Market Overview:

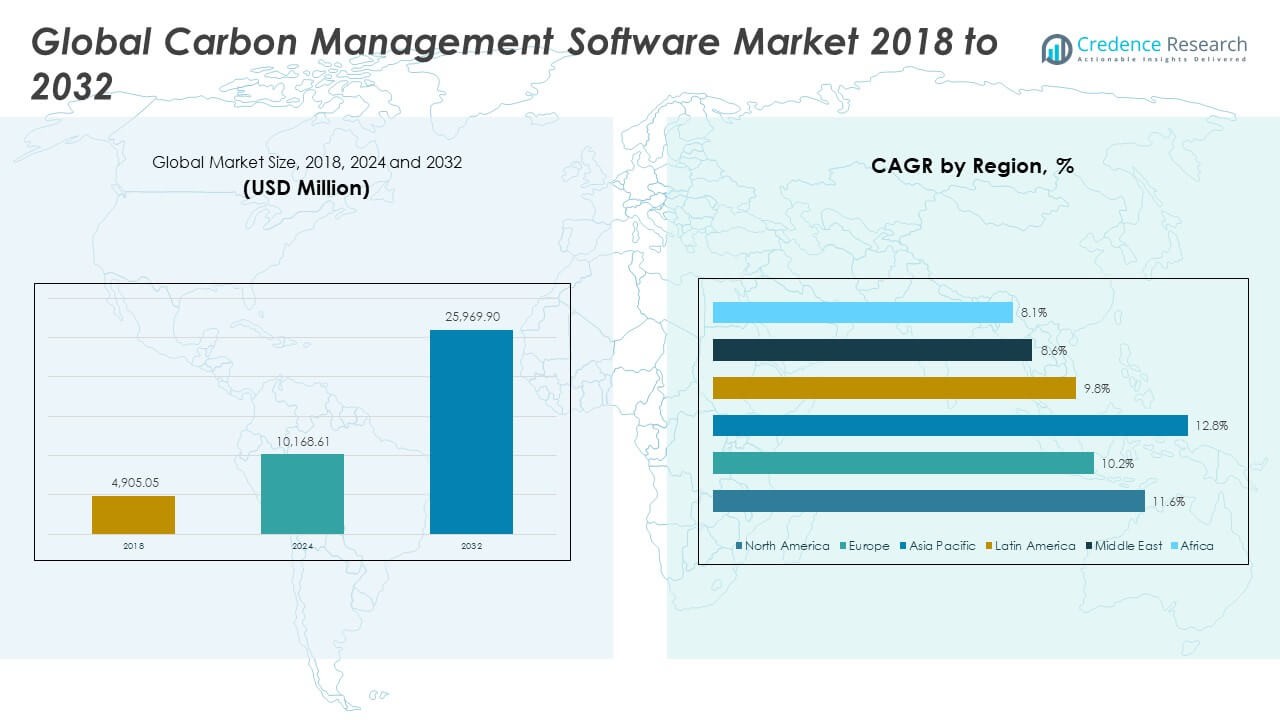

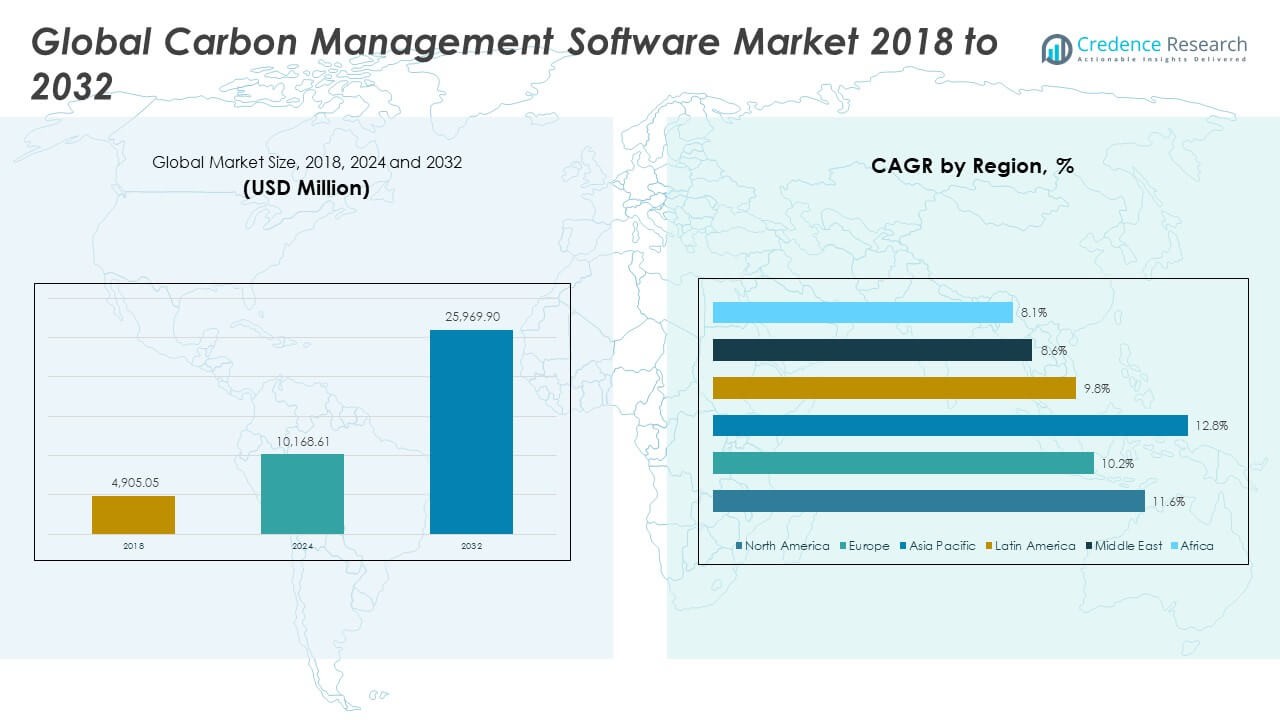

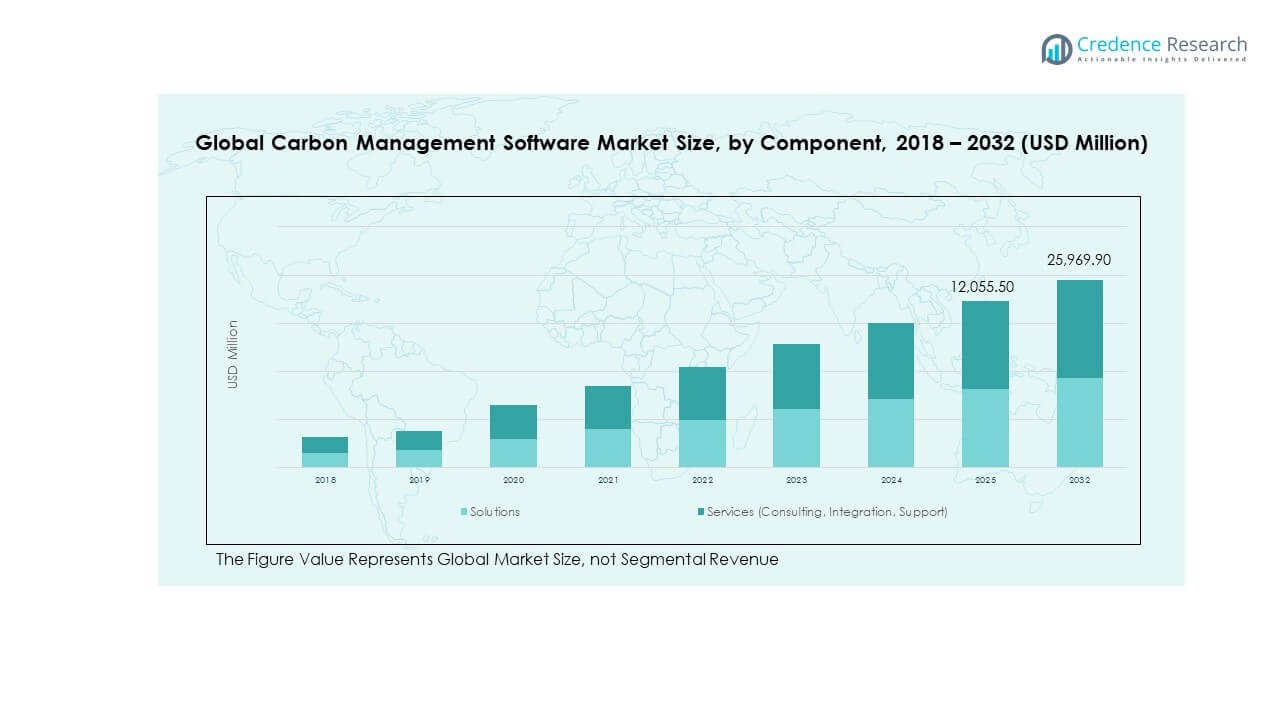

The Global Carbon Management Software Market size was valued at USD 4,905.05 million in 2018 to USD 10,168.61 million in 2024 and is anticipated to reach USD 25,969.90 million by 2032, at a CAGR of 11.59% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Carbon Management Software Market Size 2024 |

USD 10,168.61 Million |

| Carbon Management Software Market, CAGR |

11.59% |

| Carbon Management Software Market Size 2032 |

USD 25,969.90 Million |

The market grows with rising demand for transparent carbon tracking and compliance with regulatory mandates. Organizations adopt software to align with sustainability goals, strengthen ESG reporting, and optimize energy use. It benefits from corporate commitments to carbon neutrality, supported by technological advances in AI, analytics, and automation. Strong focus on climate change awareness among stakeholders continues to accelerate adoption across multiple industries, particularly energy, manufacturing, and IT services.

North America leads the Global Carbon Management Software Market, supported by strict environmental regulations and early adoption of advanced platforms. Europe follows closely, driven by the EU’s emission reduction targets and regulatory frameworks. Asia Pacific emerges as the fastest-growing region, fueled by industrial expansion, digital transformation, and government-backed sustainability initiatives. Latin America, the Middle East, and Africa show gradual adoption, supported by modernization efforts, renewable projects, and increasing climate-conscious policies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Carbon Management Software Market size was USD 4,905.05 million in 2018, USD 10,168.61 million in 2024, and is projected to reach USD 25,969.90 million by 2032, at a CAGR of 11.59%.

- North America held 43.67% share in 2024, Europe held 17.38%, and Asia Pacific accounted for 30.93%, with dominance linked to strong regulations, early adoption, and corporate sustainability initiatives.

- Asia Pacific is the fastest-growing region with 30.93% share, supported by industrial expansion, government-backed programs, and rising corporate ESG commitments.

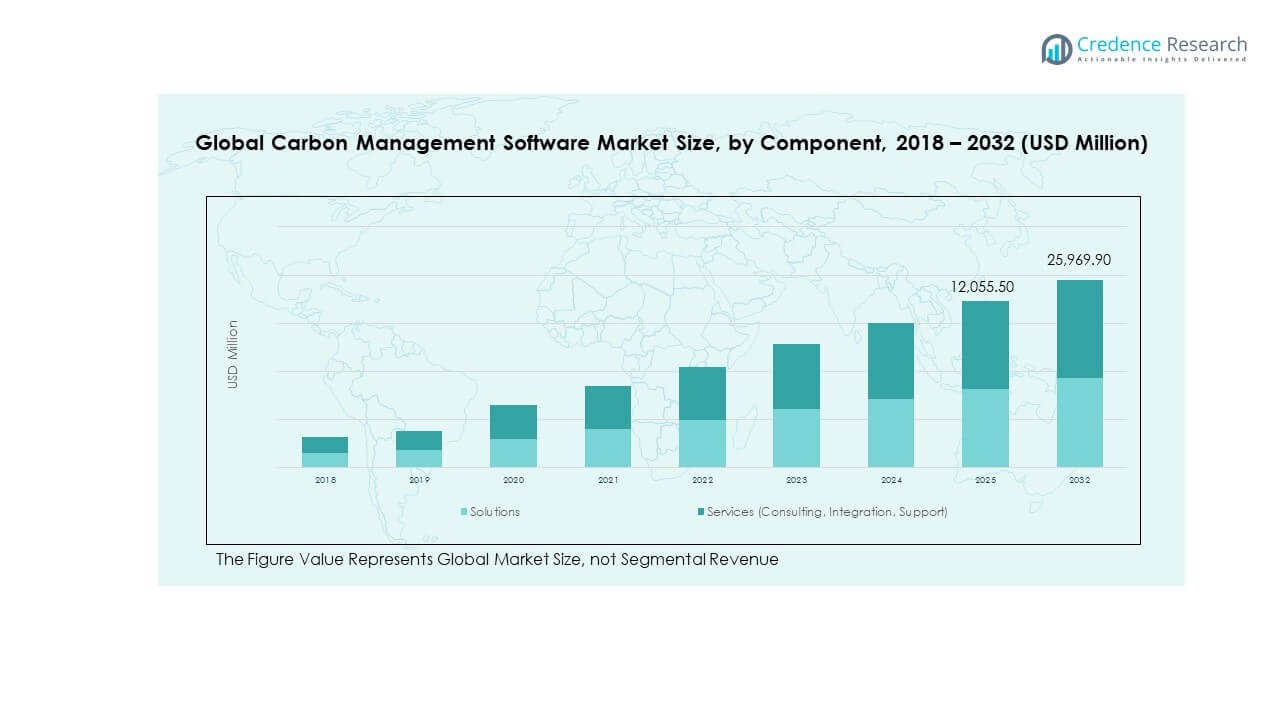

- Solutions contributed 70% of the 2024 market share, driven by demand for carbon accounting, reporting, and compliance platforms.

- Services, including consulting, integration, and support, accounted for 30% of the 2024 share, highlighting enterprise reliance on expert guidance for effective implementation.

Market Drivers

Rising Regulatory Requirements and Governmental Mandates on Emission Monitoring and Reporting

Governments worldwide enforce strict environmental policies to lower emissions and promote sustainable practices. Regulatory bodies demand compliance with emission reduction targets across industries, creating a need for efficient software solutions. Enterprises face pressure to adopt digital tools that track, analyze, and manage carbon data effectively. These regulations ensure transparency and accountability in corporate sustainability strategies. The Global Carbon Management Software Market gains momentum from companies aiming to meet mandatory reporting standards. It helps firms avoid penalties and strengthen their corporate image. Regulatory alignment acts as a major growth driver across developed and emerging economies. Strong enforcement encourages investments in advanced software platforms.

- For example, Microsoft Sustainability Manager helps organizations prepare CSRD-compliant ESG and emissions reports by integrating Scope 1, Scope 2, and selected Scope 3 data. The solution provides built-in calculation methods, workflow tools, and templates aligned with regulatory and voluntary reporting frameworks.

Growing Corporate Adoption of Sustainability Goals and Environmental, Social, and Governance Commitments

Businesses focus on sustainability goals as part of their corporate identity and long-term planning. Executives prioritize carbon footprint reduction to align with global ESG frameworks. Enterprises recognize carbon management software as a tool to achieve measurable results. The Global Carbon Management Software Market benefits from growing boardroom-level commitments to sustainability. It strengthens trust with stakeholders and enhances brand reputation. Investors also demand higher levels of transparency in climate-related disclosures. Companies use software to integrate carbon data with financial and operational systems. Growing corporate accountability creates strong demand for reliable and scalable solutions.

Increasing Demand for Energy Optimization and Efficiency Across Industrial Operations

Industries emphasize reducing energy waste and optimizing resources to improve competitiveness. Carbon management software enables accurate monitoring of energy consumption across complex operations. It supports real-time data analysis that highlights inefficiencies and helps design corrective strategies. Firms in energy-intensive sectors rely on these solutions to minimize costs and reduce emissions. The Global Carbon Management Software Market grows with industries prioritizing efficiency in operations. It integrates predictive analytics to support long-term energy planning. Decision-makers adopt such solutions to achieve both environmental and financial objectives. Adoption continues to rise across energy, manufacturing, and transportation industries.

- For example, Schneider Electric’s EcoStruxure Resource Advisor is a cloud-based platform that helps organizations manage energy and emissions data across operations. It supports compliance with frameworks such as California’s climate disclosure laws and provides dashboards and workflows for audit-ready reporting.

Rising Climate Change Awareness Among Consumers and Business Stakeholders

Awareness of climate change increases public and corporate demand for sustainable practices. Consumers prefer brands that demonstrate transparency in environmental performance. Carbon management software provides the digital backbone for accurate reporting of such efforts. The Global Carbon Management Software Market benefits from this growing environmental consciousness. It drives organizations to invest in platforms that validate their carbon reduction initiatives. Corporate leaders respond by embedding sustainability metrics into operational frameworks. Employees and stakeholders push for digital tools that align with climate goals. Widening awareness strengthens adoption across multiple industries and regions.

Market Trends

Integration of Carbon Management Platforms with Advanced Artificial Intelligence and Automation

Software vendors integrate artificial intelligence to improve accuracy in carbon data tracking. Automation reduces manual errors and enhances predictive modeling capabilities. Firms adopt these advanced features to generate reliable forecasts for energy consumption and emission levels. The Global Carbon Management Software Market expands as automation reduces operational complexity. It supports seamless integration with IoT devices for real-time monitoring. AI-driven analytics provide actionable insights that guide sustainability strategies. Predictive features help organizations prepare for regulatory changes in advance. The trend highlights a shift toward intelligent and automated platform across industries.

Expansion of Cloud-Based Deployment Models Offering Scalability and Accessibility

Cloud platforms dominate deployments due to their flexibility, scalability, and cost-effectiveness. Enterprises prefer cloud solutions for easier integration across multiple sites and regions. The Global Carbon Management Software Market benefits from rapid adoption of SaaS-based models. Cloud-based platforms provide remote access and centralized data control for global corporations. Vendors deliver subscription models that enhance affordability for small and medium enterprises. Real-time collaboration features improve transparency across departments and external stakeholders. Enhanced security measures strengthen trust in cloud adoption for sensitive carbon data. Growing demand for flexibility continues to expand the cloud-based adoption trend.

- For example, Salesforce Net Zero Cloud tracks Scope 1, Scope 2, and most Scope 3 emissions by integrating data from energy use, travel, and suppliers. It includes report builders for CSRD, SASB, GRI, and CDP, helping customers align with global reporting frameworks.

Development of Industry-Specific Software Modules for Specialized Needs

Vendors design specialized modules for industries such as manufacturing, utilities, and logistics. These tailored solutions address unique operational challenges in emission monitoring and energy optimization. The Global Carbon Management Software Market sees increasing adoption of such targeted tools. Industry-specific modules enhance accuracy in reporting for highly regulated sectors. Custom solutions improve efficiency in managing compliance across diverse frameworks. Companies adopt modular approaches to optimize investment in carbon software. Vendors gain competitive advantage by providing sector-focused features. The trend highlights a shift toward personalization in sustainability solutions.

- For example, Schneider Electric’s EcoStruxure Resource Advisor analyzes data from more than 400 streams across an enterprise and has helped clients increase data accuracy from about 50 % to above 90 %. It provides tools and workflows aligned with regulatory reporting standards including CSRD.

Integration with Broader Digital Transformation Strategies Across Enterprises

Carbon management platforms become part of enterprise-wide digital transformation initiatives. Firms align carbon tracking with enterprise resource planning and financial systems. The Global Carbon Management Software Market grows as businesses integrate sustainability with core operations. Companies treat carbon reporting as part of broader business intelligence. Software providers expand interoperability to align with corporate digital strategies. Integration strengthens decision-making by linking environmental metrics with financial outcomes. It enhances enterprise competitiveness in markets driven by sustainability. Growing synergy between carbon platforms and digital ecosystems defines this trend.

Market Challenges Analysis

High Implementation Costs and Limited Budget Allocation Among Small and Medium Enterprises

Adopting advanced carbon management solutions requires significant upfront investment in software and training. Many small and medium enterprises lack the budget to implement these systems effectively. The Global Carbon Management Software Market faces slower penetration in cost-sensitive sectors. It struggles to balance affordability with the need for advanced functionality. Vendors must design pricing strategies that address SME constraints. Limited financial resources hinder software adoption despite growing regulatory pressure. High costs also restrict continuous updates and scalability of deployed platforms. Enterprises delay adoption when cost outweighs immediate compliance needs.

Complex Integration with Legacy Systems and Lack of Skilled Workforce

Carbon management solutions require integration with existing operational and IT systems. Many organizations face challenges connecting new platforms with outdated infrastructure. The Global Carbon Management Software Market contends with resistance from firms unprepared for digital upgrades. Integration complexity increases project timelines and costs. Shortage of skilled professionals further slows down implementation. Many companies lack internal expertise to manage advanced platforms. Training requirements add to operational expenses during the adoption phase. These barriers reduce efficiency and hinder smooth adoption across diverse industries.

Market Opportunities

Expansion of Emerging Markets Driven by Regulatory Programs and Sustainability Agendas

Emerging economies focus on sustainable development programs that encourage carbon reduction. Governments introduce initiatives that require enterprises to adopt digital tools for compliance. The Global Carbon Management Software Market benefits from expanding opportunities in Asia Pacific, Latin America, and the Middle East. Enterprises adopt software to align with international trade requirements and sustainability standards. It creates growth opportunities for vendors offering scalable and localized solutions. Expansion across these regions supports broader market penetration. Companies leveraging this shift can secure strong competitive positions.

Growing Demand for Integration with Renewable Energy and Smart Infrastructure Projects

Countries invest heavily in renewable energy and smart city initiatives. Enterprises align carbon management with clean energy adoption for improved reporting. The Global Carbon Management Software Market gains opportunities from integration with smart infrastructure. Software supports transparency in green energy adoption and emission monitoring. It strengthens partnerships between technology vendors and government-led projects. Integration with renewable platforms ensures accurate reporting of carbon savings. Vendors targeting smart infrastructure projects expand their market reach. Rising global focus on renewables boosts demand for advanced carbon platforms.

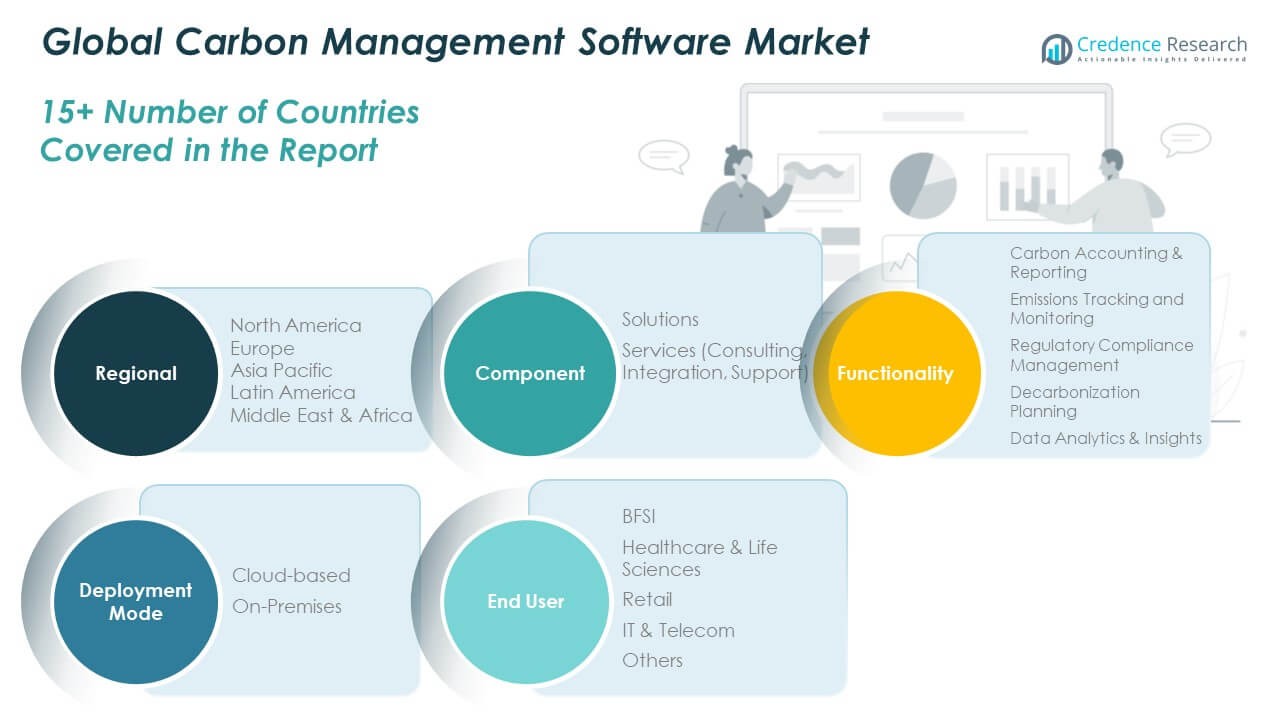

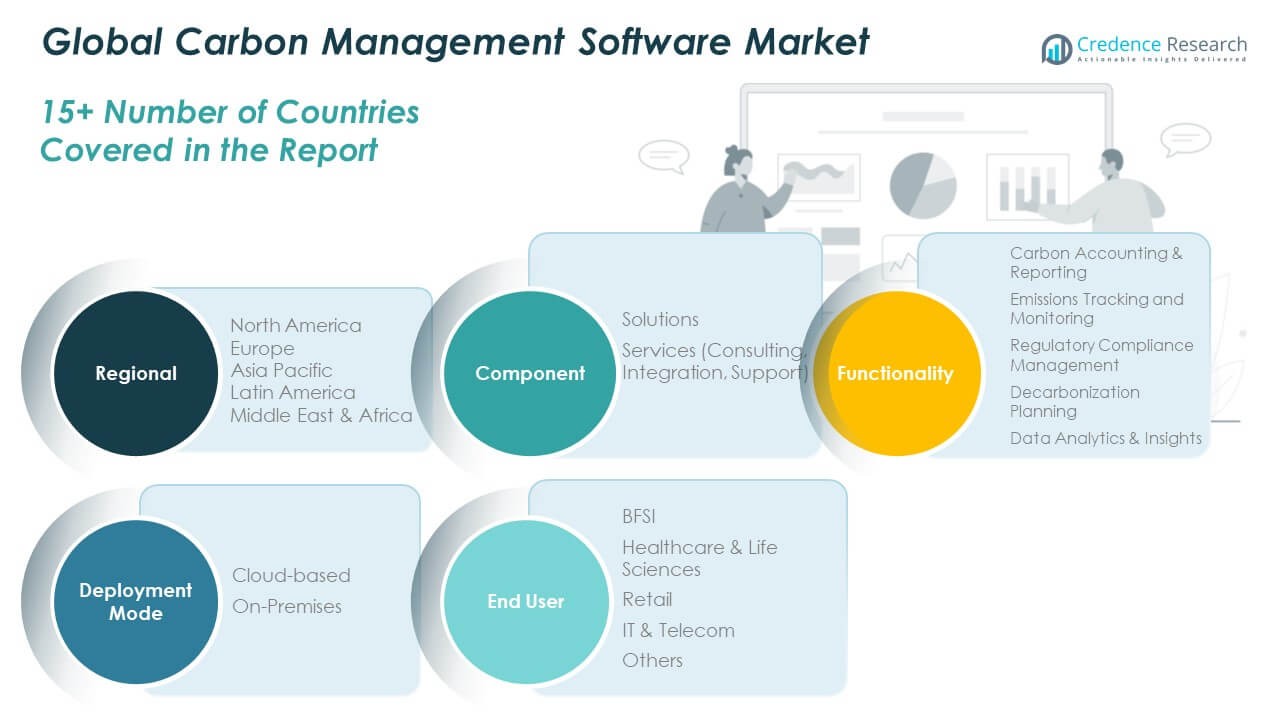

Market Segmentation Analysis:

By component

The Global Carbon Management Software Market is driven by strong demand for solutions that streamline carbon accounting, emissions tracking, and compliance reporting. Solutions lead adoption due to their ability to provide measurable results and seamless integration with enterprise systems. Services such as consulting, integration, and support complement solutions by offering expertise, technical assistance, and ongoing platform optimization for diverse industries.

- For instance, TELUS, a Canadian telecommunications company, uses Salesforce Net Zero Cloud to consolidate over 300,000 emissions records annually including challenging Scope 3 data for its carbon accounting process, supporting its public commitment to hit carbon neutrality by 2030

By functionality

Carbon accounting and reporting represent the most widely used application, driven by mandatory disclosure requirements and investor expectations. Emissions tracking and monitoring tools support organizations in managing real-time data, while regulatory compliance management ensures alignment with local and international standards. Decarbonization planning and data analytics further enhance decision-making and allow enterprises to design effective long-term sustainability strategies.

- For example, Wolters Kluwer enhanced its Enablon ESG Excellence platform in November 2023 by integrating ESG reporting and disclosure features from CCH Tagetik, enabling companies to map data to CSRD, GRI, and SASB frameworks with audit-level rigor alongside financial data.

By deployment mode

Cloud-based platforms dominate due to scalability, cost efficiency, and remote accessibility across global operations. Enterprises choose cloud adoption to integrate sustainability with wider digital transformation goals. On-premises deployment maintains relevance where organizations prioritize strict data control, security, and customized system configurations for sensitive operations.

By end user

The Global Carbon Management Software Market sees high demand from BFSI, healthcare and life sciences, retail, and IT & telecom sectors. These industries adopt advanced platforms to align with ESG frameworks and regulatory standards. Others, including manufacturing and energy, also contribute by seeking transparency and efficiency in carbon reduction practices. Sector diversity underscores broad applicability across industries pursuing sustainability.

Segmentation:

By Component

- Solutions

- Services (Consulting, Integration, Support)

By Functionality

- Carbon Accounting & Reporting

- Emissions Tracking and Monitoring

- Regulatory Compliance Management

- Decarbonization Planning

- Data Analytics & Insights

By Deployment Mode

By End User

- BFSI

- Healthcare & Life Sciences

- Retail

- IT & Telecom

- Others

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Global Carbon Management Software Market size was valued at USD 2,164.27 million in 2018 to USD 4,440.62 million in 2024 and is anticipated to reach USD 11,372.19 million by 2032, at a CAGR of 11.6% during the forecast period. North America accounts for 43.67% of the 2024 market share. The Global Carbon Management Software Market in this region grows with strong regulatory frameworks such as the U.S. EPA’s climate programs and Canada’s carbon pricing mechanisms. Enterprises adopt advanced solutions to ensure compliance and achieve corporate sustainability goals. Demand rises from energy, manufacturing, and technology-driven industries that require transparent carbon tracking. It benefits from a robust digital infrastructure and high adoption of cloud-based platforms. The presence of global players such as IBM, Microsoft, and Salesforce further accelerates adoption. Stakeholder focus on ESG reporting strengthens demand in corporate sectors.

Europe

The Europe Global Carbon Management Software Market size was valued at USD 903.68 million in 2018 to USD 1,769.41 million in 2024 and is anticipated to reach USD 4,103.42 million by 2032, at a CAGR of 10.2% during the forecast period. Europe holds 17.38% of the 2024 market share. The Global Carbon Management Software Market in this region benefits from the European Union’s stringent carbon neutrality targets. The EU Emissions Trading System drives adoption of solutions for compliance and emissions tracking. Companies across Germany, France, and the UK lead in adopting carbon management platforms. It reflects the strong role of government regulations in shaping demand. Firms integrate digital sustainability tools to align with climate disclosures under EU directives. The market benefits from advanced R&D capabilities and growing investment in green technologies. Energy-intensive industries rely on software to manage complex reporting requirements.

Asia Pacific

The Asia Pacific Global Carbon Management Software Market size was valued at USD 1,438.33 million in 2018 to USD 3,145.85 million in 2024 and is anticipated to reach USD 8,752.09 million by 2032, at a CAGR of 12.8% during the forecast period. Asia Pacific represents 30.93% of the 2024 market share. The Global Carbon Management Software Market in this region grows rapidly due to industrial expansion and rising government-led sustainability initiatives. China, Japan, and India lead in adoption driven by emission reduction commitments and renewable energy projects. Large enterprises invest in cloud-based platforms to enhance transparency and efficiency. It also benefits from smart city initiatives and investments in digital transformation. Regional governments encourage adoption through policies aligned with climate agreements. Growth in manufacturing and energy sectors drives demand for real-time carbon tracking. Strong focus on ESG reporting among multinational corporations strengthens the market position.

Latin America

The Latin America Global Carbon Management Software Market size was valued at USD 216.97 million in 2018 to USD 443.83 million in 2024 and is anticipated to reach USD 994.30 million by 2032, at a CAGR of 9.8% during the forecast period. Latin America accounts for 4.37% of the 2024 market share. The Global Carbon Management Software Market in this region gains traction from growing environmental regulations and sustainability goals. Brazil and Mexico drive demand with corporate and government initiatives toward decarbonization. Organizations adopt digital platforms to meet international sustainability standards and attract global investors. It benefits from modernization efforts in industrial and energy sectors. Regional adoption grows despite limited digital infrastructure compared to developed markets. Multinationals with operations in Latin America drive integration of advanced solutions. Governments encourage sustainable practices to reduce environmental impact and enhance trade competitiveness.

Middle East

The Middle East Global Carbon Management Software Market size was valued at USD 113.42 million in 2018 to USD 210.66 million in 2024 and is anticipated to reach USD 434.13 million by 2032, at a CAGR of 8.6% during the forecast period. Middle East holds 2.07% of the 2024 market share. The Global Carbon Management Software Market in this region expands through increasing government-led sustainability programs. Countries such as the UAE and Saudi Arabia invest in green energy and carbon neutrality projects. Enterprises adopt software to align with international carbon reporting standards. It gains support from diversification strategies beyond oil and gas. Adoption grows among industries modernizing operations with smart city and renewable energy projects. Regional governments set ambitious targets under frameworks such as Vision 2030. Software providers collaborate with local entities to support compliance and reporting.

Africa

The Africa Global Carbon Management Software Market size was valued at USD 68.38 million in 2018 to USD 158.24 million in 2024 and is anticipated to reach USD 313.77 million by 2032, at a CAGR of 8.1% during the forecast period. Africa represents 1.55% of the 2024 market share. The Global Carbon Management Software Market in this region develops steadily with growing awareness of climate change. South Africa leads adoption due to advanced policies promoting emission reduction. Other regions, including Egypt, focus on aligning carbon initiatives with international agreements. It grows with international funding support and partnerships with global organizations. Local industries adopt carbon platforms gradually to improve compliance and sustainability reporting. Limited infrastructure and lower digital maturity hinder rapid expansion. However, government-driven renewable energy projects encourage adoption of software solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ENGIE Impact

- GreenStep Solutions Inc.

- Greenstone+ Ltd.

- Metrix Software Solutions (Pty) Ltd.

- Salesforce Inc.

- SAP SE

- Sphera Solutions Inc.

- Wolters Kluwer N.V.

- IBM Corporation

- Microsoft Corporation

Competitive Analysis:

The Global Carbon Management Software Market is highly competitive with established players and emerging providers focusing on innovation and integration. Leading companies such as IBM Corporation, Microsoft Corporation, SAP SE, Salesforce Inc., and Sphera Solutions Inc. dominate with comprehensive platforms that support carbon accounting, emissions tracking, and compliance reporting. It shows strong competition driven by technological advancements, cloud adoption, and growing demand for ESG-focused solutions. Vendors differentiate through AI-enabled analytics, sector-specific modules, and integration with enterprise systems. Smaller firms such as GreenStep Solutions Inc. and Metrix Software Solutions strengthen their position by offering niche solutions tailored to regional and industry needs. Partnerships, mergers, and product launches remain critical strategies to expand customer base and global reach. Competitive intensity continues to rise as organizations prioritize sustainability goals, creating strong demand for scalable, transparent, and cost-effective carbon management platforms.

Recent Developments:

- In September 2025, Gravity, the enterprise carbon accounting and energy management platform, was recognized for market-leading functionality in a comprehensive evaluation of 22 carbon management software providers performed by Verdantix. The company excelled in AI-driven data collection, abatement identification, and emissions forecasting, becoming the youngest platform to secure the top score across multiple innovation categories.

- In August 2025, Position Green announced the acquisition of Morescope, a Norwegian platform with advanced carbon measurement and modeling tools. This acquisition will allow Morescope to focus on product development while leveraging Position Green’s infrastructure, strengthening the latter’s portfolio and capacity to deliver comprehensive carbon management solutions across Europe.

- In July 2025, ENGIE North America expanded its renewable energy efforts by acquiring a portfolio of 22 net energy metered solar projects in Pennsylvania, representing over 70 megawatts of capacity. This acquisition from Prospect14 will contribute to Pennsylvania’s renewable energy growth and strengthen ENGIE’s leadership in sustainable energy.

- In January 2025, LRQA finalized the acquisition of RESET Carbon, a corporate carbon management firm, to expand its ESG assurance and risk management services globally. RESET Carbon’s expertise in supply chain carbon management and solutions for Scope 3 emissions reporting is now being scaled through LRQA’s international platform, further advancing ESG leadership in the carbon management software market.

Report Coverage:

The research report offers an in-depth analysis based on Component, Functionality, Deployment Mode and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Carbon Management Software Market will expand with strong adoption across enterprises prioritizing sustainability.

- It will gain momentum from stricter government regulations requiring transparent carbon reporting and compliance.

- Demand for AI-driven analytics and automation will shape future solution development.

- Cloud-based deployment will dominate due to its scalability, cost efficiency, and remote accessibility.

- Industry-specific modules will see higher adoption as enterprises demand customized sustainability solutions.

- Integration with renewable energy and smart infrastructure projects will create new growth opportunities.

- Strategic partnerships between technology providers and governments will accelerate regional adoption.

- Small and medium enterprises will increasingly adopt cost-effective SaaS platforms to meet ESG goals.

- Competitive intensity will rise as established players enhance product portfolios through innovation and acquisitions.

- Emerging economies will play a larger role in shaping demand through modernization and sustainability initiatives.