Market Overview

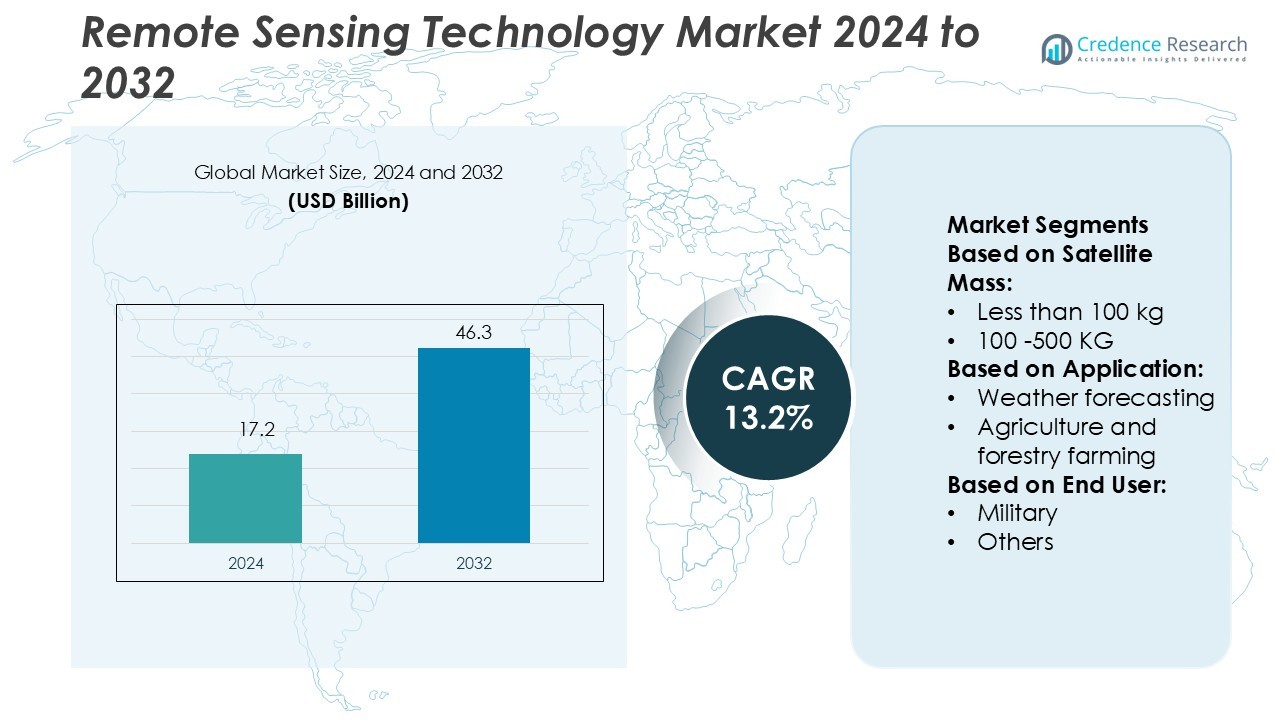

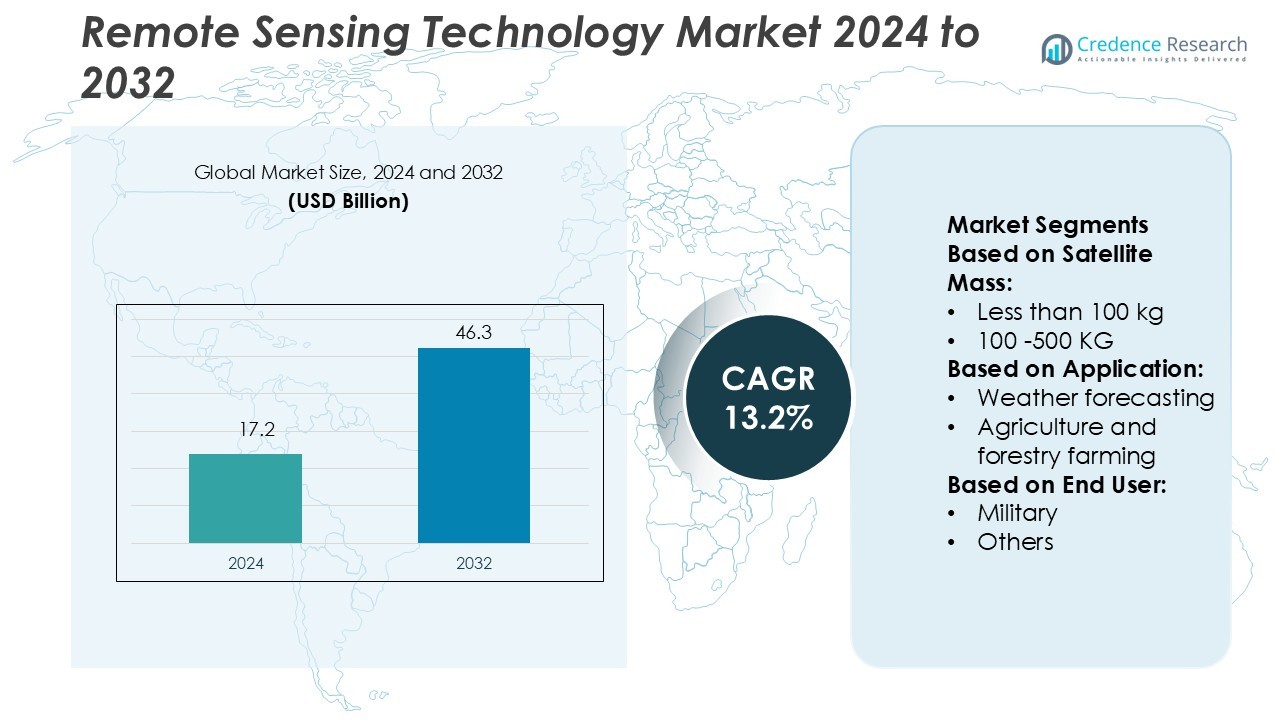

Remote Sensing Technology Market size was valued USD 17.2 billion in 2024 and is anticipated to reach USD 46.3 billion by 2032, at a CAGR of 13.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Remote Sensing Technology Market Size 2024 |

USD 17.2 Billion |

| Remote Sensing Technology Market, CAGR |

13.2% |

| Remote Sensing Technology Market Size 2032 |

USD 46.3 Billion |

The remote sensing technology market is driven by top players including Dhruva Space, Boeing, EnduroSat, Airbus, INVAP, Blue Canyon Technologies, BAE Systems, Indian Space Research Organisation, Lockheed Martin, and Beijing Smart Satellite. These companies focus on enhancing satellite imaging, real-time data analytics, and advanced sensor technologies to strengthen their competitive positions. Strategic partnerships and investments in AI-driven platforms support expanded global coverage and faster data delivery. North America leads the market with a 36% share, supported by strong government funding, advanced infrastructure, and widespread adoption across defense, agriculture, and environmental monitoring applications. This leadership is reinforced by early technology integration and frequent satellite deployments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The remote sensing technology market was valued at USD 17.2 billion in 2024 and is projected to reach USD 46.3 billion by 2032, growing at a CAGR of 13.2%.

- Rising demand for climate monitoring, defense surveillance, and precision agriculture is driving strong adoption across both government and commercial sectors.

- AI-driven analytics and miniaturized satellite constellations are key trends enhancing data accuracy and lowering operational costs.

- The market is led by major players focusing on advanced imaging and strategic collaborations, with North America holding a 36% share and Europe 27%.

- Satellite imaging systems hold the largest segment share due to high demand for environmental, security, and infrastructure applications, while emerging regions like Asia Pacific are expected to record the fastest growth.

Market Segmentation Analysis:

By Satellite Mass

Satellites weighing 100–500 kg dominate the Remote Sensing Technology Market with the largest share. These satellites offer an optimal balance between launch cost, payload capacity, and imaging resolution. Medium-sized platforms support advanced sensors, including hyperspectral and synthetic aperture radar systems, which are ideal for environmental and agricultural monitoring. Their compatibility with multiple launch vehicles improves deployment flexibility. The strong demand from commercial and defense applications boosts their market position. Miniaturization of sensors and increased private sector launches further drive this sub-segment’s growth.

- For instance, Dhruva Space launched two Thybolt nanosatellites in November 2022, each weighing less than 750 grams. The mission was a technology demonstration for a store-and-forward communications payload for amateur radio operators.

By Application

Weather forecasting holds the leading share in the market, driven by rising demand for accurate climate monitoring. Advanced sensors provide real-time atmospheric data, supporting disaster management and agricultural planning. Continuous investments from national meteorological agencies and private operators enhance forecasting precision. High-resolution optical and radar imagery allows early detection of extreme weather events, improving preparedness. This segment benefits from improved satellite revisit rates and data integration with AI and cloud-based analytics platforms, strengthening its dominance across applications.

- For instance, Boeing’s contribution to the GOES‑15 weather satellite included a launch mass of 3,238 kg and a power system delivering about 2.3 kW at beginning-of-life.

By End-User

The government sector leads the end-user segment with a significant market share. Governments use remote sensing technologies for national security, infrastructure planning, and environmental monitoring. Public agencies invest heavily in advanced Earth observation constellations and geospatial data platforms. These systems enable efficient border surveillance, disaster management, and resource mapping. Strategic collaborations with private companies expand data access and enhance operational capabilities. Strong funding support and regulatory frameworks maintain government dominance in the end-user landscape.

Key Growth Drivers

Rising Demand for Climate and Environmental Monitoring

The growing need to track climate patterns and natural resources drives the adoption of remote sensing technology. Governments and private organizations use high-resolution satellite imagery for early warning systems, drought prediction, and land use monitoring. This technology supports disaster management, sustainable agriculture, and water resource planning. Enhanced imaging sensors and better spectral resolution improve the accuracy of real-time assessments. Increasing global climate challenges accelerate investments in satellite-based observation systems, making environmental monitoring one of the strongest market drivers.

- For instance, EnduroSat’s Gen3 satellite platform, unveiled in 2025, features a payload capacity of up to 70 kg for certain models (such as the FRAME SmallSat), peak power of up to 3.5 kW, and data throughput of 2 Gbps, enabling rapid transmission of high-resolution environmental data.

Expanding Use in Defense and Security Operations

Remote sensing technology plays a critical role in border surveillance, reconnaissance, and threat detection. Defense agencies use satellite and aerial imagery to track troop movements, detect unauthorized activities, and support strategic decision-making. The integration of AI with geospatial data enables faster analysis and more precise targeting. Growing geopolitical tensions and increased defense spending push governments to invest in advanced sensing systems. This steady demand from the military and defense sector fuels strong market expansion globally.

- For instance, Airbus’ Pléiades Neo constellation consists of two active satellites (launched in 2021) and delivers 30 cm native resolution imagery. Each satellite weighs 920 kg, and the system provides a revisit time of twice a day at any point on Earth.

Technological Advancements and Cost Efficiency

Advancements in sensor miniaturization, cloud computing, and data processing are lowering operational costs. Modern satellites deliver higher-quality imagery at shorter revisit intervals, improving situational awareness across sectors. Open data initiatives and private satellite launches increase data availability, driving commercial adoption. Cloud-based analytics enable faster interpretation of large datasets, supporting industries such as agriculture, infrastructure, and energy. These advancements make remote sensing more accessible, cost-efficient, and scalable, accelerating its adoption across developed and emerging economies.

Key Trends & Opportunities

Growth of Commercial Satellite Constellations

Private companies are rapidly launching small satellite constellations to enhance global coverage. These networks provide near real-time imagery and offer high revisit rates for continuous monitoring. Businesses use this data for urban planning, environmental protection, and logistics optimization. Lower launch costs and shared satellite infrastructure are creating new opportunities for small and medium enterprises. This trend supports a strong commercial ecosystem, diversifying the market beyond traditional government applications.

- For instance, INVAP’s SAOCOM-1A and SAOCOM-1B satellites, launched in 2018 and 2020, each carry an L-band synthetic aperture radar with a 6.7 kW peak transmit power. Each satellite has a wet mass of around 1,600 kg and an overall launch mass of around 3,000 kg.

Integration of AI and Machine Learning in Data Analytics

AI and ML algorithms are transforming remote sensing data processing. These tools reduce manual analysis time and improve the accuracy of image classification and change detection. Automated pattern recognition helps industries such as agriculture, mining, and construction make faster operational decisions. Real-time analytics solutions enhance value-added services, driving demand for AI-integrated platforms. This integration creates new opportunities for analytics providers and technology developers.

- For instance, Blue Canyon Technologies offers the X-SAT Venus Class microsatellite platform, which supports a payload mass of 90 kg and has been used for various missions since its introduction.

Expansion in Precision Agriculture and Smart Infrastructure

Remote sensing supports efficient farm management and urban development. Farmers use satellite data for crop health monitoring, irrigation scheduling, and yield forecasting. Governments and private developers apply the technology for infrastructure planning and traffic management. Expanding adoption in precision agriculture and smart city projects is opening strong revenue opportunities. This growing commercial use is expected to strengthen the market’s long-term outlook.

Key Challenges

High Initial Investment and Operational Costs

Deploying remote sensing systems requires large capital investments for satellite manufacturing, launching, and maintenance. Data processing infrastructure and skilled labor also add to operational costs. These financial barriers limit adoption by smaller businesses and developing economies. While technology is becoming more affordable, the initial investment remains a significant challenge, especially for large-scale, high-resolution applications.

Data Privacy, Security, and Regulatory Restrictions

Data privacy and strict regulatory frameworks can restrict access to high-resolution imagery. Many countries impose limitations on satellite imaging over sensitive areas, affecting commercial use. Cybersecurity threats also raise concerns over the misuse of geospatial data. Navigating complex international regulations adds operational complexity for providers. These constraints can slow down market growth and limit expansion opportunities in sensitive regions.

Regional Analysis

North America

North America leads the remote sensing technology market with a 36% share, driven by strong investments in defense, environmental monitoring, and precision agriculture. The U.S. dominates regional growth through NASA, NOAA, and commercial satellite operators. High adoption of AI-driven analytics and advanced sensor technologies enhances the accuracy and speed of data interpretation. Strong regulatory frameworks and established infrastructure support large-scale satellite launches and data processing. Expanding applications in disaster management and urban planning further boost demand. Strategic collaborations between government agencies and private players strengthen North America’s leadership in the global market.

Europe

Europe holds a 27% share of the global market, supported by the European Space Agency’s Copernicus program and strong climate initiatives. Countries like Germany, France, and the U.K. are major contributors to satellite deployment and earth observation missions. The region emphasizes environmental protection, agricultural optimization, and urban sustainability. Robust R&D investments and collaborative space projects enhance data accuracy and availability. Growing commercial demand from infrastructure, forestry, and maritime sectors further supports market growth. Strict environmental regulations and climate monitoring policies make Europe a strategic hub for remote sensing technology development and adoption.

Asia Pacific

Asia Pacific accounts for a 22% share and is the fastest-growing region in the remote sensing technology market. China, India, and Japan are expanding satellite constellations and investing heavily in earth observation programs. Rapid urbanization, climate challenges, and agricultural modernization drive adoption across industries. National space agencies and private firms are deploying small satellites for crop monitoring, disaster response, and resource mapping. The rise of cloud-based data platforms improves access for commercial users. Strong government support and increasing private investments position Asia Pacific as a key growth engine in the global market.

Latin America

Latin America captures a 9% market share, driven by increasing use of satellite imagery for agriculture, mining, and environmental conservation. Brazil, Chile, and Argentina lead regional adoption with projects focused on deforestation control and natural resource mapping. Government agencies are partnering with international space organizations to access high-resolution data. The growing need for precision agriculture and natural disaster management strengthens market demand. Though infrastructure remains limited, expanding public-private initiatives and cloud technology are improving accessibility. This growing adoption supports steady expansion of remote sensing applications in key industries across Latin America.

Middle East & Africa

The Middle East & Africa region holds a 6% market share, with growing interest in remote sensing for resource management, defense, and infrastructure planning. Countries like the UAE, Saudi Arabia, and South Africa are investing in satellite programs to support national development goals. Applications include water resource mapping, land use monitoring, and urban development. Rising environmental challenges and climate adaptation programs create strong opportunities for market growth. While technical capacity is developing, increasing collaborations with international organizations and technology providers are accelerating the region’s participation in the global remote sensing landscape.

Market Segmentations:

By Satellite Mass:

- Less than 100 kg

- 100 -500 KG

By Application:

- Weather forecasting

- Agriculture and forestry farming

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the remote sensing technology market is shaped by key players such as Dhruva Space, Boeing, EnduroSat, Airbus, INVAP, Blue Canyon Technologies, BAE Systems, Indian Space Research Organisation, Lockheed Martin, and Beijing Smart Satellite. The remote sensing technology market is defined by rapid innovation, strategic collaborations, and rising private sector participation. Companies are focusing on enhancing imaging resolution, reducing satellite weight, and integrating advanced AI-driven analytics to gain a competitive edge. Government and commercial partnerships are expanding satellite coverage and improving real-time data accessibility. Investment in small satellite constellations and cost-efficient launch solutions is increasing global market reach. Defense modernization, environmental monitoring, and agricultural applications are further accelerating demand. Strong R&D capabilities, robust infrastructure, and scalable technologies continue to shape competitive strategies across the industry.

Key Player Analysis

- Dhruva Space

- Boeing

- EnduroSat

- Airbus

- INVAP

- Blue Canyon Technologies

- BAE Systems

- Indian Space Research Organisation

- Lockheed Martin

- Beijing Smart Satellite

Recent Developments

- In March 2025, Comptroller and Auditor General (CAG) of India signed an agreement with the Bhaskaracharya National Institute of Space Application and Geo-informatics (BISAG-N) to leverage advanced technologies in geographic information systems and remote sensing.

- In January 2024, TeamViewer, in collaboration with Almer, introduced an innovative AR (Augmented Reality) bundle with a subscription-driven software/hardware bundle and combined marketing activities.

- In July 2023, Hexagon, a company in digital reality solutions, acquired HARD-LINE, a Canada-based automation company specializing in mining operations. This acquisition strengthened Hexagon’s position in the mining industry and helped the company offer a more comprehensive suite of solutions for mine operators.

- In January 2023, Airbus Defence and Space signed a contract with Poland to deliver a complete geospatial intelligence system. This deal covers the creation, manufacturing, launch, and in-orbit delivery of two advanced optical Earth observation satellites.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Satellite Mass, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see strong growth with rising use in environmental and climate monitoring.

- Advanced satellite constellations will enhance global coverage and revisit rates.

- AI and machine learning integration will improve real-time data processing and decision-making.

- Defense and security applications will continue to drive major technology investments.

- Precision agriculture will emerge as a key commercial growth area.

- Cloud-based platforms will expand accessibility and reduce operational complexity.

- Public-private collaborations will increase innovation and lower launch costs.

- Miniaturized and modular satellites will enable flexible and cost-effective deployments.

- Regulatory frameworks will evolve to address data privacy and security challenges.

- Emerging economies will adopt remote sensing technology to support infrastructure and resource planning.