Market Overview

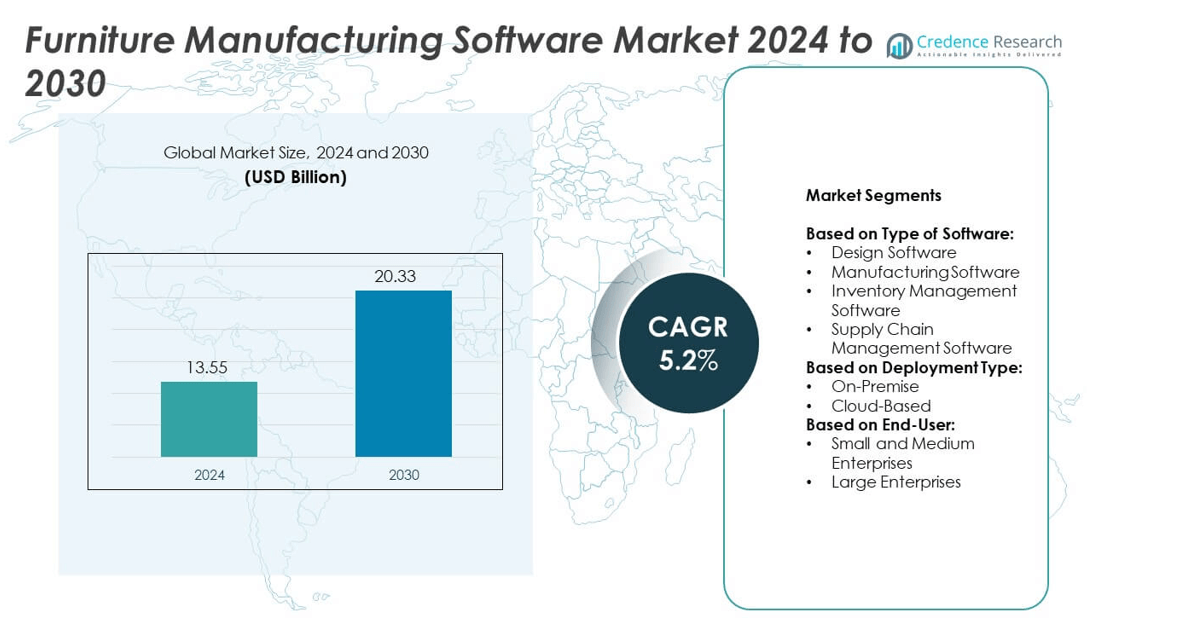

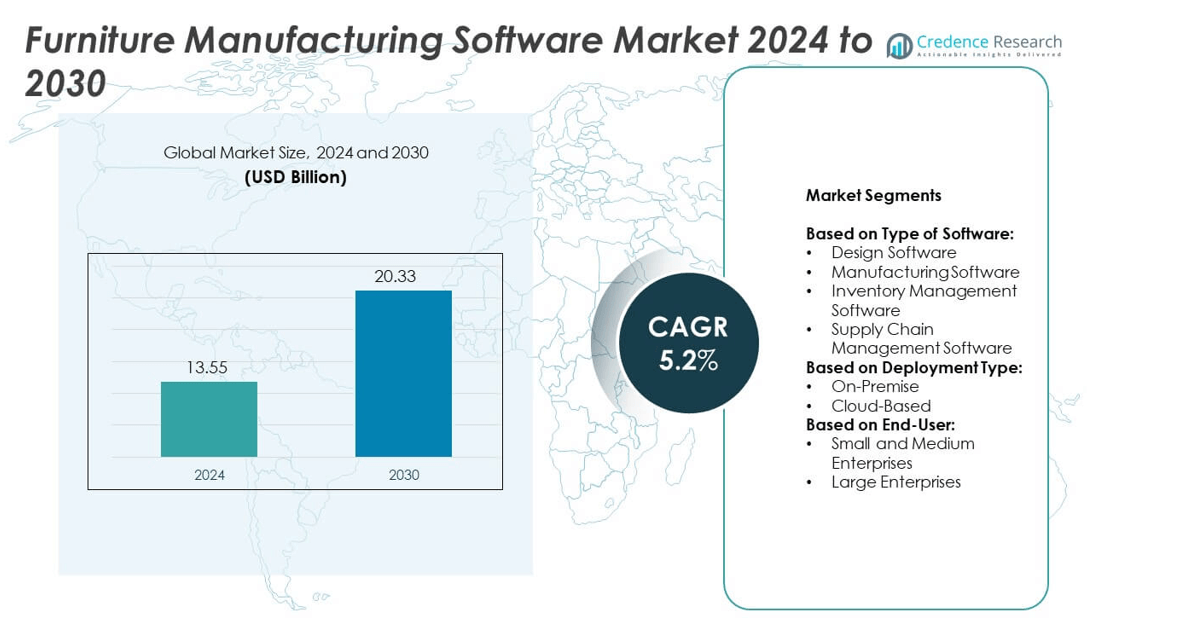

The furniture manufacturing software market size was valued at USD 13.55 billion in 2024 and is expected to reach USD 20.33 billion by 2030, growing at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Furniture Manufacturing Software Market Size 2024 |

USD 13.55 billion |

| Furniture Manufacturing Software Market, CAGR |

5.2% |

| Furniture Manufacturing Software Market Size 2032 |

USD 20.33 billion |

The Furniture Manufacturing Software market grows with rising demand for customized furniture and efficient production systems. Manufacturers adopt digital tools to streamline workflows, reduce waste, and improve design accuracy. Cloud-based solutions gain popularity for their scalability and remote access capabilities. Integration of AI, IoT, and automation enhances real-time monitoring and predictive maintenance. Sustainability goals drive adoption of software that tracks material usage and carbon footprint. These factors together strengthen competitiveness and support long-term growth in global manufacturing operations.

North America leads the Furniture Manufacturing Software market due to strong adoption of Industry 4.0 and advanced automation. Europe follows with demand driven by strict quality and sustainability regulations. Asia-Pacific shows fastest growth supported by rapid industrialization and rising furniture exports. Key players such as SAP, Autodesk, Microsoft, and Epicor focus on developing scalable cloud-based platforms, AI-enabled analytics, and integrated design-to-production solutions. Their strategies emphasize innovation, partnerships, and regional expansion to meet growing demand across diverse manufacturing sectors.

Market Insights

- The Furniture Manufacturing Software market was valued at USD 13.55 billion in 2024 and is projected to reach USD 20.33 billion by 2030 at a CAGR of 5.2%.

- Rising demand for customized furniture and faster production cycles drives software adoption globally.

- Trends include cloud-based deployment, AI-enabled analytics, IoT monitoring, and AR/VR integration for design visualization.

- The market is competitive with players like SAP, Autodesk, Microsoft, Trello, Epicor, Polyboard, and NetSuite investing in innovation.

- High implementation costs, integration complexity, and lack of skilled workforce remain major restraints.

- North America leads due to strong digital transformation, while Asia-Pacific shows fastest growth supported by industrialization and rising exports.

- Europe focuses on sustainability and compliance, Latin America and Middle East & Africa show gradual adoption supported by modernization initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Customization and Smart Manufacturing

Furniture Manufacturing Software market grows due to rising demand for personalized furniture solutions. Consumers expect tailored designs and faster delivery timelines. Manufacturers rely on software to streamline production and reduce errors. It improves coordination between design and production teams. Integration with CAD tools supports advanced modeling and visualization. Adoption enables quick configuration of designs based on customer inputs. This drives higher efficiency and better customer satisfaction.

- For instance, Premier Custom-Built uses Onshape CAD software and has developed more than 50 custom cabinet features, reducing time by 50-75 % when modeling multiple cabinets rather than one by one.

Focus on Digital Transformation and Industry 4.0 Adoption

The market expands with the ongoing shift toward digital manufacturing ecosystems. Software solutions support IoT-enabled monitoring and predictive maintenance. It helps reduce downtime and optimize machine utilization. Real-time data collection improves decision-making and inventory control. Cloud-based platforms offer scalability for small and large manufacturers. Integration with ERP systems enhances supply chain visibility. This strengthens competitiveness in global markets.

- For instance, imos AG’s imos iX CAD/CAM software is used by more than 4,500 furniture producers globally. It supports the complete digital workflow from sales, design, and room-planning to CNC-machine control and the automatic flow of order-to-production data

Growing Pressure for Cost Optimization and Resource Efficiency

Manufacturers adopt software to reduce operational costs and material waste. It automates production planning and resource allocation. Advanced analytics identify inefficiencies and suggest process improvements. Real-time scheduling ensures optimal machine usage and labor management. Demand for sustainable manufacturing drives adoption of energy-saving tools. The software reduces rework and improves profitability. This supports long-term business growth.

Regulatory Compliance and Quality Assurance Requirements

The market benefits from rising focus on quality standards and compliance. Furniture producers use software to meet safety and sustainability regulations. It ensures traceability of raw materials and finished products. Automated quality checks reduce human error and improve consistency. Digital records support faster audits and certification processes. The software aligns manufacturing operations with environmental guidelines. This strengthens brand reputation and market acceptance.

Market Trends

Adoption of Cloud-Based and SaaS Solutions

Furniture Manufacturing Software market witnesses strong shift toward cloud deployment models. Companies prefer SaaS solutions for flexibility and reduced upfront costs. It allows remote access to data and collaboration across locations. Automatic updates improve security and keep systems current. Cloud platforms support scalability for growing production needs. Integration with third-party applications enhances workflow efficiency. This trend enables faster technology adoption for manufacturers.

- For instance, MBFZ toolcraft GmbH (Germany) used Visual Components simulation software to design a production line for drawers (size range 170 mm to 1450 mm) with “batch size 1” variant manufacturing.

Integration of AI, IoT, and Automation Tools

The market advances with rising use of AI-driven analytics and IoT sensors. Real-time monitoring improves production planning and predictive maintenance. It reduces downtime and improves machine performance. Automation tools streamline repetitive tasks and cut labor costs. AI-powered demand forecasting supports better inventory management. Software vendors invest in developing smarter interfaces and analytics dashboards. This trend enhances decision-making and operational precision.

- For instance, Bellmont Cabinet reduced manual label scans by 800 per shift using RFID-based operational step via Cyncly.

Emphasis on Sustainable and Eco-Friendly Manufacturing

Manufacturers focus on reducing waste and improving resource use. Furniture Manufacturing Software market supports compliance with green building standards. It tracks material usage and carbon footprint metrics. Optimized cutting patterns minimize raw material waste. Digital documentation reduces paper-based processes across facilities. Sustainability dashboards help companies report environmental performance. This trend aligns with rising demand for eco-friendly furniture solutions.

Growth of AR and VR in Design and Sales Processes

AR and VR integration transforms design and customer engagement workflows. It allows buyers to visualize furniture in real spaces before purchase. Designers use 3D modeling tools to refine concepts faster. Virtual showrooms reduce dependence on physical display areas. It improves customer confidence and reduces return rates. Integration with e-commerce platforms expands reach to online buyers. This trend creates immersive experiences that boost sales conversion.

Market Challenges Analysis

High Implementation Costs and Complexity of Integration

Furniture Manufacturing Software market faces challenges due to high initial investment requirements. Small and medium manufacturers hesitate to adopt due to limited budgets. It often demands costly customization to match specific production needs. Integration with existing ERP and CAD systems can be complex. Training employees to use new platforms requires time and resources. Slow adoption delays return on investment for many businesses. This creates barriers for rapid market penetration.

Data Security Concerns and Lack of Skilled Workforce

The market struggles with concerns over cybersecurity and data breaches. Cloud-based solutions raise questions about data privacy and control. It requires strong IT policies and regular security audits. Lack of skilled workforce limits full software utilization in many regions. Employees need technical expertise to manage digital tools effectively. Resistance to technology change also slows adoption. This challenge impacts productivity gains expected from digital transformation.

Market Opportunities

Expansion of Smart Factories and Digital Twins

Furniture Manufacturing Software market gains opportunities from rapid adoption of smart factories. Manufacturers invest in digital twins to simulate production processes. It enables predictive maintenance and better resource planning. Real-time analytics support quick decision-making and improved productivity. Integration with robotics enhances automation and reduces manual errors. Growing demand for data-driven manufacturing drives software upgrades. This creates strong potential for innovation and growth.

Rising Demand in Emerging Markets and Omnichannel Retail

Emerging economies present untapped opportunities for software vendors. Furniture manufacturers in Asia-Pacific and Latin America modernize operations to meet rising demand. It helps local companies compete with global players. Omnichannel retail expansion requires connected systems for inventory and production visibility. Software solutions support seamless coordination between online and offline channels. Growing furniture exports increase need for compliance and quality tracking. This fuels long-term adoption across developing regions.

Market Segmentation Analysis:

By Type of Software:

Design software holds a major share due to its role in creating precise 3D models and customized layouts. It supports faster prototyping and reduces design errors. Manufacturing software follows closely, enabling production scheduling, workflow automation, and machine integration. Inventory management software is crucial for controlling material usage and reducing waste. Supply chain management software ensures smooth coordination between suppliers, manufacturers, and distributors. It helps businesses maintain delivery timelines and improve customer satisfaction.

- For instance, Lista Office LO, a Swiss manufacturer of office furniture, implemented Siemens Teamcenter for product lifecycle management (PLM) and Solid Edge for computer-aided design (CAD). By utilizing Teamcenter’s part family capabilities, they were able to dramatically reduce the time required for design modifications. A specific case study detailed a modification to a control unit for an adjustable-height desk which previously took two people two weeks (10 working days). After the Teamcenter implementation,

By Deployment Type:

Cloud-based solutions dominate due to their scalability and lower upfront costs. It offers remote access, making collaboration easier for distributed teams. Automatic updates and data backups improve system reliability and reduce downtime. On-premise deployment retains relevance for companies with strict data security requirements. Large manufacturers prefer hybrid models that combine flexibility and security. This segmentation highlights growing interest in digital transformation strategies.

- For instance, Silent Infotech implemented a tailored Odoo ERP solution for a US-based custom furniture manufacturer. The implementation resulted in significant operational improvements, including a 29% reduction in production lead times, not operational cost. The company also experienced a 20% decrease in production costs, a 50% increase in order-handling capacity, and a 70% improvement in customer satisfaction metrics due to reduced delivery times and stable product quality.

By End-User:

Large enterprises account for significant adoption due to complex production needs. It enables them to integrate multi-factory operations and gain real-time visibility. Advanced analytics help in resource optimization and process control. Small and medium enterprises are rapidly adopting cloud-based systems to remain competitive. User-friendly interfaces and subscription models lower entry barriers for these businesses. This encourages wider adoption across emerging markets and supports overall industry growth.

Segments:

Based on Type of Software:

- Design Software

- Manufacturing Software

- Inventory Management Software

- Supply Chain Management Software

Based on Deployment Type:

Based on End-User:

- Small and Medium Enterprises

- Large Enterprises

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Furniture Manufacturing Software market with 38% in 2024. Strong adoption of Industry 4.0 technologies drives growth across the United States and Canada. Manufacturers invest heavily in automation, digital twins, and advanced analytics to boost efficiency. It supports lean production, faster product launches, and higher customization. Cloud-based platforms gain traction, enabling remote collaboration and better scalability. Rising demand for sustainable manufacturing practices also encourages adoption of software that tracks material usage and waste reduction. Presence of leading vendors and technology providers further strengthens regional market leadership.

Europe

Europe accounts for 28% of the market share, driven by stringent regulatory standards and sustainability goals. Manufacturers focus on meeting EU directives on environmental compliance and product traceability. It promotes adoption of advanced software tools for quality assurance and supply chain transparency. Demand for premium and customized furniture solutions fuels investment in design software. Industry players adopt digital platforms to improve energy efficiency and production planning. Cloud-based solutions expand in Germany, France, and the UK to support multi-site operations. The region shows strong potential for continued growth with rising investment in smart manufacturing.

Asia-Pacific

Asia-Pacific represents 22% of the Furniture Manufacturing Software market and is the fastest-growing region. Rapid industrialization and urbanization in China, India, and Southeast Asia increase furniture production capacity. It supports adoption of inventory and supply chain management solutions to meet export demand. Government initiatives encouraging smart factory setups accelerate software integration in manufacturing units. Local manufacturers shift toward cloud-based systems to reduce IT infrastructure costs. Rising disposable incomes drive demand for customized furniture, boosting design software usage. The region offers strong opportunities for vendors targeting mid-sized manufacturers with affordable solutions.

Latin America

Latin America captures 7% of the market share, supported by gradual digital transformation in the furniture sector. Brazil and Mexico lead in adopting ERP-integrated manufacturing software for efficiency improvements. It enables better control over raw material procurement and production planning. Cloud adoption grows as enterprises seek cost-effective, scalable systems. Rising urban housing demand drives investment in furniture production and technology upgrades. Regional players focus on improving competitiveness against imported products through automation. Government programs supporting industry modernization also contribute to growth.

Middle East & Africa

Middle East & Africa hold a smaller share of 5% but show steady growth potential. The UAE and Saudi Arabia invest in modern manufacturing facilities to meet domestic demand. It encourages adoption of software that improves production visibility and inventory control. Growth of the hospitality and real estate sectors boosts demand for customized furniture solutions. Cloud-based systems are gaining adoption due to lower upfront investment needs. Regional manufacturers explore partnerships with global software providers for technology transfer. Focus on diversifying economies beyond oil strengthens future demand for digital solutions in manufacturing.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Epicor

- Trello

- Autodesk

- SAP

- Lucidchart

- SolidWorks

- Microsoft

- Chairish

- Infor

- CADprofi

- SketchUp

- Panthera

- Polyboard

- NetSuite

- Furnishings

Competitive Analysis

The Furniture Manufacturing Software market is highly competitive with key players including SAP, Trello, Autodesk, Microsoft, SketchUp, Epicor, Polyboard, Infor, SolidWorks, NetSuite, Chairish, Panthera, Lucidchart, and CADprofi, SketchUp, Panthera, Polyboard, NetSuite, Furnishings. These companies focus on delivering comprehensive solutions that support design, production, and inventory management for furniture manufacturers. The market features a mix of enterprise-level vendors and specialized software providers catering to small and medium enterprises. It is characterized by strong investment in product innovation, with companies integrating AI, IoT, and cloud capabilities to enhance efficiency. Vendors compete by offering scalable solutions with intuitive interfaces to attract a broader customer base. Strategic partnerships with furniture producers and ERP system providers strengthen their market position. Continuous updates and feature enhancements help retain existing customers and improve user experience. Competition also drives focus on pricing flexibility, with subscription-based models gaining popularity. Regional expansion remains a priority, especially in Asia-Pacific and Latin America, where manufacturing is growing rapidly. Strong after-sales support and training services further differentiate leading vendors in this dynamic market.

Recent Developments

- In 2024, SketchUp remains a popular tool for furniture designers by providing flexible modeling, quick design reviews, and alternative solutions. It is noted for its ease of use and rich plugin ecosystem that supports high-quality renderings and graphics for 3D models.

- In 2024, Autodesk announced its AutoCAD 2025 update, which enhanced industry-specific toolsets (architecture, mechanical, electrical, MEP, etc.) and improved collaboration via shared changes syncing across users

- In 2023, Epicor released Kinetic 2023.1. It introduced elevated browser UX, automated fulfillment rules, procure-to-pay visualization, LOT trace views, and enhanced dashboards.

Report Coverage

The research report offers an in-depth analysis based on Type of Software, Deployment Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising adoption of cloud-based platforms for scalable operations.

- Integration of AI and machine learning will improve production planning and forecasting.

- Demand for design software will grow with rising preference for customized furniture.

- IoT-enabled monitoring will enhance real-time visibility and predictive maintenance.

- Vendors will focus on developing user-friendly interfaces for small and medium enterprises.

- Sustainability reporting tools will gain importance for meeting regulatory requirements.

- Virtual and augmented reality will expand for customer visualization and virtual showrooms.

- Hybrid deployment models will rise to balance data security and flexibility.

- Collaboration tools will strengthen remote design and cross-location manufacturing coordination.

- Emerging markets will drive new growth opportunities through rapid industrialization and urban demand.