Market Overview

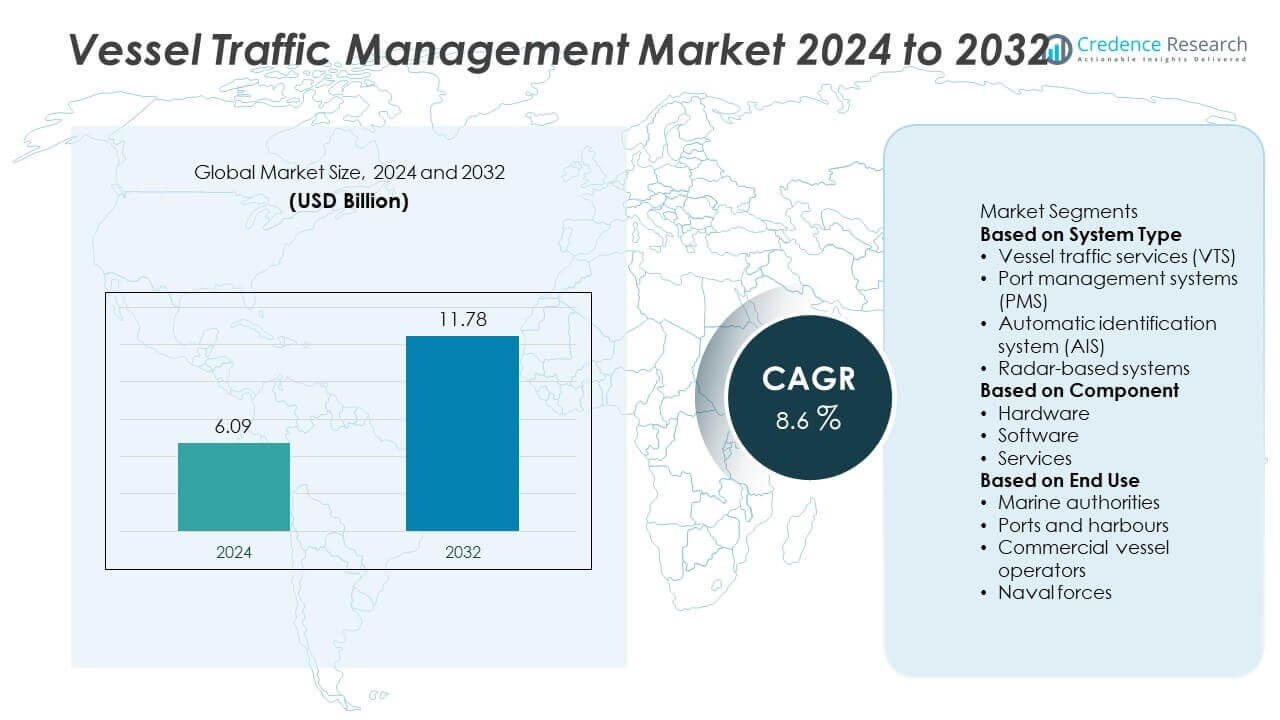

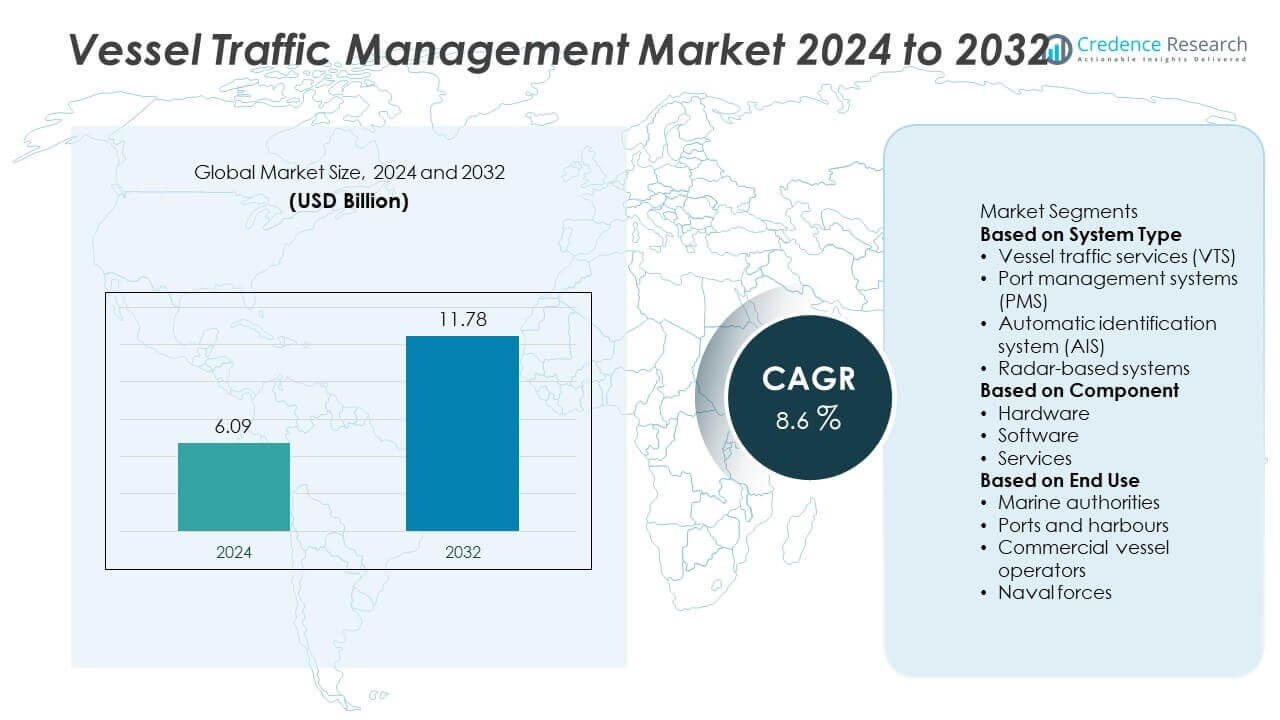

The Vessel Traffic Management Market size was valued at USD 6.09 billion in 2024 and is anticipated to reach USD 11.78 billion by 2032, growing at a CAGR of 8.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vessel Traffic Management Market Size 2024 |

USD 6.09 Billion |

| Vessel Traffic Management Market, CAGR |

8.6% |

| Vessel Traffic Management Market Size 2032 |

USD 11.78 Billion |

The Vessel Traffic Management Market grows through rising global trade, expanding port operations, and increasing maritime safety requirements. Ports adopt advanced traffic management systems to optimize docking, reduce congestion, and improve turnaround times.

The Vessel Traffic Management Market shows strong geographical expansion across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, each region contributing with unique drivers. North America leads with adoption of advanced maritime safety systems supported by strong investments in port modernization and defense applications. Europe emphasizes digital transformation of ports, sustainability initiatives, and regulatory compliance, fostering demand for innovative vessel traffic technologies. Asia-Pacific grows rapidly with China, Japan, and South Korea investing heavily in smart ports and large-scale maritime trade routes. Latin America and the Middle East & Africa present emerging opportunities driven by port expansion projects and increasing trade flows. Key players such as Wärtsilä Corporation, Thales Group, Saab AB, and Transas focus on innovation, automation, and integration of advanced systems like radar, AIS, and analytics. Their strategies strengthen safety, efficiency, and competitiveness, ensuring wider adoption across global maritime operations.

Market Insights

- The Vessel Traffic Management Market was valued at USD 6.09 billion in 2024 and is projected to reach USD 11.78 billion by 2032, growing at a CAGR of 8.6%.

- Rising demand for maritime safety and efficiency drives adoption of vessel traffic management systems in ports and coastal regions.

- Trends highlight integration of radar, AIS, satellite, and real-time analytics to improve navigation and reduce port congestion.

- Leading companies including Wärtsilä Corporation, Thales Group, Saab AB, and Transas compete through innovation, automation, and advanced monitoring solutions.

- High installation costs, complex integration requirements, and regulatory variations act as restraints, limiting adoption in smaller ports.

- North America leads with advanced port modernization projects, Europe emphasizes sustainability and compliance, and Asia-Pacific records rapid growth with smart port investments.

- Latin America and the Middle East & Africa show gradual adoption supported by expanding trade routes, port development projects, and international collaborations.

Market Drivers

Rising Global Maritime Trade and Expanding Port Infrastructure

The Vessel Traffic Management Market is strongly driven by the growth of international maritime trade. Expanding global shipping volumes increase demand for efficient vessel tracking and navigation systems. It supports ports and coastal authorities in managing dense traffic, reducing risks of congestion, and improving safety. Large-scale port infrastructure projects worldwide integrate vessel traffic management solutions to streamline operations. Governments prioritize maritime trade as a backbone of economic growth, creating consistent investments in advanced traffic control systems. It reinforces the role of vessel traffic management in enabling secure and efficient shipping lanes.

- For instance, Wärtsilä deployed its Navi-Harbour VTMS at Peru’s Port of Callao, which handles more than 70% of the nation’s import and export cargo, enhancing safety and vessel coordination across multiple terminals.

Growing Emphasis on Maritime Safety and Accident Prevention

The Vessel Traffic Management Market benefits from rising awareness about safety in maritime operations. High-profile accidents, oil spills, and collisions highlight the need for advanced monitoring systems. It provides real-time data on vessel movements, weather conditions, and navigational hazards to prevent mishaps. International regulations from the International Maritime Organization (IMO) and national authorities push operators to adopt vessel traffic systems. Coastal security agencies and port operators prioritize safety as part of broader risk management strategies. It strengthens the case for widespread adoption of these solutions.

- For instance, Transas, part of Wärtsilä, implemented a Vessel Traffic Management System for Kenya’s Port of Mombasa with control centers and sensor nodes at Ras Serani Station, Likoni Sector Light, and KPA headquarters to improve navigational safety and accident prevention.

Technological Advancements in Digital Navigation Systems

The Vessel Traffic Management Market gains momentum from continuous innovation in navigation and surveillance technologies. Integration of radar, Automatic Identification Systems (AIS), GPS, and satellite-based monitoring improves accuracy and coverage. It enables operators to manage complex traffic flows with real-time insights and predictive analytics. The use of AI and machine learning enhances decision-making and resource optimization. Digitalization of ports and adoption of smart technologies expand opportunities for intelligent vessel traffic solutions. It positions vessel traffic management as a central component of modern maritime infrastructure.

Government Investments and Regulatory Mandates in Maritime Operations

The Vessel Traffic Management Market grows through strong government initiatives and compliance requirements. Public sector agencies invest in coastal surveillance, smart ports, and traffic management infrastructure. It ensures safe navigation in both domestic and international waters. Regulatory frameworks mandate the adoption of vessel tracking systems in busy shipping routes and strategic trade corridors. Rising defense spending also supports deployment of advanced vessel traffic management systems to enhance national security. It aligns maritime modernization programs with long-term safety and sustainability goals.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Trends

Integration of Smart Port and Digital Maritime Solutions

The Vessel Traffic Management Market is witnessing strong adoption of smart port technologies. Ports worldwide are deploying digital traffic monitoring and predictive analytics to optimize vessel movement. It allows operators to reduce delays, manage congestion, and improve fuel efficiency. Integration with port community systems supports data exchange among stakeholders, ensuring seamless logistics. Smart port initiatives link vessel traffic management with broader digitalization goals. It positions advanced traffic systems as key enablers of efficient port ecosystems.

- For instance, Wärtsilä secured the prototyping contract for Singapore’s Next-Generation Vessel Traffic Management System (NGVTMS), designed to manage more than 1,000 vessel calls daily in one of the world’s busiest ports through advanced digital monitoring and predictive analytics.

Rising Adoption of AI and Machine Learning for Predictive Navigation

The Vessel Traffic Management Market benefits from rapid advances in artificial intelligence and machine learning. These technologies enhance real-time vessel tracking, anomaly detection, and route optimization. It helps reduce human error and improves response to dynamic maritime conditions. Predictive algorithms enable faster decision-making during peak traffic or emergencies. Maritime operators adopt AI-driven tools to improve safety compliance and operational planning. It reinforces vessel traffic management as a data-driven decision support system.

- For instance, ABB launched its Flexley Mover P603 autonomous mobile robot equipped with Visual SLAM and AI-driven positioning achieving ±5 mm accuracy, showcasing the same predictive navigation algorithms now being adapted into maritime traffic management for real-time route optimization.

Expansion of Satellite-Based and Remote Monitoring Capabilities

The Vessel Traffic Management Market is shaped by growing reliance on satellite-based systems for navigation. Satellite connectivity ensures vessel monitoring in remote waters and congested trade corridors. It improves global coverage where traditional radar or terrestrial systems face limitations. Remote monitoring solutions enhance visibility across international shipping lanes and Exclusive Economic Zones. Governments and defense agencies adopt these systems for improved maritime domain awareness. It highlights satellite integration as a core trend in traffic management.

Emphasis on Sustainability and Emission Reduction in Shipping

The Vessel Traffic Management Market aligns with global sustainability and decarbonization goals. Efficient vessel traffic solutions help reduce fuel consumption and greenhouse gas emissions. It supports compliance with International Maritime Organization (IMO) emission targets. Ports are adopting green traffic management systems that optimize docking schedules and minimize idle time. Maritime operators view these systems as tools to achieve environmental and operational efficiency. It underscores the trend of linking vessel traffic systems with sustainable shipping practices.

Market Challenges Analysis

High Implementation Costs and Infrastructure Constraints

The Vessel Traffic Management Market faces challenges from the high capital investment required for advanced systems. Modern solutions integrating radar, AIS, satellite, and analytics demand significant infrastructure upgrades. It creates barriers for small ports and developing regions with limited budgets. Maintenance and training costs further add to the financial burden. Integration with legacy port systems can be complex and time-consuming, slowing deployment. It restricts faster adoption in regions where port modernization is still at an early stage.

Operational Limitations and Regulatory Inconsistencies

The Vessel Traffic Management Market also struggles with operational limitations linked to environmental and regulatory challenges. Systems may underperform in extreme weather or congested waterways with heavy vessel density. It increases reliance on human intervention, reducing efficiency gains from automation. Regulatory frameworks vary across regions, creating uncertainty for global shipping operators. Lack of uniform standards complicates cross-border adoption of advanced vessel management practices. It highlights the need for international collaboration to ensure smoother implementation and reliable outcomes.

Market Opportunities

Expansion of Smart Ports and Global Trade Networks

The Vessel Traffic Management Market presents strong opportunities through the expansion of smart ports and rising global trade volumes. Governments and port authorities are investing in digital infrastructure to handle larger ships and higher traffic density. It enables efficient coordination of shipping schedules, reduces port congestion, and improves turnaround times. The growth of international trade routes across Asia-Pacific, Europe, and the Middle East strengthens adoption potential. Ports modernizing their facilities seek advanced traffic management to stay competitive. It creates sustained demand for solutions that enhance efficiency and global connectivity.

Integration of Emerging Technologies and Green Shipping Initiatives

The Vessel Traffic Management Market also benefits from opportunities linked to new technologies and environmental regulations. Artificial intelligence, IoT, and blockchain integration allow advanced analytics, predictive navigation, and secure data sharing. It enhances decision-making for both commercial and defense applications. Increasing focus on green shipping and emission reduction creates prospects for eco-friendly vessel management systems. Smart scheduling and fuel optimization features align with International Maritime Organization goals. It positions advanced traffic management solutions as central to achieving sustainability and digital transformation in maritime operations.

Market Segmentation Analysis:

By System Type

The Vessel Traffic Management Market by system type is divided into port management systems, coastal surveillance systems, and others. Port management systems hold a strong share, driven by rising adoption in busy commercial ports to optimize vessel traffic flow and reduce congestion. It ensures safer docking, faster turnaround, and improved resource utilization. Coastal surveillance systems are gaining importance as governments invest in maritime safety, border security, and anti-smuggling operations. Integration of radar, AIS, and satellite technology supports continuous monitoring in national waters. It highlights how system types serve both commercial efficiency and national security objectives.

- For instance, Transas, part of Wärtsilä, deployed a Vessel Traffic Management System at Kenya’s Port of Mombasa, installing nodes at Ras Serani Station, Likoni Sector Light, and KPA headquarters to oversee traffic movements across a coastline handling over 1,700 vessel calls annually.

By Component

The Vessel Traffic Management Market by component includes hardware, software, and services. Hardware such as radar, communication devices, and AIS transponders form the backbone of vessel monitoring operations. It ensures reliable navigation and communication between ships and port authorities. Software solutions are expanding rapidly with demand for real-time data analytics, predictive modeling, and automation. These platforms integrate seamlessly with port operations and logistics systems, enabling smarter decision-making. Services, including maintenance, training, and system upgrades, contribute significantly to long-term operational reliability. It shows how each component plays a crucial role in delivering end-to-end traffic management solutions.

- For instance, Wärtsilä’s Navi-Harbour 5 VTMS integrates data from sensors, including radars and AIS, offering 3D views to enhance situational awareness at busy ports. Services, including maintenance, training, and system upgrades, contribute significantly to long-term operational reliability. It shows how each component plays a crucial role in delivering end-to-end traffic management solutions

By End Use

The Vessel Traffic Management Market by end use is segmented into commercial and defense applications. Commercial adoption dominates as global trade expands and port authorities seek greater efficiency in vessel handling. It provides operators with tools to manage increasing cargo volumes while ensuring compliance with safety standards. Defense end use is also growing, driven by the need for enhanced coastal monitoring, naval operations, and maritime domain awareness. Advanced traffic management systems strengthen national security by detecting unauthorized vessel movements. It demonstrates how the market supports both civilian and defense objectives with tailored solutions for each sector.

Segments:

Based on System Type

- Vessel traffic services (VTS)

- Port management systems (PMS)

- Automatic identification system (AIS)

- Radar-based systems

Based on Component

- Hardware

- Software

- Services

Based on End Use

- Marine authorities

- Ports and harbours

- Commercial vessel operators

- Naval forces

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for a 32% share of the Vessel Traffic Management Market, supported by advanced port infrastructure and strong adoption of maritime technologies. The United States leads the region with significant investments in modernizing coastal surveillance and traffic management systems. It benefits from the presence of high-traffic ports such as Los Angeles, New York, and Houston, which require advanced systems for safety and efficiency. Canada contributes through development of smart port initiatives and strengthening Arctic navigation safety. Mexico expands adoption with investments in oil and gas terminals and container ports. Rising focus on enhancing maritime domain awareness for security and trade efficiency ensures steady demand. It positions North America as a leader in technological innovation and operational adoption.

Europe

Europe holds a 28% share of the Vessel Traffic Management Market, driven by busy shipping routes and strong regulatory frameworks. Countries such as Germany, the UK, France, and the Netherlands invest heavily in traffic management solutions to support their global trade hubs. It benefits from the European Union’s emphasis on maritime safety and environmental compliance, which encourages digitalization of ports. Advanced radar, AIS, and satellite-based traffic systems are deployed across key commercial routes in the North Sea, Baltic Sea, and Mediterranean. Growing adoption of green port strategies also aligns vessel traffic management with broader sustainability goals. The region remains a strong market with its focus on safety, automation, and environmental responsibility.

Asia-Pacific

Asia-Pacific commands a 26% share of the Vessel Traffic Management Market, making it one of the fastest-growing regions. China leads adoption through massive investments in port expansions and smart logistics hubs. It also focuses on securing high-traffic maritime routes in the South China Sea. Japan and South Korea advance adoption with highly automated ports, supporting trade, defense, and industrial shipping. India shows strong growth, driven by modernization projects across major ports under government-led maritime development programs. Rising container traffic, coupled with growing naval operations, accelerates demand across the region. It highlights Asia-Pacific as a dynamic and high-potential market with diverse commercial and defense applications.

Latin America

Latin America contributes a 7% share of the Vessel Traffic Management Market, supported by modernization of ports and growing maritime trade. Brazil drives adoption with its large shipping terminals serving agriculture and energy exports. Mexico and Chile also invest in upgrading vessel monitoring systems to strengthen operational safety. Expanding oil and gas trade routes further stimulate adoption of traffic management solutions. Limited budgets and slower technology adoption in smaller ports act as constraints, but regional modernization initiatives offer opportunities. It reflects a growing market where international partnerships and government programs are key enablers.

Middle East & Africa

The Middle East & Africa account for a 7% share of the Vessel Traffic Management Market, supported by strong investments in maritime security and port development. Gulf countries such as Saudi Arabia and the UAE lead adoption, integrating vessel traffic management with global trade hubs and oil export facilities. It benefits from rising container traffic through ports like Jebel Ali and King Abdullah Port. Africa, led by South Africa and Nigeria, adopts vessel traffic systems to support growing energy exports and regional trade. Limited infrastructure and funding challenges slow widespread adoption, but international collaborations support growth. It positions the region as an emerging market with long-term opportunities tied to global shipping and energy exports.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the Vessel Traffic Management Market features leading players such as Wärtsilä Corporation, Thales Group, Saab AB, Transas, Navantia, Indra Sistemas, IBM Corporation, SRT Marine Systems, Hexagon AB, and MarineTraffic. These companies focus on expanding their portfolios by integrating advanced radar, AIS, satellite communication, and real-time data analytics to enhance maritime safety and efficiency. They invest heavily in automation, artificial intelligence, and cloud-based platforms to deliver scalable solutions for ports, coastal surveillance, and offshore operations. Strategic collaborations with governments, naval authorities, and port operators strengthen their market presence while ensuring compliance with global maritime regulations. Innovation in smart port infrastructure and digital monitoring technologies drives competition, as players aim to provide end-to-end solutions that optimize vessel routing, reduce congestion, and improve environmental compliance. With rising demand for secure and efficient maritime operations, these companies emphasize technological leadership, regional expansion, and long-term service contracts to maintain a strong competitive edge.

Recent Developments

- In August 2025, Navantia signed a contract with the Royal Thai Navy to modernize two Pattani-class Offshore Patrol Vessels (OPVs), integrating advanced combat management and surveillance systems to enhance rapid response and operational capacity, each designed for maritime traffic surveillance, search and rescue, and supporting multiple vessel control tasks.

- In February 2025, Indra Sistemas launched the SMAUG RDI project, bringing together entities from seven European countries to collaborate on underwater threat detection using their iSIM system.

- In September 2024, Wärtsilä Corporation secured the prototyping contract for Singapore’s Next‑Generation Vessel Traffic Management System (NGVTMS) project awarded by the Maritime and Port Authority of Singapore (MPA).

Report Coverage

The research report offers an in-depth analysis based on System Type, Component, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for safe and efficient maritime operations.

- Ports will adopt advanced vessel traffic solutions to improve real-time navigation management.

- Artificial intelligence and automation will enhance decision-making in traffic monitoring systems.

- Cloud-based platforms will gain traction for scalable and cost-effective maritime solutions.

- Integration of satellite and AIS technologies will strengthen surveillance and tracking capabilities.

- Smart port development will drive adoption of digital vessel traffic management systems.

- Naval and defense applications will expand through modernization of coastal security systems.

- Emerging economies will invest in advanced maritime infrastructure to support trade growth.

- Cybersecurity solutions will become critical to safeguard connected vessel traffic platforms.

- Strategic partnerships will shape innovation and global expansion of leading market players.