areas further contribute to Asia-Pacific’s expanding market position.

Latin America

Latin America continues to expand its share supported by national immunization plans, increased healthcare spending, and modernization of vaccine distribution networks. Brazil, Mexico, and Argentina lead demand for medical-grade refrigerators, particularly in public hospitals and regional vaccination centers. Challenges related to inconsistent power supply have increased interest in energy-stable and battery-supported units. International funding programs aid cold-chain expansion across rural and underserved regions. The growing presence of pharmaceutical manufacturing and clinical trial activity also supports adoption of ULT systems, gradually strengthening the region’s contribution to the global market.

Middle East & Africa

The Middle East & Africa market is expanding steadily as governments prioritize immunization access, strengthen primary healthcare infrastructure, and invest in temperature-controlled storage under regional vaccination programs. Gulf countries drive demand for advanced medical refrigerators, while African nations focus on solar-powered and voltage-stabilized units to address grid instability. International agencies continue to support large-scale cold-chain upgrades, especially for childhood vaccines and outbreak preparedness. The region’s growing pharmaceutical presence and rising number of diagnostic laboratories contribute to incremental adoption of ULT and cryogenic equipment, although overall penetration remains comparatively lower.

Market Segmentations:

By Product Type

- Blood Bank Refrigerator & Plasma Freezers

- Laboratory Refrigerators

- Pharmacy Refrigerators

- Chromatography Refrigerators

- Enzyme Refrigerators

- Ultra-Low-Temperature (ULT) Freezers

- Cryogenic Storage Systems

By End Use

- Blood Banks

- Pharmaceutical Companies

- Hospitals & Pharmacies

- Research Institutes

- Medical Laboratories

- Diagnostic Centres

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the vaccine storage medical refrigerators market is characterized by a mix of global manufacturers and specialized regional suppliers competing on performance reliability, temperature accuracy, regulatory compliance, and energy efficiency. Leading players focus on developing medical-grade units with advanced microprocessor controls, uniform airflow, and integrated data-logging technologies to meet strict WHO, CDC, and ISO standards. Companies increasingly differentiate through IoT-enabled monitoring platforms, remote alarm systems, and cloud-based compliance reporting that minimize temperature excursion risks. Expansion into ULT and cryogenic storage categories has intensified competition as biologics and mRNA platforms gain prominence. Major manufacturers also invest in sustainable designs using natural refrigerants and low-power compressors to meet hospital energy-reduction targets. Strategic partnerships with pharmaceutical companies, hospitals, and immunization programs enable deeper market penetration, while distributors and service providers enhance competitiveness through rapid installation, calibration, and maintenance support. Overall, innovation-driven product development and service quality define market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ARCTIKO

- Cardinal Health

- Blue Star Limited

- Thermo Fisher Scientific

- Dulas

- Eppendorf

- PHC Holdings Corporation

- Standex International Corporation

- Azenta

- EVERMED

Recent Developments

- In May 2025, ARCTIKO further launched its Flexaline+ series as an upgraded biomedical refrigeration range, balancing precision, efficiency and compliance for clinical and pharmaceutical cold storage needs.

Report Coverage

The research report offers an in-depth analysis based on Product type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly shift toward smart, connected refrigerators with real-time temperature monitoring and automated compliance reporting.

- Adoption of ultra-low-temperature and cryogenic systems will accelerate as mRNA, viral-vector, and cell-based vaccines expand globally.

- Healthcare facilities will replace domestic-grade units with medical-grade models to meet tightening regulatory and audit requirements.

- Solar-powered and hybrid energy vaccine refrigerators will see wider deployment in regions with unstable power infrastructure.

- Manufacturers will focus on energy-efficient compressors and natural refrigerants to meet sustainability targets.

- Integration of AI-driven predictive maintenance will reduce downtime and improve cold-chain reliability.

- Pharmaceutical companies will expand their storage fleets to support growing biologics pipelines and decentralized production models.

- Hospitals and pharmacies will adopt centralized digital platforms to monitor multi-site storage assets.

- Emerging markets will increase investment in last-mile cold-chain infrastructure to strengthen immunization coverage.

- Service-based models, including remote monitoring support and long-term maintenance contracts, will gain prominence.