Market Overview

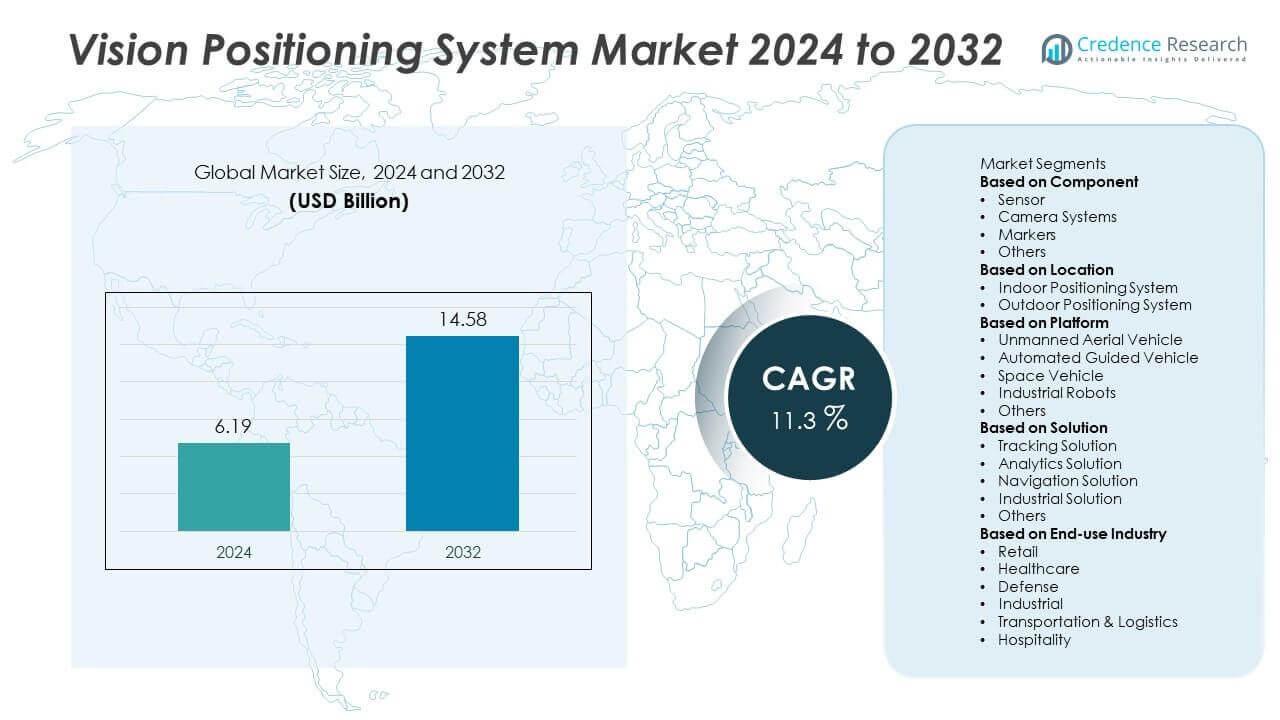

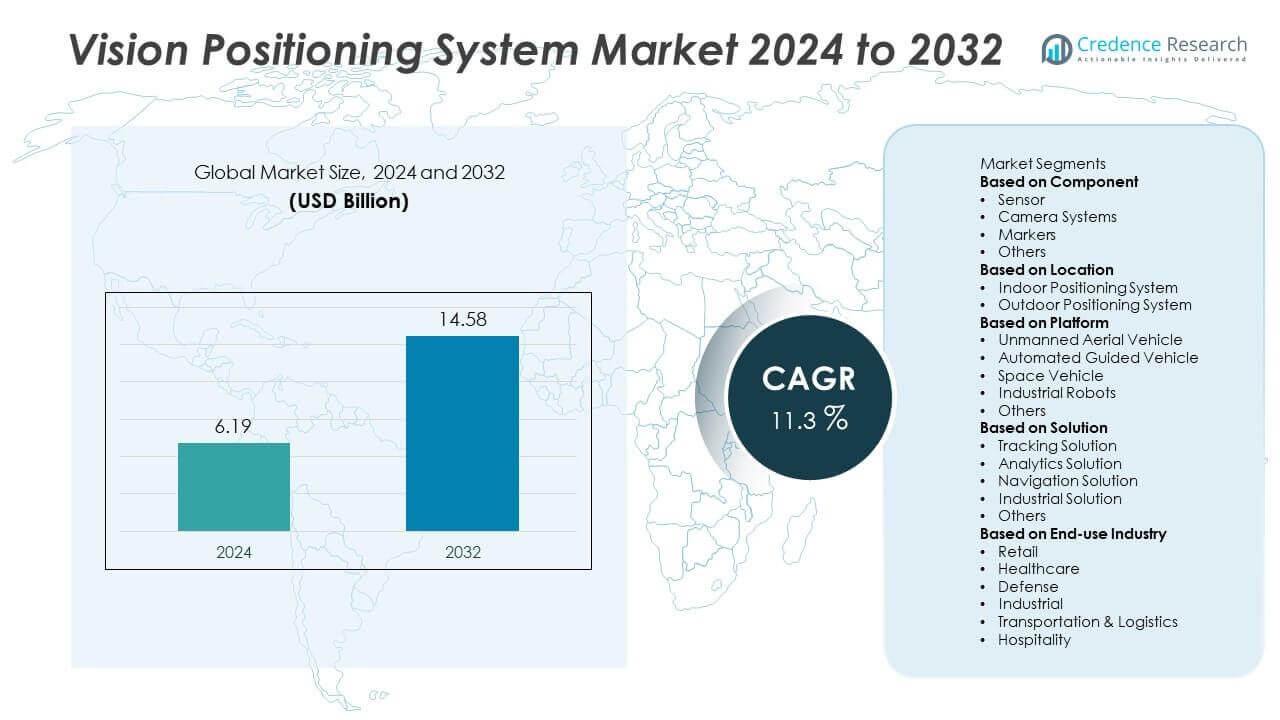

The Vision Positioning System Market size was valued at USD 6.19 billion in 2024 and is anticipated to reach USD 14.58 billion by 2032, growing at a CAGR of 11.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vision Positioning System Market Size 2024 |

USD 6.19 Billion |

| Vision Positioning System Market, CAGR |

11.3% |

| Vision Positioning System Market Size 2032 |

USD 14.58 Billion |

The Vision Positioning System Market grows through strong drivers and evolving trends across multiple industries. Rising demand for drones, autonomous vehicles, and industrial robots accelerates adoption of vision-based navigation. It provides accurate positioning in GPS-denied environments, supporting logistics, defense, and mobility applications.

The Vision Positioning System Market demonstrates strong geographical growth across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, each region contributing with unique strengths. North America leads with advanced adoption in drones, autonomous vehicles, and industrial robotics, supported by a strong innovation ecosystem. Europe emphasizes Industry 4.0 initiatives, autonomous mobility, and aerospace projects that integrate high-precision navigation. Asia-Pacific shows rapid expansion with China, Japan, and South Korea driving large-scale adoption in manufacturing, logistics, and smart cities. Latin America and the Middle East & Africa display emerging potential, supported by agriculture, mining, and defense applications. Key players shaping this market include ABB Ltd., Cognex Corporation, DJI Technology Co., Ltd, and Sony Corporation, who compete through advanced AI integration, sensor fusion, and smart connectivity. Their focus on innovation, partnerships, and industry-specific solutions enhances competitiveness and ensures global adoption across diverse sectors.

Market Insights

- The Vision Positioning System Market was valued at USD 6.19 billion in 2024 and is anticipated to reach USD 14.58 billion by 2032, growing at a CAGR of 11.3%.

- Rising demand from drones, autonomous vehicles, and industrial robotics drives adoption of high-precision vision-based navigation solutions.

- Advancements in artificial intelligence, machine learning, and sensor fusion strengthen accuracy and reliability across diverse applications.

- Leading companies such as ABB Ltd., Cognex Corporation, DJI Technology Co., Ltd, and Sony Corporation compete through innovation, partnerships, and industry-specific product development.

- High implementation costs, environmental limitations, and regulatory inconsistencies act as restraints, slowing adoption in cost-sensitive regions.

- North America and Europe show strong growth supported by innovation in autonomous mobility and smart infrastructure, while Asia-Pacific leads adoption with large-scale manufacturing and logistics deployments.

- Latin America and the Middle East & Africa show emerging opportunities through agriculture, mining, and defense applications, supported by modernization and government initiatives.

Market Drivers

Rising Adoption in Drones and Autonomous Vehicles

The Vision Positioning System Market is driven by the growing use of drones and autonomous vehicles across industries. Logistics, agriculture, and surveillance rely on these systems for accurate navigation in GPS-denied environments. It enhances flight stability, obstacle detection, and route optimization. Increasing applications in defense and urban air mobility further boost demand. Commercial drone operators also prefer vision-based navigation to ensure safe and precise operations. It highlights the importance of advanced positioning systems in enabling next-generation mobility.

- For instance, DJI launched the Matrice 350 RTK drone equipped with a dual-vision positioning system and a maximum flight endurance of 55 minutes, enabling centimeter-level navigation accuracy for commercial and defense applications.

Expanding Role in Industrial Automation and Robotics

The Vision Positioning System Market gains momentum from rising deployment in automated manufacturing and robotics. Factories integrate these systems to improve accuracy in assembly lines and material handling. It ensures high precision in processes that require exact positioning. Robots equipped with vision positioning achieve improved productivity and reduced error rates. Industrial players adopt these systems to meet growing demand for flexible and scalable automation. It strengthens the role of vision technologies in smart manufacturing strategies.

- For instance, Fanuc, in collaboration with Inbolt, showcased its CRX cobot with integrated 3D vision that performs dynamic assembly tasks such as screw installation and filter placement on moving lines, maintaining real-time precision without halting production.

Growing Demand from Retail and Warehousing Applications

The Vision Positioning System Market benefits from rapid adoption in retail and warehouse operations. Automated guided vehicles and robotic systems use vision positioning to navigate complex layouts. It supports efficient inventory management, order fulfillment, and real-time tracking. The rise of e-commerce creates strong demand for solutions that enhance logistics speed and accuracy. Retailers invest in such systems to meet customer expectations for timely delivery. It underscores the value of vision positioning in modern supply chain management.

Advancements in AI, Machine Learning, and Sensor Fusion

The Vision Positioning System Market is fueled by continuous progress in artificial intelligence and sensor integration. AI-powered algorithms improve image recognition, navigation, and obstacle avoidance. It allows systems to operate reliably in dynamic and unpredictable environments. Combining vision data with LiDAR, radar, and GPS enhances accuracy and resilience. Developers invest in advanced software and hardware to expand capabilities across industries. It ensures vision positioning remains central to innovation in autonomous and intelligent systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Trends

Integration with Autonomous Mobility Solutions

The Vision Positioning System Market is witnessing rapid integration into autonomous mobility platforms. Drones, self-driving cars, and delivery robots increasingly depend on vision systems for real-time navigation. It enables accurate obstacle detection, smoother movement, and safe route planning. Rising investments in autonomous mobility programs across logistics and transportation fuel this trend. Companies prioritize vision-based solutions to reduce dependency on GPS alone. It reinforces vision positioning as a core element of next-generation mobility solutions.

- For instance, DJI launched the Matrice 350 RTK drone with a dual-vision positioning system and a maximum endurance of 55 minutes, supporting centimeter-level navigation accuracy for commercial and defense operators.

Advancements in Artificial Intelligence and Deep Learning

The Vision Positioning System Market benefits from advances in artificial intelligence and deep learning. Machine learning algorithms improve image processing speed, accuracy, and adaptability in complex environments. It enhances decision-making for autonomous systems across industrial, defense, and commercial sectors. Deep learning models allow vision positioning to detect patterns and anomalies with greater precision. Hardware improvements such as high-resolution cameras and advanced processors support these developments. It ensures stronger adoption of AI-driven positioning systems worldwide.

- For instance, Cognex introduced OneVision, a new cloud-based AI platform that, according to the company, shortens machine vision setup times from months to minutes and streamlines multi-site deployment. The platform is available to select customers using the In-Sight 3800 and 8900 vision systems, with broader availability planned for 2026.

Expansion in Industrial and Warehouse Automation

The Vision Positioning System Market shows increasing demand from industrial automation and warehouse management. Automated guided vehicles and robotics adopt these systems to improve navigation in dynamic layouts. It supports efficiency in material handling, inventory tracking, and order fulfillment. The growth of e-commerce accelerates adoption of vision-based navigation for large warehouses. Industrial users prefer systems that offer scalability and integration with existing automation infrastructure. It highlights vision positioning as a critical enabler of productivity in modern supply chains.

Growth of Multi-Sensor Fusion and Hybrid Systems

The Vision Positioning System Market is shaped by the growing adoption of hybrid positioning solutions. Combining vision data with LiDAR, radar, and GPS enhances reliability in challenging environments. It enables continuous operation even in low-light or GPS-denied conditions. Industries such as mining, defense, and construction demand robust systems for harsh terrains. Sensor fusion also improves redundancy and resilience, reducing risks of navigation failures. It drives development of advanced vision positioning platforms capable of operating in diverse conditions.

Market Challenges Analysis

High Implementation Costs and Infrastructure Requirements

The Vision Positioning System Market faces challenges due to high costs of deployment and supporting infrastructure. Advanced cameras, processors, and AI-powered software require significant investment, limiting adoption by small and medium enterprises. It also demands robust connectivity, reliable power supply, and integration with existing automation systems. For industries in developing regions, these requirements create financial and operational barriers. Maintenance and upgrades further increase long-term costs. It slows widespread adoption despite the growing need for advanced positioning solutions.

Operational Limitations and Environmental Constraints

The Vision Positioning System Market also struggles with environmental and operational limitations. Performance can be reduced in low-light, foggy, or dusty conditions where cameras fail to capture accurate images. It creates challenges for industries like mining, construction, and agriculture that operate in harsh settings. Dependence on complex algorithms increases vulnerability to technical errors and cybersecurity risks. Variability in regulatory standards for autonomous systems adds uncertainty for manufacturers. It highlights the need for continuous improvement in hardware, software, and compliance frameworks to ensure reliability across diverse environments.

Market Opportunities

Expansion in Autonomous Vehicles and Drone Applications

The Vision Positioning System Market presents significant opportunities with the rapid adoption of autonomous vehicles and drones. Self-driving cars, delivery robots, and commercial drones increasingly rely on vision systems for navigation and obstacle detection. It provides precise localization in GPS-denied or urban canyon environments where traditional methods struggle. Governments and corporations are investing in drone delivery programs and smart transportation projects, expanding the scope for vision technologies. Demand for safety, reliability, and real-time decision-making ensures strong uptake. It positions vision positioning as a foundational technology for autonomous mobility ecosystems.

Integration into Industrial Automation and Smart Infrastructure

The Vision Positioning System Market also benefits from rising demand in industrial automation and smart city projects. Manufacturing plants deploy these systems to improve robotic accuracy and streamline material handling. It supports efficient operations in warehouses, logistics hubs, and production lines. Smart city initiatives adopt vision positioning to enhance traffic management, public safety, and infrastructure monitoring. Emerging economies with growing urbanization provide new growth avenues for suppliers. It highlights the opportunity to expand adoption across both advanced and developing markets with scalable, high-precision solutions.

Market Segmentation Analysis:

By Component

The Vision Positioning System Market by component is segmented into cameras, sensors, processors, and software. Cameras dominate adoption as they serve as the primary input devices for capturing environmental data. It supports applications across drones, autonomous vehicles, and robotics where precision is essential. Sensors such as LiDAR and ultrasonic units are integrated to enhance accuracy and resilience in challenging environments. Processors handle large volumes of image and sensor data, enabling real-time decision-making. Software powered by AI and machine learning optimizes navigation, object detection, and route planning. It highlights the combined role of hardware and software in delivering reliable positioning outcomes.

- For instance, Sony Semiconductor Solutions introduced the IMX479 SPAD LiDAR sensor, which offers a 5 cm distance resolution and a high frame rate of up to 20 fps for automotive applications like ADAS.

By Location

The Vision Positioning System Market by location divides into indoor and outdoor applications. Indoor environments include warehouses, manufacturing plants, and retail stores where automated guided vehicles and robots require precise navigation. It ensures efficiency in inventory management, order fulfillment, and industrial automation. Outdoor applications dominate due to demand from drones, autonomous vehicles, and defense systems. These platforms rely on vision systems to operate in urban spaces, rural areas, and GPS-limited zones. The ability to function in diverse terrains and weather conditions strengthens outdoor adoption. It positions vision positioning as a critical enabler of both commercial and industrial operations.

- For instance, Seegrid Corporation unveiled its Lift CR1 autonomous lift truck at MODEX 2024. The CR1 can reach 15 ft in height, handle a payload of 4,000 lb, and operates at speeds up to 5 mph, using advanced 3D vision and dynamic path planning.

By Platform

The Vision Positioning System Market by platform includes unmanned aerial vehicles, autonomous ground vehicles, and industrial robots. Unmanned aerial vehicles benefit most, as drones depend on vision positioning for stable flight and navigation in GPS-denied areas. It supports applications in logistics, agriculture, and surveillance. Autonomous ground vehicles, including self-driving cars and delivery robots, integrate these systems to enhance safety and efficiency. Industrial robots adopt vision positioning to improve accuracy in manufacturing, assembly, and material handling. It shows strong versatility, with platforms across mobility, defense, and industrial domains driving sustained growth.

Segments:

Based on Component

- Sensor

- Camera Systems

- Markers

- Others

Based on Location

- Indoor Positioning System

- Outdoor Positioning System

Based on Platform

- Unmanned Aerial Vehicle

- Automated Guided Vehicle

- Space Vehicle

- Industrial Robots

- Others

Based on Solution

- Tracking Solution

- Analytics Solution

- Navigation Solution

- Industrial Solution

- Others

Based on End-use Industry

- Retail

- Healthcare

- Defense

- Industrial

- Transportation & Logistics

- Hospitality

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a 38% share of the Vision Positioning System Market, driven by advanced adoption across aerospace, defense, automotive, and industrial automation. The United States leads with strong investments in autonomous vehicles, drone technology, and robotics. It benefits from a robust ecosystem of tech companies, research institutions, and government-backed projects. Defense applications, including surveillance drones and navigation systems, contribute significantly to demand. Canada shows steady adoption in logistics, warehouse automation, and smart infrastructure projects. Rising focus on precision agriculture and healthcare robotics also boosts the regional market. It positions North America as a frontrunner in both innovation and deployment of vision-based technologies.

Europe

Europe accounts for a 27% share of the Vision Positioning System Market, supported by strong automotive, aerospace, and industrial sectors. Germany, France, and the UK are leading adopters with their focus on Industry 4.0 and automation. It benefits from stringent regulations on vehicle safety, pushing adoption of advanced vision systems in autonomous and semi-autonomous cars. European aerospace and defense programs also integrate vision-based navigation in drones and aircraft. Warehousing and logistics in Western Europe increasingly use automated guided vehicles powered by vision systems. The region’s commitment to sustainability drives the use of vision technologies in smart cities and green mobility projects. It highlights Europe as a key region with balanced growth across multiple industries.

Asia-Pacific

Asia-Pacific commands a 25% share of the Vision Positioning System Market, making it one of the fastest-growing regions. China leads with large-scale investments in autonomous vehicles, drones, and industrial robotics. It benefits from a strong manufacturing base and rapid adoption of AI-driven technologies. Japan and South Korea drive innovation in automotive and robotics, focusing on compact, energy-efficient systems. India shows rising demand in logistics, agriculture, and defense, supported by digitalization initiatives. Expanding e-commerce in Southeast Asia strengthens warehouse automation using vision positioning. It establishes Asia-Pacific as a dynamic region with significant potential for both production and adoption.

Latin America

Latin America contributes a 6% share to the Vision Positioning System Market, reflecting gradual but promising adoption. Brazil leads through demand from agriculture drones, logistics, and security applications. It benefits from growing use of automation in mining and industrial operations. Mexico records adoption in automotive and manufacturing sectors, driven by regional supply chain growth. Chile and Argentina also explore vision technologies in agriculture and defense. Limited infrastructure and budget constraints slow wider adoption, but international partnerships are expanding access. It highlights the region’s steady progress with opportunities tied to modernization and automation.

Middle East & Africa

The Middle East & Africa hold a 4% share of the Vision Positioning System Market, supported by growing investments in smart city projects and defense applications. The UAE and Saudi Arabia lead with strong adoption in drones, autonomous vehicles, and infrastructure monitoring. It complements national strategies for economic diversification and technological leadership. Africa, led by South Africa, shows demand in mining, agriculture, and security sectors. Limited local production capacity creates reliance on imported technologies. It reflects an emerging market where government initiatives and international collaborations will be critical to future growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the Vision Positioning System Market features leading players such as ABB Ltd., Cognex Corporation, DJI Technology Co., Ltd, Fanuc Corporation, Omron Corporation, Qualcomm Technologies, Inc., Seegrid, Sick AG, Sony Corporation, and Verizon Communications. These companies compete by leveraging advanced technologies, including artificial intelligence, machine learning, and sensor fusion, to deliver precise and reliable navigation solutions. They focus on enhancing applications in drones, autonomous vehicles, industrial automation, and smart infrastructure. Strategic collaborations with governments, research institutions, and commercial enterprises strengthen their ability to expand market presence and accelerate adoption. Investments in product innovation and integration of multi-sensor platforms ensure higher efficiency and adaptability in complex environments. Companies also pursue partnerships with logistics providers and smart city developers to align solutions with real-world demands. Competition emphasizes sustainability, cost-effectiveness, and regulatory compliance to maintain industry leadership. This strategic focus positions key players to capture growth across mobility, defense, manufacturing, and urban development applications worldwide.

Recent Developments

- In June 2025, Sony Corporation, Sony Semiconductor Solutions launched a new stacked SPAD distance sensor (IMX479) for automotive LiDAR, delivering the high-resolution and high-speed distance measuring performance required for advanced driver assistance systems.

- In June 2025, ABB introduced its Flexley Mover P603 Autonomous Mobile Robot, featuring AI-driven Visual SLAM navigation with positioning accuracy of ±5 mm and a payload capacity of 1,500 kg, enabling highly precise and autonomous intralogistics operations without additional infrastructure.

- In May 2025, Fanuc Corporation in collaboration with Inbolt, showcased a CRX cobot integrated with a 3D vision system capable of performing assembly tasks—such as inserting screws and installing filters—on moving assembly lines in real time. This system enables robots to track and manipulate parts dynamically without stopping the line.

- In September 2024, Seegrid Corporation secured $50 million in Series D funding to support its robotics expansion, intended to accelerate development and rollout of its CR1 high-reach vision-guided lift truck for automated material handling.

Report Coverage

The research report offers an in-depth analysis based on Component, Location, Platform, Solution, End-use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with growing adoption of autonomous vehicles and drones.

- Industrial automation will strengthen demand for precise vision-based navigation systems.

- AI and machine learning integration will improve accuracy and adaptability of solutions.

- Sensor fusion with LiDAR, radar, and GPS will enhance system reliability.

- Warehousing and logistics will adopt vision positioning for efficiency in material handling.

- Smart city projects will integrate these systems for infrastructure monitoring and traffic management.

- Defense and aerospace sectors will continue to invest in vision-based navigation technologies.

- Compact and energy-efficient platforms will gain prominence in consumer and commercial applications.

- Emerging economies will adopt vision positioning for agriculture, mining, and industrial growth.

- Strategic partnerships and R&D investments will drive innovation and global competitiveness.