Market overview

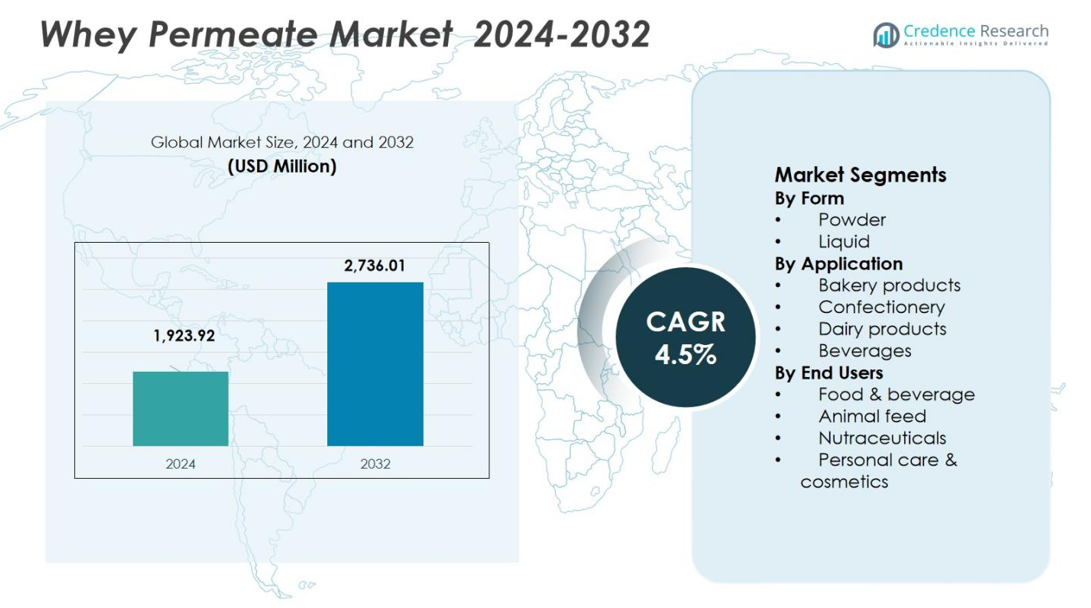

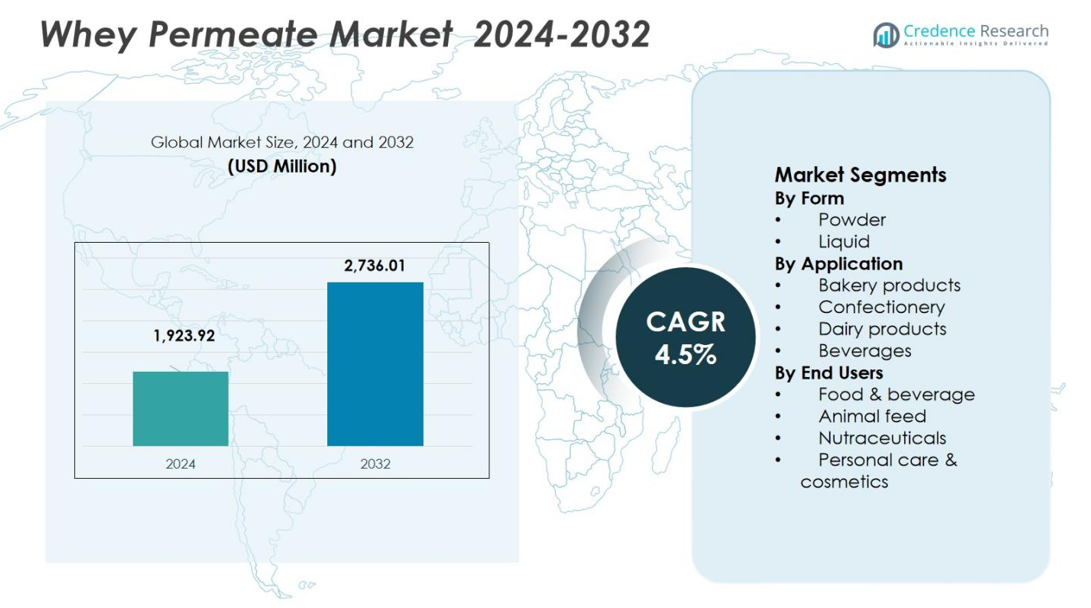

The Whey Permeate Market size was valued at USD 1,923.92 Million in 2024 and is anticipated to reach USD 2,736.01 Million by 2032, at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Whey Permeate Market Size 2024 |

SD 1,923.92 Million |

| Whey Permeate Market, CAGR |

4.5% |

| Whey Permeate Market Size 2032 |

USD 2,736.01 Million |

The Whey Permeate Market features prominent players including Arla Foods amba, Agri‑Dairy Products, Inc., LACTALIS Ingredients, Arion Dairy Products B.V. and Agropur Ingredients, among others that drive innovation and production scale. These organizations invest in capacity expansion and processing technologies to convert whey by‑product into high‑value permeate ingredients, strengthening their global reach. Regionally, North America leads with a market share of 45%, followed by Europe at 30% and Asia‑Pacific holding about 20% of the market. Their dominance reflects advanced dairy infrastructure, regulatory support and growing demand for functional dairy‑derived ingredients worldwide.

Market Insights

- The global Whey Permeate Market size was valued at USD 1,923.92 Million in 2024 and is projected to reach USD 2,736.01 Million by 2032, at a CAGR of 5%.

- Demand is driven by rising consumption of functional foods and cost‑efficient dairy‑derived ingredients, with the powder form segment holding about 63.5% share and the bakery application accounting for 19% share of the market.

- Trends reflect heightened adoption of up‑cycled dairy by‑products, clean‑label claims and expansion into animal feed and non‑traditional end‑uses, while the food & beverage end‑user holds 38.2% share.

- The market faces restraints from raw‑material price volatility, supply chain disruptions and competition from plant‑based substitutes, which exert pressure on margins and adoption.

- Regionally, North America leads with 45% market share, Europe follows with 30%, Asia‑Pacific holds about 20%, and Middle East & Africa contributes around 5% of the global market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Form

In the global Whey Permeate market, the powder form segment dominates with approximately 63.5 % share of the total market. This dominance is anchored in the powder variant’s advantages longer shelf life, reduced transportation and storage costs, and highly convenient handling for formulators. These features make powder permeate the preferred choice across numerous high‑volume applications such as bakery, dairy and feed industries. Conversely, the liquid form continues to gain traction, driven by growing demand for ready‑to‑use formulations in beverages and animal feed where ease of incorporation is critical.

- For instance, Arla Foods ensures consistent high-quality whey permeate powders like Variolac series, which offer excellent free-flowing properties and a sweet, milky flavor ideal for bakery products like biscuits, cakes, and baking mixes, enabling straightforward 1:1 replacement of bulk dairy solids.

By Application

Within the application segmentation, the bakery products category emerged as a dominant sub‑segment, capturing 19 % of the market share. This strong presence is explained by whey permeate’s functionality: it enhances flavour, moisture retention and texture in bakery items while offering cost‑efficiencies compared to milk solids. The bakery segment benefits from the ongoing expansion of processed food consumption globally, especially in emerging markets. Complementary segments such as confectionery, dairy products and beverages also leverage whey permeate’s lactose‑ and mineral‑rich profile, but none match the bakery share at present.

- For instance, Agropur Ingredients offers whey permeate products such as PermoLife and PermoDry, which find applications in bakery products by enhancing texture and flavor while reducing costs.

By End‑Users

In terms of end‑user segments, the food & beverage end‑use category leads the market with 38.2 % share. This reflects the high uptake of whey permeate across diverse food applications from bakery and confectionery to dairy drinks – where its functional and cost‑benefit credentials align strongly with industry needs for natural, versatile ingredients. The animal feed segment follows with a notable share, driven by the rising demand for nutrient‑rich feed ingredients in livestock and aquaculture, while nutraceuticals and personal care & cosmetics remain smaller yet growing niches.

Key Growth Drivers

Increasing demand for functional food ingredients

The global whey permeate market is being propelled by the rising consumer focus on health, wellness, and enriched food products. Manufacturers actively incorporate whey permeate into bakery, dairy, and snack formulations to enhance nutritional value, improve texture, and lower costs benefits which extend from ingredients such as its lactose- and mineral-rich profile. As processed food consumption expands and clean-label demand grows, food & beverage industry uptake becomes a key driver for permeate market expansion.

- For instance, Arla Foods Ingredients supplies whey permeate used widely in bakery products like biscuits and cakes, valued for its cost-effectiveness and ability to replace other dairy solids while ensuring consistent taste and quality across global production facilities.

Cost-efficiency and dairy-byproduct valorisation

Whey permeate benefits from its origin as a by-product of cheese or whey protein concentrate manufacture, enabling manufacturers to valorise dairy streams by converting whey into a marketable ingredient rather than waste. This cost-effectiveness and sustainability appeal translates into a competitive advantage for ingredient formulators, driving volume uptake of whey permeate in both food applications and animal feed.

- For instance, Fonterra, through its NZMP brand, has developed advanced dairy ingredient solutions that include whey permeate and related byproducts. Fonterra partners with global nutrition companies to supply high-value dairy ingredients for medical, infant, and active nutrition products.

Expansion of animal feed and alternative applications

Beyond food applications, whey permeate is increasingly adopted in animal nutrition, especially in piglet and calf feed formulations, due to its digestible lactose, proteins, and minerals. Simultaneously, technological advancements are unlocking novel uses (such as bio-based materials, functional supplements) thereby widening the addressable market and corroborating further growth potential.

Key Trends & Opportunities

Sustainability and circular-economy integration

A significant trend in the whey permeate market is the shift toward sustainability-driven formulations, where dairy producers and ingredient manufacturers deploy whey permeate to minimise waste and adopt circular-economy models. This presents a dual opportunity: reducing disposal costs for dairy processors and marketing permeate-based ingredients to environmentally conscious food brands.

- For instance, FrieslandCampina Ingredients incorporates whey permeate into functional beverage applications, enhancing product value while achieving waste reduction targets outlined in its sustainability reporting.

Clean-label, natural and functional ingredient positioning

Consumers increasingly demand minimally processed, natural-origin ingredients that deliver functional benefits. Whey permeate aligns with this trend its mild dairy flavour, solubility, and nutritional credentials position it as a clean-label alternative to synthetic fillers and expensive milk solids. Ingredient suppliers can seize this opportunity by developing tailored permeate grades (e.g., low-lactose, high-minerals) and expanding into growth markets such as nutraceuticals and personal care.

- For instance, Volac’s permeate powder is used in ready-to-mix meal shakes, enabling brands to meet clean-label requirements by replacing artificial additives with a single dairy-derived ingredient boasting standardized nutritional values.

Key Challenges

Competition from substitutes and raw-material volatility

Despite its advantages, whey permeate faces increasing competition from plant-based proteins, milk solids, and other carbohydrate fillers, which are often marketed as more sustainable or aligned with consumer dietary preferences. Additionally, fluctuations in milk and whey supply, processing costs, and whey permeate pricing pose significant risks to margin stability and supply consistency. These factors are especially critical as demand grows for more reliable, cost-effective alternatives in various food and beverage products. Manufacturers must therefore adopt strategic approaches to mitigate substitution risk and manage feedstock volatility, ensuring they can maintain a steady supply and sustain growth while balancing production costs.

Limited consumer awareness and application constraints

Although technically strong, whey permeate remains less familiar to many food manufacturers and end consumers compared with more popular ingredients like whey protein isolates or concentrates. Some food formulators still regard it as a low-value by-product, rather than recognizing its potential as a versatile, value-added ingredient. Overcoming this perception through targeted education, innovative application development, and certifications that highlight its nutritional and functional benefits remains a critical challenge. Efforts to position whey permeate as a premium ingredient in food and beverage formulations will be vital for boosting consumer demand and encouraging wider adoption in diverse product categories.

Regional Analysis

North America

North America commands a dominant position in the global whey permeate market, securing 45 % of total revenue. This strong performance results from a well‑established dairy processing infrastructure in the United States and Canada alongside high consumer health consciousness that drives demand for functional ingredients. Ingredient formulators in the region actively integrate whey permeate for bakery, dairy and animal feed applications. Furthermore, regulatory support for dairy production and efficient supply‑chain logistics enhance the region’s competitive edge and facilitate sustained uptake of whey permeate across multiple application segments.

Europe

Europe holds 30 % share of the global whey permeate market, positioning it as the second‑largest regional contributor. Growth is driven by consumer preference for high‑protein and clean‑label products, combined with well‑structured dairy sectors in Germany, France and the Netherlands. The region’s regulatory frameworks and agricultural subsidies under the European Union promote sustainable dairy production, which in turn fosters whey permeate utilisation. With established cooperative models and innovation in dairy ingredients, the European market continues to adopt whey permeate for bakery, confectionery and animal‑feed solutions.

Asia‑Pacific

Asia‑Pacific represents 20 % of the global whey permeate market, offering noteworthy growth potential due to rapid urbanisation, rising disposable incomes and shifting dietary patterns toward convenience foods. Countries such as China, India and Australia are increasingly integrating whey permeate into processed foods and animal feed as dairy manufacturing expands. Government initiatives to upgrade dairy quality standards and import liberalisation in key markets further support uptake. As local dairy supply chains strengthen, Asia‑Pacific is poised to accelerate its share and narrow the gap with established regions.

Middle East & Africa

The Middle East & Africa region contributes about 5 % of the global whey permeate market and is characterised by emerging dairy industries and evolving consumer preferences toward healthier ingredients. While urbanisation and nutritional awareness are increasing, infrastructural and logistical constraints limit immediate acceleration. Nevertheless, growing investments in dairy processing facilities and rising demand in feed applications signal untapped potential. As regulatory frameworks and supply chains mature, this region is expected to offer new avenues for whey permeate suppliers seeking to diversify beyond traditional markets.

Market Segmentations:

By Form

By Application

- Bakery products

- Confectionery

- Dairy products

- Beverages

By End Users

- Food & beverage

- Animal feed

- Nutraceuticals

- Personal care & cosmetics

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the whey permeate market features key players such as Arla Foods amba, Agri‑Dairy Products, Inc., LACTALIS Ingredients, Arion Dairy Products B.V. and Agropur Ingredients leading the industry. These companies actively leverage strategic investments—such as capacity expansions and process innovations—to strengthen their global footprint and product portfolios. They collaborate closely with dairy processors to capture whey streams and convert them into value‑added permeate products, thereby securing competitive advantages in cost and sustainability. Firms also engage in mergers, acquisitions and joint ventures to access emerging markets and advanced functional‑ingredient capabilities. As a result, the market is becoming more consolidated, with major players dominating scale and distribution, while smaller firms focus on regional niche opportunities or specialized product grades.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Milcobel and NoPalm Ingredients entered a partnership to valorize whey permeate into sustainable palm‑oil alternatives, with a supply and feasibility study agreement for a commercial facility targeted by 2028.

- In April 2025, Actus Nutrition acquired a 99,000 sq. ft. whey–processing facility from Foremost Farms USA, as part of a network‑wide whey protein partnership relevant from a broader whey/permeate ingredients angle.

- In May 2022, Arla Foods Ingredients launched its whey permeate product Variolac®, designed to help food manufacturers meet Brazil’s upcoming “no added sugar” labelling regulations.

Report Coverage

The research report offers an in-depth analysis based on Form, Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Market participants will increasingly prioritise product innovations that enhance solubility, functional performance and tailored nutritional profiles to capture growing formulators’ demand.

- Emerging‑market adoption will accelerate as dairy industry capacity expands and ingredient costs decline, enabling whey permeate to penetrate newer geographies and applications.

- The trend toward circular‑economy production will elevate whey permeate’s role as a valorised by‑product in dairy processing, reducing waste and improving sustainability credentials.

- Clean‑label and natural‑ingredient claims will push ingredient suppliers to position whey permeate as a cost‑effective alternative to synthetic bulking and flavour‑carriers.

- Growth in animal‑nutrition and aquaculture feed will open additional end‑user channels for whey permeate beyond food & beverage applications.

- Strategic partnerships and mergers between dairy‑ingredient producers and global food formulators will enhance supply‑chain integration and geographic reach.

- Price volatility of raw milk and whey streams will challenge margins, pressing producers to improve process efficiency and cost control.

- Regulatory frameworks around sugar‑reduction, dairy‑by‑product sourcing and sustainability disclosures will drive ingredient shift toward whey permeate.

- Substitution risk from plant‑based lactose alternatives and other bulking agents will require whey permeate suppliers to emphasise performance, provenance and cost‑advantages.

- Digital‑driven traceability and certification (e.g., GMO‑free, sustainable sourcing) will become important differentiators for whey permeate suppliers in premium applications.