Market Overview

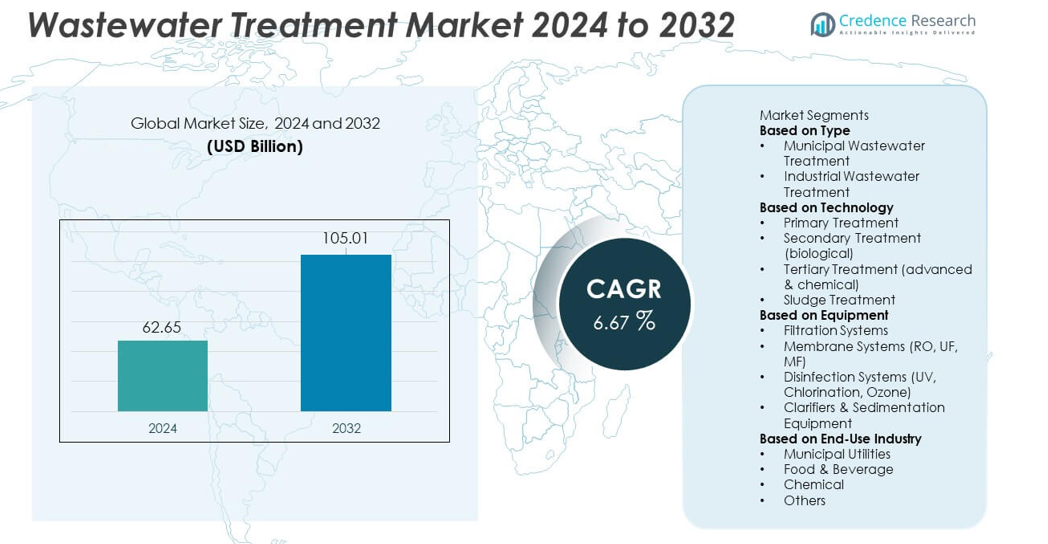

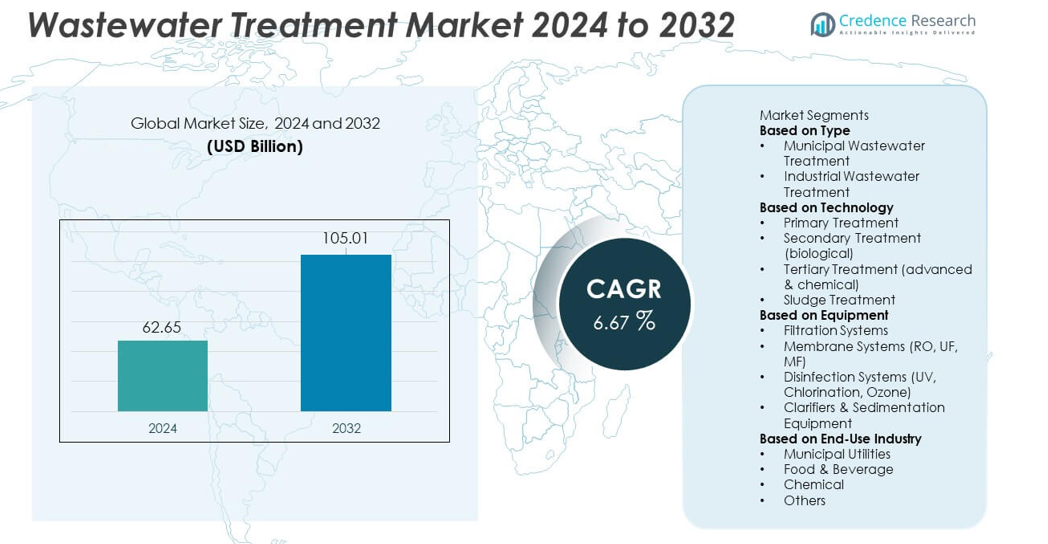

The Wastewater Treatment market size reached USD 62.65 billion in 2024 and is projected to reach USD 105.01 billion by 2032, supported by a 6.67% CAGR during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wastewater Treatment market Size 2024 |

USD 62.65 billion |

| Wastewater Treatment market, CAGR |

6.67% |

| Wastewater Treatment market Size 2032 |

USD 105.01 billion |

Top players in the Wastewater Treatment market include leading global providers that focus on membrane systems, biological treatment technologies, and advanced sludge management solutions. These companies strengthen their presence through large municipal contracts, industrial partnerships, and investments in smart monitoring platforms that enhance energy efficiency and regulatory compliance. North America leads the market with a 34% share, driven by stringent discharge norms and modernization of aging treatment plants. Europe follows with a 30% share, supported by strong sustainability mandates and advanced nutrient-removal systems. Asia Pacific holds a 28% share, expanding rapidly due to rising urbanization, industrial growth, and large government-backed wastewater infrastructure projects.

Market Insights

- The Wastewater Treatment market reached USD 62.65 billion in 2024 and is set to grow at a 6.67% CAGR, driven by rising global demand for efficient water management.

- Strong market growth comes from expanding municipal wastewater needs and industrial compliance requirements, pushing adoption of advanced biological, membrane, and tertiary treatment systems.

- Key trends include smart monitoring, digital automation, and rising investment in membrane technologies, with secondary treatment leading the technology segment with a 48% share.

- Competitive activity intensifies as major players invest in energy-efficient systems, sludge-to-resource solutions, and long-term service contracts to support operational reliability across large utilities.

- North America leads with a 34% share, followed by Europe at 30% and Asia Pacific at 28%, while membrane systems dominate the equipment segment with a 39% share, supported by growing water reuse and high-purity treatment demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Municipal wastewater treatment leads the segment with a 61% share, driven by rising urban populations, stricter discharge norms, and expanding public infrastructure. Governments invest heavily in treatment plants to manage domestic sewage and prevent contamination of surface and groundwater sources. Aging municipal networks in developed regions create strong demand for upgrades, while developing economies expand new capacity to meet sanitation goals. Industrial wastewater treatment holds the remaining share, supported by growing effluent output from chemicals, food processing, pharmaceuticals, and power plants. Rising compliance pressure and zero-liquid-discharge initiatives continue to boost investment across industrial facilities.

- For instance, Veolia deployed a biological treatment upgrade using a 245,000 m³/day capacity system at the Doha South facility (or a similar Veolia project site) or, more accurately, the Doha North Sewage Treatment Works (STW), which has a peak design capacity of 439,000 m³/day and was developed by Keppel Seghers for the public works authority in Qatar.

By Technology

Secondary treatment dominates the technology segment with a 48% share, supported by its essential role in biological degradation of organic pollutants across both municipal and industrial systems. Growing adoption of activated sludge, MBBR, and sequencing batch reactors strengthens its position. Primary treatment remains vital for solid removal and sedimentation but holds a smaller share as regulations push plants toward advanced purification stages. Tertiary treatment expands steadily due to rising demand for nutrient removal, disinfection, and water reuse. Sludge treatment gains traction as operators adopt efficient dewatering and anaerobic digestion to reduce disposal risks.

- For instance, the Brightwater Wastewater Treatment Facility in King County, Washington, is a large operating facility utilizing Membrane Bioreactor (MBR) technology in North America, with a design average flow capacity of 36 mgd (million gallons per day).

By Equipment

Membrane systems lead the equipment segment with a 39% share, driven by strong demand for RO, UF, and MF technologies used in water reuse, desalination, and high-purity industrial processes. Their ability to remove fine particles, pathogens, and dissolved solids supports widespread adoption. Filtration systems hold a steady share as they provide essential primary and secondary clarification functions. Disinfection systems grow due to increasing reliance on UV, ozone, and chlorination for safe effluent discharge. Clarifiers and sedimentation equipment remain critical in early treatment stages. Rising focus on reclaimed water and advanced purification continues to boost membrane system deployment.

Key Growth Drivers

Rising Urbanization and Expanding Municipal Wastewater Needs

Rapid urban expansion increases sewage generation and places greater pressure on municipal utilities, driving strong demand for advanced wastewater treatment systems. Cities invest in modern plants to manage rising loads, upgrade aging networks, and comply with stricter environmental regulations. Population growth and new residential developments require added treatment capacity and improved sanitation infrastructure. Governments also prioritize sustainable water management, encouraging recycling and reuse programs. These factors collectively strengthen the need for reliable municipal wastewater treatment solutions across both developed and developing regions.

- For instance, SUEZ is supplying equipment for the new Buaran III water treatment plant in Jakarta, which is designed to handle an additional 260,000 m³/day of clean water supply.

Stringent Environmental Regulations and Industrial Compliance Requirements

Tightening discharge standards push industries to adopt advanced wastewater treatment technologies that reduce pollutants, meet compliance targets, and support safer effluent disposal. Sectors such as chemicals, pharmaceuticals, food processing, and oil and gas face strict monitoring requirements that demand robust treatment systems. Regulatory bodies enforce penalties for non-compliance, compelling companies to upgrade outdated facilities. Zero-liquid-discharge initiatives and sustainability commitments further motivate industries to invest in modern treatment solutions. This ongoing compliance pressure drives continuous adoption of efficient and high-performance wastewater treatment technologies.

- For instance, Aquatech installed a ZLD system processing 22,000 m³/day for a major petrochemical complex.

Growing Focus on Water Reuse and Resource Recovery

Rising water scarcity encourages industries and municipalities to invest in systems that enable wastewater reuse for irrigation, cooling, and industrial processes. Advanced technologies such as membrane filtration, UV disinfection, and tertiary treatment support high-quality reclaimed water. Facilities also explore resource recovery through sludge-to-energy processes, nutrient extraction, and biogas generation, reducing operational costs and enhancing sustainability. The shift toward circular water management strengthens demand for efficient treatment solutions that maximize water reuse and minimize waste. This trend significantly boosts long-term market growth.

Key Trends & Opportunities

Adoption of Smart Monitoring and Automation Technologies

Digital transformation accelerates the use of automation, sensors, and real-time monitoring systems across wastewater treatment facilities. Smart controllers enhance process accuracy, reduce energy consumption, and support predictive maintenance. IoT-enabled platforms allow operators to detect performance issues early and optimize chemical dosing, aeration, and filtration. These advancements reduce operational costs and improve treatment efficiency. As water utilities modernize and industrial plants embrace digitalization, smart wastewater solutions create strong opportunities for advanced technology providers.

- For instance, Xylem acquired Sensus, a company whose smart metering devices support digital monitoring in utility networks, and are installed in the millions globally.

Expansion of Advanced Treatment and Membrane-Based Solutions

Growing demand for high-quality effluent and water reuse pushes facilities toward advanced treatment systems, including RO, UF, MF, and tertiary purification technologies. Membrane systems gain traction due to improved durability, lower maintenance needs, and better contaminant removal. Industries adopting zero-liquid-discharge strategies rely heavily on advanced filtration and evaporation techniques. These innovations open new opportunities in industrial clusters, desalination-linked facilities, and municipalities seeking to enhance water recovery rates. Continued R&D in membrane efficiency and fouling resistance further boosts this trend.

- For instance, DuPont Water Solutions provides many RO and UF membrane elements for reuse and ZLD operations globally. They have worked on significant projects, including a plant for Reliance Industries using up to 20,000 elements and a major desalination facility in Israel using 40,000 elements.

Key Challenges

High Capital Costs and Operational Expenses

Wastewater treatment plants often require significant upfront investment in equipment, construction, and advanced technology integration. Operational costs remain high due to energy-intensive processes, specialized labor needs, and ongoing maintenance requirements. Smaller municipalities and industries face financial barriers that delay upgrades or limit adoption of modern systems. Budget constraints also affect long-term sustainability of treatment operations. These cost-related challenges slow adoption, especially in developing regions with limited infrastructure spending.

Complex Sludge Management and Disposal Issues

Sludge generated during wastewater treatment presents handling, transportation, and disposal challenges that increase operational complexity. Environmental regulations restrict landfilling and promote safe disposal methods, forcing facilities to adopt costly dewatering, digestion, or thermal treatment technologies. Industrial sludge containing hazardous substances complicates treatment further. Odor control, storage, and compliance with disposal standards require ongoing investment. Effective sludge management remains one of the most demanding issues for treatment operators, impacting both cost and operational performance.

Regional Analysis

North America

North America holds a 34% share of the Wastewater Treatment market, driven by strict regulatory frameworks, advanced municipal infrastructure, and ongoing investments in upgrading aging treatment plants. The United States leads due to strong enforcement of the Clean Water Act and rising demand for nutrient removal technologies. Industrial sectors such as chemicals, pharmaceuticals, and food processing invest heavily in compliance-focused treatment systems. Growth in water reuse projects and smart monitoring technologies strengthens market expansion. Canada contributes through modernization of municipal facilities and increasing adoption of membrane filtration and disinfection systems across urban regions.

Europe

Europe accounts for a 30% share, supported by stringent wastewater directives, strong sustainability goals, and high adoption of advanced treatment technologies. Countries such as Germany, France, and the Netherlands invest in nutrient removal, tertiary treatment, and large-scale reuse initiatives. The region benefits from robust industrial wastewater regulations that drive adoption of high-performance biological and chemical treatment systems. EU funding programs support modernization of sewer networks and treatment infrastructure in Eastern Europe. A strong focus on circular water management and resource recovery further reinforces Europe’s leadership in advanced wastewater treatment solutions.

Asia Pacific

Asia Pacific holds a 28% share, driven by rapid urbanization, industrialization, and government-led investments in municipal sewage treatment infrastructure. China and India lead with large-scale construction of treatment plants to address pollution and improve water security. ASEAN countries expand capacity to support industrial growth in textiles, chemicals, and food processing. Rising awareness of water reuse and adoption of membrane-based technologies strengthen market momentum. Growing population density and expanding megacities continue to increase wastewater volumes, pushing the region toward higher investment in modern treatment and sludge management systems.

Latin America

Latin America represents a 5% share, driven by rising urban water demand, growing pollution concerns, and government initiatives to expand wastewater treatment coverage. Brazil and Mexico lead adoption as cities modernize sewer networks and industries upgrade effluent treatment systems to meet tightening regulations. Mining, food processing, and oil and gas sectors contribute significantly to industrial wastewater treatment needs. Limited infrastructure in rural areas presents challenges but also opens opportunities for decentralized treatment solutions. Continued investment in water quality improvement and public health initiatives supports steady market growth across the region.

Middle East & Africa

The Middle East & Africa region accounts for a 3% share, supported by increasing focus on water scarcity, desalination-linked wastewater reuse, and industrial development. Gulf countries such as the UAE and Saudi Arabia invest in advanced tertiary treatment and membrane technologies to support irrigation and non-potable reuse programs. Africa experiences growing demand due to urban expansion and the need to improve sanitation infrastructure, particularly in South Africa, Kenya, and Nigeria. Industrial zones adopt modern treatment systems to meet environmental standards. Rising investments in water recycling and sustainable resource management continue to shape long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Type

- Municipal Wastewater Treatment

- Industrial Wastewater Treatment

By Technology

- Primary Treatment

- Secondary Treatment (biological)

- Tertiary Treatment (advanced & chemical)

- Sludge Treatment

By Equipment

- Filtration Systems

- Membrane Systems (RO, UF, MF)

- Disinfection Systems (UV, Chlorination, Ozone)

- Clarifiers & Sedimentation Equipment

By End-Use Industry

- Municipal Utilities

- Food & Beverage

- Chemical

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Major players in the Wastewater Treatment market include Veolia, SUEZ, Xylem, Ecolab, Pentair, DuPont Water Solutions, Aquatech International, Evoqua Water Technologies, Toshiba Water Solutions, and Kurita Water Industries. These companies strengthen their competitive positions through advanced membrane technologies, high-efficiency biological systems, and smart monitoring solutions that address rising municipal and industrial demand. Many invest in R&D to enhance nutrient removal, sludge management, and water reuse capabilities. Strategic partnerships with governments and industrial clients support long-term service contracts and large-scale EPC projects. Players also expand their global footprint through acquisitions, digital optimization platforms, and energy-efficient treatment solutions. As regulations tighten and water scarcity intensifies, leading companies focus on sustainable designs, modular systems, and decentralized treatment units to meet evolving client needs. Continuous innovation and service-oriented business models shape competition across global markets.

Key Player Analysis

Recent Developments

- In November 2025, Xylem (along with peers like Veolia) was identified among leading firms in a market report related to the expansion of the mobile-water-treatment market and the advancement of membrane technology.

- In May 2025, Aquatech International was named “Water Technology Company of the Year” at the Global Water Summit, part of the Global Water Awards, for its various innovations including its BioMOD (modular, biological treatment solution), BioCon (integrated fixed-film activated sludge systems), and the development of AquaODA (high-purity water solutions for the semiconductor industry).

- In June 2024, Veolia Water Technologies & Solutions signed a global collaboration with Capture6 to deploy carbon dioxide removal alongside wastewater and industrial-water treatment operations.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Equipment, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced treatment technologies will rise as water scarcity intensifies worldwide.

- Municipal utilities will invest more in modern plants and upgraded sewer networks.

- Adoption of membrane filtration and tertiary treatment will increase due to rising reuse needs.

- Industrial sectors will deploy high-performance systems to meet stricter discharge regulations.

- Smart monitoring and automation will expand to improve operational efficiency and reduce downtime.

- Decentralized and modular treatment units will gain popularity in developing regions.

- Sludge-to-energy and resource recovery solutions will see wider adoption across facilities.

- Energy-efficient treatment technologies will grow as utilities aim to reduce operating costs.

- Public-private partnerships will increase to support large infrastructure projects.

- Climate resilience programs will accelerate the need for robust and future-ready wastewater systems.