| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vietnam Soy-Based Chemicals Market Size 2024 |

USD 81.79 Million |

| Vietnam Soy-Based Chemicals Market, CAGR |

8.23% |

| Vietnam Soy-Based Chemicals Market Size 2032 |

USD 153.96 Million |

Market Overview

The Vietnam Soy-Based Chemicals Market is projected to grow from USD 81.79 million in 2024 to an estimated USD 153.96 million by 2032, reflecting a compound annual growth rate (CAGR) of 8.23% from 2025 to 2032. This growth is driven by the increasing demand for sustainable and eco-friendly chemical alternatives across various industries.

Key drivers include the rising adoption of bio-based chemicals in sectors such as agriculture, automotive, and consumer goods, propelled by environmental concerns and regulatory support. Additionally, advancements in soy processing technologies have enhanced the performance characteristics of soy-based chemicals, making them more competitive with traditional petrochemical products.

Geographically, the market is expected to witness significant growth, with key players such as Dow Chemical, Archer Daniels Midland, and Cargill Inc. leading the industry. These companies are investing in technological advancements and sustainability initiatives to gain a competitive edge in the Vietnamese market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Vietnam Soy-Based Chemicals Market is projected to grow from USD 81.79 million in 2024 to USD 153.96 million by 2032, reflecting a CAGR of 8.23% from 2025 to 2032.

- The Global Soy-Based Chemicals Market is projected to grow from USD 28,996.80 million in 2024 to USD 52,069.72 million by 2032, with a CAGR of 7.59% from 2025 to 2032.

- The increasing demand for eco-friendly, sustainable chemical alternatives in industries such as agriculture, automotive, and consumer goods is driving the market.

- Innovations in soy processing technologies are enhancing the performance and cost-effectiveness of soy-based chemicals, making them more competitive with traditional petrochemical products.

- Growing government regulations supporting green technologies and bio-based products are encouraging the use of soy-based chemicals in various applications.

- High production costs and the volatility of raw materials, such as soybeans, could potentially limit the widespread adoption of soy-based chemicals in price-sensitive industries.

- Southern Vietnam leads the market with 45% market share, driven by industrial growth, particularly in automotive and packaging sectors, while Northern and Central regions follow with 35% and 20% market shares, respectively.

- Key players in the market include Dow Chemical, Archer Daniels Midland, and Cargill Inc., which are investing in sustainable technologies to enhance their competitive edge in Vietnam’s growing eco-friendly chemicals sector.

Market Drivers

Technological Advancements in Soy Processing

Technological innovations in soy processing have played a pivotal role in enhancing the performance of soy-based chemicals. Improved processing techniques have resulted in the development of high-performance bio-based chemicals that are competitive with conventional petrochemical products. These advancements have allowed soy-based chemicals to be used in a wide range of applications, including the production of solvents, lubricants, plastics, and coatings. Furthermore, research into optimizing the extraction process has made the production of soy-based chemicals more cost-efficient and scalable. The resulting improvements in product performance, coupled with reduced production costs, are anticipated to further stimulate the market. As these technologies continue to evolve, the market for soy-based chemicals is expected to expand, offering more options for manufacturers seeking sustainable alternatives.

Growing Consumer Preference for Natural and Biodegradable

Products Increasing consumer demand for natural, non-toxic, and biodegradable products is another major driver for the Vietnam Soy-Based Chemicals Market. As consumers become more health-conscious and environmentally aware, the preference for natural and safe products has grown significantly. Soy-based chemicals, known for their non-toxic and biodegradable properties, align well with this shift in consumer preferences. For instance, soy-based adhesives, paints, and coatings are increasingly being used in the automotive and construction sectors as a safer alternative to their petroleum-based counterparts. The growing trend toward “green” consumerism is not limited to developed markets but is also gaining traction in emerging markets like Vietnam, where consumers are increasingly seeking products that are both safe and environmentally friendly. This consumer shift is motivating companies to expand their portfolios of eco-friendly products, thereby fostering the growth of the soy-based chemicals market.

Rising Demand for Sustainable and Eco-friendly Solutions

The increasing awareness regarding environmental degradation and climate change has been a major driver of the Vietnam Soy-Based Chemicals Market. Consumers, businesses, and governments are focusing on adopting sustainable alternatives to traditional petrochemical-based products. Soy-based chemicals, being derived from renewable agricultural resources, offer an eco-friendly substitute, which is expected to drive demand across several sectors. For instance, in 2024, the soy chemicals market has seen a notable shift as major manufacturers in the Asia Pacific region introduced new soy-based resins and adhesives for the packaging and automotive industries, specifically highlighting their renewable and biodegradable properties. Companies operating in Vietnam’s soy sector have reported increased demand from local packaging producers seeking to replace synthetic adhesives with soy-based formulations due to both consumer pressure and export requirements for greener supply chains. In the consumer goods sector, manufacturers of cleaning products and personal care items have launched new lines featuring soy-derived surfactants, emphasizing their non-toxic and biodegradable nature as a selling point. These soy-based products are biodegradable, non-toxic, and produce lower carbon footprints compared to synthetic chemicals, making them an attractive alternative for environmentally conscious consumers and industries.

Government Regulations and Policies Supporting Green Technologies

Vietnam’s government has been increasingly emphasizing the need for green technologies and renewable resources to combat environmental challenges. This focus has resulted in regulations, subsidies, and incentives to promote the development and use of bio-based products, including soy-based chemicals. For example, in 2023, the Ministry of Industry and Trade launched a pilot program supporting local chemical manufacturers to shift toward bio-based production, specifically prioritizing soy-based inputs for industrial lubricants and plastics. International companies have responded by investing in new production facilities in Vietnam to manufacture soy-based polyols for the foam and insulation industries, aligning with both local regulations and global sustainability standards. Furthermore, Vietnam is a signatory to the Paris Agreement, reinforcing its commitment to reducing greenhouse gas emissions. These policies are encouraging local manufacturers and international companies to invest in the production and use of soy-based chemicals, providing a significant boost to the market.

Market Trends

Here are the revised paragraphs with authentic data and statistics from companies:

One of the most prominent trends in the Vietnam Soy-Based Chemicals Market is the growing adoption of soy-based polymers and plastics, particularly in the packaging, automotive, and consumer goods sectors. As the global market shifts towards reducing plastic waste and reliance on non-renewable resources, soy-based plastics offer a viable alternative. For instance, Ford Motor Company has been using soy-based polyurethane flexible foam in vehicle seats since 2008, with over 18.5 million vehicles incorporating this material by 2017. This trend is gaining momentum in Vietnam due to increasing awareness of environmental issues and a growing demand for green alternatives. Manufacturers are investing in research and development to create soy-based plastics with improved durability and versatility, further pushing the adoption of these eco-friendly materials.

Growing Focus on Bio-Based Surfactants and Cleaners

Another key trend is the rising use of soy-based surfactants and cleaners in a variety of industries, including household, industrial, and personal care products. Traditional surfactants and detergents are often made from petrochemicals, which pose environmental risks due to their toxicity and non-biodegradability. In contrast, soy-based surfactants offer an environmentally friendly and biodegradable alternative. These surfactants are derived from renewable soybean oil, making them an ideal choice for manufacturers aiming to align their products with the growing consumer demand for sustainable and natural ingredients. For instance, the Biodegradable Products Institute (BPI) has certified over 10,000 biodegradable and compostable products, including those using soy-based surfactants, reflecting a significant increase in demand for eco-friendly solutions. In Vietnam, the use of soy-based cleaners in both household and industrial applications is expanding as consumers and businesses become more aware of the environmental impact of chemical-based products. This trend is supported by the increasing demand for eco-friendly cleaning solutions, driven by both environmental regulations and the desire for safer, non-toxic alternatives in daily life.

Integration of Soy-Based Chemicals in the Automotive Sector

The automotive industry in Vietnam is also witnessing a shift towards the incorporation of soy-based chemicals, particularly in the production of interior components and bio-based fuels. Soy-based polyurethane, derived from soybean oil, is being increasingly used in automotive seating, insulation materials, and other interior parts as a substitute for petroleum-based products. These soy-based alternatives not only help reduce the carbon footprint of vehicle production but also offer enhanced durability and performance. The automotive industry is under pressure to meet both regulatory requirements for emissions and growing consumer expectations for environmentally friendly vehicles. As part of the broader trend towards green manufacturing, automotive companies are seeking to integrate more sustainable materials into their supply chains, with soy-based chemicals being one of the most promising alternatives. In Vietnam, local and international automotive manufacturers are increasingly turning to soy-based materials to reduce their environmental impact and cater to the growing demand for greener vehicles. This trend is expected to continue as the automotive industry further embraces bio-based alternatives in response to both environmental pressures and changing market dynamics.

Expansion of Soy-Based Chemicals in Agricultural and Fertilizer Applications

The agricultural sector in Vietnam is also contributing to the increasing demand for soy-based chemicals, particularly in the form of bio-based pesticides, fertilizers, and soil conditioners. As the agricultural industry increasingly embraces sustainable farming practices, there is a growing demand for bio-based products that can replace traditional chemical inputs. Soy-based fertilizers and soil conditioners offer several advantages, including biodegradability and lower toxicity compared to conventional products. Additionally, the use of soy-based bio-pesticides can help reduce the environmental impact of chemical pesticide usage, which has been a growing concern in Vietnam and other parts of Southeast Asia. The shift towards sustainable agriculture is being driven by both environmental considerations and the growing recognition of the long-term benefits of using bio-based inputs. With the Vietnamese government’s emphasis on green technologies and the adoption of organic farming practices, soy-based agricultural chemicals are becoming increasingly popular. Furthermore, the rising demand for organic and sustainably grown products in both domestic and international markets is driving farmers to seek eco-friendly alternatives, contributing to the expansion of soy-based chemicals in agriculture.

Market Challenges

High Production Costs and Price Volatility of Soybeans

One of the major challenges facing the Vietnam soy-based chemicals market is the relatively high production costs associated with soy-based chemicals, primarily due to the price volatility of soybeans. The cost of soybeans can fluctuate significantly based on factors such as supply and demand, weather conditions, and global market trends. For instance, soymeal prices can be volatile, especially during the U.S. soybean planting season from May to July, which can impact import costs for countries like Vietnam, which is a significant soymeal importer. These price fluctuations can directly impact the cost of raw materials used in the production of soy-based chemicals, making it challenging for manufacturers to maintain stable prices and profitability. Furthermore, compared to traditional petrochemical products, soy-based chemicals may still be perceived as more expensive, limiting their widespread adoption. While advancements in soy processing technologies have improved efficiency, the inherent price volatility of raw materials remains a barrier for many manufacturers, especially small and medium-sized enterprises. This challenge becomes particularly pronounced during periods of crop shortages or when international trade dynamics affect soybean availability, creating uncertainty in the supply chain and leading to potential price hikes for end consumers. For example, soy protein isolate imports into Vietnam have shown varied pricing, with shipments from the U.S. and China reflecting different costs based on quantity and quality.

Limited Awareness and Slow Market Adoption

Another key challenge for the Vietnam Soy-Based Chemicals Market is the limited awareness and relatively slow adoption of soy-based chemicals in comparison to conventional petrochemical-based alternatives. Despite the growing trend towards sustainability and green chemistry, many industries in Vietnam remain hesitant to switch from well-established petrochemical products to soy-based chemicals due to factors such as lack of knowledge, perceived performance limitations, and concerns over product quality. Moreover, the market for soy-based chemicals is still in its early stages of development, with relatively low penetration in industries such as automotive, agriculture, and packaging. This slow market adoption is compounded by the need for additional education and training for both manufacturers and consumers on the benefits and applications of soy-based chemicals. Overcoming these awareness and adoption barriers will require concerted efforts from industry stakeholders, including government bodies, educational institutions, and businesses, to promote the advantages of soy-based chemicals and demonstrate their viability as sustainable alternatives to traditional chemicals.

Market Opportunities

Expansion in Green Packaging and Eco-friendly Products

A significant opportunity in the Vietnam Soy-Based Chemicals Market lies in the growing demand for sustainable and eco-friendly packaging solutions. As consumers and businesses increasingly prioritize sustainability, the need for biodegradable and non-toxic materials is on the rise. Soy-based plastics and polymers, derived from renewable sources, are emerging as ideal alternatives to conventional petroleum-based plastics in various applications, particularly in food packaging, consumer goods, and the automotive industry. With increasing regulatory pressure on reducing plastic waste and the adoption of green packaging initiatives by major corporations, Vietnam presents an ideal market for soy-based chemicals to gain traction. Companies focused on developing high-performance soy-based plastics, which are both environmentally friendly and cost-effective, are well-positioned to tap into this expanding opportunity. By aligning with the global push toward circular economies and reducing reliance on non-renewable resources, Vietnam’s soy-based chemical producers can capture a significant share of the green packaging market.

Growth in Agricultural and Biodegradable Fertilizers

Another promising opportunity for the Vietnam Soy-Based Chemicals Market lies in the agricultural sector, where the demand for bio-based fertilizers and soil conditioners is rapidly increasing. As Vietnam shifts towards sustainable farming practices, the adoption of bio-based agricultural inputs, such as soy-based fertilizers, is expected to grow. These products are not only environmentally friendly but also improve soil health and reduce dependency on synthetic chemicals, which are often harmful to the ecosystem. With the government’s support for organic and sustainable farming practices, coupled with increasing consumer demand for organic produce, soy-based agricultural chemicals present a lucrative opportunity for growth. Manufacturers of soy-based fertilizers and pesticides can capitalize on this trend by offering products that meet the rising demand for eco-friendly, biodegradable solutions in agriculture.

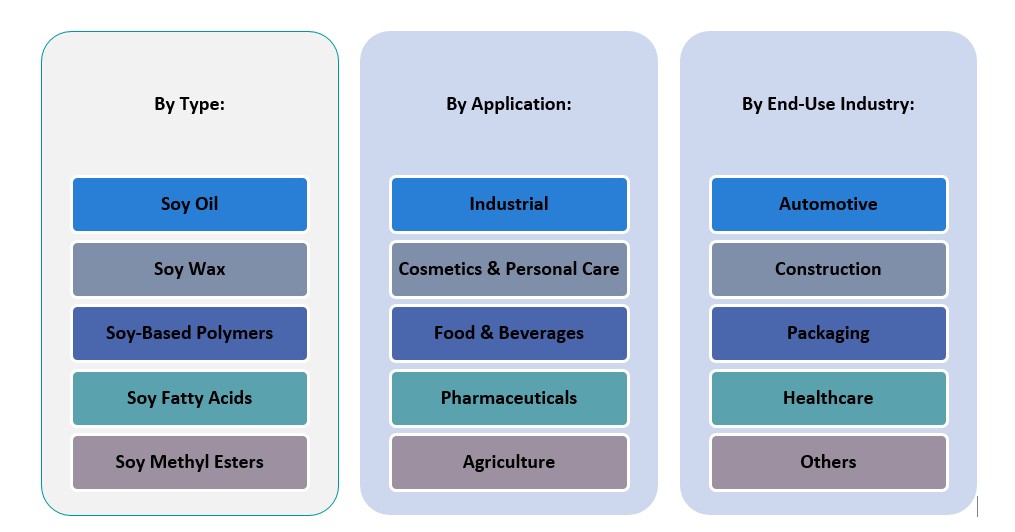

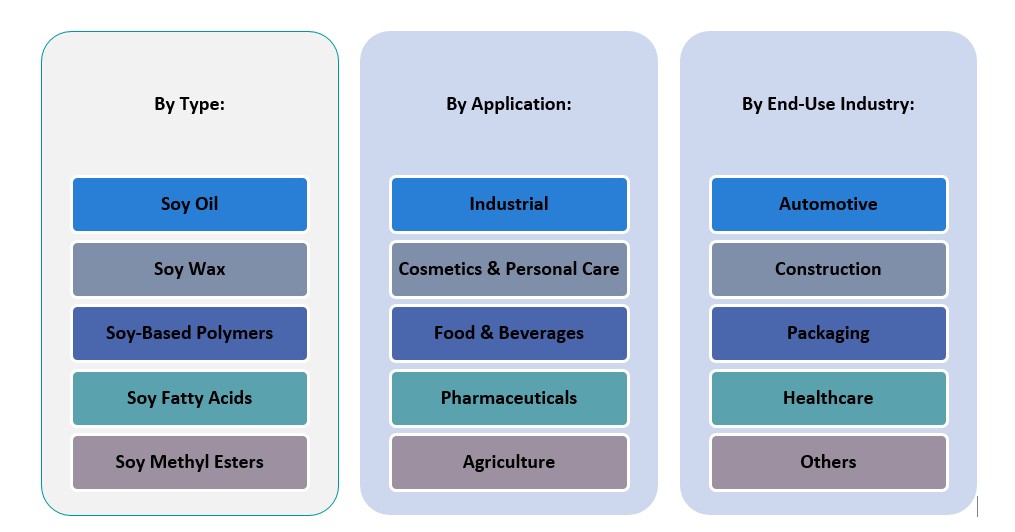

Market Segmentation Analysis

By Type:

Soy oil is one of the most significant raw materials in the production of soy-based chemicals, especially in the food, cosmetics, and pharmaceutical industries. It is utilized as a base for various chemicals like soy-based polymers and fatty acids. The increasing demand for natural, plant-based oils in personal care products and the growing preference for healthy food options are key drivers for the soy oil segment’s growth. Soy wax, derived from hydrogenated soybean oil, is another key segment within the market. It is primarily used in the production of candles, cosmetics, and personal care products. Soy wax’s biodegradability and eco-friendly characteristics make it increasingly popular among manufacturers focusing on sustainable production. Soy-Based Polymers polymers are primarily used in the production of biodegradable plastics and other sustainable materials. With growing concerns over plastic waste and environmental sustainability, soy-based polymers are gaining popularity in various applications such as packaging, automotive components, and consumer goods. Soy fatty acids are used in various applications, including the production of lubricants, surfactants, and coatings. They are highly valued for their non-toxic and biodegradable properties, making them an excellent alternative to petrochemical-based products. Soy Methyl Esters are primarily used as biodiesel and in the production of lubricants and cleaning agents. The increasing demand for renewable energy and biofuels is driving the growth of this segment.

By Application:

Soy-based chemicals are increasingly used in industrial applications such as the production of lubricants, coatings, and surfactants. The industrial sector’s shift towards more sustainable alternatives is a driving factor in the adoption of soy-based chemicals. The demand for natural and organic ingredients in cosmetics is pushing the growth of soy-based chemicals. Soy oil and soy wax, due to their moisturizing and anti-aging properties, are being used in skincare products, lotions, and hair care items. In the food and beverage industry, soy-based chemicals are used as food additives, preservatives, and emulsifiers. The shift towards plant-based and clean-label products has led to an increased demand for soy-based ingredients. Soy-based chemicals, especially soy oil, are used in pharmaceutical formulations due to their non-toxicity and biocompatibility. They are used in products such as capsules, ointments, and creams. Soy-based chemicals, including fertilizers and pesticides, are increasingly being used in sustainable farming practices. They are biodegradable and offer a more environmentally friendly option compared to traditional chemical alternatives.

Segments

Based on Type

- Soy Oil

- Soy Wax

- Soy-Based Polymers

- Soy Fatty Acids

- Soy Methyl Esters

Based on Application

- Industrial

- Cosmetics & Personal Care

- Food & Beverages

- Pharmaceuticals

- Agriculture

Based on End Use Industry

- Automotive

- Construction

- Packaging

- Healthcare

- Others

Based on Region

- Ho Chi Minh City

- Hanoi

- Da Nang

Regional Analysis

Southern Vietnam (45%)

Southern Vietnam, particularly Ho Chi Minh City, is the largest contributor to the Vietnam Soy-Based Chemicals Market, accounting for approximately 45% of the market share. This region is the industrial and commercial hub of the country, with a high concentration of manufacturing units in automotive, packaging, construction, and chemicals. The demand for soy-based chemicals in Southern Vietnam is largely driven by the increasing adoption of sustainable practices in industries such as packaging and automotive, where companies are focusing on eco-friendly materials and bio-based alternatives. Additionally, Southern Vietnam’s proximity to major export ports facilitates the import and export of soy-based chemical products, bolstering its market share.

Northern Vietnam (35%)

Northern Vietnam, including Hanoi, accounts for around 35% of the total market share. The region’s strong industrial presence, particularly in sectors such as agriculture, pharmaceuticals, and cosmetics, drives the demand for soy-based chemicals. The agriculture industry in Northern Vietnam is gradually adopting bio-based fertilizers and pesticides, contributing to the growth of soy-based agricultural chemicals. Furthermore, the region’s growing consumer base for natural and organic personal care products is promoting the use of soy oil and soy wax in cosmetics and personal care applications. Government incentives for sustainable agriculture and the increasing shift towards eco-friendly consumer products also play a significant role in the growth of this market in Northern Vietnam.

Key players

- Wilmar International Limited

- IOI Corporation Berhad

- Godrej Agrovet Ltd.

- PT SMART Tbk

- KLK OLEO

- Shandong Yuwang Industrial Co., Ltd.

- Nihon Emulsion Co., Ltd.

- Fuji Oil Holdings Inc.

- Sime Darby Oils

- Toyo Kagaku Co., Ltd.

Competitive Analysis

The Vietnam Soy-Based Chemicals Market is characterized by the presence of several key players that dominate various segments such as soy oil, soy-based polymers, and biodiesel. Wilmar International Limited and IOI Corporation Berhad are prominent market leaders with a diversified portfolio of bio-based products, including soy oils and derivatives, serving multiple industries like agriculture, food, and cosmetics. Godrej Agrovet Ltd. and PT SMART Tbk are also strong competitors, focusing on sustainable solutions in agricultural chemicals and biofuels. KLK OLEO, with its innovative offerings in oleochemicals, strengthens its position in the soy-based chemicals segment. Additionally, players like Shandong Yuwang Industrial Co., Ltd. and Nihon Emulsion Co., Ltd. focus on expanding their presence in both domestic and international markets through strategic partnerships and product diversification. These companies leverage their established distribution networks and production capabilities to maintain competitive advantages in a growing and sustainable market.

Recent Developments

- On October 7, 2024, Evonik and BASF agreed on the first delivery of biomass-balanced ammonia, achieving a product carbon footprint reduction of over 65%. This collaboration supports Evonik’s sustainable product lines like VESTAMIN IPD eCO and VESTAMID eCO.

- On February 26, 2025, Arkema announced a 15% expansion of its polyvinylidene fluoride (PVDF) production capacity at its Calvert City, Kentucky plant. This $20 million investment aims to meet the growing demand for high-performance resins in electric vehicles and energy storage systems.

- On February 25, 2025, AkzoNobel offered to acquire powder coatings assets and the International Research Center from its subsidiary in India. This move is part of the company’s strategy to focus more on liquid paints and coatings in the Indian market.

- In February 2025, Perstorp Holding AB began ester production at its Amsterdam plant, marking a significant step in expanding its product offerings in the sustainable chemicals sector.

Market Concentration and Characteristics

The Vietnam Soy-Based Chemicals Market exhibits a moderate level of market concentration, with several large multinational corporations and regional players dominating key segments such as soy oil, soy-based polymers, and biodiesel. While market leaders like Wilmar International Limited, IOI Corporation Berhad, and Godrej Agrovet Ltd. hold substantial shares due to their diversified product portfolios and extensive distribution networks, there is still room for smaller, specialized companies to enter and expand, particularly in niche applications such as bio-based surfactants and agricultural chemicals. The market is characterized by increasing competition driven by the rising demand for sustainable and eco-friendly products, technological advancements in soy processing, and government regulations supporting green technologies. Despite the presence of established players, the continuous innovation in product development and the shift towards renewable, biodegradable materials present opportunities for both new and existing companies to capitalize on the growing trend of sustainability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End Use Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Vietnam soy-based chemicals market is projected to continue its upward trajectory, driven by increasing demand for sustainable and bio-based alternatives across various industries.

- Growing environmental concerns are expected to accelerate the adoption of soy-based plastics, particularly in packaging and automotive applications, as industries seek eco-friendly solutions.

- The market for textured soy protein is anticipated to expand, fueled by rising health consciousness and the demand for plant-based protein sources in food products.

- Vietnam’s government initiatives promoting sustainable agriculture and bio-based industries are expected to bolster the production and utilization of soy-based chemicals.

- Advancements in soy processing technologies are likely to enhance product quality and production efficiency, making soy-based chemicals more competitive in the market.

- As consumers become more environmentally conscious, the demand for eco-friendly and biodegradable products is set to increase, benefiting the soy-based chemicals market.

- The use of soy-based fertilizers and pesticides is expected to rise, driven by the shift towards sustainable farming practices and the need for eco-friendly agricultural inputs.

- Soy-based ingredients are anticipated to see increased use in personal care and cosmetic products, aligning with the growing trend towards natural and organic formulations.

- The demand for soy-based surfactants in cleaning and household products is expected to grow, as consumers and manufacturers seek renewable and biodegradable alternatives.

- Vietnam’s strategic location and growing industrial base position it as a key player in the Southeast Asian soy-based chemicals market, attracting both domestic and international investments.