Market Overview:

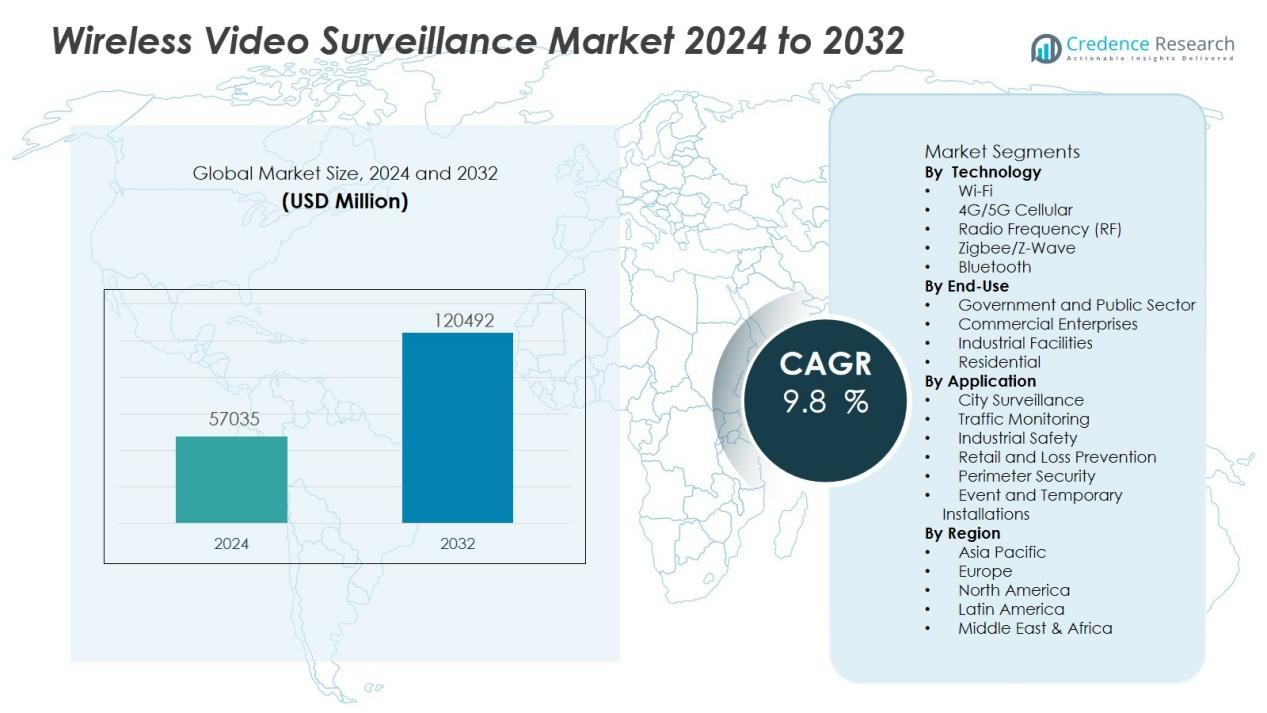

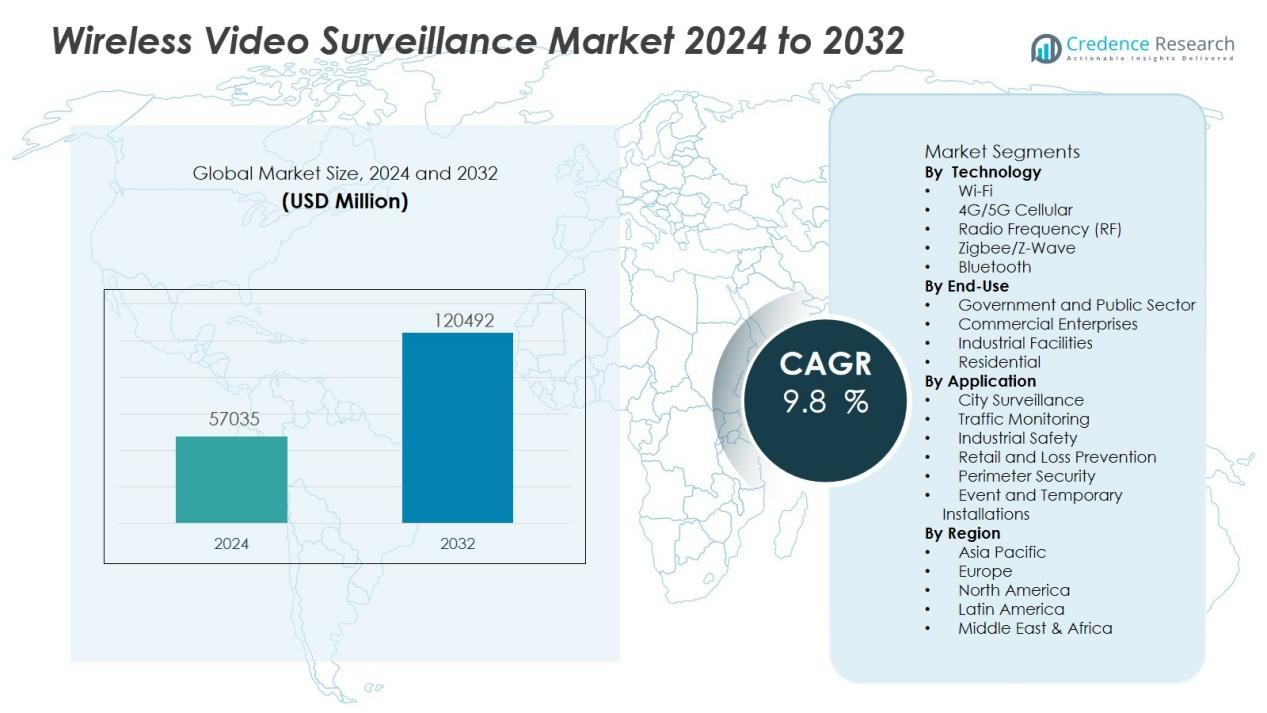

The Wireless video surveillance market size was valued at USD 57035 million in 2024 and is anticipated to reach USD 120492 million by 2032, at a CAGR of 9.8 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wireless video surveillance market Size 2024 |

USD 57035Million |

| Wireless video surveillance market , CAGR |

9.8 % |

| Wireless video surveillance market Size 2032 |

USD 120492 Million |

Key drivers for the wireless video surveillance market include heightened concerns over public safety, increased investments in smart city initiatives, and rising crime rates that prompt greater security spending. Advancements in camera resolution, edge analytics, and cloud-based storage enable organizations to leverage sophisticated surveillance solutions with enhanced image quality and remote accessibility. The proliferation of IoT devices, combined with declining costs of wireless technology and growing need for integrated security systems, continues to support market expansion across commercial, industrial, and residential sectors.

Regionally, North America leads the wireless video surveillance market due to early adoption of advanced security solutions and significant government initiatives to enhance public safety infrastructure. Asia-Pacific is expected to exhibit the fastest growth, driven by rapid urbanization, rising security needs, and large-scale smart city projects, particularly in China and India. Europe maintains steady demand, bolstered by regulatory mandates and continuous infrastructure modernization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The wireless video surveillance market was valued at USD 57,035 million in 2024 and is projected to reach USD 120,492 million by 2032, with a CAGR of 9.8% during the forecast period.

- Heightened public safety concerns, rising crime rates, and increased investments in smart city initiatives are key drivers for market growth.

- Technological advancements in wireless connectivity, camera resolution, edge analytics, and cloud storage enable organizations to deploy sophisticated surveillance with real-time remote access.

- The proliferation of IoT devices and declining wireless technology costs continue to support adoption in commercial, industrial, and residential sectors.

- North America holds a 35% market share, driven by early adoption of advanced solutions and robust infrastructure, while Asia-Pacific, with a 30% share, leads in growth due to rapid urbanization and government smart city projects.

- Europe maintains a 25% market share, supported by regulatory mandates and ongoing infrastructure modernization across transportation, retail, and municipal sectors.

- Key challenges include cybersecurity risks, data privacy concerns, and high initial investment costs, which require robust encryption, compliance, and careful integration planning for widespread adoption.

Market Drivers:

Rising Security Concerns and Demand for Real-Time Monitoring:

Escalating security threats and increasing incidents of theft, vandalism, and terrorism have elevated the need for advanced surveillance solutions. Businesses, governments, and homeowners seek reliable real-time monitoring to deter criminal activities and respond quickly to incidents. Wireless video surveillance systems offer the flexibility and scalability that traditional wired systems lack. The capability to monitor multiple locations remotely ensures proactive security management across critical assets and public spaces.

- For instance, Verkada’s Command platform supports Local and Live-Low Latency grids of up to 12 cameras per array, delivering live video streams with under 2-second latency over LAN connections.

Advancements in Wireless and Video Technologies Fuel Adoption:

Recent innovations in wireless connectivity, high-resolution imaging, and edge analytics are transforming the surveillance landscape. Improvements in Wi-Fi, 4G/5G, and IoT protocols support seamless data transmission and remote access, enabling efficient surveillance operations. Enhanced camera resolution and integrated analytics provide sharper images and automated threat detection. These technological upgrades lower the barrier to entry for organizations looking to modernize their security infrastructure.

- For instance, Avigilon’s H5 Pro security camera delivers ultra-high 10K (61 MP) single-sensor image detail, enabling airports to identify airplane tail numbers from great distances and stadiums to resolve seat numbers with one device—transforming real-world perimeter monitoring as of 2025.

Smart City Initiatives and Infrastructure Investments Accelerate Market Growth:

Governments and municipalities around the world are prioritizing smart city projects to improve urban safety, traffic management, and public services. The wireless video surveillance market benefits from large-scale deployments of connected cameras and intelligent monitoring systems in city centers, transportation hubs, and critical infrastructure. These investments drive long-term demand for reliable, scalable surveillance networks. Integration with citywide data platforms further enhances operational efficiency and incident response.

Lower Total Cost of Ownership and Simplified Installation Drive Adoption:

The cost-effectiveness of wireless video surveillance solutions appeals to organizations of all sizes. Eliminating complex cabling and minimizing installation labor significantly reduces upfront and maintenance expenses. Flexible deployment options make it easier to cover remote or temporary locations without disruptive construction. This ease of installation, coupled with advancements in battery life and wireless power options, ensures broader market accessibility for security-conscious customers.

Market Trends:

Integration of AI and Edge Analytics in Surveillance Systems Shapes Industry Direction:

The growing integration of artificial intelligence (AI) and edge analytics stands out among the most significant trends in wireless video surveillance market development. Modern surveillance cameras incorporate embedded AI capabilities, enabling features such as facial recognition, object detection, and behavioral analysis directly at the device level. This approach reduces data transmission loads and supports faster response times in security events. Edge-based analytics improve operational efficiency by filtering and processing video streams locally, minimizing the need for costly centralized storage. Security teams can make decisions based on real-time insights rather than rely on manual video review. The demand for intelligent, automated monitoring continues to drive the evolution of wireless video surveillance deployments across all sectors.

- For instance, Hikvision’s DeepinView Series cameras can accurately detect and analyse humans and vehicles at distances up to 40 m with 99% accuracy, processing six object types simultaneously on-device to reduce false alarms by over 95%.

Cloud-Based Video Storage and Mobile Access Gain Strong Momentum:

The shift toward cloud-based video management platforms marks a transformative trend in the wireless video surveillance market. Organizations now prioritize solutions that enable secure storage, retrieval, and sharing of surveillance footage from any location. Cloud platforms support scalable expansion, remote management, and automatic updates, meeting the requirements of distributed operations. Mobile access to surveillance feeds empowers security personnel and stakeholders to monitor assets on the move, improving responsiveness and situational awareness. The flexibility of cloud and mobile solutions appeals to enterprises seeking to future-proof their security infrastructure. With heightened focus on data privacy and cybersecurity, providers invest in advanced encryption and compliance features to build customer trust.

- For instance, Genetec’s Stratocast service enabled remote access for more than 10,000 enterprise users across 18 countries.

Market Challenges Analysis:

Cybersecurity Risks and Data Privacy Concerns Hamper Market Expansion:

The proliferation of wireless video surveillance solutions introduces significant cybersecurity and data privacy risks. Unsecured wireless networks and devices may expose surveillance systems to hacking, unauthorized access, or data breaches. Ensuring end-to-end encryption, regular firmware updates, and strict access controls remains critical for system integrity. Organizations must address evolving regulatory requirements for video data storage and handling, which differ across regions. The wireless video surveillance market faces ongoing scrutiny from both consumers and authorities over potential misuse and privacy violations. Building user confidence requires transparent practices and robust security frameworks.

High Initial Investment and Integration Complexities Slow Adoption:

Despite falling hardware prices, the upfront investment for advanced wireless video surveillance systems can be substantial, especially for large-scale projects. Integrating new wireless cameras with legacy security infrastructure often presents technical challenges, resulting in added costs and project delays. Limited wireless bandwidth in dense urban environments may affect system reliability and video quality. Maintenance and power management for remote or battery-operated devices can strain operational budgets. Addressing these integration and operational issues is essential for broadening the market’s reach, especially among cost-sensitive users.

Market Opportunities:

Rising Adoption in Emerging Markets and Non-Traditional Applications Expands Potential:

The wireless video surveillance market has significant growth opportunities in emerging economies, where rapid urbanization and rising security concerns drive demand for advanced monitoring solutions. Governments and private sectors in regions such as Asia-Pacific, Latin America, and Africa are investing in smart infrastructure, public safety, and critical facility protection. Non-traditional applications, including surveillance for agriculture, mining, and construction sites, also present new revenue streams. The market can leverage the flexibility and scalability of wireless systems to support temporary or remote installations in these sectors. Vendors who tailor offerings for local requirements and varied environmental conditions are well positioned to capture new customers.

Integration with IoT Ecosystems and Value-Added Services Creates New Revenue Avenues:

The convergence of wireless video surveillance with broader IoT ecosystems unlocks multiple opportunities for value-added services. Integration with smart building management, access control, and environmental monitoring platforms increases solution appeal to enterprise customers. It enables real-time data sharing and unified command, enhancing operational efficiency and risk mitigation. The trend toward video analytics-as-a-service allows end users to access advanced features such as automated alerts and predictive analytics on a subscription basis. Companies can build recurring revenue models by providing managed services and cloud storage options. As adoption grows, the market will benefit from ongoing innovation and cross-industry partnerships.

Market Segmentation Analysis:

By Technology:

The wireless video surveillance market spans a diverse technology landscape, including Wi-Fi, 4G/5G cellular, and proprietary radio frequency protocols. Wi-Fi-based systems dominate in residential and small business deployments due to their ease of integration and cost efficiency. 4G/5G solutions lead in large-scale, mission-critical environments, supporting high-definition streaming and real-time remote access. Edge analytics and AI integration enhance the value proposition of all wireless technologies, enabling automated threat detection and proactive security management.

- For instance, Ericsson’s 5G trials in automotive manufacturing connected wireless production robots with video surveillance feeds, showcasing the use of 5G to enable real-time monitoring for quality control and safety in industrial settings.

By Application:

Market applications range from city surveillance and traffic management to industrial safety, retail loss prevention, and perimeter protection. City surveillance remains the largest application segment, with governments deploying wireless systems to monitor urban areas and critical infrastructure. Retailers use wireless surveillance for loss prevention and crowd management, while industrial users rely on these systems for worker safety and asset monitoring. The flexibility of wireless technology supports diverse and evolving surveillance requirements.

- For instance, McDonald’s Malaysia outfitted its 300 branches with Hikvision IP CCTV cameras integrated into a wireless network, which improved theft deterrence and reduced shrinkage incidents by over 15%.

By End-Use:

The market serves government, commercial, industrial, and residential end-users. Government and public sector organizations account for the largest share, driven by smart city initiatives and regulatory mandates. Commercial entities such as retail, hospitality, and healthcare value wireless solutions for scalability and rapid deployment. Industrial end-users focus on process safety and regulatory compliance, while residential consumers seek simple, cost-effective options to enhance home security. The wireless video surveillance market adapts to each end-user’s unique needs with tailored solutions and services.

Segmentations:

By Technology:

- Wi-Fi

- 4G/5G Cellular

- Radio Frequency (RF)

- Zigbee/Z-Wave

- Bluetooth

By Application:

- City Surveillance

- Traffic Monitoring

- Industrial Safety

- Retail and Loss Prevention

- Perimeter Security

- Event and Temporary Installations

By End-Use:

- Government and Public Sector

- Commercial Enterprises

- Industrial Facilities

- Residential

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America :

North America holds 35% market share in the wireless video surveillance market, supported by early adoption of advanced security technologies and strong government initiatives. The region’s robust infrastructure, strict regulatory standards, and high awareness of security risks underpin steady demand for wireless solutions. Public safety agencies, transportation networks, and private enterprises invest heavily in upgrading to smart, wireless surveillance systems for improved situational awareness and crime prevention. The presence of leading technology vendors and rapid integration of AI-driven analytics further enhance market growth. Urban centers and critical infrastructure projects in the United States and Canada prioritize scalable, real-time video surveillance. The competitive landscape features frequent product launches, acquisitions, and partnerships that reinforce regional market leadership.

Asia-Pacific :

Asia-Pacific accounts for 30% market share and registers the fastest growth rate, propelled by rapid urbanization and ambitious smart city initiatives. Governments in China, India, Japan, and Southeast Asian countries allocate substantial resources for deploying citywide surveillance networks, intelligent transportation systems, and public safety solutions. The expansion of manufacturing, logistics, and commercial sectors increases demand for advanced wireless surveillance in both urban and rural settings. The wireless video surveillance market benefits from large-scale infrastructure investments and a tech-savvy population seeking innovative, affordable security options. Price-sensitive customers in the region prefer flexible, scalable systems that minimize installation complexity. Vendors who localize their offerings and provide robust after-sales support achieve strong penetration in this dynamic environment.

Europe :

Europe captures 25% market share in the wireless video surveillance market, supported by stringent regulatory mandates and continuous infrastructure modernization. Government policies across the European Union emphasize data privacy, cyber protection, and standardized security practices, shaping market requirements for wireless surveillance deployments. The region’s mature industrial base and growing emphasis on public safety drive adoption in transportation, retail, and municipal sectors. Investments in next-generation communication networks and cross-border security initiatives further stimulate growth. End users demand integrated, compliant solutions that can be seamlessly upgraded within existing environments. Leading players focus on partnerships, innovation, and sustainable practices to maintain a competitive edge in the European market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The wireless video surveillance market features strong competition among global leaders and innovative technology firms. Leading companies such as Vivint Smart Home, Inc., ADT Inc., Xiaomi Inc., Samsung Electronics Co, Ltd., Skylinkhome, SimpliSafe, Inc., and Blink drive innovation and set industry standards. It emphasizes rapid development cycles, strategic partnerships, and differentiated offerings in AI analytics, cloud storage, and edge computing. Competitors invest heavily in research and development to enhance video quality, system reliability, and cybersecurity features. They target diverse customer segments, from government and enterprises to residential users, customizing solutions to meet regional regulations and unique end-user needs. The market encourages continuous product launches and aggressive marketing strategies to capture share in high-growth regions. Companies leverage strong distribution networks and after-sales support to maintain customer loyalty and expand their presence in both established and emerging markets.

Recent Developments:

- In July 2025, ADT completed the acquisition of approximately 50,000 residential customer accounts for $89 million as part of its growth strategy.

- In May 2025, Xiaomi extended its multi-year partnership with Qualcomm to adopt future Snapdragon flagship chipsets and expand collaboration across smartphones, AR/VR, wearables, tablets, smart home devices, and electric vehicles.

- In April 2025, Impulse Alarm joined the Brinks Home dealer sales program, expanding customer access to Brinks Home’s security products.

Market Concentration & Characteristics:

The wireless video surveillance market exhibits moderate to high market concentration, with a core group of multinational technology leaders such as Axis Communications, Hikvision, Dahua Technology, Bosch Security Systems, and Hanwha Techwin holding significant shares. It features a competitive environment driven by rapid innovation, frequent product launches, and strategic partnerships. Companies focus on integrating AI analytics, edge processing, and cloud-based platforms to differentiate their offerings and address evolving customer needs. The market supports both large-scale enterprise deployments and flexible solutions for small and medium businesses. Price sensitivity, regulatory compliance, and the need for robust cybersecurity measures shape purchasing decisions and competitive dynamics across regions.

Report Coverage:

The research report offers an in-depth analysis based on Technology, Application, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Demand for wireless video surveillance systems will increase across public, commercial, and residential sectors due to heightened security concerns.

- Adoption of AI-powered analytics and edge computing will enhance real-time threat detection and automated response capabilities.

- Integration with broader IoT and smart city platforms will position wireless surveillance as a foundational component of urban infrastructure.

- Cloud-based video management and remote access solutions will see accelerated deployment for scalability and operational flexibility.

- Vendors will expand offerings for non-traditional applications such as agriculture, mining, and temporary event security.

- Enhanced data privacy, encryption, and regulatory compliance measures will shape product development and customer adoption.

- Growth in emerging markets will continue, driven by infrastructure investments and increased awareness of security risks.

- Cost-effective wireless solutions will gain traction among small and medium enterprises seeking scalable security options.

- Partnerships between hardware manufacturers, software providers, and telecom companies will foster innovation and integrated solutions.

- Advances in battery life, wireless power, and low-bandwidth technology will support deployment in remote and challenging environments.