Market Overview

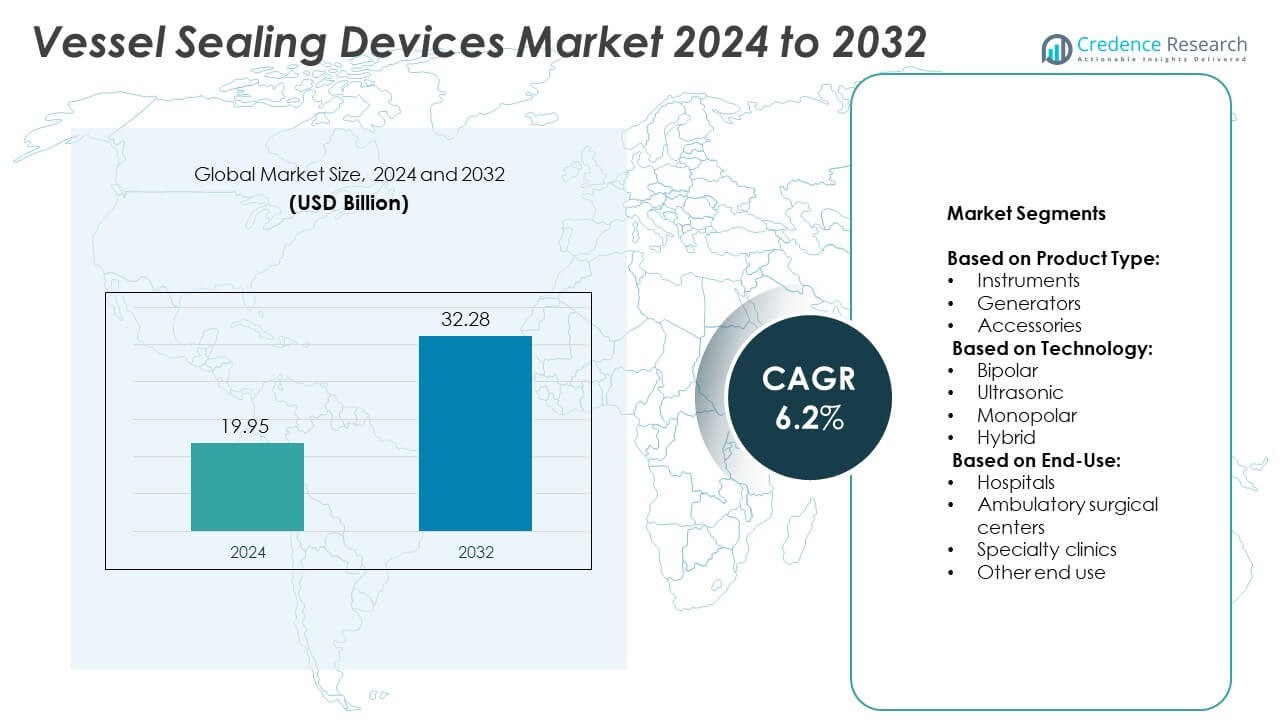

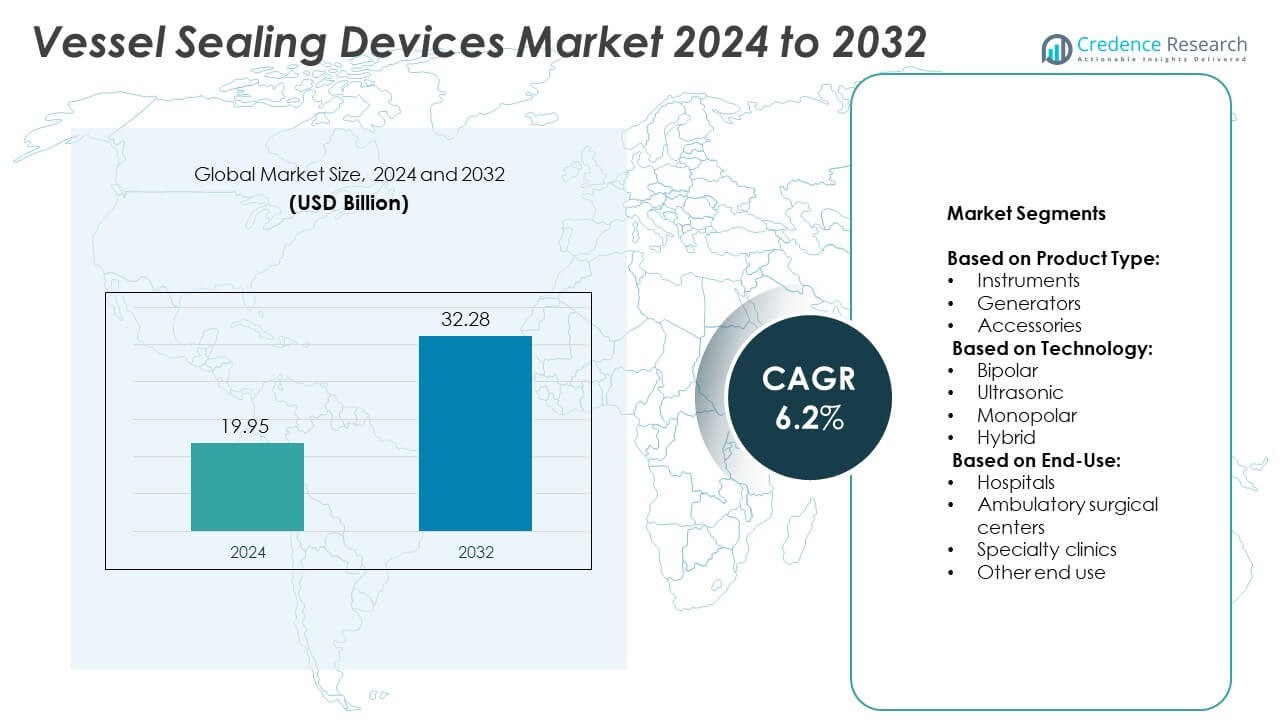

Vessel Sealing Devices Market size was valued at USD 19.95 billion in 2024 and is anticipated to reach USD 32.28 billion by 2032, at a CAGR of 6.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vessel Sealing Devices Market Size 2024 |

USD 19.95 Billion |

| Vessel Sealing Devices Market, CAGR |

6.2% |

| Vessel Sealing Devices Market Size 2032 |

USD 32.28 Billion |

The vessel sealing devices market grows due to rising demand for minimally invasive surgeries, increased surgical volumes, and a shift toward outpatient care. Hospitals and surgical centers adopt energy-based sealing systems to improve safety, reduce blood loss, and shorten procedure times. Advancements in ultrasonic, bipolar, and hybrid technologies enhance precision and reduce thermal damage. Manufacturers focus on feedback-enabled devices and ergonomic designs. Growing healthcare investments in emerging markets further support global expansion and drive product innovation across surgical applications.

North America leads the vessel sealing devices market due to advanced surgical infrastructure and high procedural volume. Europe follows with strong adoption of energy-based systems across hospitals and ambulatory centers. Asia Pacific shows rapid growth supported by rising healthcare investments and increasing access to surgical care. Latin America and the Middle East & Africa expand steadily through public health initiatives. Key players shaping this landscape include Olympus Corporation, Medtronic plc, Johnson & Johnson, and Intuitive Surgical.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The vessel sealing devices market was valued at USD 19.95 billion in 2024 and is projected to reach USD 32.28 billion by 2032, growing at a CAGR of 6.2%.

- Rising demand for minimally invasive surgeries and increased chronic disease cases drive steady market growth.

- Hospitals and surgical centers adopt feedback-enabled and hybrid vessel sealing systems to improve safety and reduce thermal damage.

- Key players focus on ergonomic designs, disposable product lines, and OEM partnerships to gain competitive advantage.

- High equipment cost and limited access in resource-constrained regions restrict broader market penetration.

- North America leads due to advanced healthcare infrastructure, followed by Europe and Asia Pacific showing strong growth.

- Companies like Olympus Corporation, Johnson & Johnson, Medtronic plc, and Intuitive Surgical shape global product innovation and adoption.

Market Drivers

Strong Demand for Minimally Invasive Procedures Across Surgical Disciplines Supports Device Adoption

The Vessel Sealing Devices market benefits from the rising demand for minimally invasive surgeries across general, gynecological, urological, and cardiovascular procedures. Surgeons prefer vessel sealing systems due to their ability to reduce blood loss, improve visibility, and shorten operation time. Patients also show preference for less invasive approaches due to reduced recovery time and lower risk of complications. Hospitals invest in advanced sealing devices to meet growing patient expectations and optimize procedural outcomes. The shift toward day surgeries further accelerates the adoption of energy-based sealing technologies. It reinforces the need for compact, efficient devices that deliver reliable performance across multiple tissue types.

- For instance, Medtronic’s LigaSure technology has been adopted in more than 35 million procedures globally, demonstrating high reliability across multiple surgical disciplines and countries

Rising Surgical Volume Driven by Chronic Disease Prevalence Expands Device Utilization Globally

Chronic diseases such as cancer, obesity, and cardiovascular disorders continue to increase worldwide, leading to a higher number of surgical interventions. This trend directly boosts the demand for vessel sealing devices across both inpatient and outpatient facilities. Health systems face mounting pressure to manage surgical backlogs and increase operating room efficiency. Vessel sealing technology provides reliable vessel closure, which supports reduced procedural times and minimizes complications. It also contributes to improved throughput in high-volume centers. The Vessel Sealing Devices market grows in response to healthcare systems seeking faster and safer surgical solutions.

- For instance, Olympus highlights that its Thunderbeat device can simultaneously seal and cut vessels up to 7 mm in diameter, offering rapid-cutting performance with minimal thermal spread, according to a March 2012 FDA clearance announcement

Technological Innovations Focused on Precision, Safety, and Ergonomics Drive Market Expansion

Advancements in energy-based technologies, such as bipolar and ultrasonic systems, significantly enhance device performance. Manufacturers introduce tools with real-time feedback, adaptive energy delivery, and improved sealing consistency. These innovations help reduce thermal spread and preserve surrounding tissue integrity. Ergonomically designed handpieces and intuitive controls improve surgeon comfort and precision during long procedures. It strengthens product differentiation and drives replacement cycles in hospitals and ambulatory surgical centers. The Vessel Sealing Devices market benefits from innovation that prioritizes clinical performance and ease of use.

Favorable Regulatory Approvals and Global Healthcare Investments Strengthen Market Opportunities

Governments and regulatory bodies support faster approvals of vessel sealing technologies through well-defined frameworks and safety standards. This trend encourages faster adoption of new-generation products across mature and emerging markets. Rising healthcare infrastructure investment in countries like India, China, and Brazil also improves market penetration. Public-private partnerships and funding programs enable hospitals to procure high-performance surgical tools. It supports greater access to advanced sealing systems beyond Tier 1 cities. The Vessel Sealing Devices market aligns with national surgical care improvement initiatives and growing global health expenditure.

Market Trends

Shift Toward Robotic and Image-Guided Surgeries Encourages Demand for Advanced Sealing Systems

The rise in robotic and image-guided surgeries increases the need for highly compatible vessel sealing devices. Surgeons expect seamless integration with robotic platforms for improved precision and control. Manufacturers design specialized sealing instruments that fit robotic arms and deliver controlled energy for safe vessel closure. Hospitals adopt robotic-assisted systems in oncology, gynecology, and urology, expanding the scope of device utilization. It supports multi-specialty adoption and drives innovation in miniaturized, articulating sealing tools. The Vessel Sealing Devices market aligns with this trend by offering tools that match robotic workflow demands.

- For instance, Medtronic’s newly CE-marked LigaSure RAS Maryland instrument for its Hugo robotic-assisted system can reliably seal vessels and thick tissue up to 7 mm in diameter, and seals in approximately 2 seconds, while minimizing thermal spread

Growing Popularity of Disposable and Single-Use Devices Promotes Infection Control

The global healthcare industry sees strong movement toward disposable vessel sealing tools to prevent cross-contamination and reduce sterilization costs. Hospitals prefer single-use instruments for procedures with high infection risk or in facilities with limited reprocessing capacity. This trend supports consistent performance and quicker surgical turnaround. It also simplifies inventory management and reduces the burden on sterile processing departments. Manufacturers respond by expanding product portfolios with cost-effective, high-performance disposable sealing instruments. The Vessel Sealing Devices market gains traction in both high-volume hospitals and small surgical centers due to this shift.

- For instance, Olympus’ POWERSEAL™ single-use Sealer/Divider devices offer a greater than 99% probability of vessel burst pressure above 360 mmHg, for vessels up to 7 mm, and 97% of surgeons in pre-launch clinical cases reported equal or fewer jaw cleanings compared to their current energy device

Integration of Feedback-Enabled Energy Delivery Enhances Precision and Safety in Tissue Sealing

Technology developers focus on integrating sensors and smart algorithms to control energy output in real time. Feedback-enabled vessel sealing devices monitor tissue resistance and adjust output for optimal seal strength. This minimizes thermal spread, reduces tissue charring, and ensures consistent outcomes. Surgeons benefit from predictable performance across different vessel types and sizes. It leads to fewer complications and greater procedural confidence. The Vessel Sealing Devices market evolves with these advancements in intelligent energy control.

Rising Adoption in Emerging Markets Through Expanding Healthcare Access and Surgeon Training

Emerging economies expand access to advanced surgical care through growing hospital infrastructure and training initiatives. Governments and NGOs support skill development in electrosurgery and laparoscopic procedures. Surgeons in Tier 2 and Tier 3 cities increasingly adopt energy-based vessel sealing tools for general and specialty surgeries. It reflects higher awareness, affordability, and clinical acceptance across diverse regions. Manufacturers target these markets with portable, cost-efficient systems tailored for limited-resource settings. The Vessel Sealing Devices market benefits from increasing penetration in underserved geographies.

Market Challenges Analysis

High Equipment Cost and Limited Access in Resource-Constrained Settings Restrict Broader Market Penetration

The high cost of advanced vessel sealing systems poses a major barrier for small hospitals and clinics. Many facilities in low- and middle-income countries struggle to invest in capital-intensive surgical tools. Procurement delays and limited reimbursement further slow the adoption of energy-based sealing devices. It impacts procedural efficiency in rural or underfunded health systems. Manufacturers face challenges in scaling distribution and support infrastructure in these regions. The Vessel Sealing Devices market must address pricing flexibility and localized production to improve accessibility.

Steep Learning Curve and Device Standardization Issues Hinder Seamless Clinical Integration

Vessel sealing technologies vary in energy delivery methods, controls, and compatibility across surgical systems. Surgeons and operating room staff require proper training to use these tools safely and effectively. Hospitals encounter challenges in maintaining standardized protocols, especially in high-turnover environments. It may lead to inconsistent sealing performance and increase the risk of procedural errors. Delays in certification and user adaptation can limit device utilization even after purchase. The Vessel Sealing Devices market must prioritize education, intuitive design, and simplified interfaces to ease clinical integration.

Market Opportunities

Expansion of Ambulatory Surgical Centers and Day Care Facilities Creates Strong Growth Potential

Ambulatory surgical centers (ASCs) continue to expand due to demand for outpatient procedures with shorter recovery times. These facilities prioritize efficiency, low complication rates, and faster patient turnaround. Vessel sealing devices support these needs by enabling faster vessel closure and reducing blood loss. Manufacturers have the opportunity to develop compact, portable devices tailored for ASC environments. It allows easier adoption in space-constrained settings without compromising clinical outcomes. The Vessel Sealing Devices market benefits from this shift toward decentralized, high-efficiency surgical care.

Rising Demand for Customized Devices and OEM Partnerships Drives Long-Term Product Development

Hospitals and device integrators increasingly seek customized vessel sealing tools that align with specific surgical platforms. This opens opportunities for original equipment manufacturer (OEM) partnerships focused on co-developing compatible, branded systems. Companies that offer modular components and flexible configurations gain a competitive edge in large-scale procurement contracts. It promotes deeper integration with robotic, laparoscopic, and hybrid operating suites. The Vessel Sealing Devices market can capitalize on these collaborations by aligning product development with user-specific performance goals and workflows.

Market Segmentation Analysis:

By Product Type:

Instruments lead the product segment due to their direct use in vessel sealing across multiple surgeries. These include handheld tools with energy delivery capabilities, preferred for their precision and ergonomic design. Hospitals prioritize instruments that integrate sealing and cutting functions to save time and improve safety. Generators also hold a notable share, supplying controlled energy for bipolar and ultrasonic devices. It enables accurate energy modulation, supporting better sealing outcomes. Accessories, such as footswitches and cables, complement primary devices and ensure seamless surgical workflow. The Vessel Sealing Devices market grows steadily across all three product types, driven by increased procedural demand.

- For instance, Ethicon’s ENSEAL X1 Curved Jaw Tissue Sealer features a jaw 3.4 mm longer and a cut length 3.5 mm longer than LigaSure Maryland. In bench tests on porcine arteries, it achieved a burst pressure of 1 055 mmHg, compared to 862 mmHg for LigaSure Maryland

By Technology:

Bipolar technology remains the most widely used, favored for its effectiveness, safety, and compatibility with standard electrosurgical units. It provides consistent vessel closure and reduced lateral thermal spread, making it suitable for both open and laparoscopic procedures. Ultrasonic technology is gaining traction for its ability to cut and coagulate with minimal smoke and precise energy delivery. It is preferred in advanced laparoscopic and robotic-assisted surgeries. Monopolar technology still finds use in general surgeries but is gradually being replaced by safer, energy-efficient systems. Hybrid technology combines bipolar and ultrasonic capabilities and is emerging in complex surgical environments. The Vessel Sealing Devices market reflects rising preference for systems that offer speed, accuracy, and reduced post-operative risks.

- For instance, Intuitive’s Vessel Sealer Extend, used with its E-200 generator, can seal twice as fast as when used with the older ERBE VIO dV generator. The seals it achieves can withstand more than three times normal systolic pressure, while maintaining minimal lateral thermal spread of 1–2 mm.

By End-Use:

Hospitals account for the largest end-use share, driven by high surgical volumes and advanced infrastructure. They demand multi-functional sealing systems to handle a broad range of procedures in general surgery, gynecology, and urology. Ambulatory surgical centers show rapid adoption due to the shift toward outpatient surgeries and demand for compact, efficient devices. Specialty clinics also contribute to growth, especially those focused on oncology, ENT, and cardiovascular care. Other end-use settings, such as veterinary and rural surgical units, are adopting basic vessel sealing tools to improve procedural efficiency. The Vessel Sealing Devices market caters to diverse clinical needs by offering tailored solutions across healthcare settings.

Segments:

Based on Product Type:

- Instruments

- Generators

- Accessories

Based on Technology:

- Bipolar

- Ultrasonic

- Monopolar

- Hybrid

Based on End-Use:

- Hospitals

- Ambulatory surgical centers

- Specialty clinics

- Other end use

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for 38.7% share of the global vessel sealing devices market in 2024. This dominance stems from the region’s advanced healthcare infrastructure, high surgical volumes, and strong adoption of minimally invasive procedures. Hospitals across the United States and Canada invest in technologically advanced sealing tools to support general, gynecologic, and colorectal surgeries. Robotic-assisted and laparoscopic procedures are widespread, further fueling the demand for compatible sealing devices. Surgeons and operating room teams in North America also benefit from structured training programs and early exposure to electrosurgical systems. Favorable reimbursement structures encourage hospitals and ambulatory surgical centers to adopt high-cost, high-performance instruments. The presence of leading manufacturers and medical technology innovators continues to push the adoption of feedback-enabled, energy-efficient sealing systems across major healthcare facilities.

Europe

Europe held a market share of 26.5% in 2024, supported by high clinical awareness and stringent healthcare quality standards. Countries like Germany, France, and the United Kingdom are early adopters of smart surgical tools, including bipolar and ultrasonic vessel sealing systems. The market benefits from growing demand for day surgeries and expanding use of ambulatory surgical centers across Western Europe. Hospitals in the region emphasize clinical precision, shorter procedural time, and better patient outcomes, which promotes interest in intelligent energy systems with real-time feedback. European governments also fund surgical innovation and education programs, further improving technology penetration. Healthcare providers prioritize safety and standardization, which aligns well with hybrid vessel sealing platforms offering better control and lower thermal damage. Adoption is slower in Eastern Europe, but rising investments in surgical care infrastructure are gradually closing the gap.

Asia Pacific

Asia Pacific captured 21.3% share of the vessel sealing devices market in 2024 and is expected to grow at the fastest rate through 2032. Rapid urbanization, improving healthcare access, and rising surgical volumes across China, India, Japan, and Southeast Asia drive regional expansion. Governments invest in hospital infrastructure and surgical equipment modernization programs, especially in Tier 2 and Tier 3 cities. Local and international manufacturers target this region with cost-effective, compact, and energy-efficient devices tailored for general and specialty surgeries. Surgeons in high-volume public hospitals increasingly adopt bipolar systems due to reliability and low operational costs. Ultrasonic and hybrid technologies are also gaining attention in top-tier academic and oncology centers. The market reflects a strong push toward clinical standardization and expanded surgeon training programs to improve the use of vessel sealing systems across diverse healthcare settings.

Latin America

Latin America accounted for 8.1% of the global market in 2024, supported by growing investment in surgical care infrastructure and public health systems. Countries such as Brazil, Mexico, and Argentina drive demand through public-private partnerships and expanding insurance coverage. Hospitals seek affordable vessel sealing instruments to manage high patient loads and reduce complications. Reprocessing limitations and infection control priorities also support a shift toward disposable and single-use sealing tools. Surgeons adopt bipolar and monopolar systems in open procedures, while laparoscopic capabilities expand gradually in urban centers. Local distributors play a key role in improving access to certified, reliable electrosurgical equipment. Training and technical support remain a challenge, but continued focus on surgical safety creates space for new market entrants and technology transfer initiatives.

Middle East & Africa

The Middle East & Africa represented 5.4% of the vessel sealing devices market in 2024. The region shows steady growth due to healthcare modernization efforts in the Gulf Cooperation Council (GCC) countries and rising surgical procedures across South Africa and Nigeria. Major hospitals in Saudi Arabia and the UAE adopt ultrasonic and hybrid systems to improve surgical efficiency and meet international care standards. Rural and underserved areas still rely on basic bipolar sealing instruments due to limited resources and inconsistent power infrastructure. Governments partner with global health agencies to enhance surgical training and provide access to essential equipment. It creates opportunities for mid-tier and budget-friendly systems that meet performance benchmarks while addressing cost constraints. The growing presence of private hospitals and international medical providers supports long-term market expansion in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Olympus Corporation

- Micromed

- Johnson & Johnson

- BOWA Medical

- OmniGuide Holdings

- KLS Martin Group

- Bolder Surgical

- Medtronic plc

- Erbe Elektromedizin

- Intuitive Surgical

- CONMED Corporation

- Braun

Competitive Analysis

The competitive landscape of the vessel sealing devices market includes Olympus Corporation, Micromed, Johnson & Johnson, BOWA Medical, OmniGuide Holdings, KLS Martin Group, Bolder Surgical, Medtronic plc, Erbe Elektromedizin, Intuitive Surgical, CONMED Corporation, and B. Braun. These companies compete through innovation, global distribution, and diverse product portfolios. Leading players invest in R&D to improve energy delivery precision, device ergonomics, and feedback-enabled systems. Companies with strong presence in minimally invasive and robotic-assisted surgery maintain an edge through integrated platforms. Several manufacturers expand their footprint in emerging markets by launching cost-effective, portable systems tailored to local needs. Strategic moves include OEM collaborations, clinical training programs, and acquisitions to strengthen surgical technology offerings. Firms also enhance their product differentiation by focusing on safety features and disposable device lines. While global brands lead in advanced hybrid and ultrasonic systems, smaller players gain ground by offering specialized tools for niche surgical needs. Competitive intensity remains high, with continuous demand for customization, speed, and procedural safety. Players that align with evolving hospital procurement models and regulatory standards are better positioned to sustain market share. The market favors companies capable of combining clinical performance, training support, and service infrastructure in a single value proposition.

Recent Developments

- In 2024, Olympus Corporation launched two new jaw designs—POWERSEAL Straight Jaw, Double-action (SJDA) and POWERSEAL Curved Jaw, Single-action (CJSA).

- In 2024, Intuitive Surgical received FDA 510(k) clearance for the da Vinci 5 system, placing 362 systems by year-end and securing a growing footprint

- In 2023, Ethicon (Johnson & Johnson) obtained CE Mark approval for its ETHIZIA™ Hemostatic Sealing Patch on, designed to control disruptive bleeding and expected to launch in EMEA in 2024.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising adoption of advanced vessel sealing tools in ambulatory surgical centers.

- Manufacturers will focus on developing compact, ergonomic instruments with improved energy control.

- Hospitals will increasingly integrate feedback-enabled systems for consistent sealing outcomes.

- Robotic-assisted surgeries will expand the need for compatible sealing devices.

- Disposable and single-use sealing tools will gain traction for infection control and operational efficiency.

- Emerging markets will drive demand through government healthcare investments and surgical training programs.

- Hybrid technologies combining bipolar and ultrasonic features will support broader clinical applications.

- OEM partnerships will increase to create customized solutions for surgical platforms.

- Product innovation will prioritize safety, reduced thermal damage, and shorter procedure times.

- The market will grow steadily due to rising global surgical volumes and demand for precision tools.