Market Overview

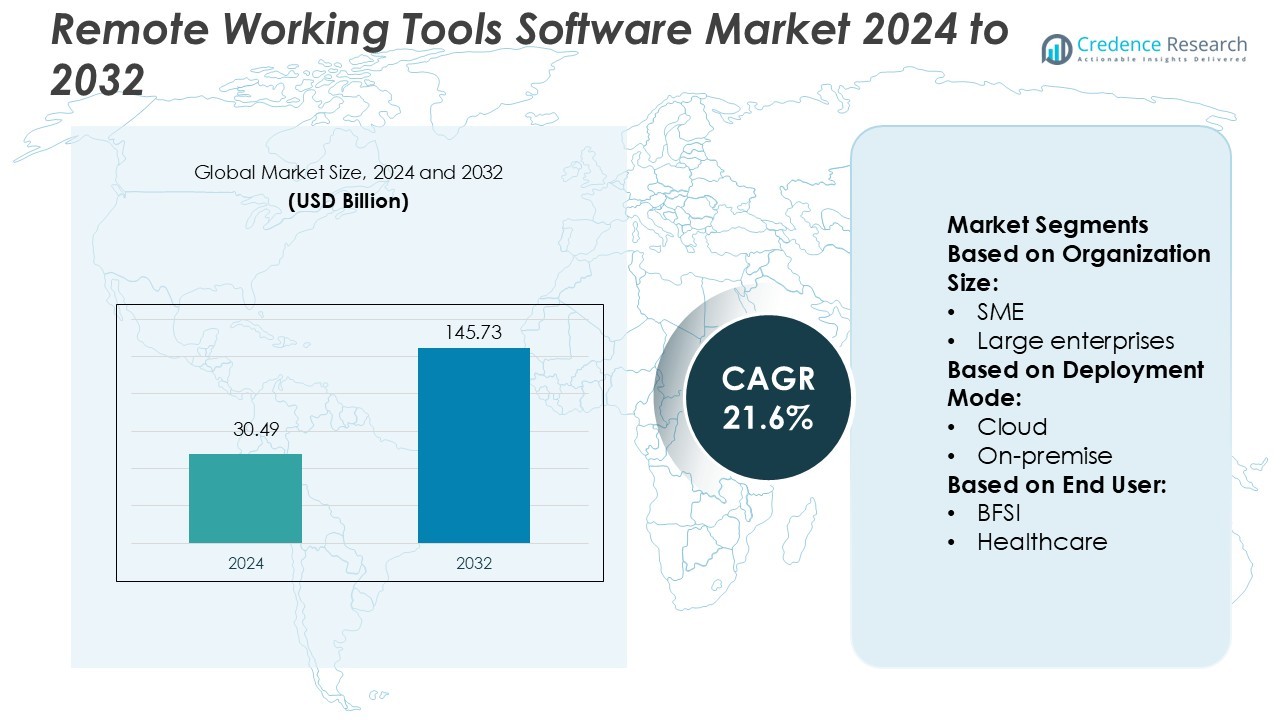

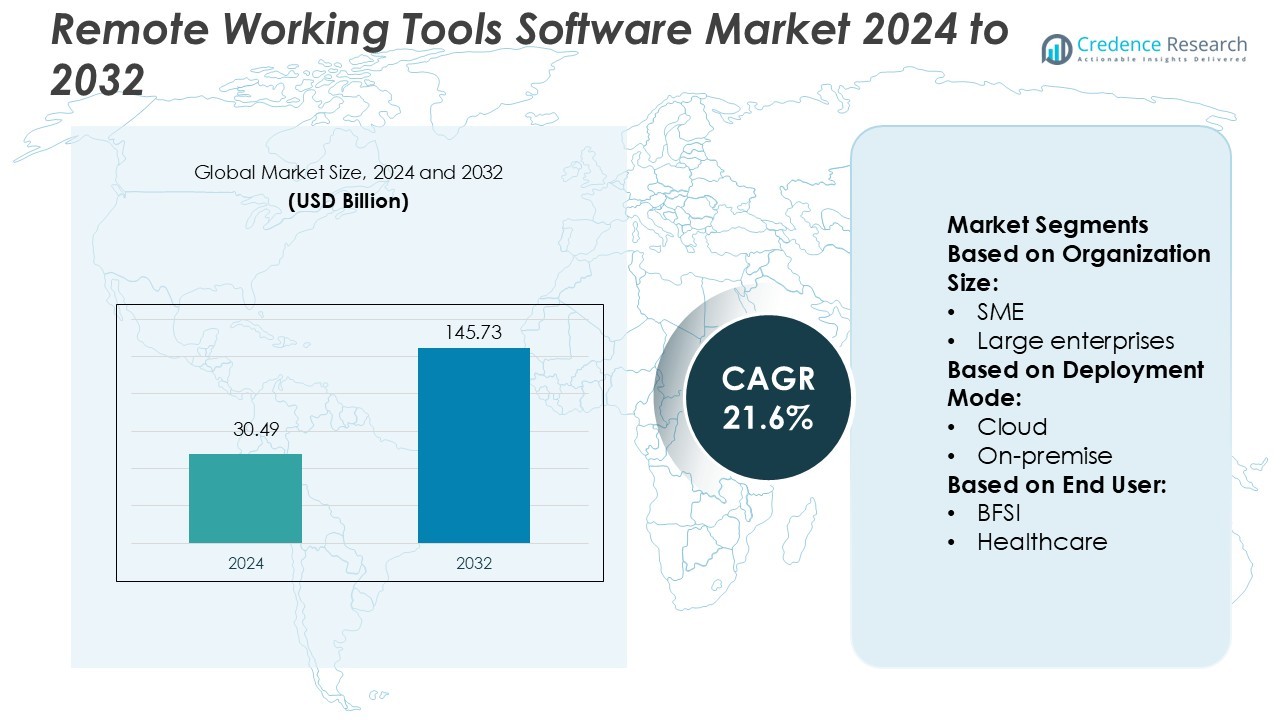

Remote Working Tools Software Market size was valued USD 30.49 billion in 2024 and is anticipated to reach USD 145.73 billion by 2032, at a CAGR of 21.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Remote Working Tools Software Market Size 2024 |

USD 30.49 Billion |

| Remote Working Tools Software Market, CAGR |

21.6% |

| Remote Working Tools Software Market Size 2032 |

USD 145.73 Billion |

The Remote Working Tools Software Market is shaped by strong competition among leading companies, including Forcepoint, Fortinet, Inc., Microsoft Corporation, Broadcom Inc., CrowdStrike Holdings, Inc., Cisco Systems, Inc., Cloudflare, Inc., IBM Corporation, Check Point Software Technologies Ltd., and CyberArk Software Ltd. These players focus on secure, scalable platforms that support hybrid work environments and enable seamless communication. Their strategies emphasize cloud integration, AI-driven productivity, and advanced cybersecurity to meet evolving enterprise demands. North America leads the global market with a 34% share, supported by mature digital infrastructure, high cloud adoption, and strong enterprise investment in remote work solutions, making it the dominant region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Remote Working Tools Software Market was valued at USD 30.49 billion in 2024 and is expected to reach USD 145.73 billion by 2032, growing at a CAGR of 21.6%.

- Rising hybrid work adoption and increasing demand for secure cloud-based collaboration tools are key growth drivers.

- Integration of AI, automation, and cybersecurity solutions is a major trend shaping competitive strategies among leading vendors.

- North America leads the market with a 34% share, followed by Europe with 28% and Asia Pacific with 25%, reflecting strong regional adoption patterns.

- Cloud deployment dominates the segment with the highest share, driven by flexibility, cost-efficiency, and scalability across industries such as IT, BFSI, and healthcare.

Market Segmentation Analysis:

By Organization Size

Large enterprises dominate the Remote Working Tools Software Market with the highest market share. This segment benefits from large-scale digital transformation programs, global team coordination needs, and advanced cybersecurity frameworks. Enterprises invest in integrated platforms that support secure collaboration, real-time communication, and workflow automation. Many organizations deploy AI-driven features to improve operational visibility and reduce downtime. Scalable tools such as video conferencing, cloud storage, and project management software help maintain productivity across distributed teams. SMEs are growing steadily, driven by flexible subscription models and easy-to-use platforms that enable remote operations with limited infrastructure.

- For instance, Fortinet, Inc. expanded its FortiGate 4800F next-generation firewall, delivering 2.4 Tbps firewall throughput and supporting 400G interfaces to secure large-scale remote access networks.

By Deployment Mode

The cloud segment holds the dominant market share in the Remote Working Tools Software Market. Businesses prefer cloud solutions due to lower infrastructure costs, easier scalability, and rapid deployment. These tools support remote access from multiple devices, improving workforce flexibility. Companies benefit from continuous updates, strong data backup, and advanced security layers. The rising use of SaaS platforms boosts collaboration efficiency and reduces IT maintenance. On-premise deployment maintains a smaller share but remains important for organizations with strict data control and compliance requirements, especially in regulated industries like government and banking.

- For instance, Microsoft 365 cloud services run on Azure infrastructure, Azure Ultra Disk Storage is typically used for specific, high-performance workloads, like those on virtual machines, and is not the blanket storage for all of Microsoft 365.

By End-User

IT & Telecom leads the Remote Working Tools Software Market with the largest share. This sector has a high adoption rate of advanced collaboration platforms, project management tools, and secure communication software to support distributed teams. Strong demand comes from agile development practices, customer support functions, and global outsourcing activities. BFSI and healthcare sectors follow closely, driven by strict data security standards and compliance needs. Education is another fast-growing segment as schools and universities expand e-learning infrastructure. Manufacturing, government, and others also invest in secure and flexible platforms to support hybrid work environments.

Key Growth Drivers

Rising Demand for Flexible Work Environments

The growing acceptance of hybrid and remote work models drives strong demand for remote working tools software. Enterprises adopt advanced communication, project management, and collaboration platforms to support distributed teams. These tools help maintain productivity, ensure real-time coordination, and enable faster decision-making. Many organizations prefer software that integrates messaging, conferencing, and document sharing in one platform. This shift toward flexible work arrangements is boosting software investments across industries, especially IT, BFSI, and education sectors.

- For instance, CrowdStrike Holdings, Inc. advanced its Falcon platform with a cloud-native architecture capable of processing 2 trillion security events per day. The platform uses 180+ machine learning models for real-time threat detection and integrates automated response features to secure remote endpoints at scale.

Cost Optimization and Productivity Gains

Companies adopt remote working solutions to reduce operational costs while increasing workforce productivity. Cloud-based tools eliminate the need for expensive physical infrastructure, allowing businesses to scale efficiently. Automation features reduce repetitive tasks and improve workflow visibility. Advanced analytics embedded in these platforms help track employee performance and project timelines. These productivity improvements, combined with lower overhead costs, make remote working software a strategic investment for enterprises of all sizes.

- For instance, Cisco Systems, Inc. enhanced its Webex platform with Webex Calling, a cloud-based phone system that is integrated into the Webex app. In June 2024, Webex announced that its Webex Calling service had surpassed 15 million users.

Advancements in Cloud and Security Infrastructure

Robust cloud infrastructure and improved cybersecurity frameworks are accelerating market expansion. Vendors now provide multi-layer encryption, secure access control, and compliance certifications to protect sensitive data. These advancements enable enterprises to confidently deploy remote work solutions at scale. Real-time updates and centralized management further strengthen operational resilience. As organizations prioritize secure digital transformation, the demand for reliable cloud-based collaboration tools continues to surge.

Key Trends & Opportunities

Integration of AI and Automation

AI-powered tools are enhancing productivity and decision-making in remote work environments. Features such as automated scheduling, intelligent meeting summaries, and real-time language translation improve collaboration. Workflow automation reduces delays and improves task accuracy. Companies are integrating AI chatbots to manage repetitive support queries, further improving efficiency. This trend creates opportunities for vendors to offer intelligent, adaptive platforms that meet evolving enterprise needs.

- For instance, Cloudflare also reported that training-purpose AI crawling rose to approximately 80 % of all bot traffic by mid-2025, up from 72 % a year prior, allowing firms to optimise automation workflows and fine-tune bot-driven task management.

Expansion of Industry-Specific Platforms

Vendors are developing industry-focused solutions tailored to specific regulatory and operational needs. For example, secure video conferencing and document management tools are being adopted in BFSI and healthcare sectors. Education platforms offer virtual classrooms with interactive learning modules. These customized solutions create new revenue streams and strengthen vendor positioning. The increasing focus on compliance-ready platforms is opening growth opportunities in regulated industries.

- For instance, IBM’s hybrid cloud platform and Red Hat OpenShift are used by more than 4,000 government and corporate entities in critical infrastructure domains such as banking, telecom and healthcare.

Growing Demand in Emerging Markets

Rapid digital adoption in emerging economies presents strong opportunities for market expansion. SMEs in Asia Pacific, Latin America, and Africa are adopting affordable cloud-based tools to support distributed teams. Governments and private players are investing in broadband infrastructure, enabling broader access to remote work solutions. This growing user base encourages software vendors to offer scalable, localized solutions, boosting market penetration.

Key Challenges

Cybersecurity and Data Privacy Risks

The increasing use of cloud collaboration platforms raises concerns around cybersecurity and data breaches. Unsecured networks, weak access controls, and phishing attacks expose organizations to potential threats. Regulatory frameworks such as GDPR and HIPAA demand strict compliance, increasing the pressure on vendors and users. Companies need continuous investments in advanced security solutions, making implementation complex and costly for smaller organizations.

Integration and Compatibility Issues

Enterprises often face challenges integrating multiple remote working tools into existing IT systems. Incompatibility between platforms leads to workflow disruptions, productivity loss, and higher IT costs. Legacy infrastructure in some industries limits the seamless adoption of modern solutions. Vendors need to enhance interoperability and provide robust API frameworks to address these issues. Failure to resolve integration gaps can slow adoption rates, especially in large organizations.

Regional Analysis

North America

North America holds a 34% share of the Remote Working Tools Software Market, supported by early cloud adoption and mature digital infrastructure. The U.S. leads due to extensive enterprise digitalization and strong demand for secure collaboration platforms. Major technology providers enhance market penetration through AI-driven productivity tools and integrated video conferencing solutions. High internet penetration and flexible work policies further boost usage across industries such as IT, BFSI, and healthcare. Strong investments in cybersecurity and communication tools reinforce the region’s leadership. The growing focus on hybrid work models continues to strengthen market demand and software innovation.

Europe

Europe accounts for a 28% market share, driven by government support for digital transformation and enterprise adoption of hybrid work models. Countries like Germany, the U.K., and France are leading markets due to strong corporate investments in productivity software and cloud solutions. Enterprises prioritize GDPR-compliant platforms to maintain data privacy, boosting demand for secure tools. The presence of large multinationals and cross-border teams increases collaboration software usage. Remote work policies in both private and public sectors support steady growth. The region also witnesses rising integration of automation and AI features to enhance workforce productivity.

Asia Pacific

Asia Pacific holds a 25% share of the Remote Working Tools Software Market and is the fastest-growing region. Rapid digitization, large SME presence, and expanding internet connectivity drive strong demand across China, India, Japan, and Southeast Asia. Companies adopt cloud-based collaboration platforms to manage distributed teams and enhance real-time communication. Governments promote digital workplace initiatives, further accelerating adoption. Major global players are expanding operations in the region, supported by rising mobile workforce adoption. Competitive pricing strategies and increasing localization of platforms strengthen regional penetration, making Asia Pacific a key growth engine for the market.

Latin America

Latin America captures an 8% market share, supported by growing enterprise digitalization and increasing internet penetration. Countries like Brazil and Mexico lead adoption due to rising demand for cost-effective collaboration tools among SMEs. Organizations are shifting to cloud platforms to support hybrid work environments and enhance team efficiency. Global vendors are expanding their footprint through regional partnerships and language localization. Investment in IT infrastructure and increasing acceptance of flexible work models are fueling market expansion. Limited regulatory complexity compared to other regions provides a favorable environment for SaaS-based remote work platforms to scale.

Middle East & Africa

The Middle East & Africa region holds a 5% market share, with gradual adoption of remote work solutions across corporate and public sectors. The UAE, Saudi Arabia, and South Africa are key markets driven by digital transformation programs and 5G expansion. Governments are promoting workplace modernization, encouraging cloud adoption and collaboration tools. Global software providers are investing in localized data centers to meet compliance needs and improve performance. Growing investments in education and healthcare are also supporting remote working software uptake. While adoption remains lower than other regions, steady infrastructure development indicates promising growth potential.

Market Segmentations:

By Organization Size:

By Deployment Mode:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Remote Working Tools Software Market features strong competition among leading players such as Forcepoint, Fortinet, Inc., Microsoft Corporation, Broadcom Inc., CrowdStrike Holdings, Inc., Cisco Systems, Inc., Cloudflare, Inc., IBM Corporation, Check Point Software Technologies Ltd., and CyberArk Software Ltd. The Remote Working Tools Software Market is highly competitive, driven by rapid digital transformation and the global shift toward hybrid work models. Companies focus on developing secure, scalable, and cloud-based collaboration platforms to support remote operations. Continuous innovation in AI, automation, and cybersecurity integration enhances product value and user experience. Strategic mergers, acquisitions, and partnerships strengthen global presence and expand customer reach. Vendors also prioritize compliance with regional data protection regulations to build trust and improve adoption rates. The competitive intensity is rising as enterprises seek flexible, cost-efficient solutions to manage distributed teams, optimize productivity, and secure remote infrastructure.

Key Player Analysis

- Forcepoint

- Fortinet, Inc.

- Microsoft Corporation

- Broadcom Inc.

- CrowdStrike Holdings, Inc.

- Cisco Systems, Inc.

- Cloudflare, Inc.

- IBM Corporation

- Check Point Software Technologies Ltd.

- CyberArk Software Ltd.

Recent Developments

- In April 2025, Palo Alto Networks introduced Prisma Access Browser 2.0, a secure browser designed for the modern, cloud-centric workplace. As the industry’s only Secure Access Service Edge (SASE)-native browser, it offers advanced security features tailored for perimeterless environments. This innovation aims to enhance user protection and streamline secure access, addressing the evolving needs of organizations embracing remote and hybrid work models.

- In April 2025, Forcepoint launched its Data Security Cloud, an AI-driven platform that unifies data protection across various channels, including users, devices, SaaS, web, email, and networks. Powered by AI Mesh, it integrates Data Security Posture Management (DSPM), Data Detection and Response (DDR), and other security solutions to provide comprehensive data visibility and control.

- In September 2024, Proofpoint and CyberArk expanded their strategic partnership to enhance identity security across hybrid and multi-cloud environments. This collaboration introduces new integrations, including Proofpoint’s ZenWeb browser extension and CyberArk’s Secure Browser, aiming to prevent phishing attacks and secure user identities.

- In July 2024, Microsoft and Lumen Technologies partnered to boost AI features and evolve business processes across the world. The contract’s goal is to merge Lumen’s Edge Platform with Microsoft Azure in order to provide application programmable interfaces that harness the Internet to support diverse AI and IoT solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Organization Size, Deployment Mode, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Hybrid work adoption will continue to drive demand for collaboration platforms.

- AI-powered features will enhance productivity, communication, and workflow automation.

- Cybersecurity integration will become a key factor in product differentiation.

- Cloud-based deployment will dominate due to flexibility and scalability.

- Vendors will expand regional data centers to meet compliance and performance needs.

- SMEs will increasingly adopt cost-efficient and easy-to-integrate solutions.

- Partnerships between software providers and telecom operators will strengthen market reach.

- Demand for mobile-friendly platforms will grow with the rise of distributed teams.

- Automation and predictive analytics will improve remote workforce management.

- Competition will intensify as vendors innovate to offer secure, unified platforms.