Market Overview

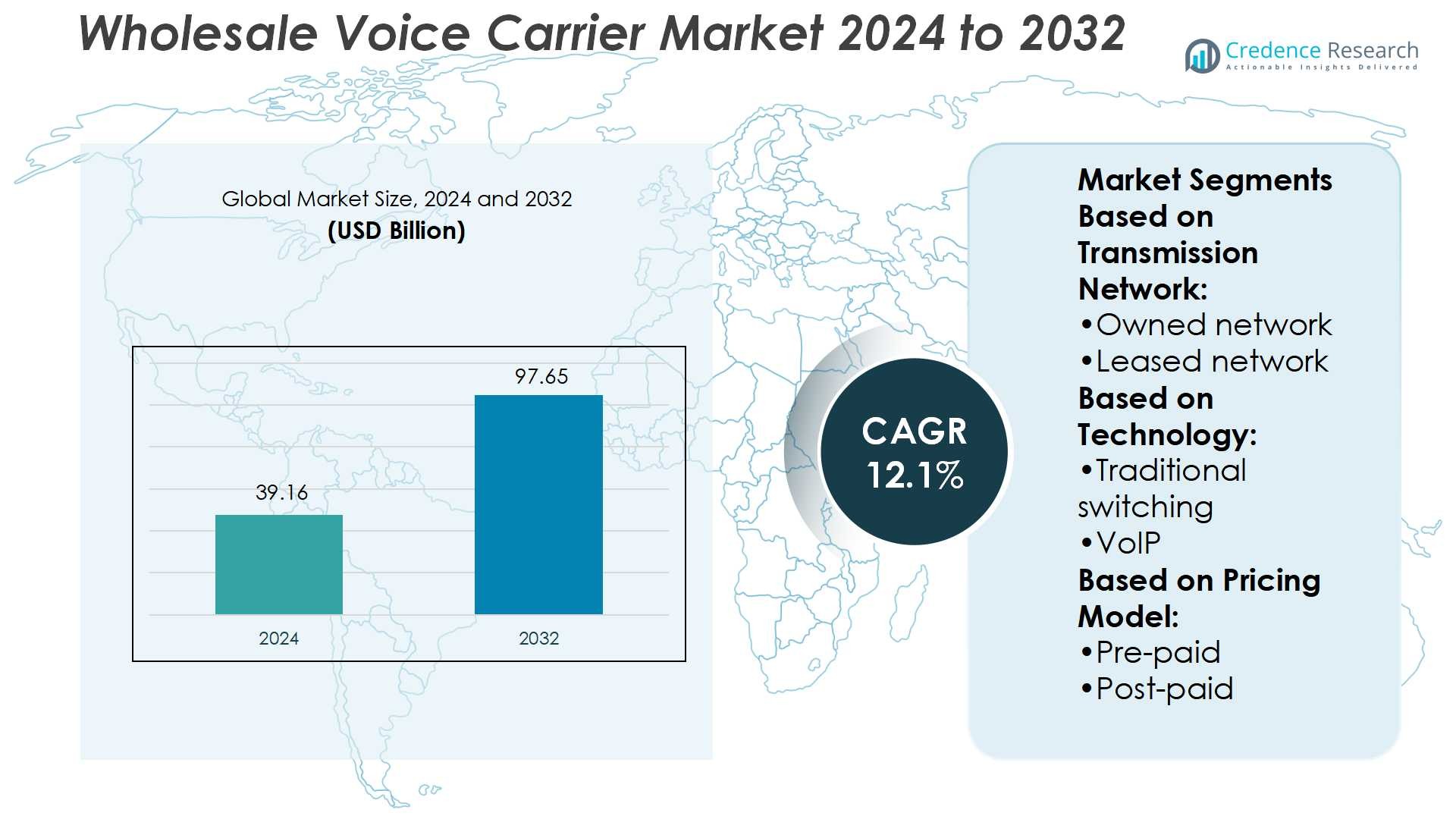

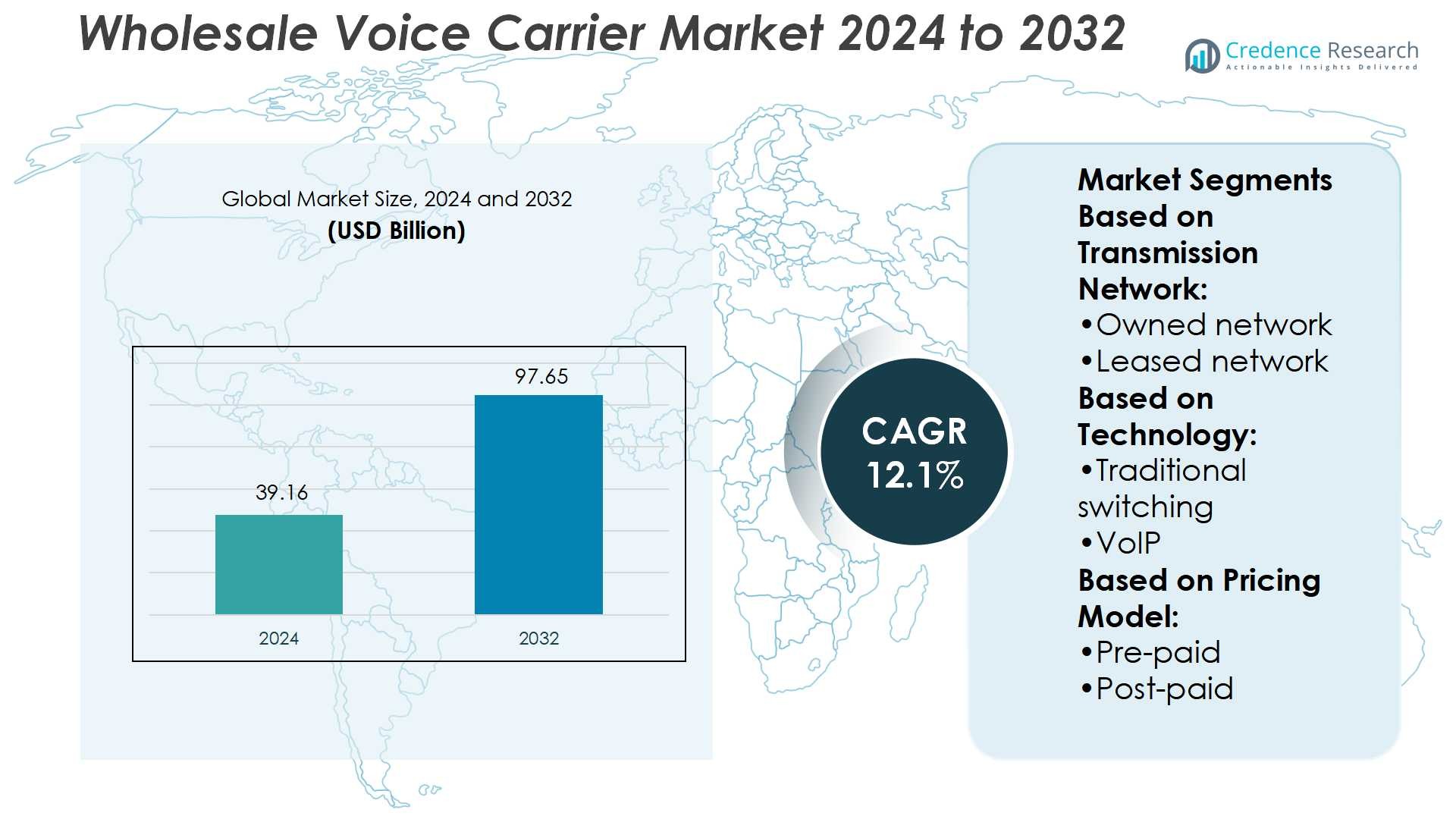

Wholesale Voice Carrier Market size was valued USD 39.16 billion in 2024 and is anticipated to reach USD 97.65 billion by 2032, at a CAGR of 12.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wholesale Voice Carrier Market Size 2024 |

USD 39.16 Billion |

| Wholesale Voice Carrier Market, CAGR |

12.1% |

| Wholesale Voice Carrier Market Size 2032 |

USD 97.65 Billion |

The wholesale voice carrier market is driven by leading players such as Deutsche Telekom AG, Lumen Technologies, BT, Telstra, Verizon Partner Solutions, Orange, Tata Communications Limited, Cox Communications, IDT Global Services, and NTT Ltd. These companies leverage extensive global networks, advanced VoIP platforms, and cloud-based solutions to deliver secure and efficient communication services. North America leads the market with a 34% share, supported by advanced telecom infrastructure, high enterprise adoption, and strong investments in fiber and 5G. The region’s dominance is reinforced by strategic partnerships, international route expansions, and growing demand for reliable cross-border voice connectivity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The wholesale voice carrier market was valued at USD 39.16 billion in 2024 and is projected to reach USD 97.65 billion by 2032, growing at a CAGR of 12.1%.

- Growth is driven by the rising adoption of VoIP and cloud-based solutions, which offer cost efficiency, scalability, and integration with enterprise communication systems.

- The competitive landscape features global players focusing on infrastructure expansion, fraud management, and partnerships to strengthen service quality and global coverage.

- Market restraints include declining profit margins due to pricing pressure, regulatory challenges, and increasing competition from OTT platforms offering low-cost alternatives.

- North America leads with a 34% share, supported by advanced telecom infrastructure and 5G adoption, while VoIP dominates the technology segment with a 67% share, reinforcing its position as the preferred communication model across regions.

Market Segmentation Analysis:

By Transmission Network

The owned network segment dominates the wholesale voice carrier market with a 61% share. Carriers with owned infrastructure benefit from higher reliability, lower latency, and greater control over service quality. These advantages attract enterprises and operators that prioritize consistent international connectivity. Investments in submarine cables and intercontinental fiber routes further strengthen this segment. Demand for secure and scalable connections continues to rise as global data and voice traffic grows, reinforcing the position of owned networks as the preferred choice for major carriers.

- For instance, Google is the primary investor and owner of the Dunant and Grace Hopper submarine cable systems. The Dunant cable, with a capacity of 250 terabits per second (Tbps), and the Grace Hopper cable, with a capacity of 352 Tbps, collectively add significant transatlantic capacity.

By Technology

VoIP leads the technology segment with a 67% share, surpassing traditional switching. This dominance is driven by cost efficiency, scalability, and support for advanced features such as real-time analytics and HD voice. Operators favor VoIP due to its compatibility with cloud communication platforms and seamless integration with enterprise systems. The adoption of 5G networks also enhances VoIP performance, reducing call drop rates and improving latency. These advantages ensure VoIP remains the preferred technology for both retail and wholesale carriers, supporting its strong market leadership.

- For instance, Lumen upgraded its VoIP service for the U.S. Department of Defense (DoD) to support over 250,000 concurrent voice connections through its voice cloud system, using cloud data centers certified at DoD Impact Level-5 for security.

By Pricing Model

The post-paid model accounts for 58% of the wholesale voice carrier market, making it the leading segment. Enterprises and telecom operators prefer post-paid agreements for predictable billing and transparent usage tracking. This model provides flexibility in handling large-scale international traffic, with discounts on higher volumes. Post-paid contracts also foster long-term relationships between carriers and clients, ensuring stable revenue streams. While pre-paid models appeal to smaller players and niche operators, post-paid remains dominant due to its alignment with enterprise-grade requirements and cross-border voice traffic management.

Key Growth Drivers

Rising International Voice Traffic

The wholesale voice carrier market benefits from the steady rise in international voice traffic. Growth in global trade, tourism, and cross-border migration drives higher demand for reliable international communication. Carriers expand coverage through owned and leased networks to meet this need. Enterprises, especially in financial services and logistics, require high-quality international voice services for operational efficiency. The increasing reliance on international connectivity for both consumer and enterprise use continues to strengthen the demand base for wholesale voice carriers worldwide.

- For instance, BT’s Global Voice solutions currently route over 320 million minutes per month on its SIP platform across more than 350 customers, hosting more than 4 million telephone numbers for those clients.

Adoption of VoIP and IP-Based Solutions

VoIP adoption is a major driver, as it reduces operational costs while offering scalability and flexibility. IP-based networks enable carriers to provide enhanced services like real-time analytics, call monitoring, and high-definition voice. Businesses prefer VoIP for its integration with cloud platforms and enterprise applications. The rollout of 5G networks further improves VoIP performance by lowering latency and increasing capacity. These advancements ensure strong migration from legacy switching systems to IP-based frameworks, positioning VoIP as a long-term growth driver in wholesale voice services.

- For instance, Telstra’s IP Telephony over ADSL limits concurrent calls per site to 3 calls and mandates a minimum of 512 kbps uplink and downlink speed to ensure quality. Each voice line requires a fraction of that bandwidth, typically around 100 kbps, depending on the codec.

Expansion of Telecom Infrastructure

Global investments in telecom infrastructure are fueling wholesale voice market growth. Carriers are deploying submarine cables, upgrading terrestrial fiber, and expanding points of presence in high-demand regions. These developments enhance coverage, capacity, and call quality across continents. Expanding digital economies in Asia Pacific, Africa, and Latin America further increase infrastructure demand. Operators leverage these advancements to serve international businesses and retail carriers with reliable services. Infrastructure growth ensures scalability for future demand while strengthening the competitive position of wholesale carriers in the global market.

Key Trends & Opportunities

Shift Toward Cloud-Based Voice Services

Carriers are rapidly transitioning to cloud-based voice platforms, enabling flexible and cost-effective service delivery. Cloud systems support advanced features such as unified communications, AI-driven call routing, and real-time data analytics. Enterprises increasingly adopt these services to enhance collaboration and reduce infrastructure costs. This trend opens opportunities for carriers to bundle voice with digital solutions, including collaboration and messaging platforms. Cloud integration not only modernizes operations but also positions wholesale carriers as strategic partners in the evolving digital communications landscape.

- For instance, Tata Communications carries 32 billion voice minutes every year via its carrier services, connecting through 1,600+ communications service provider relationships and interconnecting with 700+ mobile network operators.

Emergence of Wholesale Voice Aggregators

The rise of wholesale voice aggregators presents a strong opportunity for market players. Aggregators consolidate multiple carrier routes and provide optimized pricing, reliability, and quality to clients. This model attracts enterprises seeking cost-effective international communication without managing multiple vendor relationships. Carriers that partner with or acquire aggregators can broaden their service portfolios and reach new customer segments. The aggregator trend supports competitive differentiation, fosters operational efficiency, and creates growth opportunities in markets with diverse international voice demands.

- For instance, IDT Express, a division of IDT Corporation, is a wholesale voice carrier that terminates over 20 billion minutes annually. The company offers over 550 direct routes and more than 1,000 CLI-certified routes, relying on its extensive network to deliver reliable voice termination services.

Key Challenges

Declining Profit Margins

Profitability in the wholesale voice carrier market is challenged by price erosion and strong competition. The commoditization of voice services has led to reduced average revenue per minute. Additionally, regulatory pressure and interconnect rate reductions further compress margins. Carriers face difficulty sustaining profitability while maintaining service quality and infrastructure investment. To overcome this, players must diversify into value-added services such as fraud management, analytics, and unified communication. Margin pressure remains a persistent barrier to long-term growth and stability in the market.

Impact of Over-the-Top (OTT) Services

OTT platforms like WhatsApp, Skype, and Zoom significantly disrupt the wholesale voice carrier market. These applications bypass traditional carriers by offering free or low-cost international calling over data networks. As consumer and enterprise users increasingly adopt OTT services, wholesale carriers face declining voice traffic volumes. This substitution effect threatens revenue streams, particularly in high-margin international calling segments. Carriers must innovate by integrating voice with digital services, offering enterprise-grade security, and leveraging partnerships to remain relevant against the rapid growth of OTT alternatives.

Regional Analysis

North America

North America holds a 34% share of the wholesale voice carrier market, driven by advanced telecom infrastructure and high enterprise demand. The region benefits from strong investments in IP-based networks, data centers, and 5G rollouts. Enterprises in finance, healthcare, and logistics rely heavily on international voice connectivity, reinforcing carrier revenues. U.S. and Canadian operators lead with robust international routes, supported by partnerships with global carriers. Growth is further supported by the adoption of VoIP and cloud-based communication solutions. Regulatory compliance and fraud prevention initiatives also strengthen the region’s competitive edge in wholesale voice services.

Europe

Europe accounts for 28% of the wholesale voice carrier market, supported by extensive cross-border communication within the EU. The region’s carriers benefit from harmonized regulations, dense fiber connectivity, and strong demand from multinational corporations. Countries such as Germany, the UK, and France remain key contributors due to their strong enterprise ecosystems. The adoption of VoIP and cloud-based services accelerates digital transformation across industries. EU policies promoting fair interconnect rates create a balanced competitive environment. Europe’s strategic position as a hub between Asia, Africa, and the Americas enhances its importance in global wholesale voice operations.

Asia Pacific

Asia Pacific commands a 22% share of the wholesale voice carrier market, fueled by rapid telecom infrastructure growth and rising international traffic. The region is home to a large base of mobile subscribers and increasing demand for cross-border communication from expanding digital economies. China, India, and Southeast Asia drive growth with high adoption of VoIP and cloud-based voice services. Investments in submarine cables and 5G deployments strengthen capacity and call quality. Carriers benefit from partnerships with global players to expand coverage. Asia Pacific’s expanding digital ecosystem ensures sustained growth for wholesale voice services.

Latin America

Latin America holds an 8% share of the wholesale voice carrier market, with demand supported by growing cross-border trade and tourism. Brazil and Mexico dominate regional growth due to their large populations and expanding enterprise sectors. Carriers invest in fiber-optic networks and submarine cable connections to improve international call reliability. The adoption of VoIP and digital voice services is rising as businesses seek cost-effective communication tools. Regulatory reforms in telecom markets encourage competition and infrastructure development. Despite challenges like price sensitivity, Latin America shows steady potential for wholesale voice service expansion.

Middle East & Africa

The Middle East & Africa region contributes a 7% share to the wholesale voice carrier market, driven by increasing mobile penetration and growing demand for international connectivity. Key markets such as the UAE, South Africa, and Saudi Arabia lead with expanding telecom investments and strategic geographic positioning. Carriers in the region focus on enhancing international routes and deploying submarine cables to support rising traffic. The adoption of VoIP and digital solutions grows as enterprises modernize communication. Despite margin pressures and infrastructure gaps in some areas, the region remains a growth frontier for wholesale voice services.

Market Segmentations:

By Transmission Network:

- Owned network

- Leased network

By Technology:

- Traditional switching

- VoIP

By Pricing Model:

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of the wholesale voice carrier players such as Deutsche Telekom AG (Germany), Lumen Technologies (U.S.), BT (U.K.), Telstra (Australia), Verizon Partner Solutions (U.S.), Orange (France), Tata Communications Limited (India), Cox Communications, Inc. (U.S.), IDT Global Services (U.S.), and NTT Ltd. (U.S.). The wholesale voice carrier market is shaped by strong global networks, advanced technology adoption, and service innovation. Companies focus on expanding international routes, deploying VoIP platforms, and integrating cloud-based communication systems to enhance efficiency and reduce costs. The market is highly competitive, with carriers investing in submarine cables, fiber connectivity, and 5G infrastructure to strengthen scalability and call quality. Strategic partnerships and alliances play a key role in extending global coverage and addressing growing international traffic. Emphasis on fraud prevention, analytics, and enterprise-grade services ensures differentiation in this price-sensitive environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Deutsche Telekom AG (Germany)

- Lumen Technologies. (U.S.)

- BT (U.K.)

- Telstra (Australia)

- Verizon Partner Solutions (U.S.)

- Orange (France)

- Tata Communications Limited. (India)

- Cox Communications, Inc. (U.S.)

- IDT global Services (U.S.)

- NTT Ltd. (U.S.)

Recent Developments

- In February 2025, AT&T expanded its voice core partnership with Nokia through a multi-year deal focused on network security, automation, and Voice-over-New-Radio capabilities, including deployment of Nokia’s Digital Operations software for automated service delivery.

- In February 2025, Nokia, Vodafone, and RingCentral showcased Immersive Voice and Audio Services at MWC 2025, introducing three-dimensional sound experiences that enhance business communications through metadata-assisted spatial audio technology.

- In July 2024, New York-listed Greek bulker owner Diana Shippinsg acquired an extension for the time charter contract with Nippon Yusen Kabushiki Kaisha (NYK Line) for one of its newcastlemax vessels.

- In February 2024, 5g—KPN, the top telecom provider in the Netherlands, and iBASIS, a well-known global supplier of communications solutions for operators and digital players, extended their outsourcing contract for voice and mobile services for an extra three years.

Report Coverage

The research report offers an in-depth analysis based on Transmission Network, Technology, Pricing Model and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising adoption of VoIP as enterprises shift from legacy systems.

- Cloud-based communication platforms will drive integration of voice with digital services.

- Expansion of submarine cables and fiber networks will strengthen international coverage.

- 5G rollouts will improve call quality, reduce latency, and support advanced voice solutions.

- Carriers will focus on value-added services such as fraud detection and analytics.

- Partnerships with digital service providers will expand customer reach and offerings.

- Pricing pressure will push operators toward efficiency and service diversification.

- Demand from emerging markets will grow with rising mobile and internet penetration.

- Enterprise demand for secure and reliable voice connectivity will remain strong.

- Consolidation and strategic alliances will reshape the competitive landscape globally.