Market Overview:

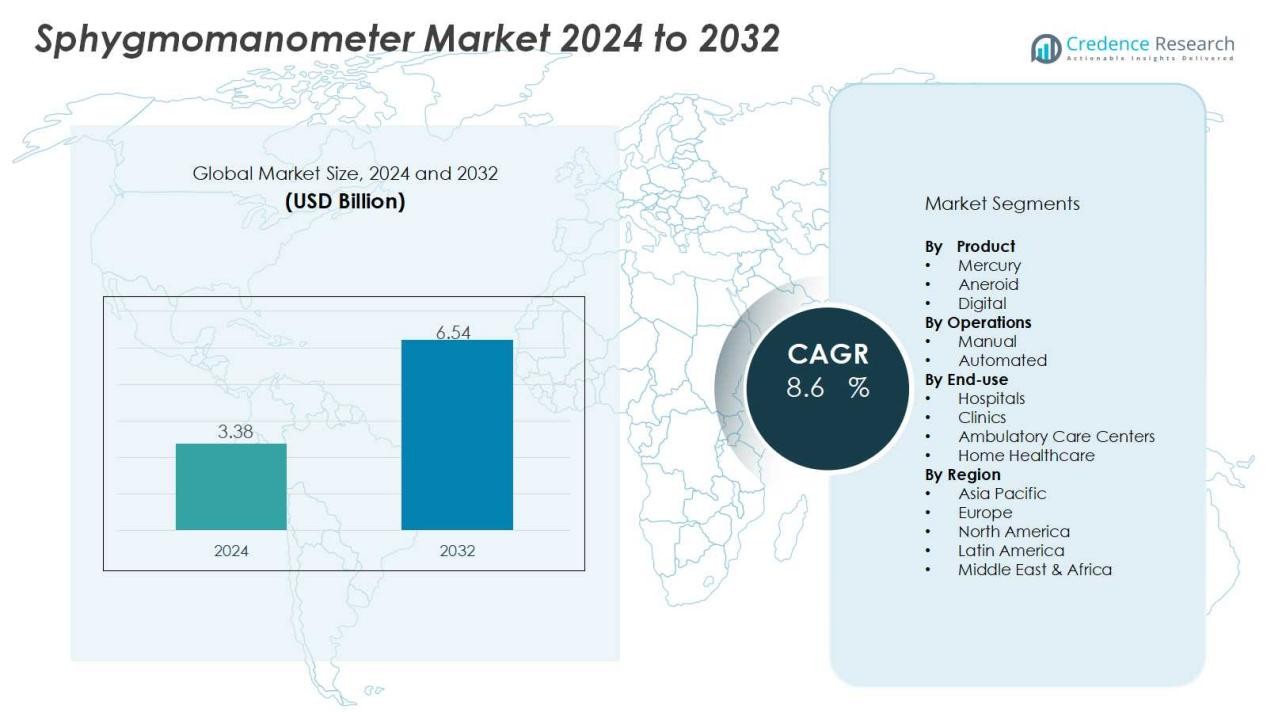

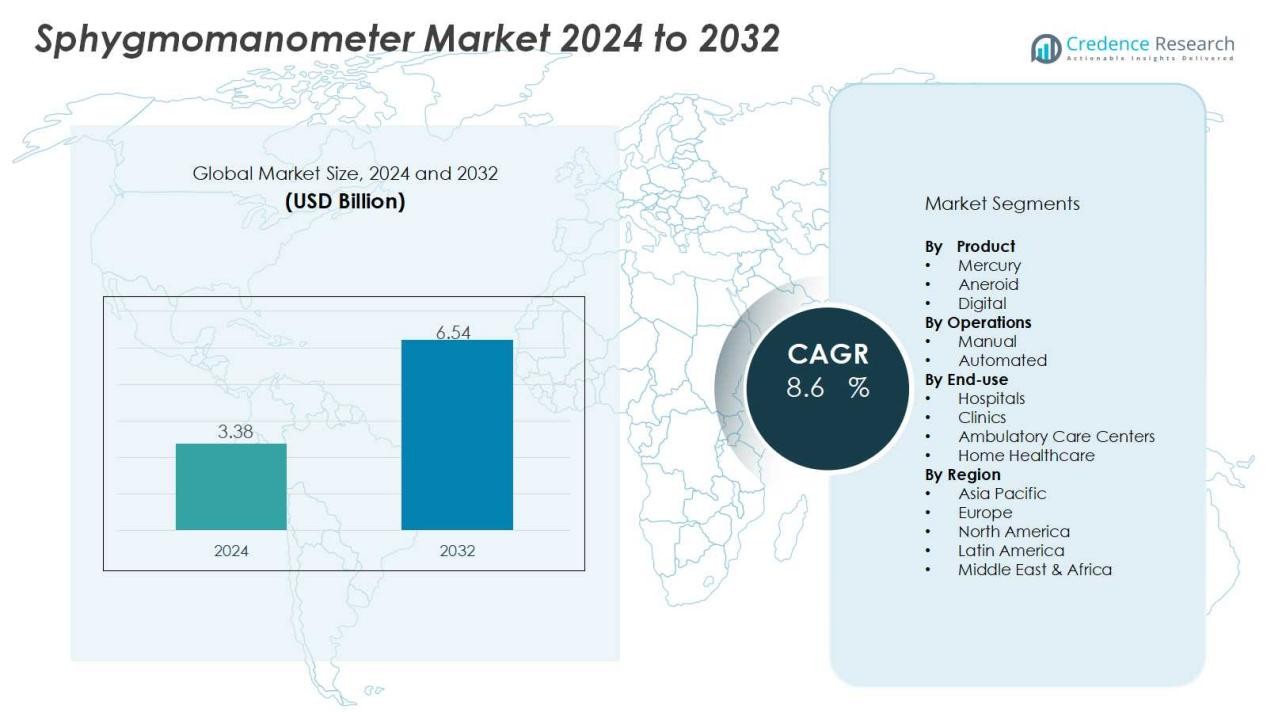

The sphygmomanometer market size was valued at USD 3.38 billion in 2024 and is anticipated to reach USD 6.54 billion by 2032, at a CAGR of 8.6 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sphygmomanometer Market Size 2024 |

USD 3.38 Billion |

| Sphygmomanometer Market, CAGR |

8.6 % |

| Sphygmomanometer Market Size 2032 |

USD 6.54 Billion |

Key drivers include the rising prevalence of hypertension, cardiovascular diseases, and lifestyle-related health conditions. Increased awareness of regular blood pressure monitoring, coupled with advancements in digital and automated devices, supports widespread adoption. Governments and health organizations are also promoting early detection and monitoring programs, further boosting demand. In addition, the shift from manual to digital sphygmomanometers enhances convenience, accuracy, and patient compliance, creating strong growth prospects.

Regionally, North America leads the sphygmomanometer market, driven by robust healthcare infrastructure, high disease prevalence, and early technology adoption. Europe follows closely, supported by strong public health initiatives and advanced clinical practices. Asia-Pacific is expected to record the fastest growth due to a rising patient pool, expanding healthcare access, and increasing investments in medical devices. Meanwhile, Latin America and the Middle East & Africa show emerging opportunities, supported by improving healthcare infrastructure and growing awareness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The sphygmomanometer market size was valued at USD 3.38 billion in 2024 and is anticipated to reach USD 6.54 billion by 2032, growing at a CAGR of 8.6% during the forecast period.

- Rising prevalence of hypertension and cardiovascular disorders remains the strongest driver, with urbanization, poor diets, and sedentary lifestyles accelerating cases worldwide.

- Technological advancements, including automated and digital devices with greater precision and ease of use, are reshaping adoption across hospitals and households.

- Preventive healthcare initiatives and the growing practice of home monitoring create strong demand for convenient and reliable devices.

- Regulatory barriers and environmental concerns tied to mercury-based models continue to disrupt usage, pushing adoption of eco-friendly and digital alternatives.

- Affordability and accuracy challenges in emerging economies remain barriers, limiting access in rural and unregulated markets where low-cost models often fail to meet standards.

- North America led with 34% share in 2024, Europe followed with 28%, Asia-Pacific posted 26% with the fastest growth, while Latin America and the Middle East & Africa together accounted for 12%, supported by improving infrastructure and awareness.

Market Drivers:

Rising Prevalence of Hypertension and Cardiovascular Disorders:

The sphygmomanometer market is strongly driven by the increasing prevalence of hypertension and cardiovascular conditions. Growing urbanization, dietary habits, and sedentary lifestyles contribute to rising blood pressure cases across all age groups. Healthcare systems worldwide prioritize early detection and consistent monitoring to reduce disease burden. It creates sustained demand for accurate and reliable blood pressure measuring devices.

- For Instance, The Omron HEM-7600T blood pressure monitor, featuring Bluetooth connectivity and an “Intelli Wrap” pre-formed cuff, was launched in Japan in 2017. The device’s internal memory stores a total of 100 measurements and syncs with the OMRON connect app, rather than capturing 100 readings per session.

Technological Advancements Enhancing Accuracy and Ease of Use:

Continuous product innovation supports the adoption of modern sphygmomanometers. Automated and digital models replace traditional mercury-based devices, offering greater precision and ease of operation. Patients benefit from user-friendly interfaces and data storage features that simplify long-term monitoring. It encourages use in both clinical settings and at-home healthcare, strengthening the market footprint.

- For instance, Smart Meter launched the iBloodPressure Classic Multi Cuff Monitor in July 2024, offering three different cuff sizes that fit arms from 8.6 to 20.5 inches and improving accuracy for a broader range of patients.

Growing Focus on Preventive Healthcare and Home Monitoring:

Preventive healthcare initiatives are gaining importance across both developed and emerging regions. Regular blood pressure monitoring at home is encouraged by medical professionals to reduce hospital visits and detect risks earlier. Governments and insurance providers support awareness campaigns that highlight the role of blood pressure control in disease prevention. The sphygmomanometer market benefits from this increasing preference for convenient and routine self-monitoring.

Expanding Healthcare Infrastructure and Access to Medical Devices:

Rapid improvements in healthcare infrastructure, especially in Asia-Pacific, accelerate device adoption. Hospitals, clinics, and diagnostic centers integrate advanced sphygmomanometers to support patient screening and treatment plans. Wider availability of cost-effective models ensures greater penetration across rural and underserved regions. It positions the sphygmomanometer market for long-term growth, supported by both public investments and private healthcare initiatives.

Market Trends:

Shift Toward Digital and Connected Monitoring Solutions:

The sphygmomanometer market is experiencing a clear shift toward digital and smart monitoring solutions. Manufacturers are introducing devices with Bluetooth and mobile app integration to track and analyze data more efficiently. Healthcare providers favor these devices for remote patient monitoring, improving clinical decision-making and reducing hospital visits. Consumers also value the convenience of automatic inflation, compact design, and enhanced accuracy compared to traditional models. It is reinforcing the decline of mercury-based sphygmomanometers, which face regulatory restrictions in many countries. Continuous research efforts in sensor technology support the evolution of these devices, ensuring sustained demand across clinical and homecare settings.

- For Instance, OMRON Healthcare offers the OMRON Connected Blood Pressure Monitor (model HEM-9210T), an upper arm monitor with Bluetooth connectivity. The HEM-9210T was validated in clinical studies and available well before 2024, with peer-reviewed publications as early as 2018 referencing its use for remote monitoring.

Rising Emphasis on Preventive Healthcare and Expanding Homecare Adoption:

Preventive healthcare initiatives drive higher adoption of at-home monitoring devices across regions. Consumers are investing in personal health devices to manage chronic conditions and reduce the likelihood of emergency care. The sphygmomanometer market benefits from this trend, as regular self-monitoring supports early detection and long-term disease control. It is also gaining traction among the elderly population, where blood pressure management is critical. Growing online retail channels make advanced devices more accessible, supporting awareness and usage among urban and semi-urban households. Governments and healthcare organizations encourage these practices through campaigns and reimbursement policies, further supporting market expansion.

- For instance, in October 2024, Novosound, a Scottish technology firm, unveiled the world’s first ultrasonic, cuffless blood pressure monitor, which completed clinical trials with more than 250 patients achieving an average accuracy error below 5 mmHg.

Market Challenges Analysis:

Regulatory Barriers and Environmental Concerns with Mercury Devices:

The sphygmomanometer market faces significant challenges due to strict regulations on mercury-based models. Many countries have banned or restricted their use, citing environmental and health hazards. This limits availability for healthcare providers still accustomed to traditional devices. Transitioning to digital alternatives requires training and adaptation, creating resistance in some clinical environments. It also raises procurement costs for institutions in developing regions, where budgets remain limited. Despite innovation, the complete phase-out of mercury devices continues to disrupt established practices.

Accuracy Limitations and Cost Constraints in Emerging Economies:

Ensuring accuracy across different models remains a persistent issue for manufacturers. Low-cost devices, particularly in unregulated markets, may not meet required clinical standards. This undermines patient trust and can impact adoption rates among medical professionals. The sphygmomanometer market also faces pricing pressures in cost-sensitive economies, where affordability often outweighs performance. It challenges companies to balance innovation with competitive pricing while maintaining quality standards. Limited access to advanced models in rural regions further slows global market penetration.

Market Opportunities:

Expansion of Home Healthcare and Remote Patient Monitoring:

The sphygmomanometer market offers strong opportunities in the growing home healthcare segment. Rising awareness of preventive health practices encourages individuals to invest in personal monitoring devices. Remote patient monitoring programs supported by telemedicine platforms create new demand for connected and digital models. It enables healthcare professionals to track patient data continuously and provide timely interventions. The aging population further accelerates the need for at-home blood pressure management, particularly in developed regions. Wider product availability through e-commerce platforms enhances accessibility and adoption.

Emerging Markets and Affordable Device Innovation:

Developing economies present significant growth prospects with expanding healthcare infrastructure and rising disposable income. Governments and private players are investing in awareness campaigns that highlight the importance of regular blood pressure monitoring. The sphygmomanometer market can benefit from affordable innovations that balance cost-effectiveness with accuracy. It allows manufacturers to penetrate rural and underserved regions where adoption remains limited. Partnerships with local distributors and healthcare providers can further strengthen market presence. Growing investments in low-power sensors and AI-driven analytics also open new pathways for product differentiation.

Market Segmentation Analysis:

By Product:

The sphygmomanometer market is segmented into mercury, aneroid, and digital devices. Mercury models are declining due to environmental concerns and regulatory restrictions. Aneroid devices remain relevant in clinics for their durability and cost-effectiveness. Digital sphygmomanometers lead growth, driven by ease of use, accuracy, and integration with smart technologies. It supports adoption across both hospitals and households, reinforcing the demand for modern solutions.

- For instance, since June 2024, Malaysia has enforced an import ban on mercury-based sphygmomanometers, eliminating approximately 4,000 units from annual hospital procurement lists

By Operations:

Segments include manual and automated operations, with manual models still in use across resource-limited settings. Automated sphygmomanometers dominate the market, supported by their precision and time-saving features. Hospitals prefer automated systems for large patient volumes, while individuals adopt them for home monitoring. It ensures consistent growth for automated devices, supported by awareness campaigns and improved affordability.

- For instance, the Heine Gamma G7 manual sphygmomanometer is recognized for its precision and durability, delivering highly accurate results and supporting over 1,000 clinical measurements per year in busy hospital settings.

By End-use:

The sphygmomanometer market serves hospitals, clinics, ambulatory care centers, and home healthcare. Hospitals hold a significant share due to high patient traffic and the need for accurate monitoring. Clinics and ambulatory centers adopt compact and efficient devices to manage routine diagnostics. Home healthcare is expanding rapidly with rising consumer awareness and preventive care practices. It highlights a clear shift toward personal monitoring, supported by e-commerce and telemedicine platforms.

Segmentations:

By Product:

By Operations:

By End-use:

- Hospitals

- Clinics

- Ambulatory Care Centers

- Home Healthcare

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America and Europe:

North America accounted for 34% share in 2024, supported by advanced healthcare infrastructure and high disease prevalence. Europe followed with 28% share, driven by robust public health initiatives and adoption of modern monitoring devices. The sphygmomanometer market benefits from early technology acceptance in these regions, supported by strict clinical standards. It is further reinforced by strong reimbursement policies and widespread use of telehealth platforms. Manufacturers also expand their presence through partnerships with hospitals and clinics. Continuous investments in R&D enhance product quality, reinforcing leadership across both regions.

Asia-Pacific:

Asia-Pacific recorded 26% share in 2024 and is expected to post the highest growth rate. Rising patient pools, increasing cases of hypertension, and expanding healthcare access drive demand. The sphygmomanometer market in this region is shaped by government-led health campaigns and growing adoption of affordable devices. It is further supported by rising disposable incomes and urbanization across India, China, and Southeast Asia. Local manufacturers play a critical role in catering to cost-sensitive consumers. E-commerce platforms also contribute to broader device availability and awareness in rural and semi-urban areas.

Latin America and Middle East & Africa:

Latin America captured 7% share in 2024, supported by gradual healthcare modernization and expanding access to diagnostic equipment. The Middle East & Africa held 5% share, with growth driven by government investments in public health programs. The sphygmomanometer market in these regions continues to face challenges of affordability and uneven access. It is gradually improving through partnerships between global firms and local distributors. Rising awareness of preventive healthcare supports steady adoption, especially in urban centers. Strategic efforts to introduce cost-effective and portable devices will shape future market penetration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- A&D Company, Limited

- American Diagnostic Corporation

- ACCOSON

- Beurer GmbH

- BPL Medical Technologies Pvt. Ltd.

- Bosch + Sohn GmbH & Co. KG

- GE Healthcare

- Prestige Medical

- Microlife Corporation

- Little Doctor International (S) Pte. Ltd.

- Omron Healthcare, Inc.

Competitive Analysis:

The sphygmomanometer market features strong competition among global and regional manufacturers. Key players include A&D Company, Limited, American Diagnostic Corporation, ACCOSON, Beurer GmbH, BPL Medical Technologies Pvt. Ltd., Bosch + Sohn GmbH & Co. KG, and GE Healthcare. These companies focus on product innovation, accuracy, and design improvements to strengthen their presence. It is driven by the growing shift from mercury-based devices to digital and automated models. Companies invest in research to enhance user-friendly features, integrate connectivity, and meet regulatory standards. Strategic partnerships with hospitals, clinics, and distributors expand their reach across developed and emerging markets. Pricing strategies and product differentiation play a critical role in maintaining competitiveness. Continuous R&D efforts ensure advancements in sensors, portability, and data integration. This competitive landscape highlights the balance between established multinational firms and specialized regional players, shaping future growth through innovation and market responsiveness.

Recent Developments:

- In November 2024:,Beurer India launched the GL 22 Blood Glucose Monitor, aimed at enhancing diabetes care in the Indian market.

- In July 2025, BPL Medical Technologies announced a strategic partnership with Panacea Medical Technologies to distribute advanced mammography solutions across India.

Report Coverage:

The research report offers an in-depth analysis based on Product, Operations, End-use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The sphygmomanometer market will continue shifting from mercury-based devices to digital and automated models, driven by regulations and consumer demand.

- Integration of Bluetooth, mobile apps, and cloud platforms will strengthen adoption of connected monitoring solutions.

- Home healthcare expansion will create sustained demand for compact and easy-to-use devices.

- Telemedicine and remote patient monitoring programs will position digital sphygmomanometers as essential diagnostic tools.

- Emerging economies will provide strong opportunities through government health initiatives and rising healthcare spending.

- Elderly populations worldwide will support higher adoption due to increased cardiovascular risks and need for continuous monitoring.

- Manufacturers will invest in sensor innovation, AI-driven analytics, and user-friendly features to differentiate products.

- Online retail and e-commerce growth will expand global accessibility of both premium and cost-effective models.

- Collaborations between healthcare providers, insurers, and device makers will accelerate adoption in preventive healthcare programs.

- Sustainability initiatives, including silica-free and eco-friendly designs, will guide future product development and regulatory compliance.